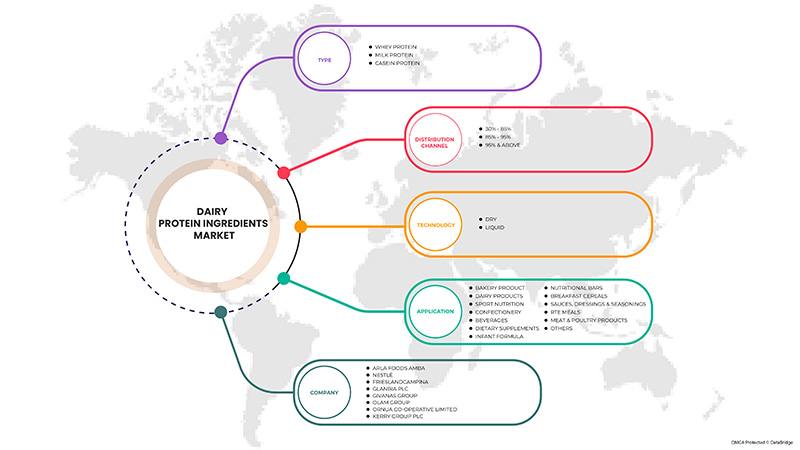

Marché des ingrédients protéiques du lait de vache en Afrique de l'Ouest, par type (protéine de lactosérum, protéine de lait et protéine de caséine), teneur (30 % - 85 %, 85 % - 95 % et 95 % et plus), forme (sec et liquide), application (produit de boulangerie, produits laitiers, nutrition sportive, confiserie, boissons, compléments alimentaires, préparations pour nourrissons, barres nutritionnelles, céréales pour petit-déjeuner, sauces, vinaigrettes et assaisonnements, plats préparés, produits à base de viande et de volaille et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des ingrédients protéiques laitiers en Afrique de l'Ouest

Les protéines du lait de vache sont des ingrédients qui peuvent être utilisés pour donner une texture appropriée aux produits laitiers. Elles ont également une qualité liante qui lie toute la valeur nutritionnelle des aliments. Elles sont très riches en protéines, ce qui contribue à offrir une meilleure qualité de régime alimentaire aux humains. Les protéines laitières sont également un ingrédient des préparations pour nourrissons pour offrir une meilleure nutrition aux nouveau-nés en phase de croissance. Ces protéines ont de nombreuses applications dans les produits de boulangerie, les boissons, les glaces et autres. Pour répondre à la demande, les fabricants se concentrent sur la fourniture de produits à base d'ingrédients laitiers sur le marché.

Français Ces ingrédients protéiques laitiers sont utilisés dans la fabrication de produits de boulangerie, de confiserie, de plats préparés, de sauces, de vinaigrettes et d'assaisonnements, de boissons, de produits laitiers, de céréales pour petit-déjeuner, de barres nutritionnelles, de nutrition sportive, de produits à base de viande et de volaille, de compléments alimentaires , de préparations pour nourrissons et autres. Data Bridge Market Research analyse que le marché des ingrédients protéiques laitiers devrait atteindre la valeur de 219 130,04 milliers de dollars d'ici 2029, à un TCAC de 11,0 % au cours de la période de prévision. La « boulangerie » représente le segment d'application le plus important. Le rapport de marché organisé par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de la chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type (protéine de lactosérum, protéine de lait et protéine de caséine), teneur (30 % - 85 %, 85 % - 95 % et 95 % et plus), forme (sèche et liquide), application (produits de boulangerie, produits laitiers, nutrition sportive , confiserie, boissons, compléments alimentaires, préparations pour nourrissons, barres nutritionnelles , céréales pour petit-déjeuner, sauces , vinaigrettes et assaisonnements, plats préparés, produits à base de viande et de volaille et autres) |

|

Pays couverts |

Nigéria, Ghana, Bénin, Libéria et reste de l'Afrique de l'Ouest |

|

Acteurs du marché couverts |

Arla Foods Amba, Nestlé, FrieslandCampina, Glanbia PLC, GIVANAS GROUP, Olam Group, Ornua Co-operative Limited et Kerry Group plc |

