Marché américain des congélateurs de plain-pied, par type (autonome, condensation à distance et condensation multiplex), type de système (systèmes à distance, systèmes à distance pré-assemblés, système de réfrigération standard à montage supérieur, système de réfrigération à montage latéral, système de réfrigération à montage en selle, système de réfrigération en attique, système de réfrigération enroulable et autres), type de porte (porte simple, porte double, porte triple et autres), technologie (entièrement automatique, semi-automatique et manuelle), type de rideau (rideaux à lanières et rideaux d'air), canal de distribution (ventes directes/B2B, magasins spécialisés, commerce électronique et autres), utilisateur final (industriel, commercial, transport et résidentiel) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des congélateurs de plain-pied aux États-Unis

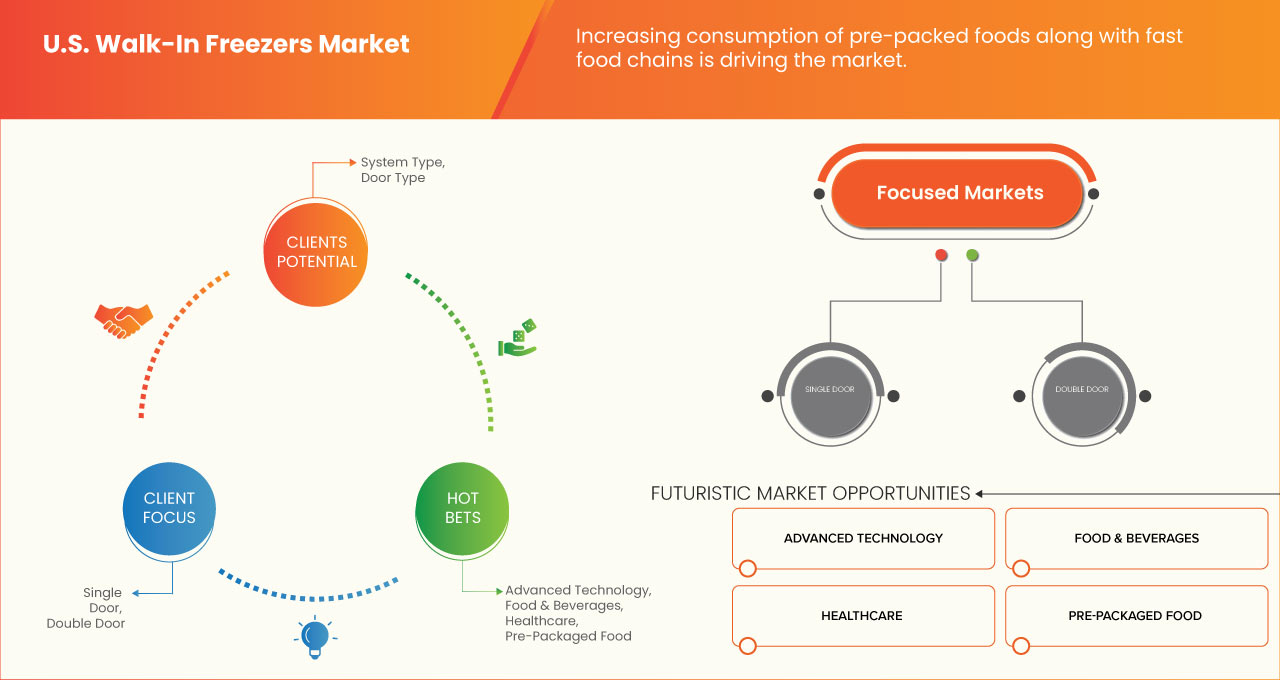

Le marché américain des congélateurs devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,4 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 468 742,94 milliers USD d'ici 2030. Le principal facteur à l'origine de la consommation croissante d'aliments préemballés ainsi que des chaînes de restauration rapide à travers les États-Unis

