Republic Of Ireland Roi And Northern Ireland Mri And Ct Scan Radiology Services Market

Taille du marché en milliards USD

TCAC :

%

USD

357.83 Million

USD

498.61 Million

2022

2030

USD

357.83 Million

USD

498.61 Million

2022

2030

| 2023 –2030 | |

| USD 357.83 Million | |

| USD 498.61 Million | |

|

|

|

Marché des services de radiologie par IRM et tomodensitométrie en République d'Irlande (ROI) et en Irlande du Nord, par appareils (imagerie par résonance magnétique (IRM) et tomodensitométrie (TDM) ), utilisateur final (hôpitaux et cliniques, centres d'imagerie diagnostique, soins à domicile et soins ambulatoires) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des services de radiologie par IRM et par tomodensitométrie en République d'Irlande (ROI) et en Irlande du Nord

Le marché des services de radiologie par IRM et tomodensitométrie de la République d'Irlande (ROI) et d'Irlande du Nord devrait croître au cours de l'année de prévision en raison d'une augmentation du nombre de lancements de services de radiologie. L'innovation et les progrès technologiques pour répondre aux besoins du marché devraient favoriser la croissance du marché. Les principaux acteurs du marché sont de plus en plus intéressés par l'utilisation de nouvelles technologies pour attirer l'attention de l'utilisateur final. L'incidence accrue du cancer et d'autres troubles chroniques augmente la demande de détection et de diagnostic précoces via l'utilisation des dernières technologies, propulsant ainsi la croissance du marché des services de radiologie. Par conséquent, le marché des services de radiologie par IRM et tomodensitométrie de la République d'Irlande (ROI) et d'Irlande du Nord devrait connaître une forte croissance au cours de la période de prévision.

Cependant, le manque de professionnels qualifiés et certifiés pour installer des appareils avancés avec les services devrait freiner la croissance du marché.

Le marché des services de radiologie IRM et CT Scan de la République d'Irlande (ROI) devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,2 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 498,61 millions USD, contre 357,83 millions USD respectivement pour la République d'Irlande (ROI).

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par appareils ( imagerie par résonance magnétique (IRM) et tomodensitométrie (TDM)), utilisateur final (hôpitaux et cliniques, centres d'imagerie diagnostique, soins à domicile et soins ambulatoires) |

|

Pays couverts |

République d'Irlande (ROI) et Irlande du Nord |

|

Acteurs du marché couverts |

Les principales entreprises présentes sur le marché sont NOAH, Mater Private Network, SVPH, Beacon Hospital, The Ulster Independent Clinic Ltd, St. James's Private Radiology, UPMC Affiliated with the University of Pittsburgh Schools of the Health Sciences, Blackrock Clinic Limited et Alliance Medical Diagnostic Imaging Ltd. entre autres |

Définition du marché

La radiologie est une spécialité médicale qui utilise la technologie de l'imagerie pour identifier et traiter les maladies. La radiologie diagnostique et la radiologie interventionnelle sont deux sous-domaines de la radiologie. Les radiologues sont des professionnels de la santé spécialisés dans la radiologie. Ils interprètent une large gamme de procédures diagnostiques, telles que les rayons X, l'échographie, la densitométrie minérale osseuse, la fluoroscopie, la mammographie, la médecine nucléaire, la tomodensitométrie et l'IRM. Le diagnostic de nombreuses maladies, dont le cancer, dépend de la radiologie. Une détection précoce permet de sauver des vies. Il ne peut y avoir de traitement ou de guérison sans diagnostic.

L'imagerie par résonance magnétique (IRM), une forme de scanner, utilise des champs magnétiques puissants et des ondes radio pour fournir des images précises de l'intérieur du corps. Les résultats d'une IRM peuvent être utilisés pour planifier des traitements, diagnostiquer des maladies et évaluer le succès des thérapies antérieures. Grâce au traitement informatique, des images transversales (tranches) des os, des artères sanguines et des tissus mous à l'intérieur de votre corps sont produites au cours d'une tomodensitométrie (TDM), qui combine plusieurs images radiographiques collectées sous différents angles sur tout votre corps. Les images d'une tomodensitométrie offrent plus d'informations qu'une radiographie. Il existe diverses applications pour une tomodensitométrie, mais elle est particulièrement utile pour examiner immédiatement les patients présentant des lésions internes dues à des accidents de voiture ou à d'autres types de traumatismes. Presque toutes les régions peuvent être visualisées à l'aide d'une tomodensitométrie pour planifier des traitements médicaux, chirurgicaux ou radiologiques et détecter des maladies et des blessures. Cependant, le coût élevé des techniques de radiologie ou d'imagerie et le risque élevé de rayonnement devraient freiner la croissance du marché.

