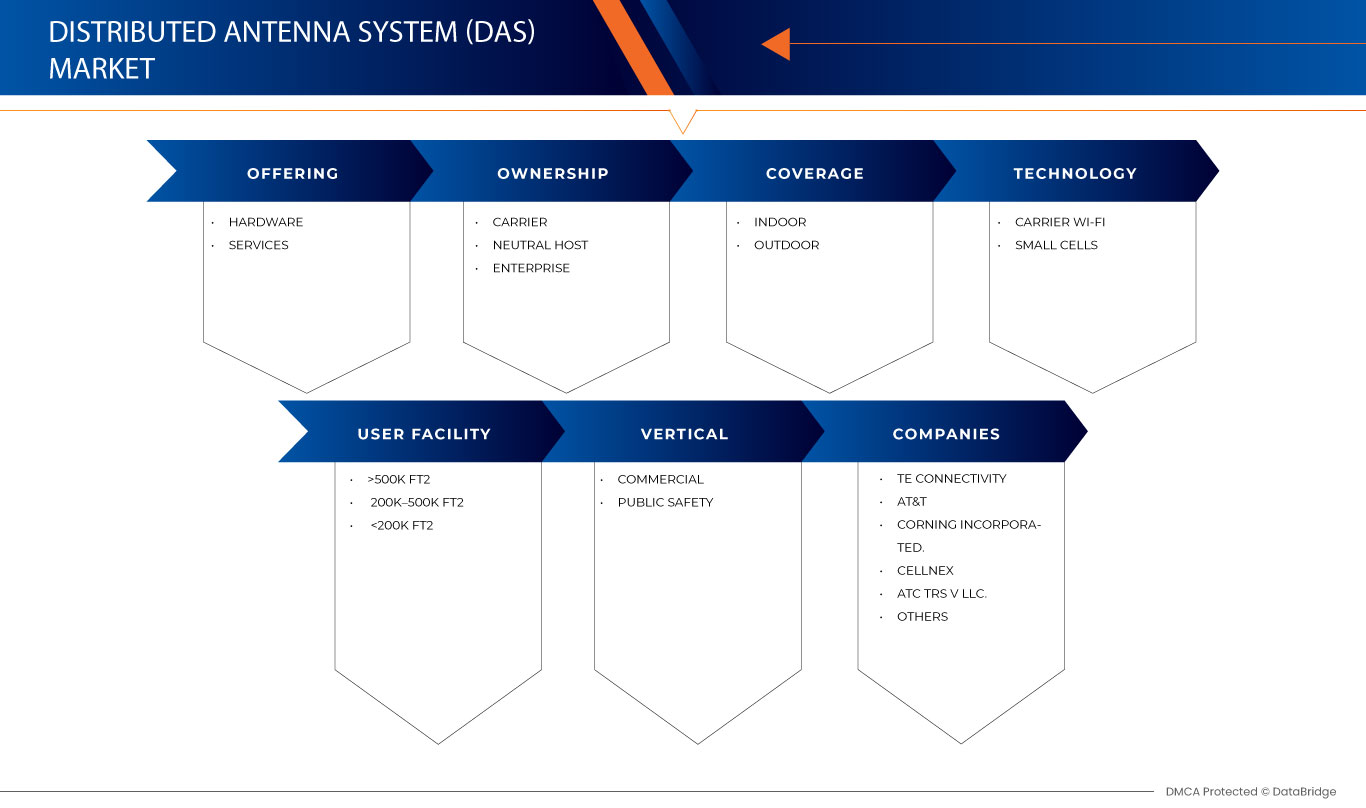

Marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal, par offre (matériel et services), couverture (intérieure et extérieure), propriété (opérateur, hôte neutre et entreprise), technologie (opérateur WI-FI et petites cellules), installation utilisateur ( 500 000 pi2, 200 000 à 500 000 pi2,

