Us Office Seating Market

Taille du marché en milliards USD

TCAC :

%

USD

8.48 Billion

USD

10.36 Billion

2024

2032

USD

8.48 Billion

USD

10.36 Billion

2024

2032

| 2025 –2032 | |

| USD 8.48 Billion | |

| USD 10.36 Billion | |

|

|

|

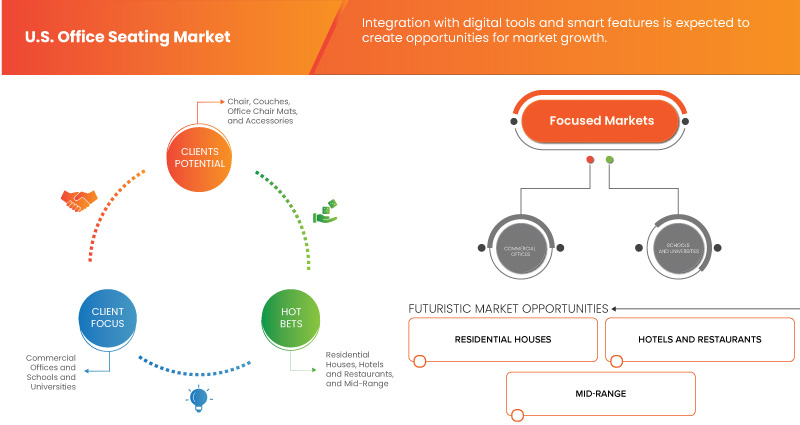

U.S. Office Seating Market Segmentation, By Product (Chair, Couches, Office Chair Mats, Accessories and Others), Material (Plastic, Metal, Wood, Leather and Others), Price Range (Economy, Mid-Range, Premium and Luxury), End User (Commercial Offices, Schools and Universities, Hospitals, Hotels and Restaurants, Retail Outlets, Residential Houses and Others), Distribution Channel (Retail and Direct) – Industry Trends and Forecast to 2031.

Office Seating Market Analysis

Office Seating rising demand for home office seating, driven by hybrid work models, is significantly influencing the office seating market. Hybrid work arrangements, which blend remote and in-office work, have become increasingly popular as organizations seek flexibility and improved employee work-life balance. This shift has created a burgeoning market for high-quality home office furniture, particularly ergonomic seating solutions. As organizations and employees become more conscious of the long-term effects of sedentary work and poor ergonomics, the demand for ergonomic and health-conscious office seating solutions has surged. The modern office landscape is increasingly recognizing the link between ergonomic design and employee health. The heightened awareness of health impacts is also reflected in corporate wellness programs, which increasingly incorporate ergonomic assessments and investments in high-quality office seating.

Office Seating Market Size

U.S. office seating market size was valued at 8.48 billion in 2024 and is projected to reach USD 10.11 billion by 2031, with a CAGR of 2.57% during the forecast period of 2025 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Office Seating Market Trends

“Rising Demand for Home Office Seating Driven by Hybrid Work Models”

As businesses and employees increasingly adopt flexible work arrangements that blend remote and in-office work, there is a growing demand for home office seating solutions. This shift is transforming the traditional office furniture landscape, with a notable focus on ergonomic and versatile seating options designed to enhance comfort and productivity in a home environment. Hybrid work models require office furniture that supports extended hours of use and accommodates various work styles. Consequently, there is a heightened emphasis on ergonomic chairs that offer adjustable features, lumbar support, and improved posture alignment to prevent discomfort and strain. In addition, the aesthetic appeal and integration of office furniture into home settings are becoming important, with many opting for stylish yet functional designs that complement their home decor.

Manufacturers are responding to these needs by innovating with new materials and technologies, and offering customizable solutions that cater to diverse preferences. As remote work continues to solidify its place in the professional landscape, the demand for high-quality, ergonomic home office seating is set to remain strong, driving growth in the office seating market.

