의료 약물 오류로 인한 사고 및 사망 발생률 증가는 일반 의료 분야에 엄청난 부담을 주고 있습니다. 의료 전문가와 약사 모두 이러한 빈번한 의료 사고를 방지하기 위해 더욱 효과적이고 정확한 해결책을 모색하고 있습니다. 또한, 환자와 방문객 수의 증가와 그에 따른 안전 요구 증가로 인해 약물 전달 시스템은 날로 복잡해지고 있습니다. 이러한 심각한 문제를 해결하기 위해 약국 자동화 시스템과 같은 첨단 기술이 가장 강력한 도구로 부상하고 있습니다. 이러한 도구의 목표는 의료 처방 오류를 줄이고 환자 안전을 극대화하는 것입니다. 따라서 이러한 약국 자동화 시스템을 구축하면 의료 서비스 제공자와 약사의 손실을 최소화하고 품질과 생산성을 향상시키는 데 도움이 됩니다.

전체 보고서는 https://www.databridgemarketresearch.com/reports/global-pharmacy-automation-market 에서 확인하세요.

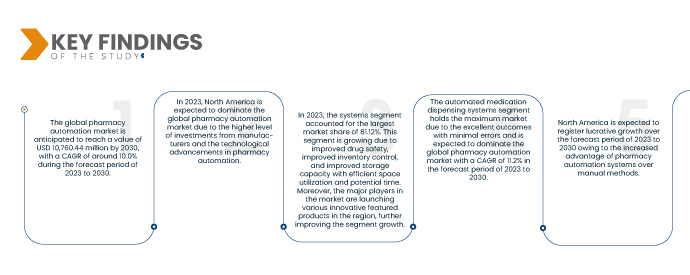

Data Bridge Market Research에 따르면, 글로벌 약국 자동화 시장은 2023년부터 2030년까지 연평균 성장률 10.0%로 성장할 것으로 예상되며, 2030년에는 107억 6,044만 달러 규모에 이를 것으로 전망됩니다. 2023년에는 기술 발전과 해당 지역의 정밀 로봇 도구 수요 증가로 인해 이 제품 부문이 시장을 주도할 것으로 예상됩니다.

연구의 주요 결과

수동 방식 대비 약국 자동화 시스템의 장점

약물 전달은 약국 서비스의 주요 책임이자 환자 치료 과정의 필수적인 부분이며 임상 결과에 직접적인 영향을 미칩니다. 약국에서 약물을 투여하는 작업은 여러 단계로 구성되고 많은 직원이 필요하기 때문에 투약 오류 및 부작용 발생 위험이 높습니다. 미국과 캐나다를 포함한 여러 국가와 태국의 일부 사립 병원에서는 자동 조제기(ADM)가 널리 사용되고 있습니다. 조제 과정에 ADM을 도입하면 인력 자원의 효율적인 활용과 약물 전달 과정의 효율성 향상이라는 이점을 기대할 수 있습니다. 자동화 기술을 업무 흐름에 도입함으로써 약국은 많은 이점을 얻을 수 있습니다. 이러한 시스템에 대한 초기 투자로 인해 약국 운영이 중단될 수 있지만, 그로 인한 단점은 즉각적이고 장기적인 이점보다 훨씬 큽니다. 더욱이, 정부 법률과 환자의 요구가 약국 운영을 지속적으로 압박함에 따라, 약국 자동화 도입은 시장 성장에 도움이 되는 필수 요소로 자리 잡고 있습니다.

약국 자동화 시스템은 약품 조제 및 캡핑, 약품 관리 및 보관, 처방 라벨링 등 약국 운영 프로세스를 강화했습니다. 이러한 시스템은 200~300개 이상의 약품과 환자 정보를 효율적이고 안전하게 저장하고 처리할 수 있습니다.

자동화 시스템 도입 확대는 장기적인 운영 비용을 절감하여 약국의 효율성을 크게 높이고, 약국에서 제공하는 의약품 수를 증가시킬 것으로 예상됩니다. 따라서 약국 자동화 시스템이 수동 시스템보다 갖는 장점은 시장 성장의 원동력으로 작용합니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2023년부터 2030년까지

|

기준 연도

|

2022

|

역사적인 해

|

2021 (2015~2020년으로 맞춤 설정 가능)

|

양적 단위

|

매출(백만 달러) 및 가격(미국 달러)

|

다루는 세그먼트

|

제품(시스템, 소프트웨어 및 서비스), 약국 유형(독립형, 체인형 및 연방형), 약국 규모(대형 약국, 중형 약국 및 소형 약국), 애플리케이션(약물 분배 및 포장, 약물 보관 및 재고 관리), 최종 사용자(입원 약국, 외래 약국, 소매 약국, 온라인 약국, 중앙 조제/우편 주문 약국, 약국 혜택 관리 기관 및 기타), 유통 채널(직접 입찰 및 제3자 유통업체)

