Marché des tests d'allergènes et d'intolérances alimentaires aux États-Unis (analyse État par État), par type de test ( test d'allergènes et test d'intolérance), méthode (in vitro et in vivo), utilisateur final (utilisateur final de test d'allergènes et utilisateur final de test d'intolérance) Tendances et prévisions de l'industrie jusqu'en 2030

Analyse du marché et de la taille des tests d'allergènes et d'intolérances alimentaires aux États-Unis (analyse État par État)

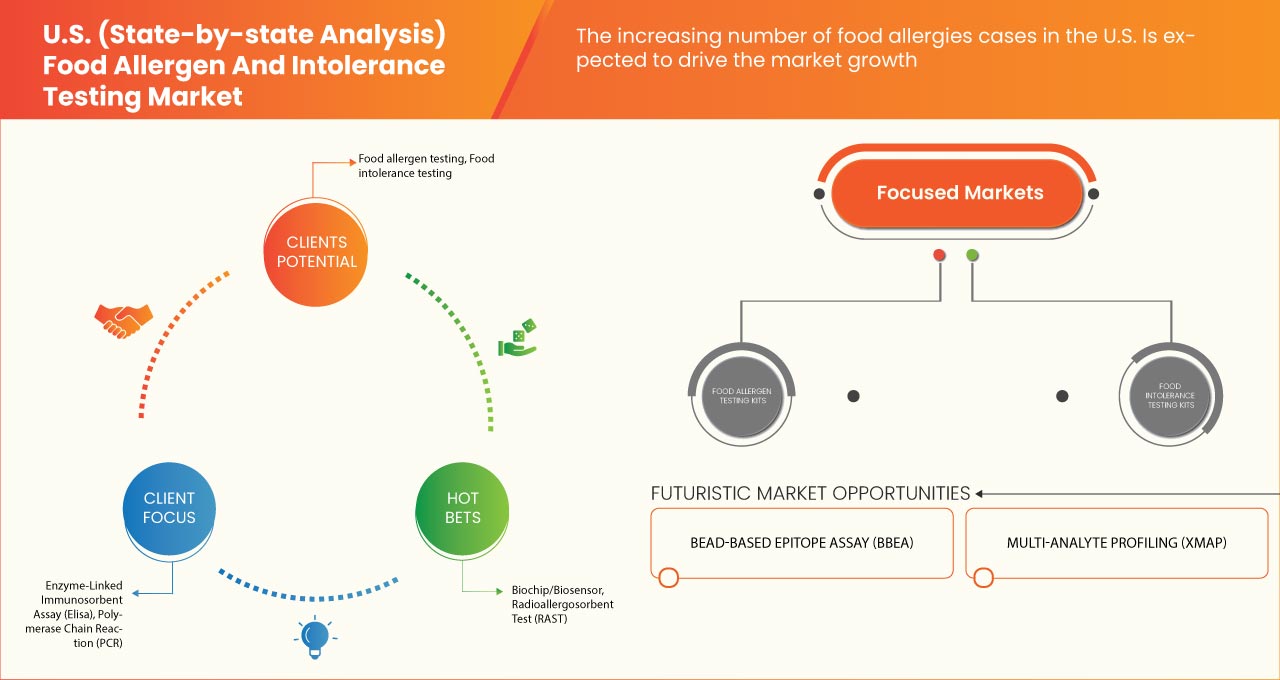

La sensibilisation croissante des consommateurs à la tolérance alimentaire et aux allergènes alimentaires est un moteur important pour le marché américain des tests d'allergies et d'intolérances alimentaires (analyse État par État). La sensibilisation croissante des consommateurs à l'achat d'aliments sans allergènes, obligeant les fabricants à produire des produits testés contre les allergènes et sans allergènes, devrait propulser la croissance du marché américain des tests d'allergies et d'intolérances alimentaires (analyse État par État).

Data Bridge Market Research analyse que le marché américain des tests d'allergènes et d'intolérances alimentaires (analyse État par État) devrait atteindre la valeur de 642,46 millions USD d'ici 2030, à un TCAC de 11,2 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de test (test d'allergène et test d'intolérance), méthode (in vitro et in vivo), utilisateur final (utilisateur final de test d'allergène et utilisateur final de test d'intolérance). |

|

Acteurs du marché couverts |

Bureau Veritas, Neogen Corporation , Intertek Group plc , ALS, Mérieux NutriSciences Corporation TÜV SÜD , Global Testing Lab , SGS Société Générale de Surveillance SA , YorkTest , US BioTek Laboratories, LLC ALLETESS MEDICAL LABORATORY, Microbac Laboratories, Inc., Healthy Stuff Online Ltd , PCAS Labs, Eurofins USA |

Définition du marché

Une allergie alimentaire se produit lorsque le système immunitaire du corps réagit anormalement à certains aliments. Les réactions allergiques sont souvent bénignes mais peuvent être très graves. Les allergies et les intolérances alimentaires touchent presque tout le monde à un moment donné de sa vie. Cependant, il existe des différences entre les allergies et les intolérances alimentaires. Les allergies alimentaires rendent le système immunitaire du corps trop sensible. Il s'agit d'une réaction anormale déclenchée par le système immunitaire lorsque certains aliments sont ingérés, tandis que si le système immunitaire n'est pas impliqué dans la réaction à un aliment, on parle alors d'intolérance alimentaire. Les allergènes alimentaires les plus courants sont le lait, les arachides, les œufs, les fruits de mer, les crustacés, le soja, le blé, les amandes et bien d'autres.

