潤滑剤は、接触面間の摩擦と発熱を最小限に抑えるために用いられる有機化合物です。また、力や粒子を伝達したり、温度を調節したりする特性を持つ場合もあり、高温下でもその効果を維持することが期待されています。工業化の進展は市場にとって極めて重要な推進力であり、潤滑剤の消費量と業界全体の状況に大きな影響を与えています。この推進力には、工業化と潤滑剤の共生関係を浮き彫りにする幅広い要因が絡み合っています。

工業化の進展は、市場にとってダイナミックかつ多面的な原動力となっています。様々な産業、セクター、用途を網羅し、それらすべてが円滑で効率的、そして環境に配慮した操業のために潤滑油に依存しています。工業化が進む中で、潤滑油市場は産業の成長と持続可能性に不可欠な要素であり続け、様々なセクターの機械・装置のシームレスな稼働を確保します。したがって、工業化の進展は機械・装置における潤滑油の使用を促進し、市場の成長を牽引すると予想されます。

完全なレポートは https://www.databridgemarketresearch.com/reports/us-lubricants-marketでご覧いただけます。

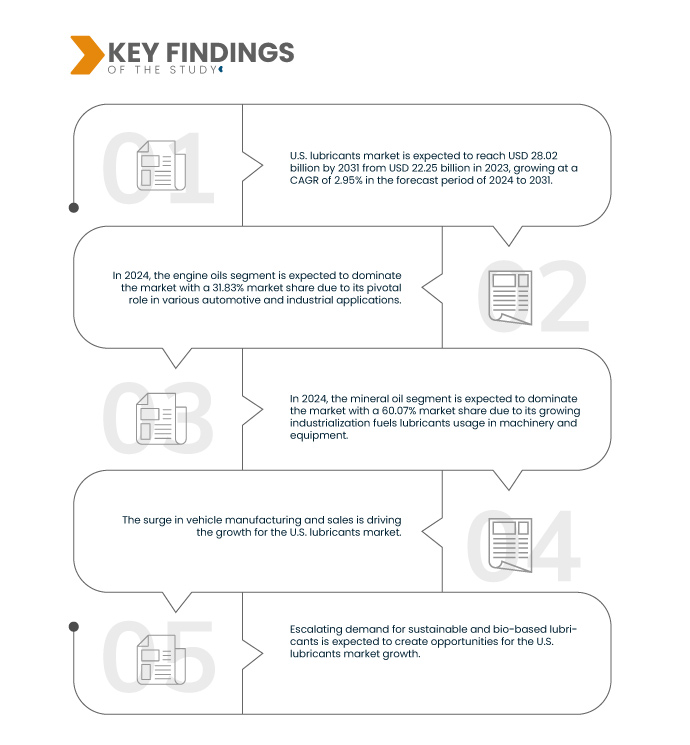

データブリッジマーケットリサーチは、米国の潤滑油市場は2023年の222.5億米ドルから2031年には280.2億米ドルに達し、2024年から2031年の予測期間に2.95%のCAGRで成長すると分析しています。

研究の主な結果

自動車製造と販売の急増

自動車の生産・販売の急増は、市場を大きく牽引する要因として浮上しています。この急増には、潤滑油業界への影響を及ぼしている複数の相互に関連した要因があります。米国の自動車産業は、消費者需要の高まり、新興国における中流階級人口の拡大、そして都市化の進展に牽引され、目覚ましい成長を遂げてきました。自動車の所有を望む人が増えるにつれ、こうした需要に応えるために自動車製造が急増しています。これは、エンジンの性能維持とメンテナンスのために潤滑油が必要となるため、潤滑油の消費量の増加につながります。

