Marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses, par type de bâtiment (commercial et industriel), taille du bâtiment (bâtiments de petite taille (20 000 à 50 000 pieds carrés), bâtiments de taille moyenne (50 001 à 70 000 pieds carrés), bâtiments de grande taille (plus de 70 000 pieds carrés)), matériau de construction (acier, aluminium et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses

Le marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses est en pleine croissance. La rentabilité et l'efficacité du temps devraient stimuler la croissance du marché. De plus, les progrès technologiques et les innovations en matière de conception et de matériaux stimulent les progrès dans le secteur de la construction et devraient stimuler la croissance du marché. Cependant, le coût associé au transport des modules préfabriqués devrait constituer un défi pour la croissance du marché, ce qui devrait freiner la croissance du marché.

Data Bridge Market Research analyse que le marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses devrait atteindre la valeur de 2 490,94 millions USD d'ici 2030, à un TCAC de 8,4 % au cours de la période de prévision 2023-2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (Personnalisable 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type de bâtiment (commercial et industriel), taille du bâtiment (bâtiments de petite taille (20 000 à 50 000 pieds carrés), bâtiments de taille moyenne (50 001 à 70 000 pieds carrés), bâtiments de grande taille (plus de 70 000 pieds carrés)), matériau de construction (acier, aluminium et autres) |

|

Pays couverts |

Floride, Caroline du Nord, Géorgie, Virginie, Tennessee, Caroline du Sud, Louisiane, Alabama, Mississippi et Virginie-Occidentale, Colorado, Utah, Montana, Wyoming, Idaho et Nouveau-Mexique |

|

Acteurs du marché couverts |

Nucor Corporation, Cornerstone Building Brands, Inc., ATCO LTD., Allied Builders, Stevens, Wollam Construction, JB STEEL, BlueScope Buildings North America, Mountain State Construction, AA Metal Buildings, Sunward Steel Buildings, Whirlwind Steel, CanAm Steel Buildings, Pluma Construction Systems Steel Buildings, Federal Steel Systems, DFB Buildings, Great Western Building Systems, Schulte Building Systems, Inc, Pacific Building Systems et entre autres |

Définition du marché

Les bâtiments préfabriqués (BPE) sont un type de solution de construction caractérisée par l'utilisation de composants structurels préfabriqués et préconçus. Ces composants, notamment les colonnes, les poutres, les fermes de toit, les panneaux muraux et d'autres éléments, sont fabriqués hors site dans une usine ou une usine de fabrication. Ils sont ensuite transportés sur le chantier où ils sont assemblés et érigés pour créer la structure finale du bâtiment.

Dynamique du marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Devenant de plus en plus des facteurs essentiels dans le secteur de la construction, la rentabilité et l'efficacité du temps deviennent des forces motrices de plus en plus importantes

L’importance croissante des facteurs moteurs dans le secteur de la construction, tels que la rentabilité et le gain de temps, devrait stimuler considérablement la croissance du marché. Ces facteurs remodèlent le secteur de la construction en proposant des solutions pratiques pour répondre aux défis urgents de la réduction des coûts et de l’accélération des délais des projets. Les bâtiments préfabriqués offrent des avantages distincts en termes de rentabilité et de gain de temps par rapport aux méthodes de construction traditionnelles. Les structures préfabriquées sont conçues et fabriquées hors site, ce qui permet une planification précise et minimise le gaspillage de matériaux.

Cela se traduit par une réduction des coûts de construction, car les constructeurs peuvent acheter des matériaux en gros et rationaliser le processus de construction. De plus, les composants préfabriqués sont conçus pour un assemblage rapide, ce qui réduit considérablement les besoins en main-d'œuvre sur site et les coûts associés. En revanche, les méthodes de construction traditionnelles impliquent souvent une planification longue, une fabrication sur mesure et une construction complexe sur site, ce qui peut entraîner des dépenses plus élevées en raison des délais de projet prolongés et des travaux à forte intensité de main-d'œuvre. La nature rentable des bâtiments préfabriqués, combinée à leur processus de construction accéléré, en fait un choix convaincant pour les projets où les contraintes de budget et de temps sont des considérations essentielles.