Définition du marché

Les ingrédients protéiques laitiers sont des ingrédients secs aux propriétés nutritionnelles élevées qui libèrent des peptides dans le corps humain pour renforcer le métabolisme. Les protéines laitières contiennent divers ingrédients, notamment des protéines de lait, des protéines de lactosérum, de la caséine et des caséinates. Elles sont disponibles sous forme de protéines de lactosérum, de protéines de lait et de protéines de caséine. Les protéines de lactosérum sont très utilisées dans les performances physiques et l'amélioration du corps. Les protéines de lait sont généralement utilisées comme préparation pour nourrissons, car elles aident le nourrisson à obtenir les protéines vitales importantes pour sa croissance. Les protéines de caséine sont utilisées pour minimiser la dégradation musculaire et améliorer la croissance musculaire.

Le COVID-19 a eu un impact minimal sur le marché des ingrédients protéiques laitiers

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. En raison du confinement, le marché des ingrédients protéiques laitiers a connu un impact significatif sur l'importation et l'exportation de produits à base d'ingrédients protéiques laitiers au cours des dernières années. En raison de l'épidémie de COVID-19, le secteur agricole a été affecté négativement. Environ 5 millions de personnes se sont appauvries au Nigéria en raison des taux d'infection, de la gravité de la maladie et de la mortalité. Pour la sécurité des personnes, des limitations ont été imposées à la production agricole, au commerce agricole international et à un accès sécurisé à une alimentation saine pour tous. Mais avec le développement de la COVID-19, des défis sont apparus en Afrique de l'Ouest pour relancer la production et la main-d'œuvre agricole, qui avait déjà un profil nutritionnel et sanitaire relativement médiocre. Avec la demande croissante d'aliments sains parmi les consommateurs d'Afrique de l'Ouest, le besoin d'ingrédients protéiques laitiers a augmenté.

La dynamique du marché des ingrédients protéiques laitiers comprend :

Cette section traite de la compréhension des moteurs, des opportunités, des défis et des contraintes du marché. Tout cela est discuté en détail ci-dessous :

Facteurs moteurs du marché des ingrédients protéiques laitiers

- L'importance croissante de la nutrition sportive

La consommation de nutrition sportive ne se limite pas aux athlètes professionnels ou aux sportifs, mais est largement consommée par les millennials et la jeune génération pour se construire un corps et rester en bonne santé. La demande en énergie, en force et en santé musculaire augmente pour la nutrition sportive de presque toutes les tranches d'âge, comme les millennials et les seniors. Cette nutrition fournit des niveaux élevés de puissance et est consommée avant ou après l'entraînement. Par conséquent, la sensibilisation croissante des personnes de tous les groupes d'âge à la forme physique est susceptible de stimuler l'utilisation de la nutrition sportive, ce qui entraînera une demande accrue d'ingrédients protéiques laitiers.

- Croissance de la demande de produits de boulangerie et de produits laitiers

Certains produits de boulangerie et produits laitiers sont fabriqués à partir de protéines laitières, ce qui augmente le facteur nutritionnel des produits. Les protéines de lactosérum, de lait et de caséine sont utilisées pour fabriquer des produits destinés à diverses applications, telles que le pain, les gâteaux, les pâtisseries, les biscuits et les craquelins, les glaçages, les garnitures et les glaçages. La protéine de lactosérum est utilisée en boulangerie pour ses propriétés émulsifiantes, moussantes, gélifiantes, stabilisantes, brunissantes et nutritionnelles et est utilisée comme substitut aux blancs d'œufs. La demande de baguettes augmente considérablement en Afrique de l'Ouest, contribuant à la croissance des produits de boulangerie dans la région. Divers produits laitiers tels que les yaourts, le fromage et les glaces sont fabriqués à partir de protéines laitières. Le lactosérum est utilisé pour produire des fromages de lactosérum tels que la ricotta, le brunost et le beurre.