Analyse et taille du marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal

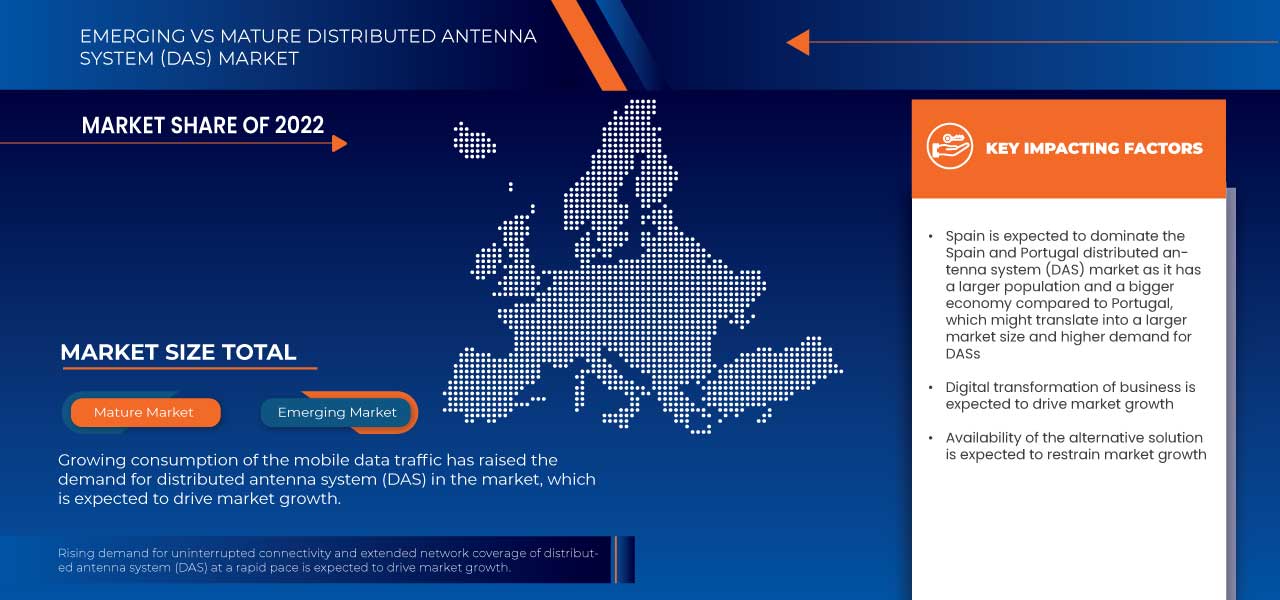

Les principaux facteurs qui devraient stimuler la croissance du marché des systèmes d'antennes distribuées (DAS) au cours de la période de prévision sont la numérisation croissante, la consommation de smartphones et la population technophile qui augmente la croissance du marché en créant une demande pour la solution de connectivité réseau améliorée. L'utilisation croissante des données mobiles sur les appareils stimule la croissance du marché pour fournir un service avancé aux fournisseurs de réseau. Les entreprises adoptent des systèmes d'antennes distribuées (DAS), ce qui accélère l'adoption des services et la pénétration du marché à l'échelle mondiale.

Data Bridge Market Research analyse que le marché espagnol des systèmes d'antennes distribuées (DAS) devrait atteindre la valeur de 657 839,01 millions USD d'ici 2030, à un TCAC de 11,2 %, et que le marché portugais des systèmes d'antennes distribuées (DAS) devrait atteindre la valeur de 59 434,92 millions USD d'ici 2030, à un TCAC de 8,5 % au cours de la période de prévision. Le rapport sur le marché des systèmes d'antennes distribuées (DAS) couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers, prix en USD |

|

Segments couverts |

Offre (matériel et services), couverture (intérieure et extérieure), propriété (opérateur, hôte neutre et entreprise), technologie (opérateur Wi-Fi et petites cellules), installation utilisateur (> 500 000 pi2, 200 000 à 500 000 pi2, < 200 000 pi2), verticale (commerciale, sécurité publique) |

|

Pays couverts |

Espagne et Portugal |

|

Acteurs du marché couverts |

TE Connectivity (Suisse), ATC TRS V LLC. (États-Unis), Corning Incorporated. (États-Unis), Cellnex (Espagne), AT&T (États-Unis), Comba Telecom Systems Holdings Ltd (Chine), HUBER+SUHNER (Suisse), Anixter Inc. (États-Unis), DigitalBridge Group (États-Unis), Inc, Axians (Allemagne), Honeywell International Inc (États-Unis), CommScope, Inc. (États-Unis), Harris Communications (États-Unis), JMA Wireless (États-Unis), entre autres. |

Définition du marché

Le système d'antennes distribuées (DAS) désigne la conception, l'installation et la maintenance d'un réseau d'antennes interconnectées utilisées pour améliorer la couverture et la capacité de communication sans fil dans les environnements intérieurs ou extérieurs. Un DAS est un réseau d'antennes réparties de manière stratégique dans une zone donnée pour améliorer la puissance et la qualité du signal pour les appareils mobiles, tels que les smartphones , les tablettes et autres appareils sans fil.

