Us Business Travel Accident Insurance Market

Taille du marché en milliards USD

TCAC :

%

USD

3.27 Billion

USD

11.81 Billion

2024

2032

USD

3.27 Billion

USD

11.81 Billion

2024

2032

| 2025 –2032 | |

| USD 3.27 Billion | |

| USD 11.81 Billion | |

|

|

|

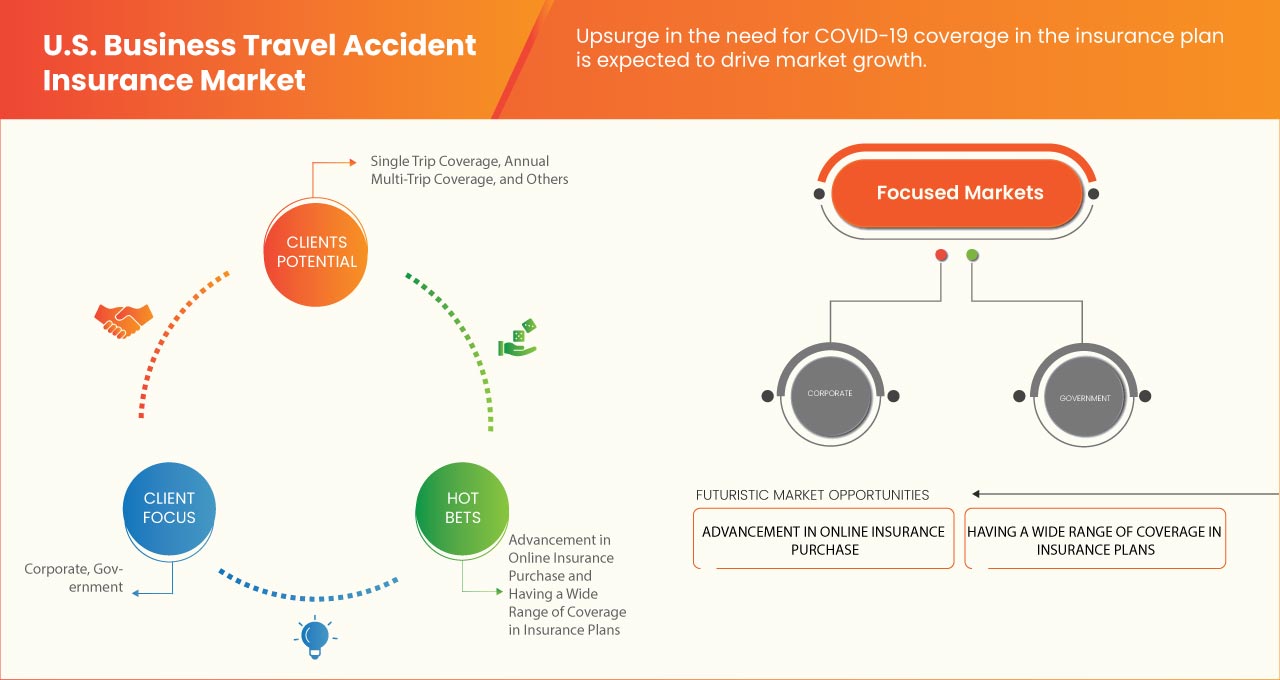

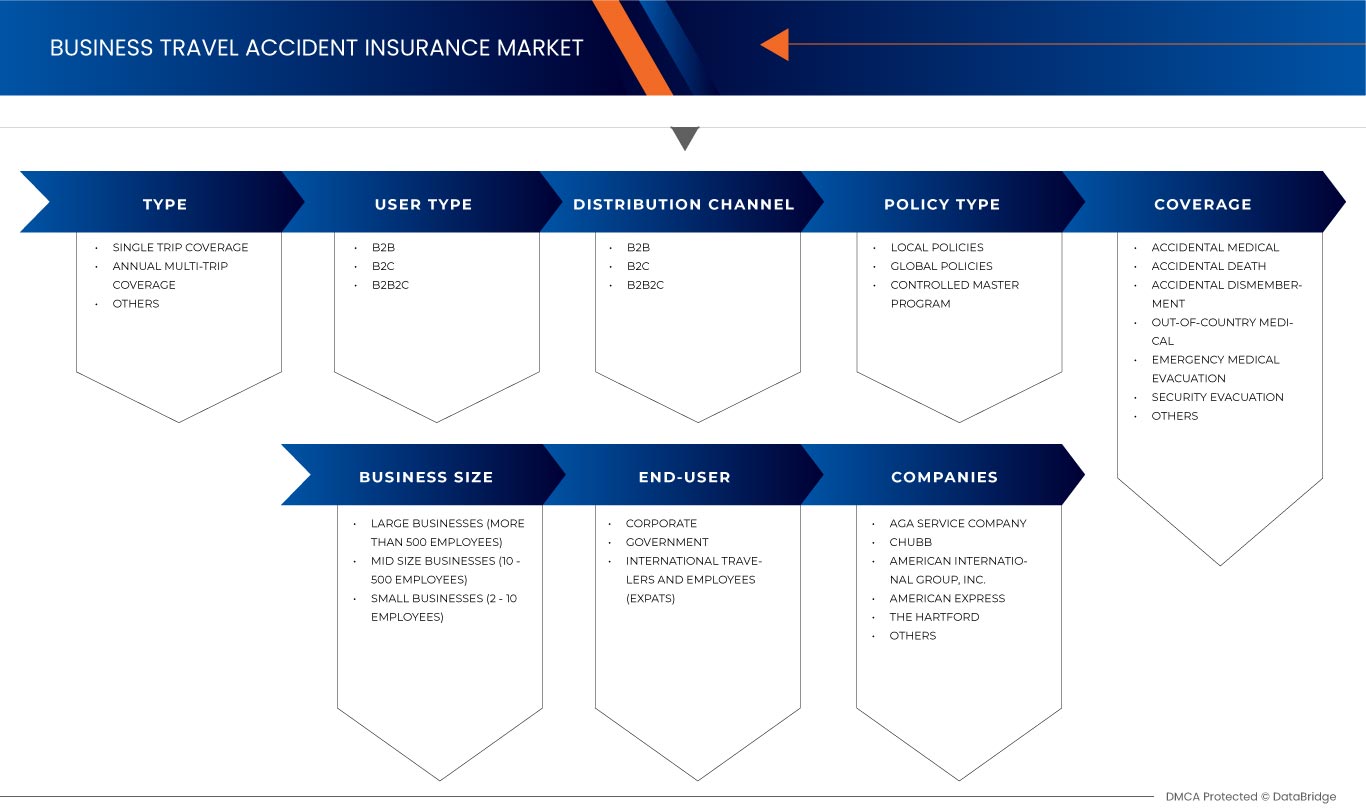

U.S. Business Travel Accident Insurance Market Segmentation, By Type (Single Trip Coverage, Annual Multi-Trip Coverage, and Others), User Type (B2B, B2C, and B2B2C), Distribution Channel (Insurance Brokers, Insurance Aggregators, Insurance Company, Bank, and Others), Coverage (Accidental Medical, Accidental Death, Accidental Dismemberment, Out-of-Country Medical, Emergency Medical Evacuation, Security Evacuation, and Others), Policy Type (Local Policies, Global Policies, and Controlled Master Program), Business Size (Large Businesses (More Than 500 Employees), Mid-Size Businesses (10 - 500 Employees), and Small Businesses (2 - 10 Employees)), End-User (Corporate, Government, International Travelers, and Employees (Expats)) – Industry Trends and Forecast to 2031

