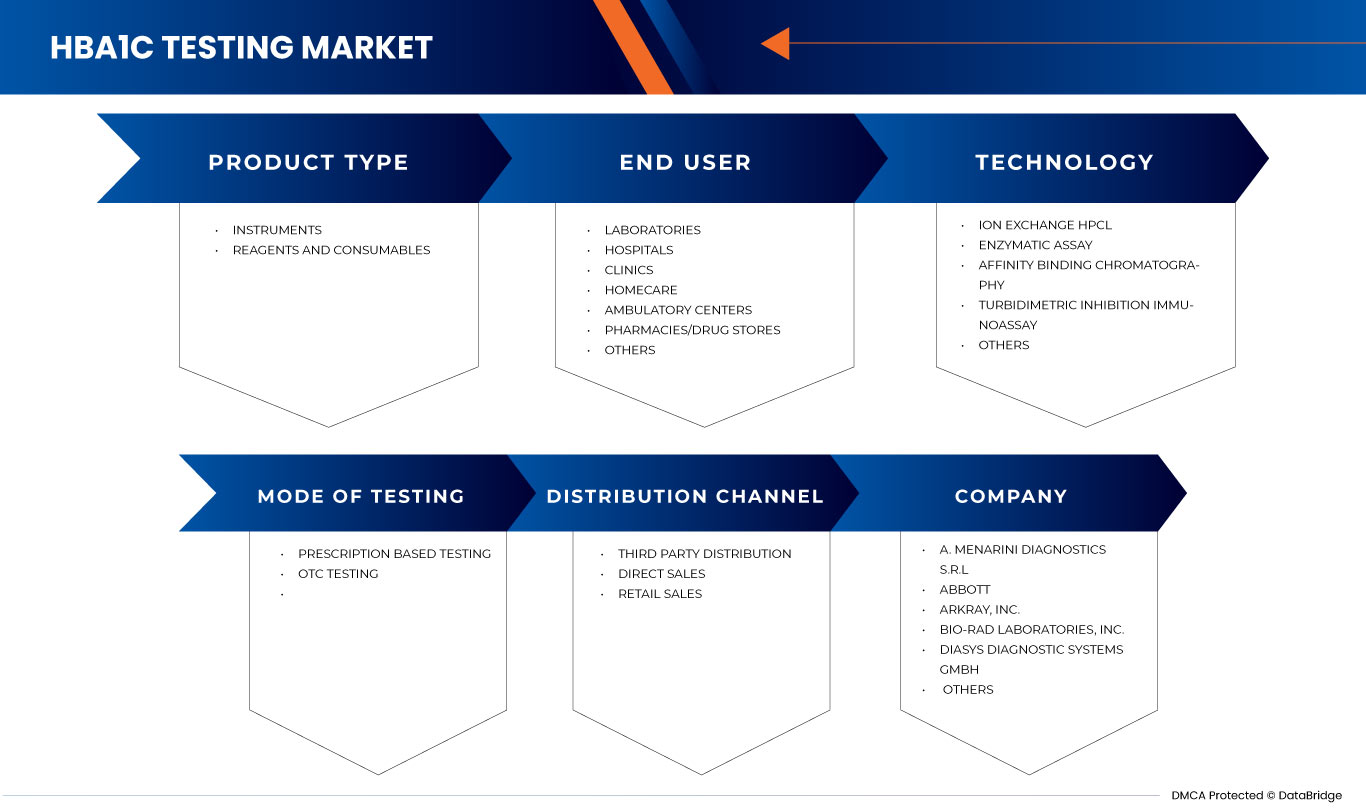

Marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte, par type de produit (instruments, réactifs et consommables), mode de test (tests sur ordonnance et tests en vente libre), technologie (HPCL à échange d'ions, dosage enzymatique, chromatographie de liaison par affinité, immuno-essai d'inhibition turbidimétrique et autres), utilisateur final (laboratoires, hôpitaux, cliniques, soins à domicile, centres ambulatoires, pharmacies/pharmacies et autres), canal de distribution (distribution par des tiers, ventes directes et ventes au détail) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte

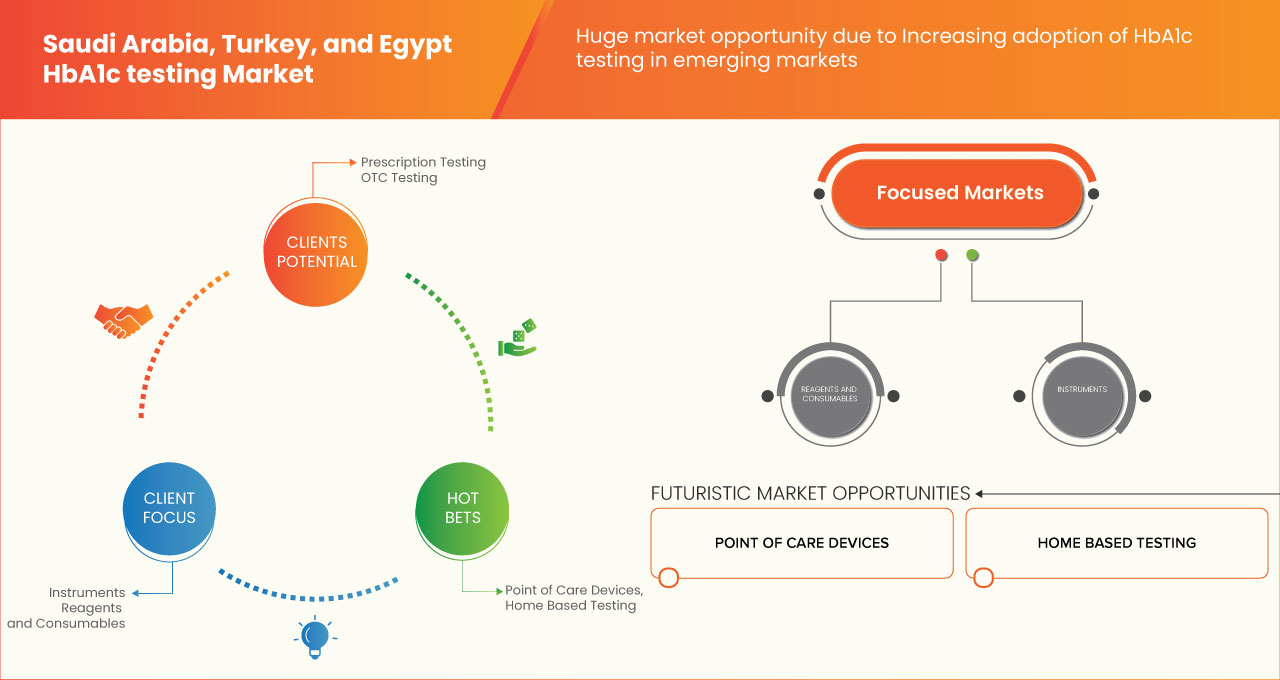

La sensibilisation croissante au diabète et aux maladies rénales a accru la demande sur le marché. L'augmentation des dépenses de santé pour de meilleurs services de santé contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent sur le lancement et l'approbation de divers services au cours de cette période cruciale. En outre, l'augmentation du nombre d'appareils de point de service améliorés pour le diabète contribue également à la demande croissante de tests de diabète ou d'HBA1C.

Data Bridge Market Research analyse que le marché des tests HbA1c devrait croître avec un TCAC de 4,4 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 61,59 millions USD d'ici 2030 en Arabie saoudite et en Turquie. Le marché des tests HbA1c devrait croître avec un TCAC de 5,4 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 73,73 millions USD d'ici 2030 en Turquie et en Égypte. Le segment des instruments devrait propulser la croissance du marché grâce au développement de technologies avancées

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type de produit (instruments, réactifs et consommables), mode de test (tests sur ordonnance et tests en vente libre), technologie (HPCL à échange d'ions, dosage enzymatique, chromatographie par liaison d'affinité, immuno-essai d'inhibition turbidimétrique et autres), utilisateur final (laboratoires, hôpitaux, cliniques, soins à domicile, centres ambulatoires, pharmacies/pharmacies et autres), canal de distribution (distribution par des tiers, ventes directes et ventes au détail), pays (Arabie saoudite, Égypte et Turquie) |

|

Pays couverts |

Arabie Saoudite, Egypte et Turquie |

|

Acteurs du marché couverts |

Certains des principaux acteurs opérant sur le marché des tests HbA1c en Arabie saoudite, en Égypte et en Turquie sont Siemens Healthcare GmbH, A. Menarini Diagnostics srl, ARKRAY, Inc., Trinity Biotech, Thermo Fisher Scientific Inc., Abbott, Wondfo, F. Hoffmann-La Roche Ltd, Ortho Clinical Diagnostics, DxGen Corp. et entre autres. |