La technologie DAS est couramment utilisée dans divers environnements où une connectivité sans fil fiable et de haute qualité est essentielle, notamment les grands bâtiments, les stades, les aéroports, les hôpitaux, les centres commerciaux, les campus et autres lieux publics. Elle offre une solution efficace pour relever les défis liés à la mauvaise couverture sans fil, aux zones mortes et aux limitations de capacité dans les zones encombrées.

Dynamique du marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

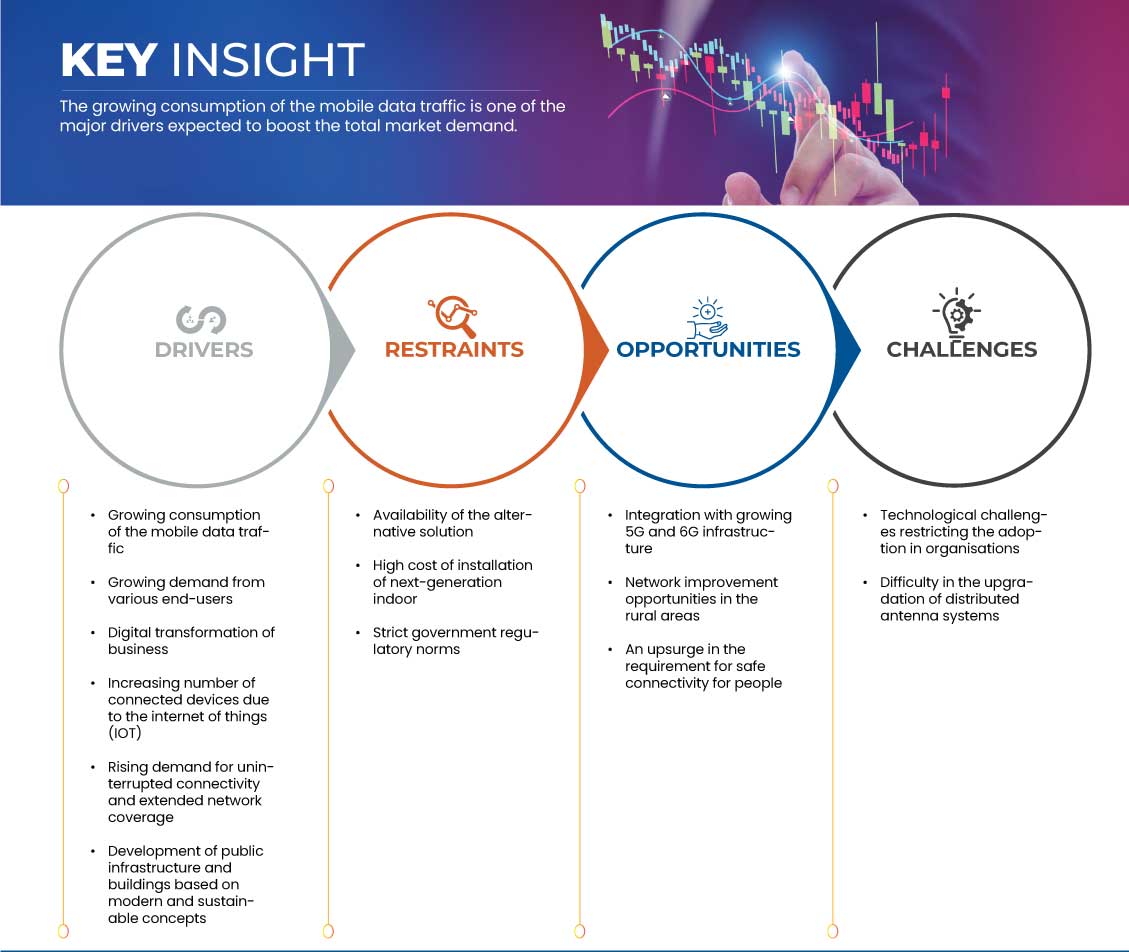

Conducteurs

- Demande croissante des différents utilisateurs finaux

La demande croissante des différents types d'utilisateurs alimente l'expansion du marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal. Alors que de plus en plus de personnes dépendent des données mobiles, des secteurs tels que les télécommunications, les entreprises, les lieux publics, les établissements de santé et les transports ont besoin d'une meilleure couverture et d'une meilleure capacité de réseau. Les systèmes DAS offrent une solution en améliorant la connectivité dans les zones très fréquentées et en garantissant une communication sans fil fiable. Cette demande croissante de la part d'utilisateurs divers favorise l'adoption de la technologie DAS, ce qui conduit à une croissance du marché et à des expériences sans fil améliorées pour tous.

