Global Acoustic Wave Sensor Market

Taille du marché en milliards USD

TCAC :

%

USD

3.10 Billion

USD

6.20 Billion

2024

2032

USD

3.10 Billion

USD

6.20 Billion

2024

2032

| 2025 –2032 | |

| USD 3.10 Billion | |

| USD 6.20 Billion | |

|

|

|

|

Global Acoustic Wave Sensor Market Segmentation, By Type (Surface Acoustic Wave (SAW), Bulk Acoustic Wave (BAW)), Device (Resonator, Delay Line), Sensing Parameter (Temperature, Pressure, Humidity, Chemical Vapor or Gas, Torque, Mass, Viscosity, Others), Vertical (Military, Automotive, Industrial, Healthcare, Food and Beverages, Environment, Others) - Industry Trends and Forecast to 2032

Acoustic Wave Sensor Market Size

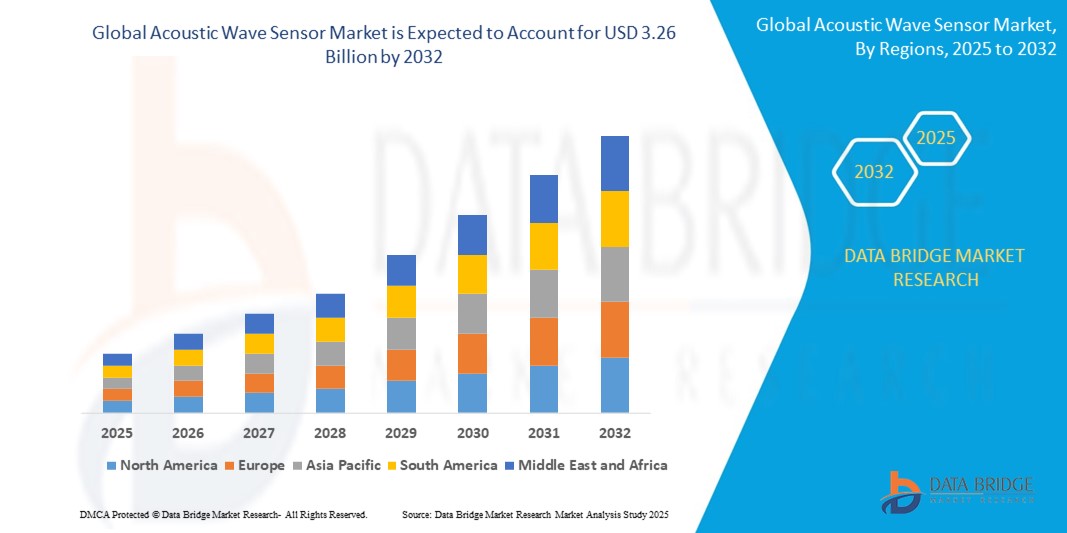

- The global Acoustic Wave Sensor Market size was valued at USD 1.48 billion in 2024 and is expected to reach USD 3.26 billion by 2032, at a CAGR of 9.2% during the forecast period

- This growth is driven by factors such as the Advancements in Sensor Technology, Integration with Internet of Things (IoT) and Industrial IoT (IIoT), and Cost-Effectiveness and Manufacturing Advancements

Acoustic Wave Sensor Market Analysis

- Acoustic wave sensor utilities piezoelectric material to generate the acoustic wave. The changes to the features of the propagation path may impact the amplitude and velocity of the wave due to the acoustic wave is caused on the surface of the material.

- Acoustic wave sensors offer competitive advantage over the conventional sensors because of the features like the passive operation, lesser response time, and wireless. The surface acoustic wave is based on temperature sensors with higher response rate, accuracy, low cost, and range of wide sensing temperature.

- North America dominates the acoustic wave sensor market because of the technological developments and the low manufacturing cost. Furthermore, the wireless and the passive nature of the products will further boost the growth of the acoustic wave sensor market in the region during the forecast period.