Dynamique du marché

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

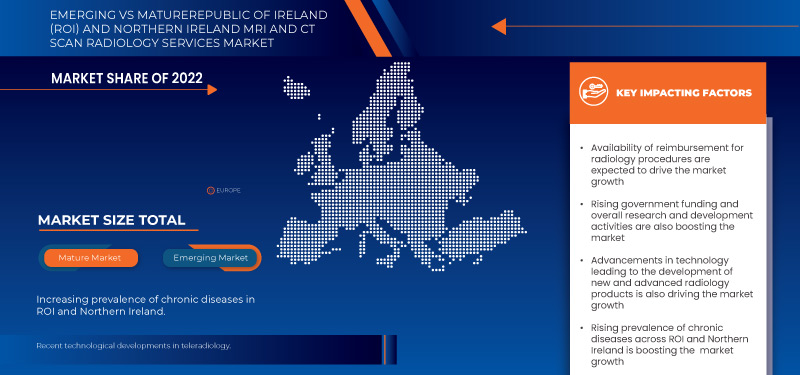

- Augmentation de la prévalence des maladies chroniques

Les maladies chroniques sont en augmentation en raison de mauvaises habitudes de vie telles que le tabagisme, une mauvaise alimentation, une consommation excessive d'alcool, un manque d'exercice physique et un soulagement insuffisant du stress chronique. Ces mauvais choix de vie entraînent des maladies cardiaques, de l'arthrite, du cancer, des crises cardiaques, des accidents vasculaires cérébraux, du diabète, de l'épilepsie , de l'obésité et des problèmes de santé bucco-dentaire. La radiologie est pratiquée pour l'observation interne à l'aide de procédures d'imagerie médicale pour traiter et diagnostiquer les maladies chroniques. Cependant, la maladie chronique persiste pendant une période plus longue et nécessite une conformité continue. Par conséquent, la prévalence croissante des maladies chroniques pourrait stimuler la croissance du marché des services de radiologie par IRM et par tomodensitométrie en République d'Irlande (ROI) et en Irlande du Nord.

- Développements technologiques récents en téléradiologie

La téléradiologie consiste à transmettre des images médicales d'un établissement à un autre afin que ces images puissent être observées et expliquées à des fins de diagnostic lors d'une consultation par un radiologue. Les hôpitaux, les cliniques de soins d'urgence et les centres d'imagerie diagnostique adoptent largement la téléradiologie. La téléradiologie a changé la radiologie et son approche des services grâce aux nouvelles avancées technologiques en matière de téléradiologie.

Le nombre croissant de lancements de téléradiologie, associé à une demande croissante de services de téléradiologie en raison de ses avantages, pourrait stimuler la croissance du marché. La téléradiologie est un élément notable développé dans la prestation de services radiologiques en raison de la haute qualité et de la rapidité de la transmission des données. Le transfert d'images entre radiologues via des réseaux locaux ou distants est largement disponible pour solliciter un avis spécialisé dans des cas sélectionnés. Dans le même temps, la téléradiologie améliore les soins aux patients en permettant aux radiologues de montrer leur expertise sans avoir à être présents au même endroit que le patient. Ainsi, la téléradiologie a transformé la radiologie en termes de mobilité, de rapports et de réduction des erreurs. Ces facteurs devraient propulser la croissance du marché des services de radiologie IRM et CT scan en République d'Irlande (ROI) et en Irlande du Nord.

- Disponibilité du remboursement des actes de radiologie

Le remboursement est le paiement effectué aux centres de diagnostic, hôpitaux, médecins et autres prestataires de soins de santé pour les services médicaux. Le remboursement administré par les assureurs maladie/le gouvernement couvre tous les coûts ou une partie de vos frais de santé en fonction du plan de santé/des politiques/des procédures des patients. Les politiques de remboursement croissantes pour les procédures de radiologie dans les pays européens stimulent la demande de services de radiologie sur le marché régional.