La sécurité et la qualité des aliments sont une préoccupation majeure pour les industries agroalimentaires, de vente au détail et d'hôtellerie. Les allergies alimentaires sont en augmentation aux États-Unis, notamment en ce qui concerne le nombre d'allergènes, les taux de sensibilisation et la prévalence. Pour contrôler les cas d'allergie alimentaire dans la région, les allergies alimentaires doivent être correctement contrôlées, testées dans les aliments transformés et correctement étiquetées. La fonction la plus importante des laboratoires d'allergènes alimentaires est de tester les aliments pour détecter la présence d'allergènes tels que le soja, les produits laitiers, les arachides et les noix, entre autres.

Dynamique du marché des tests d'allergies et d'intolérances alimentaires aux États-Unis (analyse État par État)

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- RÈGLES ET RÉGLEMENTATIONS DE SÉCURITÉ STRICTES POUR LES ALIMENTS

Le gouvernement édicte des règles et réglementations strictes pour garantir la sécurité alimentaire, ce qui peut stimuler la croissance du marché. Avec l'augmentation du nombre de cas d'allergies et d'intolérances alimentaires aux États-Unis, le gouvernement a adopté des règles et réglementations strictes pour la fabrication, l'emballage, les tests, le contrôle de la qualité et la vente des produits alimentaires. Les règles formulées garantissent que les aliments parvenant au consommateur final répondent aux normes de qualité minimales, disposent d'un étiquetage approprié et ont assuré la certification pour ceux-ci. La sécurité alimentaire étant la principale clé de l'industrie alimentaire, le gouvernement a rendu obligatoires de nombreuses certifications pour garantir la sécurité alimentaire. Ces réglementations ont sensibilisé les fabricants ainsi que les consommateurs aux tests et à la sécurité des aliments, ce qui a augmenté la demande de produits testés sur le marché.

Par conséquent, le gouvernement a établi des réglementations strictes pour les fabricants de produits alimentaires et de boissons afin de prévenir les allergies et les intolérances alimentaires et de garantir la sécurité alimentaire aux États-Unis.

- SENSIBILISATION CROISSANTE DES CONSOMMATEURS À LA TOLÉRANCE ALIMENTAIRE ET AUX ALLERGÈNES ALIMENTAIRES

Avec l'augmentation du nombre de cas d'allergies alimentaires et de problèmes d'intolérance alimentaire, de plus en plus de consommateurs prennent conscience de l'importance de manger des aliments sûrs et sains. Cela a conduit à une demande accrue d'aliments de bonne qualité et sûrs parmi les individus, ce qui génère une demande d'équipements de test d'allergènes et d'intolérances alimentaires. L'incidence croissante des maladies alimentaires a incité les consommateurs à apporter des changements vitaux à leur régime alimentaire et à leur mode de vie, les rendant plus soucieux de la sécurité alimentaire. Les consommateurs sont désormais très conscients de la nourriture qu'ils mangent et la sécurité alimentaire est leur principale préoccupation. La sécurité alimentaire est importante non seulement pour la santé des consommateurs, mais aussi pour l'ensemble de l'industrie alimentaire et les autorités réglementaires. Face à l'inquiétude croissante des consommateurs concernant la sécurité alimentaire, le gouvernement et d'autres autorités prennent également des initiatives pour promouvoir la sécurité alimentaire auprès des consommateurs.

Opportunités

- UTILISATION CROISSANTE DE L'AUTOMATISATION DANS LE SECTEUR DE LA TOLÉRANCE ALIMENTAIRE ET DES TESTS ALIMENTAIRES

L'augmentation des cas d'allergies alimentaires dus à la présence d'ingrédients dans les aliments responsables de ces allergies a fait évoluer l'industrie des tests d'allergies et d'intolérances alimentaires au cours des dernières années. La demande de services de tests d'allergies alimentaires efficaces et technologiquement avancés augmente en raison des préoccupations croissantes liées aux allergies et aux intolérances alimentaires. Diverses méthodes traditionnelles de test des allergènes et des intolérances alimentaires prenaient du temps et le besoin de méthodes technologiques avancées augmente donc. De nouvelles technologies automatisées sont développées afin de tester les allergies et les intolérances alimentaires. De nos jours, les dernières technologies de test des allergènes et des intolérances alimentaires, notamment la réaction en chaîne par polymérase (PCR), le test immuno-enzymatique (ELISA), la nouvelle méthode de développement de capteurs et d'autres, gagnent en popularité en raison de leur détection rapide, sensible et précise des allergies alimentaires. L'automatisation croissante des services de test des allergènes et des intolérances alimentaires parmi les fabricants pour vérifier rapidement les allergènes dans les aliments ainsi que dans le corps humain créera d'immenses opportunités pour les tests des allergènes et des intolérances alimentaires.

