Marché américain de l'ostéonécrose, par type de maladie (traumatique, non traumatique et idiopathique), type (diagnostic et traitement), stades (stade 1, stade 2, stade 3 et stade 4), localisation (ostéonécrose de la hanche/tête fémorale, ostéonécrose du genou, ostéonécrose de l'épaule, ostéonécrose du talus, ostéonécrose du lunatum, ostéonécrose du scaphoïde et autres), type de médicament (de marque et générique), ordonnance ( médicaments en vente libre et médicaments sur ordonnance), sexe (homme et femme), âge (enfants, adultes et gériatriques), utilisateur final (hôpitaux, cliniques spécialisées, cliniques orthopédiques, centres ambulatoires et autres), canal de distribution (appels d'offres directs et ventes au détail) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de l'ostéonécrose aux États-Unis

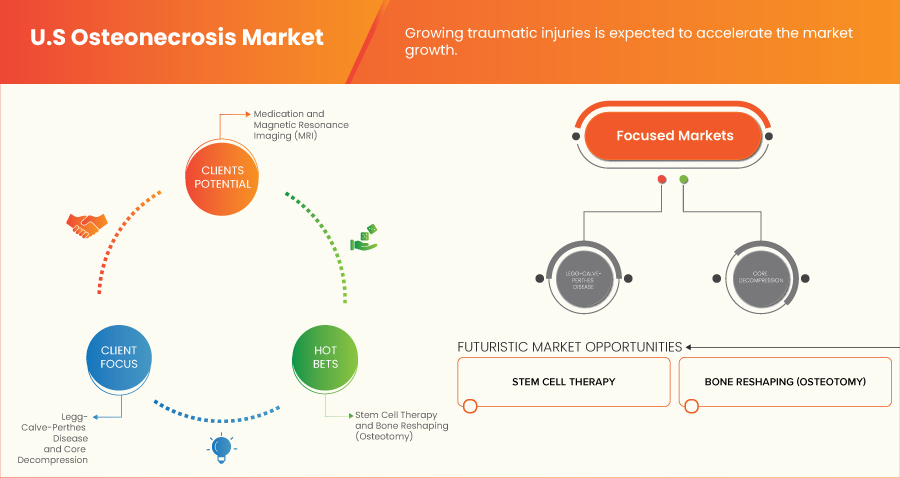

Le nombre croissant de blessures traumatiques au sein de la population américaine devrait stimuler la croissance du marché américain de l'ostéonécrose. L'augmentation des initiatives gouvernementales et du financement de la découverte de médicaments et des programmes de recherche connexes contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent sur divers lancements et approbations de services au cours de cette période cruciale. En outre, l'augmentation des progrès des techniques d'imagerie à des fins de diagnostic de l'ostéonécrose stimule également la croissance du marché au cours de la période prévue.

Le marché américain de l'ostéonécrose devrait croître au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la disponibilité d'appareils diagnostiques et chirurgicaux technologiques avancés. Le développement croissant dans le domaine des techniques avancées devrait encore stimuler la croissance du marché. Cependant, des difficultés telles que les réglementations strictes pour la production et la commercialisation de médicaments de traitement et de dispositifs médicaux pour le diagnostic et la chirurgie devraient freiner la croissance du marché au cours de la période de prévision.

Différentes entreprises prennent des initiatives qui conduisent progressivement à une croissance du marché :

Par exemple,

- En janvier 2021, Stryker a annoncé l'acquisition d'OrthoSensor, un acteur du marché qui applique la technologie numérique et le big data aux prothèses articulaires totales. Cette acquisition permettrait à l'entreprise d'acheter les technologies numériques d'OrthoSensor pour les utiliser dans les technologies de diagnostic et de traitement de l'ostéonécrose.

- En mars 2020, Sciegen Pharmaceuticals a reçu l'approbation ANDA pour les comprimés de naproxène USP 250 mg, 375 mg et 500 mg. Cette approbation contribuera davantage à la croissance du portefeuille de produits de l'entreprise.

Data Bridge Market Research analyse que le marché américain de l'ostéonécrose devrait atteindre la valeur de 843 039,67 milliers USD d'ici 2030, à un TCAC de 5,9 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers, volumes en unités, prix en USD |

|

Segments couverts |

Type de maladie (traumatique, non traumatique et idiopathique), type (diagnostic et traitement), stades (stade 1, stade 2, stade 3 et stade 4), localisation (ostéonécrose de la hanche/ostéonécrose de la tête fémorale, ostéonécrose du genou, ostéonécrose de l'épaule, ostéonécrose du talus, ostéonécrose du lunatum, ostéonécrose du scaphoïde et autres), type de médicament (de marque et générique), ordonnance (médicaments en vente libre et médicaments sur ordonnance), sexe (homme et femme), âge (enfants, adultes et gériatriques), utilisateur final (hôpitaux, cliniques spécialisées, cliniques orthopédiques, centres ambulatoires et autres), canal de distribution (vente directe et vente au détail) |

|

Pays couvert |

NOUS |

|

Acteurs du marché couverts |

Sciegen Pharmaceuticals, Almatica Pharma, Dr. Reddy's Laboratories Ltd., Bayer AG, Pfizer Inc., Haleon Group of Companies, Zimmer Biomet, Stryker, Teva Pharmaceuticals USA, Inc. (filiale de Teva Pharmaceutical Industries Ltd.) et Arthrex, Inc., entre autres. |