Report Scope and Office Seating Market Segmentation

|

Attributes |

Office Seating Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Haworth, Inc. (U.S.), Steelcase Inc. (U.S.), HNI Corp. (U.S.), KI (U.S.), Herman Miller, Inc (U.S.), LA-Z-BOY INCORPORATED (U.S.), Teknion (Canada), UCHIDA YOKO GLOBAL LIMITED / UCHIDA YOKO GLOBAL CO., LTD. (Hong Kong), OFS (U.S.), Kinnarps AB (Sweden), OKAMURA CORPORATION (Japan), Humanscale (U.S.), Itoki Corporation (Japan), Kimball International (U.S.), Hooker Furniture (U.S.), Flexsteel Industries, Inc. (U.S.), JASPER GROUP (U.S.), Wilkhahn Wilkening+Hahne GmbH+Co. KG (Germany), Fursys Inc. (South Korea), Virco Inc. (U.S.), Groupe Lacasse (Canada), Affordable Interior Systems (U.S.), ACTIU Berbegal y Formas S.A. (Spain), Berco Designs (U.S.), UPLIFT DESK (U.S.), HOWE-MOVING DESIGN (Denmark), Trendway Corporation (U.S.), Great Openings (U.S.), and INTER IKEA SYSTEMS B.V. (Netherlands) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire . |

Définition du marché des sièges de bureau

Le marché des sièges de bureau englobe l'offre et la demande de divers types de chaises de bureau et de solutions d'assise, notamment des chaises de travail, des chaises de direction, des chaises de conférence et des modèles ergonomiques. Il comprend des produits conçus pour le confort, la fonctionnalité et l'attrait esthétique dans les environnements de travail. Ce marché s'adresse aux entreprises de toutes tailles, des petites startups aux grandes entreprises, et est influencé par les tendances en matière d'aménagement du lieu de travail, les innovations ergonomiques et l'importance croissante accordée au bien-être des employés. La dynamique du marché est déterminée par des facteurs tels que les avancées technologiques, les conditions économiques et l'évolution des styles de travail.

Dynamique du marché des sièges de bureau

Conducteurs

- La demande croissante de sièges de bureau à domicile stimulée par les modèles de travail hybrides

La demande croissante de sièges de bureau à domicile, alimentée par les modèles de travail hybrides, influence considérablement le marché américain des sièges de bureau. Les modalités de travail hybrides, qui combinent travail à distance et travail au bureau, sont devenues de plus en plus populaires, car les organisations recherchent la flexibilité et un meilleur équilibre entre vie professionnelle et vie privée des employés. Cette évolution a créé un marché florissant pour le mobilier de bureau à domicile de haute qualité, en particulier les solutions de sièges ergonomiques. Comme de plus en plus d'employés travaillent à domicile, le besoin d'installations de bureau à domicile confortables et fonctionnelles augmente. La chaise de bureau traditionnelle est remplacée par des sièges de bureau à domicile plus sophistiqués conçus pour une utilisation prolongée, reflétant une attention accrue à l'ergonomie et au bien-être. Les employés investissent désormais dans des chaises offrant des fonctionnalités réglables, un soutien lombaire et des matériaux durables pour imiter le confort et le soutien des environnements de bureau. En outre, l'essor des modèles de travail hybrides a entraîné une augmentation des dépenses d'aménagement de bureaux à domicile, ce qui a stimulé la demande pour diverses options de sièges, des chaises de travail aux chaises de style exécutif. Ce marché en pleine croissance attire également de nouveaux acteurs et innovations, les fabricants proposant des fonctionnalités avancées telles que la technologie intégrée et des conceptions personnalisables.

Par exemple,

Selon un article publié par Steelcase Inc., les recherches de Steelcase montrent que les modèles de travail hybrides, qui ont pris de l'ampleur pendant la pandémie, sont désormais largement adoptés, 89 % des chefs d'entreprise mondiaux prévoyant de proposer des options hybrides. Les employés apprécient la flexibilité du travail à distance, 78 % d'entre eux souhaitant continuer à pouvoir travailler à distance. Steelcase souligne qu'une approche de travail hybride bien conçue doit équilibrer le travail au bureau et à distance, en offrant choix et contrôle tout en préservant la culture organisationnelle. Leurs études révèlent qu'un travail hybride efficace nécessite des espaces qui favorisent la concentration, la collaboration et le bien-être des employés, faisant du bureau une option attrayante et fonctionnelle.