Contraintes/Défis

- INVESTISSEMENT INITIAL ÉLEVÉ POUR L'INSTALLATION D'ÉQUIPEMENT DE TEST ALIMENTAIRE

Les équipements et systèmes de test alimentaire contiennent divers dispositifs, capteurs et consommables qui les rendent assez coûteux pour les fabricants et les industriels du secteur alimentaire. Les petites entreprises en particulier ne peuvent pas se permettre le coût élevé des équipements de test alimentaire. Le coût élevé associé à l'installation initiale, aux services de test des allergènes et des intolérances, aux milieux de culture, aux consommables et autres peut entraver la croissance du marché. De plus, les outils de diagnostic nécessitent un entretien approprié sur une base régulière, ce qui augmente le coût global des outils de diagnostic tels que PCR, ELISA, biocapteur et autres. Les outils de diagnostic dotés d'une technologie de pointe et le coût des milieux sont également élevés, ce qui devrait freiner la croissance du marché. Tous les facteurs susmentionnés peuvent entraver la croissance du marché des tests de sécurité alimentaire. Le coût élevé associé aux équipements de test des allergènes et des intolérances alimentaires peut freiner la croissance du marché .

- MANQUE DE SENSIBILISATION AUX RÈGLES EN MATIÈRE D'ÉTIQUETAGE

L'incidence des allergies et des intolérances alimentaires a augmenté rapidement aux États-Unis au cours des 20 dernières années. La plupart des allergies alimentaires sont dues à la présence de différents types d'ingrédients dans les aliments, ce qui est dû au manque de sensibilisation aux réglementations en matière d'étiquetage qui peuvent entraver la croissance du marché américain des tests d'allergènes et d'intolérances alimentaires. Les aliments transformés sont généralement considérés comme inférieurs aux aliments non transformés. Ils peuvent recommander des aliments emballés contenant de nombreux ingrédients, tels que des colorants artificiels, des arômes ou même d'autres additifs chimiques. On pense que c'est un facteur contribuant à l'allergie et à l'intolérance alimentaire. Le manque de formation et de connaissances adéquates des employés sur la réglementation édictée par le gouvernement peut limiter la croissance du marché.

Ainsi, ces connaissances erronées dues au manque de sensibilisation sont à l'origine de dangers pour l'industrie alimentaire. Il est essentiel que chaque personne travaillant dans l'entreprise soit informée des règles et réglementations appropriées en matière de fabrication, d'étiquetage, d'emballage et de transport des aliments.

Développements récents

- En août 2022, selon le magazine Food Safety, l'industrie agroalimentaire a connu une transformation numérique. Aux États-Unis, les entreprises utilisent les technologies numériques pour collecter davantage de données sur leurs processus de travail et pour garantir la sécurité et la qualité de la transformation, de l'emballage et de la distribution des aliments, qu'il s'agisse de grandes entreprises ou de marques plus petites et plus flexibles.

- En mai 2022, la Food Allergy and Anaphylaxis Connection Team (FAACT) a organisé une campagne nommée #OurTealWayOfLife pour sensibiliser aux allergies alimentaires aux États-Unis. Cette campagne vise à réduire les cas croissants d'allergies aux États-Unis en sensibilisant les gens à la sécurité des aliments.

États-Unis (analyse État par État) Portée du marché des tests d'allergènes et d'intolérances alimentaires

