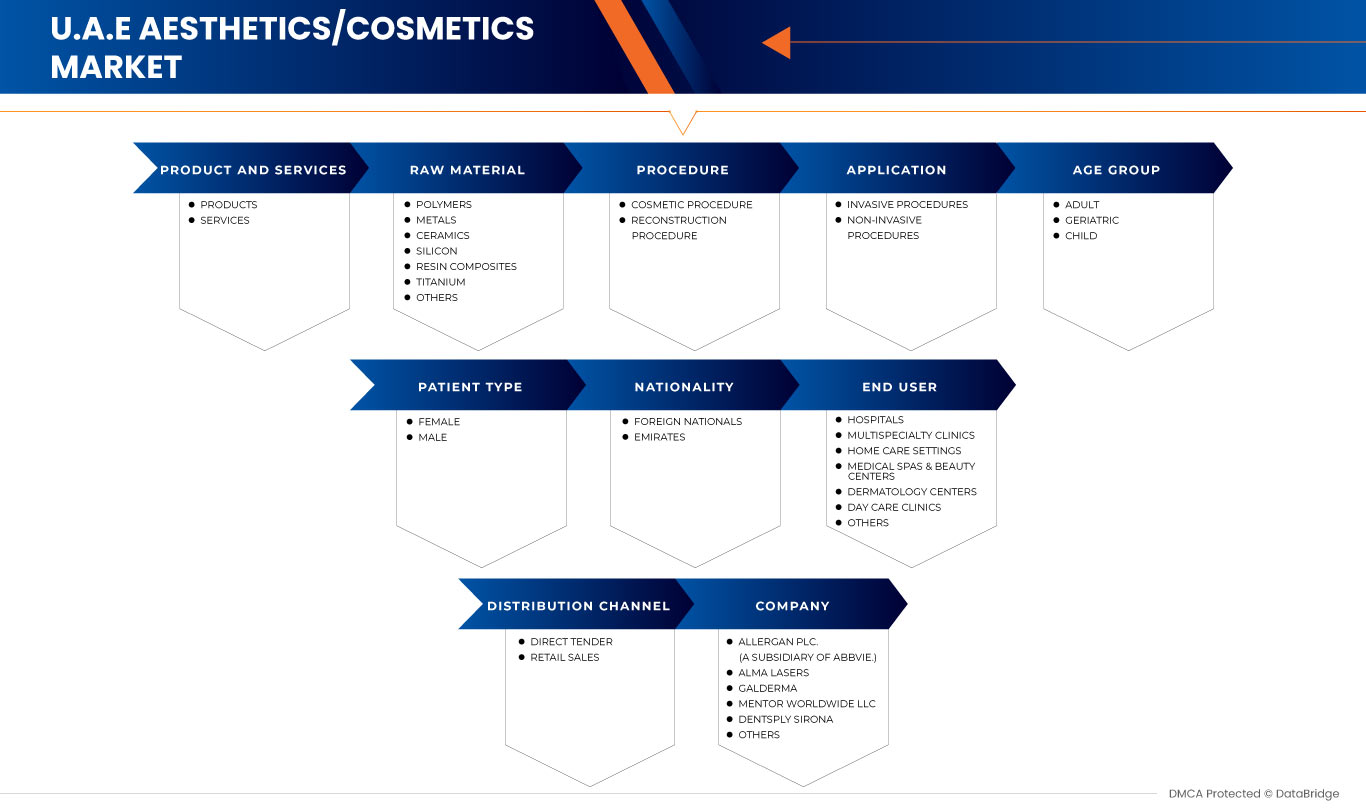

U.A.E Aesthetics/Cosmetics Market, By Product and Services (Products and Services), Raw Material (Polymers, Metals, Ceramics, Resin Composites, Silicon, Titanium, and Others), Procedure (Cosmetic Procedure and Reconstruction Procedure), Application (Invasive Procedures and Non-Invasive Procedures), Age Group (Child, Adult, and Geriatric), Patient Type (Male and Female), Nationality (Foreign Nationals and Emirates), End User (Hospitals, Multispeciality Clinics, Home Care Settings, Medical Spas & Beauty Centers, Dermatology Centers, Day Care Clinics, and Others), Distribution Channel (Direct Tender and Retail Sales) - Industry Trends and Forecast to 2030.

U.A.E Aesthetics/Cosmetics Market Analysis and Size

The use of minimally invasive procedures has been shifted compared to traditional methods for aesthetic and cosmetic surgeries, including laser and other energy-based devices. For the benefit of surgical or non-surgical procedures, specially designed instruments have been developed for minimally used procedures.

Minimally Invasive Surgery (MIS) is a procedure conducted with the scope of viewing and specially equipped surgical instruments. This is why minimally invasive procedures allow no cuts or minimal cuts with a lesser recovery time, increasing demand and use of minimally invasive procedures.

The reasons for the rising of procedures can be defined by the increasing number of aging people and the requirement for healthcare facilities, including patient-friendly techniques whose medical requirements are maximum, which can further result in a decreased burden on healthcare facilities.

The technological advancements in aesthetics and cosmetic procedures and strategic initiatives by market players are acting as an opportunity for market growth. However, the stringent regulatory framework for performing surgeries, post-surgery complications among the population, and the long approval time associated with product launches are key challenges to market growth.

