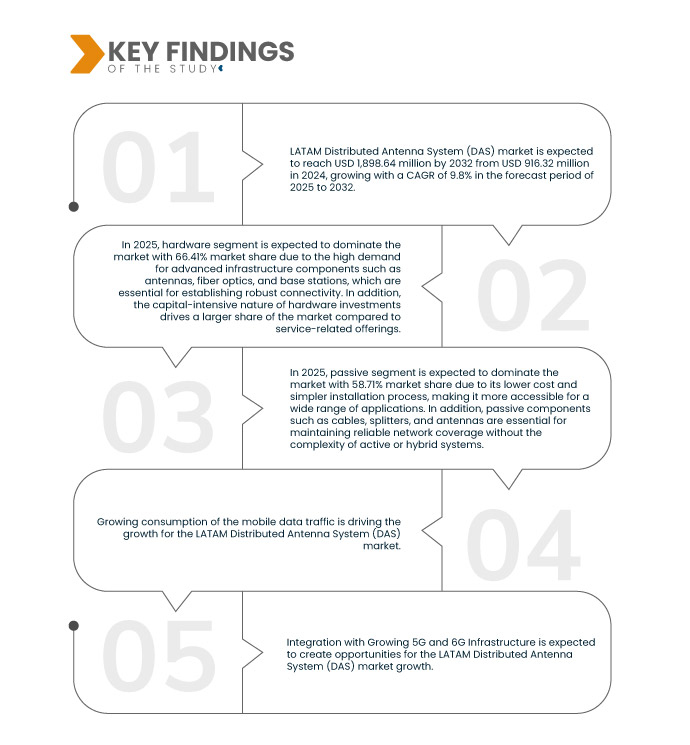

ラテンアメリカ(LATAM)では、スマートフォンの普及とデジタル接続の需要が急増しており、モバイルデータトラフィックの消費量の増加が分散アンテナシステム(DAS)市場の主要な牽引役となっています。動画ストリーミング、オンラインゲーム、リモートワークツールといった高帯域幅アプリケーションの利用増加に伴い、モバイルネットワークはシームレスな接続の提供に対するプレッシャーが高まっています。DASは、特に人口密度の高い都市や、空港、スタジアム、ショッピングモールといったインフラ整備が進む地域において、信号カバレッジとネットワーク容量を向上させる効果的なソリューションを提供します。これらの地域では、従来のネットワークシステムでは課題が山積しています。デジタル化とスマートフォンの消費量の増加、そしてテクノロジーに精通した人口の増加が、強化されたネットワーク接続ソリューションへの需要を牽引しています。モバイルデータ使用量の増加に伴い、ネットワークプロバイダーと企業の両方が、高度なサービスを提供するために分散アンテナシステム(DAS)に注目しています。こうしたDASの普及は、世界的に市場への浸透と採用を加速させています。これらのシステムは、ますますつながる世界において、シームレスで信頼性の高い接続を提供するために不可欠となっているからです。

データブリッジマーケットリサーチは、ラテンアメリカの分散アンテナシステム(DAS)市場は、2025年から2032年の予測期間に9.8%のCAGRで成長し、2024年の9億1,632万米ドルから2032年には18億9,864万米ドルに達すると予測しています。

研究の主な結果

ビジネスのデジタル変革

LATAMの分散アンテナシステム(DAS)市場では需要が急増しており、ビジネスのデジタルトランスフォーメーションは、プロセス時間の短縮、セキュリティの強化、顧客サービスの向上につながるため、今日の状況では重要なトレンドになりつつあります。企業は、データ分析、管理、ストレージに対する高まる需要を満たすためにITインフラストラクチャを強化しています。技術によって操作が容易になるにつれて、顧客はより技術に精通するようになっています。高度な技術に基づくサービスに対する高まる需要を満たすために、組織はデジタル技術の採用に投資しています。ビジネスを進化させながら安全性とセキュリティを維持するために、企業はデータ転送用の高度なネットワーク接続ソリューションに資金を確保しており、これが市場の成長を牽引しています。企業は、データ転送のための社内通信と接続性を高めるためにDASテクノロジーを実装しています。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2025年から2032年

|

基準年

|

2024

|

歴史的な年

|

2023年(2013~2017年にカスタマイズ可能)

|

定量単位

|

収益(百万米ドル)

|

対象セグメント

|

提供内容(ハードウェアとサービス)、DAS タイプ(パッシブ、アクティブ、ハイブリッド)、カバレッジ(屋内および屋外)、所有権(ニュートラルホスト、キャリア、エンタープライズ)、テクノロジー(キャリア Wi-Fi およびスモールセル)、ユーザー施設(>500K FT2、200K~500K FT2、および <200K FT2)、垂直(商業および公共安全)

|

対象国

|

ブラジル、メキシコ、アルゼンチン、コロンビア、その他のラテンアメリカ諸国

|

対象となる市場プレーヤー

|

AT&T Intellectual Property(米国)、ATC TRS V LLC.(米国)、Corning Incorporated(米国)、CommScope, Inc.(米国)、Hughes Network Systems, LLC(米国)、Zinwave(米国)、HUBER+SUHNER(スイス)、BTI wireless(米国)、WESCO INTERNATIONAL, INC.(米国)、Advanced RF Technologies, Inc.(米国)など