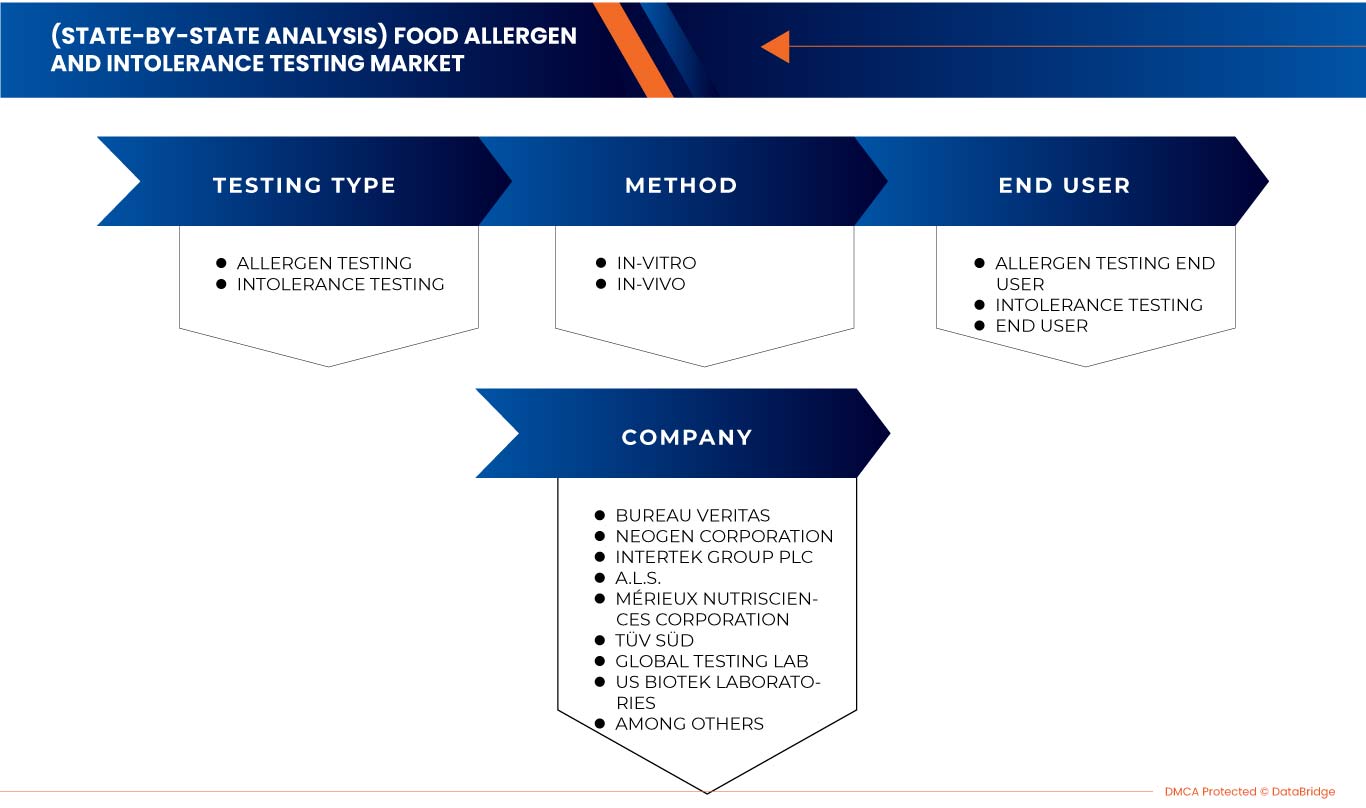

Le marché américain des tests d'allergies et d'intolérances alimentaires (analyse État par État) est segmenté en fonction du type de test, de la méthode et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de test

- Test d'allergènes

- Test d'intolérance

Sur la base du type de test, le marché américain des tests d'allergènes et d'intolérances alimentaires (analyse État par État) est segmenté en tests d'allergènes et tests d'intolérance.

Méthode

- In vitro

- In vivo

Sur la base de la méthode, le marché américain des tests d'allergènes et d'intolérances alimentaires (analyse État par État) est segmenté en in vitro et in vivo.

Utilisateur final

- Test d'allergènes pour l'utilisateur final

- Test d'intolérance pour l'utilisateur final

Sur la base de l'utilisateur final, le marché américain des tests d'allergènes et d'intolérances alimentaires (analyse État par État) est segmenté en utilisateur final de tests d'allergènes et utilisateur final de tests d'intolérances.

Analyse du paysage concurrentiel et des parts de marché des tests d'allergènes et d'intolérances alimentaires aux États-Unis (analyse État par État)

Le paysage concurrentiel du marché américain des tests d'allergènes et d'intolérances alimentaires (analyse État par État) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché américain des tests d'allergènes et d'intolérances alimentaires (analyse État par État).

Certains des principaux acteurs du marché opérant sur le marché sont Bureau Veritas, NEOGEN Corporation, Intertek Group plc, ALS, Mérieux NutriSciences Corporation TÜV SÜD, Global Testing Lab, .GSSGS Société Générale de Surveillance SA, YorkTest, US BioTek Laboratories, LLC ALLETESS MEDICAL LABORATORY, Microbac Laboratories, Inc., Healthy Stuff Online Ltd, PCAS Labs, Eurofins .SAUSA sont entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING PRODUCT LIFE LINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.1.1 CUSTOMER BARGAINING POWER:

4.1.2 SUPPLIER BARGAINING POWER:

4.1.3 THE THREAT OF NEW ENTRANTS

4.1.4 THE THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION (RIVALRY)

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVE IN U.S. (STATE-BY-STATE) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

4.4 LIST OF MAIN COMPETETORS

4.5 PRICING ANALYSIS

4.6 SUMMARY OF EVALUATION OF THE MARKET

4.7 OVERVIEW OF TECHNOLOGICAL ADVANCEMENTS

4.8 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK

5.1 GLOBAL FOOD SAFETY INITIATIVE

5.2 INTERNATIONAL BODY FOR FOOD SAFETY STANDARDS AND REGULATIONS

5.3 FEDERAL LEGISLATION

5.4 FOOD AND DRUG ADMINISTRATION (FDA)

5.5 FOOD SAFETY ON TRACEABILITY SYSTEMS AND FOOD DIAGNOSTICS

5.6 TOXIC SUBSTANCES CONTROL ACT OF 1976

5.7 REGULATORY IMPOSITIONS ON GM LABELING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING NUMBER OF FOOD ALLERGIES CASES

