飼料添加物など ビタミン、鉱物、そして プロバイオティクス ラテンアメリカの家畜や家禽の健康には、飼料添加物が不可欠です。これらの添加物は栄養不足を防ぎ、動物が成長と健康に不可欠な要素を摂取できるようにします。プロバイオティクスは免疫システムを強化し、この地域で蔓延している病気に対する感受性を低下させます。適切なビタミンとミネラルの補給は、骨の発達と生殖の健康に役立ちます。栄養上の課題が変化する可能性があるラテンアメリカの気候では、飼料添加物はさまざまな環境で最適な健康を維持する上で重要な役割を果たします。

完全なレポートにアクセスするには、 https://www.databridgemarketresearch.com/reports/latin-america-feed-additives-market

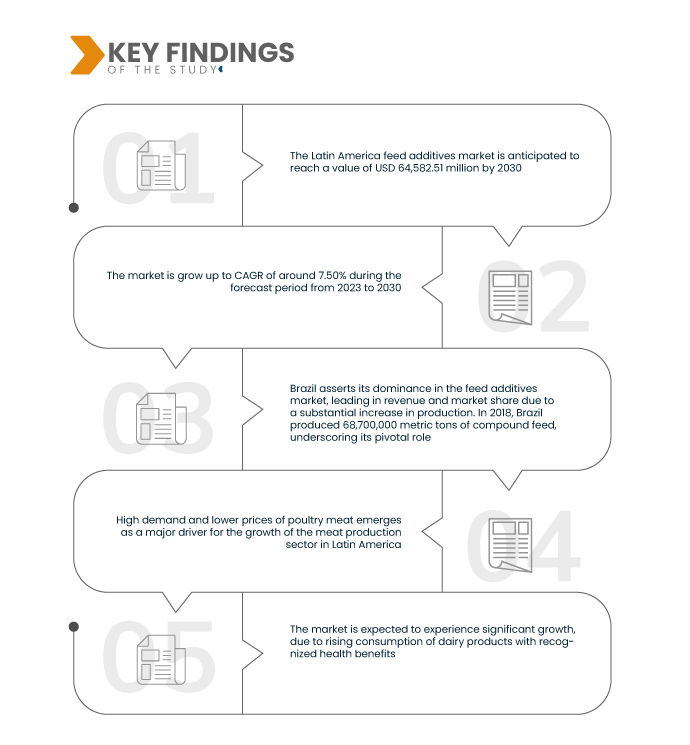

データブリッジマーケットリサーチの分析によると、 ラテンアメリカの飼料添加物市場 2030年までに645億8,251万米ドルに達すると予想され、2022年には362億1,155万米ドルに達し、2023年から2030年の予測期間中に7.50%のCAGRを記録すると予想されています。市場は、肉、卵、乳製品、乳製品ベースの製品の消費の増加により成長しています。動物由来製品に対する需要の急増は、畜産業の成長の原動力として機能します。

研究の主な結果

家禽生産における天然成長促進剤の普及の増加は、市場の成長率を押し上げると予想される。

ラテンアメリカの飼料添加物市場は、家禽生産における天然成長促進剤への移行によって推進されています。この変化は、抗生物質耐性に対する世界的な懸念への対応であり、規制の変更を促し、より健康的で持続可能な方法で生産された食品に対する消費者の好みに合致しています。環境に優しい慣行の重要性が高まる中、この地域の家禽生産者は、市場競争力を高めるために天然成長促進剤を採用しています。この戦略的な動きは、環境の持続可能性に対処するだけでなく、家禽製品を抗生物質フリーとして位置付け、変化する消費者の需要に対応します。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2023-2030

|

|

基準年

|

2022

|

|

歴史的な年

|

2021 (2015~2020年にカスタマイズ可能)

|

|

定量単位

|

売上高(百万米ドル)、販売数量(個数)、価格(米ドル)