Définition du marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte

Un test sanguin appelé test d'hémoglobine A1C (HbA1C) révèle votre taux moyen de sucre dans le sang (glucose) au cours des deux à trois derniers mois. Votre sang contient du glucose, une forme de sucre obtenue à partir des aliments que vous mangez. Le glucose fournit de l'énergie à vos cellules. L'hormone insuline facilite l'absorption du glucose par vos cellules. Si vous souffrez de diabète, votre corps produit soit une quantité insuffisante d'insuline, soit vos cellules ne l'utilisent pas correctement. En raison de l'incapacité du glucose à pénétrer dans vos cellules, votre taux de sucre dans le sang augmente.

Le diabète est une maladie endémique mondiale dont la prévalence augmente rapidement dans les pays en développement et développés. L'hémoglobine glyquée (HbA1c) comme substitut possible de la glycémie à jeun pour le diagnostic du diabète L'HbA1c est un indicateur important du contrôle glycémique à long terme avec la capacité de refléter l'historique glycémique cumulé des deux à trois mois précédents. L'HbA1c fournit une mesure fiable de l'hyperglycémie chronique et est bien corrélée au risque de complications du diabète à long terme. Une HbA1c élevée a également été considérée comme un facteur de risque indépendant de maladie coronarienne et d'accident vasculaire cérébral chez les sujets diabétiques ou non. Les précieuses informations fournies par un seul test HbA1c en ont fait un biomarqueur fiable pour le diagnostic et le pronostic du diabète. Cependant, le coût élevé des dispositifs et kits de test HBA1C et des normes pour l'approbation et la commercialisation des produits devrait freiner la croissance du marché.

Dynamique du marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la prévalence du diabète dans le monde

Le nombre de jeunes de moins de 20 ans souffrant de diabète devrait augmenter plus rapidement à l'avenir. Diverses études ont également été réalisées sur l'augmentation du diabète de type 2, notamment sur la prévalence croissante de l'obésité infantile. La présence de diabète chez les personnes en âge de procréer pourrait être très importante, car le diabète maternel augmente le risque de diabète chez les enfants.

La demande croissante de tests Hba1c plus précis et moins contraignants dans le temps pousse les principaux acteurs à prendre des initiatives stratégiques. Les personnes diabétiques présentent en effet un risque plus élevé de maladie cardiaque ou d'accident vasculaire cérébral, de complications liées au diabète et de décès prématuré que les personnes non diabétiques.

- Prise de conscience croissante de l’importance du contrôle glycémique

Un mauvais contrôle glycémique se caractérise par des niveaux chroniquement élevés de sucre dans le sang et d'hémoglobine glyquée, ce qui fait que les patients diabétiques, en particulier ceux traités à l'insuline, risquent de développer une hypoglycémie. Certaines études suggèrent qu'une augmentation de l'activité physique non liée à l'exercice est efficace pour réduire l'hyperglycémie postprandiale et améliorer le contrôle glycémique

Plusieurs études ont révélé que de nombreux patients diabétiques présentaient un contrôle glycémique inadéquat et médiocre. Ce phénomène était associé à un âge plus avancé, à une durée de diabète plus longue, à une insulinothérapie, à une mauvaise conformité au régime alimentaire et à l’absence d’objectifs de contrôle. Cela nécessite de se concentrer sur les facteurs identifiés et sur des mécanismes de gestion adaptés pour maintenir un bon contrôle glycémique. Les personnes sont donc de plus en plus préoccupées par ce facteur et se préparent à contrôler leur niveau de glycémie

Cependant, un faible niveau de connaissance du diabète peut servir de prédicteur d’un mauvais contrôle glycémique, mais pas d’un bon respect du traitement.