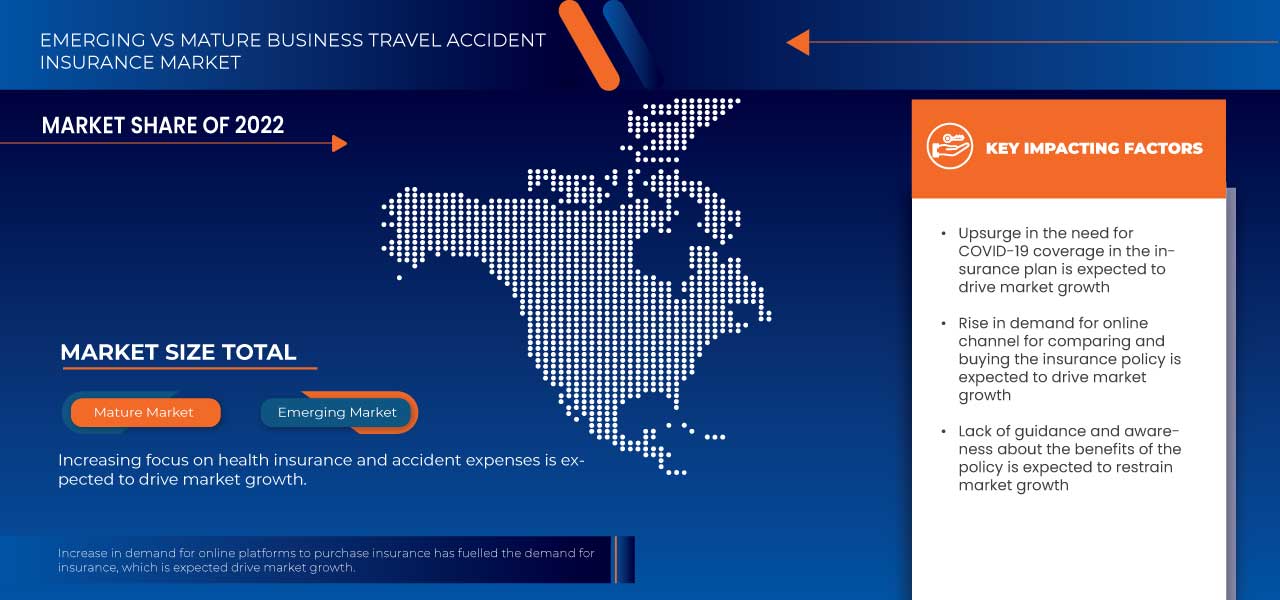

U.S. Business Travel Accident Insurance Market Analysis

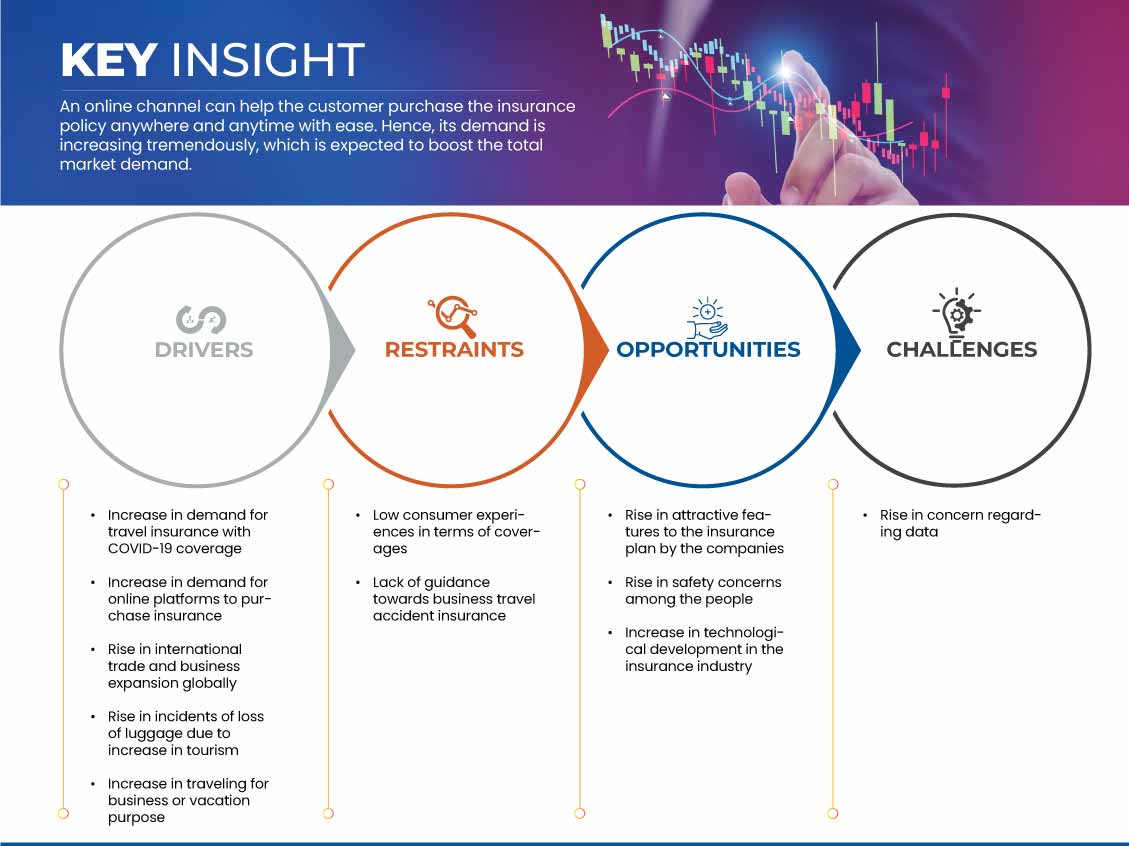

The U.S. business travel accident insurance market is driven by increase in demand for online platforms to purchase insurance also rise in international trade and business expansion globally enhance market growth, while low consumer experiences in terms of and rise in concern regarding data posses emerging challenges for future development.

U.S. Business Travel Accident Insurance Market Size

The U.S. business travel accident insurance market is expected to reach USD 10.07 billion by 2031 from USD 2.84 billion in 2023, growing with a substantial CAGR of 17.4 % in the forecast period of 2024 to 2031.

U.S. Business Travel Accident Insurance Market Trends

“Rise In International Trade and Business Expansion Globally”

Globalization has increased the integration of the world economy through the rise of international trade. Thus, both consumers and companies can now choose from a broader range of products and services. Also, many companies are expanding their geographical reach by investing in foreign companies and are setting up their branches in others countries. They have to travel from one place to another numerous times to expand their business and look into the flow of operations. Many insurance companies are coming up with different plans like multi-trip travel protection plans helping their clients for necessary coverage. Also, the companies are coming with a plan which can provide them complete travel safety.

