North America Whole Exome Sequencing Market

Taille du marché en milliards USD

TCAC :

%

USD

435.97 Million

USD

2,192.73 Million

2022

2030

USD

435.97 Million

USD

2,192.73 Million

2022

2030

| 2023 –2030 | |

| USD 435.97 Million | |

| USD 2,192.73 Million | |

|

|

|

Marché nord-américain du séquençage de l'exome entier, par composant (séquençage de l'exome entier, séquençage de deuxième génération et séquençage de troisième génération), produit et services (systèmes, kits et services), application (diagnostic, découverte et développement de médicaments, médecine personnalisée, agriculture et recherche animale, et autres), utilisateur final (hôpitaux et cliniques, sociétés pharmaceutiques et biotechnologiques, instituts universitaires et de recherche, laboratoires cliniques, et autres), canal de distribution (commerce direct, ventes au détail, et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du séquençage de l'exome entier en Amérique du Nord

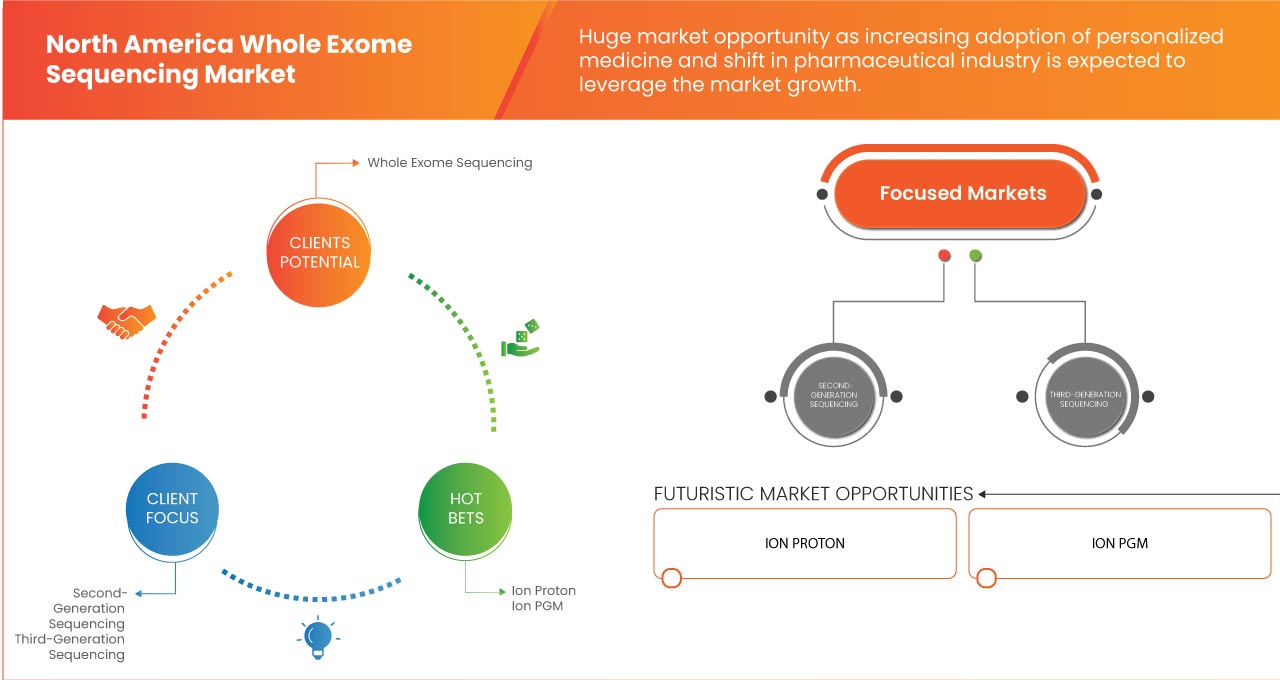

La préférence croissante du WES par rapport au séquençage du génome entier en raison de sa capacité de séquençage à faible coût est l'un des principaux facteurs de croissance du marché au cours de la période de prévision. Cependant, les coûts élevés des instruments, le besoin de professionnels qualifiés et la forte dépendance aux subventions et aux fonds peuvent entraver la croissance future du marché du séquençage de l'exome entier. L'adoption d'alliances stratégiques telles que les partenariats et les acquisitions par les principaux acteurs du marché constitue une opportunité pour la croissance du marché du séquençage de l'exome entier.