世界中で自動車が普及し、自動車所有率は大幅に増加しました。これには乗用車だけでなく、トラックやバスなどの商用車も含まれます。これらの車両は多くの地域で交通システムの基盤を担っており、エンジンの効率と寿命を維持するために定期的な潤滑油の使用が不可欠です。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2021年(2016年から2021年までカスタマイズ可能)

|

定量単位

|

収益(10億米ドル)

|

対象セグメント

|

製品(エンジンオイル、油圧油、循環液、ギアオイル、グリース、金属加工油、風力タービンオイル、コンプレッサーオイル、ガスタービンオイル、伝熱油、防錆油、浸透剤など)、ベースオイル(鉱油、合成油、半合成油、バイオベースオイル)、グレード(工業用および食品用)、フォーマット(バルク、ミニバルク、小パックなど)、販売チャネル(販売代理店、小売、Eコマース、エンドユーザーへの直接販売)、最終用途(自動車および輸送、海洋、エネルギーおよび発電、冶金および金属加工、化学製造、建設機械/土木、重機、鉱業、工業、航空宇宙および航空、鉄道、農業、電気/ユーティリティ、製造プラント、石油およびガス、食品および飲料、セメント、プラスチックおよびゴム加工、繊維、パルプおよび紙、コンシューマー/DIY、その他

|

対象となる市場プレーヤー

|

シェル(英国)、エクソンモービル(米国)、フックス(ドイツ)、USベンチャー(米国)、BASF(ドイツ)、BP plc(英国)、シェブロン(米国)、デュポン(米国)、ENEOS(日本)、ルクオイル(ロシア)、モチュール(フランス)、ペトロリアムナショナルベルハッド(ペトロナス)(マレーシア)、フィリップス66カンパニー(米国)、トタルエナジーズ(フランス)、クエーカーケミカルコーポレーション(クエーカーホートン)(米国)など

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力の概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。

|

セグメント分析

米国の潤滑油市場は、製品、基油、グレード、形式、販売チャネル、最終用途に基づいて 6 つの主要なセグメントに分割されています。

- 製品に基づいて、米国の潤滑油市場は、エンジンオイル、油圧油、循環液、ギアオイル、グリース、金属加工油、風力タービンオイル、コンプレッサーオイル、ガスタービンオイル、伝熱油、防錆油、浸透剤、その他に分類されます。

2024年には、エンジンオイルセグメントが米国の潤滑油市場を支配すると予想されています。

2024年には、エンジンオイル部門がさまざまな自動車および産業用途で重要な役割を果たしているため、31.83%の市場シェアで市場を支配すると予想されています。

- 米国の潤滑油市場は、ベースオイルに基づいて、鉱油、合成油、半合成油、バイオベースオイルに分類されます。

2024年には、鉱油セグメントが米国の潤滑油市場を支配すると予想されている。

2024年には、機械設備における工業化燃料の潤滑油としての使用の増加により、鉱油セグメントが60.07%の市場シェアで市場を支配すると予想されています。

- グレードに基づいて、米国の潤滑油市場は工業用と食品用の2つに区分されています。2024年には、工業用セグメントが97.53%の市場シェアで市場を独占すると予想されています。

- 米国の潤滑油市場は、形態に基づいてバルク、ミニバルク、小パック、その他に分類されます。2024年には、バルクセグメントが43.98%の市場シェアで市場を独占すると予想されています。

- 販売チャネルに基づいて、米国の潤滑油市場は、販売代理店、小売、電子商取引、エンドユーザーへの直接販売に分類されます。2024年には、販売代理店セグメントが74.89%の市場シェアで市場を独占すると予想されています。

- 米国の潤滑油市場は、最終用途別に、自動車・輸送、海洋、エネルギー・発電、冶金・金属加工、化学製造、建設機械・土木、重機、鉱業、工業、航空宇宙・航空、鉄道、農業、電気・公益事業、製造プラント、石油・ガス、食品・飲料、セメント、プラスチック・ゴム加工、繊維、パルプ・紙、消費者・DIY、その他に分類されています。2024年には、自動車・輸送分野が12.80%の市場シェアで市場を席巻すると予想されています。

主要プレーヤー

データブリッジマーケットリサーチは、米国潤滑油市場の主要企業として、シェル(英国)、エクソンモービルコーポレーション(米国)、BP plc(英国)、シェブロンコーポレーション(米国)、デュポン(米国)、ルクオイル(ロシア)などを認識しています。