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、専門家による詳細な分析、輸入/輸出分析、価格分析、生産消費分析、乳棒分析が含まれています。

|

セグメント分析

LATAM 分散アンテナ システム (DAS) 市場は、提供内容、DAS タイプ、カバレッジ、所有権、テクノロジー、ユーザー ファシリティ、垂直に基づいて、7 つの主要なセグメントに分類されています。

- 提供に基づいて、LATAM分散アンテナシステム(DAS)市場はハードウェアとサービスに分類されます。

2025年には、ハードウェアセグメントがLATAM分散アンテナシステム(DAS)市場を支配すると予想されます。

2025年には、堅牢な接続性を確立するために不可欠なアンテナ、光ファイバー、基地局といった高度なインフラコンポーネントへの高い需要により、ハードウェアセグメントが66.41%の市場シェアで市場を席巻すると予想されています。さらに、ハードウェア投資は資本集約的な性質を持つことから、サービス関連の製品と比較して市場シェアが拡大しています。

- DASタイプに基づいて、LATAM分散アンテナシステム(DAS)市場は、パッシブ、アクティブ、ハイブリッドに分類されます。

2025年には、パッシブセグメントがLATAM分散アンテナシステム(DAS)市場を支配すると予想されます。

2025年には、パッシブセグメントが市場シェア58.71%を占め、市場を席巻すると予想されています。これは、パッシブセグメントの低コストと設置プロセスの簡略化により、幅広いアプリケーションで利用しやすくなっているためです。さらに、ケーブル、スプリッター、アンテナなどのパッシブコンポーネントは、アクティブシステムやハイブリッドシステムの複雑さを伴わずに、信頼性の高いネットワークカバレッジを維持するために不可欠です。

- ラテンアメリカの分散アンテナシステム(DAS)市場は、カバレッジに基づいて屋内と屋外に区分されています。2025年には、屋内セグメントが65.81%の市場シェアで市場を独占すると予想されています。

- ラテンアメリカの分散アンテナシステム(DAS)市場は、所有権に基づいて、ニュートラルホスト、キャリア、エンタープライズに分類されます。2025年には、ニュートラルホストセグメントが63.10%の市場シェアで市場を独占すると予想されています。

- ラテンアメリカの分散アンテナシステム(DAS)市場は、技術に基づいて、キャリアWi-Fiとスモールセルに分類されます。2025年には、キャリアWi-Fiセグメントが67.44%の市場シェアで市場を独占すると予想されています。

- ラテンアメリカの分散アンテナシステム(DAS)市場は、ユーザー設備に基づいて、50万FT2超、20万~50万FT2、20万FT2未満の3つに分類されます。2025年には、50万FT2超のセグメントが62.45%の市場シェアを占めると予想されています。

- ラテンアメリカの分散アンテナシステム(DAS)市場は、垂直市場に基づいて、商業用と公共安全用に分類されます。2025年には、商業用セグメントが78.84%の市場シェアで市場を独占すると予想されています。

主要プレーヤー

Data Bridge Market Research は、LATAM 分散アンテナ システム (DAS) 市場で事業を展開している主要企業として、AT&T Intellectual Property (米国)、ATC TRS V LLC. (米国)、Corning Incorporated (米国)、CommScope, Inc. (米国)、および Hughes Network Systems, LLC (米国) を分析しています。

