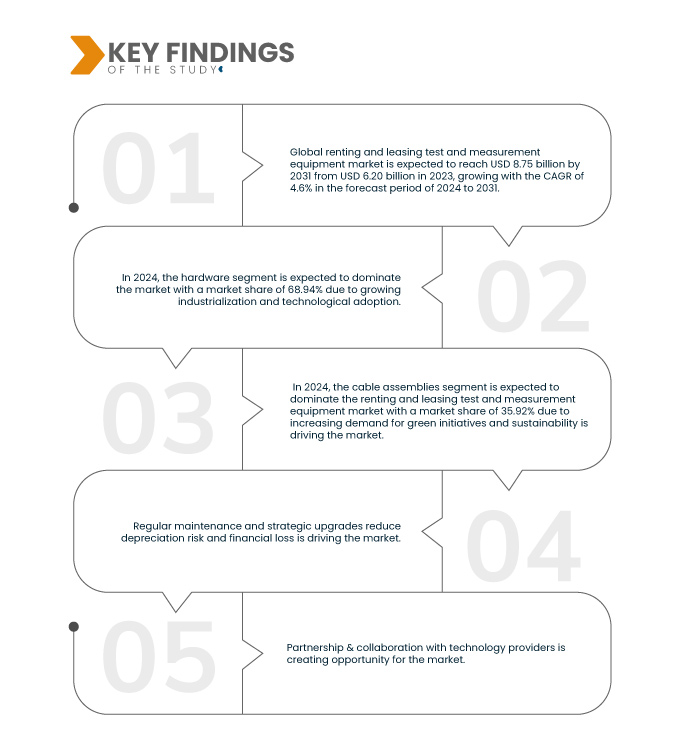

임대 계약에 유지보수 및 지원 서비스를 포함하면 기업의 운영 효율성이 크게 향상됩니다. 유지보수 및 지원을 아웃소싱함으로써 기업은 이러한 기능을 사내에서 관리하는 데 따르는 복잡성과 비용을 피할 수 있습니다. 이러한 방식을 통해 기업은 핵심 운영에 집중하는 동시에 임대 장비의 지속적인 유지보수 및 교정을 보장할 수 있습니다. 이러한 효율성은 프로젝트 마감일 준수 및 생산성 유지를 위해 장비 가동 시간과 안정성이 필수적인 수요가 높은 환경에서 특히 중요합니다. 유지보수 및 지원을 임대 계약에 포함하면 기업은 비용을 더욱 효과적으로 관리할 수 있습니다. 정기적인 서비스, 수리, 문제 해결을 포함한 장비 유지 관리에 대한 재정적 부담을 완전히 감수하는 대신, 기업은 이러한 서비스가 포함된 예측 가능하고 종종 더 낮은 임대 비용의 이점을 누릴 수 있습니다.

Data Bridge Market Research에 따르면, 시험 및 측정 장비 임대 및 리스 시장 규모는 2023년 62억 달러에서 2031년 87억 5천만 달러로 성장할 것으로 예상되며, 2024년부터 2031년까지의 예측 기간 동안 연평균 성장률 4.6%로 성장할 것으로 전망됩니다.

연구의 주요 결과

프로젝트 기반 장비 수요 증가

프로젝트 기반 장비에 대한 수요 증가는 시험 및 측정 장비 임대 및 리스 시장의 주요 성장 동력입니다. 프로젝트는 종종 한정된 기간 동안 특수 시험 및 측정 장비를 필요로 하며, 임대는 이러한 단기적인 요구를 충족하는 유연한 솔루션을 제공합니다. 기업은 장기 소유에 대한 부담 없이 필요한 특정 도구를 활용할 수 있으며, 이는 프로젝트 요구 사항이 변동하는 산업이나 일시적인 프로젝트를 시작하는 기업에 이상적입니다. 프로젝트 기반 작업을 위한 시험 및 측정 장비 임대는 비용 효율성을 제공합니다. 시험 및 측정 장비 임대 및 리스 부문에서 구매와 관련된 높은 초기 비용과 감가상각을 피할 수 있기 때문입니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2024년부터 2031년까지

|

기준 연도

|

2023

|

역사적인 해

|

2022 (2016년부터 2021년까지 사용자 정의 가능)

|

양적 단위

|

매출 (USD 10억)