Le rapport sur le marché des congélateurs-chambres aux États-Unis fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (Personnalisable 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Type (autonome, condensation à distance et condensation multiplex), type de système (systèmes à distance, systèmes à distance pré-assemblés, système de réfrigération standard à montage supérieur, système de réfrigération à montage latéral, système de réfrigération à montage en selle, système de réfrigération en attique, système de réfrigération à enroulement et autres), type de porte (porte simple, porte double, porte triple et autres), technologie (entièrement automatique, semi-automatique et manuelle), type de rideau (rideaux à lanières et rideaux d'air), canal de distribution (ventes directes/B2B, magasins spécialisés, commerce électronique et autres), utilisateur final (industriel, commercial, transport et résidentiel) |

|

États couverts |

Californie, Texas, Floride, New York, Pennsylvanie et reste des États-Unis |

|

Acteurs du marché couverts |

Amerikooler. , Polar King. International, Inc., Master-Bilt Products, LLC, AMERICAN WALK-IN COOLERS LLC, US Cooler. (filiale de Craig Industries, Inc.), Foster Refrigerators Enterprise, Inc., NorLake, Inc., Welbilt, Arctic Industries, American Cooler Technologies et Darwin Chambers, entre autres. |

Définition du marché

Les congélateurs-chambres sont des espaces de réfrigération gigantesques, fermés et isolés, principalement utilisés pour stocker des aliments ou d'autres produits facilement périssables exposés à l'humidité et à l'oxygène de l'atmosphère. Les principaux utilisateurs finaux de ces énormes réfrigérateurs-chambres et congélateurs sont principalement les aliments et les boissons , les soins de santé, les restaurants, les bars, les supermarchés et autres.

Dynamique du marché des congélateurs-chambres aux États-Unis

Cette section traite de la compréhension des moteurs, des avantages, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la consommation d'aliments et de boissons préemballés par les chaînes de restauration rapide aux États-Unis

Les aliments et boissons préemballés ainsi que les produits de restauration rapide gagnent en popularité dans le monde entier au fil des ans. Cette consommation croissante d'aliments et de boissons préemballés ainsi que les chaînes de restauration rapide du monde entier agissent comme un moteur viable pour le marché américain des congélateurs-chambres, car la consommation croissante doit être répondue par une production accrue de ces produits alimentaires qui nécessiteraient des unités de réfrigération commerciales telles que des congélateurs-chambres pour la conservation, car ces produits ont une durée de conservation très courte.

- Disponibilité de réfrigérateurs et de congélateurs commerciaux personnalisés selon la demande des utilisateurs

Bien que la taille et l'espace requis par les réfrigérateurs et congélateurs commerciaux ne constituent qu'un léger frein aux ventes de ces unités de réfrigération, la disponibilité de restaurants commerciaux et de congélateurs personnalisés en fonction de la demande des utilisateurs agit comme une contre-mesure à ce retard, stimulant ainsi davantage les ventes et les revenus du marché américain des congélateurs-chambres. Étant donné que plusieurs fabricants proposent des services permettant aux utilisateurs de personnaliser la taille et d'autres spécifications techniques des congélateurs-chambres, la menace posée par la taille et les exigences financières énormes des congélateurs est atténuée dans une moindre mesure. De plus, ces services de personnalisation permettent aux utilisateurs de personnaliser chaque centimètre de leur produit en fonction de leurs besoins personnels et d'espace. En conséquence, la disponibilité de tels congélateurs commerciaux personnalisés en fonction de la demande des utilisateurs agit comme un moteur substantiel de la croissance du marché.

Opportunités

- Progrès technologiques dans les technologies de compression et de refroidissement

Les technologies modernes se développent à un rythme effréné en raison de plusieurs découvertes et réalisations scientifiques. L'une des principales industries où ces développements peuvent être observés est l'évolution technologique qui s'est produite dans les technologies de compression et de refroidissement au cours des dernières années. Ces développements dans les technologies de compression et de refroidissement agissent comme un moteur important pour le marché des congélateurs-chambres en raison des améliorations de l'efficacité et du refroidissement de ces technologies, car ces avancées technologiques peuvent améliorer l'efficacité des unités de réfrigération et réduire leur consommation d'énergie, de nombreux nouveaux clients sont motivés à acheter ces congélateurs-chambres.

