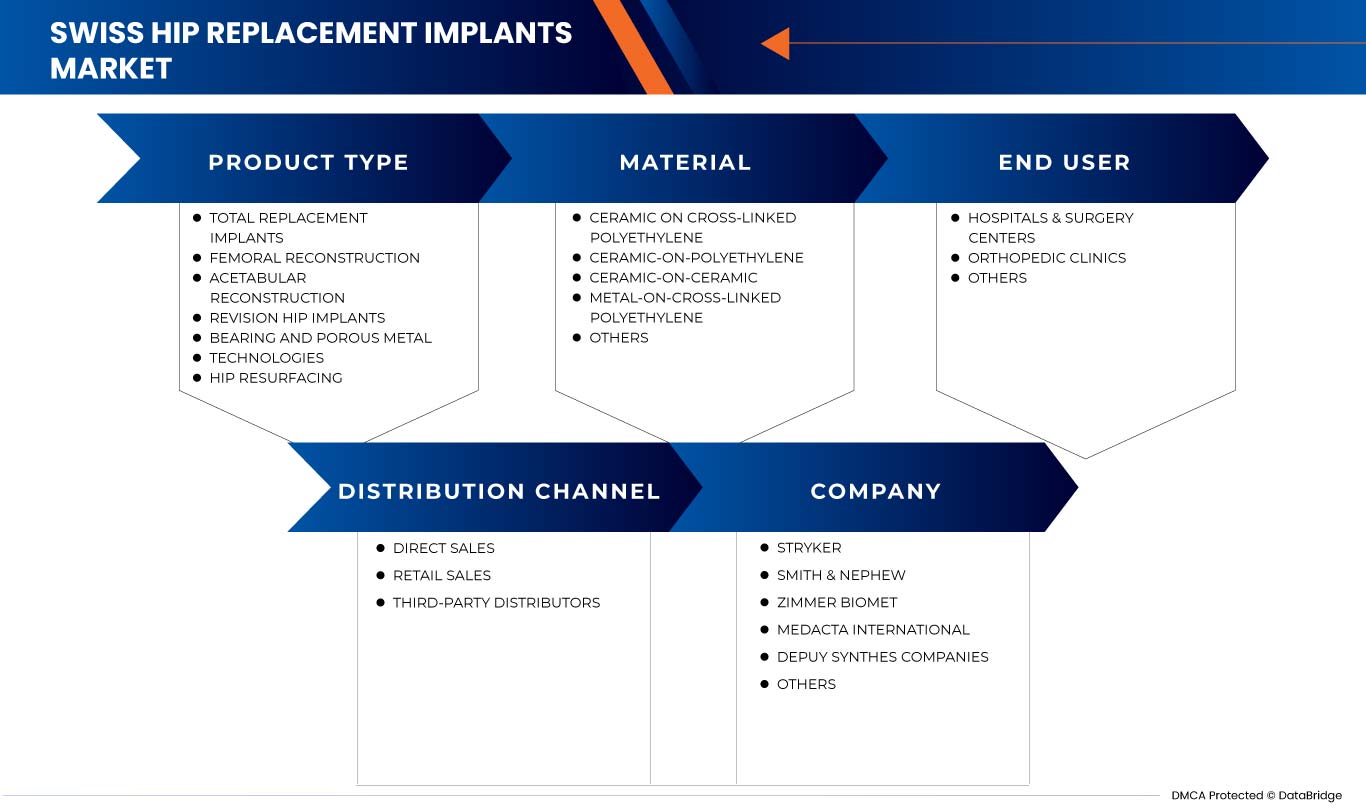

Marché suisse des implants de remplacement de la hanche, par type de produit (reconstruction fémorale, reconstruction acétabulaire, resurfaçage de la hanche, implants de révision de la hanche, technologies de roulement et de métal poreux et implants de remplacement total), matériau (céramique sur polyéthylène réticulé, céramique sur polyéthylène, céramique sur céramique, métal sur polyéthylène réticulé et autres), utilisateur final (cliniques orthopédiques, hôpitaux et centres de chirurgie et autres), canal de distribution (ventes directes, distributeurs tiers et ventes au détail) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des implants de remplacement de la hanche en Suisse