Retenue

- Coût élevé des appareils et kits de test Hba1c

Le coût des appareils et des kits joue un rôle important sur le marché des tests Hba1c. Le processus de développement de ces appareils et kits est assez coûteux et prend beaucoup de temps pour passer par la R&D, la réglementation et diverses autres conformités. Ces appareils et kits nécessitent de commencer par une compréhension de haut niveau du processus, de la conception à la production jusqu'à la façon dont le produit sera fabriqué, car une seule erreur à n'importe quelle étape peut entraîner une perturbation de l'ensemble de la production.

Par exemple,

- En décembre 2020, selon un article du NCBI, en Arabie saoudite, les dépenses de santé pour les personnes diagnostiquées avec le diabète par rapport aux dépenses en l'absence de diabète sont dix fois plus élevées

Cependant, ces appareils et kits hba1c nécessitent un investissement efficace pour des opérations réussies ainsi qu'un plan de gestion des risques du projet.

Opportunité

-

Adoption croissante des tests Hba1c dans les marchés émergents

La réglementation et les recommandations des médecins jouent un rôle important dans l'augmentation de l'adoption du test HbA1c. Des règles et réglementations strictes sont nécessaires à l'approbation du gouvernement pour assurer la sécurité et la sûreté des humains et de l'environnement. L'HbA1c est l'un des tests les plus couramment utilisés pour diagnostiquer le prédiabète et le diabète et est également considéré comme le principal test pour vous aider, vous et votre équipe soignante, à gérer votre diabète. Les prédiabétiques ou les personnes atteintes de diabète limite sont également conseillés par les médecins de se faire tester pour vérifier la stabilité de leur taux de sucre dans le sang. De l'avis général des médecins, les personnes atteintes de diabète et de prédiabète devraient faire tester leur HbA1c tous les 3 mois.

Défi

- Défis dans l'interprétation des résultats d'HbA1c chez les patients souffrant d'anémie ou d'une maladie rénale

Les défis sous-jacents associés à la capacité prédictive de l'HbA1c persistent dans les environnements de maladie rénale chronique. L'excès de liquide et de déchets sanguins reste dans l'organisme et peut causer d'autres problèmes de santé tels que des maladies cardiaques et des accidents vasculaires cérébraux.

Cependant, les taux d'HbA1c peuvent être faussement élevés ou diminués dans les maladies rénales chroniques , car un environnement urémique réduit la durée de vie des globules rouges. Plusieurs études ont émis l'hypothèse que dans les populations présentant une prévalence élevée d'inflammation et de malnutrition, comme celles atteintes de maladies rénales chroniques, les taux d'HbA1c pourraient être moins prédictifs des résultats cliniques.

Par exemple-

- En février 2022 – Selon un article du NCBI, une étude menée par des chercheurs des pays du Conseil de coopération du Golfe a indiqué qu'un taux d'HbA1c de 7 à 8 % pourrait être le plus favorable pour les meilleurs résultats chez les patients atteints de diabète sucré dans une maladie rénale chronique avancée

Cependant, l’anémie légère à modérée et la maladie rénale chronique peuvent ne pas affecter la relation entre l’hémoglobine glyquée et le taux de glucose sanguin.

Développements récents

- En mars 2020, PTS Diagnostics a récemment annoncé le lancement des contrôles A1CNow+ pour le système de test A1CNow®+. Les contrôles A1CNow+ sont initialement disponibles aux États-Unis, dans l'UE et au Royaume-Uni. Ils peuvent être conservés congelés jusqu'à trois ans, réfrigérés pendant huit mois ou à température ambiante pendant sept jours. La solution comporte deux niveaux, chacun dans un flacon de type compte-gouttes, et peut être utilisée efficacement en quelques minutes. Son objectif est de garantir des résultats A1C précis.

- En mars 2023, Abbott a annoncé un accord définitif avec Cardiovascular Systems, Inc. (CSI), un fabricant de dispositifs médicaux doté d'un système d'athérectomie de pointe utilisé pour traiter les maladies artérielles périphériques et coronariennes, en vertu duquel Abbott achèterait CSI. La gamme de dispositifs vasculaires leader du marché d'Abbott aura accès à des innovations nouvelles et complémentaires grâce à l'achat de CSI. Cela a permis à l'entreprise de croître.