Data Bridge Market Research analyzes that the U.A.E aesthetics/ cosmetics market is expected to reach a value of USD 427.51 million by 2030, at a CAGR of 8.3% during the forecast period. The type segment accounts for the largest segment in the U.A.E aesthetics/ cosmetics market.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Million Units, and Pricing in USD |

|

Segments Covered |

Par produit et services (produits et services), matière première (polymères, métaux, céramiques , composites de résine, silicium , titane et autres), procédure (procédure cosmétique et procédure de reconstruction), application (procédures invasives et procédures non invasives), groupe d'âge (enfant, adulte et gériatrique), type de patient (homme et femme), nationalité (ressortissants étrangers et émiratis), utilisateur final (hôpitaux, cliniques multispécialités, établissements de soins à domicile, spas médicaux et centres de beauté, centres de dermatologie, cliniques de jour et autres), canal de distribution (appel d'offres direct et ventes au détail) |

|

Pays couvert |

Émirats arabes unis |

|

Acteurs du marché couverts |

AESTHETICS INTERNATIONAL, Allergan PLC. (une filiale d'Abbvie.), Alma Lasers, Al Shunnar Plastic Surgery, Al Zahra Hospital Dubai, American British Surgical & Medical Centre, Bausch Health Companies Inc., BTL Group of Companies, Candela Corporation, Celia Aesthetic Clinic, CYNOSURE, Dentsply Sirona, GALDERMA, Institut Straumann AG, LaseTech Trading LLC., Maria Medical Technology, Mentor Worlwide LLC, Proderma-me, Silkor Laser & Aesthetic Center, The Private Clinic et ZIMMER GROUP entre autres |

Définition du marché

Le mot « plastique » vient du verbe grec « plastikos », qui signifie « mouler ou fabriquer ». Cette merveilleuse spécialité chirurgicale est sans aucun doute la plus imaginative de toutes les spécialités chirurgicales. La chirurgie esthétique et la chirurgie plastique esthétique font toutes deux référence à des opérations qui améliorent l'apparence du visage et du corps. Elles comprennent le lifting du visage, l'augmentation mammaire, la réduction mammaire, la chirurgie des paupières, la rhinoplastie, l'abdominoplastie et l'élimination de la graisse (liposuccion). Afin d'améliorer l'apparence et l'estime de soi du patient, la chirurgie plastique est pratiquée pour réorganiser les composants normaux du corps. La chirurgie reconstructive est la pratique consistant à opérer des structures corporelles défectueuses provoquées par des malformations congénitales, des défauts de développement, un traumatisme, une infection, des tumeurs ou une maladie. La chirurgie est généralement pratiquée pour améliorer la fonction, mais elle peut également être pratiquée pour ressembler davantage à une apparence normale.

Dynamique du marché de l'esthétique et des cosmétiques aux Émirats arabes unis

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Une prise de conscience croissante des procédures esthétiques

Les interventions esthétiques sont l'une des procédures médicales les plus fréquemment pratiquées. Ces interventions sont devenues de plus en plus populaires. Les médias sociaux sont un terme utilisé pour décrire les plateformes électroniques qui favorisent la diffusion d'informations auprès des utilisateurs cibles. Ces plateformes jouent un rôle essentiel dans la facilitation des interventions esthétiques. Historiquement, les chirurgiens utilisaient leurs comptes Web privés, mais aujourd'hui, les chirurgiens modernes utilisent progressivement Instagram, LinkedIn, Snapchat, Twitter et d'autres sites de réseaux sociaux. Ces deux outils ont été utilisés pour améliorer les contacts, la promotion et la sensibilisation des collègues et du grand public.

La nécessité de recourir à des traitements esthétiques est très forte afin de permettre aux patients et aux professionnels de la santé de rester en contact avec les nouvelles options thérapeutiques technologiquement avancées. Ainsi, la sensibilisation croissante aux chirurgies esthétiques devrait agir comme un moteur de croissance du marché.

- Croyances et tendances en matière de chirurgie esthétique chez les jeunes adultes

L'intérêt pour la chirurgie esthétique a été observé dans le monde arabe en général, et les Émirats arabes unis ne font pas exception. Le nombre de cliniques de chirurgie esthétique et de dermatologie a augmenté de façon constante avec ce qui semble être une population sûre. Ces cliniques ont attiré les deux sexes et des patients d'âges variés, et on a observé que les jeunes s'intéressaient davantage à ces procédures. Cela a été observé chez les adolescents qui viennent avec leurs parents. Ces facteurs ont conduit à un intérêt pour explorer les motivations de la population jeune à subir ces procédures et à découvrir si elles ont des facteurs communs dans leur profil. La présente étude vise à améliorer la sensibilisation aux perceptions culturelles de la beauté, aux points de vue personnels sur les procédures cosmétiques, aux expériences personnelles et à la perception de la société sur les procédures cosmétiques aux Émirats arabes unis.

De plus, en raison des tendances et de la prise de conscience de l’apparence, l’esthétique et la chirurgie esthétique pourraient également être une raison de l’attrait des jeunes adultes pour ces procédures.

Opportunités

- Influence croissante des médias sociaux

Les procédures esthétiques peuvent être influencées par divers facteurs, dont l’utilisation des réseaux sociaux. Les réseaux sociaux créent un standard de beauté irréaliste, ce qui amène certaines personnes à être gênées par leur apparence. Par conséquent, elles utilisent des filtres et Photoshop pour masquer leurs défauts. La plupart des utilisateurs de filtres photo de notre étude ont envisagé des procédures esthétiques s’ils n’en avaient pas déjà une. Ainsi, l’influence des réseaux sociaux devrait constituer une opportunité de croissance du marché.

