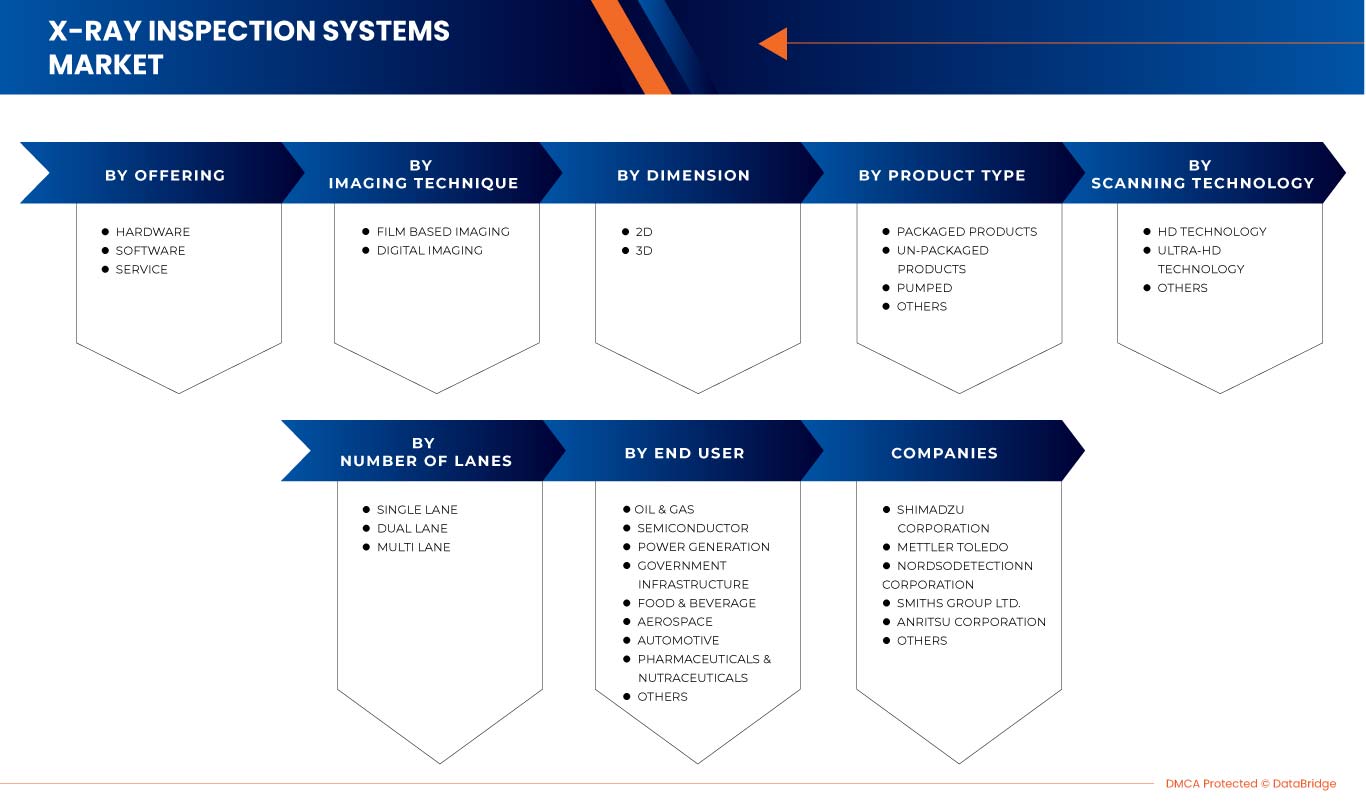

Marché des systèmes d'inspection par rayons X en Amérique du Nord, par offre (matériel, logiciel et services), technique d'imagerie (imagerie sur film et imagerie numérique ), dimension (2D et 3D), type de produit (produits emballés, produits non emballés, pompés et autres), technologie de numérisation (technologie HD, technologie Ultra-HD et autres), nombre de voies (voie unique, voies multiples et double voie), utilisation finale (pétrole et gaz, production d'électricité, infrastructure gouvernementale, alimentation et boissons, aérospatiale, automobile, produits pharmaceutiques et nutraceutiques, semi-conducteurs et autres), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et taille du marché des systèmes d'inspection par rayons X en Amérique du Nord

