デジタル患者モニタリング システムの導入により、コストを大幅に削減し、医療費全体を下げることができます。世界中の多くの政府が慢性疾患の経済的損失に取り組んでいます。米国疾病予防管理センターによると、心臓病と脳卒中は米国の医療システムに年間 2,140 億ドル以上のコストをかけています。リスクのある人は、デジタル患者モニタリング デバイスを使用して遠隔でモニタリングできるため、入院を回避し、医療費を削減できます。

完全なレポートはこちらからアクセスしてください:https://databridgemarketresearch.com/reports/global-digital-health-monitoring-devices-market

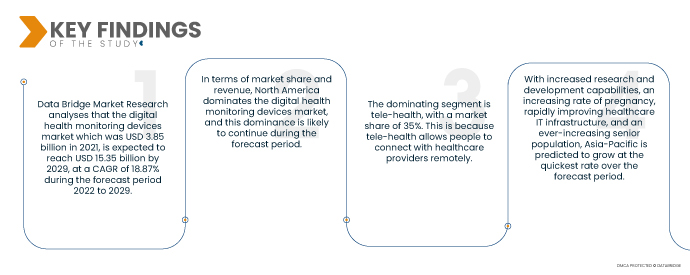

データブリッジマーケットリサーチの分析によると、 デジタルヘルスモニタリングデバイス市場 2021年の38億5,000万米ドルであった医療費は、2022年から2029年の予測期間中に18.87%のCAGRで成長し、2029年には153億5,000万米ドルに達すると予想されています。特に病院での医療費の高騰により、近年は在宅医療などの代替治療手段に焦点が当てられています。その結果、体温計、パルスオキシメーター、体重計、心電図モニター、イベントモニター、脳波レコーダー、胎児モニターなどの効果的な家庭用機器の需要が高まっています。現在の医療制度の持続可能性は、世界中の政府にとって大きな懸念事項となっています。

センサーベースのウェアラブルデバイスの採用が拡大し、 市場の成長率を牽引すると予想される

近年、持続血糖モニターや心電図などのセンサーベースのウェアラブル デバイスが患者や医療従事者の間で人気を集めています。これらのデバイスは患者のバイタル サインをリアルタイムで追跡し、それを電子的に医師に中継して EHR に統合することができます。これにより、臨床医は患者を継続的に監視できるため、病院に頻繁に通う必要がなくなります。ウェアラブル デバイスの需要が高まるにつれ、主要企業は広範な調査を行い、革新的なデジタル患者監視デバイスを市場に投入しています。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2022年から2029年

|

|

基準年

|

2021

|

|

歴史的な年

|

2020 (2014~2019年にカスタマイズ可能)

|

|

定量単位

|

売上高(10億米ドル)、販売数量(個数)、価格(米ドル)

|

|

対象セグメント

|

製品 (デバイス、ソフトウェア、サービス)、タイプ (ワイヤレス ヘルス、M-health、テレヘルス、EHR/EMR など)、エンド ユーザー (病院、在宅ケア施設、診療所、外来手術センターなど)

|

|

対象国

|

北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、ヨーロッパではその他のヨーロッパ、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、中東およびアフリカ (MEA) の一部としてその他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、南米のその他の地域

|

|

対象となる市場プレーヤー

|

Medtronic(アイルランド)、Boston Scientific Corporation(米国)、NEVRO CORP(米国)、Cyberonics, Inc.(米国)、Inspire Medical Systems, Inc.(米国)、SPR Therapeutics(米国)、ALEVA NEUROTHERAPEUTICS SA(スイス)、Bioness Inc.(米国)、ReShape Lifesciences, Inc.(米国)、LivaNova PLC(英国)、NeuroPace, Inc.(米国)、Synapse Biomedical Inc.(米国)、Soterix Medical Inc.(米国)、Accellent Technologies, Inc.(米国)、Abbott(米国)、Bioventus(米国)、Soterix Medical Inc.(米国)、Integer Holdings Corporation(米国)

|

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、詳細な専門家分析、患者の疫学、パイプライン分析、価格分析、規制枠組みが含まれています。

|

セグメント分析:

デジタル健康モニタリングデバイス市場は、製品、タイプ、エンドユーザーに基づいて分類されています。

- 製品に基づいて、デジタル健康モニタリングデバイス市場は、デバイス、ソフトウェア、サービスに分類されます。

製品セグメントのデバイスセグメントはデジタルヘルスモニタリングデバイスを支配している 市場

市場シェアが 60% を占める、支配的なセグメントはデバイスです。これは、デバイスが最も一般的なタイプのデジタル健康モニタリング デバイスであるためです。デバイスには、インスリン ポンプ、持続血糖モニター (CGM)、血糖値測定器が含まれます。デバイスにより、慢性疾患を持つ人々は健康データを追跡し、より効果的に病状を管理できます。

- タイプ別に見ると、デジタルヘルスモニタリングデバイス市場は、遠隔医療、EHR/電子磁気共鳴、m-Health、ワイヤレスヘルスなどがあります。市場シェアが35%のテレヘルスが主流の分野です。テレヘルスにより、人々は遠隔地から医療提供者とつながることができるからです。これは、ビデオ会議、電話、テキストメッセージを通じて行うことができます。テレヘルスは、慢性疾患のモニタリング、カウンセリングの提供、相談の実施など、さまざまな目的で使用できます。

- エンドユーザーに基づいて、デジタル健康モニタリングデバイス市場は、病院、診療所、外来手術センター、在宅ケア環境などに分類されます。

エンドユーザーセグメントの在宅ケア設定セグメントは、デジタル健康モニタリングデバイスを支配している。 市場

最も大きなセグメントは在宅ケア環境で、市場シェアは 65% です。これは、慢性疾患を持つほとんどの人が在宅ケア環境で自分の状態を管理しているためです。在宅ケア環境では、慢性疾患を持つ人々にとって、健康データをより頻繁に追跡したり、自分の状態をより効果的に管理したり、自己管理について学んだりできるなど、多くの利点があります。

主要プレーヤー

Data Bridge Market Research は、以下の企業を主要な市場プレーヤーとして認識しています:Medtronic (アイルランド)、Boston Scientific Corporation (米国)、NEVRO CORP (米国)、Cyberonics, Inc. (米国)、Inspire Medical Systems, Inc. (米国)、SPR Therapeutics (米国)、ALEVA NEUROTHERAPEUTICS SA (スイス)、Bioness Inc. (米国)、ReShape Lifesciences, Inc. (米国)、LivaNova PLC (英国)、NeuroPace, Inc. (米国)、Synapse Biomedical Inc. (米国)、Soterix Medical Inc. (米国)、Accellent Technologies, Inc. (米国)、Abbott (米国)、Bioventus (米国)、Soterix Medical Inc. (米国)、Integer Holdings Corporation (米国)。

