Marché hôtelier américain en fonction des dépenses des entreprises B2B, par chaîne (luxe, haut de gamme, haut de gamme, milieu de gamme supérieur, milieu de gamme et économique), domaine (international et national), secteur (BFSI, fabrication, soins de santé, services informatiques, gouvernement et autres), canal de réservation (réservations directes, agences de voyages en ligne (OTAS) et sociétés de gestion de voyages (TMC)) - Tendances et prévisions du secteur jusqu'en 2029.

Analyse et perspectives des dépenses des entreprises B2B sur le marché hôtelier américain

Le marché hôtelier américain des dépenses des entreprises B2B devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,7 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 22 640,46 millions USD d'ici 2029. Le principal facteur à l'origine de la croissance du marché est l'adoption de stratégies et de pratiques marketing innovantes dans le secteur de l'hôtellerie au cours de la période de prévision. L'évolution de la préférence des entreprises pour les événements en ligne et la numérisation devrait freiner la croissance du marché.

L'augmentation des différents types de plateformes de réservation d'espaces hôteliers devrait offrir de grandes opportunités au marché. Cependant, l'épidémie de COVID-19 a entraîné l'annulation de divers événements d'entreprise et les dépenses B2B devraient remettre en cause la croissance du marché.

Le rapport sur les dépenses des entreprises B2B sur le marché hôtelier américain fournit des détails sur les parts de marché, les nouveaux développements, l'impact des acteurs du marché national et local, l'analyse des opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par chaîne (luxe, haut de gamme, haut de gamme, milieu de gamme supérieur, milieu de gamme et économique), domaine (international et national), secteur (BFSI, fabrication, soins de santé, services informatiques, gouvernement et autres), canal de réservation (réservations directes, agences de voyages en ligne (OTAS) et sociétés de gestion de voyages (TMC)) |

|

Pays couverts |

NOUS |

|

Acteurs du marché couverts |

Marriott International Inc., Hyatt Hotel Corp., Hilton Worldwide Holdings Inc., Wyndham Hotels & Resorts Inc., Groupe hôtelier Radisson MARRIOTT, Groupe hôtelier Rosewood |

Définition du marché

Les dépenses d'entreprise B2B dans les hôtels peuvent être définies comme des dépenses liées à des événements tels que des rassemblements organisés par les propriétaires d'entreprise dans les hôtels pour se concentrer sur les employés et les clients et renforcer davantage la clientèle, ainsi que des séjours pour les employés de l'entreprise lors de divers événements. Diverses entreprises et sociétés organisent des événements pour de nombreuses raisons. Elles peuvent vouloir éduquer, récompenser, motiver, célébrer, marquer des étapes clés, gérer le changement organisationnel ou encourager la collaboration.

Le marché hôtelier américain selon la dynamique du marché des dépenses des entreprises B2B

Conducteurs

- Adoption de stratégies et de pratiques marketing innovantes dans le secteur de l'hôtellerie

La réalité virtuelle (RV) est devenue l’une des plus grandes tendances émergentes en matière de technologie et de marketing hôtelier de ces dernières années. Les visites en RV de l’espace et des hôtels offrent le moyen idéal de découvrir un lieu à distance, en recréant l’environnement d’une manière qui permet un certain degré d’exploration et d’immersion. Pour les clients des événements d’entreprise, cela signifie la possibilité d’explorer les lieux de l’événement sans avoir à s’y rendre physiquement pour le visionner. Cela est particulièrement précieux à une époque où les déplacements sont limités. En outre, divers groupes et marques hôteliers font la promotion de leurs marques et chaînes hôtelières par le biais de vidéos sur les plateformes de médias sociaux, en utilisant des hashtags et des campagnes d’engagement de marque mises en œuvre sur des plateformes numériques, ce qui est considéré comme la meilleure pratique dans le secteur de l’hôtellerie. Par conséquent, avec de telles pratiques innovantes du secteur de l’hôtellerie, les dépenses B2B des entreprises devraient augmenter, ce qui stimulera la croissance du marché.