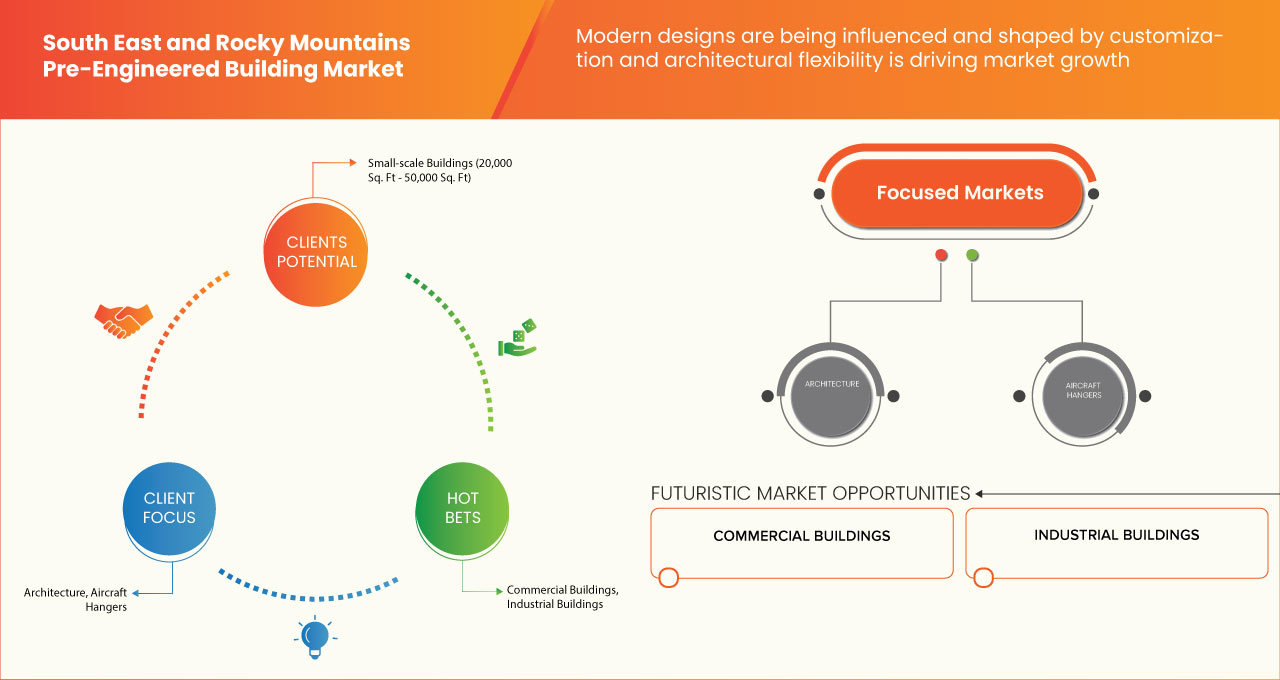

- Les conceptions modernes sont influencées et façonnées par la personnalisation et la flexibilité architecturale

La personnalisation et la polyvalence architecturale jouent un rôle essentiel dans la conception des designs modernes et sont sur le point de stimuler la croissance du marché. Cette tendance reflète un changement fondamental dans les préférences en matière de construction, motivé par des facteurs tels que l'esthétique, la fonctionnalité et la rentabilité.