|

포함 국가

|

미국, 캐나다, 멕시코, 독일, 프랑스, 이탈리아, 영국, 스페인, 네덜란드, 러시아, 스위스, 터키, 벨기에, 유럽의 나머지 지역, 일본, 중국, 인도, 한국, 호주, 싱가포르, 말레이시아, 태국, 인도네시아, 필리핀, 아시아 태평양의 나머지 지역, 브라질, 아르헨티나, 남미의 나머지 지역, 사우디 아라비아, 남아프리카, UAE, 이스라엘, 이집트, 중동 및 아프리카의 나머지 지역

|

시장 참여자 포함

|

ARxIUM(미국), OMNICELL INC.(미국), Cerner Corporation(미국), Capsa Healthcare(미국), ScriptPro LLC(미국), RxSafe, LLC. (미국), MedAvail Technologies, Inc.(캐나다), Asteres Inc.(미국), InterLink AI, Inc.(미국), BD(미국), Baxter(미국), Fullscript(캐나다), McKesson Corporation(미국), Innovation Associates(미국), AmerisourceBergen Corporation(미국), UNIVERSAL LOGISTICS HOLDINGS, INC(미국), Takazono Corporation(일본), TOSHO Inc.(일본), Willach Group(독일), BIQHS(포르투갈), Synergy Medical(캐나다), Yuyama(일본), APD Algoritmos Procesos y Diseños SA(스페인), JVM Europe BV(네덜란드), Genesis Automation LTD(이탈리아), myPak Solutions Pty Ltd.(호주), Demodeks Pharmacy Shelving(호주), Deenova Srl(이탈리아), KUKA AG(독일), KLS Pharma Robotics GmbH(독일) 등이 있습니다.

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 적용 범위, 주요 기업 등 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 환자 역학, 파이프라인 분석, 가격 분석, 규제 프레임워크가 포함됩니다.

|

세그먼트 분석

글로벌 약국 자동화 시장은 제품, 약국 유형, 약국 규모, 응용 분야, 최종 사용자 및 유통 채널별로 세분화됩니다.

- 제품 기준으로 시장은 시스템, 소프트웨어, 서비스로 세분화됩니다. 2023년에는 시스템 부문이 81.12%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

약국 유형을 기준으로 시장은 독립형, 체인형, 연방형으로 구분됩니다.

- 약국 유형을 기준으로 시장은 독립 약국, 체인 약국, 연방 약국으로 구분됩니다. 2023년에는 독립 약국 부문이 47.23%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 약국 규모를 기준으로 시장은 대형 약국, 중형 약국, 소형 약국으로 구분됩니다. 2023년에는 대형 약국 부문이 53.21%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 시장은 용도별로 약물 조제 및 포장, 약물 보관, 재고 관리로 구분됩니다. 2023년에는 약물 조제 및 포장 부문이 54.21%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

- 최종 사용자 기준으로 시장은 입원 약국, 외래 약국, 소매 약국, 온라인 약국, 중앙 조제/우편 주문 약국, 약국 혜택 관리 기관(PBM) 등으로 세분화됩니다. 2023년에는 입원 약국 부문이 65.11%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

유통채널을 기준으로 시장은 직접입찰과 제3자 유통업체로 구분됩니다.

- 유통 채널을 기준으로 시장은 직접 입찰과 제3자 유통업체로 구분됩니다. 2023년에는 직접 입찰 부문이 78.87%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research에서는 ARxIUM(미국), OMNICELL INC.(미국), Cerner Corporation(미국), Capsa Healthcare(미국), ScriptPro LLC(미국), RxSafe, LLC를 포함한 글로벌 약국 자동화 시장의 주요 기업으로 인식하고 있습니다. (미국), MedAvail Technologies, Inc.(캐나다), Asteres Inc.(미국), InterLink AI, Inc.(미국), BD(미국), Baxter(미국), Fullscript(캐나다), McKesson Corporation(미국), Innovation Associates(미국), AmerisourceBergen Corporation(미국), UNIVERSAL LOGISTICS HOLDINGS, INC(미국), Takazono Corporation(일본), TOSHO Inc.(일본), Willach Group(독일), BIQHS(포르투갈), Synergy Medical(캐나다), Yuyama(일본), APD Algoritmos Procesos y Diseños SA(스페인), JVM Europe BV(네덜란드), Genesis Automation LTD(이탈리아), myPak Solutions Pty Ltd.(호주), Demodeks Pharmacy Shelving(호주), Deenova Srl(이탈리아), KUKA AG(독일), KLS Pharma Robotics GmbH(독일) 등이 있습니다.