Contraintes/Défis

- Complications postopératoires

Les procédures esthétiques continuent de gagner en popularité aux Émirats arabes unis et dans le monde entier. Cependant, ces procédures, même celles qui sont peu invasives, ne sont pas sans risques. Par conséquent, à mesure que le nombre de procédures a augmenté, les complications qui y sont associées ont également augmenté.

Les complications postopératoires liées aux procédures esthétiques et cosmétiques constituent la partie la plus préoccupante. Elles menacent la santé globale et la vie du patient, comme les complications impliquant des hématomes et des ecchymoses, la formation de sérome, des lésions nerveuses entraînant une perte sensorielle ou motrice, une infection, des cicatrices et des pertes de sang. Des complications liées à l'anesthésie peuvent également survenir lors de chirurgies esthétiques et cosmétiques . Des complications plus graves telles que la thrombose veineuse profonde (TVP) et l'embolie pulmonaire (EP) peuvent entraîner la mort. Ainsi, les complications postopératoires devraient constituer un défi à la croissance du marché.

- Cadre réglementaire rigoureux

Les dispositifs médicaux sont réglementés à l’échelle mondiale par la loi fédérale sur les médicaments et les dispositifs médicaux et l’ordonnance sur les dispositifs médicaux, qui comprennent la loi fédérale sur la recherche sur l’être humain et l’ordonnance sur les essais cliniques dans la recherche sur l’être humain afin de confirmer l’efficacité et la sécurité des dispositifs d’ablation.

De plus, les entreprises impliquées dans la fabrication d'appareils esthétiques doivent examiner attentivement les spécifications de leur produit avant de classer leur produit conformément à leurs lois sur les dispositifs médicaux dans le respect des normes et réglementations spécifiques de chaque pays.

Par conséquent, des réglementations strictes pour l’approbation de nouveaux appareils devraient constituer un défi à la croissance du marché.

Impact post-COVID-19 sur le marché de l'esthétique et des cosmétiques aux Émirats arabes unis

La pandémie de COVID-19 a eu un impact négatif considérable sur le marché. Au cours de cette phase, le nombre d’interventions chirurgicales non électives et non essentielles a considérablement diminué et les chirurgies esthétiques et cosmétiques n’ont pas été incluses dans la liste des interventions essentielles. Les pertes financières importantes subies au cours de cette phase de pandémie ont entraîné un déraillage de la croissance du marché.

Développements récents

- En janvier 2023, GALDERMA a annoncé le lancement de FACE by Galderma. FACE est une application de visualisation esthétique de pointe qui simule en temps réel les résultats des traitements injectables, grâce à une évaluation faciale numérique. Cette application fournit une détection avancée des rides ainsi que les résultats possibles de 19 traitements injectables.

- En janvier 2022, Mentor Worldwide LLC (une filiale de Johnson & Johnson Medical Devices Company) a annoncé que la FDA avait approuvé l'implant mammaire MENTOR MemoryGel BOOST pour l'augmentation et la reconstruction mammaires. Ce produit a aidé l'entreprise à élargir son portefeuille de produits esthétiques.

Portée du marché de l'esthétique et des cosmétiques aux Émirats arabes unis

Le marché de l'esthétique et des cosmétiques aux Émirats arabes unis est segmenté en neuf segments notables basés sur le produit et les services, la matière première, la procédure, l'application, la tranche d'âge, le type de patient, la nationalité, l'utilisateur final et le canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Marché de l'esthétique et des cosmétiques aux Émirats arabes unis, par produits et services

- Produits

- Services

En fonction des produits et des services, le marché est segmenté en produits et services.

Marché de l'esthétique et des cosmétiques aux Émirats arabes unis, par matière première

- Polymères

- Métaux

- Céramique

- Composites à base de résine

- Silicium

- Titane

- Autres

En fonction des matières premières, le marché est segmenté en polymères, métaux, céramiques, composites de résine, silicium, titane et autres.

Marché de l'esthétique et des cosmétiques aux Émirats arabes unis, par procédure

- Procédure cosmétique

- Procédure de reconstruction

En fonction de la procédure, le marché est segmenté en procédure cosmétique et procédure de reconstruction.

Marché de l'esthétique et des cosmétiques aux Émirats arabes unis, par application

- Procédures invasives

- Procédures non invasives

En fonction de l'application, le marché est segmenté en procédures invasives et procédures non invasives

Marché de l'esthétique et des cosmétiques aux Émirats arabes unis, groupe d'âge

- Enfant

- Adulte

- Gériatrie

En fonction de la tranche d’âge, le marché est segmenté en enfants, adultes et gériatriques.

Marché de l'esthétique et des cosmétiques aux Émirats arabes unis, par type de patient

- Mâle

- Femelle

En fonction du type de patient, le marché est segmenté en hommes et femmes.

Marché de l'esthétique et des cosmétiques aux Émirats arabes unis, nationalité

- Ressortissants étrangers

- Émirats

En fonction de la nationalité, le marché est segmenté en ressortissants étrangers et Émirats.

Marché de l'esthétique et des cosmétiques aux Émirats arabes unis, par utilisateur final

- Hôpitaux

- Cliniques multi-spécialités

- Cadres de soins à domicile

- Spas médicaux et centres de beauté

- Centres de dermatologie

- Cliniques de jour

- Autres

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, cliniques multispécialités, établissements de soins à domicile, spas médicaux et centres de beauté, centres de dermatologie, cliniques de jour et autres.