En raison des réglementations gouvernementales strictes qui exigent la sécurité et de la demande croissante de tests non destructifs, le marché nord-américain des systèmes d'inspection par rayons X est en plein essor. Cependant, les menaces de sécurité associées aux systèmes d'inspection par rayons X et aux systèmes d'inspection par rayons X freinent la croissance du marché nord-américain des systèmes d'inspection par rayons X. L'adoption croissante dans les secteurs de l'alimentation et des boissons et dans d'autres secteurs devrait offrir des opportunités de croissance pour le marché nord-américain des systèmes d'inspection par rayons X. Cependant, le manque de conformité réglementaire associé aux systèmes d'inspection par rayons X est devenu un défi pour la croissance du marché.

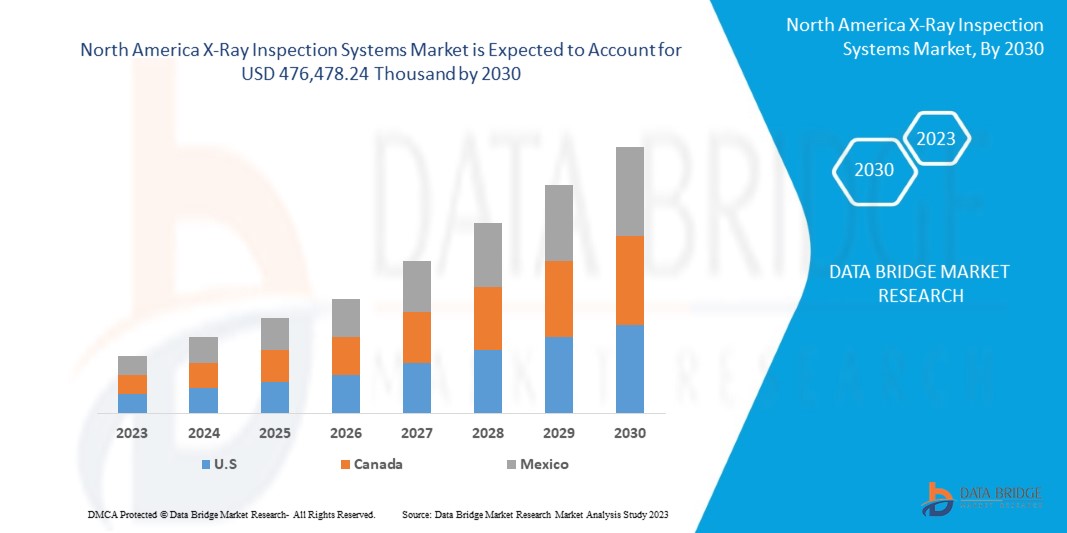

Data Bridge Market Research analyse que le marché nord-américain des systèmes d'inspection par rayons X devrait atteindre la valeur de 476 478,24 milliers USD d'ici 2030, à un TCAC de 7,6 % au cours de la période de prévision. Le rapport sur le marché nord-américain des systèmes d'inspection par rayons X couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en milliers, volumes en unités, prix en USD |

|

Segments couverts |

Par offre (matériel, logiciel et services), technique d'imagerie (imagerie sur film et imagerie numérique), dimension (2D et 3D), type de produit (produits emballés, produits non emballés, pompés et autres), technologie de numérisation (technologie HD, technologie Ultra-HD et autres), nombre de voies (voie unique, voies multiples et double voie), utilisation finale (pétrole et gaz, production d'électricité, infrastructure gouvernementale, alimentation et boissons, aérospatiale, automobile, produits pharmaceutiques et nutraceutiques, semi-conducteurs et autres). |

|

Pays couvert |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

SHIMADZU CORPORATION, METTLER TOLEDO, Nordson Corporation, Smiths Detection Group Ltd, ANRITSU CORPORATION, ZEISS, A&D Company, Limited, Sesotec GmbH, Nikon Metrology Inc., Comet Group, North Star Imaging Inc, Viscom AG, ISHIDA CO., LTD, groupe Mekitec, MATSUSADA PRECISION Inc, Scienscope, SYSTEMS SQUARE INC., MAHA X-RAY EQUIPMENTS PVT. LTD, Sapphire Inspection, VJ Electronix, Inc., Loma Systems, Minebea Intec GmbH, TDI PACKSYS, entre autres |

