食品、医薬品、その他温度に敏感な製品の消費増加に伴い、効率的なコールドチェーン物流の需要が高まっています。このセクターは、これらの生鮮食品が生産から配送まで、サプライチェーン全体を通して必要な温度範囲内に保たれるようにすることで、品質と安全性を維持します。こうした製品のニーズが高まるにつれ、腐敗を防ぎ、健康・安全基準の遵守を確保するというコールドチェーン物流の役割は、ますます重要になっています。

完全なレポートは https://www.databridgemarketresearch.com/reports/ksa-cold-chain-logistics-marketでご覧いただけます。

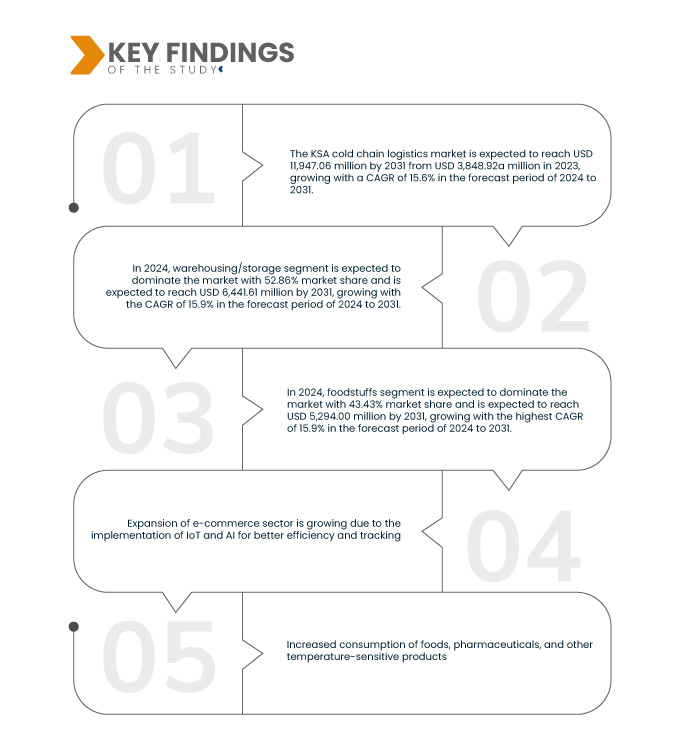

データブリッジ市場調査は、サウジアラビアのコールドチェーン物流市場は、2023年の38億4,892万米ドルから2031年には119億4,706万米ドルに達し、2024年から2031年の予測期間に年平均成長率(CAGR)15.6%で成長すると分析しています。コールドチェーン物流分野の発展には、物流インフラへの政府の取り組みと投資が不可欠です。近代的な保管施設の開発を優先し、輸送ネットワークを強化し、高度な追跡システムを実装することで、これらの取り組みは、温度に敏感な製品の取り扱いにおける効率性と信頼性の向上を目指しています。こうした投資は、コールドチェーン物流に依存する産業の成長を支えるだけでなく、シームレスな商品の流れを確保し、運用コストを削減することで、経済発展と競争力の強化にもつながります。

研究の主な結果

電子商取引セクターの拡大

eコマースの拡大は、コールドチェーン物流の成長を大きく牽引してきました。特に生鮮食品や医薬品といった生鮮食品のオンラインショッピングが増加するにつれ、効率的で信頼性の高いコールドチェーンソリューションに対する需要が急増しています。eコマースプラットフォームでは、温度に敏感な製品を最適な状態で保管、取り扱い、配送するために、堅牢なコールドチェーン物流が求められています。こうした状況を受け、サプライチェーン全体で製品の品質を維持し、新鮮で安全な製品に対する消費者の高まる期待に応えることを目的とした物流インフラ、テクノロジー、そしてプロセスの進歩が進められています。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(2016年から2021年までカスタマイズ可能)

|

定量単位

|

収益(百万米ドル)

|

対象セグメント

|

タイプ(倉庫保管、物流(道路)、物流(海上)、物流(鉄道)、物流(航空)、フルフィルメント&ラストマイル配送)、商品の種類/重要な属性(食料品、一般物品(医療用品を含む)、危険物(危険化学物質を含む)、その他、技術(急速冷凍、蒸発冷却、蒸気圧縮、極低温システム、プログラマブルロジックコントローラ)、温度タイプ(常温、冷蔵、冷凍、その他)、ペイロードサイズ(大、中、小、超小、プチ)、オペレーション(国内、国際/越境物流)、顧客タイプ(B2B、B2C、Eコマース&ラストマイル配送)、ビジネスモデル(アセットベースキャリア、ブローカー&サードパーティロジスティクス(3PL)、フォースパーティロジスティクス(4PL))、距離( 500マイル、201マイル~500マイル、101マイル~200マイル、50マイル~100マイル、50マイル未満