Définition du marché de l'ostéonécrose aux États-Unis

L'ostéonécrose, également appelée nécrose avasculaire ou nécrose aseptique, est une affection caractérisée par la mort ou la détérioration du tissu osseux en raison d'un apport sanguin insuffisant. Elle peut survenir dans divers os du corps, mais elle affecte le plus souvent l'articulation de la hanche. Le flux sanguin compromis prive les cellules osseuses d'oxygène et de nutriments essentiels, entraînant leur mort et des dommages ultérieurs à l'os affecté. En conséquence, la structure osseuse s'affaiblit, devient moins capable de résister au stress normal et peut éventuellement s'effondrer ou se déformer. L'ostéonécrose peut provoquer des douleurs, une amplitude de mouvement limitée et une déficience fonctionnelle. Les causes courantes de l'ostéonécrose comprennent les traumatismes, l'utilisation de corticostéroïdes, la consommation excessive d'alcool, certaines conditions médicales et les facteurs sous-jacents qui affectent la circulation sanguine. Un diagnostic précoce et une prise en charge appropriée sont essentiels pour prévenir d'autres lésions osseuses et préserver la fonction articulaire. Les options de traitement de l'ostéonécrose peuvent inclure des mesures conservatrices pour gérer les symptômes et ralentir la progression de la maladie et des interventions chirurgicales pour soulager la douleur et restaurer la fonction articulaire.

Dynamique du marché de l'ostéonécrose aux États-Unis

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteur

- Augmentation du nombre de blessures traumatiques

Le nombre croissant de blessures traumatiques aux États-Unis est un facteur important pour le marché américain de l'ostéonécrose. Les blessures traumatiques, causées par divers facteurs tels que les accidents, les incidents liés au sport, les chutes et les blessures au travail, sont devenues plus fréquentes ces dernières années. Ces blessures peuvent avoir un impact profond sur la santé osseuse, entraînant souvent des fractures, des luxations et une instabilité articulaire. Lorsque l'apport sanguin à l'os affecté est compromis pendant la blessure, cela ouvre la voie au développement potentiel d'une ostéonécrose. Les vaisseaux sanguins endommagés perturbent l'apport essentiel d'oxygène et de nutriments au tissu osseux, entraînant la mort des cellules osseuses. L'ostéonécrose post-traumatique est une conséquence bien connue des blessures traumatiques graves. Un diagnostic et une prise en charge non rapides peuvent entraîner des complications telles qu'un effondrement des articulations, des douleurs chroniques et une réduction de la fonction articulaire.

Un traumatisme peut endommager les vaisseaux sanguins qui transportent l'oxygène et les nutriments vers le tissu osseux. Cette perturbation entraîne une diminution ou un blocage du flux sanguin, ce qui entraîne la mort cellulaire et le développement d'une ostéonécrose. De plus, le traumatisme peut augmenter la pression sur l'os ou l'articulation, compromettant le flux sanguin et provoquant une ischémie. Le manque d'apport sanguin et les lésions cellulaires qui en résultent peuvent déclencher une réponse inflammatoire, aggravant encore la maladie. Le nombre croissant d'accidents de la route et de sport est en augmentation, ce qui entraîne une augmentation de l'ostéonécrose.

Retenue

- Coût élevé associé au diagnostic et au traitement de l’ostéonécrose

Les progrès des techniques de diagnostic et des options de traitement ont amélioré les résultats pour les patients. Cependant, le fardeau financier de la gestion de l'ostéonécrose reste un défi important pour les patients, les prestataires de soins de santé et le système de santé. Les facteurs clés qui déterminent le coût du diagnostic et du traitement de l'ostéonécrose comprennent l'établissement médical ou la clinique choisi pour la procédure, la zone de traitement, la complexité et le spécialiste choisi, entre autres.

Le diagnostic précis de l'ostéonécrose nécessite souvent des techniques d'imagerie spécialisées, telles que l'imagerie par résonance magnétique (IRM) , la tomodensitométrie (TDM) ou la scintigraphie osseuse. Ces procédures de diagnostic sont coûteuses, nécessitent un équipement spécialisé, un personnel formé et une interprétation par des radiologues qualifiés. Le coût élevé de ces procédures d'imagerie limite l'accès à un diagnostic rapide et précis, ce qui entraîne un retard de traitement et des complications potentielles. Le coût du traitement augmente proportionnellement, de sorte que le coût élevé du traitement peut entraver la demande du marché.