La personnalisation des bâtiments préfabriqués permet aux architectes et aux constructeurs de répondre aux besoins uniques de diverses industries et entreprises. Ces structures peuvent être adaptées pour s'adapter à des fonctions et préférences de conception spécifiques, ce qui les rend hautement adaptables à un large éventail d'applications. Par exemple, la région du Sud-Est nécessite souvent des bâtiments capables de résister aux ouragans et à une forte humidité, tandis que la région des montagnes Rocheuses exige des structures capables de supporter de lourdes charges de neige. La personnalisation garantit que les PEB peuvent répondre efficacement à ces divers défis climatiques et environnementaux. En outre, la polyvalence architecturale joue un rôle clé pour répondre aux exigences de conception moderne. Les systèmes de construction préfabriqués ont évolué pour offrir un large éventail d'options esthétiques, notamment divers matériaux de revêtement, couleurs et finitions.

Cette polyvalence permet aux architectes et aux concepteurs de créer des structures visuellement attrayantes qui correspondent à l'identité de marque et à la vision architecturale de leur client. De plus, les PEB peuvent intégrer des caractéristiques architecturales telles que de grandes fenêtres, des puits de lumière et des mezzanines, améliorant encore leur attrait esthétique et leur fonctionnalité. La rentabilité est un autre facteur essentiel qui favorise l'adoption de bâtiments préfabriqués personnalisables et polyvalents sur le plan architectural. Les PEB permettent souvent de raccourcir les délais de projet et de réduire les coûts de main-d'œuvre en rationalisant le processus de conception et de construction. De plus, la possibilité de personnaliser les tailles et les caractéristiques des bâtiments optimise l'utilisation de l'espace, réduisant ainsi la surface gaspillée et, par conséquent, le coût global de la construction.

- Les changements rapides dans le développement urbain et la croissance industrielle subissent une transformation rapide

La transformation rapide de l'urbanisation et de l'industrialisation devrait stimuler la croissance du marché. Plusieurs facteurs contribuent à cette influence significative du marché.

L'accélération du rythme d'urbanisation dans les régions du Sud-Est et des Rocheuses entraîne une demande accrue d'infrastructures et d'espaces commerciaux. La demande de solutions de construction efficaces, économiques et rapides augmente à mesure que les villes s'étendent et que la population augmente. Les PEB offrent une solution idéale en raison de leur rapidité de construction, de leur polyvalence et de leur prix abordable. Des industries allant de la fabrication à l'entreposage, en passant par la logistique et l'immobilier commercial, se tournent de plus en plus vers les PEB pour répondre à leurs besoins de construction. Cette tendance devrait entraîner une croissance substantielle du marché. En outre, l'industrialisation de ces régions favorise le développement de diverses industries, notamment la fabrication, l'énergie et la logistique. Ces industries ont besoin de grands espaces conçus sur mesure qui peuvent être rapidement érigés pour accueillir leurs opérations. Les PEB sont bien adaptés à ces fins, car ils peuvent être adaptés pour répondre à des exigences industrielles spécifiques, notamment des conceptions à portée libre pour un espace au sol dégagé et la capacité d'abriter des machines et des équipements lourds. L'industrialisation croissante devrait augmenter considérablement la demande de PEB en tant qu'installations industrielles.

Opportunités

- Les progrès technologiques et les innovations en matière de conception et de matériaux stimulent le progrès dans le secteur de la construction

Les avancées technologiques et les innovations en matière de conception et de matériaux sont sur le point de créer d’importantes opportunités de croissance du marché. Ces avancées représentent un changement radical dans le secteur de la construction et offrent une gamme d’avantages qui séduisent à la fois les constructeurs et les clients. L’une des principales opportunités réside dans l’amélioration de l’efficacité et de la rapidité de la construction grâce à des systèmes de construction préfabriqués. Les logiciels de conception avancés, la fabrication assistée par ordinateur (FAO) et la modélisation des informations du bâtiment (BIM) ont révolutionné la façon dont les bâtiments préfabriqués sont conçus et fabriqués. Cela se traduit par des délais de projet plus rapides, des coûts de main-d’œuvre réduits et une précision accrue pendant la construction, ce qui séduit les développeurs et les entrepreneurs qui souhaitent terminer leurs projets plus rapidement et à moindre coût.

