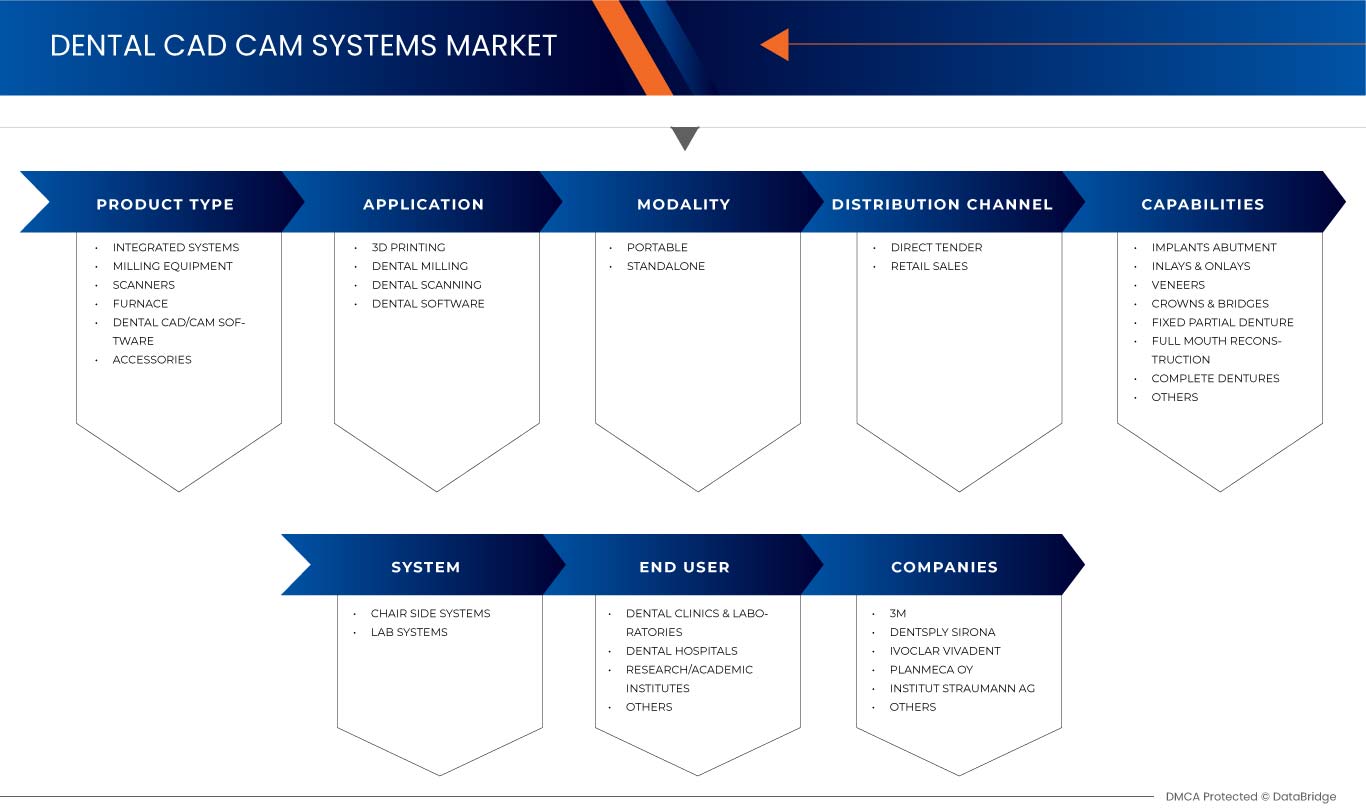

Marché des systèmes CFAO dentaires en Arabie saoudite, par type de produit (systèmes intégrés, équipements de fraisage, scanners, fours, logiciels CFAO dentaires et accessoires), capacités (piliers d'implants, incrustations et onlays, facettes, couronnes et ponts, prothèses partielles fixes, reconstruction de la bouche entière, prothèses complètes et autres), application (impression 3D, fraisage dentaire, numérisation dentaire et logiciel dentaire), système (systèmes côté fauteuil et systèmes de laboratoire), modalité (portable et autonome), utilisateur final (cliniques et laboratoires dentaires, hôpitaux dentaires, instituts de recherche/universitaires et autres), canal de distribution (appel d'offres direct et ventes au détail) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des systèmes de CFAO dentaires en Arabie saoudite