Définition du marché

Les systèmes d'inspection par rayons X sont utilisés pour l'inspection non destructive d'une zone d'échantillon. Les systèmes d'inspection par rayons X sont utilisés pour détecter les défauts des matériaux par des méthodes non destructives. Les avantages des systèmes d'inspection par rayons X comprennent de meilleurs mécanismes de contrôle de la qualité, une vérification facile des produits manquants, une collecte de données améliorée et un risque réduit de rappel de produits et bien plus encore. Dans les systèmes d'inspection par rayons X, l'objet à inspecter et son image sont produits à l'aide de rayons X qui sont à leur tour traités par un logiciel de traitement d'images pour vérifier les éléments manquants, dessiner une analyse de forme, vérifier l'intégrité de l'emballage et détecter toute contamination.

Dynamique du marché des systèmes d'inspection par rayons X en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante en matière de contrôles non destructifs

Les essais non destructifs (END) sont une technique de test et d'analyse utilisée par l'industrie pour évaluer les propriétés d'un matériau, d'un composant, d'une structure ou d'un système afin de détecter les différences caractéristiques ou les défauts et discontinuités de soudure sans endommager la pièce d'origine. Les END sont également connus sous le nom d'examen non destructif (END), d'inspection non destructive (IND) et d'évaluation non destructrice (END). Ces méthodes sont largement utilisées dans des secteurs tels que l'aérospatiale, l'automobile et la fabrication pour garantir la qualité et la sécurité des produits. Les systèmes d'inspection par rayons X sont un élément essentiel des END car ils permettent une détection précise et fiable des défauts et des contaminants qui peuvent compromettre la qualité et la sécurité des produits. Aujourd'hui, les essais non destructifs modernes sont utilisés dans la fabrication, la fabrication et les inspections en service pour garantir l'intégrité et la fiabilité des produits, pour contrôler les processus de fabrication, réduire les coûts de production et maintenir un niveau de qualité uniforme.