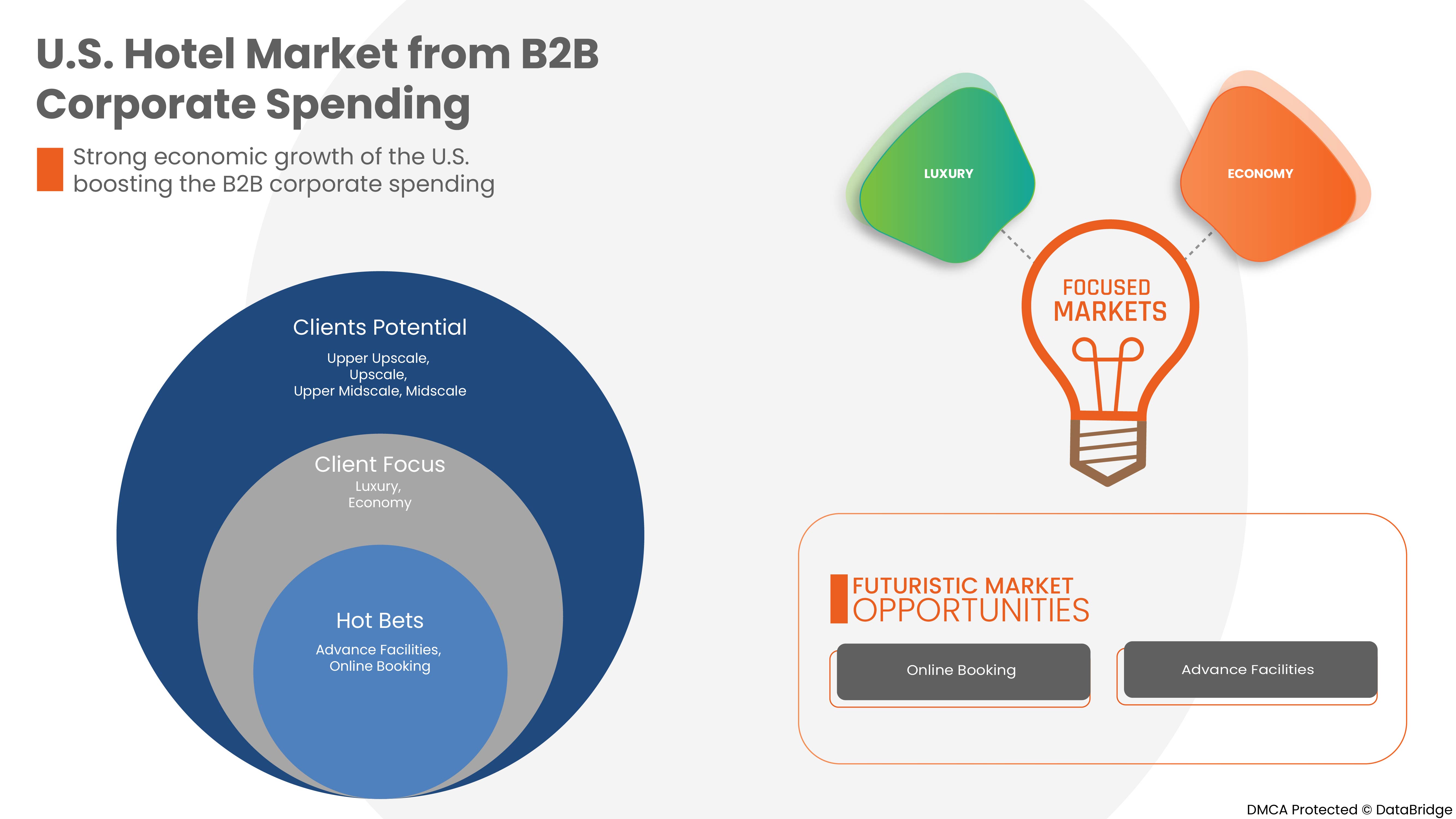

- La forte croissance économique des États-Unis stimule les dépenses des entreprises B2B

Avec la croissance de l'économie du pays, chaque entreprise et startup a besoin de se faire connaître et de se faire connaître. Par conséquent, les dépenses des entreprises B2B dans les hôtels en termes d'événements constituent la meilleure plate-forme pour commercialiser leur entreprise en sponsorisant des spectacles de divertissement comme des événements de musique en direct, des événements sportifs et bien d'autres. Les entreprises de la région cherchent de plus en plus à introduire de nouveaux produits et technologies sur le marché pour obtenir un avantage concurrentiel plus important. Cela se traduit par divers salons professionnels, événements de lancement de nouveaux produits, expositions de produits et autres à grande échelle pour faciliter l'interaction des clients potentiels et des investisseurs. De ce fait, les dépenses des entreprises B2B dans le secteur hôtelier connaissent une forte croissance.