Le marché des systèmes CFAO dentaires est propulsé par sa capacité de précision et de personnalisation des restaurations dentaires, garantissant un ajustement optimal et des résultats pour les patients. L'efficacité du temps offerte par la dentisterie le jour même, où les prothèses peuvent être rapidement conçues et fabriquées au sein du cabinet dentaire, améliore la commodité pour les praticiens et les patients. La capacité du système à produire des restaurations esthétiques et naturelles et l'intégration transparente du flux de travail numérique rationalisent la communication et la planification du traitement dans les cabinets dentaires. La rentabilité, l'engagement des patients grâce à la planification interactive du traitement, les avancées technologiques continues et la demande croissante de dentisterie esthétique contribuent à la croissance du marché.

Data Bridge Market Research analyse que le marché des systèmes dentaires CFAO en Arabie saoudite devrait atteindre la valeur de 77 420,54 milliers USD d'ici 2030, à un TCAC de 6,5 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (Personnalisable 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volume en unités et prix en dollars américains/unité |

|

Segments couverts |

Type de produit (systèmes intégrés, équipement de fraisage, scanners, four, logiciel de CFAO dentaire et accessoires), capacités (piliers d'implants, inlays et onlays, facettes, couronnes et bridges, prothèses partielles fixes, reconstruction de la bouche entière, prothèses complètes et autres), application ( impression 3D , fraisage dentaire, numérisation dentaire et logiciel dentaire), système (systèmes de fauteuil et systèmes de laboratoire), modalité (portable et autonome), utilisateur final (cliniques et laboratoires dentaires, hôpitaux dentaires, instituts de recherche/universitaires et autres), canal de distribution (offres directes et ventes au détail) |

|

Pays couvert |

Arabie Saoudite |

|

Acteurs du marché couverts |

3M, Dentsply Sirona, Ivoclar Vivadent, PLANMECA OY, Institut Straumann AG, 3D Systems, Inc, imes-icore GmbH et Kulzer GmbH, entre autres |

Définition du marché

Les systèmes de CFAO (conception assistée par ordinateur/fabrication assistée par ordinateur) dentaires représentent une technologie transformatrice en dentisterie, combinant la conception numérique et la fabrication contrôlée par ordinateur pour des prothèses dentaires précises et personnalisées. La CAO permet aux professionnels dentaires de créer des modèles 3D détaillés de restaurations, en tenant compte de facteurs tels que l'anatomie et l'esthétique des dents. Le composant FAO consiste à utiliser des machines contrôlées par ordinateur, telles que des fraiseuses ou des imprimantes 3D, pour fabriquer les prothèses physiques à partir de matériaux tels que la céramique ou les résines. L'intégration de la CFAO améliore la précision, l'efficacité et la personnalisation des flux de travail dentaires, réduisant ainsi le temps nécessaire aux procédures de restauration. Ces systèmes ont révolutionné les cabinets dentaires, offrant des processus rationalisés, minimisant les erreurs et améliorant la qualité globale dans la création de couronnes, de ponts et d'autres restaurations dentaires, bénéficiant en fin de compte aux professionnels dentaires et aux patients avec de meilleurs résultats de traitement.