Les centres remboursent les services Medicare et Medicaid pour motiver le radiologue et le patient. Le remboursement a augmenté la demande de services de radiologie, de sorte que la disponibilité du remboursement des procédures de radiologie devrait propulser la croissance du marché des services de radiologie IRM et CT scan en République d'Irlande (ROI) et en Irlande du Nord.

Opportunités

- Utilisation de la blockchain dans l'imagerie diagnostique

La téléradiologie a transformé la radiologie et créé des besoins de stockage. Le transfert de données d'images sur des supports imprimés ou optiques n'est plus suffisant pour les besoins actuels. La blockchain est une méthode sécurisée de stockage de données en ligne et peut également être utilisée dans l'imagerie diagnostique.

Il existe une demande croissante d'accessibilité rapide aux données d'imagerie médicale. À ce jour, le grand nombre d'images radiologiques à auditer et à stocker peut être réalisé par blockchain. Il peut également être utilisé par d'autres disciplines telles que la dermatologie, l'ophtalmologie, la dentisterie, la pathologie, les sous-spécialités chirurgicales et la médecine interne qui créent et stockent de plus en plus d'images et de vidéos numériques. C'est pourquoi l'utilisation de la blockchain dans l'imagerie diagnostique devrait créer des opportunités de croissance pour le marché des services de radiologie IRM et CT scan de la République d'Irlande (ROI) et d'Irlande du Nord

- Solutions de radiologie contractuelles et solutions mobiles

Les contrats entre hôpitaux et groupes de radiologie évoluent pour répondre aux besoins changeants des soins de santé. L'accord est régulièrement mis à jour en fonction des besoins changeants en fonction des services et de l'échelle de qualité. Parallèlement, les solutions mobiles répondent aux besoins logistiques et administratifs grâce aux applications pour tablettes et smartphones.

Les solutions mobiles peuvent fournir des rapports et des images rapides, efficaces et précis. Mais, au moment opportun, la radiologie contractuelle permet de contrôler les coûts budgétaires, de créer un bon rapport qualité-prix puisque les contrats sont révisés en fonction des performances annuelles et de tirer parti des opportunités de réduction des dépenses des années suivantes. C'est pourquoi la radiologie contractuelle et les solutions mobiles devraient créer des opportunités de croissance pour le marché des services de radiologie IRM et CT scan en République d'Irlande (ROI) et en Irlande du Nord.

Contraintes/Défis

- Coût élevé des services de radiologie

La radiologie repose davantage sur des coûts fixes que sur des coûts variables et les prix des appareils sont élevés. La radiologie est réalisée à l'aide d'IRM, de tomodensitométrie, de tomographie par émission de positons, d'imagerie nucléaire et d'appareils coûteux. De plus, le développement des équipements de radiologie implique des coûts de recherche élevés, ce qui rend ces appareils plus coûteux.

Par conséquent, les prix élevés des services de radiologie peuvent limiter la croissance du marché des services de radiologie par IRM et par tomodensitométrie en République d'Irlande (ROI) et en Irlande du Nord. La technologie étant en constante évolution, les hôpitaux et les cliniques doivent investir davantage dans les nouvelles technologies lorsque leurs appareils de radiographie sur le marché deviennent obsolètes après quelques années, ce qui augmente leur charge financière et affecte l'efficacité. C'est pourquoi le coût élevé des services de radiologie devrait entraver la croissance du marché des services de radiologie par IRM et par tomodensitométrie en République d'Irlande (ROI) et en Irlande du Nord.

- Manque de main d'oeuvre qualifiée et de radiologues

La population est en augmentation en raison de la charge croissante des maladies chroniques et du nombre croissant de radiologues nécessaires. Par conséquent, l'offre et la demande de radiologues sont basées sur une analyse des personnes, des cabinets et des hôpitaux.

L'Irlande du Nord est confrontée à une pénurie de radiologues. De plus, l'écart entre l'offre et la demande s'est creusé pour de nombreuses raisons, notamment en matière d'éducation. La qualification minimale requise pour être nommé radiologue est d'avoir effectué quatre années de résidence après la faculté de médecine ou 12 années d'enseignement.

Par conséquent, le manque de ressources humaines qualifiées et de radiologues devrait constituer un obstacle à la croissance du marché des services de radiologie IRM et CT Scan en République d'Irlande (ROI) et en Irlande du Nord.