- Forte demande d'ingrédients protéiques laitiers pour répondre à un problème alimentaire humain majeur

Les Africains sont de plus en plus conscients des risques pour leur santé et ont commencé à modifier leur mode de vie. La prise de conscience croissante des principaux problèmes alimentaires humains a contribué à l'apparition des salles de sport et à la consommation de protéines laitières dans les régions. Les gens se tournent vers l'exercice pour avoir un cœur en bonne santé ou pour traiter des problèmes médicaux spécifiques tels que l'hypertension, le diabète, l'obésité et le cancer. Avec la salle de sport, les gens consomment davantage d'ingrédients à base de protéines laitières pour leur santé. Ainsi, la forte demande d'ingrédients à base de protéines laitières pour les principaux problèmes alimentaires humains est un moteur du marché.

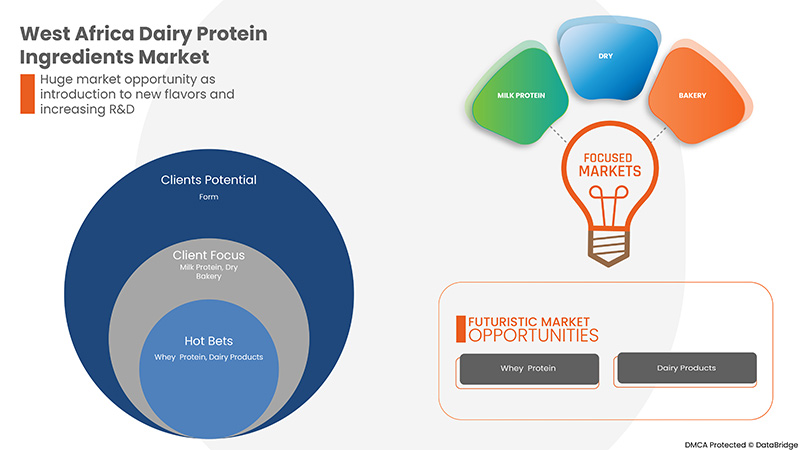

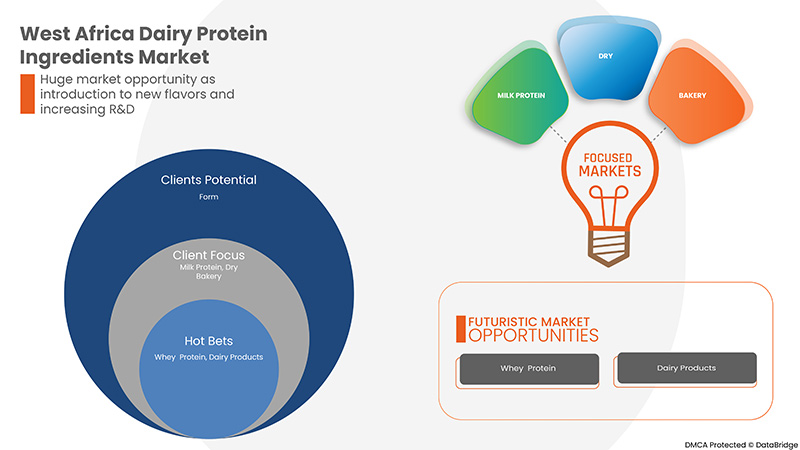

L'opportunité pour le marché des ingrédients protéiques laitiers

- Introduction à de nouvelles saveurs et augmentation de la R&D

Les habitudes alimentaires actuelles ont eu un impact sur l'apport quotidien en micronutriments, qui est inférieur aux quantités recommandées. De ce fait, le besoin d'enrichir les aliments ou les produits laitiers augmente rapidement. Les nouvelles avancées dans la technologie alimentaire aident les fabricants à augmenter la durée de conservation et les propriétés des produits. Les fabricants engagés dans la production d'ingrédients protéiques laitiers se sont concentrés sur la R&D. Certains travaillent avec des start-up innovantes et des marques de consommation multinationales bien établies pour lancer des produits à succès contenant des protéines nutritives de haute qualité. Ainsi, l'introduction de nouvelles saveurs et l'augmentation de la R&D constituent une opportunité de contribuer à la croissance du marché des ingrédients protéiques laitiers