Dynamique du marché des systèmes de CFAO dentaires en Arabie saoudite

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Développement des infrastructures de soins dentaires pour les cliniques et les établissements de soins dentaires en Arabie saoudite

L’expansion des infrastructures de soins dentaires en Arabie saoudite est un moteur important pour le marché des systèmes de CFAO (conception assistée par ordinateur/fabrication assistée par ordinateur) en Arabie saoudite. Le nombre croissant d’établissements dentaires, associé à la demande de qualité, d’efficacité et de personnalisation, propulse l’adoption de la technologie CFAO. Les cliniques dentaires et les établissements de soins adoptent ces systèmes pour fournir des soins avancés centrés sur le patient. La croissance du marché en Arabie saoudite est sur le point de se poursuivre. Ainsi, l’infrastructure croissante des soins dentaires pour les cliniques dentaires et les établissements de soins en Arabie saoudite devrait stimuler la croissance du marché.

- Demande croissante de systèmes CAO/FAO avancés

La demande de systèmes avancés de CFAO (conception assistée par ordinateur/fabrication assistée par ordinateur) en Arabie saoudite est un moteur incontournable de la croissance du marché dans le pays. En Arabie saoudite, les patients dentaires souhaitent souvent des soins personnalisés qui répondent à leurs besoins et préférences particuliers. En raison de la demande de traitements sur mesure, la technologie CFAO permet aux professionnels dentaires de concevoir des produits dentaires hautement personnalisés. Le besoin croissant de soins dentaires de haute qualité, efficaces et personnalisés, le soutien gouvernemental et les avancées technologiques positionnent le marché pour une croissance robuste. Les cliniques dentaires et les établissements de soins continuent d'adopter ces systèmes. Ils peuvent proposer des traitements de pointe et améliorer la qualité globale des soins dentaires en Arabie saoudite. Ainsi, la demande de systèmes avancés de CFAO en Arabie saoudite devrait stimuler la croissance du marché.

Opportunités

- Expansion du secteur dentaire en Arabie saoudite

L’expansion du secteur dentaire en Arabie saoudite offre un potentiel de croissance important pour la croissance du marché. Le secteur des soins dentaires du pays connaît une croissance remarquable, tirée par plusieurs facteurs clés, créant un environnement favorable à l’adoption et à l’expansion de la technologie CFAO. La demande de services dentaires continue d’augmenter. Les établissements dentaires doivent adopter des technologies avancées pour répondre aux attentes des patients et rester compétitifs. Les systèmes CFAO, avec leur précision, leur efficacité et leur capacité à fournir des soins spécialisés, sont bien placés pour jouer un rôle central dans la modernisation et l’amélioration des services de soins dentaires en Arabie saoudite, au bénéfice à la fois du secteur et des patients. En conclusion, l’expansion du secteur dentaire devrait créer des opportunités de croissance du marché.

- La CFAO permet de réaliser des prothèses dentaires hautement personnalisées

La capacité des systèmes CFAO (conception assistée par ordinateur/fabrication assistée par ordinateur) à permettre la réalisation de prothèses dentaires hautement personnalisées représente une opportunité de croissance du marché en Arabie saoudite. Les prothèses dentaires, notamment les couronnes, les ponts, les prothèses dentaires et les implants, sont essentielles aux soins dentaires modernes. Les patients recherchent des solutions dentaires personnalisées, esthétiques et peu invasives. La technologie CFAO est bien placée pour jouer un rôle essentiel dans la prestation de soins centrés sur le patient. Ainsi, les prothèses dentaires hautement personnalisées fournies par CFAO devraient constituer une opportunité de croissance du marché.