Opportunité

-

Progrès de la technologie médicale pour l'ostéonécrose

Les progrès de la technologie médicale offrent des opportunités importantes sur le marché américain de l'ostéonécrose. Ces innovations améliorent la précision du diagnostic, offrent des options de traitement régénératif, permettent des procédures mini-invasives, facilitent les soins personnalisés et améliorent les résultats des patients. L'investissement continu dans la recherche et le développement, la collaboration entre l'industrie et les professionnels de la santé et le soutien réglementaire aux technologies innovantes sont essentiels pour exploiter pleinement le potentiel des avancées médicales et favoriser les progrès dans le domaine de l'ostéonécrose. Par conséquent, elles devraient constituer une opportunité sur le marché.

Défi

- Disponibilité d'options de traitement limitées

L'absence d'alternatives thérapeutiques sur le marché américain de l'ostéonécrose entrave la prise en charge optimale des patients et les résultats. L'ostéonécrose, communément appelée nécrose avasculaire, est une maladie dans laquelle le tissu osseux périt en raison d'un flux sanguin inadéquat. Bien qu'il existe diverses options thérapeutiques, les choix sont souvent limités en fonction du stade, de la localisation et de l'étiologie sous-jacente de l'ostéonécrose.

Développements récents

- En janvier 2023, Zimmer Biomet a annoncé avoir conclu un accord définitif pour acquérir Embody, Inc., une société privée de dispositifs médicaux axée sur la cicatrisation des tissus mous, pour 155 000 $ à la clôture. L'acquisition comprend le portefeuille complet de solutions biointégratives à base de collagène d'Embody pour soutenir la cicatrisation des lésions orthopédiques des tissus mous les plus difficiles, notamment l'implant biointégratif TAPESTRY pour la cicatrisation des tendons et TAPESTRY RC, l'un des premiers systèmes d'implants arthroscopiques pour la réparation de la coiffe des rotateurs. Cette acquisition aidera l'entreprise dans son portefeuille de produits et dans l'expansion de ses activités.

- En juillet 2022, le groupe Haleon a annoncé la finalisation de la scission de l'activité Consumer Healthcare du groupe GSK pour former le groupe Haleon. Cette scission a permis à l'entreprise de prendre le contrôle de l'ensemble des activités de santé grand public et de les développer.

Portée du marché de l'ostéonécrose aux États-Unis

Le marché américain de l'ostéonécrose est segmenté en dix segments notables en fonction du type de maladie, du type, des stades, de la localisation, du type de médicament, de la prescription, du sexe, de l'âge, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type de maladie

- Traumatique

- Non-traumatique

- Idiopathique

En fonction du type de maladie, le marché est segmenté en traumatique, non traumatique et idiopathique.

Taper

- Diagnostic

- Traitement

Sur la base du type, le marché est segmenté en diagnostic et traitement.

Étapes

- Étape 1

- Étape 2

- Étape 3

- Étape 4

Sur la base des étapes, le marché est segmenté en étape 1, étape 2, étape 3 et étape 4.

Emplacement

- Ostéonécrose de la hanche/Ostéonécrose de la tête fémorale

- Ostéonécrose du genou

- Ostéonécrose de l'épaule

- Ostéonécrose du talus

- Ostéonécrose du lunatum

- Ostéonécrose du scaphoïde

- Autres

Sur la base de la localisation, le marché est segmenté en ostéonécrose de la hanche/tête fémorale, ostéonécrose du genou, ostéonécrose de l'épaule, ostéonécrose du talus, ostéonécrose du lunatum, ostéonécrose du scaphoïde et autres.

Type de médicament

- De marque

- Générique

En fonction du type de médicament, le marché est segmenté en médicaments de marque et génériques.

Ordonnance

- Médicaments en vente libre

- Médicaments sur ordonnance

Sur la base de la prescription, le marché est segmenté en médicaments en vente libre et en médicaments sur ordonnance.

Genre

- Mâle

- Femelle

Sur la base du sexe, le marché est segmenté en hommes et femmes.

Âge

- Enfants

- Adulte

- Gériatrie

En fonction de l’âge, le marché est segmenté en enfants, adultes et gériatriques.

Utilisateur final

- Hôpitaux

- Cliniques spécialisées

- Cliniques orthopédiques

- Centres ambulatoires

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en hôpitaux, cliniques spécialisées, cliniques orthopédiques, centres ambulatoires et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

Sur la base du canal de distribution, le marché est segmenté en appels d'offres directs et ventes au détail.

Analyse/perspectives du marché de l'ostéonécrose aux États-Unis

Le marché américain de l'ostéonécrose est classé en dix segments notables en fonction du type de maladie, du type, des stades, de l'emplacement, du type de médicament, de la prescription, du sexe, de l'âge, de l'utilisateur final et du canal de distribution.