- La préférence croissante des consommateurs pour les produits alimentaires biologiques

Selon de nombreuses études récentes, l'alimentation joue un rôle crucial dans la détermination de la santé d'une personne et joue un rôle essentiel pour assurer une vie sans maladie. En conséquence de cette prise de conscience, de plus en plus de personnes se tournent vers les produits alimentaires biologiques pour remplacer les produits alimentaires cultivés de manière pratique qui ont été cultivés en utilisant des insecticides et des pesticides pendant leurs phases de croissance. Cependant, la préférence croissante des consommateurs pour les produits alimentaires biologiques constitue une opportunité pour le marché des congélateurs-chambres, car ces produits alimentaires biologiques ne contiennent pas de conservateurs et doivent être stockés à des conditions de température appropriées pour atteindre leur durée de conservation maximale. Les congélateurs-chambres font un travail remarquable pour garantir que ces produits alimentaires biologiques sont correctement conservés sans perdre leur fraîcheur.

Contraintes/Défis

- Forte consommation d'énergie et empreinte carbone importante

L'empreinte carbone fait référence à la quantité de dioxyde de carbone rejetée dans l'atmosphère en raison du travail ou des activités d'un individu ou d'un équipement. L'empreinte carbone a une relation directe avec l'énergie, car les combustibles fossiles qui libèrent du dioxyde de carbone dans l'atmosphère sont utilisés pour la production de tous les modes d'énergie. La forte consommation d'énergie des réfrigérateurs et congélateurs de plain-pied est l'un des plus grands freins du marché des congélateurs de plain-pied, car ces appareils de réfrigération commerciaux consomment une grande unité d'énergie, ce qui entraînera indirectement une empreinte carbone beaucoup plus importante en raison du dioxyde de carbone généré lors de la production de chacune de ces unités. Le résultat de la combinaison de ces deux problèmes associés au marché des congélateurs de plain-pied est dévastateur pour l'usine. Et cette tendance destructrice du marché américain des congélateurs de plain-pied agit comme un frein à la croissance du marché américain des congélateurs de plain-pied.

- Coûts de réparation et d'entretien élevés

Contrairement aux unités de réfrigération domestiques, les unités commerciales sont plus grandes et plus complexes, par conséquent, tout problème mineur survenant dans ces systèmes entraînerait des problèmes mécaniques complexes qui pourraient nécessiter des soins spécialisés. Cependant, le coût de ces soins spécialisés serait encore plus élevé que celui des unités de réfrigération domestiques traditionnelles. De plus, les pièces associées à ces unités sont également chères.

La réparation et l'entretien d'un appareil de réfrigération commercial tel qu'un réfrigérateur ou un congélateur de type chambre froide sont extrêmement complexes et le coût des pièces détachées est énorme. En raison des dépenses plus importantes, cette réparation et ce remplacement entraîneraient un coût bien supérieur au coût requis pour le remplacement de ces unités par une nouvelle. Par conséquent, le coût élevé de la réparation et de l'entretien des congélateurs de type chambre froide constitue un frein considérable à la croissance du marché américain des congélateurs de type chambre froide.

Développements récents

- En octobre 2022, US Cooler. a fourni des isolants extrudés ainsi qu'une capacité de production supplémentaire de produits surgelés et réfrigérés extrudés. En raison des perturbations de la chaîne d'approvisionnement affectant l'ensemble du secteur, la mousse de polyuréthane expansée (FIP) est rare aux États-Unis. Toutes les commandes en attente ont été exécutées immédiatement. Cela a contribué à l'expansion du marché de l'entreprise.

- En juin 2021, Roller + Associates et Arctic Industries ont lancé un nouveau partenariat. Dans l’État de Washington, de l’Oregon, de l’Idaho et de l’Alaska, Roller a défendu les fabricants d’équipements de restauration. Ce partenariat avec Roller + Associates a permis à Arctic Industries de progresser sur le marché.