En outre, le nombre croissant d'entreprises dans les secteurs de la santé et de l'informatique et l'augmentation des dépenses consacrées aux salons professionnels, aux conférences et aux séminaires par les entreprises stimulent la croissance du marché.

Opportunité

- Augmentation des différents types de plateformes de réservation de chambres d'hôtel

Les agences de voyages sont l'un des canaux de distribution les plus importants dans le marketing de l'hôtellerie. Ces dernières années, le nombre d'agences de voyages a considérablement augmenté. Cela permet aux clients de rechercher des produits ou des services de voyage en ligne plutôt que de se rendre sur les sites Web des entreprises individuelles. Il est donc de la plus haute importance de s'associer à des agences de voyages. La présence d'une grande variété de canaux de réservation pour les réservations dans le secteur de l'hôtellerie offre une opportunité lucrative pour la croissance et le développement du marché.

Retenue/Défi

- Les entreprises privilégient de plus en plus les événements en ligne et la numérisation

Hopin est désormais devenue une plateforme populaire pour l'organisation d'événements et de conférences. De nombreuses entreprises de ce type se concentrent sur la réduction du fossé entre les événements en direct et en ligne. Toutes ces initiatives devraient générer un énorme potentiel de croissance dans le secteur de l'événementiel. Cependant, on estime que ces initiatives limiteront les dépenses des entreprises B2B en matière d'hôtels et affecteront négativement la croissance du marché, car les restrictions liées au COVID-19 ont obligé les entreprises à s'appuyer sur la technologie pour se connecter avec les gens afin d'organiser des séminaires et des événements d'entreprise. Zoom, une plateforme de communication, est devenue très populaire pour y parvenir.

- L'épidémie de COVID-19 a entraîné l'annulation de divers événements d'entreprise et dépenses B2B

Compte tenu de la réduction généralisée des dépenses des entreprises et des groupes d'affaires aux États-Unis, l'industrie hôtelière a été l'un des secteurs les plus durement touchés par la pandémie de COVID-19. De plus, les hôtels gérés par des chaînes sont les plus touchés par la pandémie de COVID-19 par rapport aux hôtels franchisés et indépendants. Les défis créés par la COVID-19 ont eu un impact sur presque tous les aspects des opérations d'un hôtel, du niveau d'occupation des chambres et des plans de dotation en personnel à l'approvisionnement en nourriture et en boissons. La pandémie a le potentiel d'avoir des effets de grande envergure sur le secteur, créant un défi pour la croissance du marché.

Impact de la pandémie de COVID-19 sur le marché hôtelier américain en raison des dépenses des entreprises B2B

La pandémie de COVID-19 a gravement affecté le secteur de l'hôtellerie en raison des confinements communautaires, de la distanciation sociale, des ordres de confinement, des restrictions de voyage et de mobilité qui ont entraîné la fermeture temporaire de nombreuses entreprises du secteur de l'hôtellerie et ont considérablement réduit la demande pour les entreprises autorisées à fermer. Les restrictions imposées aux voyages et les ordres de confinement émis par les autorités ont entraîné une forte baisse du taux d'occupation et des revenus des hôtels, tandis que le secteur de l'hôtellerie se redresse lentement, ce qui augmentera la croissance du marché.

Développement récent

- En septembre 2022, Mark Hoplamazian, président et chef de la direction de Hyatt Hotels Corporation, a fait une présentation lors de la conférence Bank of America Securities 2022 Gaming & Lodging à New York, le jeudi 8 septembre 2022.