|

対象国

|

サウジアラビア

|

対象となる市場プレーヤー

|

Cold Chain Packing & Logistics(リヤド、サウジアラビア)、AP Moller– Maersk(デンマーク)、CGS(リヤド、サウジアラビア)、Mosanada Logistics Services(Naghi & Sons傘下)(ジェッダ、サウジアラビア)、Wared Logistics(サウジアラビア王国)、NAQEL Company(ジェッダ、サウジアラビア)、Agility(クウェート)、IFFCO(UAE、ドバイ)、Almajdouie Logistics(ダンマン、サウジアラビア)、Advanced Storage Co(リヤド、サウジアラビア)、United Group(ジェッダ、サウジアラビア)、Four Winds、Jones International Transportation(ジェッダ、サウジアラビア)、SMSA Express Transportation Company Ltd.(サウジアラビア)、Transcorp(ジェッダ、サウジアラビア)、Tamer Logistics(ジェッダ、サウジアラビア王国)、Flow(ジェッダ、サウジアラビア王国)、Starlinks、Binzagr(リヤド、この市場で事業を展開している大手企業には、ムバラッド、エトマム・ロジスティクス(アルマライの子会社)、アマン・ロジスティクス(サウジアラビア、ジェッダ)、ロジクサ(サウジアラビア、ジェッダ)などがある。

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、専門家による詳細な分析、輸出入分析、価格分析、生産消費分析、ペストル分析が含まれています。

|

セグメント分析

市場は、タイプ、商品タイプ/重要な属性、テクノロジー、温度タイプ、ペイロードサイズ、操作、顧客タイプ、ビジネスモデル、距離に基づいて、9 つの主要なセグメントに分類されています。

- タイプ別に見ると、サウジアラビアのコールドチェーン物流市場は、倉庫/保管、物流(道路)、物流(海上)、物流(鉄道)、物流(航空)、フルフィルメントおよびラストマイル配送に分類されます。

2024年には、倉庫/保管セグメントがサウジアラビアのコールドチェーン物流市場を支配すると予想されています。

2024年には、食品、医薬品、その他の温度に敏感な製品の消費増加により、倉庫/保管セグメントが52.86%の市場シェアで市場を支配すると予想されています。

- 技術に基づいて、KSA コールド チェーン物流市場は、急速冷凍、蒸発冷却、蒸気圧縮、極低温システム、プログラマブル ロジック コントローラーなどに分類されます。

2024年には、急速冷凍セグメントがサウジアラビアのコールドチェーン物流市場を支配すると予想されています。

2024年には、政府の取り組みと物流への投資の増加により、急速冷凍セグメントが23.69%の市場シェアで市場を支配すると予想されています。

- 温度タイプに基づいて、サウジアラビアのコールドチェーン物流市場は、常温、冷蔵、冷凍、その他に分類されます。2024年には、常温セグメントが市場シェア72.32%で市場を独占すると予想されています。

- サウジアラビアのコールドチェーン物流市場は、積載量に基づいて、大型、中型、小型、超小型、小型に分類されています。2024年には、大型セグメントが市場シェア33.60%で市場を席巻すると予想されています。

- サウジアラビアのコールドチェーン物流市場は、業務内容に基づいて、国内物流と国際/越境物流に分類されます。2024年には、国内物流が市場シェア75.35%で市場を独占すると予想されています。

- 顧客タイプに基づいて、サウジアラビアのコールドチェーン物流市場は、B2B、B2C、eコマースおよびラストマイル配送に分類されます。2024年には、B2Bセグメントが市場シェア58.26%で市場を席巻すると予想されています。

主要プレーヤー

データブリッジ市場調査は、KSAコールドチェーン物流市場で活動する主要企業として、Cold Chain Packing & Logistics、AP Moller–Maersk(デンマーク)、CGS(リヤド、サウジアラビア)、Mosanada Logistics Services(Naghi & Sons傘下)(ジェッダ、サウジアラビア)、Wared Logistics(サウジアラビア王国)を分析しています。