Contraintes/ Défis

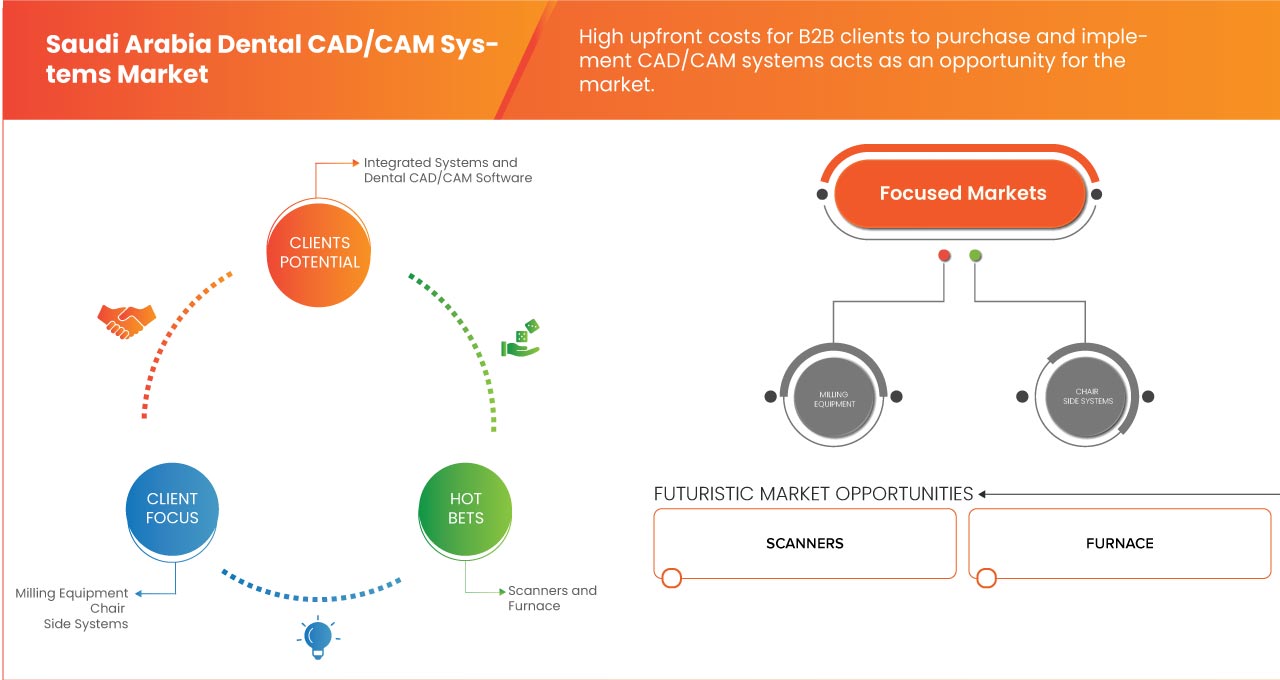

- Coûts initiaux élevés pour les clients B2B lors de l'achat et de la mise en œuvre de systèmes CAO/FAO

Le coût initial élevé pour les clients B2B (business-to-business) de l’achat et de la mise en œuvre de systèmes de CFAO (conception assistée par ordinateur/fabrication assistée par ordinateur) représente un frein important pour le marché saoudien. Bien que ces systèmes offrent de nombreux avantages, leur investissement financier substantiel peut poser plusieurs défis aux entreprises qui adoptent cette technologie. Des réglementations plus strictes peuvent parfois freiner l’innovation dans le secteur dentaire. Les professionnels et les entreprises du secteur dentaire peuvent devenir prudents quant à l’adoption de nouvelles technologies, y compris les systèmes de CFAO, en raison de préoccupations concernant la conformité réglementaire et les changements potentiels des normes. Par conséquent, le respect des réglementations en constante évolution dans le secteur dentaire en Arabie saoudite devrait freiner la croissance du marché.

- Concurrence accrue entre les fournisseurs de systèmes CAO/FAO B2B

La concurrence accrue entre les fournisseurs de systèmes de CFAO (conception assistée par ordinateur/fabrication assistée par ordinateur) B2B (business-to-business) sur le marché saoudien représente un défi de taille. La demande de technologie CFAO augmente dans le secteur des soins dentaires à mesure que de plus en plus de fournisseurs entrent sur le marché, ce qui intensifie la concurrence. Les fournisseurs de systèmes CFAO en Arabie saoudite doivent se concentrer sur l'innovation, le service client et les services à valeur ajoutée. Les fournisseurs peuvent se différencier sur un marché encombré et prospérer malgré une concurrence accrue en améliorant continuellement leurs offres de produits, en fournissant un excellent support client et en proposant des solutions uniques qui répondent aux besoins spécifiques des cliniques dentaires. En outre, la collaboration avec les associations et organisations dentaires peut aider les fournisseurs à informer les clients potentiels des avantages et de la valeur de la technologie CFAO, garantissant ainsi que le marché reste réceptif à ces systèmes avancés. Ainsi, la concurrence accrue entre les fournisseurs de systèmes CFAO B2B devrait remettre en cause la croissance du marché.