- Sensibilisation accrue aux impacts sur la santé

Les entreprises et les employés étant de plus en plus conscients des effets à long terme du travail sédentaire et d’une mauvaise ergonomie, la demande de solutions de sièges de bureau ergonomiques et soucieuses de la santé a augmenté. Le paysage de bureau moderne reconnaît de plus en plus le lien entre la conception ergonomique et la santé des employés. Une position assise prolongée sur des chaises non ergonomiques a été associée à une série de problèmes de santé, notamment des troubles musculo-squelettiques, des maux de dos et une mauvaise posture. Cela a conduit à une importance croissante accordée au mobilier de bureau qui favorise une bonne posture et réduit la tension physique. En conséquence, les chaises de bureau ergonomiques, conçues pour offrir un réglage, un soutien lombaire et un meilleur alignement de la posture, sont devenues très recherchées.

La prise de conscience accrue des impacts sur la santé se reflète également dans les programmes de bien-être en entreprise, qui intègrent de plus en plus des évaluations ergonomiques et des investissements dans des sièges de bureau de haute qualité. Les entreprises reconnaissent qu’investir dans la santé des employés peut conduire à une réduction de l’absentéisme, à une augmentation de la productivité et à une meilleure satisfaction globale au travail.

Par exemple,

- En août 2024, selon un article publié par Wirecutter, les meilleures chaises de bureau mettent l’accent sur l’évolution vers des conceptions ergonomiques motivées par une sensibilisation accrue à la santé. Parmi les choix mis en avant, citons le Steelcase Gesture pour sa capacité de réglage et son confort exceptionnels, le Herman Miller Aeron pour sa respirabilité et sa durabilité, et le Herman Miller Sayl pour son design et son soutien uniques à un prix inférieur. Le HON Ignition 2.0, plus économique, est réputé pour offrir de bons réglages et un bon confort pour moins de 500 $. Ces recommandations reflètent la demande croissante de mobilier de bureau qui favorise la santé et la productivité à long terme.

Opportunités

- Sensibilisation croissante à la durabilité pour proposer des options de sièges de bureau écologiques

L’importance croissante accordée à la durabilité représente une opportunité de croissance significative pour le marché américain des sièges de bureau. Les préoccupations environnementales devenant de plus en plus importantes, les entreprises sont soumises à une pression croissante pour adopter des pratiques durables, y compris dans le choix de leur mobilier de bureau. Cette tendance est motivée par une combinaison d’exigences réglementaires telles que l’Environmental Protection Agency (EPA), l’US Green Building Council (USGBC) et bien d’autres, les préférences des consommateurs et les valeurs d’entreprise axées sur la responsabilité environnementale. Sur le marché américain des sièges de bureau, les options écologiques comprennent des chaises fabriquées à partir de matériaux recyclés, du bois certifié durable et des finitions à faible teneur en COV. Les conceptions ergonomiques et modulaires prolongent le cycle de vie des produits, tandis que la fabrication économe en énergie et les emballages recyclés réduisent encore davantage l’impact environnemental. Des certifications telles que GREENGUARD et Cradle to Cradle garantissent la durabilité. Les cinq entreprises américaines qui fabriquent des chaises de bureau écologiques sont Herman Miller, Steelcase, Humanscale, Knoll et HON.