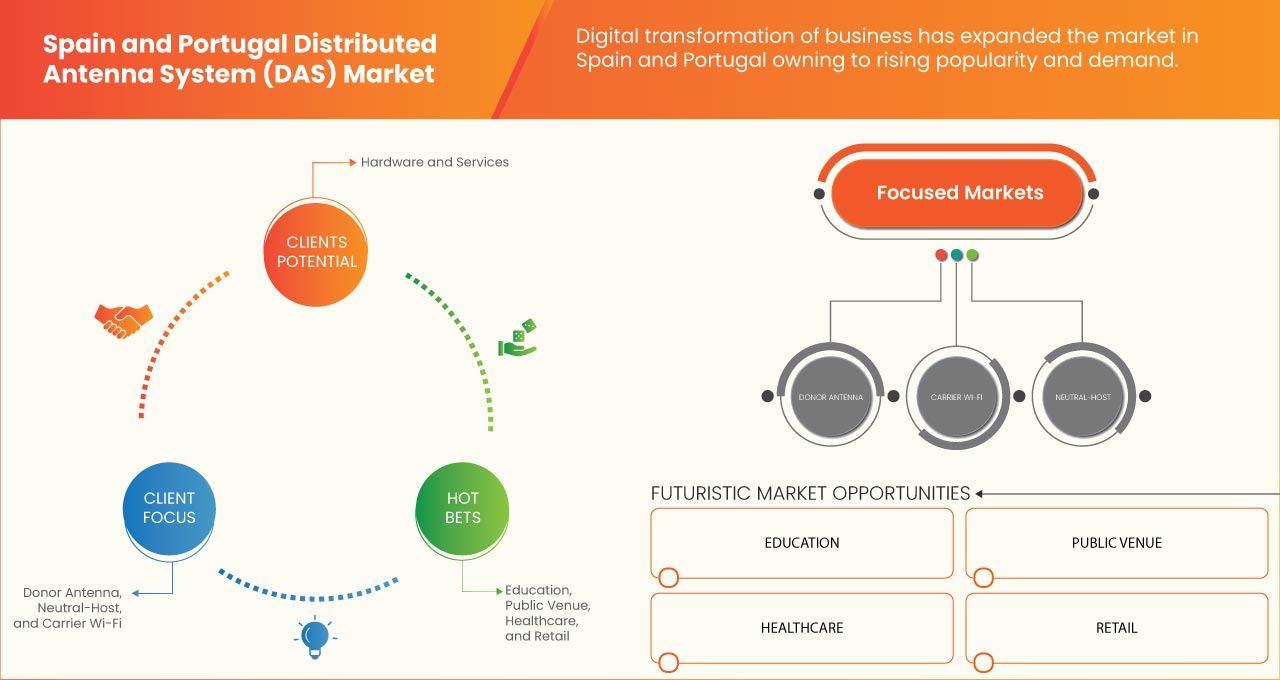

- Transformation numérique des entreprises

La transformation numérique des entreprises devient la tendance essentielle dans les scénarios actuels, car elle réduit les délais de traitement, améliore la sécurité et, surtout, le service aux clients. Les entreprises améliorent leur infrastructure informatique pour répondre aux nouveaux besoins d'analyse, de gestion et de stockage des données. Les clients deviennent de plus en plus férus de technologie, car la technologie offre une facilité d'utilisation. Les entreprises investissent dans l'adoption de la technologie numérique pour répondre à ce besoin émergent de services technologiques avancés. Pour garantir la sécurité tout en transformant l'entreprise, les entreprises créent une demande pour la solution de connectivité réseau avancée pour le transfert de données, ce qui stimule la croissance du marché. Les entreprises adoptent la technologie DAS pour améliorer la communication interne et la connectivité pour le transfert de données.