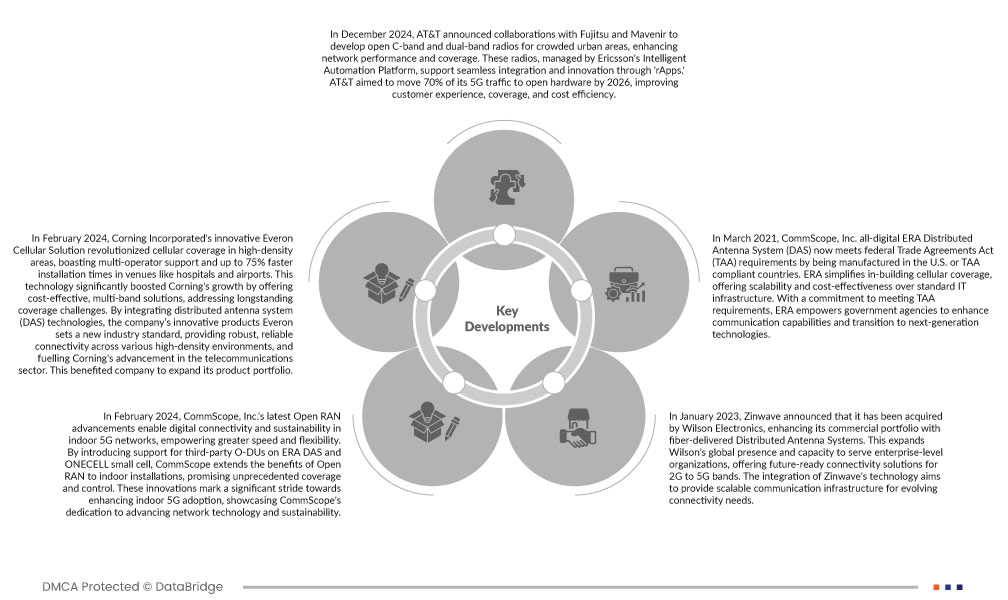

市場動向

- 2024年12月、AT&Tは富士通およびMavenirと提携し、混雑した都市部向けのオープンCバンドおよびデュアルバンド無線を開発し、ネットワークのパフォーマンスとカバレッジを向上させることを発表しました。これらの無線は、EricssonのIntelligent Automation Platformによって管理され、「rApps」を通じてシームレスな統合とイノベーションをサポートします。AT&Tは、2026年までに5Gトラフィックの70%をオープンハードウェアに移行し、顧客体験、カバレッジ、コスト効率を向上させることを目指しています。

- 2020年1月、AT&Tは無線通信容量とカバレッジの向上に8,500万ドルを投資すると発表しました。これにより、マイアミ地域全体のカバレッジが拡大し、業績は大きく向上しました。これにより、同社は顧客体験を向上させ、顧客維持率も向上しました。

- 2023年7月、ATC TRS V LLCとミネソタ・ワイルドは、最先端の分散アンテナシステム(DAS)ソリューションを導入し、エクセル・エナジー・センターでのファン体験を向上させ、アリーナに5Gテクノロジーを導入しました。このアップグレードは、年間170万人の来場者と、NHLの44試合を含む150以上のイベントの需要を満たすことを目的としていました。(ATC TRS V LLC)アメリカンタワーのスポーツ会場の接続性と技術革新に関する専門知識は、この重要なネットワークアップグレードを容易にし、ファンがライブ体験を共有するための高速で信頼性の高い接続を利用できるようにしました。この開発により、アメリカンタワーは主要会場向けの高度な接続ソリューションの主要プロバイダーとしての評判を固め、市場での存在感を高め、スポーツおよびエンターテインメント業界におけるより多くのパートナーシップを引き付けることで、さらなる成長に向けての基盤を築きました。

- 2024年2月、コーニング・インコーポレイテッドの革新的なEveronセルラーソリューションは、高密度エリアにおける携帯電話の通信範囲に革命をもたらしました。複数の通信事業者に対応し、病院や空港などの施設における設置時間を最大75%短縮しました。この技術は、コスト効率の高いマルチバンドソリューションを提供することで、長年の通信範囲の課題を解決し、コーニングの成長を大きく後押ししました。分散アンテナシステム(DAS)技術を統合することで、革新的な製品であるEveronは新たな業界標準を確立し、様々な高密度環境において堅牢で信頼性の高い接続性を提供し、通信分野におけるコーニングの発展を後押ししました。これにより、同社は製品ポートフォリオを拡大することができました。

- 2024年2月、コムスコープは最新のOpen RAN技術により、屋内5Gネットワークにおけるデジタル接続と持続可能性を実現し、速度と柔軟性の向上を実現します。ERA DASおよびONECELLスモールセルにおけるサードパーティ製O-DUのサポートを導入することで、コムスコープはOpen RANのメリットを屋内設備にも拡張し、かつてないカバレッジと制御を実現します。これらのイノベーションは、屋内5Gの普及促進に向けた大きな一歩であり、コムスコープのネットワーク技術と持続可能性の向上への取り組みを示すものです。

地域分析

地理的に見ると、世界的な仮想インフラストラクチャ マネージャー市場レポートでカバーされている国は、ブラジル、メキシコ、アルゼンチン、コロンビア、およびその他の LATAM 諸国です。

Data Bridge Market Researchの分析によると:

ブラジルは、LATAM分散アンテナシステム(DAS)市場で優位に立ち、最も急速に成長する国になると予想されています。

ブラジルは、先進的な通信インフラと無線技術の広範な導入により、市場をリードすると予想されています。

LATAM分散アンテナシステム(DAS)市場レポートの詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/latam-distributed-antenna-system-das-market