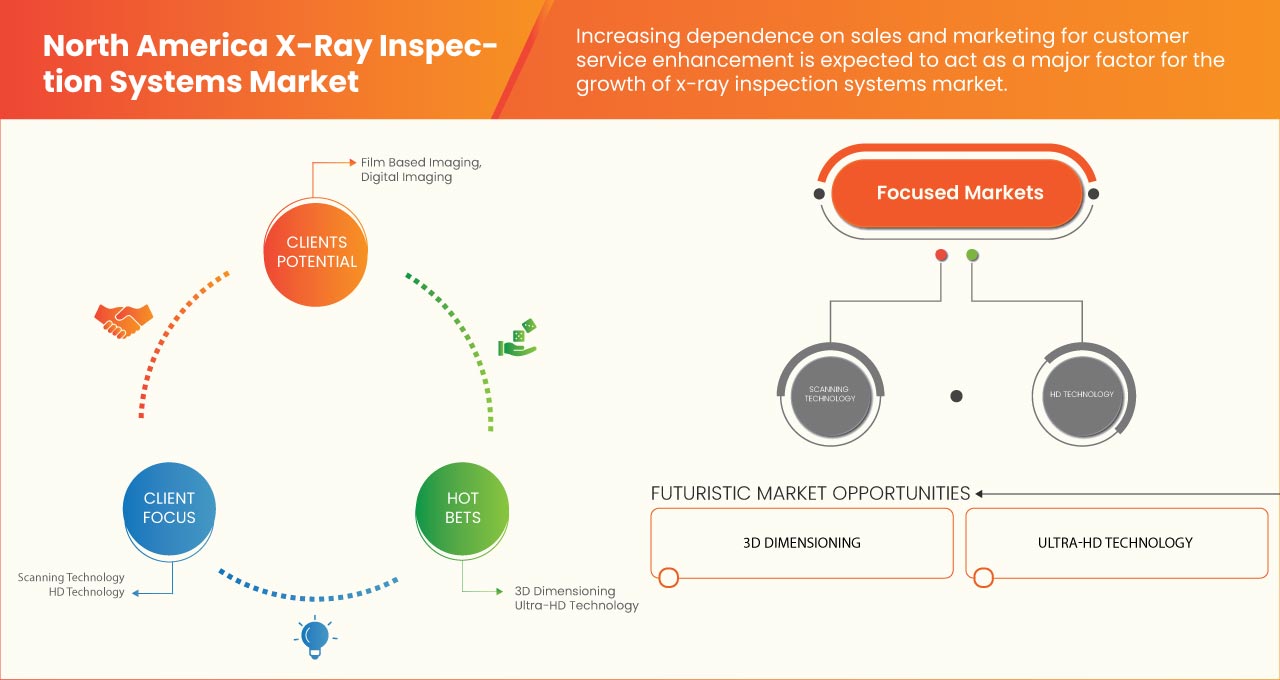

- Progrès technologiques dans les systèmes d'inspection par rayons X

Les avancées technologiques dans les systèmes d'inspection par rayons X devraient stimuler le marché. Le développement de technologies nouvelles et avancées, telles que l'imagerie haute résolution, l'imagerie 3D et des temps de numérisation plus rapides, rend les systèmes d'inspection par rayons X plus précis, efficaces et conviviaux. Cela conduit à leur adoption croissante dans divers secteurs tels que l'automobile, l'aérospatiale et l'électronique. Au cours des 10 dernières années, la technologie d'inspection par rayons X 2D a enregistré d'énormes progrès en termes de capacités. Les systèmes d'inspection par rayons X 2D avancés actuels disposent de sources de rayons X extrêmement nettes et puissantes (tubes à rayons X) avec une reconnaissance de caractéristiques submicroniques jusqu'à 0,1 micron ou 100 nanomètres.

Opportunité

- Adoption croissante dans le secteur de l'alimentation et des boissons

Un système d'inspection à rayons X est une méthode de test non destructif qui utilise les rayons X pour examiner la structure interne des objets ou des matériaux. Les rayons X sont une forme de rayonnement électromagnétique qui peut pénétrer les matériaux et produire une image basée sur l'absorption des rayons X par différentes parties de l'objet. Ces systèmes sont couramment utilisés dans diverses industries telles que la fabrication, l'aérospatiale, l'automobile et la médecine pour inspecter les composants, les produits et les matériaux à la recherche de défauts, de fissures, de vides, d'objets étrangers ou d'autres anomalies. Ces systèmes se composent généralement d'une source de rayons X, d'un détecteur ou d'un capteur et d'une unité de traitement qui génère une image à partir des rayons X détectés. Au cours de la dernière décennie, l'utilisation de systèmes d'inspection à rayons X dans le secteur des aliments et des boissons a augmenté rapidement. Le secteur des aliments et des boissons exige des normes de qualité élevées et les systèmes d'inspection à rayons X sont capables de détecter des contaminants tels que des fragments de métal, de verre et d'os dans les produits alimentaires.

Retenue/Défi

- Coûts élevés associés aux systèmes d'inspection par rayons X

L'utilisation et l'application des systèmes d'inspection par rayons X ont augmenté au cours des deux dernières décennies, et à mesure que les caractéristiques et les spécifications ont augmenté, le coût de ces systèmes a également augmenté. Aujourd'hui, le coût des systèmes d'inspection par rayons X varie en fonction de la technologie utilisée, de la complexité du système et de l'application. Par exemple, certains systèmes d'inspection par rayons X haut de gamme utilisés dans les industries des semi-conducteurs et de l'électronique peuvent coûter des centaines de milliers, voire des milliers de dollars aux entreprises. Ces coûts élevés peuvent constituer un obstacle majeur pour les petites et moyennes entreprises, qui peuvent ne pas avoir les ressources financières nécessaires pour investir dans ces systèmes

Impact post-COVID-19 sur le marché des systèmes d'inspection par rayons X en Amérique du Nord

La COVID-19 a eu un impact négatif sur le marché des systèmes d’inspection par rayons X en Amérique du Nord en raison de l’arrêt de la logistique et du transport en Amérique du Nord et du manque de tests pour le système.

La pandémie de COVID-19 a eu un impact négatif sur le marché nord-américain des systèmes d'inspection par rayons X. Cependant, l'automatisation est devenue une priorité pour de nombreuses industries, notamment l'automobile, l'électronique et l'aérospatiale, car elle offre plusieurs avantages, notamment une productivité accrue, un contrôle qualité amélioré et des coûts de main-d'œuvre réduits. Les systèmes d'inspection par rayons X jouent un rôle essentiel dans l'automatisation en fournissant des tests non destructifs des produits et des composants pendant le processus de fabrication. La demande croissante d'automatisation a donc un impact positif sur la demande de systèmes d'inspection par rayons X dans le monde entier. Les acteurs du marché nord-américain des systèmes d'inspection par rayons X réagissent en augmentant leur portefeuille de produits pour les systèmes d'inspection.