Les pays couverts dans ce rapport de marché sont les États-Unis

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'ostéonécrose aux États-Unis

Le paysage concurrentiel du marché américain de l'ostéonécrose fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'ampleur du produit, la domination des applications et la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché américain de l'ostéonécrose.

Certains des principaux acteurs du marché opérant sur le marché américain de l'ostéonécrose sont Sciegen Pharmaceuticals, Almatica Pharma, Dr. Reddy's Laboratories Ltd., Bayer AG, Pfizer Inc., Haleon Group of Companies, Zimmer Biomet, Stryker, Teva Pharmaceuticals USA, Inc. (filiale de Teva Pharmaceutical Industries Ltd.) et Arthrex, Inc. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. OSTEONECROSIS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DISEASE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS

4.3.1 DEMOGRAPHIC TRENDS: IMAPCTS ON ALL INCIDENCE RATES

4.3.2 PATIENT FLOW DIAGRAM

4.3.3 KEY PRICING STRATEGIES

4.4 HEALTHCARE ECONOMY

4.4.1 HEALTHCARE EXPENDITURE

4.4.2 CAPITAL EXPENDITURE

4.4.3 CAPEX TRENDS

4.4.4 CAPEX ALLOCATION

4.4.5 FUNDING SOURCES

4.4.6 INDUSTRY BENCHMARKS

4.4.7 GDP RATIO IN OVERALL GDP

4.4.8 HEALTHCARE SYSTEM STRUCTURE

4.4.9 GOVERNMENT POLICIES

4.4.10 ECONOMIC DEVELOPMENT

4.5 PIPELINE ANALYSIS

4.6 REIMBURSEMENT FRAMEWORK

4.7 TECHNOLOGY ROADMAP

4.8 VALUE CHAIN ANALYSIS

5 EPIDEMIOLOGY

6 REGULATIONS

6.1 REGULATORY APPROVAL PROCESS AND PATHWAYS:

6.2 LICENSING AND REGISTRATION:

6.3 POST-MARKETING SURVEILLANCE:

6.4 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING NUMBER OF TRAUMATIC INJURIES