- Risque de sécurité des données et des conceptions des patients

Assurer la sécurité des données et des conceptions des patients est un défi crucial pour la croissance du marché. Les systèmes CFAO sont importants pour les opérations de soins dentaires, traitant des informations sensibles sur les patients et des données de conception. Répondre aux préoccupations en matière de sécurité des données est essentiel pour maintenir la confiance, le respect des réglementations et l'intégrité globale du marché. Face au défi de garantir la sécurité des données et des conceptions des patients, les fournisseurs de systèmes CFAO en Arabie saoudite doivent investir dans des mesures de cybersécurité robustes. Cependant, les fournisseurs de systèmes CFAO peuvent favoriser la confiance entre les cliniques dentaires et assurer la croissance et l'adoption continues de ces systèmes sur le marché saoudien. Par conséquent, l'augmentation des risques de sécurité liés aux données et aux conceptions des patients devrait créer des défis pour la croissance du marché.

Développements récents

- En mars 2023, Ivoclar Vivadent a présenté le PrograScan PS7, le premier scanner de laboratoire haut de gamme capable de numériser simultanément des modèles de mâchoire supérieure et inférieure en moins de 10 secondes, de manière entièrement automatisée et en une seule procédure. Ce nouveau PrograScan PS7 est spécialement conçu pour les laboratoires dentaires à haut débit. Le nouveau PrograScan PS7 fonctionne parfaitement avec toutes les opérations Ivoclar Vivadent, qu'elles soient traditionnelles ou numériques.

- En mars 2023, PLANMECA OY a annoncé un nouvel équipement d'usinage au fauteuil capable d'usiner à la fois à sec et par voie humide. L'unité d'usinage Planmeca PlanMill 35 traite une large gamme de matériaux avec précision et efficacité, ce qui en fait un partenaire idéal pour les cabinets dentaires à la recherche d'une solution tout-en-un pour la fabrication de restaurations dentaires en interne, notamment à partir de dioxyde de zirconium. Cela permet à l'organisation de garder une longueur d'avance sur ses empreintes inventives avec la plus grande efficacité et précision.

- En mars 2023, Planmeca Romexis était la plateforme logicielle la plus avancée pour la dentisterie, avec des fonctionnalités d'imagerie dentaire, de diagnostic et de planification de traitement pour toutes les indications et spécialisations dentaires. Planmeca est ravi de dévoiler diverses améliorations et de nouvelles fonctionnalités basées sur l'IA pour Romexis lors du salon dentaire international 2023, qui aident à optimiser les opérations quotidiennes dans un cabinet dentaire et rendent le traitement des photos des patients et la planification des traitements encore plus faciles et plus rapides.

- En septembre 2022, Dentsply Sirona a présenté des produits et solutions innovants issus de son « monde numérique » au Dentsply Sirona World 2022, dans le but d'élever la dentisterie à un nouveau niveau. L'un des points forts est le nouveau Primescan Connect, une version pour ordinateur portable du scanner intraoral Primescan de Dentsply Sirona, facile à utiliser, rapide et précis. DS Core complète l'expérience de la dentisterie numérique en ajoutant de nouvelles fonctionnalités. Cela a facilité l'incursion de l'entreprise dans la dentisterie numérique.

- En février 2022, 3D Systems et Saremco Dental AG ont formé une alliance stratégique pour stimuler l'innovation en matière de dentisterie numérique. Cette collaboration associe la puissance de la solution de dentisterie numérique NextDent de 3D Systems, leader du secteur, à l'expertise en science des matériaux de Saremco, permettant aux laboratoires et cliniques dentaires de traiter un large éventail d'indications avec une précision, une répétabilité, une productivité et un coût total inférieurs inégalés.