|

|

対象セグメント

|

添加物の種類(酵素、 アミノ酸、飼料酸性化剤、マイコトキシン解毒剤、プロバイオティクス、ビタミン、保存料、香料および甘味料、窒素、植物性、カロテノイド、微量ミネラル、抗酸化剤、その他)、ライフサイクル(育成飼料、肥育飼料、スターター飼料、育雛飼料)、形態(粉末/乾燥、液体)、カテゴリー(従来型、有機)、家畜(反芻動物、家禽、豚、その他)、エンドユーザー(飼料メーカー、契約メーカー、家畜生産者、その他)

|

|

対象国

|

メキシコ、コロンビア、ペルー、エクアドル、グアテマラ、コスタリカ、パナマ、エルサルバドル、ホンジュラス、ドミニカ共和国、ジャマイカ、プエルトリコ、ブラジル、アルゼンチン、チリ、パラグアイ、ウルグアイ、その他のラテンアメリカ諸国

|

|

対象となる市場プレーヤー

|

Cargill, Incorporated(米国)、ADM(米国)、DuPont(米国)、BASF SE(ドイツ)、DSM(オランダ)、Chr. Hansen A/S(デンマーク)、Alltech(米国)、Kemin Industries Inc.(米国)、Palital Feed Additives BV(オランダ)、Bentoli(米国)、Adisseo(フランス)、Novozymes(デンマーク)、TEGASA(スペイン)、Tate & Lyle(英国)、味の素株式会社(日本)、Nutreco(オランダ)、Global Nutrition International(フランス)、Centafarm SRL(イタリア)、NUQO Feed Additives(フランス)、Novus International, Inc.(米国)

|

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要企業などの市場シナリオに関する洞察に加えて、専門家による詳細な分析、地理的に表された企業別の生産量と生産能力、販売業者とパートナーのネットワークレイアウト、詳細かつ最新の価格動向分析、サプライチェーンと需要の不足分析も含まれています。

|

セグメント分析:

ラテンアメリカの飼料添加物市場は、添加物の種類、ライフサイクル、形態、カテゴリ、家畜、およびエンドユーザーに基づいて分類されています。

- 添加物の種類に基づいて、ラテンアメリカの飼料添加物市場は、酵素、アミノ酸、 飼料酸性化剤、マイコトキシン解毒剤、プロバイオティクス、ビタミン、保存料、香料および甘味料、窒素、植物性、カロテノイド、微量ミネラル、抗酸化剤など

- ライフサイクルに基づいて、ラテンアメリカの飼料添加物市場は、育成飼料、肥育飼料、スターター飼料、ブローダー飼料に分類されます。

- 形態に基づいて、ラテンアメリカの飼料添加物市場は粉末/乾燥、および液体に分類されます。

- カテゴリーに基づいて、ラテンアメリカの飼料添加物市場は、従来のものと有機のものに分けられます。

- 家畜に基づいて、ラテンアメリカの飼料添加物市場は反芻動物、家禽、豚、その他に分類されます。

- エンドユーザーに基づいて、ラテンアメリカの飼料添加物市場は、飼料メーカー、契約製造業者、畜産生産者、その他に分類されます。

主要プレーヤー

データブリッジマーケットリサーチは、ラテンアメリカ飼料添加物市場における主要なラテンアメリカ飼料添加物市場プレーヤーとして、カーギル社(米国)、ADM社(米国)、デュポン社(米国)、BASF SE社(ドイツ)、DSM社(オランダ)、Chr. Hansen A/S社(デンマーク)、オールテック社(米国)、ケミンインダストリーズ社(米国)、Palital Feed Additives BV社(オランダ)を挙げています。

市場動向

- 2023年にノバス・インターナショナルがアグリビダを買収したことは、革新的な飼料添加物の開発能力を強化するための戦略的な動きを示しています。アグリビダのバイオテクノロジーの専門知識を統合することで、ノバスは新しい高度なソリューションを市場に投入し、動物飼料の栄養価と全体的な有効性を向上させることを目指しています。