Les implants de hanche sont des dispositifs médicaux utilisés lorsqu'une partie de l'os est manquante ou qu'une articulation de soutien spécifique a été fabriquée pour cet os afin d'éviter d'autres dommages. Cet implant artificiel est fabriqué en acier inoxydable et en alliages tels que le titane pour une résistance maximale et est étiqueté avec un plastique qui agit comme cartilage dans la hanche du corps pour maintenir la structure et la fonction de l'articulation. Pour les opérations qui nécessitent des interventions chirurgicales minimales, des implants artificiels du type souvent observés dans le traitement des blessures à la hanche sont utilisés dans d'autres conditions similaires, telles que la sténose de la hanche. Ces dernières années, une augmentation rapide du nombre de blessures à la hanche a été observée en raison du développement de diverses maladies rampantes liées au squelette. La fréquence d'autres blessures par chute localisées chez les personnes âgées s'est également avérée être un moteur de croissance du marché. En outre, les avancées et innovations technologiques telles que les dispositifs chirurgicaux robotisés, l'adoption rapide des implants de hanche et des dispositifs médicaux implantables, et de nombreuses autres technologies modernes pour traiter les problèmes liés à la hanche ont alimenté le marché au cours de la période de prévision.

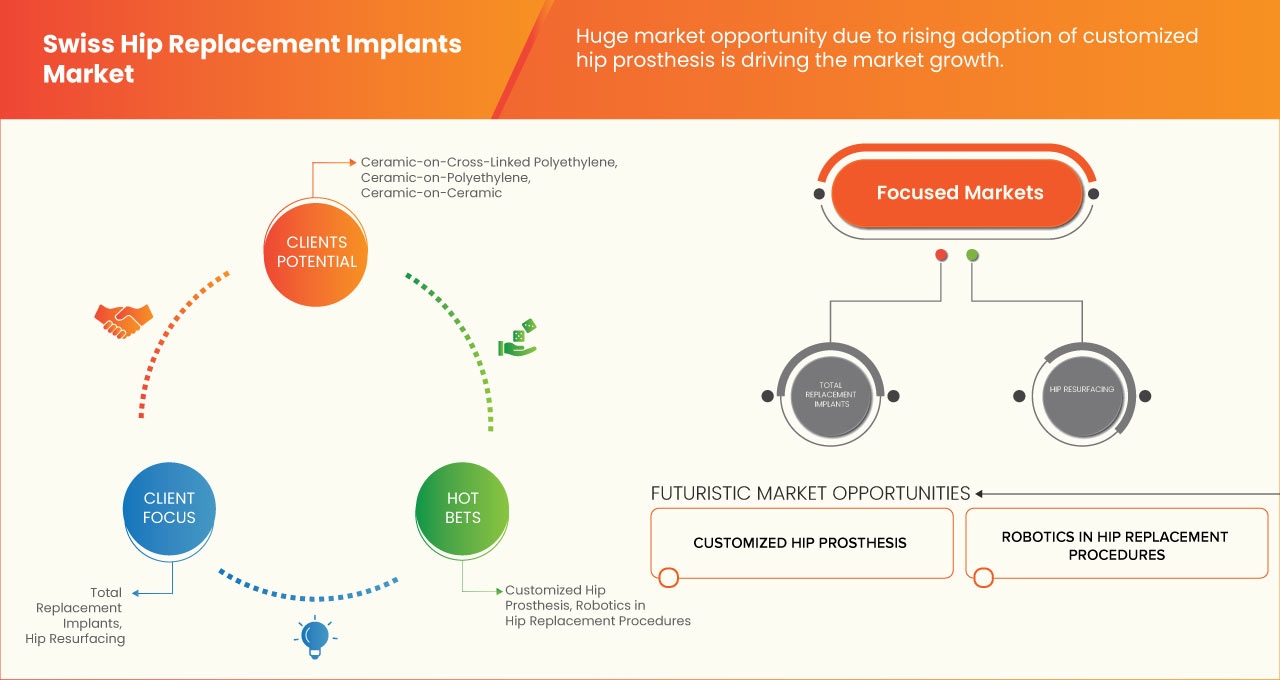

La prévalence croissante des blessures à la hanche ou des maladies telles que l'arthrite de la hanche et la croissance rapide de la population âgée sujette aux maladies orthopédiques sont quelques-uns des facteurs qui stimulent la croissance du marché. Cependant, le coût élevé associé à l'utilisation de technologies avancées dans le traitement du remplacement de la hanche est l'un des principaux facteurs limitant la croissance du marché. En conséquence, la croissance du marché pourrait être entravée à long terme.