Marché hôtelier américain du point de vue du marché des dépenses d'entreprise B2B

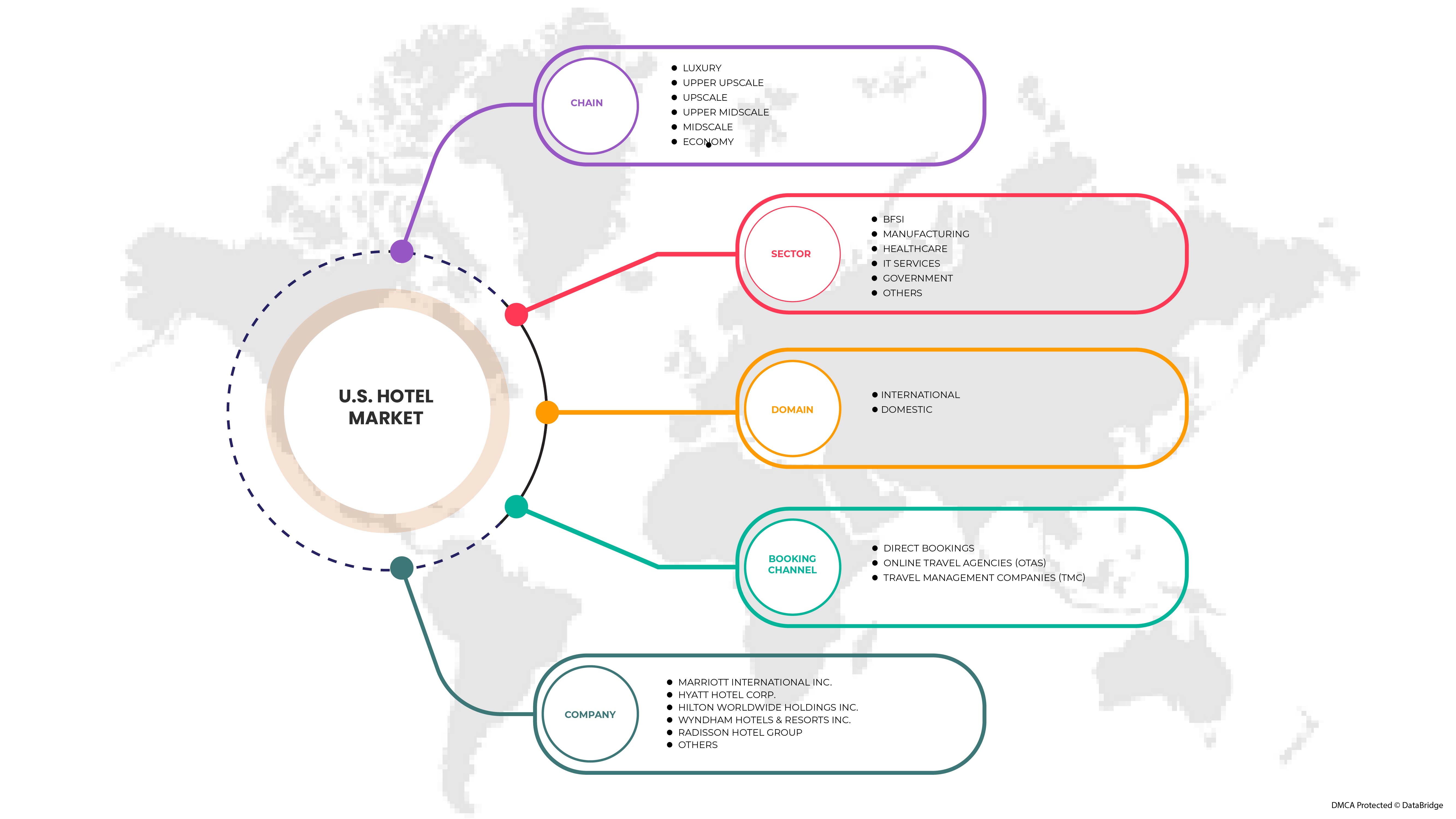

Le marché hôtelier américain, en termes de dépenses d'entreprise B2B, est classé en quatre segments notables basés sur la chaîne, le domaine, le secteur et le canal de réservation.

La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Chaîne

- Luxe

- Haut de gamme supérieur

- Haut de gamme

- Milieu de gamme supérieur

- Milieu de gamme

- Économie

En fonction de la chaîne, le marché est segmenté en luxe, haut de gamme supérieur, haut de gamme, milieu de gamme supérieur, milieu de gamme et économique.

Domaine

- International

- Domestique

En fonction du domaine, le marché est segmenté en international et national.

