The digital payment market has experienced remarkable growth and transformation, revolutionizing financial transactions for individuals and businesses. This highly competitive market includes various players, such as traditional financial institutions, technology companies, and innovative fintech startups. These entities offer a diverse range of services to cater to evolving consumer needs. As digital payment methods continue to gain popularity, the market landscape is characterized by intense competition, innovation, and the ongoing development of secure and convenient payment solutions.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-digital-payment-market

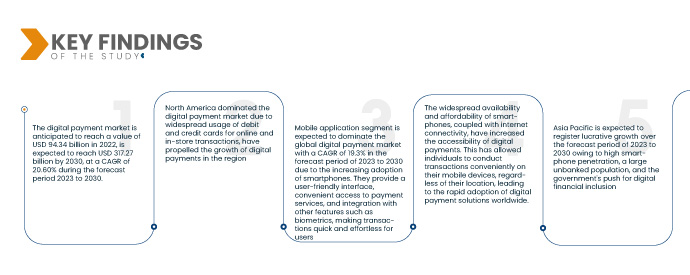

Data Bridge Market Research analyses that the Digital Payment Market is expected to grow at a value of USD 94.34 billion in 2022, and is expected to reach USD 317.27 billion by 2030, at a CAGR of 20.60% during the forecast period 2023 to 2030. The widespread use of smartphones and tablets has provided a foundation for the growth of digital payments. Mobile devices serve as convenient platforms for conducting transactions, enabling users to make payments anytime and anywhere.

Key Findings of the Study

Shift toward cashless societies is expected to drive the market's growth rate

Governments and financial institutions are actively encouraging the transition towards cashless societies. Promoting digital payments, they aim to enhance transparency, as electronic transactions leave a digital trail. Additionally, reducing cash usage can help combat illicit activities and the black market. Embracing digital payments also fosters financial inclusion, as it enables easier access to financial services for individuals who may not have traditional banking facilities, thus promoting economic participation and empowerment.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2023 to 2030

|

Base Year

|

2022

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

Segments Covered

|

Offering (Solutions, Services), Deployment Model (On-Premises, Cloud), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Mode of Payment (Payment Cards, Point of Sale, Unified Payments Interface (UPI) Service, Mobile Payment, Online Payment), Mode of Usage (Mobile Application, Desktop/Web Browser), Technology (Application Programming Interface (API), Data Analytics and ML, Digital Ledger Technology (DLT), AI and IoT, Biometric Authentication), End-User (BFSI, Healthcare, IT and Telecom, Media and Entertainment, Retail and E-Commerce, Transportation, Others)

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

Market Players Covered

|

PayPal Holdings, Inc (U.S.), Fiserv, Inc (U.S.), Alipay (China), Apple Inc. (U.S.), Google, LLC (U.S.), Visa (U.S.), Mastercard (U.S.), American Express (U.S.), Amazon Pay (U.S.), Aurus Inc. (U.S.), Adyen (Netherlands), Kakao Pay Corp (South Korea), Grab (India), Paytm (India), SAMSUNG (South Korea), UnionPay International (China), MercadoLibre S.R.L (Argentina), WeChat Pay (China), Financial Software and Systems Pvt. Ltd. (U.S.), Novatti Group Ltd (Australia) among others

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

The digital payment market is segmented on the basis of offering, deployment model, and organization size, mode of payment, mode of usage, technology, and end-user.

- On the basis of offering, the market is segmented into solutions and services. The solutions segment is expected to dominate the global digital payment market with a CAGR of 19.2% in the forecast period of 2023 to 2030 due to delivering convenience, security, and efficiency, addressing customer needs, and staying ahead of evolving trends, thus ensuring its market dominance.

- On the basis of the deployment model, the market is segmented into cloud, and on-premises. On-premises segment is expected to dominate the global digital payment market with a CAGR of 18.4% in the forecast period of 2023 to 2030 due to its ability to provide organizations with complete control over their payment infrastructure, ensuring data privacy, compliance, and customized configurations to meet specific business requirements.

- On the basis of organization size, the market is segmented into large enterprises, and small and medium enterprises (SMEs). The large enterprises segment is expected to dominate the global digital payment market with a CAGR of 18.5% in the forecast period of 2023 to 2030 due to their extensive resources, established market presence, economies of scale, and ability to invest in research and development, allowing them to outcompete smaller players and maintain market dominance.

- On the basis of mode of payment, the market is segmented into payment cards, point of sale, unified payments interface (UPI) service, mobile payment, and online payment. The payment cards segment is expected to dominate the global digital payment market with a CAGR of 19.0% in the forecast period of 2023 to 2030 due to their widespread acceptance, ease of use, and familiarity among consumers. They offer convenience, security, and seamless integration with existing payment infrastructure, contributing to their dominance.

In 2023, the payment cards segment is expected to dominate the mode of payment segment in the global digital payment market

In 2023, the payment cards segment is expected to dominate the global digital payment market owing to their wide acceptance, simplicity of use, and ubiquity among customers. They support their dominance by providing ease of use, security, and seamless integration with the current payment infrastructure with a CAGR of 19.0% in the forecast period of 2023 to 2030

- On the basis of mode of usage, the market is segmented into mobile application, and desktop/web browser. The mobile application segment is expected to dominate the global digital payment market with a CAGR of 19.3% in the forecast period of 2023 to 2030 due to the increasing adoption of smartphones. They provide a user-friendly interface, convenient access to payment services, and integration with other features like biometrics, making transactions quick and effortless for users.

- On the basis of technology, the market is segmented into application programming interface (API), data analytics and ML, digital ledger technology (DLT), AI and IoT, and biometric authentication. The application programming interface (API) segment is expected to dominate the global digital payment market with a CAGR of 20.0% in the forecast period of 2023 to 2030 due to enabling seamless integration of payment services into various applications. They facilitate secure data exchange, streamline transactions, and promote interoperability, allowing businesses to leverage a wide range of payment functionalities.

