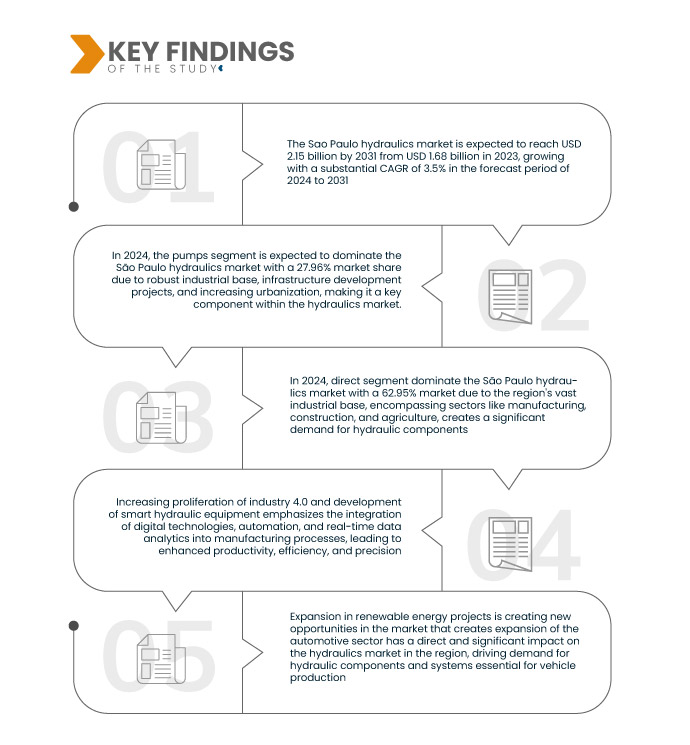

インダストリー4.0の導入拡大は、特にサンパウロの活況を呈する油圧市場において、産業オペレーションの変革をもたらしています。インダストリー4.0は、デジタル技術、自動化、リアルタイムデータ分析を製造プロセスに統合することを重視しており、生産性、効率性、精度の向上につながります。このデジタル変革は、建設、製造、エネルギー生産、石油・ガスなど、様々な産業用途で重要な役割を果たすスマート油圧機器の需要を促進しています。

完全なレポートは https://www.databridgemarketresearch.com/reports/so-paulo-hydraulics-marketからご覧いただけます。

データブリッジマーケットリサーチは、サンパウロの油圧市場は2023年の16億8,000万米ドルから2031年には21億5,000万米ドルに達し、2024年から2031年の予測期間に3.5%という大幅なCAGRで成長すると分析しています。

研究の主な結果

都市におけるインフラ開発の拡大

サンパウロ市は、特に商業および住宅建設部門において、インフラ開発の著しい成長を遂げています。都市の拡大と人口増加、そして土地の利用可能性に支えられ、同市では住宅団地、商業センター、公共インフラの開発など、数多くのプロジェクトが進行中です。この建設ブームは近代的な設備や機械の需要を生み出し、油圧ソリューションにとって魅力的な市場となっています。油圧機器は、掘削機、ブルドーザー、クレーン、ローダー、コンクリートポンプなど、前述の建設活動で使用される重機の操作において重要な役割を果たしています。これらの機械は、パワー、精度、効率性のために油圧システムに依存しており、重い荷物を扱い、さまざまな建設作業を容易に実行することができます。油圧機器は、効率的で安全な建設作業を確保するために不可欠であり、サンパウロのインフラプロジェクトにおいて重要なコンポーネントとなっています。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(2021~2016年にカスタマイズ可能)

|

定量単位

|

収益(10億米ドル)

|

対象セグメント

|

コンポーネント別(ポンプ、バルブ、シリンダー、モーター、アキュムレーター、フィルター、トランスミッション)、タイプ別(モバイルおよび産業用)、流通チャネル別(直接および間接)

|

対象となる市場プレーヤー

|

KSB Brasil Ltda(ブラジル)、Parker Hannifin Corp(米国)、Bosch Rexroth AG(ドイツ)、Voith GmbH & Co. KGaA(ドイツ)、M+S HYDRAULIC PLC(ブルガリア)、ANDRITZ(オーストリア)、BUCHER HYDRAULICS(スイス)、HAWE Hydraulik SE(ドイツ)、Danfoss A/S(デンマーク)、Jiangsu Hengli Hydraulic Co., LTD.(中国)、FLUTROL(ブラジル)、UFI Filters(イタリア)、Fluid Power Hydraulics(ブラジル)など

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。

|

セグメント分析

サンパウロの油圧市場は、コンポーネント、タイプ、流通チャネルに基づいて 3 つの主要なセグメントに分割されています。

- コンポーネントに基づいて、サンパウロの油圧市場は、ポンプ、バルブ、シリンダー、モーター、アキュムレーター、フィルター、トランスミッション、その他に分類されます。

2024年には、ポンプがサンパウロの油圧市場を支配すると予想されています。

2024年には、堅固な産業基盤、インフラ開発プロジェクト、都市化の進展により、ポンプ部門がサンパウロの油圧市場で27.96%の市場シェアを占め、油圧市場の主要構成要素になると予想されています。

- タイプ別では、サンパウロの油圧市場はモバイルと産業に分類されます。

2024年にはモバイルがサンパウロの油圧市場を支配すると予想されている

2024年には、モバイル油圧機器に大きく依存している建設、鉱業、農業産業により、モバイル部門がサンパウロの油圧市場を67.75%の市場シェアで支配すると予想されています。