Secteur

- BFSI

- Fabrication

- Soins de santé

- Services informatiques

- Gouvernement

- Autres

En fonction du secteur, le marché est segmenté en BFSI, fabrication, soins de santé, services informatiques, gouvernement et autres

Canal de réservation

- Réservations directes

- Agences de voyages en ligne (OTAS)

- Sociétés de gestion de voyages (TMC)

En fonction du canal de réservation, le marché est segmenté en réservations directes, agences de voyages en ligne (OTAS) et sociétés de gestion de voyages (TMC)

Analyse et perspectives des dépenses des entreprises B2B sur le marché hôtelier américain

Le marché hôtelier américain est analysé à partir des dépenses des entreprises B2B et des informations sur la taille du marché et les tendances sont fournies en fonction de la chaîne, du domaine, du secteur et du canal de réservation.

Les États couverts dans ce rapport de marché sont la Californie, la Floride, New York, le Texas, l'Illinois, la Géorgie, la Pennsylvanie, l'Ohio et le reste des États-Unis. En 2022, l'État de Californie devrait dominer le marché hôtelier américain en termes de dépenses d'entreprise B2B.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse de la chaîne de valeur en aval et en amont des points de données, les tendances techniques et l'analyse des cinq forces de Porter ainsi que les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Paysage concurrentiel et marché hôtelier américain selon l'analyse des parts de dépenses des entreprises B2B

Le marché hôtelier américain, issu du paysage concurrentiel des dépenses des entreprises B2B, fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue des produits, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Certains des principaux acteurs opérant sur le marché sont Marriott International Inc., Hyatt Hotel Corp., Hilton Worldwide Holdings Inc., Wyndham Hotels & Resorts Inc., Radisson Hotel Group MARRIOTT et Rosewood Hotel Group.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent des grilles de positionnement des fournisseurs, une analyse de la chronologie du marché, un aperçu et un guide du marché, des grilles de positionnement des entreprises, une analyse des parts de marché des entreprises, des normes de mesure, une analyse des parts de marché américaines par rapport aux parts régionales et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 CHAIN LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET CHALLENGE MATRIX

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OVERVIEW: U.S. LEISURE SPENDING BY THE CONSUMERS

4.2 REGULATORY COVERAGE

4.3 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: COMPANY LANDSCAPE

4.3.1 COMPANY SHARE ANALYSIS: U.S.

4.4 U.S. HOTEL MARKET, BRAND SHARE ANALYSIS, 2021, (%)

4.4.1 MARRIOTT

4.4.2 HYATT

4.4.3 HILTON

4.4.4 WYNDHAM

4.4.5 RADISSON

4.4.6 ROSEWOOD

4.5 RECENT DEVELOPMENT AND BRAND STRATEGIES

4.5.1 HYATT

4.5.2 RADDISON

4.5.3 MARRIOTT

4.5.4 FOUR SEASONS HOTELS AND RESORTS

4.5.5 HILTON

4.5.6 WYNDHAM HOTELS

4.6 CONSUMERS’ TRENDS/ RESPONSE

4.7 U.S. HOTEL MARKET, MARKET ANALYSIS

5 U.S. HOTEL MARKET: LUXURY SEGMENT, BRAND SHARE ANALYSIS, 2021, (%)

6 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN

6.1 OVERVIEW

6.2 UPSCALE

6.3 UPPER UPSCALE

6.4 UPPER MIDSCALE

6.5 MIDSCALE

6.6 ECONOMY

6.7 LUXURY

6.7.1 INTERNATIONAL

6.7.2 DOMESTIC

6.7.2.1 IT SERVICES

6.7.2.2 BFSI

6.7.2.3 MANUFACTURING

6.7.2.4 HEALTHCARE

6.7.2.5 GOVERNMENT

6.7.2.6 OTHERS

6.7.2.6.1 DIRECT BOOKINGS

6.7.2.6.2 ONLINE TRAVEL AGENCIES (OTAS)

6.7.2.6.3 TRAVEL MANAGEMENT COMPANIES (TMC)

7 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN

7.1 OVERVIEW

7.2 INTERNATIONAL

7.3 DOMESTIC

8 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR

8.1 OVERVIEW

8.2 IT SERVICES

8.3 BFSI

8.4 MANUFACTURING

8.5 HEALTHCARE

8.6 GOVERNMENT

8.7 OTHERS

9 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL

9.1 OVERVIEW

9.2 DIRECT BOOKINGS

9.3 ONLINE TRAVEL AGENCIES (OTAS)

9.4 TRAVEL MANAGEMENT COMPANIES (TMC)

10 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY STATE

10.1 CALIFORNIA

10.2 FLORIDA

10.3 NEW YORK

10.4 TEXAS

10.5 ILLINOIS

10.6 GEORGIA

10.7 PENNSYLVANIA

10.8 OHIO

10.9 REST OF U.S.

11 SWOT

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 3 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 4 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 5 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 6 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 7 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 8 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 9 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY STATE, 2018-2029 (USD MILLION)