Les économies émergentes devraient offrir des opportunités de croissance lucratives pour le marché. En revanche, les défaillances de produits et le rappel des produits d'implants de hanche pourraient mettre à mal la croissance du marché.

Selon les analyses de Data Bridge Market Research, le marché suisse des prothèses de hanche devrait atteindre une valeur de 98,92 millions USD d'ici 2030, à un TCAC de 10,5 % au cours de la période de prévision. Le type de produit représente le segment le plus important du marché suisse des prothèses de hanche.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions, volumes en millions d'unités et prix en USD |

|

Segments couverts |

Par type de produit (reconstruction fémorale, reconstruction acétabulaire, resurfaçage de la hanche, implants de révision de la hanche, technologies de roulement et de métal poreux et implants de remplacement total), matériau (céramique sur polyéthylène réticulé, céramique sur polyéthylène, céramique sur céramique, métal sur polyéthylène réticulé et autres), utilisateur final (cliniques orthopédiques, hôpitaux et centres de chirurgie et autres), canal de distribution (ventes directes, distributeurs tiers et ventes au détail) |

|

Pays couvert |

Suisse |

|

Acteurs du marché couverts |

Atesos, B. Braun Melsungen AG, Conformis, Corin Group, DePuy Synthes Companies, DJO, LLC, Exactech, Inc., KYOCERA Medical Technologies, Inc., Mathys Ltd Bettlach, Medacta International, MicroPort Scientific Corporation, Smith & Nephew, Stryker, Symbios Orthopedie SA, Waldemar Link GmbH & Co. KG et Zimmer Biomet, entre autres |

Définition du marché

Le remplacement de la hanche est une intervention chirurgicale au cours de laquelle l'articulation de la hanche est remplacée par un implant prothétique, c'est-à-dire une prothèse de hanche. L'opération de remplacement de la hanche peut être réalisée sous forme de remplacement total ou de remplacement partiel.

Les implants de hanche sont des dispositifs médicaux destinés à restaurer la mobilité et à soulager la douleur généralement associée à l'arthrite et à d'autres maladies ou blessures de la hanche. Chaque implant de hanche présente des avantages et des risques. Chaque système d'implant de hanche présente des caractéristiques de conception uniques telles que la taille, la forme, le matériau et les dimensions. De plus, le même système d'implant de hanche peut avoir des résultats différents chez différents patients. Plusieurs facteurs peuvent influencer le résultat et la longévité d'un implant de hanche, notamment les caractéristiques de conception du dispositif, l'expérience du chirurgien et la technique d'implantation, ainsi que les caractéristiques individuelles du patient telles que l'âge, le sexe, le poids, le niveau d'activité et l'état de santé général.

Dynamique du marché suisse des prothèses de hanche

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

- Une augmentation de la prévalence de l’arthrite de la hanche

L’arthrite est l’une des maladies articulaires invalidantes les plus courantes. Elle endommage le cartilage articulaire, l’os sous-chondral et la membrane synoviale, entre autres composants articulaires. Avec des effets considérables sur les personnes touchées, les systèmes de santé et des conséquences socio-économiques importantes, l’arthrite est un problème de santé publique majeur. Même si l’arthrite peut toucher n’importe quelle articulation, la hanche représente une part importante de la charge de morbidité. L’arthrite de la hanche peut éventuellement entraîner une défaillance articulaire et nécessiter un remplacement chirurgical. L’arthrite de la hanche est la détérioration du cartilage de l’articulation de la hanche. La hanche est une articulation à rotule dont la boule se trouve au sommet de l’os de la cuisse (la tête fémorale). La boule est séparée de la cavité (l’acétabulum) par du cartilage.

L’augmentation de la prévalence de l’arthrite de la hanche en Suisse devrait donc stimuler la croissance du marché.

- Initiatives gouvernementales et privées pour les investissements dans les soins de santé et les assurances

Le système de santé universel suisse est très décentralisé, les cantons jouant un rôle clé dans son fonctionnement. Le système est financé par les primes des assurés, les impôts (essentiellement cantonaux), les cotisations d'assurance sociale et les paiements directs. Les résidents sont tenus de souscrire une assurance auprès d'assureurs privés à but non lucratif. Les adultes paient également des franchises annuelles et une coassurance (avec un plafond annuel) pour tous les services. La couverture comprend la plupart des visites chez le médecin, les soins hospitaliers, les produits pharmaceutiques, les appareils, les soins à domicile, les services médicaux en soins de longue durée et la physiothérapie. Une assurance privée complémentaire peut être souscrite pour les services non couverts par l'assurance maladie obligatoire afin de garantir un plus grand choix de médecins et d'obtenir de meilleurs hébergements hospitaliers.

