サウジアラビアの建築用ガラス市場は、国内の建築建設および設計に使用されるガラスの生産、流通、そして適用を網羅しています。この市場には、強化ガラス、合わせガラス、断熱ガラス、コーティングガラスなど、現代建築に不可欠な様々な種類のガラス製品が含まれており、美観、エネルギー効率、そして安全機能を備えています。市場成長の主な要因としては、急速な都市化、インフラプロジェクトへの投資増加、そして環境に優しくエネルギー効率の高い建築資材への需要の急増などが挙げられます。さらに、持続可能な開発を促進する政府の取り組みも市場をさらに推進しています。主な用途は住宅、商業、産業用建物で、ガラスはファサード、窓、そして内装に不可欠な要素となっています。この市場は、地元メーカーと国際的プレーヤーの両方が参入する競争の激しい市場環境を特徴としています。全体として、サウジアラビアの建築用ガラス市場は、この地域の建設業界における近代化と持続可能性という幅広いトレンドを反映し、成長が見込まれています。

完全なレポートは https://www.databridgemarketresearch.com/reports/saudi-arabia-architectural-glass-marketでご覧いただけます。

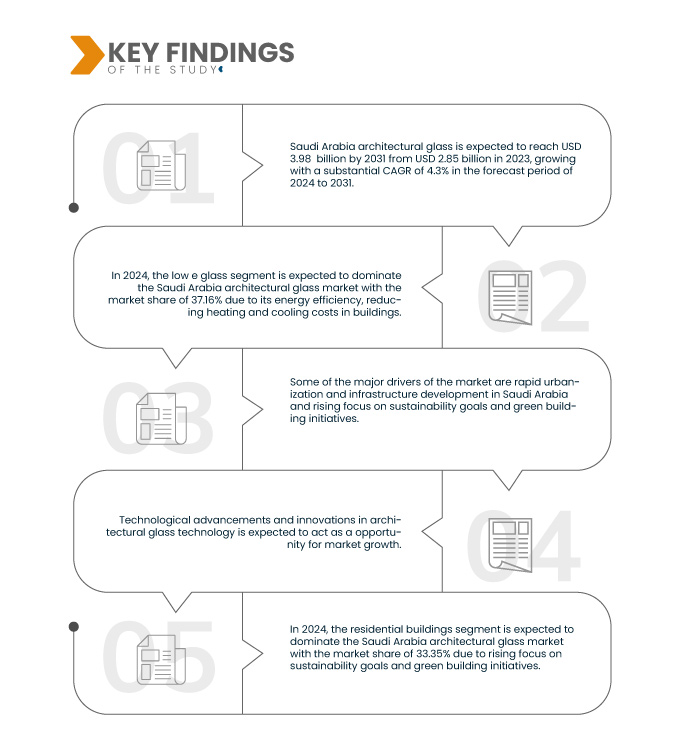

データブリッジマーケットリサーチは、サウジアラビアの建築用ガラス市場は、2023年の28億5,000万米ドルから2031年には39億8,000万米ドルに達し、2024年から2031年の予測期間に4.3%という大幅なCAGRで成長すると分析しています。

研究の主な結果

- 持続可能性目標とグリーンビルディングイニシアチブへの注目の高まり

サウジアラビアの建築用ガラス市場は、持続可能性目標とグリーンビルディングへの取り組みへの関心の高まりを主な原動力として、大幅な成長を遂げています。国がより持続可能な未来へと向かう中で、建築用ガラスはエネルギー効率の向上、二酸化炭素排出量の削減、そして環境に配慮した建築手法の促進において重要な役割を果たしています。

建築用ガラス市場の主要な牽引力の一つは、建物のエネルギー効率を向上させるという本質的な能力です。低放射率(Low-E)ガラスやトリプルガラスといった高性能ガラスは、熱伝達を最小限に抑えることでエネルギー消費を大幅に削減できます。サウジアラビアのように気温が上昇しやすい国では、エネルギー効率の高いガラスは快適な室内環境を維持し、エアコンへの依存度を軽減するのに役立ちます。これは消費者の光熱費を削減するだけでなく、サウジアラビア・ビジョン2030の目標に沿って、エネルギー消費量全体を削減するという国家的な取り組みにも貢献します。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(2016~2021年にカスタマイズ可能)

|

定量単位

|

収益(10億米ドル)

|

対象セグメント

|

タイプ(Low Eガラス、断熱ガラス、合わせガラス、太陽光反射ガラス、焼きなましガラス、防犯ガラス、強化サンドイッチガラス、強化ガラス、低鉄ガラス、着色ガラス、模様付きガラス、無垢ガラス、ボディ着色ガラス、熱強化ガラス、中空ガラスなど)、厚さ(4~8MM、9~12MM、13~16MM、16MM以上、4MM未満)、用途(住宅、商業ビル、公共施設、家庭、自動車)、流通チャネル(直販および小売販売)

|

対象国

|

サウジアラビア

|

対象となる市場プレーヤー

|

Guardian Industries Holdings(米国)、Saint-Gobain(フランス)、ARABIAN PROCESSING GLASS CO.(サウジアラビア)、Emirates Glass LLC(UAE)、Al-Ashoury Glass(サウジアラビア)、AGC Obeiken Glass(サウジアラビア)、Al Andalus Glass(サウジアラビア)、Alma(サウジアラビア)、IKKGlass(サウジアラビア)、Rawom Trading Company(サウジアラビア)、REGIONGLASS(サウジアラビア)