Contraintes/défis rencontrés par le marché des ingrédients protéiques laitiers

- De profondes inquiétudes concernant l’intolérance au lactose et les allergies au lait

La consommation de produits laitiers a augmenté plus rapidement parmi les consommateurs. De plus, la demande croissante d'ingrédients protéiques laitiers est l'un des facteurs importants de la croissance de l'industrie laitière. Cependant, l'incidence croissante de l'intolérance au lactose réduira la consommation d'ingrédients protéiques laitiers. L'intolérance au lactose est un trouble dans lequel l'individu a une capacité réduite à digérer le lactose contenu dans les produits laitiers. L'intolérance au lactose a augmenté au sein de la population. Ainsi, la tolérance croissante au lactose entravera la croissance du marché des ingrédients protéiques laitiers. En outre, une population spécifique souffre d'allergies au lait, principalement causées par deux protéines du lait, la caséine et le lactosérum. En raison des allergies au lait, les individus peuvent souffrir de respiration sifflante, de vomissements, d'urticaire et de problèmes digestifs, ce qui met parfois leur vie en danger.

- Une menace crédible de substituts, principalement des ingrédients protéiques d'origine végétale

La plupart des humains cessent généralement de produire de la lactase après le sevrage et deviennent par conséquent intolérants au lactose. Ainsi, le nombre croissant d'intolérants au lactose entraîne une demande de produits capables de remplacer la valeur nutritive des produits laitiers. Cela a augmenté la consommation de protéines végétales par rapport aux produits laitiers. Ces ingrédients protéiques végétaux agissent comme un substitut aux ingrédients protéiques laitiers, ce qui devrait entraver la croissance du marché des ingrédients protéiques laitiers en Afrique de l'Ouest au cours de la période de prévision.

- Incertitude dans l'approvisionnement et les prix du lait cru

Plusieurs facteurs ont affecté l’approvisionnement en lait en Afrique de l’Ouest, tels que le climat, la qualité des sols, la faible productivité animale et le manque d’investissement. Le développement de la production laitière en Afrique de l’Ouest est insuffisant pour le marché local et le lait est importé du marché européen. Les entreprises qui fabriquent des ingrédients protéiques laitiers ont du mal à évaluer correctement le risque de fortes fluctuations de la matière première laitière. Si l’augmentation des coûts des matières premières et la baisse des prix de vente se produisent en même temps, la rentabilité de l’entreprise diminue progressivement. Des coûts des matières premières très fluctuants et une gestion inefficace des prix peuvent sérieusement compromettre le succès des entreprises. Ainsi, l’incertitude quant à l’approvisionnement en lait essentiel et aux prix devrait remettre en cause la croissance du marché des ingrédients protéiques laitiers

Ce rapport sur le marché des ingrédients protéiques laitiers en Afrique de l’Ouest fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l’analyse des importations et des exportations, l’analyse de la production, l’optimisation de la chaîne de valeur, la part de marché, l’impact des acteurs du marché national et localisé, les opportunités d’analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l’analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d’application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d’informations sur le marché des ingrédients protéiques laitiers, contactez Data Bridge Market Research pour un briefing d’analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développements récents

- En septembre 2021, Arla Foods Ingredients, filiale d'Arla Foods amba, a lancé Lacprodan MFGM-10, le premier ingrédient MFGM (membrane des globules gras du lait) destiné au marché mondial des préparations pour nourrissons. Il est riche en phospholipides et en gangliosides. Cela a permis à l'entreprise de produire davantage de recettes à partir d'une seule poudre de base et d'élargir son portefeuille de produits.

- En août 2020, Glanbia Nutritionals, filiale de Glanbia PLC, a annoncé l'acquisition de Foodarom, un concepteur et fabricant d'arômes personnalisés basé au Canada qui fournit aux industries de l'alimentation, des boissons et des produits nutritionnels des arômes clés en main et un soutien à la formulation. Cela a aidé l'entreprise à augmenter son activité et ses revenus

Portée du marché des ingrédients protéiques laitiers en Afrique de l'Ouest

Le marché des ingrédients protéiques laitiers d'Afrique de l'Ouest est segmenté en fonction du type, du contenu, de la forme et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Protéine de lactosérum

- Protéine de lait

- Protéine de caséine

En fonction du type, le marché des ingrédients protéiques laitiers d’Afrique de l’Ouest est segmenté en protéines de lactosérum, protéines de lait et protéines de caséine.