Le système de santé étant largement décentralisé, les principales entités de gouvernance du système de santé se situent principalement au niveau cantonal. Chaque canton a son propre ministre de la santé publique élu. Un organe politique de coordination, la Conférence suisse des directeurs cantonaux de la santé, joue un rôle important.

Ainsi, les initiatives gouvernementales et privées en matière d’investissements dans les soins de santé et les assurances devraient servir de moteur à la croissance du marché.

OPPORTUNITÉ

- Innovations et développements de produits croissants grâce aux avancées technologiques

Les progrès technologiques dans le domaine des implants de remplacement de la hanche se traduisent par des fonctionnalités supplémentaires, un taux de réussite plus élevé et des matériaux plus récents, en fonction de leur utilisation dans différentes procédures de remplacement de la hanche. La commercialisation d'implants de remplacement de la hanche basés sur une technologie avancée utilisés pour les implants et les procédures chirurgicales a augmenté sa demande auprès des consommateurs, en raison de laquelle les progrès technologiques croissants propulsent la demande et la croissance du marché.

Ainsi, les avancées technologiques et le développement d’implants orthopédiques précis devraient constituer une opportunité de croissance du marché.

RESTRICTIONS/DÉFIS

- Rappels de produits et défaillances de produits

Au cours de la dernière décennie, plusieurs fabricants d'articulations ont rappelé des prothèses de hanche en métal sur métal. Les entreprises ont promis que leurs modèles en métal sur métal augmenteraient la mobilité. Mais certaines prothèses de hanche peuvent être plus sujettes à l'échec et au rappel.

Par exemple,

- Une étude de 2022 a rapporté qu’après un remplacement de la hanche, 46,7 % des participants ont connu une amélioration cliniquement significative, tandis que 15,5 % ont connu une détérioration des résultats.

Ainsi, les rappels de produits et les défaillances de produits devraient constituer un frein à la croissance du marché.

- Un cadre réglementaire rigoureux

Obtenir l'autorisation requise pour la commercialisation légale d'implants de hanche et de produits de remplacement dans ces juridictions peut entraîner des dépenses financières importantes, qui peuvent prendre des mois, voire des années. Les retards peuvent compromettre considérablement les chances de succès sur un marché hautement concurrentiel si ces limitations ne sont pas connues ou prises en compte.

Selon l'Office fédéral de la santé publique (OFSP), la Suisse a adapté sa réglementation sur les dispositifs médicaux aux règles de l'UE (Europe) dans l'intérêt de la sécurité des patients et de l'accès au marché européen pour l'industrie suisse des dispositifs médicaux. Ces changements auront également des répercussions sur la législation relative à la recherche sur l'être humain.

Par conséquent, des réglementations strictes pour l’approbation de nouveaux appareils devraient constituer un défi à la croissance du marché.

Impact post-COVID-19 sur le marché suisse des prothèses de hanche

La pandémie de COVID-19 a eu un impact négatif considérable sur le marché. Au cours de cette phase, le nombre d’interventions chirurgicales non électives et non essentielles a considérablement diminué et les arthroplasties de la hanche et du genou n’ont pas été incluses dans la liste des interventions essentielles. Les pertes financières importantes subies au cours de cette phase pandémique ont entraîné un déraillage de la croissance du marché.

Développements récents

- En avril 2021, Corin Group a annoncé le lancement du logiciel de planification préopératoire OPSInsight pour l'arthroplastie totale de la hanche (ATH). Cette plateforme basée sur le cloud représente la nouvelle génération de la technologie pionnière OPS (Optimized Positioning System) de Corin, qui permet d'évaluer la biomécanique articulaire unique du patient.

- En août 2021, DJO Suisse a annoncé le lancement d'EMPOWR Dual Mobility, un produit du portefeuille de hanches qui offre aux chirurgiens une solution pour traiter un large groupe de patients ayant besoin d'une meilleure stabilité articulaire.