Portée du marché des congélateurs-chambres aux États-Unis

Le marché américain des congélateurs-chambres est segmenté en sept segments notables, à savoir le type, le type de système, le type de porte, la technologie, le type de rideau, le canal de distribution et l'utilisateur final. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Autonome

- Condensation à distance

- Condensation multiplexée

Sur la base du type, le marché est segmenté en condensation autonome, condensation à distance et condensation multiplex.

Type de système

- Systèmes à distance

- Systèmes à distance pré-assemblés

- Montage supérieur standard

- Système de réfrigération à montage latéral

- Système de réfrigération monté sur selle

- Système de réfrigération Penthouse

- Système de réfrigération enroulable

- Autres

Sur la base du type de système, le marché est segmenté en systèmes distants, systèmes distants pré-assemblés, systèmes de réfrigération à montage supérieur standard, systèmes de réfrigération à montage latéral, systèmes de réfrigération à montage en selle, systèmes de réfrigération en attique, systèmes de réfrigération enroulables et autres.

Type de porte

- Porte simple

- Porte double

- Porte triple

- Autres

Sur la base du type de porte, le marché est segmenté en porte simple, porte double, porte triple et autres.

Technologie

- Entièrement automatique

- Semi-automatique

- Manuel

Sur la base de la technologie, le marché est segmenté en entièrement automatique, semi-automatique et manuel.

Type de rideau

- Rideaux à lanières

- Rideaux d'air

Sur la base du type de rideau, le marché est segmenté en rideaux à lanières et rideaux d'air.

Canal de distribution

- Vente directe/B2B

- Magasins spécialisés

- Commerce électronique

- Autres

Sur la base du canal de distribution, le marché est segmenté en ventes directes/B2B, magasins spécialisés, commerce électronique et autres.

Utilisateur final

- Industriel

- Commercial

- Transport

- Résidentiel

Sur la base de l’utilisateur final, le marché est segmenté en secteurs industriel, commercial, transport et résidentiel.

Analyse/perspectives du marché des congélateurs de plain-pied aux États-Unis

Le marché américain des congélateurs-chambres est segmenté en fonction du type, du type de système, du type de porte, de la technologie, du type de rideau, du canal de distribution et de l'utilisateur final.

Les États couverts dans le rapport sur le marché américain des congélateurs-chambres sont la Californie, le Texas, la Floride, New York, la Pennsylvanie et le reste des États-Unis. La Californie devrait dominer le marché américain des congélateurs-chambres en termes de part de marché et de revenus du marché en raison de la consommation croissante d'aliments préemballés ainsi que des chaînes de restauration rapide.

La section États du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des congélateurs-chambres aux États-Unis

Le paysage concurrentiel du marché américain des congélateurs-chambres fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Certains des acteurs du marché opérant sur le marché sont Amerikooler. , Polar King. International, Inc., Master-Bilt Products, LLC, AMERICAN WALK-IN COOLERS LLC, US Cooler. ( Filiale de Craig Industries, Inc.), Foster Refrigerators Enterprise, Inc., NorLake, Inc., Welbilt, Arctic Industries, American Cooler Technologies et Darwin Chambers, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CUSTOMER SURVEY OVERVIEW

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING CONSUMPTION OF PREPACKED FOOD & BEVERAGES ALONG WITH FAST FOOD CHAINS ACROSS THE U.S.