Portée du marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte

Le marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte est segmenté en cinq segments notables tels que le type de produit, le mode de test, la technologie, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

PAR TYPE DE PRODUIT

- Instruments

- Réactifs et consommables

Sur la base du type de produit, le marché des tests HbA1c d’Arabie saoudite, de Turquie et d’Égypte est segmenté en instruments, réactifs et consommables.

PAR MODE DE TEST

- Tests sur ordonnance

- Tests en vente libre

Sur la base du mode de test, le marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte est segmenté en tests sur ordonnance et tests en vente libre.

PAR TECHNOLOGIE

- Dosage immunologique par inhibition turbidimétrique

- HPLC à échange d'ions

- Chromatographie par liaison d'affinité

- Dosage enzymatique

- Autres

Sur la base de la technologie, le marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte est segmenté en HPCL à échange d'ions, test enzymatique, chromatographie de liaison par affinité, test immunologique par inhibition turbidimétrique et autres.

PAR UTILISATEUR FINAL

- Laboratoires

- Hôpitaux

- Cliniques

- Soins à domicile

- Centres ambulatoires

- Pharmacies/Drugstores

- Autres

Sur la base de l'utilisateur final, le marché des tests HbA1c d'Arabie saoudite, de Turquie et d'Égypte est segmenté en laboratoires, hôpitaux, cliniques, soins à domicile, centres ambulatoires, pharmacies/pharmacies et autres.

PAR CANAL DE DISTRIBUTION

- Vente directe

- Distribution par des tiers

- Ventes au détail

Sur la base du canal de distribution, le marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte est segmenté en distribution à des tiers, ventes directes et ventes au détail.

Analyse/perspectives régionales du marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte

Le marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte est segmenté en quatre segments notables tels que le type de produit, le mode de test, la technologie, l'utilisateur final et le canal de distribution.

Les pays couverts par ce rapport de marché sont l'Arabie saoudite, la Turquie et l'Égypte. La Turquie devrait dominer le marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte en raison de la prévalence croissante du diabète et du prédiabète au sein de la population.

La section États du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse de la concurrence et des parts de marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte

Le paysage concurrentiel du marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte fournit des détails par concurrent. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'ampleur du produit, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte.

Certains des principaux acteurs opérant sur le marché des tests HbA1c en Arabie saoudite, en Turquie et en Égypte sont Siemens Healthcare GmbH, A. Menarini Diagnostics srl, ARKRAY, Inc., Trinity Biotech, Thermo Fisher Scientific Inc., Abbott, Wondfo, F. Hoffmann-La Roche Ltd, Ortho Clinical Diagnostics, DxGen Corp. et entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, INDUSTRY INSIGHTS

6 REGULATORY FRAMEWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF DIABETES WORLDWIDE

7.1.2 GROWING AWARENESS ABOUT THE IMPORTANCE OF GLYCEMIC CONTROL

7.1.3 GROWING DEMAND FOR POINT-OF-CARE TESTING DEVICES

7.2 RESTRAINTS

7.2.1 HIGH COST OF HBA1C TESTING DEVICES AND KITS

7.2.2 INADEQUATE HEALTHCARE INFRASTRUCTURE IN DEVELOPING COUNTRIES

7.3 OPPORTUNITIES

7.3.1 INCREASING ADOPTION OF HBA1C TESTING IN EMERGING MARKETS

7.3.2 INTEGRATION OF HBA1C TESTING WITH ELECTRONIC MEDICAL RECORDS AND TELEMEDICINE

7.4 CHALLENGES

7.4.1 INACCURATE RESULTS DUE TO INTERFERENCE FROM VARIOUS HEMOGLOBIN VARIANTS

7.4.2 CHALLENGES IN INTERPRETING HBA1C RESULTS IN PATIENTS WITH ANEMIA OR KIDNEY DISEASE

8 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 POINT OF CARE DEVICES

8.2.2 FACILITY BASED PLATFORM

8.3 REAGENTS AND CONSUMABLES

9 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY MODE OF TESTING

9.1 OVERVIEW

9.2 PRESCRIPTION BASED TESTING

9.3 OTC TESTING

10 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 TURBIDIMETRIC INHIBITION IMMUNOASSAY