Marché de l'esthétique et des cosmétiques aux Émirats arabes unis, par canal de distribution

- Appel d'offres direct

- Ventes au détail

En fonction du canal de distribution, le marché est segmenté en ventes directes et ventes au détail.

Analyse du paysage concurrentiel et des parts de marché du secteur de l'esthétique et des cosmétiques aux Émirats arabes unis

Le paysage concurrentiel du marché de l'esthétique/des cosmétiques aux EAU fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Français Certains des principaux acteurs du marché opérant sur le marché de l'esthétique/des cosmétiques aux EAU sont AESTHETICS INTERNATIONAL, Allergan PLC. (une filiale d'Abbvie.), Alma Lasers, Al Shunnar Plastic Surgery, Al Zahra Hospital Dubai, American British Surgical & Medical Centre, Bausch Health Companies Inc., BTL Group of Companies, Candela Corporation, Celia Aesthetic Clinic, CYNOSURE, Dentsply Sirona, GALDERMA, Institut Straumann AG, LaseTech Trading LLC., Maria Medical Technology, Mentor Worlwide LLC, Proderma-me, Silkor Laser & Aesthetic Center, The Private Clinic et ZIMMER GROUP entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 PRODUCT AND SERVICES LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 INDUSTRIAL INSIGHTS