6.1.2 GROWING AWARENESS AMONG CONSUMERS REGARDING FOOD TOLERANCE AND FOOD ALLERGENS

6.1.3 STRINGENT SAFETY RULES AND REGULATIONS FOR FOOD

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INVESTMENT FOR INSTALLATION OF FOOD TESTING EQUIPMENT

6.2.2 LACK OF AWARENESS ABOUT LABELLING REGULATIONS

6.3 OPPORTUNITIES

6.3.1 RISING USE OF AUTOMATION IN THE FOOD TOLERANCE AND FOOD TESTING INDUSTRY

6.3.2 INCREASING GOVERNMENT INITIATIVES TO PROTECT CONSUMERS FROM FOOD ALLERGENS

6.3.3 GROWING DEMAND FOR ALLERGEN-FREE FOOD

6.4 CHALLENGES

6.4.1 INCREASING NUMBER OF FALSE TESTING RESULT CASES

6.4.2 HIGH COSTS ASSOCIATED WITH FOOD SAFETY TESTING PRODUCTS

7 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TESTING TYPE

7.1 OVERVIEW

7.2 ALLERGEN TESTING

7.2.1 ALLERGEN TESTING, BY TESTING TYPE

7.2.1.1 ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

7.2.1.2 POLYMERASE CHAIN REACTION (PCR)

7.2.1.3 CHROMATOGRAPHY & SPECTROSCOPY

7.2.1.3.1 LIQUID CHROMATOGRAPHY

7.2.1.3.2 GAS CHROMATOGRAPHY

7.2.1.3.3 COLUMN CHROMATOGRAPHY

7.2.1.3.4 THIN LAYER CHROMATOGRAPHY

7.2.1.3.5 PAPER CHROMATOGRAPHY

7.2.1.4 BIOCHIP/BIOSENSOR

7.2.1.5 CULTURE-BASED

7.2.1.6 MICROARRAYS

7.2.1.7 RAPID ASSAY

7.2.1.8 FLOW CYTOMETRY

7.2.2 ALLERGEN TESTING, BY ALLERGEN TYPE

7.2.2.1 TREE NUTS

7.2.2.1.1 ALMOND

7.2.2.1.2 WALNUTS

7.2.2.1.3 CASHEW

7.2.2.1.4 PISTACHIOS

7.2.2.1.5 HAZELNUT

7.2.2.1.6 PECAN

7.2.2.1.7 MACADAMIA NUTS

7.2.2.1.8 BRAZIL NUTS

7.2.2.1.9 OTHERS

7.2.2.2 GLUTEN

7.2.2.3 DAIRY

7.2.2.4 SOY

7.2.2.5 EGG

7.2.2.6 PEANUT

7.2.2.7 FISH

7.2.2.8 MUSTARD

7.2.2.9 CRUSTACEANS

7.2.2.9.1 CRABS

7.2.2.9.2 LOBSTERS

7.2.2.9.3 PRAWNS

7.2.2.9.4 OTHERS

7.2.2.10 SESAME

7.2.2.11 MOLLUSCS

7.2.2.11.1 CLAMS

7.2.2.11.2 MUSSELS

7.2.2.11.3 SCALLOP

7.2.2.11.4 OYSTERS

7.2.2.12 SULPHUR DIOXIDE AND SULPHITES

7.2.2.13 CELERY

7.2.2.14 LUPIN

7.2.2.15 OTHERS

7.3 INTOLERANCE TESTING

7.3.1 INTOLERANCE TESTING, BY TYPE

7.3.1.1 CONVENTIONAL TESTS

7.3.1.1.1 CONVENTIONAL TESTS, BY TYPE

7.3.1.1.1.1 SKIN TESTS

7.3.1.1.1.2 SKIN TESTS, BY TYPE

7.3.1.1.1.3 SCRATCH TEST

7.3.1.1.1.4 INTRADERMAL TEST

7.3.1.1.1.5 PATCH TEST

7.3.1.1.1.6 BLOOD TESTS

7.3.1.1.1.7 BLOOD TESTS, BY TYPE

7.3.1.1.1.8 ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

7.3.1.1.1.9 RADIOALLERGOSORBENT TEST (RAST)

7.3.1.2 ALTERNATIVE ALLERGY TESTS

7.3.1.2.1 ALTERNATIVE ALLERGY TESTS, BY TYPE

7.3.1.2.1.1 INVASIVE TESTS

7.3.1.2.1.2 INVASIVE TESTS, BY TYPE

7.3.1.2.1.3 IGG BLOOD TEST

7.3.1.2.1.4 ELECTRO-DERMAL TEST

7.3.1.2.1.5 MICRO-ARRAY TEST

7.3.1.2.1.6 CYTOTOXIC TEST

7.3.1.2.1.7 NON-INVASIVE TESTS

7.3.1.2.1.8 NON-INVASIVE TESTS,BY TYPE

7.3.1.2.1.9 KINESIOLOGY TEST

7.3.1.2.1.10 HAIR ANALYSIS

7.3.1.2.1.11 PULSE TEST

8 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY METHOD

8.1 OVERVIEW

8.2 IN-VITRO

8.3 IN-VIVO

9 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY END USER

9.1 OVERVIEW

9.2 ALLERGEN TESTING END USER

9.2.1 ALLERGEN TESTING END USER, BY TYPE

9.2.1.1 FOOD PROCESSOR /MANUFACTURERS

9.2.1.1.1 FOOD PROCESSOR /MANUFACTURERS, BY TYPE

9.2.1.1.1.1 SPICES

9.2.1.1.1.2 DAIRY PRODUCTS