Développements récents

- En août 2022, Mater Private Network a annoncé le lancement officiel de la nouvelle application mobile destinée aux patients, MyMaterPrivate. Nous sommes fiers d'être le premier réseau d'hôpitaux privés en Irlande à fournir aux patients une application pour smartphone qui leur donne accès 24h/24 et 7j/7 à leurs informations médicales. Cela a été rendu possible grâce à notre innovation axée sur le patient. Cela a aidé l'entreprise à utiliser la télésanté pour transformer ses installations

- En décembre 2021, l'hôpital Beacon a annoncé que l'utilisation par l'équipe de radiothérapie de la radiothérapie guidée par surface (SGRT) pour les traitements sans tatouage des patients en radiothérapie leur a valu un prix de Vision RT. Cela a aidé l'entreprise à renforcer sa confiance auprès des patients et à engager davantage de soins auprès des meilleurs établissements de traitement

Portée du marché des services de radiologie par IRM et par tomodensitométrie en République d'Irlande (ROI) et en Irlande du Nord

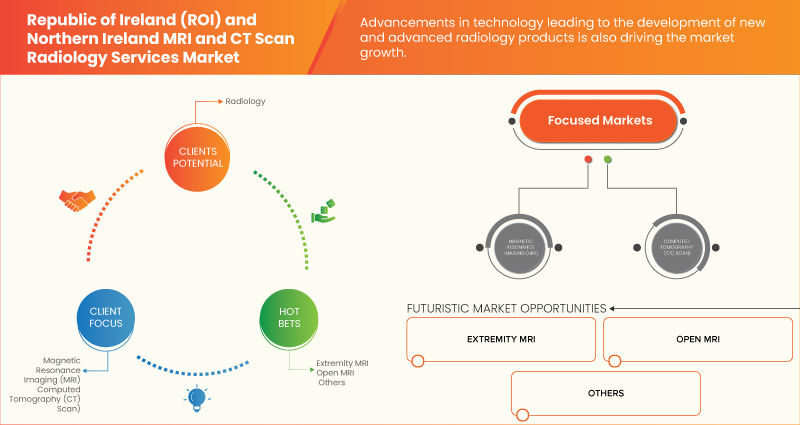

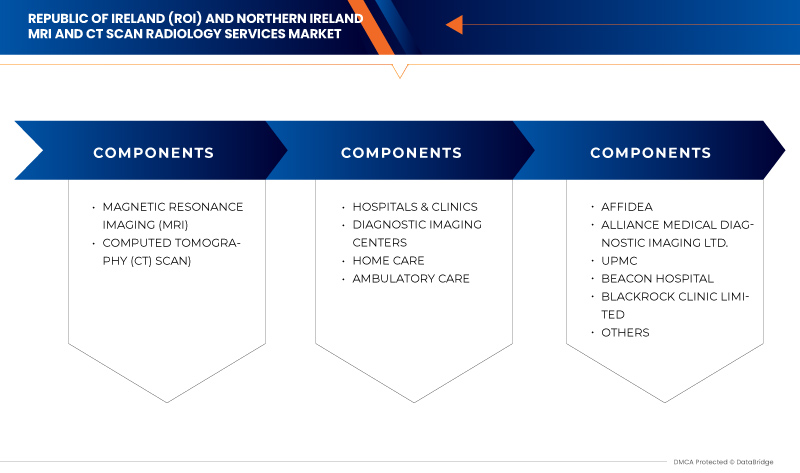

Le marché des services de radiologie par IRM et par tomodensitométrie de la République d'Irlande (ROI) et d'Irlande du Nord est segmenté en deux segments notables en fonction des appareils et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Appareil

- Imagerie par résonance magnétique (IRM)

- Tomodensitométrie (TDM)

Sur la base des appareils, le marché des services de radiologie IRM et CT Scan de la République d'Irlande (ROI) et d'Irlande du Nord est segmenté en imagerie par résonance magnétique (IRM) et tomodensitométrie (TDM).

Utilisateur final

- Hôpitaux et cliniques

- Centres d'imagerie diagnostique

- Soins à domicile

- Soins ambulatoires

Sur la base de l'utilisateur final, le marché des services de radiologie IRM et CT Scan de la République d'Irlande (ROI) et d'Irlande du Nord est segmenté en hôpitaux et cliniques, centres d'imagerie diagnostique, soins à domicile et soins ambulatoires.

Analyse/perspectives régionales du marché des services de radiologie par IRM et par tomodensitométrie en République d'Irlande (ROI) et en Irlande du Nord

Le marché des services de radiologie est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, appareils et utilisateur final.