5 PROCEDURE TREND ANALYSIS: UAE AESTHETICS/COSMETICS MARKET

5.1 LIPOSUCTION

5.2 TUMMY TUCK

5.3 BREAST AUGMENTATION

5.4 EYELID SURGERY

5.5 FACELIFT SURGERY

5.6 EAR SURGERY

5.7 CHIN SURGERY

5.8 CHEEK AUGMENTATION

5.9 BUCCAL FAT REMOVAL

5.1 BROW LIFT

5.11 RHINOPLASTY

5.12 OTHERS

6 REGULATORY FRAMEWORK

7 REGIONAL SUMMARY

8 MARKET OVERVIEW: UAE AESTHETICS/COSMETICS MARKET

8.1 DRIVERS

8.1.1 THE RISE IN THE AWARENESS OF AESTHETIC PROCEDURES

8.1.2 BELIEFS AND TRENDS OF AESTHETIC SURGERY IN YOUNG ADULTS

8.1.3 RISE IN MEDICAL TOURISM IN UAE

8.1.3.1 GOVERNMENT INITIATIVES IN MEDICAL TOURISM

8.1.3.2 ADVANTAGES OF THE MIDDLE EAST

8.1.4 RISING PREVALENCE OF MINIMALLY INVASIVE PROCEDURES

8.2 RESTRAINTS

8.2.1 SOCIAL STIGMA A BARRIER

8.2.2 STRINGENT REGULATORY FRAMEWORK

8.3 OPPORTUNITIES

8.3.1 TECHNOLOGICAL ADVANCEMENTS IN AESTHETICS AND COSMETICS PROCEDURES

8.3.2 INCREASING INFLUENCE OF SOCIAL MEDIA

8.3.3 INCREASE IN COSMETIC SURGERIES

8.4 CHALLENGES

8.4.1 POST-SURGERY COMPLICATIONS

8.4.2 HIGH COST OF PROCEDURE

9 UAE AESTHETICS/COSMETICS MARKET, BY PRODUCT AND SERVICES

9.1 OVERVIEW

9.2 PRODUCT

9.2.1 NON ENERGY BASED DEVICES

9.2.1.1 FACIAL AESTHETICS PRODUCT

9.2.1.1.1 BOTULINUM TOXIN

9.2.1.1.2 DERMAL FILLERS

9.2.1.1.2.1 NATURAL DERMAL FILLERS

9.2.1.1.2.2 SYNTHETIC DERMAL FILLERS

9.2.1.1.3 FACIAL TONING

9.2.1.1.4 CHEMICAL PEEL

9.2.1.1.4.1 LUNCH TIME PEEL

9.2.1.1.4.2 MEDIUM PEEL

9.2.1.1.4.3 DEEP PEEL

9.2.1.1.5 COLLAGEN INJECTIONS

9.2.1.1.5.1 BOVINE

9.2.1.1.5.2 PORCINE

9.2.1.1.5.3 others

9.2.1.1.6 ELECTROTHERAPY

9.2.1.1.7 MICRODERMABRASION

9.2.1.1.7.1 MICRODERMABRASION MACHINES

9.2.1.1.7.1.1 TABLE TOP

9.2.1.1.7.1.2 HAND HELD

9.2.1.1.7.2 MICRODERMABRASION TIPS

9.2.1.1.7.2.1 DIAMOND TIPS

9.2.1.1.7.2.2 BRISTLE TIPS

9.2.1.1.7.3 MICRODERMABRASION CREAMS AND SCRUBS

9.2.1.1.7.4 MICRODERMABRASION CRYSTALS

9.2.1.1.7.5 ALUMINIUM OXIDE CRYSTALS

9.2.1.1.7.6 SODIUM CHLORIDE CRYSTALS

9.2.1.1.7.7 SODIUM BICARBONATE CRYSTALS

9.2.1.1.8 FRAXEL

9.2.1.1.9 PERMANENT MAKEUP

9.2.1.1.10 COSMETIC ACUPUNCTURE

9.2.1.1.11 OTHERS

9.2.1.2 BODY CONTOURING DEVICES

9.2.1.2.1 NON-SURGICAL FAT REDUCTION DEVICES

9.2.1.2.1.1 LOW LEVEL LASERS

9.2.1.2.1.2 ULTRASOUND

9.2.1.2.1.3 CRYOLIPOLYSIS

9.2.1.2.1.4 OTHERS

9.2.1.2.2 LIPOSUCTION DEVICES

9.2.1.2.2.1 PORTABLE LIPOSUCTION DEVICES

9.2.1.2.2.2 STANDALONE LIPOSUCTION DEVICES

9.2.1.2.3 CELLULITE REDUCTION DEVICES

9.2.1.2.4 OTHERS

9.2.1.3 HAIR REMOVAL DEVICES

9.2.1.3.1 LASER HAIR REMOVAL DEVICES

9.2.1.3.2 INTENSE PULSED LIGHT HAIR REMOVAL DEVICES

9.2.1.4 SKIN AESTHETICS/ COSMETICS

9.2.1.4.1 NON-SURGICAL SKIN TIGHTENING DEVICES

9.2.1.4.2 MICRO NEEDLING PRODUCT

9.2.1.4.3 LIGHT THERAPY DEVICES

9.2.1.4.4 OTHERS

9.2.1.4.4.1 TATTOO REMOVAL DEVICES

9.2.1.4.4.2 NAIL TREATMENT LASER DEVICES

9.2.1.4.4.3 THREAD LIFT PRODUCT

9.2.1.4.4.4 PHYSICIAN DISPENSED COSMECEUTICALS AND SKIN LIGHTENERS

9.2.1.4.4.5 PHYSICIAN DISPENSED EYELASH PRODUCT

9.2.1.5 COSMETIC IMPLANTS

9.2.1.5.1 BREAST IMPLANTS

9.2.1.5.1.1 SILICONE IMPLANTS

9.2.1.5.1.2 SALINE IMPLANTS

9.2.1.5.2 DENTAL IMPLANTS

9.2.1.5.2.1 ENDOSTEAL IMPLANTS

9.2.1.5.2.1.1 TITANIUM

9.2.1.5.2.1.2 ZIRCONIUM

9.2.1.5.2.1.3 OTHERS

9.2.1.5.2.1.4 TAPERED

9.2.1.5.2.1.5 Parallel

9.2.1.5.2.2 SUB PERIOSTEAL IMPLANTS

9.2.1.5.2.2.1 TITANIUM

9.2.1.5.2.2.2 ZIRCONIUM

9.2.1.5.2.2.3 OTHERS

9.2.1.5.2.2.4 TAPERED

9.2.1.5.2.2.5 PARALLEL

9.2.1.5.2.3 ZYGOMATIC IMPLANTS

9.2.1.5.2.3.1 TITANIUM

9.2.1.5.2.3.2 ZIRCONIUM

9.2.1.5.2.3.3 OTHERS

9.2.1.5.2.3.4 TAPERED

9.2.1.5.2.3.5 PARALLEL

9.2.1.5.3 BONE REGENERATION GRAFTS

9.2.1.5.3.1 ALLOGRAFT

9.2.1.5.3.1.1 DEMINERALIZED BONE MATRIX

9.2.1.5.3.1.2 OTHERS

9.2.1.5.3.2 AUTOGRAFT

9.2.1.5.3.3 XENOGRAFT

9.2.1.5.3.4 OTHERS

9.2.1.6 IMPLANTS FOR THE BODY

9.2.1.6.1 FACIAL IMPLANTS

9.2.1.6.2 GLUTEAL/BUTTOCK IMPLANTS

9.2.1.6.3 SKIN EXPANDERS

9.2.1.6.4 NASAL STENTS

9.2.1.6.5 PENILE STENTS

9.2.1.6.6 TESTICULAR IMPLANTS

9.2.1.6.7 PECTORAL IMPLANTS

9.2.1.6.8 CALF IMPLANTS

9.2.1.6.9 EAR IMPLANTS

9.2.1.6.10 OTHERS

9.2.1.7 CUSTOM MADE IMPLANTS

9.2.2 ENERGY BASED DEVICES

9.2.2.1 LASER BASED AESTHETIC DEVICES