7.1.2 INCREASING CONSUMPTION OF STEROIDS AND RELATED DRUGS

7.1.3 INCREASING INCIDENCE OF OSTEONECROSIS

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH THE DIAGNOSIS AND TREATMENT OF OSTEONECROSIS

7.2.2 PROGNOSTIC AND DIAGNOSTIC CHALLENGES

7.3 OPPORTUNITIES

7.3.1 ADVANCEMENTS IN MEDICAL TECHNOLOGY FOR OSTEONECROSIS

7.3.2 INCREASING REIMBURSEMENTS SCENARIOS

7.4 CHALLENGES

7.4.1 AVAILABILITY OF LIMITED TREATMENT OPTIONS

7.4.2 CHALLENGING LONG-TERM MANAGEMENT AND FOLLOW UP

8 U.S. OSTEONECROSIS MARKET, BY DISEASE TYPE

8.1 OVERVIEW

8.2 TRAUMATIC

8.3 NON-TRAUMATIC

8.4 IDIOPATHIC

9 U.S. OSTEONECROSIS MARKET, BY TYPE

9.1 OVERVIEW

9.2 TREATMENT

9.2.1 SURGERY

9.2.1.1 CORE DECOMPRESSION

9.2.1.2 BONE RESHAPING (OSTEOTOMY)

9.2.1.3 BONE TRANSPLANT

9.2.1.4 JOINT REPLACEMENT THERAPY

9.2.1.5 STEM CELL THERAPY

9.2.2 MEDICATION

9.2.2.1 NSAIDS

9.2.2.1.1 IBUPROFEN

9.2.2.1.2 ASPIRIN

9.2.2.1.3 NAPROXEN

9.2.2.1.4 DICLOFENAC

9.2.2.1.5 OTHERS

9.2.2.2 BLOOD THINNERS

9.2.2.2.1 WARFARIN

9.2.2.2.2 HEPARIN

9.2.2.2.3 ENOXAPARIN

9.2.2.2.4 ARGATROBAN

9.2.2.2.5 DICOUMARAL

9.2.2.2.6 FONDAPARINUX

9.2.2.2.7 XIMELAGATRAN

9.2.2.3 OSTEOPOROSIS DRUGS

9.2.2.3.1 ALENDRONATE

9.2.2.3.2 RISEDRONATE

9.2.2.3.3 IBANDRONATE

9.2.2.3.4 ZOLEDRONIC ACID

9.2.2.3.5 DENOSUMAB

9.2.2.3.6 OTHERS

9.2.2.4 CHOLESTEROL-LOWERING DRUGS

9.2.2.4.1 ATORVASTATIN

9.2.2.4.2 PRAVASTATIN

9.2.2.4.3 FLUVASTATIN

9.2.2.4.4 ROSUVASTATIN

9.2.2.4.5 SIMVASTATIN

9.2.2.4.6 PITAVASTATIN

9.2.2.4.7 LOVASTATIN

9.2.2.5 OTHERS

9.2.3 PHYSICAL THERAPY

9.2.3.1 CRUTCHES

9.2.3.1.1 AXILLA CRUTCHES

9.2.3.1.1.1 METAL ALLOY

9.2.3.1.1.2 WOOD

9.2.3.1.1.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.1.4 OTHERS

9.2.3.1.2 ELBOW CRUTCHES

9.2.3.1.2.1 OPEN-CUFF ELBOW CRUTCHES

9.2.3.1.2.1.1 METAL ALLOY

9.2.3.1.2.1.2 WOOD

9.2.3.1.2.1.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.2.1.4 OTHERS

9.2.3.1.2.2 CLOSED-CUFF ELBOW CRUTCHES

9.2.3.1.2.2.1 METAL ALLOY

9.2.3.1.2.2.2 WOOD

9.2.3.1.2.2.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.2.2.4 OTHERS

9.2.3.1.3 GUTTER CRUTCHES

9.2.3.1.3.1 METAL ALLOY

9.2.3.1.3.2 WOOD

9.2.3.1.3.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.3.4 OTHERS

9.2.3.2 CASTING AND BRACING

9.2.3.2.1 NEWINGTON BRACE

9.2.3.2.2 TORONTO ORTHOSIS

9.2.3.2.3 SCOTTISH RITE ORTHOSIS

9.2.3.2.4 BROOMSTICK PLASTERS

9.2.3.2.5 BIRMINGHAM ORTHOSIS

9.2.3.3 OTHERS

9.2.3.3.1 CONVENTIONAL CALIPERS

9.2.3.3.2 SNYDER SLINGS

9.2.3.3.3 SLINGS WITH CRUTCHES

9.2.3.3.4 TRACTION

9.2.3.3.5 OTHERS

9.3 DIAGNOSIS

9.3.1 IMAGING TEST

9.3.1.1 MAGNETIC RESONANCE IMAGING (MRI)

9.3.1.1.1 CLOSED BORE

9.3.1.1.1.1 LOW FIELD STRENGTH

9.3.1.1.1.2 MID FIELD STRENGTH

9.3.1.1.1.3 HIGH FIELD STRENGTH

9.3.1.1.2 OPEN BORE

9.3.1.1.2.1 LOW FIELD STRENGTH

9.3.1.1.2.2 MID FIELD STRENGTH

9.3.1.1.2.3 HIGH FIELD STRENGTH

9.3.1.2 COMPUTED TOMOGRAPHY SCANNING

9.3.1.2.1 HIGH END SLICE

9.3.1.2.2 MID END SLICE

9.3.1.2.3 LOW END SLICE

9.3.1.2.4 CONE BEAN

9.3.1.3 X-RAY IMAGING

9.3.1.3.1 RADIOGRAPHY

9.3.1.3.1.1 DIGITAL IMAGING

9.3.1.3.1.2 FILM-BASED IMAGING

9.3.1.3.2 FLUOROSCOPY

9.3.1.3.2.1 DIGITAL IMAGING

9.3.1.3.2.2 FILM-BASED IMAGING

9.3.1.3.3 OTHERS

9.3.1.4 OTHERS

9.3.1.4.1 BONE SCAN

9.3.1.4.2 ULTRASOUND

9.3.1.4.2.1 2D ULTRASOUND

9.3.1.4.2.1.1 B/W ULTRASOUND

9.3.1.4.2.1.2 COLOURED

9.3.1.4.2.2 DOPPLER ULTRASOUND

9.3.1.4.2.2.1 B/W ULTRASOUND

9.3.1.4.2.2.2 COLOURED

9.3.1.4.2.3 3D & 4D ULTRASOUND

9.3.1.4.2.3.1 B/W ULTRASOUND

9.3.1.4.2.3.2 COLOURED

9.3.1.4.3 OTHERS

9.3.2 BIOPSY

9.3.2.1 NEEDLE BIOPSY

9.3.2.2 OPEN BIOPSY

9.3.2.3 OTHERS

9.3.3 OTHERS

10 U.S. OSTEONECROSIS MARKET, BY STAGES

10.1 OVERVIEW

10.2 STAGE 2

10.3 STAGE 3

10.4 STAGE 4

10.5 STAGE 1

11 U.S. OSTEONECROSIS MARKET, BY LOCATION

11.1 OVERVIEW

11.2 OSTEONECROSIS OF HIP/FEMORAL HEAD OSTEONECROSIS

11.2.1 TRAUMATIC

11.2.2 NON-TRAUMATIC

11.2.3 IDIOPATHIC OSTEONECROSIS

11.2.3.1 LEGG-CALVE-PERTHES DISEASE

11.2.3.1.1 TREATMENT

11.2.3.1.1.1 NON-SURGICAL

11.2.3.1.1.1.1 ANTI-INFLAMMATORY MEDICATION

11.2.3.1.1.1.1.1 IBUPROFEN

11.2.3.1.1.1.1.2 ASPIRIN

11.2.3.1.1.1.1.3 NAPROXEN SODIUM

11.2.3.1.1.1.1.4 NABUMETONE

11.2.3.1.1.1.1.5 OTHERS

11.2.3.1.1.1.2 BISPHOSPHONATES MEDICATIONS

11.2.3.1.1.1.2.1 ALENDRONATE

11.2.3.1.1.1.2.2 RISEDRONATE

11.2.3.1.1.1.2.3 IBANDRONATE

11.2.3.1.1.1.2.4 ZOLEDRONIC ACID

11.2.3.1.1.1.2.5 PAMIDRONATE

11.2.3.1.1.1.2.6 OTHERS

11.2.3.1.1.1.3 CRUTCHES

11.2.3.1.1.1.3.1 AXILLA CRUTCHES