Les innovations en matière de conception ont également élargi les possibilités architecturales des bâtiments préfabriqués. Historiquement associés aux structures utilitaires, les bâtiments préfabriqués intègrent désormais des options de conception polyvalentes, permettant des solutions plus esthétiques et personnalisées. Cette évolution élargit l'attrait du marché, car les bâtiments préfabriqués deviennent un choix viable pour une plus large gamme d'applications, notamment les projets commerciaux, industriels et même résidentiels. Dans le secteur commercial, ils comprennent des entrepôts pour un stockage efficace, des espaces de vente au détail, des immeubles de bureaux modernes, des salles d'exposition et des installations de loisirs. Dans les environnements industriels, les structures préfabriquées abritent des usines de fabrication, des centres de distribution, des ateliers, des installations agricoles et des unités de stockage frigorifique, optimisant ainsi les processus de production et de stockage.

Contraintes/Défis

- Les coûts associés au transport des modules préfabriqués sont sujets à fluctuation

Les bâtiments préfabriqués sont l'une des formes de construction les plus rapides et les plus uniques, car la plupart des travaux sont réalisés hors site. Ensuite, les modules sont transportés avec soin et assemblés sur place. Les bâtiments préfabriqués deviennent rapidement la méthode de construction préférée dans le monde entier. Les gens du monde entier se sont tournés vers la construction préfabriquée en raison de sa rentabilité, de son efficacité et de la sécurité associée aux travailleurs. Le transport de sections de bâtiments modulaires préfabriqués nécessite beaucoup d'espace. Les restrictions sur la fabrication et le transport peuvent limiter la taille des unités modulaires utilisées pour la construction, ce qui a un impact sur les tailles de pièces souhaitables. L'évolution des coûts de transport des modules préfabriqués peut considérablement freiner la croissance du marché.

- Pénurie de main d'oeuvre qualifiée

Les méthodes de construction de bâtiments préfabriqués deviennent progressivement une alternative recherchée aux méthodes traditionnelles de construction sur site, ce qui permet de minimiser le travail sur site et de maximiser le rendement et la livraison plus rapide du projet. Le principal avantage des bâtiments préfabriqués par rapport à la méthode de construction traditionnelle est l'amélioration de la qualité du produit construit, le maintien et le soutien d'une construction durable et plus écologique en réduisant la production de déchets.

Le principal défi auquel le marché est confronté est le manque de main-d’œuvre qualifiée dans l’industrie, ce qui freine dans une large mesure la croissance du marché. Une main-d’œuvre non qualifiée a un impact négatif sur la performance des projets. L’accent doit être mis sur l’amélioration et le renforcement des compétences de la main-d’œuvre, car elles sont très demandées dans le secteur de la construction. La performance dans n’importe quel secteur est importante pour atteindre les mesures visant à assurer la durabilité et la compétitivité

Développements récents

- En août 2023, Cornerstone Building Brands, Inc., le plus grand fabricant de produits de construction extérieurs en Amérique du Nord, a acquis MAC Metal Architectural, une entreprise basée à Saint-Hubert, au Québec, spécialisée dans les produits de revêtement et de toiture en acier haut de gamme pour les marchés résidentiels et commerciaux en Amérique du Nord. Cette acquisition vise à élargir le portefeuille de produits extérieurs de Cornerstone Building Brands, en particulier dans le segment en pleine croissance des revêtements et toitures métalliques, en renforçant sa présence sur le marché et en tirant parti de son expertise en matière de fabrication. L'acquisition devrait apporter des avantages grâce à l'expansion des marges, à l'augmentation de la part de marché et à l'efficacité de la fabrication.