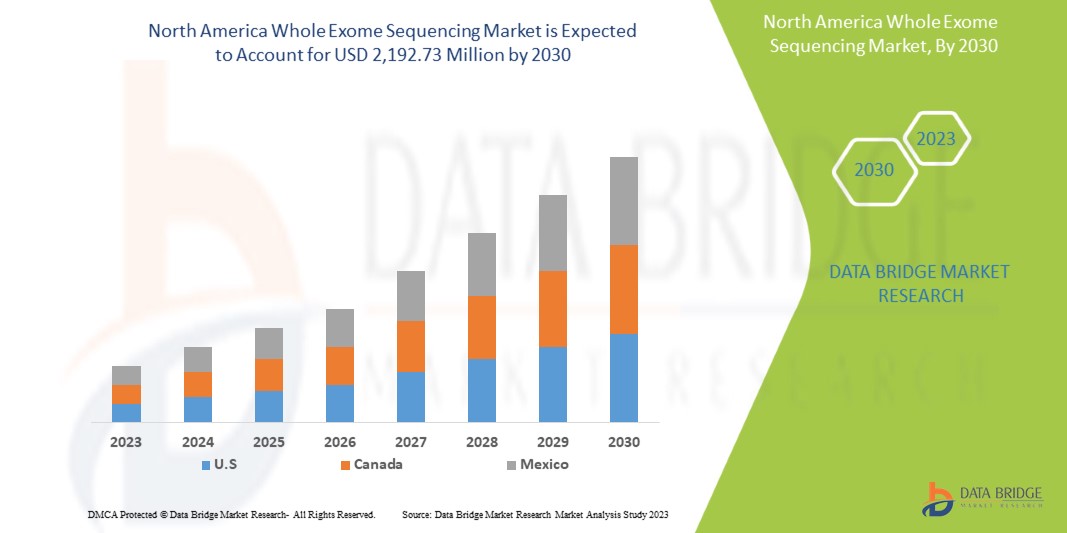

Le marché du séquençage de l'exome entier devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 22,0 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 2 192,73 millions USD d'ici 2030 contre 435,97 millions USD en 2022.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisé pour 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Composant (séquençage de l'exome entier, séquençage de deuxième génération et séquençage de troisième génération), produit et services (systèmes, kits et services), application (diagnostic, découverte et développement de médicaments, médecine personnalisée, recherche agricole et animale, et autres), utilisateur final (hôpitaux et cliniques, sociétés pharmaceutiques et biotechnologiques, instituts universitaires et de recherche, laboratoires cliniques, et autres), canal de distribution (commerce direct, ventes au détail, et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Thermo Fisher Scientific Inc., QIAGEN, Illumina, Inc., Beckman Coulter, Inc., Eurofins Scientific, BIONEER CORPORATION, ExoDx (une filiale de Bio-Techne), FOUNDATION MEDICINE, INC. (une filiale de F. Hoffmann-La Roche Ltd), GeneFirst Limited, Meridian, Merck KGaA, SOPHiA GENETICS, Azenta US Inc., CD Genomics, Twist Bioscience, PerkinElmer Genomics (une filiale de PerkinElmer Inc.), GeneDx, LLC, Psomagen et Integrated DNA Technologies, Inc. |