|

다루는 세그먼트

|

제공 품목(하드웨어 및 서비스), 구성 요소(케이블 어셈블리, 커넥터, 부가가치 액세서리 및 기타), 시스템 유형(감지 시스템, 연결 시스템, 안전 및 보안 시스템, 인간-기계 인터페이스(HMI), 전력 및 에너지 관리 시스템, 모터 제어 시스템 및 조명 시스템), 유형(임대 및 리스), 기능(진단 장비, 전기 감지, 계량 ICS 및 기타), 최종 사용자(IT 및 통신, 자동차, 항공우주 및 방위, 산업, 가전 제품 , 에너지 및 유틸리티, 의료 장비 및 기타)

|

포함 국가

|

미국, 캐나다, 멕시코, 독일, 프랑스, 영국, 이탈리아, 스페인, 러시아, 터키, 벨기에, 네덜란드, 스위스, 노르웨이, 핀란드, 덴마크, 스웨덴, 폴란드 및 기타 유럽 국가, 일본, 중국, 한국, 인도, 호주, 뉴질랜드, 싱가포르, 태국, 말레이시아, 인도네시아, 필리핀, 대만, 베트남 및 기타 아시아 태평양 국가, UAE, 사우디아라비아, 남아프리카 공화국, 이집트, 이스라엘, 바레인, 오만, 카타르, 쿠웨이트 및 기타 중동 및 아프리카 국가, 브라질, 아르헨티나 및 기타 남미 국가

|

시장 참여자 포함

|

Siemens(독일), Keysight Technologies(미국), Rohde & Schwarz(독일), Fortive(미국), Emerson Electric Co.(미국), Texas Instruments Incorporated(미국), ADVANTEST CORPORATION(일본), Viavi Solutions(미국), Yokogawa Electric Corporation(일본), STMicroelectronics(스위스), Learnado DRS(미국), General electric company(미국), Anritsu(일본), EXFO Inc.(캐나다), Megger(영국), ADLINK Technology Inc.(대만), Transcat, Inc(미국), electrorent com.Inc(미국), Good Will Instrument Co, Ltd(중국), Leader Electronics of Europe Lim(대만), Doble Engineering Company(미국), Bird(네덜란드), Boontoon Electronics(미국), Saluki Technology(대만), Fluke netoworks(미국), DS Instruments(미국) 등이 있습니다.

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위, 주요 기업 등 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 지리적으로 대표되는 회사별 생산 및 용량, 유통업체 및 파트너의 네트워크 레이아웃, 자세하고 업데이트된 가격 추세 분석, 공급망 및 수요에 대한 부족 분석이 포함됩니다.

|

세그먼트 분석

글로벌 임대 및 리스 시험 및 측정 장비 시장은 제공 품목, 구성 요소, 시스템 유형, 유형, 기능 및 최종 사용자를 기준으로 6개의 주요 세그먼트로 구분됩니다.

- 제공을 기준으로 테스트 및 측정 장비 임대 및 리스 시장은 하드웨어와 서비스로 세분화됩니다.

2024년에는 하드웨어 부문이 글로벌 임대 및 리스 테스트 및 측정 장비 시장을 지배할 것으로 예상됩니다.

2024년에는 하드웨어 부문이 68.94%의 시장 점유율로 시장을 장악할 것으로 예상됩니다. 이는 기업들이 구매보다는 임대를 선호하여 사전 자본 지출을 줄이는 특수하고 값비싼 장비에 대한 수요가 높기 때문입니다.

- 구성 요소를 기준으로 테스트 및 측정 장비 임대 및 리스 시장은 케이블 어셈블리, 커넥터, 부가가치 액세서리 및 기타로 세분화됩니다.

2024년에는 케이블 어셈블리 부문이 글로벌 임대 및 리스 테스트 및 측정 장비 시장을 지배할 것으로 예상됩니다.

2024년에는 기술 혁신의 급속한 발전으로 인해 케이블 조립 부문이 35.92%의 시장 점유율로 시장을 지배할 것으로 예상됩니다.

- 시스템 유형을 기준으로, 시험 및 계측 장비 임대 및 리스 시장은 조명 시스템, 연결 시스템, 휴먼 머신 인터페이스 (HMI), 센싱 시스템, 안전 및 보안 시스템, 모터 제어 시스템, 전력 및 에너지 관리 시스템으로 세분화됩니다. 2024년에는 센싱 시스템이 30.31%의 시장 점유율로 시험 및 계측 장비 임대 및 리스 시장을 주도할 것으로 예상됩니다.