Les acteurs du marché mènent de nombreuses activités de recherche et développement pour améliorer la technologie utilisée dans les accessoires. Grâce à cela, les entreprises apporteront des progrès et des innovations au marché. De plus, le financement gouvernemental du système d'inspection par rayons X a stimulé la croissance du marché.

Développements récents

- En septembre 2023, METTLER TOLEDO a annoncé sur son site officiel que l'entreprise avait conclu un partenariat avec Relevant Industrial, LLC. Dans le cadre de ce partenariat, l'entreprise développe divers produits, notamment des systèmes d'inspection, des instruments de précision et des services pour de nombreuses applications dans la recherche et le développement, le contrôle qualité, la production, la logistique et la vente au détail à des clients du monde entier. Cela a renforcé la position de l'entreprise sur le marché nord-américain des systèmes d'inspection par rayons X.

- En août 2022, ANRITSU CORPORATION a annoncé que l'entreprise avait été récompensée comme l'un des « Meilleurs endroits où travailler dans l'Illinois » pour 2022 par le journal The Daily Herald. L'entreprise a reçu cette reconnaissance et l'a utilisée pour promouvoir sa culture d'entreprise et son portefeuille de produits dans toute la région des États-Unis. Cela a permis à l'entreprise de générer des revenus en augmentant ses ventes de produits sur le marché nord-américain des systèmes d'inspection par rayons X.

Portée du marché des systèmes d'inspection par rayons X en Amérique du Nord

Le marché nord-américain des systèmes d'inspection par rayons X est segmenté en fonction de l'offre, de la technique d'imagerie, de la dimension, du type de produit, de la technologie de numérisation, du nombre de voies et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

OFFRE

- MATÉRIEL

- LOGICIEL

- SERVICES

Sur la base de l'offre, le marché nord-américain des systèmes d'inspection par rayons X est segmenté en matériel, logiciels et services.

TECHNIQUE D'IMAGERIE

- IMAGERIE PAR FILM

- IMAGERIE NUMÉRIQUE

Sur la base de la technique d'imagerie, le marché nord-américain des systèmes d'inspection par rayons X est segmenté en imagerie à base de film et imagerie numérique.

DIMENSION

- 2D

- 3D

Sur la base de la dimension, le marché des systèmes d’inspection par rayons X en Amérique du Nord est segmenté en 2D et 3D.

- TYPE DE PRODUIT

- PRODUITS EMBALLÉS

- PRODUITS NON EMBALLÉS

- POMPÉ

- AUTRES

Sur la base du type de produit, le marché nord-américain des systèmes d'inspection par rayons X est segmenté en produits emballés, produits non emballés, pompés et autres.

TECHNOLOGIE DE NUMÉRISATION

- TECHNOLOGIE HD

- TECHNOLOGIE ULTRA-HD

- AUTRES

Sur la base de la technologie de numérisation, le marché nord-américain des systèmes d'inspection par rayons X est segmenté en technologie HD, technologie Ultra HD et autres.

NOMBRE DE VOIES

- VOIE UNIQUE

- DOUBLE VOIE

- VOIES MULTIPLES

Sur la base du nombre de voies, le marché nord-américain des systèmes d'inspection par rayons X est segmenté en voie unique, voies multiples et double voie.

UTILISATION FINALE

- ALIMENTS ET BOISSONS

- SEMI-CONDUCTEUR

- PRODUITS PHARMACEUTIQUES ET NUTRACEUTIQUES

- AUTOMOBILE

- PÉTROLE ET GAZ

- AÉROSPATIAL

- PRODUCTION D'ÉNERGIE

- INFRASTRUCTURE GOUVERNEMENTALE

- AUTRES

Sur la base de l'utilisation finale, le marché nord-américain des systèmes d'inspection par rayons X est segmenté en pétrole et gaz, production d'électricité, semi-conducteurs, infrastructures gouvernementales, alimentation et boissons, aérospatiale, automobile, produits pharmaceutiques et nutraceutiques et autres.