- En septembre 2023, ATCO LTD. a publié son rapport de développement durable 2022 mettant en évidence la durabilité et la performance environnementale, sociale et de gouvernance (ESG) de l'entreprise, y compris les stratégies, les initiatives, les objectifs et les mesures. Le rapport se concentre sur la transition vers une énergie à faible émission de carbone; le changement climatique et la gestion de l'environnement; la fiabilité et la résilience opérationnelles; les relations avec la communauté et les autochtones; la diversité, l'équité et l'inclusion; et la sécurité. Cela aidera l'entreprise à attirer une large base de consommateurs.

Portée du marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses

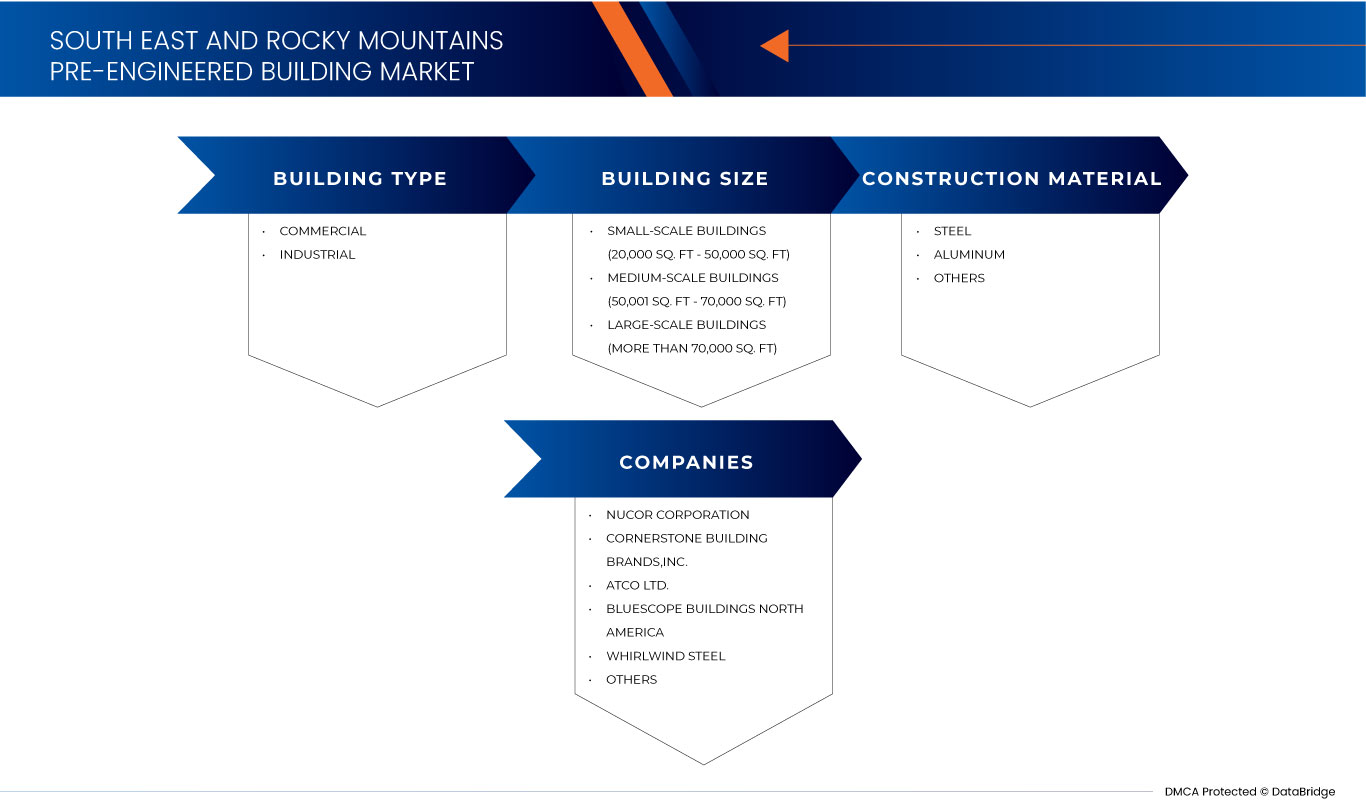

Le marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses est classé en trois segments notables par type de bâtiment, taille du bâtiment et matériau de construction. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de bâtiment

- Commercial

- Industriel

En fonction du type de bâtiment, le marché est segmenté en commercial et industriel.