Définition du marché

Le séquençage de l'exome entier est une technique génomique permettant de séquencer l'ensemble de la région codante des protéines des gènes d'un génome. Le séquençage de l'exome entier (WES) est disponible pour les patients qui recherchent un diagnostic unifié pour plusieurs pathologies. Il s'agit d'un processus de laboratoire utilisé pour déterminer la séquence nucléotidique principalement des régions exoniques (ou codantes pour les protéines) du génome d'un individu et des séquences associées, représentant environ 1 % de la séquence d'ADN complète, appelée WES. Le séquençage de l'exome entier est une méthode de séquençage de l'exome entier (WES) largement utilisée qui consiste à séquencer les régions codantes pour les protéines du génome. L'exome humain représente moins de 2 % du génome, mais contient environ 85 % des variantes connues liées à la maladie, 1 ce qui fait de cette méthode une alternative rentable au séquençage du génome entier

Dynamique du marché du séquençage de l'exome entier en Amérique du Nord

Conducteurs

- Applications diagnostiques croissantes du séquençage de l'exome entier

Il existe plus de 7 000 maladies rares identifiées et environ 80 % d’entre elles sont liées à des causes génétiques. Diagnostiquer les patients atteints de maladies rares peut souvent s’avérer difficile, ce qui entraîne des odyssées diagnostiques longues, coûteuses et émotionnelles.

Par conséquent, les applications diagnostiques de WES devraient propulser la taille du marché et devraient servir de moteur au marché mondial du séquençage de l'exome entier au cours de la période de prévision.

- Utilisation croissante des méthodes de séquençage ciblé

Le séquençage de nouvelle génération (NGS) évolue en tant qu'outil puissant pour fournir un aperçu plus approfondi et plus précis des fondements moléculaires des tumeurs individuelles et des récepteurs spécifiques, alors que la pharmacologie axée sur la génomique continue de jouer un rôle plus important dans le traitement de diverses maladies chroniques, en particulier le cancer.

Le NGS offre des avantages en termes de précision, de sensibilité et de rapidité par rapport aux méthodes traditionnelles, qui ont le potentiel d'avoir un impact significatif dans le domaine de l'oncologie. La nécessité de commander plusieurs tests pour identifier la mutation causale est éliminée car le NGS peut évaluer plusieurs gènes dans un seul test.

Opportunité

- Augmentation du nombre de lancements de produits ces dernières années

Les acteurs du marché se concentrent sur le lancement de nouveaux produits dans le domaine du séquençage de l'exome entier en raison de la demande croissante de techniques de séquençage de l'exome entier. Les progrès technologiques aident les acteurs du marché à lancer plusieurs produits.

Les lancements de produits au cours des dernières années ont montré le potentiel de ces technologies et les entreprises travaillant sur ce marché tentent d'obtenir des produits plus avancés sur le marché qui constitueront une opportunité pour le marché et propulseront le marché au cours de la période de prévision.

Défis/Restrictions

- Préoccupations liées à la cybersécurité en génomique

Les logiciels sont connus pour contenir des vulnérabilités causées par un code imparfait, une mauvaise configuration, entre autres, et les logiciels liés au NGS, utilisés pour faire fonctionner les équipements de séquençage et de laboratoire ou pour effectuer les analyses bioinformatiques, ne font pas exception. Les vulnérabilités logicielles sont exploitées pour obtenir un accès non autorisé aux systèmes informatiques ou aux réseaux, divulguer des données, planter ou perturber de toute autre manière divers services.

Ces types d’incidents concernant la violation de données et la cybermenace associée à l’ensemble du séquençage de l’exome devraient entraver la croissance du marché au cours de la période de prévision.

- Manque de professionnels qualifiés

L'interprétation des données du séquençage de l'exome entier (WES) nécessite une expertise en informatique génomique et en médecine clinique pour garantir la précision et la sécurité des rapports de résultats. La première étape du WES consiste à acquérir de l'ADN génomique (ADNg) de haute qualité à partir d'échantillons biologiques, le plus souvent extraits de leucocytes du sang périphérique. Les professionnels doivent avoir des informations sur l'extraction de l'ADNg. De plus, la préparation d'une bibliothèque d'enrichissement de l'exome est requise dans le WES, ce qui n'est pas connu de nombreux spécialistes de la santé.