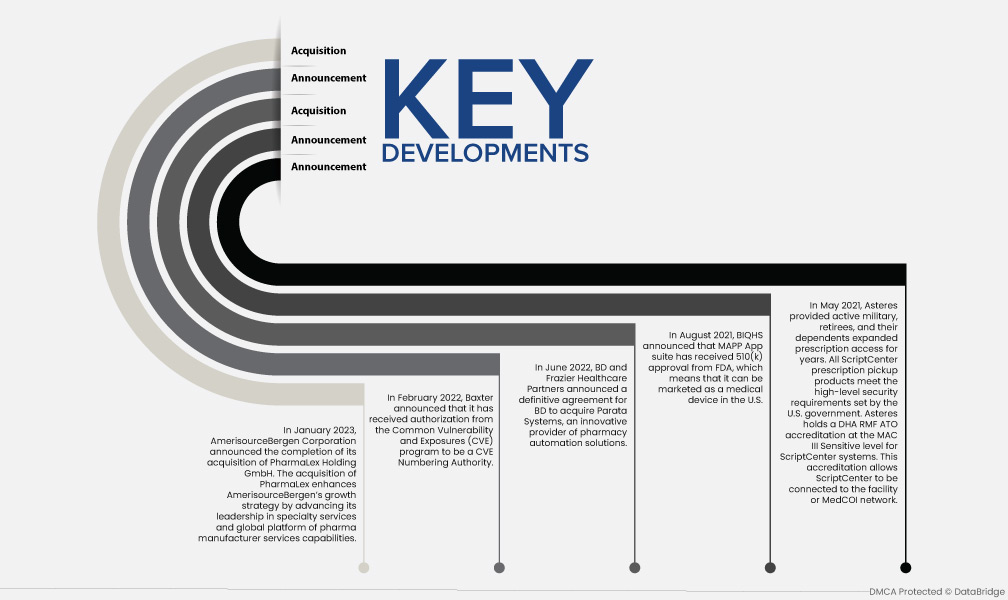

시장 개발

- 2023년 1월, AmerisourceBergen Corporation은 PharmaLex Holding GmbH 인수 완료를 발표했습니다. PharmaLex 인수를 통해 AmerisourceBergen은 전문 서비스 분야의 리더십과 제약 제조 서비스 역량의 글로벌 플랫폼을 강화함으로써 성장 전략을 강화할 수 있게 되었습니다.

- 2022년 2월, Baxter는 CVE(Common Vulnerability and Exposures) 프로그램에서 CVE 번호 지정 기관이 될 수 있는 승인을 받았다고 발표했습니다.

- 2022년 6월, BD와 Frazier Healthcare Partners는 BD가 약국 자동화 솔루션의 혁신적인 공급업체인 Parata Systems를 인수한다는 최종 계약을 발표했습니다.

- BIQHS는 2021년 8월 MAPP 앱 제품군이 FDA로부터 510(k) 승인을 받았다고 발표했습니다. 이는 미국에서 의료기기로 판매될 수 있음을 의미합니다.

- 2021년 5월, Asteres는 현역 군인, 은퇴 군인 및 그 부양가족에게 수년간 확대된 처방전 접근성을 제공했습니다. 모든 ScriptCenter 처방전 픽업 제품은 미국 정부가 정한 높은 수준의 보안 요건을 충족합니다. Asteres는 ScriptCenter 시스템에 대해 MAC III 민감 등급의 DHA RMF ATO 인증을 보유하고 있습니다. 이 인증을 통해 ScriptCenter는 해당 시설 또는 MedCOI 네트워크에 연결될 수 있습니다.

지역 분석

지리적으로, 약국 자동화 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코, 독일, 프랑스, 이탈리아, 영국, 스페인, 네덜란드, 러시아, 스위스, 터키, 벨기에, 기타 유럽, 일본, 중국, 인도, 한국, 호주, 싱가포르, 말레이시아, 태국, 인도네시아, 필리핀, 기타 아시아 태평양, 브라질, 아르헨티나, 기타 남미, 사우디 아라비아, 남아프리카 공화국, UAE, 이스라엘, 이집트, 기타 중동 및 아프리카입니다.

Data Bridge Market Research 분석에 따르면,

북미는 2023년부터 2030년까지의 예측 기간 동안 글로벌 약국 자동화 시장에서 지배적인 지역입니다.

2023년에는 다양한 제조업체의 투자 증가와 기술 발전의 가속화로 북미 지역이 글로벌 약국 자동화 시장을 주도할 것으로 예상됩니다. 북미는 시장 점유율과 매출 측면에서 글로벌 약국 자동화 시장을 지속적으로 주도할 것이며, 예측 기간 동안 그 우위를 더욱 확대할 것입니다.

아시아 태평양 지역은 2023년부터 2030년까지의 예측 기간 동안 글로벌 약국 자동화 시장에서 가장 빠르게 성장하는 지역입니다.

아시아 태평양 지역은 2023년부터 2030년까지의 예측 기간 동안 글로벌 약국 자동화 시장에서 가장 빠르게 성장하는 지역으로 추산됩니다. 이는 이 지역에서 첨단 기술 도입이 증가하고 신제품이 출시되고 있기 때문입니다.

글로벌 약국 자동화 시장 보고서에 대한 자세한 내용을 보려면 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/global-pharmacy-automation-market