Contenu

- 30% - 85%

- 85% - 95%

- 95 % et plus

En fonction du contenu, le marché des ingrédients protéiques laitiers d'Afrique de l'Ouest est segmenté en 30 % - 85 %, 85 % - 95 % et 95 % et plus.

Formulaire

- Liquide

- Sec

Sur la base de la forme, le marché des ingrédients protéiques laitiers d’Afrique de l’Ouest est segmenté en sec et liquide.

Application

- Boulangerie

- Produits laitiers

- Nutrition sportive

- Confiserie

- Compléments alimentaires

- Préparations pour nourrissons

- Barre nutritionnelle

- Céréales pour petit déjeuner

- Sauces, vinaigrettes et assaisonnements

- Plats prêts à manger

- Produits à base de viande et de volaille

- Boissons

- Autres

En fonction des applications, le marché des ingrédients protéiques laitiers d'Afrique de l'Ouest est segmenté en boulangerie, produits laitiers, nutrition sportive, confiserie, compléments alimentaires, préparations pour nourrissons, barres nutritionnelles, céréales pour petit-déjeuner, sauces, vinaigrettes et assaisonnements, repas RTE, produits à base de viande et de volaille, boissons et autres (le cas échéant).

Analyse/perspectives régionales du marché des ingrédients protéiques laitiers en Afrique de l'Ouest

Le marché des ingrédients protéiques laitiers d’Afrique de l’Ouest est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, contenu, forme et application, comme référencé ci-dessus.

Les pays concernés sont le Nigéria, le Ghana, le Bénin, le Libéria et le reste de l'Afrique de l'Ouest. Le Nigéria domine le marché des ingrédients protéiques laitiers en Afrique de l'Ouest en raison de sa grande population, ce qui crée une large base de clientèle dans la région pour le marché des ingrédients protéiques laitiers.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui influencent les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Afrique de l'Ouest et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des ingrédients protéiques laitiers en Afrique de l'Ouest

Le paysage concurrentiel du marché des ingrédients protéiques laitiers en Afrique de l'Ouest fournit des détails sur les concurrents. Les composants inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Afrique de l'Ouest, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement et la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises associée au marché des ingrédients protéiques laitiers en Afrique de l'Ouest.

Arla Foods amba domine le marché des ingrédients protéiques laitiers en Afrique de l'Ouest. Parmi les principaux acteurs opérant sur le marché des ingrédients protéiques laitiers figurent Nestlé, FrieslandCampina, Glanbia PLC, GIVANAS GROUP, Olam Group, Ornua Co-operative Limited, Kerry Group plc, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER-LEVEL TRENDS