- サンパウロの油圧市場は、流通チャネルに基づいて直接販売と間接販売に区分されています。2024年には、直接販売がサンパウロの油圧市場において62.95%の市場シェアを占めると予想されています。

主要プレーヤー

Data Bridge Market Research は、KSB Brasil Ltda (ブラジル)、Parker Hannifin Corp (米国)、Bosch Rexroth AG (ドイツ)、Voith GmbH & Co. KGaA (ドイツ)、M+S HYDRAULIC PLC. (ブルガリア) をこの市場の主要な市場プレーヤーとして分析しています。

市場動向

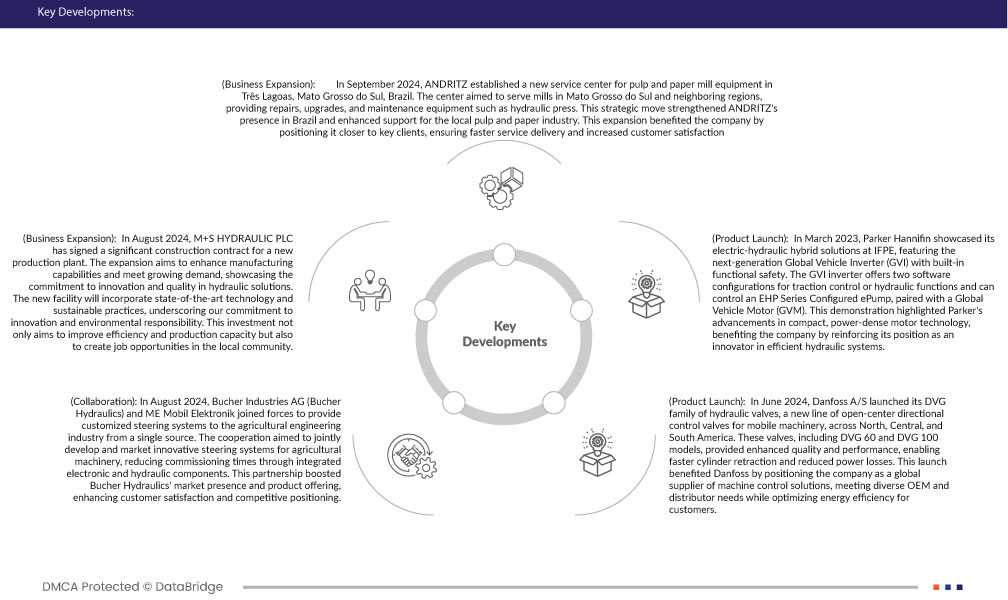

- 2024年9月、アンドリッツはブラジルのマットグロッソ・ド・スル州トレス・ラゴアスにパルプ・製紙工場向け設備の新サービスセンターを設立しました。このセンターは、マットグロッソ・ド・スル州および近隣地域の工場に対し、油圧プレスなどの設備の修理、アップグレード、メンテナンスを提供することを目的としていました。この戦略的な移転により、アンドリッツはブラジルにおけるプレゼンスを強化し、地元のパルプ・製紙業界へのサポートを強化しました。この拡張により、主要顧客への距離が縮まり、サービス提供の迅速化と顧客満足度の向上が実現しました。

- 2024年8月、M+S HYDRAULIC PLCは新生産工場の建設契約を締結しました。この拡張は、製造能力の向上と需要の増大への対応を目的としており、油圧ソリューションにおける革新と品質へのコミットメントを示すものです。新施設は最先端の技術と持続可能な生産手法を取り入れ、革新と環境への責任に対する当社のコミットメントを明確化します。この投資は、効率性と生産能力の向上だけでなく、地域社会における雇用機会の創出も目的としています。

- 2024年8月、Bucher Industries AG(Bucher Hydraulics)とME Mobil Elektronikは、農業機械業界向けにカスタマイズされたステアリングシステムをワンストップで提供するために提携しました。この提携は、農業機械向けの革新的なステアリングシステムを共同で開発・販売し、電子部品と油圧部品の統合により試運転時間を短縮することを目指しました。この提携により、Bucher Hydraulicsの市場プレゼンスと製品ラインナップが強化され、顧客満足度と競争力が向上しました。

- 2024年6月、ダンフォスA/Sは、北米、中米、南米全域で、移動機械向けオープンセンター方向制御弁の新製品であるDVG油圧バルブファミリーを発売しました。DVG 60およびDVG 100モデルを含むこれらのバルブは、品質と性能が向上し、シリンダーの収縮速度が速くなり、動力損失が低減しました。この発売により、ダンフォスは機械制御ソリューションのグローバルサプライヤーとしての地位を確立し、多様なOEMおよび販売代理店のニーズに応えると同時に、顧客のエネルギー効率を最適化することができました。

- 2023年3月、パーカー・ハネフィンはIFPEにおいて、機能安全を内蔵した次世代グローバル車両インバータ(GVI)を搭載した電動油圧ハイブリッドソリューションを展示しました。GVIインバータは、トラクションコントロールまたは油圧機能用の2つのソフトウェア構成を提供し、グローバル車両モーター(GVM)と組み合わせたEHPシリーズ構成のeポンプを制御できます。このデモンストレーションは、パーカーのコンパクトで高出力のモーター技術の進歩を強調し、効率的な油圧システムにおけるイノベーターとしての地位を強化することで、同社に利益をもたらしました。

サンパウロ油圧市場レポートの詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/so-paulo-hydraulics-market