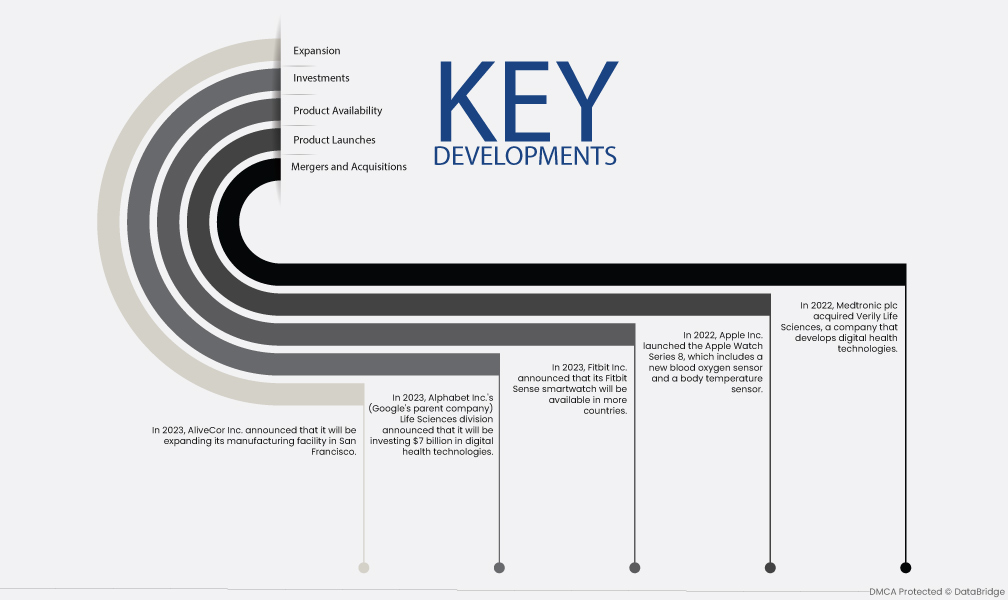

市場開拓

- 2022年、メドトロニックはデジタルヘルス技術を開発する企業であるVerily Life Sciencesを買収しました。この買収により、メドトロニックはデジタルヘルスモニタリングデバイスのポートフォリオを拡大することができます。メドトロニックは医療技術の世界的リーダーであり、Verily Life Sciencesはデジタルヘルス技術を開発する非公開企業です。この買収により、メドトロニックはVerily Life Sciencesのデジタルヘルスモニタリングの技術と専門知識にアクセスできるようになります。これにより、メドトロニックは慢性疾患を持つ人々が病状を管理するのに役立つ新しい製品とサービスを開発することができます。

- 2022年、Apple社は新しい血中酸素センサーと体温センサーを搭載したApple Watch Series 8を発売しました。これらのセンサーは、血中酸素レベルや体温など、ユーザーの健康データを追跡するために使用できます。Apple Watch Series 8はAppleのスマートウォッチの最新世代であり、以前のモデルに比べて多くの改良が施されています。新しい血中酸素センサーと体温センサーは、Apple Watch Series 8で利用できる新機能のほんの一部です。

- 2023年、Fitbit Inc.は、Fitbit Senseスマートウォッチをより多くの国で利用可能にすると発表しました。Fitbit Senseは、ECGセンサーやSpO2センサーなど、さまざまな健康センサーを搭載したスマートウォッチです。これらのセンサーを使用して、ユーザーの心臓の健康状態や血中酸素レベルを追跡できます。Fitbit Senseはすでに多くの国で利用可能ですが、同社の発表は、将来さらに多くの国で利用可能になることを意味します。これにより、より多くの人がFitbit Senseを使用して健康データを追跡できるようになります。

- 2023年、Withingsは、ScanWatch Horizonスマートウォッチをより多くの国で利用可能にすると発表しました。Withings ScanWatch Horizonは、ECGセンサーやSpO2センサーなど、さまざまな健康センサーを備えたスマートウォッチです。これらのセンサーを使用して、ユーザーの心臓の健康状態や血中酸素レベルを追跡できます。Withings ScanWatch Horizonはすでに多くの国で利用可能ですが、同社の発表は、将来さらに多くの国で利用可能になることを意味します。これにより、より多くの人がWithings ScanWatch Horizonを使用して健康データを追跡できるようになります。

- 2023年、Alphabet Inc.(Googleの親会社)のライフサイエンス部門は、デジタルヘルス技術に70億ドルを投資すると発表しました。この投資は、新しいデジタルヘルスモニタリングデバイスとサービスの開発に使用されます。Alphabet Inc.は多国籍テクノロジーコングロマリットであり、そのライフサイエンス部門はデジタルヘルス技術の開発に重点を置いています。同社のデジタルヘルスモニタリングデバイスとサービスへの投資は、これらの技術の重要性が高まっていることを示しています。

- 2023年、AliveCor Inc.はサンフランシスコの製造施設を拡張すると発表しました。この拡張により、同社は生産能力を高め、心臓モニタリング機器の需要増加に対応できるようになります。AliveCor Inc.の製造施設の拡張は、同社の成長と成功の証です。

地域分析

地理的に、市場レポートでカバーされている国は、北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米です。

Data Bridge Market Research の分析によると:

北米はデジタル健康モニタリングデバイスの主要な地域である 予測期間2022~2029年の市場

市場シェアと収益の面では、北米がデジタル健康モニタリングデバイス市場を支配しており、この優位性は予測期間中も続くと思われます。これは、神経疾患の有病率が上昇しているためです。

アジア太平洋地域 最も急速に成長している地域であると推定されています デジタル健康モニタリングデバイス 市場 予測期間2022-2029年

研究開発能力の向上、妊娠率の増加、医療ITインフラの急速な改善、高齢者人口の増加により、アジア太平洋地域は予測期間中に最も速いペースで成長すると予測されています。

デジタルヘルスモニタリングデバイスの詳細については 市場 レポートはこちらをクリックしてください – https://www.databridgemarketresearch.com/reports/global-digital-health-monitoring-devices-market