11.2.3.1.1.1.3.2 ELBOW CRUTCHES

11.2.3.1.1.1.3.3 GUTTER CRUTCHES

11.2.3.1.1.1.4 CASTINGS & BRACINGS

11.2.3.1.1.1.4.1 NEWINGTON BRACE

11.2.3.1.1.1.4.2 TORONTO ORTHOSIS

11.2.3.1.1.1.4.3 SCOTTISH RITE ORTHOSIS

11.2.3.1.1.1.4.4 BROOMSTICK PLASTERS

11.2.3.1.1.1.4.5 BIRMINGHAM ORTHOSIS

11.2.3.1.1.2 SURGICAL

11.2.3.1.1.2.1 FEMORAL OSTEOTOMY

11.2.3.1.1.2.1.1 FEMORAL DEROTATION OSTEOTOMY

11.2.3.1.1.2.1.2 VARUS DEROTATION OSTEOTOMY

11.2.3.1.1.2.2 INNOMINATE OSTEOTOMY

11.2.3.1.1.2.2.1 SALTER (SINGLE INNOMINATE OSTEOTOMY)

11.2.3.1.1.2.2.2 SUTHERLAND (DOUBLE INNOMINATE OSTEOTOMY)

11.2.3.1.1.2.2.3 STEEL, TONNIS OR CARLOS (TRIPLE INNOMINATE OSTEOTOMY)

11.2.3.1.1.2.2.4 GANZ (PERIACETABULAR)

11.2.3.1.1.2.3 SHELF ARTHROPLASTY

11.2.3.1.1.2.4 OTHERS

11.2.3.1.2 DIAGNOSIS

11.2.3.1.2.1 MAGNETIC RESONANCE IMAGING (MRI)

11.2.3.1.2.1.1 CLOSED BORE

11.2.3.1.2.1.1.1 LOW FIELD STRENGTH

11.2.3.1.2.1.1.2 MID FIELD STRENGTH

11.2.3.1.2.1.1.3 HIGH FIELD STRENGTH

11.2.3.1.2.1.2 OPEN BORE

11.2.3.1.2.1.2.1 LOW FIELD STRENGTH

11.2.3.1.2.1.2.2 MID FIELD STRENGTH

11.2.3.1.2.1.2.3 HIGH FIELD STRENGTH

11.2.3.1.2.2 COMPUTED TOMOGRAPHY SCANNING

11.2.3.1.2.2.1 HIGH END SLICE

11.2.3.1.2.2.2 MID END SLICE

11.2.3.1.2.2.3 LOW END SLICE

11.2.3.1.2.2.4 CONE BEAN

11.2.3.1.2.3 X-RAY IMAGING

11.2.3.1.2.3.1 RADIOGRAPHY

11.2.3.1.2.3.1.1 DIGITAL IMAGING

11.2.3.1.2.3.1.2 FILM-BASED IMAGING

11.2.3.1.2.3.2 FLUOROSCOPY

11.2.3.1.2.3.2.1 DIGITAL IMAGING

11.2.3.1.2.3.2.2 FILM-BASED IMAGING

11.2.3.1.2.3.3 OTHERS

11.2.3.1.2.4 OTHERS

11.2.3.2 OTHERS

11.3 OSTEONECROSIS OF THE KNEE

11.3.1 TRAUMATIC

11.3.2 NON-TRAUMATIC

11.3.3 IDIOPATHIC OSTEONECROSIS

11.4 OSTEONECROSIS OF THE SHOULDER

11.4.1 TRAUMATIC

11.4.2 NON-TRAUMATIC

11.4.3 IDIOPATHIC OSTEONECROSIS

11.5 OSTEONECROSIS OF THE TALUS

11.5.1 TRAUMATIC

11.5.2 NON-TRAUMATIC

11.5.3 IDIOPATHIC OSTEONECROSIS

11.6 OSTEONECROSIS OF THE LUNATE

11.6.1 TRAUMATIC

11.6.2 NON-TRAUMATIC

11.6.3 IDIOPATHIC OSTEONECROSIS

11.7 OSTEONECROSIS OF THE SCAPHOID

11.7.1 TRAUMATIC

11.7.2 NON-TRAUMATIC

11.7.3 IDIOPATHIC OSTEONECROSIS

11.8 OTHERS

12 U.S. OSTEONECROSIS MARKET, BY DRUG TYPE

12.1 OVERVIEW

12.2 BRANDED

12.2.1 ORAL

12.2.1.1 TABLETS

12.2.1.2 CAPSULES

12.2.2 PARENTERAL

12.2.3 OTHERS

12.3 GENERIC

12.3.1 ORAL

12.3.1.1 TABLETS

12.3.1.2 CAPSULES

12.3.2 PARENTERAL

12.3.3 OTHERS

13 U.S. OSTEONECROSIS MARKET, BY PRESCRIPTION

13.1 OVERVIEW

13.2 PRESCRIBED DRUGS

13.3 OVER THE COUNTER DRUGS

14 U.S. OSTEONECROSIS MARKET, BY GENDER

14.1 OVERVIEW

14.2 MALE

14.3 FEMALE

15 U.S. OSTEONECROSIS MARKET, BY AGE

15.1 OVERVIEW

15.2 ADULT

15.3 GERIATRIC

15.4 CHILDREN

16 U.S. OSTEONECROSIS MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 PUBLIC

16.2.2 PRIVATE

16.3 ORTHOPEDIC CLINICS

16.4 SPECIALTY CLINICS

16.5 AMBULATORY CENTERS

16.6 OTHERS

17 U.S. OSTEONECROSIS MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 RETAIL SALES

17.2.1 HOSPITAL PHARMACY

17.2.2 RETAIL PHARMACY

17.2.3 ONLINE PHARMACY

17.3 DIRECT TENDER

18 U.S. OSTEONECROSIS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: U.S.

19 SWOT ANALYSIS

20 U.S. OSTEONECROSIS MARKET, CPS

20.1 TEVA PHARMACEUTICALS USA, INC. (SUBSIDIARY OF TEVA PHARMACEUTICAL INDUSTRIES LTD.)

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 PFIZER INC. (2022)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 BAYER AG (2022)

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 STRYKER

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 ARTHREX, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 RECENT DEVELOPMENT

20.6 ALMATICA PHARMA

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 DR. REDDY'S LABORATORIES LTD. (2022)

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 HALEON GROUP OF COMPANIES

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 SCIEGEN PHARMACEUTICALS.

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 ZIMMER BIOMET

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 COST OF OSTEONECROSIS TREATMENT SURGERIES

TABLE 2 U.S. OSTEONECROSIS MARKET, PIPELINE ANALYSIS