Analyses/perspectives régionales

Le marché des systèmes d’inspection par rayons X en Amérique du Nord est analysé et des informations et tendances sur la taille du marché sont fournies par pays, offre, technique d’imagerie, dimension, type de produit, technologie de numérisation, nombre de voies et utilisation finale, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des systèmes d’inspection par rayons X en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché car le pays dispose d'un marché industriel des rayons X en raison de la base solide des établissements de santé, de la réglementation stricte et de la mise en œuvre des normes imposées par diverses associations et du nombre croissant d'activités de recherche dans cette région. La section nationale du rapport fournit également des facteurs d'impact sur le marché individuel et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des systèmes d'inspection par rayons X en Amérique du Nord

Le paysage concurrentiel du marché des systèmes d'inspection par rayons X en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des systèmes d'inspection par rayons X en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché sont SHIMADZU CORPORATION, METTLER TOLEDO, Nordson Corporation, Smiths Detection Group Ltd, ANRITSU CORPORATION, ZEISS, A&D Company, Limited, Sesotec GmbH, Nikon Metrology Inc., Comet Group, North Star Imaging Inc, Viscom AG, ISHIDA CO., LTD, Mekitec group, MATSUSADA PRECISION Inc, Scienscope, SYSTEMS SQUARE INC., MAHA X-RAY EQUIPMENTS PVT. LTD, Sapphire Inspection, VJ Electronix, Inc., Loma Systems, Minebea Intec GmbH, TDI PACKSYS, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 OFFERING TIMELINE

2.1 END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PRICING ANALYSIS

4.3 COMPANY COMPARATIVE ANALYSIS

4.4 CASE STUDY

4.5 VALUE CHAIN ANALYSIS

4.6 TECHNOLOGICAL TRENDS

4.7 PATENT ANALYSIS

4.8 IMPORTANCE OF X-RAY INSPECTION SYSTEMS IN DIFFERENT VERTICALS

4.9 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR NON-DESTRUCTIVE TESTING

5.1.2 TECHNOLOGICAL ADVANCEMENTS IN X-RAY INSPECTION SYSTEMS

5.1.3 GROWTH IN SAFETY REGULATIONS AND QUALITY STANDARDS

5.1.4 DEVELOPMENT OF PORTABLE AND MOBILE INSPECTION SYSTEMS

5.2 RESTRAINTS

5.2.1 HIGH COSTS ASSOCIATED WITH X-RAY INSPECTION SYSTEMS

5.2.2 POTENTIAL RADIATION EXPOSURE BY X-RAY INSPECTION SYSTEMS

5.3 OPPORTUNITIES

5.3.1 RISING ADOPTION IN THE FOOD AND BEVERAGE SECTOR

5.3.2 INCREASING PARTNERSHIP, ACQUISITION AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 HIGH INCREASE IN AUTOMATION ACROSS VARIOUS APPLICATION

5.3.4 PRESENCE OF DIFFERENT SCANNING TECHNOLOGY FOR X-RAY INSPECTION SYSTEMS

5.4 CHALLENGES

5.4.1 REGULATORY COMPLIANCE ASSOCIATED WITH X-RAY INSPECTION SYSTEMS

5.4.2 PRESENCE OF ALTERNATIVE INSPECTION SYSTEMS

6 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.3 SOFTWARE

6.4 SERVICES

6.4.1 SUPPORT & MAINTENANCE

6.4.2 INSTALLATION & INTEGRATION

6.4.3 TRAINING

7 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 PACKAGED PRODUCTS

7.3 UN-PACKAGED PRODUCTS

7.4 PUMPED

7.4.1 SEMI-SOLIDS

7.4.2 FLUIDS

7.5 OTHERS

8 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY

8.1 OVERVIEW

8.2 HD TECHNOLOGY

8.3 ULTRA-HD TECHNOLOGY

8.4 OTHERS

9 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET) MARKET, BY NUMBER OF LANES