- 2022年、BASFはドイツのルートヴィヒスハーフェン工場で飼料酵素の生産能力を大幅に増強しました。この拡張は、Natugrain TS(キシラナーゼおよびグルカナーゼ)、Natuphos E(フィターゼ)、および新発売のNatupulse TS(マンナナーゼ)を含むBASFの飼料酵素の需要の高まりに対応することを目的としていました。年間生産能力の増強は、安定した供給を保証するだけでなく、市場の高まるニーズに対応し、顧客に高品質の飼料添加物を提供するというBASFの取り組みを強調するものでもあります。

- 2022年、カーギルは植物由来の添加物製造の大手企業であるデラコンを買収するという戦略的な動きを見せました。この買収により、飼料添加物に関するデラコンの専門知識がカーギルのポートフォリオに加わります。デラコンの能力を統合することで、カーギルは飼料業界における持続可能で革新的なソリューションに対する世界的な需要に応え、より栄養価の高い食品の生産を目指します。この買収により、カーギルはより幅広い高品質の飼料添加物を提供し、市場における主要プレーヤーとしての地位を強化できるようになります。

- 2022年にアディセオグループがノルフィードとその子会社を買収するという決定は、動物飼料ソリューションの開発における戦略的拡大を示しています。この買収により、アディセオはノルフィードの植物添加物に関する専門知識にアクセスでき、新しい植物ベースの飼料添加物の開発と登録が可能になります。この動きは、動物栄養における自然で持続可能な代替品の探求に向けた業界の傾向と一致しています。

- 2022年、ケミン・インダストリーズが発売するToxfin Careは、マイコトキシン管理の分野における革新的なソリューションです。Toxfin Careは、動物の飼料をマイコトキシンから保護するだけでなく、免疫システムを強化し、臓器を保護し、パフォーマンスと生産性の低下を防ぎます。この導入により、飼料のマイコトキシン汚染という重大な問題に対処し、動物の健康と生産性を向上させる包括的なアプローチを提供します。

- 2021年、多国籍の動物栄養および飼料添加物企業であるバイオミンGmbHは、EUが支援する重要な研究コンソーシアムプロジェクトである3D'omicsプロジェクトへの参加を発表しました。4年間で1,190万米ドルの資金が投入されるこの取り組みは、家禽および豚の生産における課題の解決を目指しています。このプロジェクトは、動物のマイクロバイオームの相互作用を分析するための新しい技術の開発に焦点を当てており、ミクロスケールの理解のために3Dビジュアルを提供します。バイオミンの参加は、動物栄養分野の研究とイノベーションを推進し、家禽および豚の飼育における生産効率を高めることができるソリューションに貢献するという同社の取り組みを強調しています。

地域分析

地理的に、ラテンアメリカ飼料添加物市場レポートでカバーされている国は、メキシコ、コロンビア、ペルー、エクアドル、グアテマラ、コスタリカ、パナマ、エルサルバドル、ホンジュラス、ドミニカ共和国、ジャマイカ、プエルトリコ、ブラジル、アルゼンチン、チリ、パラグアイ、 . ウルグアイおよびその他のラテンアメリカ諸国

Data Bridge Market Research の分析によると:

ブラジルは、 ラテンアメリカの飼料添加物市場 予測期間2023~2030年

ブラジルは、配合飼料の生産量が多く、2018 年には 6,870 万トンに達したことから、飼料添加物市場を独占しています。同国の畜産業が盛んなことから、栄養価と飼料全体の品質を高めるための飼料添加物の需要が高まっています。ブラジルは家畜の繁殖と健康管理に重点を置いており、飼料添加物は生産効率に不可欠なものと位置付けられています。農業開発、継続的な市場拡大、世界的な影響力に対する同国の取り組みにより、飼料添加物分野における同国のリーダーシップは確固たるものとなっています。

詳細については、 ラテンアメリカの飼料添加物市場 レポートはこちらをクリックしてください –https://www.databridgemarketresearch.com/reports/latin-america-feed-additives-market