Les professionnels ne disposent pas des compétences nécessaires pour effectuer le séquençage complet de l'exome, car les échantillons diagnostiques des patients sont d'une importance capitale. Le besoin de professionnels de santé qualifiés a augmenté. Ainsi, le manque de professionnels qualifiés pour effectuer le séquençage complet de l'exome constitue un défi pour la croissance du marché.

Développement récent

- En mars, Thermo Fisher Scientific a lancé le séquenceur intégré Ion Torrent Genexus Dx, marqué CE-IVD, une plate-forme de séquençage automatisée de nouvelle génération (NGS) qui fournit des résultats en une seule journée. Conçu pour être utilisé dans les laboratoires cliniques, ce système entièrement validé permet aux utilisateurs d'effectuer à la fois des tests de diagnostic et des recherches cliniques sur un seul instrument. Cela a aidé l'entreprise à faire des progrès dans son portefeuille de produits

Portée et taille du marché du séquençage de l'exome entier en Amérique du Nord

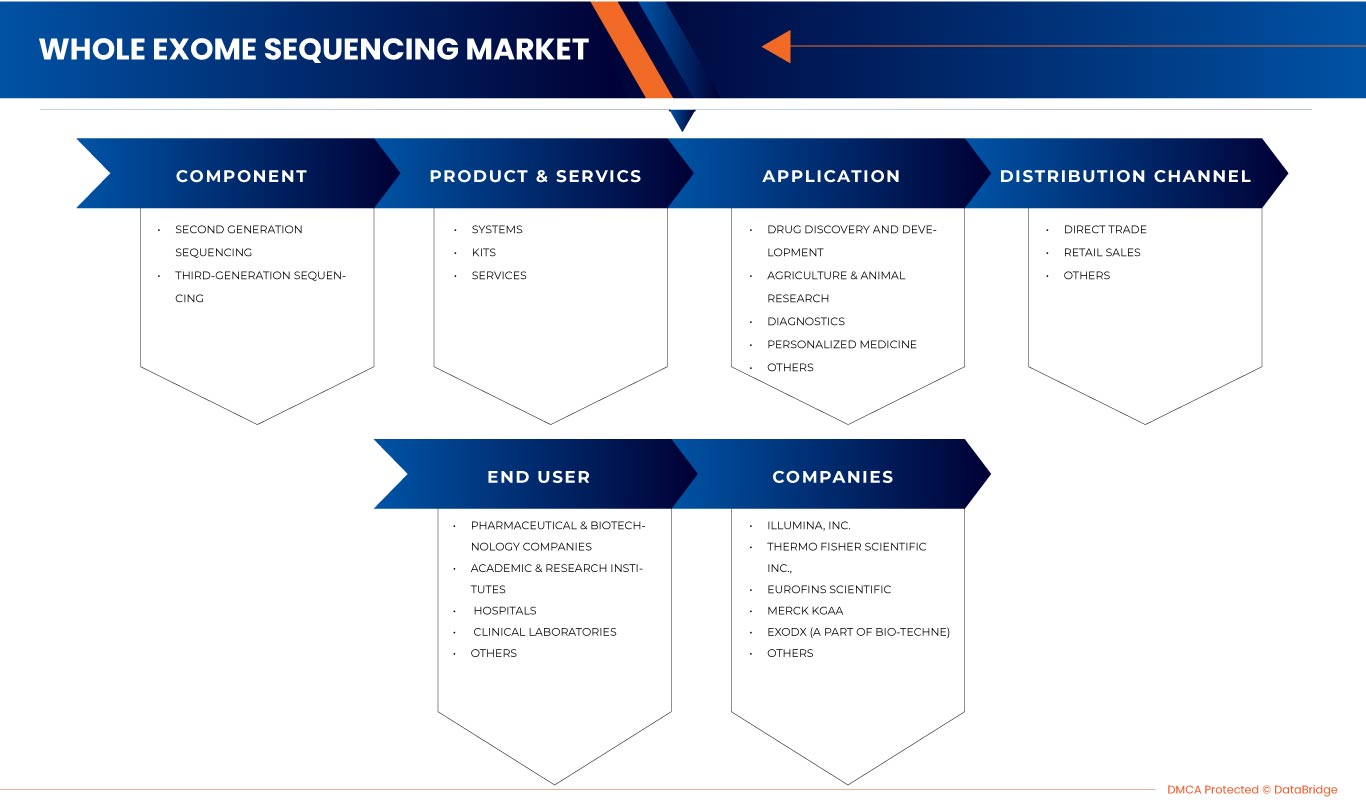

Le marché nord-américain du séquençage de l'exome entier est segmenté en fonction des composants, des produits et services, des applications, des utilisateurs finaux et des canaux de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Composant

- Séquençage de l'exome entier

- Séquençage de troisième génération

Sur la base des composants, le marché nord-américain du séquençage de l’exome entier est segmenté en séquençage de l’exome entier et séquençage de troisième génération.

Produits et services

- Systèmes

- Kits