Report Scope and Market Segmentation

|

Attributes |

U.S. Business Travel Accident Insurance Market Key Market Insights |

|

Segmentation |

|

|

Key Market Players |

Chubb (U.S.), AGA Service Company (Allianz Partners) (U.S.), American International Group, Inc. (AIG) (U.S.), AXA Partners USA S.A (U.S.), The Hartford (U.S.), American Express (U.S.), MetLife Services and Solutions, LLC (U.S.), Berkshire Hathaway Specialty Insurance (U.S.), Arch Capital Group Ltd. (Bermuda), Generali Global Assistance (U.S.), Jokio Marine HCC (U.S.), Travel Insured International (U.S.), International Medical Group, Inc. (A Subsidiary of SiriusPoint Ltd.) (U.S.), Berkley Accident and Health (U.S.), Travelex Insurance Services Inc. (U.S.), Visitors Coverage Inc (U.S.), Insubuy, LLC (U.S) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

U.S. Business Travel Accident Insurance Market Definition

Business travel accident insurance provides financial protection for employees who experience accidental injury, illness, or death while traveling for work. Typically covering costs like medical expenses, emergency evacuation, accidental death, or dismemberment, this insurance safeguards both employees and employers from unforeseen travel risks. Coverage may extend to transportation delays, repatriation, and specific expenses associated with accidents occurring during work-related travel, depending on the policy. Business Travel Accident Insurance helps organizations meet duty-of-care obligations, ensuring employees' well-being and peace of mind while on business trips, while also offering employers protection against financial liabilities linked to travel-related incidents.

U.S. Business Travel Accident Insurance Market Dynamics

Drivers

- Rise in Incident of Loss of Luggage Due to Increase in Tourism

The surge in U.S. tourism has led to a notable increase in the volume of travelers, resulting in a growing incidence of lost and mishandled luggage. This trend is significantly driving the demand for business travel accident insurance, as more corporations and individuals seek protection against the financial and logistical repercussions of lost personal and business-critical belongings. For business travelers who frequently transport valuable items, lost luggage can disrupt schedules, reduce productivity, and incur unexpected replacement costs. Consequently, organizations are increasingly investing in comprehensive business travel accident insurance to mitigate these potential losses, aiming to ensure seamless travel experiences for employees and enhance corporate responsibility.

The growing complexity of global travel logistics, driven by higher passenger volumes and expanded international routes, has heightened the probability of lost luggage incidents. Business travel accident insurance providers are responding with tailored solutions that cater to the specific needs of the corporate segment, including expedited claim processes, high-value coverage for essential business items, and dedicated customer service for rapid resolution. These enhancements not only provide peace of mind for business travelers but also enable companies to support their employees effectively in times of disruption, protecting against the financial and operational risks associated with lost luggage.

For instance,

- The World Tourism Organization (UNWTO) announced that 1.5 billion international tourist arrivals were recorded in 2019 globally. Also, according to UNWTO World Tourism Barometer, it was forecasted that there would be a 4% increase in tourism in 2020. In 2019, the Americas showed a mixed growth picture as many island destinations in the Caribbean consolidated their recovery after the 2017 hurricanes. UNWTO also said that even against a backdrop of global economic slowdown, tourism spending continued to grow. France reported the strongest increase by 11%, while U.S. tourism has increased by 6%

In summary, the rise in lost luggage incidents due to increased tourism is propelling growth in the U.S. business travel accident insurance market. As companies seek to protect employees and mitigate financial risks associated with travel disruptions, demand for comprehensive insurance solutions is surging. This trend underscores the importance of robust travel insurance as a vital component of corporate risk management, positioning the business travel accident insurance market for continued expansion.

- Increase in Traveling for Business or Vacation Purpose

The sustained growth in domestic and international travel, fueled by business expansion and a surge in vacation travel among professionals, significantly drives the U.S. business travel accident insurance market. With the U.S. economy favoring business travel as organizations strengthen client relations, explore new markets, and increase onsite management, the demand for comprehensive travel insurance is heightened to ensure workforce protection. As companies embrace a globalized operational model, employees are more frequently required to travel, exposing them to various risks, including accidents, medical emergencies, and transportation-related incidents. Thus, corporations are increasingly providing business travel accident insurance to mitigate these liabilities and safeguard employee welfare.

Similarly, there has been a marked rise in combining business with leisure travel, often referred to as "bleisure" trips, as employees take advantage of flexible work schedules and remote work arrangements to extend trips beyond core business purposes. The increase in bleisure travel underscores a growing need for insurance products that cover both business and personal travel risks, prompting insurers to develop flexible and inclusive policies. Furthermore, as travel destinations diversify and include higher-risk regions, travel insurance products are expanding in coverage options, including medical evacuation, accidental death, and dismemberment benefits tailored to the needs of frequent travelers. The heightened awareness of health risks, safety concerns, and unpredictable incidents has led corporations and individuals alike to view travel accident insurance as a necessity rather than an option.