In 2023, the application programming interface (API) segment is expected to dominate the technology segment of the global digital payment market

In 2023, the application programming interface (API) segment is expected to dominate the global digital payment market owing to making it possible for payment services to be seamlessly integrated into different applications. Businesses can take advantage of a variety of payment functionalities to their streamlined transactions, support for interoperability, and facilitation of secure data exchange with a CAGR of20.0% in the forecast period of 2023 to 2030

- On the basis of end-user, the market is segmented into BFSI, healthcare, IT and telecom, media and entertainment, retail and e-commerce, transportation, and others. BFSI (Banking, Financial Services, and Insurance) segment often dominates due to the high volume and value of financial transactions, stringent security requirements, and the need for sophisticated payment systems and infrastructure.

Major Players

Data Bridge Market Research recognizes the following companies as the major digital payment market players in digital payment market are Visa(U.S.), PayPal Holdings, Inc. (U.S.), Mastercard (U.S.), Google (a subsidiary of Alphabet Inc.) (U.S.), Global Payments Inc. (U.S.)

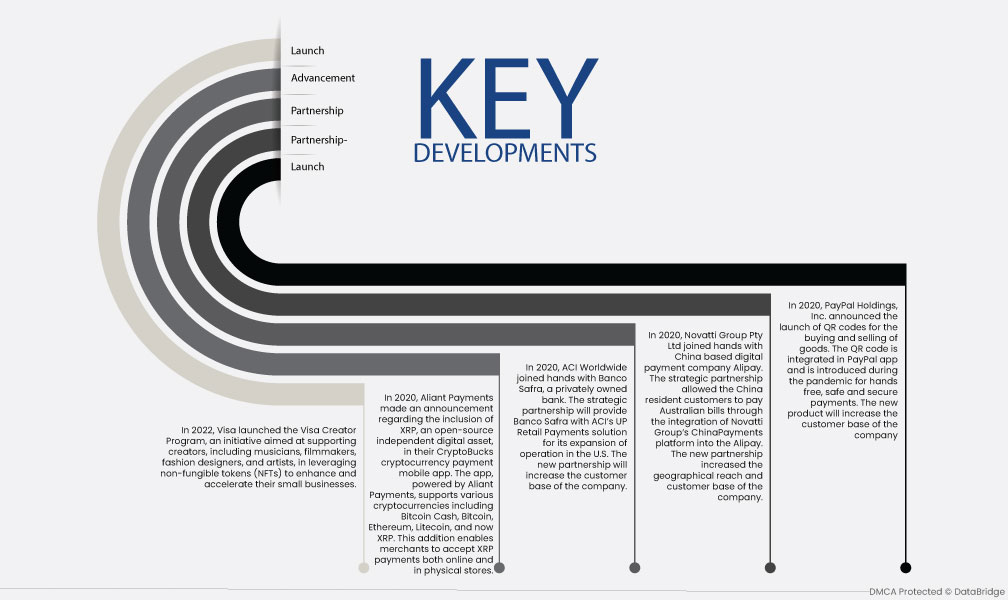

Market Development

- In 2022, Visa launched the Visa Creator Program, an initiative aimed at supporting creators, including musicians, filmmakers, fashion designers, and artists, in leveraging non-fungible tokens (NFTs) to enhance and accelerate their small businesses.

- In 2020, Aliant Payments made an announcement regarding the inclusion of XRP, an open-source independent digital asset, in their CryptoBucks cryptocurrency payment mobile app. The app, powered by Aliant Payments, supports various cryptocurrencies including Bitcoin Cash, Bitcoin, Ethereum, Litecoin, and now XRP. This addition enables merchants to accept XRP payments both online and in physical stores.

- In 2020, ACI Worldwide joined hands with Banco Safra, a privately owned bank. The strategic partnership will provide Banco Safra with ACI’s UP Retail Payments solution for its expansion of operation in the U.S. The new partnership will increase the customer base of the company.

- In 2020, Novatti Group Pty Ltd joined hands with China based digital payment company Alipay. The strategic partnership allowed the China resident customers to pay Australian bills through the integration of Novatti Group’s ChinaPayments platform into the Alipay. The new partnership increased the geographical reach and customer base of the company.

- In 2020, PayPal Holdings, Inc. announced the launch of QR codes for the buying and selling of goods. The QR code is integrated in PayPal app and is introduced during the pandemic for hands free, safe and secure payments. The new product will increase the customer base of the company.

Regional Analysis

Geographically, the countries covered in the digital payment market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

North America is the dominant region in the digital payment market during the forecast period 2023-2030

North America dominates the digital payment market, particularly the U.S. Mobile wallets such as Apple Pay and Google Pay, along with the widespread usage of debit and credit cards for online and in-store transactions, have propelled the growth of digital payments in the region. The presence of established payment processors, financial institutions, and advanced financial infrastructure has further solidified North America's position in the digital payment market.

Asia-Pacific is estimated to be the fastest-growing region in the digital payment market in the forecast period 2023-2030

The Asia-Pacific region has experienced remarkable growth in digital payments and is expected to grow during the forecast period of 2023 to 2030, primarily driven by countries such as China, India, and Southeast Asian nations. The rise of mobile payment platforms, such as Alipay and WeChat Pay, has transformed the payment landscape in the region. High smartphone penetration, a large unbanked population, and the government's push for digital financial inclusion have contributed to the dominance of the Asia-Pacific region in digital payments.

For more detailed information about the digital payment market report, click here – https://www.databridgemarketresearch.com/reports/global-digital-payment-market