9.2.2.1.1 NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES

9.2.2.1.1.1.1 RADIOFREQUENCY

9.2.2.1.1.1.2 FRACTIONAL LASER

9.2.2.1.1.1.3 INTENSE PULSED LIGHT

9.2.2.1.1.1.4 OTHERS

9.2.2.1.2 ABLATIVE SKIN RESURFACING DEVICES

9.2.2.1.2.1 ERBIUM LASER

9.2.2.1.2.2 CO2 LASER

9.2.2.1.2.3 OTHERS

9.2.2.2 ELECTRO SURGERY DEVICES

9.2.2.2.1 BIPOLAR ELECTROSURGICAL INSTRUMENTS

9.2.2.2.1.1 BIPOLAR FORCEPS

9.2.2.2.1.2 ADVANCED VESSEL SEALING INSTRUMENTS

9.2.2.2.2 ELECTROSURGICAL ACCESSORIES

9.2.2.2.3 MONOPOLAR ELECTROSURGICAL INSTRUMENTS

9.2.2.2.3.1 ELECTROSURGICAL PENCILS

9.2.2.2.3.2 ELECTROSURGICAL ELECTRODES

9.2.2.2.3.3 SUCTION COAGULATORS

9.2.2.2.3.4 MONOPOLAR FORCEPS

9.2.2.2.4 OTHERS

9.2.2.3 CRYOSURGERY DEVICES

9.2.2.4 LIGHT BASED AESTHETIC DEVICES

9.2.2.5 ULTRASOUND AESTHETIC DEVICES

9.2.2.6 MICROWAVE DEVICES

9.2.2.7 HARMONIC SCALPEL

9.2.2.8 ELECTROCAUTERY DEVICES

9.2.2.9 OTHERS

9.3 SERVICES

9.3.1 BODY CARE

9.3.1.1 LIPOSUCTION

9.3.1.2 FAT TRANSFER

9.3.1.3 TUMMY TUCK

9.3.1.4 ARM LIFT

9.3.1.5 OTHERS

9.3.2 FACE CARE

9.3.2.1 EYELID

9.3.2.2 NOSE SURGERY

9.3.2.3 FOREHEAD/ BROW LIFT

9.3.2.4 NECK LIFT

9.3.2.5 EAR SURGERY

9.3.2.6 MICROLIFT

9.3.2.7 OTHERS

9.3.3 SKIN CARE

9.3.3.1 SKIN TIGHTENING

9.3.3.2 FACIAL & SKIN REJUVENATION

9.3.3.3 ANTIAGING & WRINKLES

9.3.3.4 PIGMENTED LESION REMOVAL

9.3.3.5 ACNE TREATMENT

9.3.3.6 OTHERS

9.3.4 OTHERS

10 UAE AESTHETICS/ COSMETICS MARKET, BY RAW MATERIAL

10.1 OVERVIEW

10.2 POLYMERS

10.3 METALS

10.4 CERAMICS

10.5 SILICON

10.6 RESIN COMPOSITES

10.7 TITANIUM

10.8 OTHERS

11 UAE AESTHETICS/ COSMETICS MARKET, BY PROCEDURE

11.1 OVERVIEW

11.2 COSMETIC PROCEDURE

11.3 RECONSTRUCTION PROCEDURE

12 UAE AESTHETICS/ COSMETICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 INVASIVE PROCEDURES

12.2.1 LIPOSUCTION

12.2.2 BREAST AUGMENTATION

12.2.3 EYELID SURGERY

12.2.4 RHINOPLASTY

12.2.5 FACE LIFT SURGERY

12.2.6 BROW LIFT

12.2.7 EAR SURGERY

12.2.8 TUMMY TUCK

12.2.9 CHEEK AUGMENTATION

12.2.10 CHIN SURGERY

12.2.11 BUCCAL FAT REMOVAL

12.2.12 OTHERS

12.3 NON- INVASIVE PROCEDURES

12.3.1 BOTULINUM TOXINS

12.3.2 SOFT TISSUE FILLERS

12.3.3 CHEMICAL PEEL

12.3.4 LASER HAIR REMOVAL

12.3.5 MICRODERMABRASSION

12.3.6 OTHERS

13 UAE AESTHETICS/ COSMETICS MARKET, BY PATIENT TYPE

13.1 OVERVIEW

13.2 FEMALE

13.3 MALE

14 UAE AESTHETICS/ COSMETICS MARKET, BY AGE GROUP

14.1 OVERVIEW

14.2 ADULT

14.3 GERIATRIC

14.4 CHILD

15 UAE AESTHETICS/COSMETICS MARKET, BY NATIONALITY

15.1 OVERVIEW

15.2 FOREIGN NATIONALS

15.3 EMIRATIS

16 UAE AESTHETICS/COSMETICS MARKET, BY END USER

16.1 OVERVIEW

16.2 DERMATOLOGY CENTERS

16.2.1 INVASIVE PROCEDURES

16.2.2 NON-INVASIVE PROCEDURES

16.3 HOSPITALS

16.3.1 BY PROCEDURE

16.3.1.1 INVASIVE PROCEDURES

16.3.1.2 NON-INVASIVE PROCEDURES

16.3.2 BY TYPE

16.3.2.1 PRIVATE

16.3.2.2 PUBLIC

16.3.3 BY CATEGORY

16.3.3.1 TIER 1

16.3.3.2 TIER 2

16.3.3.3 TIER 3

16.4 MEDICAL SPAS AND BEAUTY CENTERS

16.4.1 INVASIVE PROCEDURES

16.4.2 NON-INVASIVE PROCEDURES

16.5 MULTI-SPECIALTY CLINICS

16.5.1 INVASIVE PROCEDURES

16.5.2 NON-INVASIVE PROCEDURES

16.6 DAY CARE CLINICS

16.6.1 NON-INVASIVE PROCEDURES

16.6.2 INVASIVE PROCEDURES

16.7 HOMECARE SETTINGS

16.7.1 NON-INVASIVE PROCEDURES

16.7.2 INVASIVE PROCEDURES

16.8 OTHERS

17 UAE AESTHETICS/COSMETICS MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDER

17.3 RETAIL SALES

18 UAE AESTHETICS/COSMETICS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: UAE

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 ALLERGEN PLC. (SUBSIDIARY OF ABBVIE.)

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENTS

20.2 ALMA LASERS (A SUBSIDIARY OF SISRAM MEDICAL)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENTS

20.3 GALDERMA

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 RECENT DEVELOPMENT

20.4 MENTOR WORLDWIDE LLC

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.5 DENTSPLY SIRONA

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENTS

20.6 BTL GROUP OF COMPANIES

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 BAUSCH HEALTH COMPANIES, INC.