Par exemple,

Selon un article publié par Herman Mille, l'entreprise a depuis longtemps accordé la priorité à la gestion environnementale, reflétant son engagement en faveur du développement durable. Parmi les étapes clés, citons l'objectif de zéro déchet mis en décharge en 1993, l'adhésion à NextWave Plastics en 2018 pour développer des chaînes d'approvisionnement en plastique recyclé en provenance des océans et le lancement d'une collection de textiles 100 % recyclés en 2021. La chaise Mirra de l'entreprise a obtenu la certification Cradle to Cradle, et ses chaises Aeron et Sayl intègrent désormais des plastiques recyclés en provenance des océans. Ces initiatives soulignent l'engagement d'Herman Miller à réduire son impact environnemental tout en répondant à la demande croissante des consommateurs pour des solutions de bureau durables.

- Intégration avec des outils numériques et des fonctionnalités intelligentes

L’intégration d’outils numériques et de fonctionnalités intelligentes dans les sièges de bureau représente une opportunité importante pour le marché américain des sièges de bureau. À mesure que les environnements de travail évoluent et que la technologie continue de progresser, la demande de mobilier de bureau qui non seulement offre un soutien ergonomique, mais améliore également la productivité et le bien-être grâce à une technologie intelligente augmente. Les solutions de sièges de bureau intelligents intègrent des outils numériques tels que des capteurs , des fonctions de connectivité et de réglage qui répondent aux besoins des utilisateurs en temps réel. Par exemple, les chaises équipées de capteurs peuvent surveiller et analyser la posture, avertissant les utilisateurs d’ajuster leur position assise pour éviter l’inconfort et améliorer l’ergonomie. Certains modèles se connectent même à des applications mobiles, permettant aux utilisateurs de suivre leurs habitudes d’assise et de recevoir des recommandations personnalisées pour une meilleure posture et un meilleur mouvement tout au long de la journée.

Par exemple,

- En mai 2023, selon un article publié par IEEE Xplore, une chaise de bureau standard équipée pour surveiller à la fois les paramètres physiologiques (comme la posture, la température corporelle et la fréquence respiratoire) et les facteurs environnementaux comme la température, l’humidité, les niveaux de CO2, le bruit et la lumière. Le système fournit des données en temps réel et des fonctions interactives pour ajuster le confort, conseiller sur les pauses et repositionner. Testée auprès de six utilisateurs, la chaise a atteint une précision de 100 % dans la détection de la posture et jusqu’à 18 % d’erreur dans les mesures physiologiques, démontrant son potentiel à prévenir les problèmes liés à la posture et à augmenter la productivité.

Contraintes/Défis

- Perturbations de la chaîne d'approvisionnement affectant la disponibilité et les coûts des sièges de bureau

Certains sièges de bureau, comme l'oxybenzone et l'octocrylène, suscitent des inquiétudes en raison de leurs effets potentiels sur la santé. Des recherches ont montré que ces composés peuvent avoir des effets perturbateurs endocriniens, qui peuvent interférer avec les systèmes hormonaux chez l'homme. Cela a conduit à une surveillance et une réglementation accrues, les consommateurs devenant plus conscients des risques potentiels associés à ces produits chimiques. Par conséquent, la demande de sièges de bureau est affectée par la préférence croissante pour les produits contenant des ingrédients plus sûrs et plus naturels. Les problèmes environnementaux contribuent également à la restriction du marché des sièges de bureau. Il a été constaté que de nombreux sièges de bureau ont des effets nocifs sur les écosystèmes marins. Par exemple, certains produits chimiques peuvent contribuer au blanchissement des récifs coralliens et perturber la vie aquatique, entraînant des impacts environnementaux négatifs. Cela a conduit à des réglementations plus strictes et à des interdictions sur certains sièges de bureau dans diverses régions, en particulier dans les endroits où les environnements marins sont sensibles. Ces préoccupations écologiques entraînent une augmentation des coûts de conformité réglementaire et limitent la capacité du marché à utiliser certains sièges de bureau, ce qui a un impact sur la croissance globale du marché.