9.1 OVERVIEW

9.2 SINGLE LANE

9.3 DUAL LANE

9.4 MULTI LANE

10 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET) MARKET, BY END-USE

10.1 OVERVIEW

10.2 FOOD & BEVERAGE

10.2.1 BY OFFERING

10.2.1.1 HARDWARE

10.2.1.2 SOFTWARE

10.2.1.3 SERVICES

10.2.1.3.1 SUPPORT & MAINTENANCE

10.2.1.3.2 INSTALLATION & INTEGRATION

10.2.1.3.3 TRAINING

10.2.2 BY IMAGING TECHNIQUE

10.2.2.1 DIGITAL IMAGING

10.2.2.2 FILM BASED IMAGING

10.3 SEMICONDUCTOR

10.3.1 BY OFFERING

10.3.1.1 HARDWARE

10.3.1.2 SOFTWARE

10.3.1.3 SERVICES

10.3.1.3.1 Support & Maintenance

10.3.1.3.2 INSTALLATION & INTEGRATION

10.3.1.3.3 TRAINING

10.3.2 BY IMAGING TECHNIQUE

10.3.2.1 DIGITAL IMAGING

10.3.2.2 FILM BASED IMAGING

10.4 PHARMACEUTICALS & NUTRACEUTICALS

10.4.1 BY OFFERING

10.4.1.1 HARDWARE

10.4.1.2 SOFTWARE

10.4.1.3 SERVICES

10.4.1.3.1 SUPPORT & MAINTENANCE

10.4.1.3.2 INSTALLATION & INTEGRATION

10.4.1.3.3 TRAINING

10.4.2 BY IMAGING TECHNIQUE

10.4.2.1 DIGITAL IMAGING

10.4.2.2 FILM BASED IMAGING

10.5 AUTOMOTIVE

10.5.1 BY OFFERING

10.5.1.1 HARDWARE

10.5.1.2 SOFTWARE

10.5.1.3 SERVICES

10.5.1.3.1 SUPPORT & MAINTENANCE

10.5.1.3.2 INSTALLATION & INTEGRATION

10.5.1.3.3 TRAINING

10.5.2 BY IMAGING TECHNIQUE

10.5.2.1 DIGITAL IMAGING

10.5.2.2 FILM BASED IMAGING

10.6 OIL & GAS

10.6.1 BY OFFERING

10.6.1.1 HARDWARE

10.6.1.2 SOFTWARE

10.6.1.3 SERVICES

10.6.1.3.1 SUPPORT & MAINTENANCE

10.6.1.3.2 INSTALLATION & INTEGRATION

10.6.1.3.3 TRAINING

10.6.2 BY IMAGING TECHNIQUE

10.6.2.1 DIGITAL IMAGING

10.6.2.2 FILM BASED IMAGING

10.7 AEROSPACE

10.7.1 BY OFFERING

10.7.1.1 HARDWARE

10.7.1.2 SOFTWARE

10.7.1.3 SERVICES

10.7.1.3.1 SUPPORT & MAINTENANCE

10.7.1.3.2 INSTALLATION & INTEGRATION

10.7.1.3.3 TRAINING

10.7.2 BY IMAGING TECHNIQUE

10.7.2.1 DIGITAL IMAGING

10.7.2.2 FILM BASED IMAGING

10.8 POWER GENERATION

10.8.1 BY OFFERING

10.8.1.1 HARDWARE

10.8.1.2 SOFTWARE

10.8.1.3 SERVICES

10.8.1.3.1 SUPPORT & MAINTENANCE

10.8.1.3.2 INSTALLATION & INTEGRATION

10.8.1.3.3 TRAINING

10.8.2 BY IMAGING TECHNIQUE

10.8.2.1 DIGITAL IMAGING

10.8.2.2 FILM BASED IMAGING

10.9 GOVERNMENT INFRASTRUCTURE

10.9.1 BY TYPE

10.9.1.1 AIRPORT

10.9.1.2 RAILWAY

10.9.1.3 OTHERS

10.9.2 BY OFFERING

10.9.2.1 HARDWARE

10.9.2.2 SOFTWARE

10.9.2.3 SERVICES

10.9.2.3.1 SUPPORT & MAINTENANCE

10.9.2.3.2 INSTALLATION & INTEGRATION

10.9.2.3.3 TRAINING

10.9.3 BY IMAGING TECHNIQUE

10.9.3.1 DIGITAL IMAGING

10.9.3.2 FILM BASED IMAGING

10.1 OTHERS

11 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE

11.1 OVERVIEW

11.2 DIGITAL IMAGING

11.3 FILM BASED IMAGING

12 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION

12.1 OVERVIEW

12.2 2D

12.3 3D

13 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 U.A.E.