Taille du bâtiment

- Bâtiments de petite taille (20 000 à 50 000 pieds carrés)

- Bâtiments de taille moyenne (50 001 à 70 000 pieds carrés)

- Bâtiments de grande taille (plus de 70 000 pieds carrés)

Sur la base de la taille du bâtiment, le marché est segmenté en bâtiments de petite taille (20 000 à 50 000 pieds carrés), bâtiments de taille moyenne (50 001 à 70 000 pieds carrés) et bâtiments de grande taille (plus de 70 000 pieds carrés).

Matériaux de construction

- Acier

- Aluminium

- Autres

Sur la base des matériaux de construction, le marché est segmenté en acier, aluminium et autres.

Analyse et aperçu du marché régional des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses

Le marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses est classé en trois segments notables par type de bâtiment, taille du bâtiment et matériau de construction.

Les États couverts par le rapport sur le marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses sont la Floride, la Caroline du Nord, la Géorgie, la Virginie, le Tennessee, la Caroline du Sud, la Louisiane, l'Alabama, le Mississippi et la Virginie-Occidentale, le Colorado, l'Utah, le Montana, le Wyoming, l'Idaho et le Nouveau-Mexique.

Le Sud-Est devrait dominer en raison de la présence d'acteurs clés du marché sur le plus grand marché de consommation avec un PIB élevé. La Floride devrait croître en raison de la hausse de la demande de bâtiments préfabriqués dans le segment commercial.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses

Le paysage concurrentiel du marché des bâtiments préfabriqués du Sud-Est et des Rocheuses fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des bâtiments préfabriqués du Sud-Est et des Rocheuses.

Certains des principaux acteurs opérant dans le secteur des bâtiments préfabriqués du Sud-Est et des montagnes Rocheuses sont Nucor Corporation, Cornerstone Building Brands, Inc., ATCO LTD., Allied Builders, Stevens, Wollam Construction, JB STEEL, BlueScope Buildings North America, Mountain State Construction, AA Metal Buildings, Sunward Steel Buildings, Whirlwind Steel, CanAm Steel Buildings, Pluma Construction Systems Steel Buildings, Federal Steel Systems, DFB Buildings, Great Western Building Systems, Schulte Building Systems, Inc, Pacific Building Systems et entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASINGLY BECOMING PIVOTAL FACTORS IN THE CONSTRUCTION INDUSTRY, COST-EFFECTIVENESS AND TIME EFFICIENCY ARE GAINING PROMINENCE AS DRIVING FORCES