Par exemple,

- En octobre 2023, selon un article publié par Truecommerce, l'industrie du meuble a été confrontée à de graves perturbations, avec des fermetures et une demande accrue provoquant d'importants problèmes de chaîne d'approvisionnement. Les usines ont eu du mal à répondre à la forte demande d'ameublement, ce qui a entraîné des retards et une confusion importants en raison de multiples accusés de réception de commandes et de pénuries de matières premières. Alors que l'industrie s'adaptait à une nouvelle normalité, TrueCommerce Home a proposé des solutions telles que l'EDI et l'abandon des expéditions pour rationaliser les opérations, améliorer la visibilité et renforcer son efficacité. Les détaillants ont commencé à investir dans la technologie pour mieux gérer les chaînes d'approvisionnement et répondre aux attentes changeantes des consommateurs.

Perturbations de la chaîne d'approvisionnement affectant la disponibilité et les coûts des sièges de bureau

À mesure que la technologie évolue, les attentes en matière de mobilier de bureau évoluent également, notamment en ce qui concerne la manière dont il s’intègre aux environnements de travail modernes et prend en charge les nouvelles méthodes de travail. L’un des principaux défis est la nécessité pour les sièges de bureau de suivre le rythme de la demande croissante de conceptions ergonomiques et multifonctionnelles. Les lieux de travail modernes adoptent de plus en plus des aménagements de travail flexibles, tels que les bureaux partagés et les espaces collaboratifs, ce qui nécessite des solutions d’assise adaptables et personnalisables. Le mobilier doit non seulement offrir du confort, mais également prendre en charge une gamme d’activités, du travail de bureau traditionnel aux réunions collaboratives. L’intégration de fonctionnalités avancées telles que la connectivité intégrée pour les appareils ou les mécanismes de réglage intelligents ajoute de la complexité et fait grimper les coûts pour les fabricants. En outre, l’essor des modèles de travail à distance et hybrides a introduit un nouveau niveau de concurrence. Les fabricants de sièges de bureau doivent innover pour répondre à la fois aux besoins des bureaux traditionnels et des bureaux à domicile. Cela signifie que le développement de produits à la fois esthétiques et fonctionnels pour des environnements divers peut mettre à rude épreuve les ressources et nécessiter des investissements importants en recherche et développement.

Par exemple,

Selon un article publié par Steelcase Inc., l’étude de cas de Steelcase et Microsoft est particulièrement pertinente pour le marché des sièges de bureau. Elle illustre l’évolution vers des espaces de travail flexibles et créatifs qui intègrent la technologie pour prendre en charge divers modes de travail. Cette adaptation répond au défi de l’évolution des conceptions de bureaux en réponse aux changements technologiques rapides et aux nouveaux besoins des employés. L’accent mis sur des espaces tels que Maker Commons et Focus Studios souligne l’évolution vers des environnements qui améliorent la collaboration et la créativité. Dans l’ensemble, elle reflète la tendance croissante à concevoir des bureaux pour favoriser la productivité et le bien-être dans un paysage professionnel en évolution rapide.

Ce rapport de marché fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Contenu du cadre réglementaire

Réglementations Le marché des sièges de bureau est régi par des réglementations garantissant la sécurité, l'ergonomie et les normes environnementales. Les principaux cadres réglementaires comprennent les normes ANSI/BIFMA (American National Standards Institute/Business and Institutional Furniture Manufacturers Association) en matière de performance et de sécurité, ainsi que le respect des directives OSHA (Occupational Safety and Health Administration) en matière de sécurité ergonomique sur le lieu de travail.

Vous trouverez ci-dessous une couverture détaillée des réglementations et des normes affectant le marché américain des sièges de bureau :

Réglementations aux États-Unis

Selon la réglementation de l'Administration de la sécurité et de la santé au travail (OSHA), les chaises de bureau doivent favoriser la sécurité et la productivité ergonomiques. Elles doivent être dotées d'un dossier réglable qui s'aligne avec la colonne vertébrale, d'un siège confortable permettant aux pieds de reposer à plat, d'accoudoirs réglables pour le soutien des bras et d'une base stable à cinq pieds avec roulettes. Des réglages appropriés de la chaise sont essentiels pour un poste de travail bien conçu.