Les pays couverts dans ce rapport de marché sont la République d’Irlande (ROI) et l’Irlande du Nord.

La République d’Irlande (ROI) devrait dominer en raison de l’augmentation de la prévalence des maladies chroniques.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et leurs défis en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des services de radiologie par IRM et tomodensitométrie en République d'Irlande (ROI) et en Irlande du Nord

Le paysage concurrentiel du marché de l'immunohématologie fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise sur le marché de l'ataxie.

Certains des principaux acteurs opérant sur le marché des services de radiologie IRM et CT Scan en République d'Irlande (ROI) et en Irlande du Nord sont NOAH, Mater Private Network, SVPH, Beacon Hospital, The Ulster Independent Clinic Ltd, St. James's Private Radiology, UPMC Affiliated with the University of Pittsburgh Schools of the Health Sciences, Blackrock Clinic Limited et Alliance Medical Diagnostic Imaging Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 MULTIVARIATE MODELLING

2.6 MARKET APPLICATION COVERAGE GRID

2.7 PRODUCT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 NUMBER OF RADIOLOGISTS

4.4 STRATEGIC INITIATIVES SHAPING THE FUTURE OF INDUSTRY

4.5 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND FOR MRI AND CT SCAN RADIOLOGY SERVICES MARKET ANALYSIS (QUALITATIVE AND QUANTITATIVE ANALYSIS)

5 INDUSTRY INSIGHTS

5.1 KEY PRICING STRATEGIES

6 EPIDEMIOLOGY

7 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET, REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING PREVALENCE OF CHRONIC DISEASES

8.1.2 RECENT TECHNOLOGICAL DEVELOPMENTS IN TELERADIOLOGY

8.1.3 AVAILABILITY OF REIMBURSEMENT FOR RADIOLOGY PROCEDURES

8.1.4 INCREASING GERIATRIC POPULATION

8.2 RESTRAINTS

8.2.1 HIGH COST OF RADIOLOGY SERVICES

8.2.2 HIGH-RISK RADIATION-CAUSING DISEASES

8.3 OPPORTUNITIES

8.3.1 USE OF BLOCKCHAIN IN DIAGNOSTIC IMAGING

8.3.2 CONTRACT-BASED RADIOLOGY SOLUTIONS AND MOBILE SOLUTIONS

8.4 CHALLENGES

8.4.1 LACK OF SKILLED MANPOWER AND RADIOLOGISTS

8.4.2 LEGAL AND REGULATORY ISSUES ASSOCIATED WITH RADIOLOGY SERVICES

9 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY DEVICE

9.1 OVERVIEW

9.2 COMPUTED TOMOGRAPHY (CT) SCAN

9.2.1 STATIONARY

9.2.2 PORTABLE

9.3 MAGNETIC RESONANCE IMAGING (MRI)

9.3.1 BY TYPE

9.3.1.1 CLOSED MRI

9.3.1.2 OPEN MRI

9.3.1.3 EXTREMITY MRI

9.3.1.4 OTHERS

9.3.2 BY MODALITY

9.3.2.1 STATIONARY

9.3.2.2 PORTABLE

9.3.3 BY OWNERSHIP

9.3.3.1 PRIVATE HEALTHCARE SECTOR

9.3.3.2 PUBLIC HEALTHCARE SECTOR

10 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS & CLINICS

10.3 DIAGNOSTIC IMAGING CENTERS

10.4 HOME CARE

10.5 AMBULATORY CARE

11 REPUBLIC OF IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: REPUBLIC OF IRELAND

11.2 COMPANY SHARE ANALYSIS: NORTHERN IRELAND

12 COMPANY PROFILE

12.1 AFFIDEA

12.1.1 COMPANY SNAPSHOT

12.1.2 SWOT ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 ALLIANCE MEDICAL DIAGNOSTIC IMAGING LTD.

12.2.1 COMPANY SNAPSHOT

12.2.2 SWOT ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 UPMC AFFILIATED WITH THE UNIVERSITY OF PITTSBURGH SCHOOLS OF THE HEALTH SCIENCES