- Asia Pacific is projected to observe significant amount of growth in the acoustic wave sensor market because of the occurrence of the advancing countries like India, China, Japan, and so forth. Moreover, the development of a large number of manufacturing industries is further anticipated to propel the growth of the acoustic wave sensor market in the region in the coming years.

- Surface Acoustic Wave segment is expected to dominate the market with a market share of 53.59% due to its high sensitivity, wireless capability, and strong performance in harsh environments.

Report Scope and Acoustic Wave Sensor MarketSegmentation

|

Attributes |

Acoustic Wave Sensor Key Market Insights |

|

Segments Covered |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendance du marché des capteurs d'ondes acoustiques

« Miniaturisation et intégration de capteurs d'ondes acoustiques compacts »

- La tendance vers des technologies plus compactes et plus intelligentes alimente une tendance croissante dans le secteur des capteurs d'ondes acoustiques : la miniaturisation. Les entreprises conçoivent désormais des capteurs miniatures qui s'intègrent parfaitement dans des gadgets compacts comme les montres connectées, les trackers d'activité, les smartphones et autres appareils connectés, sans compromettre les performances.

- Les innovations dans le domaine des MEMS (systèmes microélectromécaniques) ont joué un rôle majeur, permettant de créer des capteurs à la fois très sensibles et économes en énergie, tout en occupant un minimum d'espace.

- Par exemple, en mars 2023, Apple a déposé un brevet pour de nouveaux capteurs d'ondes acoustiques conçus pour fonctionner à l'intérieur de ses AirPods. Ces capteurs permettraient aux écouteurs de suivre différents signaux biologiques comme l'activité cérébrale, les réponses musculaires et le rythme cardiaque. Cette initiative reflète l'intérêt croissant pour l'utilisation de capteurs miniaturisés dans les technologies grand public afin de faciliter le suivi de la santé et du bien-être.

Dynamique du marché des capteurs d'ondes acoustiques

Conducteur

« Demande croissante d'appareils de santé portables »

- One of the key drivers of growth in the acoustic wave sensor market is the increasing demand for wearable health devices. As health-conscious consumers look for ways to monitor their well-being continuously, wearable technologies, such as smartwatches, fitness trackers, and health monitoring patches, are rapidly gaining popularity. Acoustic wave sensors, with their ability to detect various biomarkers like heart rate, respiration rate, and glucose levels, are perfect for these applications.

- These sensors offer a non-invasive, real-time solution that can provide valuable health insights. As consumers demand more portable, user-friendly, and accurate health monitoring devices, manufacturers are integrating acoustic wave sensors into wearables to meet these expectations. This growing trend in personal health tracking is driving the need for more advanced, miniaturized, and efficient sensors, further propelling the market.

- Additionally, with advancements in wireless connectivity and data analytics, these devices can seamlessly track, record, and even analyze the health data, offering actionable insights for users.

For instance,

- In May 2023, Fitbit launched its new health-focused smartwatch equipped with surface acoustic wave sensors to monitor heart rate variability and stress levels. This wearable tech represents the growing trend of integrating acoustic wave sensors in consumer health devices, providing users with real-time feedback on their well-being.

Opportunity

“Healthcare and Biomedical Advancements”

- Acoustic wave sensors are making a big difference in modern healthcare by enabling accurate, non-invasive, real-time monitoring of vital signs and medical conditions. Their incredible sensitivity helps detect early signs of disease, including biomarkers and infections, which supports early diagnosis and customized treatment options.

- These sensors are being used more in wearable health devices, quick diagnostic tools, and compact lab-on-a-chip systems. Because they’re small and can wirelessly transmit data, they’re perfect for ongoing health monitoring—especially in rural or hard-to-reach areas.

- With the rise of personalized medicine, these sensors are becoming key tools in enhancing patient care. Their real-time data improves treatment accuracy and health outcomes.