- Services

Sur la base du produit et du service, le marché nord-américain du séquençage de l’exome entier est segmenté en systèmes, kits et services.

Application

- Diagnostic

- Découverte et développement de médicaments

- Médecine personnalisée

- Agriculture et recherche animale

- Autres

Sur la base de l'application, le marché nord-américain du séquençage de l'exome entier est segmenté en découverte et développement de médicaments, recherche agricole et animale, diagnostic, médecine personnalisée et autres.

Utilisateur final

- Hôpitaux et cliniques

- Sociétés pharmaceutiques et biotechnologiques

- Instituts universitaires et de recherche

- Laboratoires cliniques

- Autres

Sur la base de l'utilisateur final, le marché nord-américain du séquençage de l'exome entier est segmenté en sociétés pharmaceutiques et biotechnologiques, instituts universitaires et de recherche, hôpitaux, laboratoires cliniques et autres.

Canal de distribution

- Commerce direct

- Ventes au détail

- Autres

Sur la base du canal de distribution, le marché nord-américain du séquençage de l'exome entier (WES) est segmenté en commerce direct, ventes au détail et autres.

Analyse du marché du séquençage de l'exome entier en Amérique du Nord

L’ensemble du marché du séquençage de l’exome est analysé et des informations sur la taille du marché sont fournies par composant, produit et service, application, utilisateur final et canal de distribution.

Les pays couverts dans l’ensemble du rapport sur le marché du séquençage de l’exome (WES) sont les États-Unis, le Canada et le Mexique.