Opportunité

- Possibilités d'amélioration du réseau dans les zones rurales

Les zones rurales évoluent vers la numérisation à l'échelle mondiale, ce qui crée une opportunité majeure pour le marché d'accroître son empreinte et sa présence. L'adoption croissante des services Internet à haut débit ouvre une formidable opportunité aux acteurs du marché de proposer des solutions avancées. Certains acteurs du marché, tels qu'AT & T et Corning Corporation, investissent massivement dans les zones rurales pour améliorer le service réseau grâce aux systèmes d'antennes distribuées (DAS). Nextivity présente Cel-FI QUATRA, la technologie hybride DAS active et d'autres.

Contraintes/Défis

- Disponibilité de la solution alternative

Les systèmes d'antennes distribuées (DAS) attirent le marché en offrant une connectivité réseau avancée avec une couverture à grande vitesse et à large portée. Cependant, ils présentent certaines limitations ou facteurs restrictifs, tels que le coût élevé, en raison duquel certaines entreprises proposent de nouvelles solutions alternatives aux clients. Les nouvelles technologies développées par les acteurs du marché alternatifs, telles que les amplificateurs de signal, les systèmes intérieurs de nouvelle génération et autres, constituent l'un des principaux obstacles à la croissance du marché. Les concurrents de substitution du marché introduisent des technologies avancées pour les clients, ce qui freine la croissance du marché.

- Défis technologiques limitant l'adoption dans les organisations

Le système d'antenne distribuée (DAS) gagne en popularité en raison de la connectivité améliorée offerte par la technologie, principalement pour les applications à l'intérieur des bâtiments. Le système DAS offre une solution puissante au marché pour améliorer la connectivité du réseau, mais présente encore certains défis techniques à surmonter. Le nombre croissant d'antennes offre une excellente couverture avec des bandes à haut débit, mais cela augmente le prix et crée un impact visuel plus important. Les acteurs du marché proposent la solution mais ont certaines restrictions ou limitations, telles que le backhaul, la mise à niveau et autres. Ces défis techniques entraînent le coût élevé du système et la complexité pour les clients.

Développements récents

- En juillet 2023, TE Connectivity a été nommée dans le top 10 du classement 2023 des meilleurs lieux de travail pour les innovateurs de Fast Company, mettant en avant sa culture mondiale conçue pour responsabiliser les équipes et favoriser les avancées technologiques. Cela a aidé l'entreprise à consolider sa réputation de leader mondial dans l'autonomisation des équipes et l'avancement des tendances technologiques, en attirant les meilleurs talents et en favorisant une culture de l'innovation.

- En juin 2023, Cellnex a considérablement amélioré sa notation de risque ESG, en obtenant la deuxième position dans le secteur des télécommunications et en obtenant une note de 11,2 points, indiquant un risque plus faible. L'entreprise a réduit son risque ESG de 55 % depuis 2018, se positionnant comme l'une des principales entreprises mondiales en matière de développement durable. Cette réalisation réaffirme l'engagement de Cellnex en faveur du développement durable et ses efforts constants pour améliorer sa performance ESG.

Portée du marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal

Le marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal est segmenté en fonction de l'offre, de la couverture, de la propriété, de la technologie, des installations pour les utilisateurs et du secteur vertical. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Matériel

- Services

Sur la base de l'offre, le marché des systèmes d'antennes distribuées (DAS) d'Espagne et du Portugal est segmenté en matériel et services.

Couverture

- Intérieur

- De plein air

Sur la base de la couverture, le marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal est segmenté en intérieur et en extérieur.

Possession

- Transporteur

- Hôte neutre

- Entreprise

Sur la base de la propriété, le marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal est segmenté en opérateur, hôte neutre et entreprise.

Technologie

- Opérateur Wi-Fi

- Petites cellules

Sur la base de la technologie, le marché des systèmes d'antennes distribuées (DAS) d'Espagne et du Portugal est segmenté en Wi-Fi opérateur et petites cellules.