Conformément à la loi Lacey, appliquée par l'USDA APHIS, le US Fish and Wildlife Service et le National Marine Fisheries Service, réglemente le commerce des plantes, des poissons et des animaux sauvages, y compris les produits en bois tels que les chaises en teck rembourrées et la vaisselle en bois. Les importateurs doivent faire preuve de la diligence requise et soumettre des déclarations pour les produits contenant des plantes répondant à des critères spécifiques.

Conformément aux normes relatives au formaldéhyde pour les produits en bois composite (40 CFR Part 770) – TSCA, la partie 770 du 40 CFR du TSCA, administrée par l'EPA, réglemente les émissions de formaldéhyde des produits en bois composite. Elle fixe des limites d'émission pour le contreplaqué de bois dur, les panneaux de fibres à densité moyenne, les panneaux de fibres à densité moyenne minces et les panneaux de particules. Les importateurs doivent obtenir une certification d'un organisme de certification tiers agréé, y compris la documentation pertinente et les rapports de test.

De plus, conformément à la loi sur la sécurité des produits de consommation (CPSA), la loi sur la sécurité des produits de consommation, entrée en vigueur le 27 octobre 1972, a été promulguée pour établir la Commission de sécurité des produits de consommation et définir son autorité dans le but de protéger le public contre les risques déraisonnables de blessures associés aux produits de consommation ; d'aider les consommateurs à évaluer la sécurité comparative des produits de consommation, d'élaborer des normes de sécurité uniformes pour les produits de consommation ; et de promouvoir la recherche et l'enquête sur les causes et la prévention des décès, des maladies et des blessures liés aux produits.

Impact et scénario actuel du marché en cas de pénurie de matières premières et de retards d'expédition

Data Bridge Market Research propose une analyse de haut niveau du marché et fournit des informations en tenant compte de l'impact et de l'environnement actuel du marché en matière de pénurie de matières premières et de retards d'expédition. Cela se traduit par l'évaluation des possibilités stratégiques, la création de plans d'action efficaces et l'assistance aux entreprises dans la prise de décisions importantes.

Outre le rapport standard, nous proposons également une analyse approfondie du niveau d'approvisionnement à partir des retards d'expédition prévus, de la cartographie des distributeurs par région, de l'analyse des produits de base, de l'analyse de la production, des tendances de la cartographie des prix, de l'approvisionnement, de l'analyse des performances des catégories, des solutions de gestion des risques de la chaîne d'approvisionnement, de l'analyse comparative avancée et d'autres services d'approvisionnement et de soutien stratégique.

Impact attendu du ralentissement économique sur les prix et la disponibilité des produits

Lorsque l'activité économique ralentit, les industries commencent à souffrir. Les effets prévus du ralentissement économique sur les prix et l'accessibilité des produits sont pris en compte dans les rapports d'analyse du marché et les services de renseignements fournis par DBMR. Grâce à cela, nos clients peuvent généralement garder une longueur d'avance sur leurs concurrents, projeter leurs ventes et leurs revenus et estimer leurs dépenses de profits et pertes.

Portée du marché des sièges de bureau

Le marché est segmenté en fonction du produit, du matériau, de la gamme de prix, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Chaise