TABLE 10 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 11 CALIFORNIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 12 CALIFORNIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 13 CALIFORNIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 14 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 15 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 16 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 17 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 18 FLORIDA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 19 FLORIDA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 20 FLORIDA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 21 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 22 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 23 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 24 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 25 NEW YORK LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 26 NEW YORK LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 27 NEW YORK LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 28 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 29 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 30 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 31 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 32 TEXAS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 33 TEXAS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 34 TEXAS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 35 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 36 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 37 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 38 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 39 ILLINOIS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 40 ILLINOIS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 41 ILLINOIS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 42 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 43 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 44 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 45 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 46 GEORGIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 47 GEORGIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 48 GEORGIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 49 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 50 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 51 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 52 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 53 PENNSYLVANIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 54 PENNSYLVANIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 55 PENNSYLVANIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 56 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 57 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 58 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 59 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 60 OHIO LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 61 OHIO LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 62 OHIO LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 63 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 64 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 65 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 66 REST OF U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

Liste des figures

FIGURE 1 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: SEGMENTATION

FIGURE 2 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: DATA TRIANGULATION

FIGURE 3 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: DROC ANALYSIS

FIGURE 4 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: U.S. MARKET ANALYSIS

FIGURE 5 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: THE CHAIN LIFE LINE CURVE

FIGURE 7 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: MULTIVARIATE MODELLING

FIGURE 8 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: THE MARKET CHALLENGE MATRIX

FIGURE 10 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: SEGMENTATION

FIGURE 11 STRONG ECONOMIC GROWTH OF THE U.S. BOOSTING THE B2B CORPORATE SPENDING IS EXPECTED TO DRIVE U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING IN THE FORECAST PERIOD

FIGURE 12 UPSCALE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING IN 2022 & 2029

FIGURE 13 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: COMPANY SHARE 2021 (%)

FIGURE 14 MARRIOTT: BRAND ANALYSIS

FIGURE 15 MARRIOTT: SELECT SEGMENT

FIGURE 16 MARRIOTT: PREMIUM SEGMENT

FIGURE 17 MARRIOTT: LUXURY SEGMENT

FIGURE 18 HYATT: BRAND ANALYSIS

FIGURE 19 HYATT: UPPER-UPSCALE

FIGURE 20 HYATT: UPSCALE

FIGURE 21 HYATT: LUXURY

FIGURE 22 HILTON: BRAND ANALYSIS

FIGURE 23 HILTON: UPPER-UPSCALE

FIGURE 24 HILTON: UPSCALE

FIGURE 25 HILTON: LUXURY

FIGURE 26 WYNDHAM: BRAND ANALYSIS

FIGURE 27 WYNDHAM: ECONOMY

FIGURE 28 WYNDHAM: MID-SCALE

FIGURE 29 WYNDHAM: UPSCALE

FIGURE 30 WYNDHAM: LIFESTYLE

FIGURE 31 WYNDHAM: EXTENDED STAY

FIGURE 32 RADISSON: BRAND ANALYSIS

FIGURE 33 RADISSON: UPPER UPSCALE

FIGURE 34 RADISSON: UPSCALE

FIGURE 35 RADISSON: MID-SCALE

FIGURE 36 RADISSON: LUXURY

FIGURE 37 ROSEWOOD: BRAND ANALYSIS

FIGURE 38 U.S. HOTEL MARKET, (USD BILLION)

FIGURE 39 LUXURY HOTELS: BRAND ANALYSIS

FIGURE 40 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY CHAIN, 2021

FIGURE 41 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY DOMAIN, 2021

FIGURE 42 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY SECTOR, 2021

FIGURE 43 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY BOOKING CHANNEL, 2021

FIGURE 44 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: SNAPSHOT (2021)

FIGURE 45 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY STATE (2021)

FIGURE 46 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY STATE (2022 & 2029)

FIGURE 47 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY STATE (2021 & 2029)

FIGURE 48 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY CHAIN (2022-2029)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.