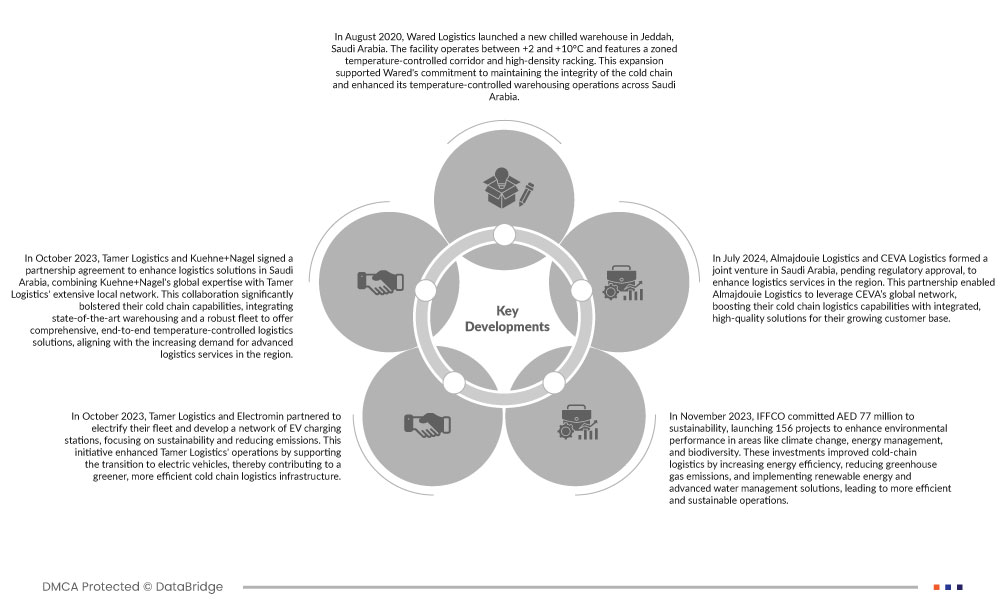

市場開発

- 2020年8月、Wared Logisticsはサウジアラビアのジッダに新しい冷蔵倉庫を開設しました。この施設は+2℃から+10℃の温度範囲で稼働し、ゾーン別温度管理通路と高密度ラックを備えています。この拡張は、Waredのコールドチェーンの完全性維持へのコミットメントを支え、サウジアラビア全土における温度管理倉庫業務を強化しました。

- 2023年10月、Tamer LogisticsとKuehne+Nagelは、サウジアラビアにおける物流ソリューションを強化するための提携契約を締結しました。Kuehne+Nagelのグローバルな専門知識とTamer Logisticsの広範な現地ネットワークを組み合わせます。この提携により、両社のコールドチェーン能力は大幅に強化され、最先端の倉庫と堅牢な車両群を統合することで、包括的でエンドツーエンドの温度管理物流ソリューションを提供することが可能になり、地域における高度な物流サービスへの需要の高まりに対応します。

- 2023年10月、Tamer LogisticsとElectrominは、持続可能性と排出量削減に重点を置いた車両の電動化とEV充電ステーションネットワークの構築で提携しました。この取り組みは、電気自動車への移行を支援することでTamer Logisticsの事業運営を強化し、より環境に優しく効率的なコールドチェーン物流インフラの構築に貢献しました。

- 2023年11月、IFFCOは持続可能性に7,700万米ドルを拠出し、気候変動、エネルギー管理、生物多様性などの分野における環境パフォーマンスの向上を目的とした156件のプロジェクトを立ち上げました。これらの投資により、エネルギー効率の向上、温室効果ガス排出量の削減、再生可能エネルギーおよび高度な水管理ソリューションの導入により、コールドチェーン物流が改善され、より効率的で持続可能な運用が実現しました。

- 2024年7月、アルマジュドゥイ・ロジスティクスとCEVAロジスティクスは、サウジアラビアにおいて、規制当局の承認を待って、同地域における物流サービスの強化を目的とした合弁会社を設立しました。この提携により、アルマジュドゥイ・ロジスティクスはCEVAのグローバルネットワークを活用し、拡大する顧客基盤向けに統合された高品質なソリューションを提供することで、コールドチェーン物流能力を強化することができました。

Data Bridge Market Researchの分析によると:

KSAコールドチェーン物流市場レポートの詳細については、こちらをクリックしてください – https://www.databridgemarketresearch.com/reports/ksa-cold-chain-logistics-market