5.1.2 MODERN DESIGNS ARE BEING INFLUENCED AND SHAPED BY CUSTOMIZATION AND ARCHITECTURAL FLEXIBILITY

5.1.3 SWIFT CHANGES IN URBAN DEVELOPMENT AND INDUSTRIAL GROWTH ARE UNDERGOING A RAPID TRANSFORMATION

5.2 RESTRAINT

5.2.1 THE COSTS ASSOCIATED WITH TRANSPORTING PREFABRICATED MODULES ARE SUBJECT TO FLUCTUATION

5.3 OPPORTUNITY

5.3.1 ADVANCES IN TECHNOLOGY AND INNOVATIONS IN DESIGN AND MATERIALS ARE DRIVING PROGRESS IN THE CONSTRUCTION SECTOR

5.4 CHALLENGE

5.4.1 A SCARCITY OF SKILLED WORKFORCE

6 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE

6.1 OVERVIEW

6.1.1 SMALL-SCALE BUILDINGS (20,000 SQ. FT - 50,000 SQ. FT)

6.1.2 MEDIUM-SCALE BUILDINGS (50,001 SQ. FT - 70,000 SQ. FT)

6.1.3 LARGE-SCALE BUILDINGS (MORE THAN 70,000 SQ. FT)

7 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE

7.1 OVERVIEW

7.2 INDUSTRIAL

7.2.1 INDUSTRIAL, BY TYPE

7.2.1.1 MANUFACTURING

7.2.1.1.1 MEDIUM-SCALE BUILDINGS (50,001 SQ. FT - 70,000 SQ. FT)

7.2.1.1.2 SMALL-SCALE BUILDINGS (20,000 SQ. FT - 50,000 SQ. FT))

7.2.1.1.3 LARGE-SCALE BUILDINGS (MORE THAN 70,000 SQ. FT)

7.2.1.2 HEAVY INDUSTRIES

7.2.1.3 PROCESSING

7.2.1.4 OTHERS

7.2.2 INDUSTRIAL, BY BUILDING SIZE

7.2.2.1 MEDIUM-SCALE BUILDINGS (50,001 SQ. FT - 70,000 SQ. FT)

7.2.2.2 SMALL-SCALE BUILDINGS (20,000 SQ. FT - 50,000 SQ. FT)

7.2.2.3 LARGE-SCALE BUILDINGS (MORE THAN 70,000 SQ. FT)

7.2.3 COMMERCIAL

7.2.4 WAREHOUSES

7.2.5 RETAIL

7.2.6 OFFICES

7.2.7 SHOWROOMS

7.2.8 OTHERS

8 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL

8.1 OVERVIEW

8.1.1 STEEL

8.1.2 ALUMINIUM

8.1.3 OTHERS

9 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY REGION

10 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: SOUTH EAST

10.2 COMPANY SHARE ANALYSIS: ROCKY MOUNTAINS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 NUCOR CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 CORNERSTONE BUILDING BRANDS, INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 ATCO LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 BLUESCOPE BUILDINGS NORTH AMERICA

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENTS

12.5 WHIRLWINDSTEEL

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT DEVELOPMENTS

12.6 AA METAL BUILDINGS

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIOS

12.6.3 RECENT DEVELOPMENTS

12.7 ALLIED BUILDERS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 CANAM STEEL BUILDINGS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 DFB BUILDINGS

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 FEDERAL STEEL SYSTEMS

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 GREAT WESTERN BUILDING SYSTEMS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 JB STEEL

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 MOUNTAINS STATE CONSTRUCTION

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 PACIFIC BUILDING SYSTEMS

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 PLUMA CONSTRUCTION SYSTEMS STEEL BUILDINGS

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 SCHULTE BUILDING SYSTEMS, INC.

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENTS

12.17 STEVENS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 SUNWARD STEEL BUILDING

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 WOLLAM CONSTRUCTION

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 SOUTH EAST PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 2 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 3 SOUTH EAST PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 4 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 5 SOUTH EAST INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 SOUTH EAST MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 8 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 9 SOUTH EAST MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 10 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 11 SOUTH EAST COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 SOUTH EAST PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 14 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 15 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 SOUTH EAST PRE-ENGINEERED BUILDING MARKET, BY STATE, 2021-2030 (USD MILLION)