For instance,

- Research done by TravelPerk S.L.U shows that before the outbreak of the coronavirus pandemic, business travel was valued at 1.28 trillion U.S. dollars in 2019. It was also seen that business travel was down by 90%, the corona was on a high peak, whereas pre-pandemic it was seen that some companies saw business travel activity return to about 80% of the levels when restrictions were eased in the summer. Pre-pandemic travel insurance consists of features like cancellation or change of flight, having access to fast security lanes, among others

In response, insurers are offering increasingly sophisticated policies, often packaged with comprehensive support services, to cater to the evolving needs of business travelers. This increase in business and vacation-related travel significantly propels the U.S. business travel accident insurance market, as companies prioritize risk management and employee safety amid expanding travel routines.

Opportunities

- Rise in Attractive Features to the Insurance Plan by the Companies

The introduction of enhanced and attractive features to business travel accident (BTA) insurance plans offers substantial opportunities for growth in the U.S. market. As companies across industries intensify their focus on employee safety, well-being, and comprehensive travel support, insurers are responding by expanding and tailoring their BTA plans to align with this evolving demand. With added benefits such as expanded medical coverage, emergency evacuation, global healthcare access, and even wellness support during travel, insurers can enhance the perceived value of BTA policies. This added value meets the growing expectations of corporations seeking to provide robust, competitive packages to retain and support employees in high-travel roles.

Enhancements in BTA plans can also serve as a differentiating factor for insurers aiming to establish or strengthen their presence in the U.S. market. The demand for more flexible and customizable insurance options has led to a higher number of small and medium-sized enterprises (SMEs) exploring BTA policies. By integrating customizable options and offering tiered coverage levels, insurers can cater to diverse corporate requirements and appeal to a broader client base. For instance, industry-specific coverage for technology, healthcare, and energy sectors can meet unique travel risks, creating a competitive edge and reinforcing client loyalty.

Furthermore, digitalization and tech-enabled service delivery are providing insurers with ways to streamline claims processes, enhance customer experience, and leverage data analytics to anticipate client needs. With the inclusion of mobile apps, 24/7 assistance, and real-time alerts for global risks, BTA insurance providers can now offer seamless, user-friendly support for traveling employees. This not only adds to customer satisfaction but positions insurers as progressive and adaptable to the modern business environment.

For instance,

- In July 2021, American Express announced that their U.S. Platinum and Business Platinum Card Members would have access to even more airport lounges and premium amenities when they travel. This member will be provided with world-class travel and lifestyle services and access exclusive travel programs, benefits, and offerings. With this, the company is baking their card member to start their return to travel

As corporate travel continues to recover, the innovation and enhancement in BTA insurance plans present clear avenues for market expansion, improved client retention, and higher revenue potential within the U.S.

- Rise in Safety Concerns Among the People

Les préoccupations croissantes des voyageurs américains en matière de sécurité représentent une opportunité considérable pour le marché américain de l’assurance accidents de voyage d’affaires (BTA). La sensibilisation croissante à la sécurité personnelle et à la santé lors des voyages d’affaires incite les entreprises à donner la priorité à une protection complète des employés en voyage. Cette évolution est motivée par plusieurs facteurs : l’instabilité politique mondiale accrue, l’exposition potentielle aux risques sanitaires et les préoccupations liées aux catastrophes naturelles. Les entreprises se concentrent sur leurs obligations de diligence pour garantir que les employés sont protégés contre les risques inattendus pendant leurs voyages, ce qui alimente la demande de polices BTA personnalisées et à couverture élevée.

Pour le marché de l’assurance BTA, ce paysage en évolution offre des opportunités d’innovation et d’élargissement des offres pour s’aligner sur l’importance croissante accordée à la sécurité. Les assureurs peuvent tirer parti de cette tendance en élaborant des politiques qui traitent de risques spécifiques, tels que les urgences médicales internationales, les actes de terrorisme et les interruptions de voyage. En outre, les progrès en matière d’analyse des données et de numérisation permettent aux assureurs d’offrir une évaluation des risques et une assistance en temps réel, ce qui renforce l’attrait de ces politiques pour les entreprises clientes qui privilégient des réponses rapides et complètes dans les situations de crise.

Un autre secteur de croissance important est l’augmentation des modèles de travail à distance et hybrides, qui nécessitent souvent des déplacements plus fréquents pour maintenir la cohésion des équipes et gérer des effectifs décentralisés. À mesure que les entreprises étendent leurs activités à des zones géographiques plus vastes, l’exposition de leurs employés aux risques liés aux voyages augmente également, ce qui entraîne le besoin de polices d’assurance BTA plus larges et plus flexibles. Les entreprises sont désormais plus enclines à proposer ces polices dans le cadre de leurs programmes d’avantages sociaux, positionnant l’assurance BTA comme un élément essentiel des programmes de voyages d’entreprise.