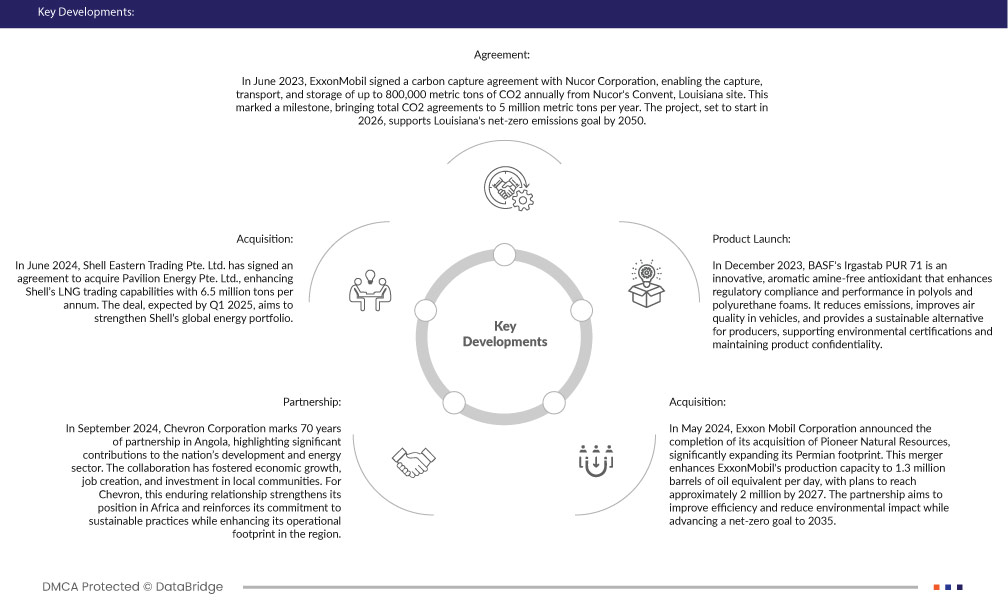

市場動向

- 2024年6月、シェル・イースタン・トレーディング社はパビリオン・エナジー社を買収する契約を締結しました。これにより、シェルのLNG取引能力は年間650万トンに拡大します。この取引は2025年第1四半期までに完了する予定で、シェルのグローバルエネルギーポートフォリオの強化を目指しています。

- 2024年5月、エクソンモービルはパイオニア・ナチュラル・リソーシズの買収完了を発表し、パーミアン地域における事業展開を大幅に拡大しました。この合併により、エクソンモービルの生産能力は日量130万バレル相当に増強され、2027年までに約200万バレルに達する予定です。この提携は、効率性の向上と環境への影響の低減を図り、2035年までにネットゼロ目標の達成を推進することを目指しています。

- 2023年12月、BASFのIrgastab PUR 71は、芳香族アミンを含まない革新的な酸化防止剤で、ポリオールおよびポリウレタンフォームの規制遵守と性能を向上させます。排出量を削減し、車内の空気質を改善するとともに、生産者に持続可能な代替品を提供し、環境認証の取得と製品の機密性維持に貢献します。

- 2024年9月、シェブロン社はアンゴラにおけるパートナーシップ70周年を迎え、同国の開発とエネルギーセクターへの多大な貢献を称えます。この協力関係は、経済成長、雇用創出、そして地域社会への投資を促進してきました。シェブロン社にとって、この永続的な関係はアフリカにおける地位を強化し、持続可能な事業へのコミットメントを強化するとともに、同地域における事業展開の拡大にもつながります。

- エクソンモービルは2023年6月、ニューコア社と二酸化炭素回収契約を締結しました。これにより、ニューコア社のルイジアナ州コンベント工場から年間最大80万トンの二酸化炭素を回収、輸送、貯留することが可能になります。これは画期的な出来事であり、二酸化炭素回収契約の総量は年間500万トンに達します。2026年に開始予定のこのプロジェクトは、ルイジアナ州が2050年までにネットゼロエミッションを達成するという目標を支えるものです。

米国潤滑油市場レポートの詳細については、こちらをクリックしてください – https://www.databridgemarketresearch.com/reports/us-lubricants-market