メキシコの化学品流通市場は、同国の産業情勢において極めて重要な役割を果たしているダイナミックな分野です。特殊化学品、産業用ガス、原材料など、多様な製品を特徴とするこの市場は、さまざまな製薬、農業、製造業にサービスを提供しています。メキシコの戦略的な立地により、同国は地域のサプライ チェーンにおける主要プレーヤーとしての地位が強化されています。

完全なレポートにアクセスするには、 https://www.databridgemarketresearch.com/reports/mexico-chemical-distribution-market

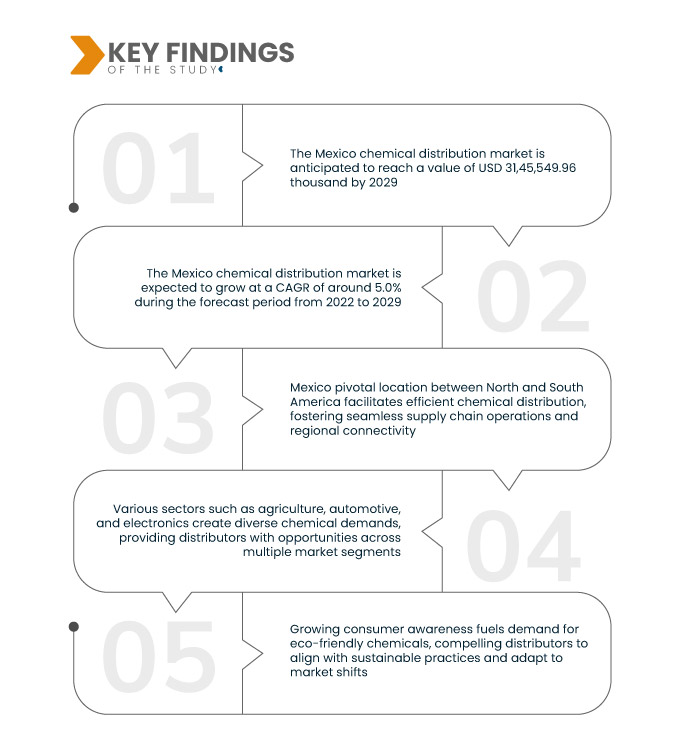

データブリッジマーケットリサーチの分析によると、 メキシコの化学品流通市場2021年の21,29,032.02千米ドルは、2029年までに31,45,549.96千米ドルに達すると予想されており、2022年から2029年の予測期間中に5.0%のCAGRで成長すると予想されています。メキシコの成長産業部門、特に製造業と製薬業は、多様な化学製品に対する需要の高まりを促進しています。この工業化の急増は、メキシコの化学品流通市場の大幅な成長を促進します。

研究の主な結果

貿易協定が市場の成長率を押し上げると予想される

米国・メキシコ・カナダ協定 (USMCA) などの貿易協定は、メキシコの化学品流通市場の触媒として機能し、国境を越えた取引を合理化します。貿易障壁を減らし、規制の整合を確保することで、これらの協定は市場へのアクセス性を高め、国際的なパートナーとの協力を促進し、化学製品のより効率的な流れを促進します。これにより、流通業者の成長機会が促進され、流通業者がより簡単かつ効果的に業務を遂行できる、強固で相互接続された市場が促進されます。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2022年から2029年

|

|

基準年

|

2021年

|

|

歴史的な年

|

2020 (2014 ~ 2019 にカスタマイズ可能)

|

|

量的単位

|

収益(千米ドル)、数量(単位)、価格(米ドル)

|

|

対象となるセグメント

|

化学物質の種類 (汎用化学物質、特殊化学物質)、流通チャネル (B2B、第三者流通、 電子商取引 その他)、配送方法(航空配送、鉄道配送、道路配送、船舶配送)、化学品包装(ドラム缶、中容量容器(IBC)、フレキシタンクなど)、包装サイズ(100~250リットル、250~500リットル、500リットル以上)