9.2.1.1.1.2.1 DAIRY PRODUCTS,BY TYPE

9.2.1.1.1.2.1.1 CHEESE BASED PRODUCTS

9.2.1.1.1.2.1.1.1 CHEESE

9.2.1.1.1.2.1.1.2 CHEESE CAKE

9.2.1.1.1.2.1.1.3 CHEESE CREAM

9.2.1.1.1.2.1.1.4 CHEESE BASED DESSERTS

9.2.1.1.1.2.1.1.5 CHEESE PUDDING

9.2.1.1.1.2.1.1.6 OTHERS

9.2.1.1.1.2.1.2 ICE CREAM

9.2.1.1.1.2.1.3 YOGURT

9.2.1.1.1.2.1.4 MILK DESSERT

9.2.1.1.1.2.1.5 PUDDING

9.2.1.1.1.2.1.6 CUSTARD

9.2.1.1.1.2.1.7 OTHERS

9.2.1.1.1.3 EDIBLE OILS

9.2.1.1.1.4 CONFECTIONERY

9.2.1.1.1.4.1 CONFECTIONERY, BY TYPE

9.2.1.1.1.4.1.1 CANDY BARS

9.2.1.1.1.4.1.2 JAMS AND JELLIES

9.2.1.1.1.4.1.3 JELLY CANDIES

9.2.1.1.1.4.1.4 MARMALADES

9.2.1.1.1.4.1.5 FRUIT JELLY DESSERT

9.2.1.1.1.4.1.6 MERINGUES

9.2.1.1.1.4.1.7 OTHERS

9.2.1.1.1.5 PROCESSED FOOD

9.2.1.1.1.5.1 PROCESSED FOOD,BY TYPE

9.2.1.1.1.5.1.1 CANNED FRUITS & VEGETABLES

9.2.1.1.1.5.1.2 JAMS, PRESERVES & MARMALADES

9.2.1.1.1.5.1.3 FRUIT & VEGETABLE PUREE

9.2.1.1.1.5.1.4 SAUCES, DRESSINGS AND CONDIMENTS

9.2.1.1.1.5.1.5 READY MEALS

9.2.1.1.1.5.1.6 PICKLES

9.2.1.1.1.5.1.7 SOUPS

9.2.1.1.1.6 MEAT & POULTRY PRODUCTS

9.2.1.1.1.7 TOBACCO

9.2.1.1.1.8 HONEY

9.2.1.1.1.9 BABY FOOD

9.2.1.1.1.10 PLANT-BASED MEAT AND MEAT ALTERNATIVES

9.2.1.1.1.10.1 PLANT-BASED MEAT AND MEAT ALTERNATIVES, BY TYPE

9.2.1.1.1.10.1.1 BURGER & PATTIES

9.2.1.1.1.10.1.2 SAUSAGES

9.2.1.1.1.10.1.3 STRIPS & NUGGETS

9.2.1.1.1.10.1.4 MEATBALLS

9.2.1.1.1.10.1.5 TEMPEH

9.2.1.1.1.10.1.6 TOFU

9.2.1.1.1.10.1.7 SEITEN

9.2.1.1.1.10.1.8 OTHERS

9.2.1.1.1.11 HERBAL EXTRACTS AND HERBS

9.2.1.1.2 FOOD PROCESSOR /MANUFACTURERS, BY TESTING TYPE

9.2.1.1.2.1 ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

9.2.1.1.2.2 POLYMERASE CHAIN REACTION (PCR)

9.2.1.1.2.3 CHROMATOGRAPHY & SPECTROSCOPY

9.2.1.1.2.4 BIOCHIP/BIOSENSOR

9.2.1.1.2.5 CULTURE-BASED

9.2.1.1.2.6 MICROARRAYS

9.2.1.1.2.7 RAPID ASSAY

9.2.1.1.2.8 FLOW CYTOMETRY

9.2.1.2 BEVERAGES PROCESSORS/MANUFACTURERS

9.2.1.2.1 BEVERAGES PROCESSOR /MANUFACTURERS, BY TYPE

9.2.1.2.1.1 NON-ALCOHOLIC

9.2.1.2.1.1.1 CARBONATED DRINKS

9.2.1.2.1.1.2 MINERAL WATER

9.2.1.2.1.1.3 COFFEE

9.2.1.2.1.1.4 JUICES

9.2.1.2.1.1.5 SMOOTHIES

9.2.1.2.1.1.6 TEA

9.2.1.2.1.1.7 PLANT-BASED MILK

9.2.1.2.1.1.7.1 SOY MILK

9.2.1.2.1.1.7.2 ALMOND MILK

9.2.1.2.1.1.7.3 OAT MILK

9.2.1.2.1.1.7.4 CASHEW MILK

9.2.1.2.1.1.7.5 RICE MILK

9.2.1.2.1.1.7.6 OTHERS

9.2.1.2.1.1.8 SPORTS DRINKS

9.2.1.2.1.1.9 NUTRITIONAL DRINKS

9.2.1.2.1.1.10 OTHERS

9.2.1.2.1.2 ALCOHOLIC

9.2.1.2.1.2.1 BEER

9.2.1.2.1.2.2 WINE

9.2.1.2.1.2.3 WHISKEY

9.2.1.2.1.2.4 VODKA

9.2.1.2.1.2.5 TEQUILA

9.2.1.2.1.2.6 GIN

9.2.1.2.1.2.7 BRANDY

9.2.1.2.1.2.8 OTHERS

9.2.1.2.2 BEVERAGES PROCESSOR /MANUFACTURERS, BY TESTING TYPE

9.2.1.2.2.1 ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

9.2.1.2.2.2 POLYMERASE CHAIN REACTION (PCR)

9.2.1.2.2.3 CHROMATOGRAPHY & SPECTROSCOPY

9.2.1.2.2.4 BIOCHIP/BIOSENSOR

9.2.1.2.2.5 CULTURE-BASED

9.2.1.2.2.6 MICROARRAYS

9.2.1.2.2.7 RAPID ASSAY

9.2.1.2.2.8 FLOW CYTOMETRY

9.2.2 FARMER/COOPERATIVES

9.2.2.1 FARMER/COOPERATIVES, BY TESTING TYPE

9.2.2.1.1 ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