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 CYNOSURE

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 CANDELA CORPORATION

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 INSTITUT STRAUMANN AG

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 LASETECH TRADING LLC.

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENTS

20.12 MARIA MEDICAL TECHNOLOGY

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 PRODERMA-ME

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENTS

20.14 SILKOR LASER & AESTHETIC CENTER

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 ZIMMER GROUP

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

21 CASE STUDY COMPANIES

21.1 AMERICAN BRITISH SURGICAL & MEDICAL CENTRE

21.1.1 COMPANY SNAPSHOT

21.1.2 PRODUCT PORTFOLIO

21.1.3 COMPANY OUTLINE

21.2 AESTHETICS INTERNATIONAL

21.2.1 COMPANY SNAPSHOT

21.2.2 PRODUCT PORTFOLIO

21.2.3 COMPANY OUTLINE

21.3 AL ZAHRA HOSPITAL DUBAI

21.3.1 COMPANY SNAPSHOT

21.3.2 PRODUCT PORTFOLIO

21.3.3 COMPANY OUTLINE

21.4 AL SHUNNAR PLASTIC SURGERY

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 COMPANY OUTLINE

21.5 CELIA AESTHETIC CLINIC

21.5.1 COMPANY SNAPSHOT

21.5.2 PRODUCT PORTFOLIO

21.5.3 COMPANY OUTLINE

21.6 THE PRIVATE CLINIC

21.6.1 COMPANY SNAPSHOT

21.6.2 PRODUCT PORTFOLIO

21.6.3 COMPANY OUTLINE

22 QUESTIONNAIRE

23 RELATED REPORTS

Liste des tableaux

TABLE 1 STATISTICS OF NON-SURGICAL PROCEDURES IN UAE

TABLE 2 UAE AESTHETICS/COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 UAE PRODUCT IN AESTHETICS/COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 UAE NON ENERGY BASED DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 UAE FACIAL AESTHETICS PRODUCT IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 UAE DERMAL FILLERS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 UAE CHEMICAL PEEL IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 8 UAE COLLAGEN INJECTIONS IN AESTHETICS/COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 UAE COLLAGEN INJECTIONS IN AESTHETICS/COSMETICS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 10 UAE MICRODERMABRASION IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 UAE MICRODERMABRASION MACHINES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 UAE MICRODERMABRASION MACHINES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 13 UAE MICRODERMABRASION TIPS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 14 UAE MICRODERMABRASION TIPS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 15 UAE MICRODERMABRASION CRYSTALS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 16 UAE MICRODERMABRASION CRYSTALS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 17 UAE BODY CONTOURING IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 18 UAE NON SURGICAL FAT REDUCTION DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 19 UAE NON SURGICAL FAT REDUCTION DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 20 UAE LIPOSUCTION DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 21 UAE LIPOSUCTION DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 22 UAE HAIR REMOVAL DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 23 UAE HAIR REMOVAL DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 24 UAE SKIN AESTHETICS/ COSMETICS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 25 UAE SKIN AESTHETICS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 26 UAE OTHERS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 UAE COSMETIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 28 UAE BREAST IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 29 UAE BREAST IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 30 UAE DENTAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 31 UAE ENDOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 32 UAE ENDOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (UNIT)

TABLE 33 UAE ENDOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 34 UAE SUB PERIOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 35 UAE SUB PERIOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (UNIT)

TABLE 36 UAE SUB PERIOSTEAL IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 37 UAE ZYGOMATIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 38 UAE ZYGOMATIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (UNIT)

TABLE 39 UAE ZYGOMATIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 40 UAE BONE REGENERATION GRAFTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 41 UAE ZYGOMATIC IMPLANTS IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (UNIT)

TABLE 42 UAE ALLOGRAFT IN AESTHETICS/COSMETICS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 43 UAE IMPLANTS FOR THE BODY IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 44 UAE ENERGY BASED AESTHETIC DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 45 UAE ENERGY BASED AESTHETIC DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 46 UAE LASER BASED AESTHETIC DEVICE IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 47 UAE NON ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 UAE NON ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 UAE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 50 UAE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 51 UAE ELECTROSURGERY DEVICES IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 52 UAE BIPOLAR ELECTROSURGICAL INSTRUMENTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 53 UAE BIPOLAR ELECTROSURGICAL INSTRUMENTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (MILLION UNIT)

TABLE 54 UAE MONOPOLAR ELECTROSURGICAL INSTRUMENTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 55 UAE MONOPOLAR ELECTROSURGICAL INSTRUMENTS IN AESTHETICS/COSMETICS MARKET, BY PRODUCT, 2021-2030 (MILLION UNIT)

TABLE 56 UAE SERVICES IN AESTHETICS/ COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 UAE BODY CARE IN AESTHETICS/ COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 UAE FACE CARE IN AESTHETICS/ COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 UAE SKIN CARE IN AESTHETICS/ COSMETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 UAE AESTHETICS/ COSMETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 61 UAE AESTHETICS/ COSMETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 62 UAE AESTHETICS/ COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 UAE INVASIVE PROCEDURES IN AESTHETICS/ COSMETICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 64 UAE NON- INVASIVE PROCEDURES IN AESTHETICS/ COSMETICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 65 UAE AESTHETICS/ COSMETICS MARKET, BY PATIENT TYPE, 2021-2030 (USD MILLION)