TABLE 17 FLORIDA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 18 FLORIDA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 FLORIDA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 20 FLORIDA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 21 FLORIDA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 FLORIDA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 23 FLORIDA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 24 NORTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH CAROLINA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH CAROLINA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 27 NORTH CAROLINA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 28 NORTH CAROLINA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 30 NORTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 31 GEORGIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 32 GEORGIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 GEORGIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 34 GEORGIA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 35 GEORGIA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 GEORGIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 37 GEORGIA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 38 VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 39 VIRGINIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 VIRGINIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 41 VIRGINIA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 42 VIRGINIA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 44 VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 45 TENNESSEE PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 46 TENNESSEE INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 TENNESSEE INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 48 TENNESSEE MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 49 TENNESSEE COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 TENNESSEE PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 51 TENNESSEE PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 52 SOUTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 53 SOUTH CAROLINA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SOUTH CAROLINA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 55 SOUTH CAROLINA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 56 SOUTH CAROLINA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 SOUTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 58 SOUTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 59 LOUISIANA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 60 LOUISIANA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 LOUISIANA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 62 LOUISIANA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 63 LOUISIANA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 LOUISIANA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 65 LOUISIANA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 66 ALABAMA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 67 ALABAMA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 ALABAMA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 69 ALABAMA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 70 ALABAMA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 ALABAMA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 72 ALABAMA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 73 MISSISSIPPI PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 74 MISSISSIPPI INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 MISSISSIPPI INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 76 MISSISSIPPI MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 77 MISSISSIPPI COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 MISSISSIPPI PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 79 MISSISSIPPI PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 80 WEST VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 81 WEST VIRGINIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 WEST VIRGINIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 83 WEST VIRGINIA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 84 WEST VIRGINIA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 WEST VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 86 WEST VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 87 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY STATE, 2021-2030 (USD MILLION)

TABLE 88 COLORADO PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 89 COLORADO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 COLORADO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 91 COLORADO MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 92 COLORADO COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 COLORADO PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 94 COLORADO PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 95 UTAH PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 96 UTAH INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 UTAH INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 98 UTAH MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 99 UTAH COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 UTAH PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 101 UTAH PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 102 MONTANA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 103 MONTANA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 MONTANA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 105 MONTANA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 106 MONTANA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 MONTANA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 108 MONTANA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 109 WYOMING PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 110 WYOMING INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 WYOMING INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 112 WYOMING MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 113 WYOMING COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 WYOMING PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 115 WYOMING PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 116 IDAHO PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 117 IDAHO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 IDAHO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 119 IDAHO MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 120 IDAHO COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 IDAHO PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 122 IDAHO PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 123 NEW MEXICO PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 124 NEW MEXICO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 NEW MEXICO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 126 NEW MEXICO MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 127 NEW MEXICO COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 NEW MEXICO PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 129 NEW MEXICO PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: SEGMENTATION

FIGURE 2 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: DATA TRIANGULATION

FIGURE 3 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: DROC ANALYSIS

FIGURE 4 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: REGIONAL VS STATE MARKET ANALYSIS

FIGURE 5 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: REGIONAL VS STATE MARKET ANALYSIS

FIGURE 6 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: MULTIVARIATE MODELLING

FIGURE 8 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: SEGMENTATION

FIGURE 11 INCREASINGLY BECOMING PIVOTAL FACTORS IN THE CONSTRUCTION INDUSTRY, COST-EFFECTIVENESS AND TIME EFFICIENCY ARE GAINING PROMINENCE IS EXPECTED TO DRIVE THE GROWTH OF THE SOUTH EAST PRE-ENGINEERED BUILDING MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 SWIFT CHANGES IN URBAN DEVELOPMENT AND INDUSTRIAL GROWTH ARE UNDERGOING A RAPID TRANSFORMATION IS EXPECTED TO DRIVE THE GROWTH OF THE ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 13 THE INDUSTRIAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SOUTH EAST PRE-ENGINEERED BUILDING MARKET IN 2023 AND 2030

FIGURE 14 THE INDUSTRIAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET IN 2023 AND 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET

FIGURE 16 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: BY BUILDING SIZE, 2022

FIGURE 17 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: BY BUILDING SIZE, 2022

FIGURE 18 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: BY BUILDING TYPE, 2022

FIGURE 19 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: BY BUILDING TYPE, 2022

FIGURE 20 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: BY CONSTRUCTION MATERIALS, 2022

FIGURE 21 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: BY CONSTRUCTION MATERIAL, 2022

FIGURE 22 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: COMPANY SHARE 2022 (%)

FIGURE 23 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.