Portée du marché des systèmes CFAO dentaires en Arabie saoudite

Le marché des systèmes CFAO dentaires en Arabie saoudite est classé en types de produits, capacités, applications, systèmes, modalités, utilisateurs finaux et canaux de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Systèmes intégrés

- Équipement de fraisage

- Scanners

- Four

- Logiciel de CFAO dentaire

- Accessoires

Sur la base du type de produit, le marché est segmenté en systèmes intégrés, équipements de fraisage, scanners, fours, logiciels de CAO/FAO dentaires et accessoires.

Capacités

- Pilier implantaire

- Incrustations et onlays

- Facettes

- Couronnes et ponts

- Prothèse partielle fixe

- Reconstruction de la bouche entière

- Prothèses dentaires complètes

- Autres

Sur la base des capacités, le marché est segmenté en implants, piliers, inlays et onlays, facettes, couronnes et bridges, prothèses partielles fixes, reconstructions complètes de la bouche, prothèses complètes et autres.

Application

- Impression 3D

- Fraisage dentaire

- Numérisation dentaire

- Logiciel dentaire

Sur la base de l'application, le marché est segmenté en impression 3D, fraisage dentaire, numérisation dentaire et logiciels dentaires.

Système

- Systèmes de fauteuils latéraux

- Systèmes de laboratoire

Sur la base du système, le marché est segmenté en systèmes de chaise et en systèmes de laboratoire.

Modalité

- Portable

- Autonome

Sur la base de la modalité, le marché est segmenté en portable et autonome.

Utilisateur final

- Cliniques et laboratoires dentaires

- Hôpitaux dentaires

- Instituts de recherche/académiques

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en cliniques et laboratoires dentaires, hôpitaux dentaires, instituts de recherche/universitaires et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

Sur la base du canal de distribution, le marché est segmenté en appels d'offres directs et ventes au détail.

Analyse du paysage concurrentiel et des parts de marché des systèmes de CFAO dentaires en Arabie saoudite

Le paysage concurrentiel du marché des systèmes CFAO dentaires en Arabie saoudite fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence dans le pays, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché des systèmes CFAO dentaires en Arabie saoudite.

Certains des principaux acteurs opérant sur le marché des systèmes CFAO dentaires en Arabie saoudite sont 3M, Dentsply Sirona, Ivoclar Vivadent, PLANMECA OY, Institut Straumann AG, 3D Systems, Inc, imes-icore GmbH et Kulzer GmbH, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 VALUE CHAIN ANALYSIS

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL PROCUREMENT

4.2.2 MANUFACTURING AND DISTRIBUTION

4.2.3 END USERS

4.3 PORTER'S FIVE FORCES

4.3.1 BARGAINING POWER OF SUPPLIERS

4.3.2 BARGAINING POWER OF BUYERS/CONSUMERS

4.3.3 THREAT OF NEW ENTRANTS

4.3.4 THREAT OF SUBSTITUTES PRODUCTS

4.3.5 INTENSITY OF COMPETITIVE RIVALRY

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING PRODUCTION OF FEED ADDITIVES

