Global Video Streaming Software Market

Taille du marché en milliards USD

TCAC :

%

USD

5.70 Billion

USD

11.90 Billion

2024

2032

USD

5.70 Billion

USD

11.90 Billion

2024

2032

| 2025 –2032 | |

| USD 5.70 Billion | |

| USD 11.90 Billion | |

|

|

|

|

Global Video Streaming Software Market Segmentation, By Component (Solutions, Services), Streaming Type (Live Streaming, Video-on-Demand Streaming), Deployment Mode (Cloud, On-Premises), End User (Media and Entertainment, Education, BFSI, Healthcare, Government, Retail and E-Commerce, IT and Telecom, Others) - Industry Trends and Forecast to 2032

Video Streaming Software Market Size

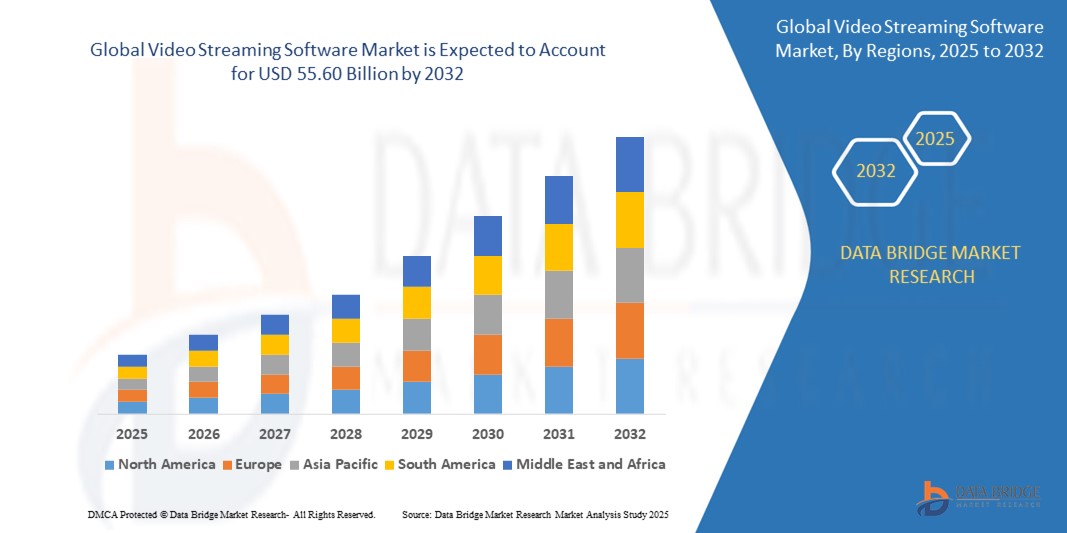

- The global Video Streaming Software market size was valued atUSD 13.00 billion in 2024and is expected to reachUSD 55.60 billion by 2032, at aCAGR of 20.00%during the forecast period

- This growth is driven by factors such as the increasing demand for over-the-top (OTT) platforms, the proliferation of high-speed internet and 5G networks, and the rising popularity of live streaming across industries.

Video Streaming Software Market Analysis

- Video Streaming Software encompasses solutions and platforms that enable the delivery, management, and monetization of video content over the internet, including live streaming, video-on-demand (VOD), content management, and analytics tools.

- The demand for video streaming software is significantly driven by the global shift from traditional TV to OTT platforms, with 70% of consumers preferring on-demand content in 2024, and the growing penetration of smartphones, reaching 4.5 billion users globally by 2025.

- North America is expected to dominate the Video Streaming Software market due to its advanced technological infrastructure and the presence of key players like Netflix and Amazon Web Services.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to increasing internet penetration and demand for localized content in countries like India and China.

- The Live Streaming segment is expected to dominate the market with a market share of 38.2% in 2025 due to its widespread use in gaming, sports, and virtual events.

Report Scope and Video Streaming Software Market Segmentation

|

Attributes |

Video Streaming Software KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Video Streaming Software Market Trends

“Rise of AI and 5G in Video Streaming Solutions”

- A prominent trend in the Video Streaming Software market is the integration of artificial intelligence (AI) and 5G technology, which enhances video quality, reduces latency, and enables personalized content recommendations, improving user engagement by up to 35%.

- AI-powered analytics and 5G’s ultra-high-definition streaming capabilities are transforming platforms, with 92% of internet users watching digital videos weekly in 2024.

- For instance, in January 2025, Brightcove launched its AI Content Suite, enhancing video content creation and distribution for global OTT platforms.

- These advancements are driving demand for innovative streaming software that supports high-quality, real-time experiences

Video Streaming Software Market Dynamics

Driver

“Surging Demand for OTT and Live Streaming Platforms”

- The rapid growth of OTT platforms, with Netflix reaching 278 million subscribers in Q2 2024, and the increasing popularity of live streaming for sports, gaming, and events are significantly contributing to the demand for video streaming software.

- These platforms leverage advanced software for content delivery, transcoding, and analytics, ensuring seamless streaming across devices.

- For instance, in April 2024, Accedo and Brightcove launched Iraq’s first SVOD platform, 1001, enhancing ad-free content delivery for Arabic-speaking audiences.

- As consumer preference for on-demand and live content grows, the demand for robust streaming software rises, ensuring high-quality user experiences

Opportunity

“Adoption of Cloud-Based Streaming Solutions”

- Cloud-based streaming solutions offer scalability, cost-efficiency, and global content delivery through content delivery networks (CDNs), reducing latency and improving streaming quality for 80% of users.