|

|

対象となる市場プレーヤー

|

Brenntag SE(ドイツ)、DKSH Management Ltd.(スイス)、Univar Solutions Inc.(米国)、Hydrite Chemical(米国)、Wilbur-Ellis Holdings, Inc.(米国)、IMCD Group(オランダ)、ICC Industries Inc.(米国)、Azelis(ベルギー)、HELM AG(ドイツ)、Aceto(米国)、Prinova Group LLC.(米国)、Barentz(オランダ)、Caldic BV(オランダ)、Safic-Alcan(フランス)、GTM(米国)など

|

|

レポートで取り上げられているデータポイント

|

市場価値、成長率、セグメンテーション、地理的範囲、主要企業などの市場シナリオに関する洞察に加えて、Data Bridge Market Researchが厳選した市場レポートには、詳細な専門家分析、地理的に代表される企業ごとの生産状況、および生産能力、販売代理店とパートナーのネットワークレイアウト、詳細かつ最新の価格傾向分析、サプライチェーンと需要の赤字分析。

|

セグメント分析:

メキシコの化学物質流通市場は、化学物質の種類、流通チャネル、流通方法、化学物質の包装、および包装サイズに基づいて分割されています。

- 化学物質の種類に基づいて、メキシコの化学物質流通市場は汎用化学物質と特殊化学物質に分類されます。

- 流通チャネルに基づいて、メキシコの化学薬品流通市場はB2B、サードパーティ流通、電子商取引などに分類されます。

- 流通方法に基づいて、メキシコの化学薬品流通市場は航空流通、鉄道流通、道路流通、海運流通に分類されます。

- メキシコの化学品流通市場は、化学品の包装に基づいて、ドラム缶、中間バルクコンテナ(IBC)、フレキシタンクなどに分類されます。

- メキシコの化学品流通市場は、包装サイズに基づいて、100 ~ 250 リットル、250 ~ 500 リットル、および 500 リットル以上に分類されます。

主要プレーヤー

データブリッジマーケットリサーチは、メキシコの化学品流通市場における主要なメキシコ化学品流通市場プレーヤーとして、HELM AG(ドイツ)、Aceto(米国)、Prinova Group LLC(米国)、Barentz(オランダ)、Caldic BV(オランダ)、Safic-Alcan(フランス)、GTM(米国)を認定しています。

市場動向

- 2022 年 12 月、Wind Point Partners の一部である Quantix は Mid-States Packaging を買収し、北米の大手化学サプライチェーン サービス プロバイダーとしての地位を強化しました。この買収により、Quantix の範囲はテキサス州、北東部、中部大西洋岸の 11 施設に拡大され、ドライバルク輸送、倉庫保管、輸出サービスの能力が強化されます。

- 2021年8月、化学薬品および原料流通のリーダーであるBrenntag SEは、Matrix Chemical, LLCを買収しました。北米の主要アセトン販売業者として、この戦略的な動きはBrenntagの能力を強化し、効率的な顧客サービスを可能にし、溶剤の需要の高まりに対応します。この買収により、北米市場でのBrenntagの地位が強化され、流通ネットワークが強化されます。

- 2021 年 8 月、Univar Solutions Inc. は、カナダのブリティッシュコロンビア州アボッツフォードで SAP 対応施設の建設開始を発表しました。 2023 年上半期にオープン予定のこのカスタムデザインのサイトは、2050 年までに実質ゼロ排出を目指す同社の持続可能性への取り組みを反映しています。この拡張により、Univar はより幅広い顧客ベースを引きつけ、この地域での存在感を強化することができます。

- 2021年7月、化学品流通の世界的リーダーであるBrenntag SEは、プラチナム・エクイティから米国を拠点とする食品原料販売業者JM Swankを買収したことを発表しました。この戦略的な動きにより、Brenntagは食品化学品分野での存在感を拡大し、ポートフォリオを強化し、業界のより幅広い顧客基盤に対応するためのサービスを強化することになります。

詳細については、 メキシコの化学薬品流通市場レポート、ここをクリック –https://www.databridgemarketresearch.com/reports/mexico-chemical-distribution-market