5.1.2 INCREASING AWARENESS OF THE BENEFITS OF PLANT-BASED PRODUCTS

5.1.3 INCREASED DEMAND AND CONSUMPTION OF LIVESTOCK-BASED PRODUCTS

5.2 RESTRAINTS

5.2.1 STRICT RESTRICTIONS AND REGULATIONS IMPOSED BY THE GOVERNMENT

5.2.2 INADEQUATE RAW MATERIAL AVAILABILITY

5.3 OPPORTUNITIES

5.3.1 GROWING COMMERCIAL APPLICATION

5.3.2 RISING RESEARCH AND DEVELOPMENT ACTIVITIES

5.4 CHALLENGES

5.4.1 AVAILABILITY OF FEED ADDITIVES SUBSTITUTES

5.4.2 PRODUCT LABELLING AND TRADE ISSUES

6 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET BY REGION

6.1 NORTH AMERICA

6.1.1 U.S.

6.1.2 MEXICO

6.1.3 CANADA

7 COMPANY SHARE ANALYSIS: NORTH AMERICA

8 SWOT ANALYSIS

9 COMPANY PROFILE

9.1 LALLEMAND INC

9.1.1 COMPANY SNAPSHOT

9.1.2 PRODUCT PORTFOLIO

9.1.3 RECENT DEVELOPMENT

9.2 EVONIK INDUSTRIES AG

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENT

9.3 INTERNATIONAL FLAVORS & FRAGRANCES INC

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 ASAHI GROUP HOLDINGS, LTD

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 PHILEO BY LESAFFRE

9.5.1 COMPANY SNAPSHOT

9.5.2 PRODUCT PORTFOLIO

9.5.3 RECENT DEVELOPMENT

9.6 ADVANCED ENZYME TECHNOLOGIES

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 CHR. HANSEN HOLDING A/S

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENT

9.8 KEMIN INDUSTRIES, INC

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENT

9.9 NOVOZYMES

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENT

9.1 UNIQUE BIOTECH

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 3 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 4 SAUDI ARABIA INTEGRATED SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 SAUDI ARABIA INTEGRATED SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 6 SAUDI ARABIA INTEGRATED SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 7 SAUDI ARABIA IN-LAB SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 SAUDI ARABIA IN-LAB SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 9 SAUDI ARABIA IN-LAB SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 10 SAUDI ARABIA IN-OFFICE SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 SAUDI ARABIA IN-OFFICE SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 12 SAUDI ARABIA IN-OFFICE SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 13 SAUDI ARABIA MILLING EQUIPMENT IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 SAUDI ARABIA MILLING EQUIPMENT IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 15 SAUDI ARABIA MILLING EQUIPMENT IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 16 SAUDI ARABIA SCANNERS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 SAUDI ARABIA SCANNERS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 18 SAUDI ARABIA SCANNERS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 19 SAUDI ARABIA FURNACE IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 SAUDI ARABIA FURNACE IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 21 SAUDI ARABIA FURNACE IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 22 SAUDI ARABIA DENTAL CAD/CAM SOFTWAR IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 SAUDI ARABIA ACCESSORIES IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 SAUDI ARABIA ACCESSORIES IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 25 SAUDI ARABIA ACCESSORIES IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 26 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY CAPABILITIES, 2021-2030 (USD THOUSAND)

TABLE 27 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 SAUDI ARABIA 3 D PRINTING IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 SAUDI ARABIA DENTAL MILLING IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 SAUDI ARABIA DENTAL SCANNING IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 SAUDI ARABIA DENTAL SOFTWARE IN DENTAL PRINTING IN CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 33 SAUDI ARABIA CHAIR SIDE SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 SAUDI ARABIA LAB SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY MODALITY, 2021-2030 (USD THOUSAND)

TABLE 36 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 37 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET

FIGURE 2 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA CAD/CAM SYSTEMS MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: MARKET END USER COVERAGE GRID

FIGURE 11 SAUDI ARABIA CAD/CAM SYSTEMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: SEGMENTATION

FIGURE 14 GROWING DENTAL HEALTHCARE INFRASTRUCTURE FOR DENTAL CLINICS AND CARE FACILITIES IN SAUDI ARABIA IS EXPECTED TO DRIVE THE SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 THE INTEGRATED SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET IN 2023 AND 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET

FIGURE 17 THE BELOW GRAPH INDICATES THE DISTRIBUTION OF DENTISTS BY REGION.

FIGURE 18 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY PRODUCT TYPE, 2022

FIGURE 19 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY CAPABILITIES, 2022

FIGURE 20 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY APPLICATION, 2022

FIGURE 21 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY SYSTEM, 2022

FIGURE 22 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY MODALITY, 2022

FIGURE 23 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY END USER, 2022

FIGURE 24 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 25 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.