Portée du marché suisse des prothèses de hanche

Le marché suisse des prothèses de hanche est segmenté en quatre segments notables en fonction du type de produit, du matériau, de l'utilisateur final et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

PAR TYPE DE PRODUIT

- RECONSTRUCTION FÉMORALE

- RECONSTRUCTION ACÉTABULAIRE

- RESURFACAGE DE LA HANCHE

- RÉVISION DES IMPLANTS DE HANCHE

- TECHNOLOGIES DES ROULEMENTS ET DES MÉTAL POREUX

- IMPLANTS DE REMPLACEMENT TOTAL

En fonction du type de produit, le marché est segmenté en reconstruction fémorale, reconstruction acétabulaire, resurfaçage de la hanche, implants de révision de la hanche, technologies de roulement et de métal poreux et implants de remplacement total.

PAR MATIÈRE

- CÉRAMIQUE SUR POLYÉTHYLÈNE RÉTICULÉ

- CÉRAMIQUE SUR POLYÉTHYLÈNE

- CÉRAMIQUE SUR CÉRAMIQUE

- POLYÉTHYLÈNE RÉTICULÉ SUR MÉTAL

- AUTRES

En fonction du matériau, le marché a été segmenté en céramique sur polyéthylène réticulé, céramique sur polyéthylène, céramique sur céramique, métal sur polyéthylène réticulé et autres.

PAR UTILISATEUR FINAL

- CLINIQUES ORTHOPEDIQUES

- HÔPITAUX ET CENTRES DE CHIRURGIE

- AUTRES

En fonction de l’utilisateur final, le marché a été segmenté en cliniques orthopédiques, hôpitaux et centres de chirurgie, et autres.

PAR CANAL DE DISTRIBUTION

- VENTE DIRECTE

- DISTRIBUTEURS TIERS

- VENTES AU DÉTAIL

En fonction du canal de distribution, le marché a été segmenté en ventes directes, distributeurs tiers et ventes au détail.

Analyse du paysage concurrentiel et des parts de marché des implants de remplacement de la hanche suisses

Le paysage concurrentiel du marché suisse des prothèses de hanche fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs opérant sur le marché suisse des implants de remplacement de la hanche sont Atesos, B. Braun Melsungen AG, Conformis, Corin Group, DePuy Synthes Companies, DJO, LLC, Exactech, Inc., KYOCERA Medical Technologies, Inc., Mathys Ltd Bettlach, Medacta International, MicroPort Scientific Corporation, Smith & Nephew, Stryker, Symbios Orthopedie SA, Waldemar Link GmbH & Co. KG et Zimmer Biomet, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SWISS HIP REPLACEMENT IMPLANTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 3D HIP MARKET & NAVIGATION/COMPUTERIZED SURGERY