5.1.2 GROWTH IN THE NUMBER OF HOTELS AND RESTAURANTS IN U.S.

5.1.3 AVAILABILITY OF COMMERCIAL WALK-IN REFRIGERATORS AND FREEZERS THAT ARE CUSTOMIZED AS PER THE DEMAND OF THE USERS

5.2 RESTRAINTS

5.2.1 HIGH ENERGY CONSUMPTION AND LARGE CARBON FOOTPRINT

5.2.2 HIGH REPAIR AND MAINTENANCE COST

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENTS IN COMPRESSOR AND COOLING TECHNOLOGIES

5.3.2 INCREASING CONSUMER PREFERENCE TOWARDS ORGANIC FOOD PRODUCTS

5.4 CHALLENGE

5.4.1 STRINGENT GOVERNMENT REGULATION FOR THE MANUFACTURES

6 U.S.

6.1 CALIFORNIA

6.2 TEXAS

6.3 FLORIDA

6.4 NEW YORK

6.5 PENNSYLVANIA

6.6 REST OF U.S.

7 U.S. WALK-IN FREEZERS MARKET, COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: U.S.

7.2 NEW PRODUCT LAUNCH

7.3 FACILITY EXPANSION

7.4 PARTNERSHIP

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 WELBILT

9.1.1 COMPANY SNAPSHOT

9.1.2 PRODUCT PORTFOLIO

9.1.3 RECENT DEVELOPMENT

9.2 MASTER-BILT PRODUCTS, LLC

9.2.1 COMPANY SNAPSHOT

9.2.2 PRODUCT PORTFOLIO

9.2.3 RECENT DEVELOPMENT

9.3 NORLAKE, INC.

9.3.1 COMPANY SNAPSHOT

9.3.2 PRODUCT PORTFOLIO

9.3.3 RECENT DEVELOPMENTS

9.4 AMERIKOOLER.

9.4.1 COMPANY SNAPSHOT

9.4.2 PRODUCT PORTFOLIO

9.4.3 RECENT DEVELOPMENTS

9.5 U.S. COOLER. (SUBSIDIARY OF CRAIG INDUSTRIES, INC.)

9.5.1 COMPANY SNAPSHOT

9.5.2 PRODUCT PORTFOLIO

9.5.3 RECENT DEVELOPMENT

9.6 AMERICAN COOLER TECHNOLOGIES

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 AMERICAN WALK-IN COOLERS LLC

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 ARCTIC INDUSTRIES

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENT

9.9 DARWIN CHAMBERS

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENTS

9.1 FOSTER REFRIGERATOR ENTERPRISE INC.

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENTS

9.11 POLAR KING. INTERNATIONAL, INC.

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 U.S. WALK-IN FREEZERS MARKET, BY STATE, 2021-2030 (USD THOUSAND)

TABLE 2 U.S. WALK-IN FREEZERS MARKET, BY STATE, 2021-2030 (UNITS)