4.2.1 CONSUMER NUTRITIONAL PREFERENCES

4.2.2 VARIOUS MARKET PARTICIPANTS' TRENDS

4.2.3 TRENDS IN SOCIAL MEDIA

4.2.4 ONLINE SHOPPING IS BECOMING MORE POPULAR

4.3 NEW PRODUCT LAUNCH STRATEGY

4.3.1 THE NUMBER OF NEW PRODUCT LAUNCHES

4.3.2 ADVERTISING AND MARKETING

4.3.3 MEETING CUSTOMER EXPECTATIONS

4.3.4 DESIGNING AND PACKAGING

4.3.5 PRODUCT BRANDING

4.3.6 CONCLUSION

4.4 PRIVATE LABEL VS BRAND LABEL IN THE

4.5 PROMOTIONAL ACTIVITIES

4.6 SHOPPING BEHAVIOUR AND DYNAMICS

4.7 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

4.8 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.9 SUPPLY CHAIN

4.1 RAW MATERIAL PROCUREMENT

4.11 MARKETING AND DISTRIBUTION

4.12 END USERS

4.13 REGULATORY FRAMEWORK AND GUIDELINES

5 GLOBAL OVERVIEW-

6 REGIONAL SUMMARY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING IMPORTANCE OF SPORTS NUTRITION

7.1.2 GROWING DEMAND FOR THE BAKERY AND DAIRY PRODUCTS

7.1.3 STRONG DEMAND FOR DAIRY PROTEIN INGREDIENTS FOR MAJOR HUMAN DIETARY PROBLEM

7.1.4 INCREASE IN THE NUMBER OF BIRTHRATES AND WORKING WOMEN

7.2 RESTRAINTS

7.2.1 HIGH CONCERNS OVER LACTOSE INTOLERANCE AND MILK ALLERGIES

7.2.2 CREDIBLE THREAT OF SUBSTITUTES, PARTICULARLY PLANT-BASED PROTEIN INGREDIENTS

7.3 OPPORTUNITY

7.3.1 INTRODUCTION TO NEW FLAVORS AND INCREASING R&D

7.4 CHALLENGE

7.4.1 UNCERTAINTY IN SUPPLY AND PRICES OF RAW MILK

8 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 MILK PROTEIN

8.2.1 MILK PROTEIN CONCENTRATES

8.2.2 MILK WHEY PROTEIN HYDROXYLATES

8.2.3 MILK PROTEIN ISOLATES

8.3 WHEY PROTEIN

8.3.1 WHEY PROTEIN CONCENTRATES

8.3.2 WHEY PROTEIN HYDROXYLATES

8.3.3 WHEY PROTEIN ISOLATES

8.4 CASEIN PROTEIN

8.4.1 CONCENTRATES

8.4.2 HYDROXYLATES

8.4.3 ISOLATES

9 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT

9.1 OVERVIEW

9.2 30%-85%

9.3 85%-95%

9.4 95% & ABOVE

10 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.3 LIQUID

11 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 BAKERY

11.2.1 BAKERY, BY APPLICATION

11.2.1.1 BREAD & ROLLS

11.2.1.2 CAKE & PASTRIES

11.2.1.3 COOKIES & BISCUITS

11.2.1.4 MUFFINS & DONUTS

11.2.1.5 OTHERS

11.2.2 BAKERY, BY TYPE

11.2.2.1 MILK PROTEIN

11.2.2.2 WHEY PROTEIN

11.2.2.3 CASEIN PROTEIN

11.3 DAIRY PRODUCTS

11.3.1 DAIRY PRODUCTS, BY APPLICATION

11.3.1.1 CHEESE

11.3.1.2 YOGURTS

11.3.1.3 DAIRY DESSERTS

11.3.1.4 CREAMER

11.3.1.5 TOFU

11.3.1.6 OTHERS

11.3.2 DAIRY PRODUCTS, BY TYPE

11.3.2.1 MILK PROTEIN

11.3.2.2 WHEY PROTEIN

11.3.2.3 CASEIN PROTEIN

11.4 SPORT NUTRITION

11.4.1 SPORT NUTRITION, BY APPLICATION

11.4.1.1 PROTEIN POWDER

11.4.1.2 PROTEIN READY TO DRINK

11.4.2 SPORT NUTRITION, BY TYPE

11.4.2.1 MILK PROTEIN

11.4.2.2 WHEY PROTEIN

11.4.2.3 CASEIN PROTEIN

11.5 CONFECTIONERY

11.5.1 CONFECTIONERY, BY APPLICATION