Par exemple,

- En juillet 2021, Generali Global Assistance a annoncé son partenariat avec FootprintID pour améliorer ses plans de protection de voyage Trip Mate. Ce partenariat permettra aux voyageurs bénéficiant des plans de protection Trip Mate d'avoir accès aux dossiers médicaux personnels portables de FootprintID, qui leur permettent d'emporter leurs informations médicales avec eux partout. Grâce à cela, l'entreprise sera en mesure d'élever le niveau de soins qu'elle offre à ses clients.

- Travelex Insurance Services s'est associé à Berkshire Hathaway Travel Protection (BHTP) de Berkshire Hathaway Specialty Insurance Company pour proposer des plans de protection de voyage innovants. Grâce à ce partenariat, les sociétés ont l'intention d'apporter un niveau élevé de service, d'innovation de produit et d'expertise et de rapidité de traitement des réclamations aux professionnels du voyage et à leurs clients. Ainsi, la société sera en mesure de fournir des plans de protection de voyage de qualité à ses clients

En conclusion, l’attention croissante portée à la sécurité des voyageurs, associée à l’augmentation des déplacements liés au travail à distance, constitue un environnement propice à l’expansion du marché américain de l’assurance contre les accidents de voyage d’affaires. En répondant à ces préoccupations avec des solutions sur mesure et réactives, les assureurs peuvent répondre aux demandes du marché et capter une part croissante de clients d’entreprise soucieux de protéger leur personnel.

Contraintes/Défis

- Inquiétude croissante concernant les données

Le marché américain de l’assurance accidents de voyage d’affaires est confronté à des défis majeurs découlant des préoccupations croissantes en matière de confidentialité et de sécurité des données. À mesure que les entreprises étendent leur présence mondiale, elles s’appuient fortement sur des informations basées sur les données pour améliorer la sécurité des voyages et les stratégies de gestion des risques. Cependant, la fréquence croissante des violations de données et la sensibilisation croissante du public aux réglementations sur la protection des données, telles que le Règlement général sur la protection des données (RGPD) et le California Consumer Privacy Act (CCPA), créent un environnement complexe pour les assureurs.

Cette préoccupation accrue concernant la sécurité des données pose plusieurs défis au secteur de l’assurance accidents de voyage d’affaires. Tout d’abord, les assureurs sont désormais tenus non seulement de fournir une couverture complète, mais également de veiller à ce que des mesures solides de protection des données soient en place. Le non-respect de ces mesures peut entraîner des dommages à la réputation et des répercussions financières en raison du non-respect des cadres juridiques en constante évolution. En outre, les entreprises examinent de plus en plus attentivement leurs partenaires d’assurance pour savoir quelles pratiques de traitement des données ils utilisent. Les assureurs qui ne peuvent pas démontrer de solides protocoles de gouvernance et de sécurité des données risquent de perdre des clients au profit de concurrents qui accordent la priorité à ces aspects. En conséquence, les assureurs doivent investir dans des technologies de pointe et des formations pour améliorer leurs capacités de protection des données, ce qui peut mettre à rude épreuve leurs ressources et affecter leur rentabilité.

En outre, les préoccupations croissantes concernant la confidentialité des données peuvent conduire à des critères de souscription plus stricts, ce qui peut augmenter les coûts pour les entreprises qui cherchent à obtenir une couverture. Les assureurs peuvent avoir du mal à évaluer avec précision les risques lorsque les clients hésitent à partager des données critiques. Ce décalage peut entraîner des lacunes dans la couverture et des primes plus élevées, ce qui complique encore davantage la relation entre les entreprises et leurs assureurs.

Par exemple,

- La loi californienne sur la protection de la vie privée des consommateurs (CCPA) est entrée en vigueur en janvier 2020. Elle oblige les entreprises à améliorer la transparence concernant les pratiques de collecte et d’utilisation des données. Les entreprises du secteur des voyages d’affaires doivent se conformer à cette réglementation, sous peine de sanctions, qui affectent la manière dont les assureurs évaluent les risques et fixent les primes. Une entreprise peut choisir de ne pas partager certaines données avec les assureurs, ce qui complique le processus de souscription et peut entraîner une augmentation des coûts ou des lacunes dans la couverture.

- Selon un article publié sur le site Web de Vox Media, LLC, Marriott a révélé une violation de données affectant environ 500 millions de clients, exposant des informations personnelles telles que les noms, adresses, numéros de téléphone et numéros de passeport. Alors que les agences de voyage comme Marriott collectent de grandes quantités de données, des incidents comme ceux-ci suscitent des inquiétudes chez les assureurs quant à la sécurité des informations des voyageurs, il est donc essentiel pour les assureurs en cas d'accident de voyage de renforcer leurs protocoles de sécurité des données

En résumé, la préoccupation croissante concernant la confidentialité et la sécurité des données présente des défis multiformes pour le marché américain de l’assurance contre les accidents de voyage d’affaires, nécessitant une approche proactive de la gestion des données et de la conformité pour assurer une croissance durable dans un paysage de plus en plus concurrentiel.