- These solutions enable businesses to manage large-scale content libraries and cater to fluctuating demand, appealing to both enterprises and content creators.

- For instance, in 2024, AWS supported major streaming services like Netflix and Formula 1, providing scalable cloud infrastructure for high-quality streaming.

- This opportunity drives market growth by addressing the need for flexible and accessible streaming platforms.

Restraint/Challenge

“Content Piracy and Bandwidth Constraints”

- Content piracy, with visits to pirated sites increasing by 20% in 2022, and bandwidth dependency, with 60% of platforms facing challenges in low-internet regions, pose significant challenges to the Video Streaming Software market.

- These issues limit adoption in emerging markets and increase operational costs for providers ensuring security and quality.

- For instance, in 2024, 45% of streaming providers reported challenges in securing content against piracy, impacting revenue streams.

- These challenges can hinder market growth, requiring advanced security measures and infrastructure investments.

Video Streaming Software Market Scope

The market is segmented on the basis of component, streaming type, deployment mode, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Streaming Type |

|

|

By Deployment Mode |

|

|

By End User

|

|

In 2025, the Live Streaming is projected to dominate the market with the largest share in Type segment

The Live Streaming segment is expected to dominate the Video Streaming Software market with the largest share of 56.22% in 2025 due to its growing popularity across entertainment, gaming, education, and corporate sectors. The increasing demand for real-time content delivery, interactive experiences, and virtual engagement is driving rapid adoption. Enhanced network capabilities, 5G rollout, and consumer preference for immersive, live content continue to fuel the segment’s strong market performance and leadership.

The Cloud is expected to account for the largest share during the forecast period in Deployment Mode market

In 2025, the Cloud segment is expected to dominate the Video Streaming Software market with the largest market share of 51.31% due to its scalability, cost efficiency, and seamless access across devices and geographies. As organizations seek flexible infrastructure to support high-quality streaming and growing user bases, cloud-based solutions offer enhanced reliability and performance. The rise of SaaS models, remote work, and digital content consumption further support the cloud segment’s dominant position.

Video Streaming Software Market Regional Analysis

“North America Holds the Largest Share in the Video Streaming Software Market”

- North America dominates the Global Video Streaming Market, driven by a combination of advanced technology infrastructure, high consumer demand for on-demand and live video content, and the presence of major streaming platforms like Netflix, Amazon Prime Video, and Hulu.

- The U.S. holds a significant share due to a mature market for video streaming, with widespread broadband access, high levels of disposable income, and strong adoption of smart devices such as smart TVs, smartphones, and tablets. The demand for diverse content, including entertainment, sports, and educational streaming, is fueling market growth.

- The availability of robust streaming infrastructure, including content delivery networks (CDNs), and the increasing adoption of 5G technology, which supports faster and higher-quality streaming, further strengthens the market position in the U.S.

- Additionally, the rising trend of cord-cutting—where consumers move away from traditional cable TV in favor of internet-based streaming services—has significantly contributed to the growth of the video streaming software market across the region.

“Asia-Pacific is Projected to Register the HighestCAGR in the Video Streaming Software Market”

- The Asia-Pacific (APAC) region is expected to witness the highest CAGR in the Global Video Streaming Market. This growth is driven by the rapid expansion of internet access, increased smartphone penetration, and the rising demand for affordable video streaming services.

- Countries like China, India, and Japan are emerging as key markets due to their large populations and rapid adoption of digital entertainment platforms. The increasing availability of low-cost smartphones and affordable internet packages has made video streaming services accessible to a broader consumer base.

- China has become one of the world's largest video streaming markets, with dominant players like iQIYI, Tencent Video, and Youku. The Chinese market is witnessing high demand for both domestic and international content, including movies, TV shows, and live streaming events. Moreover, the country’s growing focus on premium content creation and streaming platforms is expected to further boost market growth.

- India is experiencing a rapid rise in video streaming adoption, with an expanding middle class, increasing internet speeds, and the rise of mobile-first streaming platforms such as Hotstar (Disney+ Hotstar) and Zee5. The growing popularity of regional content and the increasing availability of local language programming are key drivers of growth in India.

- Japan, with its tech-savvy population, continues to be a crucial market for high-quality video streaming. The country is seeing growing adoption of streaming platforms, driven by the demand for anime content, movies, and sports events. Japan’s strong internet infrastructure and rising penetration of smart TVs and gaming consoles are key contributors to the video streaming market expansion.

- Additionally, APAC countries are witnessing increasing investment from global streaming giants, such as Netflix, Amazon Prime Video, and YouTube, who are expanding their content libraries and offering region-specific pricing and content to cater to local preferences

Video Streaming Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Netflix, Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Brightcove, Inc. (U.S.)

- Hulu LLC (The Walt Disney Company) (U.S.)

- Google LLC (YouTube) (U.S.)

- IBM Corporation (U.S.)

- Kaltura, Inc. (U.S.)

- Wowza Media Systems, LLC (U.S.)

- Akamai Technologies, Inc. (U.S.)

- Vimeo, Inc. (U.S.)

Latest Developments in Global Video Streaming Software Market

- January 2025: Brightcove launched its AI Content Suite, enhancing video content creation, distribution, and monetization for OTT platforms.

- April 2024: Accedo and Brightcove, with Al Sharqiya Group, launched Iraq’s first SVOD platform, 1001, offering ad-free premium content for Arabic-speaking audiences.

- November 2021: Amazon Web Services introduced aggregating video and live streaming software in India, integrating eight local and global streaming services.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.