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力の概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。

|

セグメント分析

サウジアラビアの建築用ガラス市場は、種類、厚さ、用途、流通チャネルに基づいて 4 つの主要なセグメントに分割されています。

- タイプに基づいて、市場は、低Eガラス、断熱ガラス、合わせガラス、太陽光反射ガラス、アニールガラス、セキュリティガラス、強化サンドイッチガラス、強化ガラス、低鉄ガラス、着色ガラス、模様付きガラス、ソリッドガラス、ボディ着色ガラス、熱強化ガラス、中空ガラス、その他に分類されます。

2024年には、低放射ガラスセグメントがサウジアラビアの建築用ガラス市場を支配すると予想されています。

2024年には、エネルギー効率が高く、建物の冷暖房コストを削減できるため、低放射ガラスセグメントが37.16%の市場シェアを獲得し、市場を支配すると予想されています。

- 厚さに基づいて、市場は4~8MM、9~12MM、13~16MM、16MM以上、4MM未満に分類されます。2024年には、4~8MMセグメントがサウジアラビアの建築用ガラス市場において34.55%の市場シェアを占めると予想されます。

- アプリケーションに基づいて、市場は住宅、商業ビル、公共ビル、家庭用、自動車用に分類されます。

2024年には、住宅建築セグメントがサウジアラビアの建築用ガラス市場を支配すると予想されています。

2024年には、持続可能性の目標とグリーンビルディングの取り組みへの注目が高まることにより、住宅建築セグメントが33.35%の市場シェアで市場を支配すると予想されています。

- 流通チャネルに基づいて、市場は直接販売と小売販売に区分されます。2024年には、直接販売が市場シェア76.45%で市場を独占すると予想されます。

主要プレーヤー

データブリッジマーケットリサーチは、サウジアラビアの建築用ガラス市場で活動する主要企業として、ガーディアン・インダストリーズ・ホールディングス(米国)、サンゴバン(フランス)、アラビアン・プロセッシング・グラス・カンパニー(サウジアラビア)、エミレーツ・グラスLLC(UAE)、アル・アシュリー・グラス(サウジアラビア)を分析しています。

市場動向

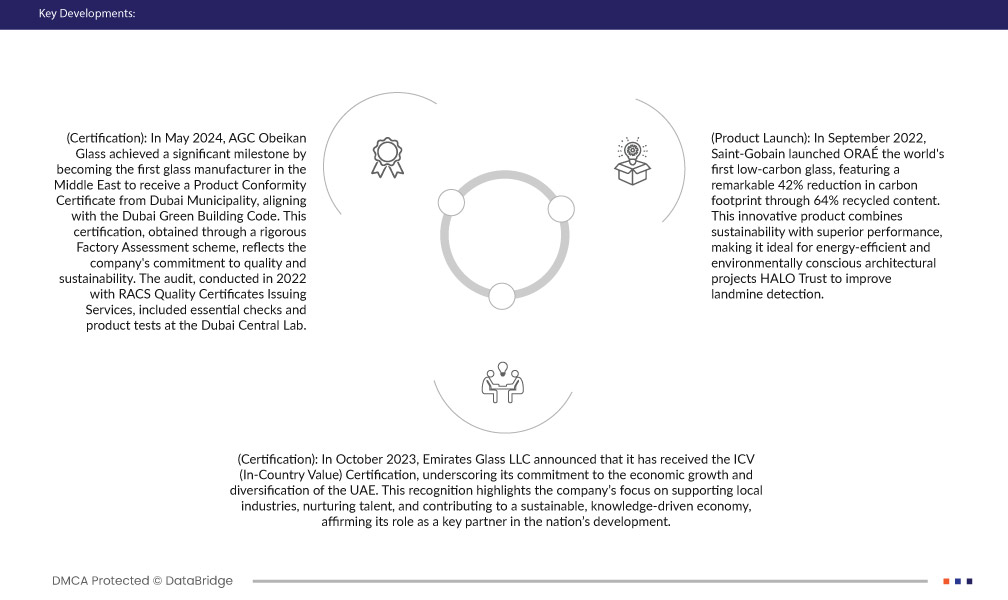

- 2024年5月、Centuro Globalが発表した記事によると、ビジョン2030は、迫り来るピークオイルの到来に備え、サウジアラビア経済を石油依存から脱却させ、多様化させることを目指している。ムハンマド・ビン・サルマン皇太子の指揮下で、この構想は文化発展を含む社会改革も推進している。計画は中間地点に達し、進展は明らかであるものの、これらの野心的な目標を完全に達成するには依然として課題が残る。

- 2022年9月、サンゴバンは世界初の低炭素ガラス「ORAÉ」を発売しました。再生素材を64%使用することで、二酸化炭素排出量を42%削減するという驚異的な性能を誇ります。この革新的な製品は、持続可能性と優れた性能を兼ね備えており、エネルギー効率と環境に配慮した建築プロジェクトに最適です。HALO Trustは地雷探知性能の向上に貢献しています。

- 2023年10月、エミレーツ・グラスLLCはICV(In-Country Value)認証を取得したと発表し、UAEの経済成長と多様化へのコミットメントを強調しました。この認証は、同社が地元産業の支援、人材育成、持続可能な知識主導型経済への貢献に重点を置いていることを浮き彫りにし、国の発展における重要なパートナーとしての役割を確固たるものにしています。

サウジアラビアの建築用ガラス市場レポートの詳細については、こちらをクリックしてください – https://www.databridgemarketresearch.com/reports/saudi-arabia-architectural-glass-market