TABLE 3 U.S. OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 U.S. OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 U.S. TREATMENT IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 U.S. SURGERY IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 7 U.S. MEDICATION IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 8 U.S. NSAIDS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 9 U.S. BLOOD THINNERS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 10 U.S. OSTEOPOROSIS DRUGS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 11 U.S. CHOLESTEROL-LOWERING DRUGS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 12 U.S. PHYSICAL THERAPY IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 13 U.S. CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 14 U.S. AXILLA CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 15 U.S. ELBOW CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 16 U.S. OPEN-CUFF ELBOW CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 17 U.S. CLOSED-CUFF ELBOW CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 18 U.S. GUTTER CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 19 U.S. CASTING AND BRACING IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. OTHERS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 21 U.S. DIAGNOSIS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. IMAGING TEST IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 U.S. MAGNETIC RESONANCE IMAGING (MRI) IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 U.S. CLOSED BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 U.S. OPEN BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 U.S. COMPUTED TOMOGRAPHY SCANNING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. X-RAY IMAGING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. RADIOGRAPHY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. FLUOROSCOPY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 U.S. OTHERS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 U.S. ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 U.S. 2D ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 U.S. DOPPLER ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 U.S. 3D & 4D ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 U.S. BIOPSY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 U.S. OSTEONECROSIS MARKET, BY STAGES, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. OSTEONECROSIS MARKET, BY LOCATION, 2021-2030 (USD THOUSAND)

TABLE 38 U.S. OSTEONECROSIS OF HIP/FEMORAL HEAD OSTEONECROSIS IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. IDIOPATHIC OSTEONECROSIS IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. LEGG-CALVE-PERTHES DISEASE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. TREATMENT IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 U.S. NON-SURGICAL IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. ANTI-INFLAMMATORY MEDICATIONS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. BISPHOSPHONATES MEDICATIONS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. CRUTCHES IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. CASTING AND BRACING IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. SURGICAL IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. FEMORAL OSTEOTOMY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. INNOMINATE OSTEOTOMY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. DIAGNOSIS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. MAGNETIC RESONANCE IMAGING (MRI) IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. CLOSED BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. OPEN BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. COMPUTED TOMOGRAPHY SCANNING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. X-RAY IMAGING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. RADIOGRAPHY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 U.S. FLUOROSCOPY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 U.S. OSTEONECROSIS OF THE KNEE IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 U.S. OSTEONECROSIS OF THE SHOULDER IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. OSTEONECROSIS OF THE TALUS IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. OSTEONECROSIS OF THE LUNATE IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 U.S. OSTEONECROSIS OF THE SCAPHOID IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.S. OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 U.S. BRANDED IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 U.S. ORAL IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 U.S. GENERIC IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 U.S. ORAL IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 U.S. OSTEONECROSIS MARKET, BY PRESCRIPTION, 2021-2030 (USD THOUSAND)