- Faible expérience consommateur en termes de couverture

Aux États-Unis, le marché de l’assurance accidents de voyage d’affaires est caractérisé par une expérience client limitée en termes de couverture. De nombreux voyageurs d’affaires, en particulier ceux qui s’y intéressent pour la première fois, sont confrontés à des polices d’assurance qui semblent complexes ou insuffisantes pour répondre aux risques spécifiques et aux besoins divers des voyages d’affaires. Les limitations de couverture ne couvrent souvent pas des aspects essentiels, tels que l’assistance médicale complète, la perte d’effets personnels, l’évacuation médicale d’urgence et les protections contre les interruptions de voyage. Ce manque d’exhaustivité des polices disponibles peut entraîner l’insatisfaction des consommateurs et les décourager d’acheter ces produits d’assurance.

L’un des principaux obstacles réside dans l’écart perçu entre les attentes des consommateurs et les garanties offertes par les polices d’assurance. Cet écart constitue un obstacle à l’adoption, car les clients potentiels peuvent hésiter à investir dans des polices d’assurance qu’ils jugent peu utiles ou pertinentes. Souvent, les polices d’assurance sont présentées avec des conditions standardisées et des options de personnalisation limitées, ce qui les rend moins attrayantes pour les entreprises ayant des besoins de voyage particuliers. Par conséquent, les entreprises qui cherchent à obtenir une couverture sur mesure pour les différents rôles de leurs employés ou pour les besoins de voyages internationaux peuvent se retrouver mal desservies, ce qui les pousse à explorer des options alternatives ou auto-assurées.

Par exemple,

- Une étude réalisée par Wonderflow montre que le secteur de l'assurance est aux prises avec un problème de réputation. Les clients se sentent éloignés de la compagnie d'assurance car ils sont souvent considérés comme égoïstes et opportunistes. En raison de l'opinion des clients, près de 44 % des clients n'ont eu aucune interaction avec leur assureur au cours des 18 derniers mois. De plus, environ 40 % des clients de l'assurance sont insatisfaits des services de l'entreprise

- L'étude ValuePenguin sur 50 polices d'assurance voyage montre que le coût moyen d'une assurance voyage aux États-Unis était de 148 USD. Mais toutes les polices d'assurance voyage ne sont pas identiques. Certaines sont beaucoup plus complètes que d'autres et, par conséquent, la fourchette de coûts entre elles peut être large. Ils ont également constaté que le coût d'une police d'assurance voyage complète était en moyenne 56 % plus élevé qu'une police d'assurance voyage de base. De plus, l'âge du preneur d'assurance a un impact sur le coût de la police ; plus l'âge est élevé, plus le coût de la police est élevé. Le coût de la police commence à partir de 82 USD jusqu'à 415 USD

En résumé, les mauvaises expériences des consommateurs en raison d’options de couverture restrictives et non transparentes freinent considérablement la croissance du marché américain de l’assurance contre les accidents de voyage d’affaires.

Impact et scénario actuel du marché en cas de pénurie de matières premières et de retards d'expédition

Data Bridge Market Research propose une analyse de haut niveau du marché et fournit des informations en tenant compte de l'impact et de l'environnement actuel du marché en matière de pénurie de matières premières et de retards d'expédition. Cela se traduit par l'évaluation des possibilités stratégiques, la création de plans d'action efficaces et l'assistance aux entreprises dans la prise de décisions importantes.

Outre le rapport standard, nous proposons également une analyse approfondie du niveau d'approvisionnement à partir des retards d'expédition prévus, de la cartographie des distributeurs par région, de l'analyse des produits de base, de l'analyse de la production, des tendances de la cartographie des prix, de l'approvisionnement, de l'analyse des performances des catégories, des solutions de gestion des risques de la chaîne d'approvisionnement, de l'analyse comparative avancée et d'autres services d'approvisionnement et de soutien stratégique.

Impact attendu du ralentissement économique sur les prix et la disponibilité des produits

Lorsque l'activité économique ralentit, les industries commencent à souffrir. Les effets prévus du ralentissement économique sur les prix et l'accessibilité des produits sont pris en compte dans les rapports d'analyse du marché et les services de renseignements fournis par DBMR. Grâce à cela, nos clients peuvent généralement garder une longueur d'avance sur leurs concurrents, projeter leurs ventes et leurs revenus et estimer leurs dépenses de profits et pertes.