TABLE 66 UAE AESTHETICS/ COSMETICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 67 UAE MEDICAL AESTHETICS MARKET, BY NATIONALITY, 2021-2030 (USD MILLION)

TABLE 68 UAE MEDICAL AESTHETICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 69 UAE DERMATOLOGY CENTERS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 70 UAE HOSPITALS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 71 UAE HOSPITALS IN MEDICAL AESTHETICS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 UAE HOSPITALS IN MEDICAL AESTHETICS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 73 UAE MEDICAL SPAS AND BEAUTY CENTERS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 74 UAE MULTI-SPECIALTY CLINICS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 75 UAE DAY CARE CLINICS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 76 UAE HOMECARE SETTINGS IN MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 77 UAE MEDICAL AESTHETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 UAE AESTHETICS/COSMETICS MARKET: SEGMENTATION

FIGURE 2 UAE AESTHETICS/COSMETICS MARKET: DATA TRIANGULATION

FIGURE 3 UAE AESTHETICS/COSMETICS MARKET: DROC ANALYSIS

FIGURE 4 UAE AESTHETICS/COSMETICS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 UAE AESTHETICS/COSMETICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 UAE AESTHETICS/COSMETICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 UAE AESTHETICS/COSMETICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 UAE AESTHETICS/COSMETICS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 UAE AESTHETICS/COSMETICS MARKET: SEGMENTATION

FIGURE 10 THE RISE IN AWARENESS ABOUT AESTHETIC PROCEDURES AND BELIEF AND TRENDS OF AESTHETIC SURGERY IN YOUNG ADULTS ARE EXPECTED TO DRIVE THE UAE AESTHETICS/COSMETICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE UAE AESTHETICS/COSMETICS MARKET IN 2023 AND 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE UAE AESTHETICS/COSMETICS MARKET

FIGURE 13 TRENDING COSMETIC SURGERIES IN UAE

FIGURE 14 UAE AESTHETICS/COSMETICS MARKET: BY TYPE, 2022

FIGURE 15 UAE AESTHETICS/COSMETICS MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 16 UAE AESTHETICS/COSMETICS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 17 UAE AESTHETICS/COSMETICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 UAE AESTHETICS/ COSMETICS MARKET: BY RAW MATERIAL, 2022

FIGURE 19 UAE AESTHETICS/ COSMETICS MARKET: BY RAW MATERIAL, 2023-2030 (USD MILLION)

FIGURE 20 UAE AESTHETICS/ COSMETICS MARKET: BY RAW MATERIAL, CAGR (2023-2030)

FIGURE 21 UAE AESTHETICS/ COSMETICS MARKET: BY RAW MATERIAL, LIFELINE CURVE

FIGURE 22 UAE AESTHETICS/ COSMETICS MARKET: BY PROCEDURE, 2022

FIGURE 23 UAE AESTHETICS/ COSMETICS MARKET: BY PROCEDURE, 2023-2030 (USD MILLION)

FIGURE 24 UAE AESTHETICS/ COSMETICS MARKET: BY PROCEDURE, CAGR (2023-2030)

FIGURE 25 UAE AESTHETICS/ COSMETICS MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 26 UAE AESTHETICS/ COSMETICS MARKET: BY APPLICATION, 2022

FIGURE 27 UAE AESTHETICS/ COSMETICS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 28 UAE AESTHETICS/ COSMETICS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 29 UAE AESTHETICS/ COSMETICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 UAE AESTHETICS/ COSMETICS MARKET: BY PATIENT TYPE, 2022

FIGURE 31 UAE AESTHETICS/ COSMETICS MARKET: BY PATIENT TYPE, 2023-2030 (USD MILLION)

FIGURE 32 UAE AESTHETICS/ COSMETICS MARKET: BY PATIENT TYPE, CAGR (2023-2030)

FIGURE 33 UAE AESTHETICS/ COSMETICS MARKET: BY PATIENT TYPE, LIFELINE CURVE

FIGURE 34 UAE AESTHETICS/ COSMETICS MARKET: BY AGE GROUP, 2022

FIGURE 35 UAE AESTHETICS/ COSMETICS MARKET: BY AGE GROUP, 2023-2030 (USD MILLION)

FIGURE 36 UAE AESTHETICS/ COSMETICS MARKET: BY AGE GROUP, CAGR (2023-2030)

FIGURE 37 UAE AESTHETICS/ COSMETICS MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 38 UAE AESTHETICS/COSMETICS MARKET: BY NATIONALITY, 2022

FIGURE 39 UAE AESTHETICS/COSMETICS MARKET: BY NATIONALITY, 2023-2030 (USD MILLION)

FIGURE 40 UAE AESTHETICS/COSMETICS MARKET: BY NATIONALITY, CAGR (2023-2030)

FIGURE 41 UAE AESTHETICS/COSMETICS MARKET: BY NATIONALITY, LIFELINE CURVE

FIGURE 42 UAE AESTHETICS/COSMETICS MARKET: BY END USER, 2022

FIGURE 43 UAE AESTHETICS/COSMETICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 44 UAE AESTHETICS/COSMETICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 45 UAE AESTHETICS/COSMETICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 46 UAE AESTHETICS/COSMETICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 47 UAE AESTHETICS/COSMETICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 48 UAE AESTHETICS/COSMETICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 49 UAE AESTHETICS/COSMETICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 50 THE UAE AESTHETICS/COSMETICS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.