Facilité d'utilisation

- >500 000 pi2

- 200 000 à 500 000 pi2

- <200 000 pi2

Sur la base des capacités des utilisateurs, le marché des systèmes d'antennes distribuées (DAS) d'Espagne et du Portugal est segmenté en > 500 000 FT2, 200 000-500 000 FT2 et < 200 000 FT2.

Verticale

- Commercial

- Sécurité publique

Sur la base de la verticale, le marché des systèmes d'antennes distribuées (DAS) d'Espagne et du Portugal est segmenté en sécurité commerciale et publique.

Analyse/perspectives du marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal

Le marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal est analysé, et des informations sur la taille et les tendances du marché sont fournies par offre, couverture, propriété, technologie, installation utilisateur et verticale.

Les pays couverts par le rapport sur le marché des systèmes d’antennes distribuées (DAS) sont l’Espagne et le Portugal.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques espagnoles et portugaises et les défis rencontrés en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal

Le paysage concurrentiel du marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal fournit des détails par concurrent. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Espagne et au Portugal, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal.

Certains des principaux acteurs opérant sur le marché des systèmes d'antennes distribuées (DAS) en Espagne et au Portugal sont TE Connectivity, ATC TRS V LLC., Corning Incorporated., Cellnex, AT&T, Comba Telecom Systems Holdings Ltd, HUBER+SUHNER, Anixter Inc., DigitalBridge Group, Inc, Axians, Honeywell International Inc, CommScope, Inc., Harris Communications, JMA Wireless.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 OFFERING LIFE-LINE CURVE

2.11 MARKET TECHNOLOGY COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET INFORMATION REGARDING MULTI-OPERATOR ACTIVE DAS AND ITS OPPORTUNITIES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC

6.1.2 GROWING DEMAND FROM VARIOUS END-USERS

6.1.3 DIGITAL TRANSFORMATION OF BUSINESS

6.1.4 INCREASING NUMBER OF CONNECTED DEVICES DUE TO THE INTERNET OF THINGS (IOT)

6.1.5 RISING DEMAND FOR UNINTERRUPTED CONNECTIVITY AND EXTENDED NETWORK COVERAGE

6.1.6 DEVELOPMENT OF PUBLIC INFRASTRUCTURE AND BUILDINGS BASED ON MODERN AND SUSTAINABLE CONCEPTS

6.2 RESTRAINTS

6.2.1 AVAILABILITY OF THE ALTERNATIVE SOLUTION

6.2.2 HIGH COST OF INSTALLATION OF NEXT-GENERATION INDOOR

6.2.3 STRICT GOVERNMENT REGULATORY NORMS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION WITH GROWING 5G AND 6G INFRASTRUCTURE

6.3.2 NETWORK IMPROVEMENT OPPORTUNITIES IN THE RURAL AREAS

6.3.3 AN UPSURGE IN THE REQUIREMENT FOR SAFE CONNECTIVITY FOR PEOPLE

6.4 CHALLENGES

6.4.1 TECHNOLOGICAL CHALLENGES RESTRICTING THE ADOPTION IN ORGANISATIONS

6.4.2 DIFFICULTY IN THE UPGRADATION OF DISTRIBUTED ANTENNA SYSTEMS

7 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 ANTENNA NODES/ RADIO NODES