- 시험 및 측정 장비 임대 및 리스 시장은 유형별로 임대와 렌트로 구분됩니다. 2024년에는 임대 부문이 59.38%의 시장 점유율로 시험 및 측정 장비 임대 및 리스 시장을 주도할 것으로 예상됩니다.

- 시험 및 계측 장비 임대 및 리스 시장은 특성에 따라 계측 ICS, 진단 장비, 전기 센싱 등으로 세분화됩니다. 2024년에는 진단 장비 부문이 40.63%의 시장 점유율로 시험 및 계측 장비 임대 및 리스 시장을 주도할 것으로 예상됩니다.

- 최종 사용자 기준으로 시험 및 측정 장비 임대 및 리스 시장은 IT 및 통신, 자동차, 항공우주 및 방위, 가전제품 , 산업, 에너지 및 유틸리티, 의료 장비 등으로 세분화됩니다. 2024년에는 IT 및 통신 부문이 29.64%의 시장 점유율로 시험 및 측정 장비 임대 및 리스 시장을 주도할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research에서는 Siemens(독일), Keysight Technologies(미국), Rohde & Schwarz(독일), Fortive(미국), Emerson Electric Co.(미국)를 이 시장에서 운영되는 주요 회사로 분석합니다.

시장 개발

- 2024년 4월, 로데슈바르즈와 IPG Automotive는 시뮬레이션 소프트웨어와 레이더 장비를 통합하는 HIL(Hardware-in-the-Loop) 자동차 레이더 테스트 솔루션을 출시했습니다. 이 솔루션은 자율주행 테스트를 시험장에서 실험실로 옮겨 비용 절감 및 효율성 향상을 실현했습니다. 이 솔루션은 테스트 및 계측 렌털 시장에서 로데슈바르즈의 입지를 강화하여 자동차 OEM과 레이더 공급업체를 유치하고 리스 기회를 확대하는 고급 도구를 제공했습니다.

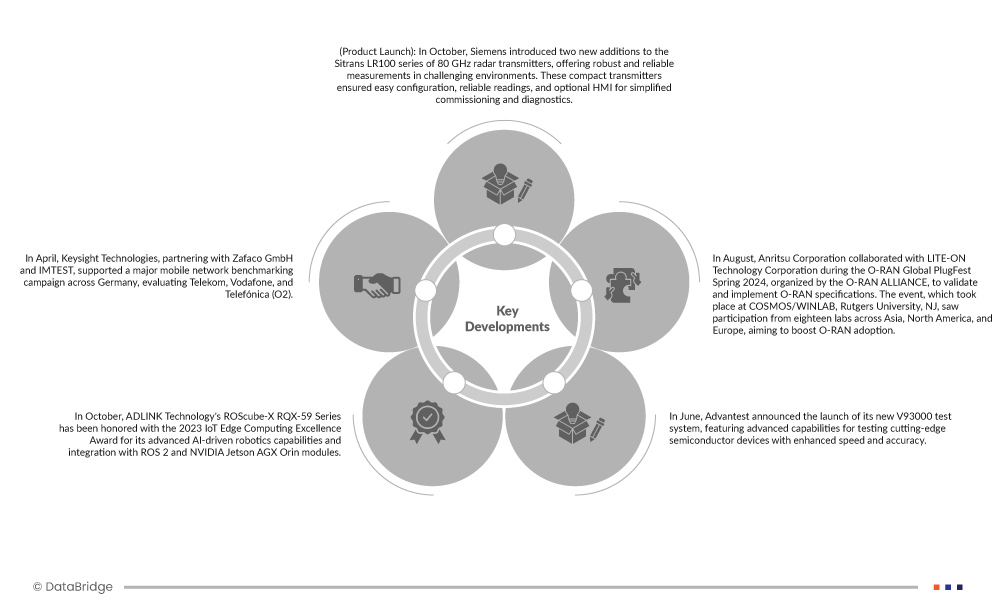

- 2024년 4월, 키사이트 테크놀로지스는 Zafaco GmbH 및 IMTEST와 협력하여 독일 전역에서 Telekom, Vodafone, Telefónica(O2)를 평가하는 대규모 모바일 네트워크 벤치마킹 캠페인을 지원했습니다. 이를 통해 키사이트의 고급 테스트 솔루션이 부각되어 시장 입지를 강화하고 테스트 및 측정 장비 임대 및 리스 사업의 잠재력을 높였습니다.