TABLE 3 U.S. WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 U.S. WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 5 U.S. WALK-IN FREEZERS MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 U.S. WALK-IN FREEZERS MARKET, BY DOOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 U.S. WALK-IN FREEZERS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 8 U.S. WALK-IN FREEZERS MARKET, BY CURTAIN TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 U.S. WALK-IN FREEZERS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 10 U.S. WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 11 U.S. INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 U.S. INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 13 U.S. COMMERCIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 U.S. COMMERCIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 15 U.S. TRANSPORTATION IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 U.S. RESIDENTIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 CALIFORNIA WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 CALIFORNIA WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 19 CALIFORNIA WALK-IN FREEZERS MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 CALIFORNIA WALK-IN FREEZERS MARKET, BY DOOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 CALIFORNIA WALK-IN FREEZERS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 22 CALIFORNIA WALK-IN FREEZERS MARKET, BY CURTAIN TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 CALIFORNIA WALK-IN FREEZERS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 24 CALIFORNIA WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 25 CALIFORNIA INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 CALIFORNIA INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 27 CALIFORNIA COMMERCIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CALIFORNIA COMMERCIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 29 CALIFORNIA TRANSPORTATION IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 CALIFORNIA RESIDENTIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 TEXAS WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 TEXAS WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 33 TEXAS WALK-IN FREEZERS MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 TEXAS WALK-IN FREEZERS MARKET, BY DOOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 TEXAS WALK-IN FREEZERS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 36 TEXAS WALK-IN FREEZERS MARKET, BY CURTAIN TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 TEXAS WALK-IN FREEZERS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 38 TEXAS WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 39 TEXAS INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 TEXAS INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 41 TEXAS COMMERCIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 TEXAS COMMERCIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 43 TEXAS TRANSPORTATION IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 TEXAS RESIDENTIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 FLORIDA WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 FLORIDA WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 47 FLORIDA WALK-IN FREEZERS MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 FLORIDA WALK-IN FREEZERS MARKET, BY DOOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 FLORIDA WALK-IN FREEZERS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 50 FLORIDA WALK-IN FREEZERS MARKET, BY CURTAIN TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 FLORIDA WALK-IN FREEZERS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 52 FLORIDA WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 53 FLORIDA INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 FLORIDA INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 55 FLORIDA COMMERCIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 FLORIDA COMMERCIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 57 FLORIDA TRANSPORTATION IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 FLORIDA RESIDENTIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 NEW YORK WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 NEW YORK WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 61 NEW YORK WALK-IN FREEZERS MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 NEW YORK WALK-IN FREEZERS MARKET, BY DOOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 NEW YORK WALK-IN FREEZERS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 64 NEW YORK WALK-IN FREEZERS MARKET, BY CURTAIN TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 NEW YORK WALK-IN FREEZERS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 66 NEW YORK WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 67 NEW YORK INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 NEW YORK INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 69 NEW YORK COMMERCIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 NEW YORK COMMERCIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 71 NEW YORK TRANSPORTATION IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 NEW YORK RESIDENTIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 PENNSYLVANIA WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 PENNSYLVANIA WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 75 PENNSYLVANIA WALK-IN FREEZERS MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 PENNSYLVANIA WALK-IN FREEZERS MARKET, BY DOOR TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 PENNSYLVANIA WALK-IN FREEZERS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 78 PENNSYLVANIA WALK-IN FREEZERS MARKET, BY CURTAIN TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 PENNSYLVANIA WALK-IN FREEZERS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 80 PENNSYLVANIA WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 81 PENNSYLVANIA INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 PENNSYLVANIA INDUSTRIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 83 PENNSYLVANIA COMMERCIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 PENNSYLVANIA COMMERCIAL IN WALK-IN FREEZERS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 85 PENNSYLVANIA TRANSPORTATION IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 PENNSYLVANIA RESIDENTIAL IN WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 REST OF U.S. WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 REST OF U.S. WALK-IN FREEZERS MARKET, BY TYPE, 2021-2030 (UNITS)

Liste des figures

FIGURE 1 U.S. WALK-IN FREEZERS MARKET

FIGURE 2 U.S. WALK-IN FREEZERS MARKET: DATA TRIANGULATION

FIGURE 3 U.S. WALK-IN FREEZERS MARKET: DROC ANALYSIS

FIGURE 4 U.S. WALK-IN FREEZERS MARKET: COUNTRY VS STATES MARKET ANALYSIS

FIGURE 5 U.S. WALK-IN FREEZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. WALK-IN FREEZERS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 U.S. WALK-IN FREEZERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. WALK-IN FREEZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. WALK-IN FREEZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. WALK-IN FREEZERS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 U.S. WALK-IN FREEZERS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 U.S. WALK-IN FREEZERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 U.S. WALK-IN FREEZERS MARKET: SEGMENTATION

FIGURE 14 GROWTH IN THE NUMBER OF HOTELS AND RESTAURANTS IN THE U.S. IS EXPECTED TO DRIVE THE U.S. WALK-IN FREEZERS MARKET IN THE FORECAST PERIOD

FIGURE 15 THE SELF-CONTAINED IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. WALK-IN FREEZERS MARKET IN 2023 AND 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. WALK-IN FREEZERS MARKET

FIGURE 17 U.S. WALK-IN FREEZERS MARKET: SNAPSHOT (2022)

FIGURE 18 U.S. WALK-IN FREEZERS MARKET: BY COUNTRY (2022)

FIGURE 19 U.S. WALK-IN FREEZERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 20 U.S. WALK-IN FREEZERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 21 U.S. WALK-IN FREEZERS MARKET: BY TYPE (2023-2030)

FIGURE 22 U.S. WALK-IN FREEZERS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.