11.5.1.1 CHOCOLATE

11.5.1.2 CANDIES

11.5.1.3 CHEWING GUM

11.5.1.4 GUMMIES & MARSHMALLOWS

11.5.1.5 OTHERS

11.5.2 CONFECTIONERY, BY TYPE

11.5.2.1 MILK PROTEIN

11.5.2.2 WHEY PROTEIN

11.5.2.3 CASEIN PROTEIN

11.6 BEVERAGES

11.6.1 BEVERAGES, BY APPLICATION

11.6.2 DAIRY ALTERNATIVE DRINKS

11.6.3 FLAVORED DRINKS

11.6.3.1 VANILLA

11.6.3.2 STRAWBERRY

11.6.3.3 CHOCOLATE

11.6.3.4 OTHERS

11.6.4 RTD DRINKS

11.6.4.1 RTD COFFEE

11.6.4.2 RTD TEA

11.6.5 OTHERS

11.6.6 BEVERAGES, BY TYPE

11.6.6.1 MILK PROTEIN

11.6.6.2 WHEY PROTEIN

11.6.6.3 CASEIN PROTEIN

11.7 DIETARY SUPPLEMENTS

11.7.1 DIETARY SUPPLEMENTS, BY TYPE

11.7.1.1 MILK PROTEIN

11.7.1.2 WHEY PROTEIN

11.7.1.3 CASEIN PROTEIN

11.8 INFANT FORMULA

11.8.1 INFANT FORMULA, BY APPLICATION

11.8.1.1 STANDARD FORMULA

11.8.1.2 GROWING-UP FORMULA

11.8.1.3 FOLLOW-ON FORMULA

11.8.1.4 SPECIALTY FORMULA

11.8.2 INFANT FORMULA, BY TYPE

11.8.2.1 MILK PROTEIN

11.8.2.2 WHEY PROTEIN

11.8.2.3 CASEIN PROTEIN

11.9 NUTRITIONAL BARS

11.9.1 NUTRITIONAL BARS, BY TYPE

11.9.1.1 MILK PROTEIN

11.9.1.2 WHEY PROTEIN

11.9.1.3 CASEIN PROTEIN

11.1 BREAKFAST CEREALS

11.10.1 BREAKFAST CEREALS, BY TYPE

11.10.1.1 MILK PROTEIN

11.10.1.2 WHEY PROTEIN

11.10.1.3 CASEIN PROTEIN

11.11 SAUCES, DRESSINGS & SEASONINGS

11.11.1 SAUCES, DRESSINGS & SEASONINGS, BY TYPE

11.11.1.1 MILK PROTEIN

11.11.1.2 WHEY PROTEIN

11.11.1.3 CASEIN PROTEIN

11.12 RTE MEALS

11.12.1 RTE MEALS, BY TYPE

11.12.1.1 MILK PROTEIN

11.12.1.2 WHEY PROTEIN

11.12.1.3 CASEIN PROTEIN

11.13 MEAT & POULTRY PRODUCTS

11.13.1 MEAT & POULTRY PRODUCTS, BY TYPE

11.13.1.1 MILK PROTEIN

11.13.1.2 WHEY PROTEIN

11.13.1.3 CASEIN PROTEIN

11.14 OTHERS

11.14.1 OTHERS, BY TYPE

11.14.1.1 MILK PROTEIN

11.14.1.2 WHEY PROTEIN

11.14.1.3 CASEIN PROTEIN

12 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET

12.1 WEST AFRICA

12.1.1 NIGERIA

12.1.2 GHANA

12.1.3 BENIN

12.1.4 LIBERIA

12.1.5 REST OF WEST AFRICA

13 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: WEST AFRICA

13.2 MERGER & ACQUISITION

13.3 NEW PRODUCT DEVELOPMENT

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ARLA FOODS AMBA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 GLANBIA PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 KERRY GROUP PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 NESTLÉ

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ORNUA CO-OPERATIVE LIMITED

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 FRIESLANDCAMPINA

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 GIVANAS GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 OLAM GROUP

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF WHEY AND MODIFIED WHEY, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER; HS CODE - 040410 (USD THOUSAND)