TABLE 69 U.S. OSTEONECROSIS MARKET, BY GENDER, 2021-2030 (USD THOUSAND)

TABLE 70 U.S. OSTEONECROSIS MARKET, BY AGE, 2021-2030 (USD THOUSAND)

TABLE 71 U.S. OSTEONECROSIS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 72 U.S. HOSPITALS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 U.S. OSTEONECROSIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 74 U.S. RETAIL SALES IN OSTEONECROSIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 U.S. OSTEONECROSIS MARKET: SEGMENTATION

FIGURE 2 U.S. OSTEONECROSIS MARKET: DATA TRIANGULATION

FIGURE 3 U.S. OSTEONECROSIS MARKET: DROC ANALYSIS

FIGURE 4 U.S. OSTEONECROSIS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. OSTEONECROSIS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. OSTEONECROSIS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. OSTEONECROSIS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. OSTEONECROSIS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 U.S. OSTEONECROSIS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. OSTEONECROSIS MARKET: SEGMENTATION

FIGURE 11 INCREASING NUMBER OF TRAUMATIC INJURIES IS EXPECTED TO DRIVE THE GROWTH OF THE U.S. OSTEONECROSIS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE TRAUMATIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. OSTEONECROSIS MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC KNEE CARTILAGE REPAIR MARKET

FIGURE 14 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, 2022

FIGURE 15 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, 2023-2030 (USD THOUSAND)

FIGURE 16 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, CAGR (2023-2030)

FIGURE 17 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 18 U.S. OSTEONECROSIS MARKET: BY TYPE, 2022

FIGURE 19 U.S. OSTEONECROSIS MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 20 U.S. OSTEONECROSIS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 21 U.S. OSTEONECROSIS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 U.S. OSTEONECROSIS MARKET: BY STAGES, 2022

FIGURE 23 U.S. OSTEONECROSIS MARKET: BY STAGES, 2023-2030 (USD THOUSAND)

FIGURE 24 U.S. OSTEONECROSIS MARKET: BY STAGES, CAGR (2023-2030)

FIGURE 25 U.S. OSTEONECROSIS MARKET: BY STAGES, LIFELINE CURVE

FIGURE 26 U.S. OSTEONECROSIS MARKET: BY LOCATION, 2022

FIGURE 27 U.S. OSTEONECROSIS MARKET: BY LOCATION, 2023-2030 (USD THOUSAND)

FIGURE 28 U.S. OSTEONECROSIS MARKET: BY LOCATION, CAGR (2023-2030)

FIGURE 29 U.S. OSTEONECROSIS MARKET: BY LOCATION, LIFELINE CURVE

FIGURE 30 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, 2022

FIGURE 31 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, 2023-2030 (USD THOUSAND)

FIGURE 32 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, CAGR (2023-2030)

FIGURE 33 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 34 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, 2022

FIGURE 35 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, 2023-2030 (USD THOUSAND)

FIGURE 36 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, CAGR (2023-2030)

FIGURE 37 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, LIFELINE CURVE

FIGURE 38 U.S. OSTEONECROSIS MARKET: BY GENDER, 2022

FIGURE 39 U.S. OSTEONECROSIS MARKET: BY GENDER, 2023-2030 (USD THOUSAND)

FIGURE 40 U.S. OSTEONECROSIS MARKET: BY GENDER, CAGR (2023-2030)

FIGURE 41 U.S. OSTEONECROSIS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 42 U.S. OSTEONECROSIS MARKET: BY AGE, 2022

FIGURE 43 U.S. OSTEONECROSIS MARKET: BY AGE, 2023-2030 (USD THOUSAND)

FIGURE 44 U.S. OSTEONECROSIS MARKET: BY AGE, CAGR (2023-2030)

FIGURE 45 U.S. OSTEONECROSIS MARKET: BY AGE, LIFELINE CURVE

FIGURE 46 U.S. OSTEONECROSIS MARKET: BY END USER, 2022

FIGURE 47 U.S. OSTEONECROSIS MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 48 U.S. OSTEONECROSIS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 49 U.S. OSTEONECROSIS MARKET: BY END USER, LIFELINE CURVE

FIGURE 50 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 51 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 52 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 53 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 54 U.S. OSTEONECROSIS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.