Portée du marché de l'assurance contre les accidents de voyage d'affaires aux États-Unis

Le marché est segmenté en fonction du type, du type d'utilisateur, du canal de distribution, de la couverture, du type de police, de la taille de l'entreprise et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Couverture pour un seul voyage

- Couverture multi-voyages annuelle

- Autres

Type d'utilisateur

- B2B

- B2C

- B2B2C

Canal de distribution

- Courtiers d'assurance

- Agrégateurs d'assurance

- Compagnie d'assurance

- Banque

- Autres

Couverture

- Accident médical

- Couverture pour un seul voyage

- Couverture multi-voyages annuelle

- Autres

- Mort accidentelle

- Couverture pour un seul voyage

- Couverture multi-voyages annuelle

- Autres

- Démembrement accidentel

- Couverture pour un seul voyage

- Couverture multi-voyages annuelle

- Autres

- Soins médicaux à l'étranger

- Couverture pour un seul voyage

- Couverture multi-voyages annuelle

- Autres

- Évacuation médicale d'urgence

- Couverture pour un seul voyage

- Couverture multi-voyages annuelle

- Autres

- Évacuation de sécurité

- Couverture pour un seul voyage

- Couverture multi-voyages annuelle

- Autres

- Autres

- Couverture pour un seul voyage

- Couverture multi-voyages annuelle

Type de politique

- Politiques locales

- Politiques mondiales

- Programme de Master Contrôlé

Taille de l'entreprise

- Grandes entreprises (plus de 500 salariés)

- Accident médical

- Mort accidentelle

- Démembrement accidentel

- Soins médicaux à l'étranger

- Évacuation médicale d'urgence

- Évacuation de sécurité

- Autres

- Entreprises de taille moyenne (10 à 500 employés)

- Accident médical

- Mort accidentelle

- Démembrement accidentel

- Soins médicaux à l'étranger

- Évacuation médicale d'urgence

- Évacuation de sécurité

- Autres

- Petites entreprises (2 à 10 employés)

- Accident médical

- Mort accidentelle

- Démembrement accidentel

- Soins médicaux à l'étranger

- Évacuation médicale d'urgence

- Évacuation de sécurité

- Autres

Utilisateur final

- Entreprise

- Gouvernement

- Voyageurs et employés internationaux (expatriés)

Part de marché de l'assurance contre les accidents de voyage d'affaires aux États-Unis

Le paysage concurrentiel du marché fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Les leaders américains de l'assurance contre les accidents liés aux voyages d'affaires opérant sur le marché sont :

- Chubb (États-Unis)

- Société de services AGA (Allianz Partners) (États-Unis)

- American International Group, Inc. (AIG) (États-Unis)

- AXA Partners USA SA (États-Unis)

- The Hartford (États-Unis), American Express (États-Unis)

- MetLife Services et Solutions, LLC (États-Unis)

- Assurance spécialisée Berkshire Hathaway (États-Unis)

- Arch Capital Group Ltd. (Bermudes)

- Generali Global Assistance (États-Unis)

Dernières évolutions du marché de l'assurance contre les accidents de voyage aux États-Unis

- En juillet 2022, Chubb a finalisé l'acquisition des sociétés d'assurance vie et non-vie qui abritent les activités d'assurance accidents personnels, santé complémentaire et vie de Cigna sur plusieurs marchés asiatiques. Chubb a payé environ 5,4 milliards USD en espèces pour les opérations, qui comprennent les activités accidents et santé (A&H) et vie de Cigna en Corée, à Taiwan, en Nouvelle-Zélande, en Thaïlande, à Hong Kong et en Indonésie, collectivement appelées les activités de Cigna en Asie. Cette acquisition stratégique complémentaire étend notre présence et fait progresser notre opportunité de croissance à long terme en Asie. À compter du 1er juillet 2022, les résultats d'exploitation de cette entreprise acquise sont principalement présentés dans notre segment Assurance vie et, dans une moindre mesure, dans notre segment Assurance générale à l'étranger

- En juillet 2023, American International Group, Inc. (NYSE : AIG) a annoncé la clôture réussie de son accord définitif avec des fonds gérés par Stone Point Capital LLC (Stone Point) pour former une agence générale de gestion (MGA) indépendante spécialisée dans les marchés des personnes fortunées et ultra fortunées appelée Private Client Select Insurance Services (PCS)

- In July 2021, AXA Partners USA S.A announced that they signed an agreement with Club Med to offer an insurance policy designed to cover the unforeseen events that travellers may encounter before, during, or after their trip, including COVID-19. The Serenity Protection Plan insurance policy includes coverage for contamination by COVID, whereby the insurance policy can reimburse the stay and transportation. Also, the policy will provide coverage for events such as a “missed flight,” baggage insurance, and compensation in case of interruption of their stay. Thus, the company will provide its customer with a policy that will allow them to enjoy their vacations while feeling secure and at ease

- In May 2021, The Hartford announced participating in the 2021 Virtual Wells Fargo Financial Services Investor Conference. The company’s Chairman and CEO Christopher Swift, and Chief Financial Officer, Beth Costello will participate in a fireside chat and speak on financial services. This will help the company to be recognized on the global platform and improve its brand image

- In July 2021, American Express Company announced that its U.S. Platinum and Business Platinum Card Members would have access to even more airport lounges and premium amenities when they travel. This member will be provided with world-class travel and lifestyle services and access to exclusive travel programs, benefits, and offerings. With this, the company is baking its cardmember to start their return to travel

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.