TABLE 2 EXPORT DATA OF WHEY AND MODIFIED WHEY, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER; HS CODE - 040410 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 GLOBAL DAIRY PROTEIN INGREDIENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 WEST AFRICA MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 WEST AFRICA WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 WEST AFRICA CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 14 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 15 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 WEST AFRICA BAKERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 WEST AFRICA BAKERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 WEST AFRICA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 19 WEST AFRICA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 WEST AFRICA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 WEST AFRICA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 WEST AFRICA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 WEST AFRICA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 WEST AFRICA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 WEST AFRICA FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 WEST AFRICA RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 27 WEST AFRICA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 WEST AFRICA DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 WEST AFRICA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 WEST AFRICA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 WEST AFRICA NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 WEST AFRICA BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 WEST AFRICA SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 WEST AFRICA RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 WEST AFRICA MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 WEST AFRICA OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 38 NIGERIA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NIGERIA WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 NIGERIA MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NIGERIA CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NIGERIA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 43 NIGERIA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 44 NIGERIA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 45 NIGERIA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 NIGERIA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 47 NIGERIA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 NIGERIA FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 NIGERIA RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 NIGERIA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 NIGERIA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 NIGERIA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 NIGERIA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 NIGERIA CONFECTIONARY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NIGERIA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 NIGERIA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 NIGERIA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 NIGERIA DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 NIGERIA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 NIGERIA NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 NIGERIA BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 NIGERIA SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 NIGERIA RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 NIGERIA MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 NIGERIA OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 GHANA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 GHANA WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 GHANA MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 GHANA CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 GHANA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 71 GHANA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 GHANA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 GHANA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 GHANA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 GHANA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 76 GHANA FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 GHANA RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 GHANA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 GHANA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 GHANA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 GHANA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 GHANA CONFECTIONARY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 GHANA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 GHANA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 GHANA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 GHANA DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 GHANA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 GHANA NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 GHANA BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 GHANA SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 GHANA RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 GHANA MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 GHANA OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 BENIN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 BENIN WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 BENIN MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 BENIN CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 BENIN DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 99 BENIN DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 100 BENIN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 BENIN BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 BENIN CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 BENIN BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 104 BENIN FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 BENIN RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 BENIN DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 BENIN SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 BENIN INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 BENIN BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 BENIN CONFECTIONARY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 BENIN BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 BENIN DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 BENIN SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 BENIN DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 BENIN INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 116 BENIN NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 BENIN BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 BENIN SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 BENIN RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 BENIN MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 BENIN OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 122 LIBERIA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 LIBERIA WHEY PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 LIBERIA MILK PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 LIBERIA CASEIN PROTEIN IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 LIBERIA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2020-2029 (USD THOUSAND)

TABLE 127 LIBERIA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 128 LIBERIA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 LIBERIA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 LIBERIA CONFECTIONERY IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 131 LIBERIA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 LIBERIA FLAVORED DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 LIBERIA RTD DRINKS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 134 LIBERIA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 LIBERIA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 LIBERIA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 137 LIBERIA BAKERY PRODUCT IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 LIBERIA CONFECTIONARY IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 LIBERIA BEVERAGES IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 LIBERIA DAIRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 LIBERIA SPORT NUTRITION IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 LIBERIA DIETARY SUPPLEMENTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 LIBERIA INFANT FORMULA IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 LIBERIA NUTRITIONAL BARS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 LIBERIA BREAKFAST CEREALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 LIBERIA SAUCES, DRESSINGS & SEASONINGS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 LIBERIA RTE MEALS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 LIBERIA MEAT & POULTRY PRODUCTS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 LIBERIA OTHERS IN DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 150 REST OF WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: SEGMENTATION

FIGURE 2 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: DATA TRIANGULATION

FIGURE 3 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: DROC ANALYSIS

FIGURE 4 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: WEST AFRICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: THE FORM LIFE LINE CURVE

FIGURE 7 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR THE BAKERY AND DAIRY PRODUCTS IS DRIVING WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 MILK PROTEIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN OF WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET

FIGURE 17 DRIVERS, RESTRAINT, OPPORTUNITY AND CHALLENGES OF WEST AFRICA DAIRY INGREDIENTS MARKET

FIGURE 18 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY TYPE, 2021

FIGURE 19 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY CONTENT, 2021

FIGURE 20 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY FORM, 2021

FIGURE 21 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2021

FIGURE 22 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: SNAPSHOT (2021)

FIGURE 23 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: BY COUNTRY (2021)

FIGURE 24 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: BY TYPE (2022-2029)

FIGURE 27 WEST AFRICA DAIRY PROTEIN INGREDIENTS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.