9.2.2.1.2 POLYMERASE CHAIN REACTION (PCR)

9.2.2.1.3 CHROMATOGRAPHY & SPECTROSCOPY

9.2.2.1.4 BIOCHIP/BIOSENSOR

9.2.2.1.5 CULTURE-BASED

9.2.2.1.6 MICROARRAYS

9.2.2.1.7 RAPID ASSAY

9.2.2.1.8 FLOW CYTOMETRY

9.3 INTOLERANCE TESTING END USER

9.3.1 HOSPITALS

9.3.1.1 HOSPITALS, BY TYPE

9.3.1.1.1 CONVENTIONAL TESTS

9.3.1.1.1.1 CONVENTIONAL TESTS, BY TYPE

9.3.1.1.1.2 SKIN TESTS

9.3.1.1.1.3 BLOOD TESTS

9.3.1.1.2 ALTERNATIVE ALLERGY TESTS

9.3.1.1.2.1 ALTERNATIVE ALLERGY TESTS,BY TYPE

9.3.1.1.2.2 INVASIVE TESTS

9.3.1.1.2.3 NON-INVASIVE TESTS

9.3.2 CLINICS

9.3.2.1 CLINICS, BY TYPE

9.3.2.1.1 CONVENTIONAL TESTS

9.3.2.1.1.1 CONVENTIONAL TESTS, BY TYPE

9.3.2.1.1.2 SKIN TESTS

9.3.2.1.1.3 BLOOD TESTS

9.3.2.1.2 ALTERNATIVE ALLERGY TESTS

9.3.2.1.2.1 ALTERNATIVE ALLERGY TESTS, BY TYPE

9.3.2.1.2.2 INVASIVE TESTS

9.3.2.1.2.3 NON-INVASIVE TESTS

9.3.3 ALLERGEN TESTING LABS

9.3.3.1 ALLERGEN TESTING LABS, BY TYPE

9.3.3.1.1 CONVENTIONAL TESTS

9.3.3.1.1.1 CONVENTIONAL TESTS, BY TYPE

9.3.3.1.1.2 SKIN TESTS

9.3.3.1.1.3 BLOOD TESTS

9.3.3.1.2 ALTERNATIVE ALLERGY TESTS

9.3.3.1.2.1 ALTERNATIVE ALLERGY TESTS, BY TYPE

9.3.3.1.2.2 INVASIVE TESTS

9.3.3.1.2.3 NON-INVASIVE TESTS

9.3.4 OTHERS

9.3.4.1 OTHERS, BY TYPE

9.3.4.1.1 CONVENTIONAL TESTS

9.3.4.1.1.1 CONVENTIONAL TESTS , BY TYPE

9.3.4.1.1.2 SKIN TESTS

9.3.4.1.1.3 BLOOD TESTS

9.3.4.1.2 ALTERNATIVE ALLERGY TESTS

9.3.4.1.2.1 ALTERNATIVE ALLERGY TESTS , BY TYPE

9.3.4.1.2.2 INVASIVE TESTS

9.3.4.1.2.3 NON-INVASIVE TESTS

10 REGIONAL SUMMARY, U.S.

11 COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: U.S.

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 BUREAU VERITAS

13.1.1 COMPANY SNAPSHOT

13.1.2 RECENT FINANCIALS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 NEOGEN CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 RECENT FINANCIALS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 INTERTEK GROUP PLC

13.3.1 COMPANY SNAPSHOT

13.3.2 RECENT FINANCIALS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 ALS

13.4.1 COMPANY SNAPSHOT

13.4.2 RECENT FINANCIALS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 MÉRIEUX NUTRISCIENCES CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 ALLETESS MEDICAL LABORATORY

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 EUROFINS USA

13.7.1 COMPANY SNAPSHOT

13.7.2 RECENT FINANCIALS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 GLOBAL TESTING LAB

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 HEALTHY STUFF ONLINE LTD

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 MICROBAC LABORATORIES, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 PCAS LABS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

13.12.1 COMPANY SNAPSHOT

13.12.2 RECENT FINANCIALS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 TUV SUD

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 US BIOTEK LABORATORIES, LLC

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 YORK TEST

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 FEW OF THE KEY COMPETITORS ARE LISTED BELOW.

TABLE 2 PRICES OF A FEW MORE MANUFACTURES ARE LISTED BELOW.