- 10월, 지멘스는 80GHz 레이더 송신기 Sitrans LR100 시리즈에 두 가지 신제품을 출시하여 까다로운 환경에서도 견고하고 안정적인 측정을 제공합니다. 이 소형 송신기는 간편한 구성, 안정적인 판독값, 그리고 간편한 시운전 및 진단을 위한 HMI(옵션)를 제공합니다. 에너지, 광업, 골재, 수자원 분야의 다양한 어플리케이션에 적합하도록 설계되었습니다. 이 소식은 지멘스가 혁신적인 측정 솔루션 분야의 선두주자로서의 입지를 더욱 공고히 하고, 명성을 높이며 제품 포트폴리오를 확장하는 데 기여했습니다.

- 5월, 로데슈바르즈의 상호작용성 테스트(Interactivity Test)가 ITU로부터 네트워크 성능 평가의 새로운 표준으로 인정받아 기존 방식보다 실시간 및 상호작용 애플리케이션에 대한 더욱 정밀한 측정을 제공합니다. 이번 개선을 통해 로데슈바르즈는 ITU 승인 최첨단 테스트 솔루션을 부각하고, 이동통신 사업자를 유치하며, 첨단 장비 임대 기회를 확대함으로써 임대 시장에서의 입지를 더욱 강화할 수 있게 되었습니다.

- 10월, 지멘스는 80GHz 레이더 송신기 Sitrans LR100 시리즈에 두 가지 신제품을 출시하여 까다로운 환경에서도 견고하고 안정적인 측정을 제공합니다. 이 소형 송신기는 간편한 구성, 안정적인 판독값, 그리고 간편한 시운전 및 진단을 위한 HMI(옵션)를 제공합니다. 에너지, 광업, 골재, 수자원 분야의 다양한 어플리케이션에 적합하도록 설계되었습니다. 이 소식은 지멘스가 혁신적인 측정 솔루션 분야의 선두주자로서의 입지를 더욱 공고히 하고, 명성을 높이며 제품 포트폴리오를 확장하는 데 기여했습니다.

지역 분석

지리적으로, 글로벌 임대 및 리스 시험 및 측정 장비 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코, 독일, 프랑스, 영국, 이탈리아, 스페인, 러시아, 터키, 벨기에, 네덜란드, 스위스, 노르웨이, 핀란드, 덴마크, 스웨덴, 폴란드 및 기타 유럽 국가, 일본, 중국, 한국, 인도, 호주, 뉴질랜드, 싱가포르, 태국, 말레이시아, 인도네시아, 필리핀, 대만, 베트남 및 기타 아시아 태평양 국가, UAE, 사우디아라비아, 남아프리카 공화국, 이집트, 이스라엘, 바레인, 오만, 카타르, 쿠웨이트 및 기타 중동 및 아프리카 국가, 브라질, 아르헨티나 및 기타 남미 국가입니다.

Data Bridge Market Research 분석에 따르면:

북미는 글로벌 임대 및 리스 테스트 및 측정 장비 시장을 지배할 것으로 예상됩니다.

북미 지역은 첨단 기술 인프라, 높은 R&D 투자, 핵심 산업의 강력한 입지로 인해 시험 및 측정 장비 임대 및 리스 시장을 주도할 것으로 예상되며, 다른 지역에 비해 시험 및 측정 장비 임대 및 리스에 대한 수요가 더 클 것으로 예상됩니다.

아시아 태평양 지역은 글로벌 임대 및 리스 테스트 및 측정 장비 시장 에서 가장 빠르게 성장하는 지역이 될 것으로 예상됩니다.

정기적인 유지관리와 전략적 업그레이드를 통해 감가상각 위험과 재정적 손실을 줄여 아시아 태평양 지역은 글로벌 테스트 및 측정 장비 임대 및 리스 시장에서 가장 빠르게 성장하는 지역이 될 것으로 예상됩니다.

글로벌 임대 및 리스 테스트 및 측정 장비 시장 보고서에 대한 자세한 내용은 여기를 클릭하세요. - https://www.databridgemarketresearch.com/reports/global-renting-and-leasing-test-and-measurement-equipment-market