13.1.2 SAUDI ARABIA

13.1.3 SOUTH AFRICA

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 OMAN

13.1.7 BAHRAIN

13.1.8 KUWAIT

13.1.9 QATAR

13.1.10 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILINGS

16.1 SHIMADZU CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 METTLER TOLEDO

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 NORDSON CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SMITHS DETECTION GROUP LTD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ANRITSU CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 A&D COMPANY, LIMITED

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 COMET GROUP

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ISHIDA CO.,LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 LOMA SYSTEMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 MAHA X-RAY EQUIPMENTS PVT. LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 MATSUSADA PRECISION INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MEKITEC GROUP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 MINEBEA INTEC GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 NIKON METROLOGY INC

16.14.1 COMPANY SNAPSHOT

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 NORTH STAR IMAGING INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 SAPPHIRE INSPECTION

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 SCIENSCOPE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 SESOTEC GMBH

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SYSTEM SQUARE INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 TDI PACKSYS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 VISCOM AG

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 VJ ELECTRONIX

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 ZEISS

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 PRICING

TABLE 2 REGULATORY BODIES IN CONCERNING REGIONS

TABLE 3 X-RAY INSPECTION SYSTEMS AND COST ASSOCIATED

TABLE 4 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA HARDWARE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA SOFTWARE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA PACKAGED PRODUCTS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA UN-PACKAGED PRODUCTS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA PUMPED IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA HD TECHNOLOGY IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ULTRA-HD TECHNOLOGY IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA OTHERS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET) MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA SINGLE LANE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA DUAL LANE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA MULTI LANE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET) MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA OTHERS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2022 (USD THOUSAND)

TABLE 59 NORTH AMERICA DIGITAL IMAGING IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA FILM BASED IMAGING IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2022 (USD THOUSAND)

TABLE 62 NORTH AMERICA 2D IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA 3D IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 80 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 84 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 86 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 90 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 NORTH AMERICA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 92 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 93 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 95 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 97 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 99 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 100 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 102 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2021-2030 (USD THOUSAND)

TABLE 103 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 U.S. PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 106 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 107 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 108 U.S. FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 111 U.S. SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 U.S. SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 115 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 117 U.S. AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 U.S. AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 121 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 U.S. AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 126 U.S. POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 127 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 U.S. POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 129 U.S. GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 U.S. GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 131 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 U.S. GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 140 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 142 CANADA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 143 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 CANADA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 145 CANADA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 146 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 CANADA SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 148 CANADA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 149 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 CANADA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 151 CANADA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 152 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 CANADA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 154 CANADA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 155 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 CANADA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 157 CANADA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 158 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 CANADA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 160 CANADA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 161 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 CANADA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 163 CANADA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 164 CANADA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 165 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 CANADA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 167 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 168 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 170 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2021-2030 (USD THOUSAND)

TABLE 171 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 MEXICO PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 173 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 174 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 175 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 176 MEXICO FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 177 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 MEXICO FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 179 MEXICO SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 180 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 MEXICO SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 182 MEXICO PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 183 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 MEXICO PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 185 MEXICO AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 186 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 MEXICO AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 188 MEXICO OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 189 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 MEXICO OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 191 MEXICO AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 192 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 MEXICO AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 194 MEXICO POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 195 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 196 MEXICO POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 197 MEXICO GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 198 MEXICO GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 199 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 200 MEXICO GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: DROC ANALYSIS

FIGURE 3 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: OFFERING TIMELINE

FIGURE 11 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 12 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR NON-DESTRUCTIVE TESTING IS EXPECTED TO BE A KEY DRIVER FOR NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 HARDWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET FROM 2023 TO 2030

FIGURE 15 BRAND COMPARISON

FIGURE 16 VALUE CHAIN FOR THE NORTH AMERICA X-RAY INSPECTION MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET

FIGURE 18 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY OFFERING, 2022

FIGURE 19 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2022

FIGURE 20 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY SCANNING TECHNOLOGY, 2022

FIGURE 21 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY NUMBER OF LANES, 2022

FIGURE 22 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY END-USE, 2022

FIGURE 23 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY IMAGING TECHNIQUE, 2022 (USD THOUSAND)

FIGURE 24 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY DIMENSION, 2022 (USD THOUSAND)

FIGURE 25 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: SNAPSHOT (2022)

FIGURE 26 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY COUNTRY (2022)

FIGURE 27 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 28 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 29 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY SERVICE (2023-2030)

FIGURE 30 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.