- Chaises de travail

- Chaise ergonomique

- Chaises de direction

- Chaise de bureau en maille

- Chaise de bureau pivotante

- Chaise à boule

- Chaise/Tabouret de dessinateur

- Chaise à genoux

- Chaise pliante

- Chaise pliante empilable

- Chaise de jeu

- Chaise spécialisée

- Autres

- Canapés

- En coupe

- Modulaire

- Causeuse

- Fauteuil inclinable

- Chesterfield

- Dormeur

- Smoking

- Lawson

- Milieu du siècle

- Bras de rouleau anglais

- Bras de chenille

- Dos de chameau

- Convertible

- Cabriole

- Enraciné profondément

- Assise basse

- Tapis de chaise de bureau

- Ampoule

- Lèvre

- Rectangulaire

- Accessoires

- Autres

Matériel

- Plastique

- Polypropylène

- ABS

- Polyéthylène

- PVC

- Polycarbonate

- Nylon

- Autres

- Métal

- Acier

- Aluminium

- Fer

- Laiton

- Autres

- Bois

- Bois dur

- Chêne

- Bois d'érable

- Bois de cerisier

- Noyer

- Acajou

- Bois de teck

- Cendre

- Bouleau

- Bois de pin

- Palissandre

- Autres

- Bois d'ingénierie

- Bois massif

- Bois tendre

- Bois dur

- Cuir

- Pigmenté

- Grain supérieur

- Lié

- Aniline

- Nubuck

- Pleine fleur

- Bi-cast

- Grain fendu

- Autres

- Autres

Gamme de prix

- Économie

- Milieu de gamme

- Prime

- Luxe

Utilisateur final

- Bureaux commerciaux

- Écoles et Universités

- Hôpitaux

- Hôtels et restaurants

- Points de vente au détail

- Maisons résidentielles

- Autres

Canal de distribution

- Vente au détail

- Hors ligne

- Magasins de meubles

- Monomarque

- Multimarque

- Magasins spécialisés

- Supermarchés et hypermarchés

- Autres

- Magasins de meubles

- En ligne

- Sites Web tiers

- Propriété de l'entreprise

- Hors ligne

- Direct

Part de marché des sièges de bureau

Le paysage concurrentiel du marché fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence aux États-Unis, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Les leaders du marché des sièges de bureau opérant sur le marché sont :

- Haworth, Inc. (États-Unis)

- Steelcase Inc. (États-Unis)

- HNI Corp. (États-Unis)

- KI (États-Unis)

- Herman Miller, Inc (États-Unis)

- LA-Z-BOY INCORPORATED (ÉTATS-UNIS)

- Teknion (Canada)

- UCHIDA YOKO GLOBAL LIMITED / UCHIDA YOKO GLOBAL CO., LTD. (Hong Kong)

- OFS (États-Unis)

- Kinnarps AB (Suède)

- OKAMURA CORPORATION (Japon)

- Humanscale (États-Unis)

- Itoki Corporation (Japon)

- Kimball International (États-Unis)

- Meubles Hooker (États-Unis)

- Flexsteel Industries, Inc. (États-Unis)

- GROUPE JASPER (ÉTATS-UNIS)

- Wilkhahn Wilkening+Hahne GmbH+Co. KG (Allemagne)

- Fursys Inc. (Corée du Sud)

- Virco Inc. (États-Unis)

- Groupe Lacasse (Canada)

- Systèmes d'intérieur abordables (États-Unis)

- ACTIU Berbegal y Formas SA (Espagne)

- Berco Designs (États-Unis)

- BUREAU UPLIFT (États-Unis)

- HOWE-MOVING DESIGN (Danemark)

- Trendway Corporation (États-Unis)

- Grandes ouvertures (États-Unis)

- INTER IKEA SYSTEMS BV (Pays-Bas)

Dernières évolutions sur le marché des sièges de bureau

- En avril 2024, Steelcase Inc. a transformé les espaces de travail dans toute la Chine en dévoilant des développements pionniers en matière de design et de durabilité, notamment la collection Spring de Vicar. Cette collaboration visait à améliorer la fonctionnalité, la résonance culturelle et l'innovation, en répondant aux besoins des espaces de travail asiatiques en évolution rapide

- En août 2024, Haworth a lancé la nouvelle chaise de bureau Breck, dotée de la technologie innovante Geostretch pour un soutien et un confort ergonomiques supérieurs. Pesant 30 lb et s'assemblant sans outil, Breck offre des fonctionnalités haut de gamme et une durabilité avec plus de 50 % de contenu recyclé. Ce développement renforce la position de Haworth sur le marché, en combinant un design avancé avec une production respectueuse de l'environnement

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.