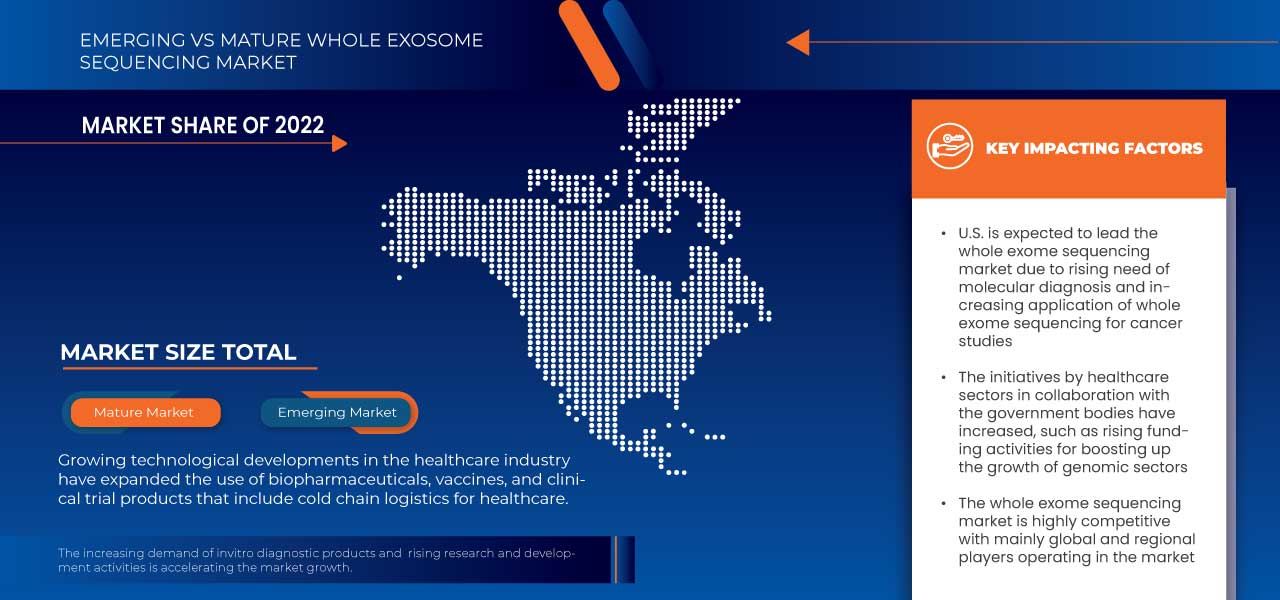

Les États-Unis devraient dominer le marché en raison de la présence d'acteurs clés du marché le long du plus grand marché de consommation avec un PIB élevé. Les États-Unis devraient croître en raison de l'augmentation des progrès technologiques.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du séquençage de l'exome entier en Amérique du Nord

Le paysage concurrentiel du marché du séquençage de l'exome entier fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché.

Français Certaines des principales entreprises qui s'occupent du marché nord-américain du séquençage de l'exome entier sont Thermo Fisher Scientific Inc., QIAGEN, Illumina, Inc., Beckman Coulter, Inc., Eurofins Scientific, BIONEER CORPORATION, ExoDx (une partie de Bio-Techne), FOUNDATION MEDICINE, INC. (Une filiale de F. Hoffmann-La Roche Ltd), GeneFirst Limited, CeGaT GmbH, Meridian, Merck KGaA, SOPHiA GENETICS, Azenta US Inc., CD Genomics, Twist Bioscience, PerkinElmer Genomics (Une filiale de PerkinElmer Inc.), GeneDx, LLC, Psomagen et Integrated DNA Technologies, Inc., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRIAL INSIGHTS:

4.4 CONCLUSION

5 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING USAGE OF TARGETED SEQUENCING METHODS

6.1.2 INCREASE IN THE ADOPTION OF NEXT GENERATION SEQUENCING

6.1.3 INCREASING DIAGNOSTICS APPLICATIONS OF WHOLE EXOME SEQUENCING

6.1.4 INCREASE TREND TOWARD PERSONALIZED MEDICATION

6.2 RESTRAINTS

6.2.1 LESS COMPREHENSIVE COVERAGE OF EXONS

6.2.2 CYBER SECURITY CONCERNS IN GENOMICS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

6.3.2 INCREASING PRODUCT LAUNCHES IN RECENT YEARS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 ETHICAL AND LEGAL ISSUES RELATED TO WHOLE EXOME SEQUENCING

7 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SECOND-GENERATION SEQUENCING

7.2.1 SEQUENCING BY SYNTHESIS (SBS)

7.2.2 SEQUENCING BY HYBRIDIZATION (SBH) AND SEQUENCING BY LIGATION (SBL)

7.3 THIRD-GENERATION SEQUENCING

8 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE

8.1 OVERVIEW

8.2 SYSTEMS

8.2.1 HISEQ SERIES

8.2.1.1 HISEQ 2500

8.2.1.2 HISEQ 1500

8.2.2 MISEQ SERIES

8.2.3 ION TORRENT PLATFORMS

8.2.3.1 ION PROTON

8.2.3.2 ION PGM

8.2.4 OTHERS

8.3 KITS

8.3.1 DNA FRAGMENTATION, END REPAIR, A-TAILING, AND SIZE SELECTION KITS

8.3.2 LIBRARY PREPARATION KITS

8.3.3 TARGET ENRICHMENT KITS

8.3.4 OTHERS

8.4 SERVICES

8.4.1 SEQUENCING SERVICES

8.4.2 DATA ANALYSIS (BIOINFORMATICS) SERVICES

8.4.3 OTHERS

9 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DRUG DISCOVERY AND DEVELOPMENT