7.2.2 DONOR ANTENNA

7.2.3 BIDIRECTIONAL AMPLIFIERS

7.2.4 RADIO UNITS

7.2.5 HEAD END UNITS

7.2.6 OTHERS

7.3 SERVICES

7.3.1 INSTALLATION SERVICES

7.3.2 PRE-SALES SERVICES

7.3.3 POST-INSTALLATION SERVICES

8 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE

8.1 OVERVIEW

8.2 INDOOR

8.2.1 PASSIVE

8.2.2 ACTIVE

8.2.3 HYBRID

8.2.4 OTHERS

8.3 OUTDOOR

9 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP

9.1 OVERVIEW

9.2 NEUTRAL HOST

9.3 CARRIER

9.4 ENTERPRISE

10 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 CARRIER WI-FI

10.3 SMALL CELLS

11 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY

11.1 OVERVIEW

11.2 >500K FT2

11.3 200K–500K FT2

11.4 <200K FT2

12 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 COMMERCIAL

12.2.1 PUBLIC VENUE

12.2.2 AIRPORTS AND TRANSPORTATION

12.2.3 ENTERPRISES

12.2.3.1 LARGE ENTERPRISES

12.2.3.2 SMALL AND MEDIUM ENTERPRISES

12.2.4 INDUSTRIAL

12.2.5 RETAIL

12.2.6 GOVERNMENT

12.2.7 HOSPITALITY

12.2.8 HEALTHCARE

12.2.9 EDUCATION

12.2.10 SHIPS

12.3 PUBLIC SAFETY

13 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SPAIN

13.2 COMPANY SHARE ANALYSIS: PORTUGAL

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 TE CONNECTIVITY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ATC IP LLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 SERVICE PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 CORNING INCORPORATED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 APPLICATION PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 CELLNEX

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 AT&T

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ANIXTER INC. (A SUBSIDIARY OF WESCO INTERNATIONAL, INC.)

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SOLUTION PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 AXIANS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 COMBA TELECOM SYSTEMS HOLDINGS LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 COMMSCOPE, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 DIGITALBRIDGE GROUP, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 BRAND PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 HARRIS COMMUNICATIONS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HONEYWELL INTERNATIONAL INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 HUBER+SUHNER

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 JMA WIRELESS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 2 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 3 SPAIN HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 PORTUGAL HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 SPAIN SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 PORTUGAL SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2021-2030 (USD THOUSAND)

TABLE 8 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2021-2030 (USD THOUSAND)

TABLE 9 SPAIN INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 PORTUGAL INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2021-2030 (USD THOUSAND)

TABLE 12 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2021-2030 (USD THOUSAND)

TABLE 13 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 14 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 15 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2021-2030 (USD THOUSAND)

TABLE 16 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2021-2030 (USD THOUSAND)

TABLE 17 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 18 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 19 SPAIN COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 PORTUGAL COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 SPAIN ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 PORTUGAL ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 2 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DATA TRIANGULATION

FIGURE 3 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DROC ANALYSIS

FIGURE 4 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 6 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET:

FIGURE 11 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET:

FIGURE 12 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MULTIVARIATE MODELLING

FIGURE 13 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: THE OFFERING LIFE-LINE CURVE

FIGURE 14 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: THE OFFERING LIFE-LINE CURVE

FIGURE 15 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET TECHNOLOGY COVERAGE GRID

FIGURE 16 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET TECHNOLOGY COVERAGE GRID

FIGURE 17 SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: SEGMENTATION

FIGURE 18 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC IS EXPECTED TO DRIVE SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 19 GROWING DEMAND FROM THE VARIOUS END USERS IS EXPECTED TO DRIVE PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 20 THE HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN 2023 AND 2030

FIGURE 21 THE HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF PORTUGUAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN 2023 AND 2030

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SPAIN AND PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 23 EASE OF DOING BUSINESS IN SPAIN DUE TO DIGITAL TRANSFORMATION

FIGURE 24 EASE OF DOING BUSINESS IN PORTUGAL DUE TO DIGITAL TRANSFORMATION

FIGURE 25 INDIVIDUALS USING THE INTERNET (% OF POPULATION) - SPAIN

FIGURE 26 INDIVIDUALS USING THE INTERNET (% OF POPULATION) – PORTUGAL

FIGURE 27 INCREASING URBAN POPULATION– SPAIN

FIGURE 28 INCREASING URBAN POPULATION– PORTUGAL

FIGURE 29 DISTRIBUTED ANTENNA SYSTEM (DAS) COST, USD

FIGURE 30 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING, 2022

FIGURE 31 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING, 2022

FIGURE 32 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COVERAGE, 2022

FIGURE 33 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COVERAGE, 2022

FIGURE 34 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OWNERSHIP, 2022

FIGURE 35 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OWNERSHIP, 2022

FIGURE 36 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY TECHNOLOGY, 2022

FIGURE 37 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY TECHNOLOGY, 2022

FIGURE 38 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY USER FACILITY, 2022

FIGURE 39 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY USER FACILITY, 2022

FIGURE 40 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY VERTICAL, 2022

FIGURE 41 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY VERTICAL, 2022

FIGURE 42 SPAIN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: 2022 (%)

FIGURE 43 PORTUGAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.