12.3.1 COMPANY SNAPSHOT

12.3.2 SWOT ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 BEACON HOSPITAL

12.4.1 COMPANY SNAPSHOT

12.4.2 SWOT ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 BLACKROCK CLINIC LIMITED

12.5.1 COMPANY SNAPSHOT

12.5.2 SWOT ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 BON SECOURS HEALTH SYSTEM, INC

12.6.1 COMPANY SNAPSHOT

12.6.2 SWOT ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 CHARTER MEDICAL

12.7.1 COMPANY SNAPSHOT

12.7.2 SWOT ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 GLOBAL DIAGNOSTICS (IRELAND) LIMITED

12.8.1 COMPANY SNAPSHOT

12.8.2 SWOT ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 MATER PRIVATE NETWORK

12.9.1 COMPANY SNAPSHOT

12.9.2 SWOT ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 NOAH

12.10.1 COMPANY SNAPSHOT

12.10.2 SWOT ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENTS

12.11 ST. JAMES'S PRIVATE RADIOLOGY

12.11.1 COMPANY SNAPSHOT

12.11.2 SWOT ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 SVPH

12.12.1 COMPANY SNAPSHOT

12.12.2 SWOT ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 THE ULSTER INDEPENDENT CLINIC LTD

12.13.1 COMPANY SNAPSHOT

12.13.2 SWOT ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 THE PRICES OF IMAGING SERVICES IN THE REPUBLIC OF IRELAND ARE AS FOLLOWS:

TABLE 2 THE PRICES OF IMAGING SERVICES IN NORTHERN IRELAND ARE AS FOLLOWS:

TABLE 3 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 5 REPUBLIC OF IRELAND (ROI) COMPUTED TOMOGRAPHY (CT) SCAN IN MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY DEVICE, 2021-2030 (USD MILLION)

TABLE 6 NORTHERN IRELAND COMPUTED TOMOGRAPHY (CT) SCAN IN MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY DEVICE, 2021-2030 (USD MILLION)

TABLE 7 REPUBLIC OF IRELAND (ROI) MAGNETIC RESONANCE IMAGING (MRI) IN MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTHERN IRELAND MAGNETIC RESONANCE IMAGING (MRI) IN MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 REPUBLIC OF IRELAND (ROI) MAGNETIC RESONANCE IMAGING (MRI) IN MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 10 NORTHERN IRELAND MAGNETIC RESONANCE IMAGING (MRI) IN MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 11 REPUBLIC OF IRELAND (ROI) MAGNETIC RESONANCE IMAGING (MRI) IN MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 12 NORTHERN IRELAND MAGNETIC RESONANCE IMAGING (MRI) IN MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 13 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET , BY END USER, 2021-2030 (USD MILLION)

TABLE 14 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: SEGMENTATION

FIGURE 2 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF CHRONIC DISEASES AND RECENT TECHNOLOGICAL DEVELOPMENTS IN TELERADIOLOGY ARE EXPECTED TO DRIVE THE GROWTH OF THE REPUBLIC OF IRELAND (ROI)MRI AND CT SCAN RADIOLOGY SERVICES MARKET FROM 2023 TO 2030

FIGURE 12 INCREASING PREVALENCE OF CHRONIC DISEASES AND RECENT TECHNOLOGICAL DEVELOPMENTS IN TELERADIOLOGY ARE EXPECTED TO DRIVE THE GROWTH OF THE NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET FROM 2023 TO 2030

FIGURE 13 THE DEVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE REPUBLIC OF IRELAND (ROI) FOR MRI AND CT SCAN RADIOLOGY SERVICES MARKET IN 2023 & 2030

FIGURE 14 THE DEVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTHERN IRELANDMRI AND CT SCAN RADIOLOGY SERVICES MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE REPUBLIC OF IRELAND (ROI) AND NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET

FIGURE 16 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY DEVICE, 2022

FIGURE 17 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY DEVICE, 2022

FIGURE 18 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY DEVICE, 2023-2030 (USD MILLION)

FIGURE 19 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY DEVICE, 2023-2030 (USD MILLION)

FIGURE 20 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY DEVICE, CAGR (2023-2030)

FIGURE 21 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY DEVICE, CAGR (2023-2030)

FIGURE 22 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY DEVICE, LIFELINE CURVE

FIGURE 23 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY DEVICE, LIFELINE CURVE

FIGURE 24 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY END USER, 2022

FIGURE 25 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY END USER, 2022

FIGURE 26 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 27 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY END USER, CAGR (2023-2030)

FIGURE 30 REPUBLIC OF IRELAND (ROI) MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 REPUBLIC OF IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 33 NORTHERN IRELAND MRI AND CT SCAN RADIOLOGY SERVICES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.