For instance,

- In April 2023, researchers at the University of Michigan unveiled "SAWSense," a system that turns everyday surfaces into precise touch-sensitive interfaces using acoustic wave sensor technology. This innovation could have meaningful applications in wearable health monitors and medical diagnostics.

Restraint/Challenge

“High Manufacturing and Development Costs”

- One of the key challenges facing the acoustic wave sensor market is the high cost associated with manufacturing and development. While these sensors are highly sensitive and versatile, their production requires specialized materials and advanced fabrication processes that can be expensive.

- The integration of acoustic wave sensors into devices often requires precise engineering and customized designs to meet specific application needs. These factors significantly increase both development and production costs. For small-scale manufacturers or those in regions with limited budgets, the high cost of producing and implementing acoustic wave sensors can act as a barrier to market entry.

- Additionally, ongoing R&D efforts to improve sensor performance and miniaturization further contribute to these costs. As a result, the high price tag on these sensors can limit their widespread adoption, especially in cost-sensitive industries such as consumer electronics and mass-market healthcare devices.

For instance,

- In June 2024, a company specializing in acoustic wave sensor technology reported delays in production due to rising costs associated with raw materials and the complex manufacturing process required for high-performance sensors. This highlights how cost constraints can impact the scalability of sensor adoption in various sectors, including industrial applications.

Acoustic Wave Sensor Market Scope

The market is segmented on the basis type, device, sensing parameter and vertical.

|

Segmentation |

Sub-Segmentation |

|

Type |

|

|

Device |

|

|

Sensing parameter |

|

|

Vertical |

|

In 2025, the Surface Acoustic Wave (SAW)is projected to dominate the market with a largest share in segment

In 2025, the Surface Acoustic Wave (SAW) segment is expected to hold the largest market share of 53.59%. This dominance is attributed to SAW sensors' ability to provide high sensitivity, accuracy, and reliability in various applications. SAW sensors are widely used in industries like telecommunications, healthcare, and automotive due to their efficiency in detecting small changes in environmental conditions. The technology's cost-effectiveness and ease of integration also contribute to its growing popularity. As demand for more precise and compact sensors increases, SAW technology continues to lead the market. This trend is expected to continue throughout 2025, with SAW sensors playing a pivotal role across various industries.

The Bulk Acoustic Wave (BAW) is expected to account for the largest share during the forecast period in market

In 2025, During the forecast period, the Bulk Acoustic Wave (BAW) segment is anticipated to capture the largest market share of 51.26%. BAW sensors are favored for their ability to operate at higher frequencies, providing enhanced performance in demanding applications. These sensors are commonly used in mobile communication, radar systems, and medical diagnostics due to their superior sensitivity and reliability. The increasing demand for high-frequency sensors in telecommunications and aerospace is driving this growth. BAW sensors are also gaining traction in the automotive industry, particularly for advanced driver-assistance systems (ADAS). As industries continue to prioritize performance and precision, BAW technology is poised for strong market growth.

Acoustic Wave Sensor Market Regional Analysis

“North America Holds the Largest Share in the Acoustic Wave Sensor Market”

- North America leads the Acoustic Wave Sensor market, primarily driven by strong demand for advanced technology across sectors like telecommunications, healthcare, and automotive. The region is home to many major technology companies and innovation hubs, which contribute to the high adoption of acoustic wave sensors in industrial and consumer applications.

- With a robust infrastructure and a focus on research and development, North America continues to dominate. The growing need for precise, reliable sensors in medical devices, defense, and environmental monitoring has further solidified the region's market leadership. Additionally, favorable government initiatives and investments in tech development are fueling further market expansion.

“Asia-Pacific is Projected to Register the Highest CAGR in the Acoustic Wave Sensor Market”

- Asia-Pacific is expected to register the highest CAGR in the Acoustic Wave Sensor market during the forecast period. This growth is attributed to the rapid industrialization in countries like China, Japan, and India, where technological advancements are being embraced at a fast pace.