5 EUROPE HIP REPLACEMENT IMPLANTS MARKET

5.1 OVERVIEW

5.2 EXECUTIVE SUMMARY

5.3 REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 A RISE IN THE PREVALENCE OF HIP ARTHRITIS

6.1.2 GOVERNMENT AND PRIVATE INITIATIVES FOR HEALTHCARE AND INSURANCE INVESTMENTS

6.1.3 INCREASING DEMAND FOR MINIMALLY INVASIVE PROCEDURES AND CEMENTLESS IMPLANTS

6.1.4 REVISION OF IMPLANTS

6.2 RESTRAINTS

6.2.1 PRODUCT RECALLS AND PRODUCT FAILURES

6.2.2 COMPLICATIONS OF IMPLANTS

6.3 OPPORTUNITIES

6.3.1 RISING PRODUCT INNOVATIONS AND DEVELOPMENT OWING TO TECHNOLOGICAL ADVANCEMENTS

6.3.2 RISING ADOPTION OF CUSTOMIZED HIP PROSTHESIS

6.3.3 INCREASE IN ADOPTION OF NAVIGATED AND ROBOTICS IN HIP REPLACEMENT PROCEDURES

6.4 CHALLENGES

6.4.1 HIGH COSTS ASSOCIATED WITH HIP REPLACEMENTS AND IMPLANTS

6.4.2 STRINGENT REGULATORY FRAMEWORK

7 SWISS HIP REPLACEMENT IMPLANTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 TOTAL REPLACEMENT IMPLANTS

7.3 FEMORAL RECONSTRUCTION

7.4 ACETABULAR RECONSTRUCTION

7.5 HIP RESURFACING

7.6 REVISION HIP IMPLANTS

7.7 BEARING AND POROUS METAL TECHNOLOGIES

8 SWISS HIP REPLACEMENT IMPLANTS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 CERAMIC-ON-METAL

8.3 METAL-ON-POLYETHYLENE

8.4 METAL-ON-METAL

8.5 CERAMIC-ON-POLYETHYLENE

8.6 CERAMIC-ON-CERAMIC

9 SWISS HIP REPLACEMENT IMPLANTS MARKET, BY END USER

9.1 OVERVIEW

9.2 HOSPITALS & SURGERY CENTERS

9.3 ORTHOPEDIC CLINICS

9.4 OTHERS

10 SWISS HIP REPLACEMENT IMPLANTS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES

10.3 RETAIL SALES

10.4 ONLINE PHARMACY AND E-COMMERCE

11 SWISS HIP REPLACEMENT IMPLANTS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SWITZERLAND

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 STRYKER

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 SMITH & NEPHEW

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 ZIMMER BIOMET

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 MEDACTA INTERNATIONAL

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 DEPUY SYNTHES COMPANIES (A PART OF JHONSON & JHONSON MEDICAL DEVICES COMPANIES) (2022)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ATESOS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 B. BRAUN MELSUNGEN AG

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 CORIN GROUP

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 CONFORMIS (2022)

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

13.1 D.J.O., LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 EXACTECH, I.N.C.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 KYOCERA MEDICAL TECHNOLOGIES, INC. (2022)

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 MICROPORT SCIENTIFIC CORPORATION (2022)

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 MATHYS LTD BETTLACH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 SYMBIOS ORTHOPEDIE S.A.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 WALDEMAR LINK GMBH & CO. KG

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE HIP REPLACEMENT IMPLANTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 EUROPE HIP REPLACEMENT IMPLANTS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 3 EUROPE HIP REPLACEMENT IMPLANTS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 4 EUROPE HIP REPLACEMENT IMPLANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 5 FACTORS AND VARIABLES COLLECTED BY THE SIRIS FOR THE REGISTRY OF IMPLANTS

TABLE 6 SWISS HIP REPLACEMENT IMPLANTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 SWISS HIP REPLACEMENT IMPLANTS MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 8 SWISS HIP REPLACEMENT IMPLANTS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 9 SWISS HIP REPLACEMENT IMPLANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 SWISS HIP REPLACEMENT IMPLANTS MARKET: SEGMENTATION

FIGURE 2 SWISS HIP REPLACEMENT IMPLANTS MARKET: DATA TRIANGULATION

FIGURE 3 SWISS HIP REPLACEMENT IMPLANTS MARKET: DROC ANALYSIS

FIGURE 4 SWISS HIP REPLACEMENT IMPLANTS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SWISS HIP REPLACEMENT IMPLANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SWISS HIP REPLACEMENT IMPLANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SWISS HIP REPLACEMENT IMPLANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SWISS HIP REPLACEMENT IMPLANTS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 SWISS HIP REPLACEMENT IMPLANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 SWISS HIP REPLACEMENT IMPLANTS MARKET: SEGMENTATION

FIGURE 11 THE RISE IN THE PREVALENCE OF HIP ARTHRITIS IS EXPECTED TO DRIVE THE SWISS HIP REPLACEMENT IMPLANTS MARKET IN THE FORECAST PERIOD

FIGURE 12 TOTAL REPLACEMENT IMPLANTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE SWISS HIP REPLACEMENT IMPLANTS MARKET IN 2023 AND 2030

FIGURE 13 CLASSIFICATION OF COMPUTER-ASSISTED ORTHOPEDIC SURGERY (CAOS)

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SWISS HIP REPLACEMENT IMPLANTS MARKET

FIGURE 15 ADVANTAGES OF MINIMALLY INVASIVE HIP REPLACEMENT SURGERIES

FIGURE 16 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY PRODUCT TYPE, 2022

FIGURE 17 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 18 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 19 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY MATERIAL, 2022

FIGURE 21 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY MATERIAL, 2023-2030 (USD MILLION)

FIGURE 22 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY MATERIAL, CAGR (2023-2030)

FIGURE 23 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 24 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY END USER, 2022

FIGURE 25 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 26 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 27 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 28 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 29 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 30 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 31 SWISS HIP REPLACEMENT IMPLANTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 32 SWISS HIP REPLACEMENT IMPLANTS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.