9.3 AGRICULTURE & ANIMAL RESEARCH

9.4 DIAGNOSTICS

9.5 PERSONALIZED MEDICINE

9.6 OTHERS

10 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

10.3 ACADEMIC & RESEARCH INSTITUTES

10.4 HOSPITALS AND CLINICS

10.5 CLINICAL LABORATORIES

10.6 OTHERS

11 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TRADE

11.3 RETAIL SALES

11.4 OTHERS

12 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 COMPANY PROFILE

14.1 PERKINELMER GENOMICS (A SUBSIDIARY OF PERKINELMER INC.)

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 MERCK KGAA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 EXODX (A PART OF BIO-TECHNE)

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 THERMO FISHER SCIENTIFIC INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 FOUNDATION MEDICINE, INC. (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 AZENTA US, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 BECKMAN COULTER, INC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 CD GENOMICS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 EUROFINS SCIENTIFIC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 GENEDX, LLC

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 GENEFIRST LIMITED.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 ILLUMINA, INC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 INTEGRATED DNA TECHNOLOGIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 MERIDIAN BIOSCIENCE, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 PSOMAGEN

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 QIAGEN

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 SOPHIA GENETICS

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 TWIST BIOSCIENCE

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 2 NORTH AMERICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 3 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 4 GLOBAL SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 5 GLOBAL HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 6 NORTH AMERICA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 7 NORTH AMERICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 8 NORTH AMERICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 9 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2021- 2030 (USD MILLION)

TABLE 10 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2021- 2030 (USD MILLION)

TABLE 11 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD MILLION)

TABLE 12 U.S. WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 13 U.S. SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 14 U.S. WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 15 U.S. SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 16 U.S. HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 17 U.S. ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 18 U.S. KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 19 U.S. SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 20 U.S. WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2021- 2030 (USD MILLION)

TABLE 21 U.S. WHOLE EXOME SEQUENCING MARKET, BY END USER, 2021- 2030 (USD MILLION)

TABLE 22 U.S. WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD MILLION)

TABLE 23 CANADA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 24 CANADA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 25 CANADA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 26 CANADA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 27 CANADA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 28 CANADA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 29 CANADA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 30 CANADA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 31 CANADA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2021- 2030 (USD MILLION)

TABLE 32 CANADA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2021- 2030 (USD MILLION)

TABLE 33 CANADA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD MILLION)

TABLE 34 MEXICO WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 35 MEXICO SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 36 MEXICO WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 37 MEXICO SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 38 MEXICO HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 39 MEXICO ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 40 MEXICO KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 41 MEXICO SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 42 MEXICO WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2021- 2030 (USD MILLION)

TABLE 43 MEXICO WHOLE EXOME SEQUENCING MARKET, BY END USER, 2021- 2030 (USD MILLION)

TABLE 44 MEXICO WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: SEGMENTATION

FIGURE 10 INCREASE IN USE OF WES TECHNOLOGY FOR NEW SCIENTIFIC APPLICATIONS AND INCREASING THE PREFERENCE OF WES OVER WHOLE-GENOME SEQUENCING IS ITS LOW-COST SEQUENCING CAPABILITY IS EXPECTED TO DRIVE THE NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE COMPONENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA WHOLE EXOME SEQUENCING MARKET

FIGURE 13 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, 2022

FIGURE 14 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 15 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 16 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 17 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, 2022

FIGURE 18 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, 2023-2030 (USD MILLION)

FIGURE 19 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, 2022

FIGURE 22 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 23 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 25 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY END USER, 2022

FIGURE 26 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 27 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 30 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 31 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 33 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: SNAPSHOT (2022)

FIGURE 34 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2022)

FIGURE 35 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 36 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 37 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT (2023-2030)

FIGURE 38 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.