- The increasing demand for acoustic wave sensors in automotive applications, healthcare, and environmental monitoring is driving the market. Furthermore, the rise of IoT devices and smart technologies in the region is boosting the need for high-performance sensors.

- As the Asia-Pacific region continues to grow its manufacturing and technological capabilities, it is set to become a major contributor to the global market. Additionally, the expanding adoption of electric vehicles and smart cities will further fuel market demand.

Acoustic Wave Sensor Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Microsemi,

- Qualtre, Inc,

- SENSeOR,

- Sensor Technology Ltd,

- NanoTemper Technologies GmbH,

- Althen GmbH Mess- und Sensortechnik,

- Transense.,

- pro-micron GmbH, H.

- Heinz Meßwiderstände GmbH,

- Hawk Measurement Systems,

- Abracon,

- A D METRO INC.,

- API Technologies Corp.,

- CTS Corporation,

- Honeywell International Inc.,

- Panasonic Corporation,

- Teledyne Defense Electronics,

- BOSTON PIEZO-OPTICS INC.,

- Christian Bürkert GmbH & Co. KG,

- Siemens,

- General Electric,

- Emerson Electric Co.,

- Mercury United,

- Electronic Sensor Technology,

- Microchip Technologies

Latest Developments in Global Acoustic Wave Sensor Market

- In March 2025, Transense Technologies advanced its SAWSense technology, utilizing surface acoustic wave (SAW) sensors to monitor key parameters like torque, force, pressure, and temperature in crucial industries such as aerospace, automotive, and robotics. The technology’s wireless, passive nature enhances the reliability and safety of systems operating under high-performance conditions. In partnership with Drive System Design Limited, Transense is enhancing the power density of electric motor systems, demonstrating the increasing adoption of SAW sensors in various industries.

- In April 2025 marked the expansion of Microchip Technology's portfolio of GaN (Gallium Nitride) Radio Frequency (RF) power devices. This expansion includes new MMICs (Monolithic Microwave Integrated Circuits) and discrete transistors that are optimized for frequencies as high as 20 GHz. These advancements support essential wireless protocols like Wi-Fi, Bluetooth, and LoRa, in line with the growing demand for high-frequency sensors in IoT and telecommunications sectors.

- Throughout 2025, NanoTemper Technologies GmbH continued its work on enhancing the performance of acoustic wave sensors, with a focus on applications requiring high sensitivity and precision. Their sensors are utilized across diverse industries, including healthcare and environmental monitoring, to ensure accurate detection and measurement. The company's ongoing research is aimed at making their sensors more versatile and efficient to meet the growing demands of modern industries that require precise acoustic sensing.

- En juin 2025, Althen GmbH Mess- und Sensortechnik a lancé un système de capteurs à ondes acoustiques de surface (SAW) sans fil conçu pour surveiller l'état structurel des matériaux dans des secteurs comme l'aérospatiale et le génie civil. Ce système assure une surveillance en temps réel, essentielle pour garantir l'intégrité des structures dans ces domaines exigeants. La fonctionnalité sans fil du système facilite le déploiement et la surveillance à distance, offrant ainsi une solution flexible et efficace pour les applications industrielles.

- En juillet 2025, SENSeOR SAS a poursuivi le développement et le déploiement de capteurs passifs sans fil à ondes acoustiques de surface (SAW), principalement destinés aux secteurs de l'énergie et de l'industrie. Ces capteurs sont particulièrement appréciés pour leur faible consommation d'énergie et leur capacité à fonctionner dans des environnements difficiles, ce qui les rend idéaux pour la surveillance de la température et de la pression dans des conditions difficiles. Le partenariat de SENSeOR avec Clere Electronics Ltd. a favorisé la généralisation de ces capteurs dans divers secteurs.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.