10.3 ION-EXCHANGE HPLC

10.4 AFFINITY BINDING CHROMATOGRAPHY

10.5 ENZYMATIC ASSAY

10.6 OTHERS

11 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 LABORATORIES

11.3 HOSPITALS

11.4 CLINICS

11.5 HOMECARE

11.6 AMBULATORY CENTRES

11.7 PHARMACIES/ DRUG STORES

11.8 OTHERS

12 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTION

12.4 RETAIL SALES

12.4.1 HOSPITAL PHARMACY

12.4.2 ONLINE PHARMACY

12.4.3 OTHERS

13 SAUDI ARABIA, TURKEY AND EGYPT HBA1C TESTING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13.2 COMPANY SHARE ANALYSIS: TURKEY

13.3 COMPANY SHARE ANALYSIS: EGYPT

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 F.HOFFMANN- LA ROCHE LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 SIEMENS HEALTHINEERS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ORTHO CLINICAL DIAGNOSTICS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ARKRAY, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 THERMO FISCHER SCIENTIFIC INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ABBOTT

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BIO RAD LABORATORIES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 DIASYS DIAGNOSTIC SYSTEMS GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 DXGEN CORP.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 A. MENARINNI DIAGNOSTICS S.R.L

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 PTS DIAGNOSTICS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 RADIOMETER MEDICAL APS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 TRINITY BIOTECH

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 VITROSENS BIOTECHNOLOGY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 WONDFO

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des figures

FIGURE 1 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS OF DIABETES AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE SAUDI ARABIA HBA1C TESTING MARKET FROM 2023 TO 2030

FIGURE 12 GROWING AWARENESS OF DIABETES AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE TURKEY HBA1C TESTING MARKET FROM 2023 TO 2030

FIGURE 13 GROWING AWARENESS OF DIABETES AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE EGYPT HBA1C TESTING MARKET FROM 2023 TO 2030

FIGURE 14 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA HBA1C TESTING MARKET IN 2023 & 2030

FIGURE 15 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE TURKEY HBA1C TESTING MARKET IN 2023 & 2030

FIGURE 16 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EGYPT HBA1C TESTING MARKET IN 2023 & 2030

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SAUDI ARABIA, TURKEY & EGYPT HBA1C TESTING MARKET

FIGURE 18 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, 2022

FIGURE 19 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 21 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, 2022

FIGURE 23 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 24 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 25 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 26 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, 2022

FIGURE 27 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 28 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 29 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 30 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, 2022

FIGURE 31 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, 2023-2030 (USD MILLION)

FIGURE 32 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, CAGR (2023-2030)

FIGURE 33 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, LIFELINE CURVE

FIGURE 34 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, 2022

FIGURE 35 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, 2023-2030 (USD MILLION)

FIGURE 36 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, CAGR (2023-2030)

FIGURE 37 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, LIFELINE CURVE

FIGURE 38 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, 2022

FIGURE 39 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, 2023-2030 (USD MILLION)

FIGURE 40 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, CAGR (2023-2030)

FIGURE 41 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, LIFELINE CURVE

FIGURE 42 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 43 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 44 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 45 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 46 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 47 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 48 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 49 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 50 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 51 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 52 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 53 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 54 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, 2022

FIGURE 55 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 56 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 57 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 58 TURKEY HBA1C TESTING MARKET: BY END USER, 2022

FIGURE 59 TURKEY HBA1C TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 60 TURKEY HBA1C TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 61 TURKEY HBA1C TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 62 EGYPT HBA1C TESTING MARKET: BY END USER, 2022

FIGURE 63 EGYPT HBA1C TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 64 EGYPT HBA1C TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 65 EGYPT HBA1C TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 66 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 67 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 68 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 69 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 70 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 71 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 72 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 73 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 74 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 75 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 76 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 77 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 78 SAUDI ARABIA HBA1C TESTING MARKET: COMPANY SHARE 2022 (%)

FIGURE 79 TURKEY HBA1C TESTING MARKET: COMPANY SHARE 2022 (%)

FIGURE 80 EGYPT HBA1C TESTING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.