TABLE 3 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TESTING TYPE 2021-2030 (USD MILLION)

TABLE 4 U.S. (STATE-BY-STATE ANALYSIS) ALLERGEN TESTING IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY STATES, 2021-2030 (USD MILLION)

TABLE 5 U.S. (STATE-BY-STATE ANALYSIS ) ALLERGEN TESTING IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 6 U.S. (STATE-BY-STATE ANALYSIS) CHROMATOGRAPHY & SPECTROSCOPY IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 U.S. (STATE-BY-STATE ANALYSIS) ALLERGEN TESTING IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY ALLERGEN TYPE, 2021-2030 (USD MILLION)

TABLE 8 U.S. (STATE-BY-STATE ANALYSIS) TREE NUTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 U.S. (STATE-BY-STATE ANALYSIS) CRUSTACEANS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 U.S. (STATE-BY-STATE ANALYSIS) MOLLUSCS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 U.S. (STATE-BY-STATE ANALYSIS) ALLERGENS TESTING IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY STATES, 2021-2030 (USD MILLION)

TABLE 12 U.S. (STATE-BY-STATE ANALYSIS)INTOLERANCE TESTING IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 U.S. (STATE-BY-STATE ANALYSIS) CONVENTIONAL TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 U.S. (STATE-BY-STATE ANALYSIS) SKIN TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.S. (STATE-BY-STATE ANALYSIS) BLOOD TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 U.S. (STATE-BY-STATE ANALYSIS) ALTERNATIVE ALLERGY TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 U.S. (STATE-BY-STATE ANALYSIS) INVASIVE TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. (STATE-BY-STATE ANALYSIS) NON-INVASIVE TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 20 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 21 U.S. (STATE-BY-STATE ANALYSIS) ALLERGEN TESTING END USER IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.S. (STATE-BY-STATE ANALYSIS) FOOD PROCESSOR /MANUFACTURERS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 U.S. (STATE-BY-STATE ANALYSIS) DAIRY PRODUCTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 U.S. (STATE-BY-STATE ANALYSIS) CHEESE BASED PRODUCTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. (STATE-BY-STATE ANALYSIS) CONFECTIONERY IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.S. (STATE-BY-STATE ANALYSIS) PROCESSED FOOD IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 U.S. (STATE-BY-STATE ANALYSIS) PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 U.S. (STATE-BY-STATE ANALYSIS) FOOD PROCESSOR /MANUFACTURERS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 29 U.S. (STATE-BY-STATE ANALYSIS) BEVERAGES PROCESSOR /MANUFACTURERS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 U.S. (STATE-BY-STATE ANALYSIS) NON-ALCOHOLIC IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 U.S. (STATE-BY-STATE ANALYSIS) PLANT-BASED MILK IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. (STATE-BY-STATE ANALYSIS) ALCOHOLIC IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. (STATE-BY-STATE ANALYSIS) BEVERAGES PROCESSOR/MANUFACTURERS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.S. (STATE-BY-STATE ANALYSIS) FARMER/COOPERATIVES IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 35 U.S. (STATE-BY-STATE ANALYSIS) INTOLERANCE TESTING END USER IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

ON THE BASIS OF TYPE, HOSPITALS IS FURTHER SEGMENTED INTO CONVENTIONAL TESTS AND ALTERNATIVE ALLERGY TESTS. 111

TABLE 36 U.S. (STATE-BY-STATE ANALYSIS) HOSPITALS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. (STATE-BY-STATE ANALYSIS) CONVENTIONAL TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.S. (STATE-BY-STATE ANALYSIS) ALTERNATIVE ALLERGY TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. (STATE-BY-STATE ANALYSIS) CLINICS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. (STATE-BY-STATE ANALYSIS) CONVENTIONAL TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 U.S. (STATE-BY-STATE ANALYSIS) ALTERNATIVE ALLERGY TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.S. (STATE-BY-STATE ANALYSIS) ALLERGEN TESTING LABS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 U.S. (STATE-BY-STATE ANALYSIS) CONVENTIONAL TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. (STATE-BY-STATE ANALYSIS) ALTERNATIVE ALLERGY TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.S. (STATE-BY-STATE ANALYSIS) OTHERS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.S. (STATE-BY-STATE ANALYSIS) CONVENTIONAL TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.S. (STATE-BY-STATE ANALYSIS) ALTERNATIVE ALLERGY TESTS IN FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET

FIGURE 2 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET : DATA TRIANGULATION

FIGURE 3 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET : DROC ANALYSIS

FIGURE 4 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET : GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET : MULTIVARIATE MODELLING

FIGURE 7 PRODUCT LIFE LINE CURVE

FIGURE 8 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET : DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL CHELATING AGENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET : SEGMENTATION

FIGURE 12 THE INCREASING NUMBER OF FOOD ALLERGIES CASES IN THE U.S. IS EXPECTED TO DRIVE THE U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET IN THE FORECAST PERIOD

FIGURE 13 IN-VITRO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGEN AND INTOLERANCE TESTING MARKET IN 2023 & 2030

FIGURE 14 VALUE CHAIN ANALYSIS OF U.S. (STATE-BY-STATE-ANALYSIS) ALLERGEN AND INTOLERANCE TESTING MARKET

FIGURE 15 THE REQUIREMENTS AND PRINCIPLES OF THE REGULATION-

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 17 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2022

FIGURE 18 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY METHOD, 2022

FIGURE 19 U.S. (STATE-BY-STATE ANALYSIS) FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY END USER, 2022

FIGURE 20 GLOBAL TOMATOES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.