Marché nord-américain des technologies de conférence portables, par offre (matériel, logiciel et services), type de conférence ( audioconférence et vidéoconférence ), mode de déploiement (sur site et cloud ), taille de l'organisation (petite et moyenne organisation et grande organisation), application (grand public et entreprise), utilisation finale (entreprise, éducation, santé, gouvernement et défense, banque, services financiers et assurances (BSFI), médias et divertissement et autres), pays (États-Unis, Canada et Mexique) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché : marché nord-américain des technologies de conférence portables

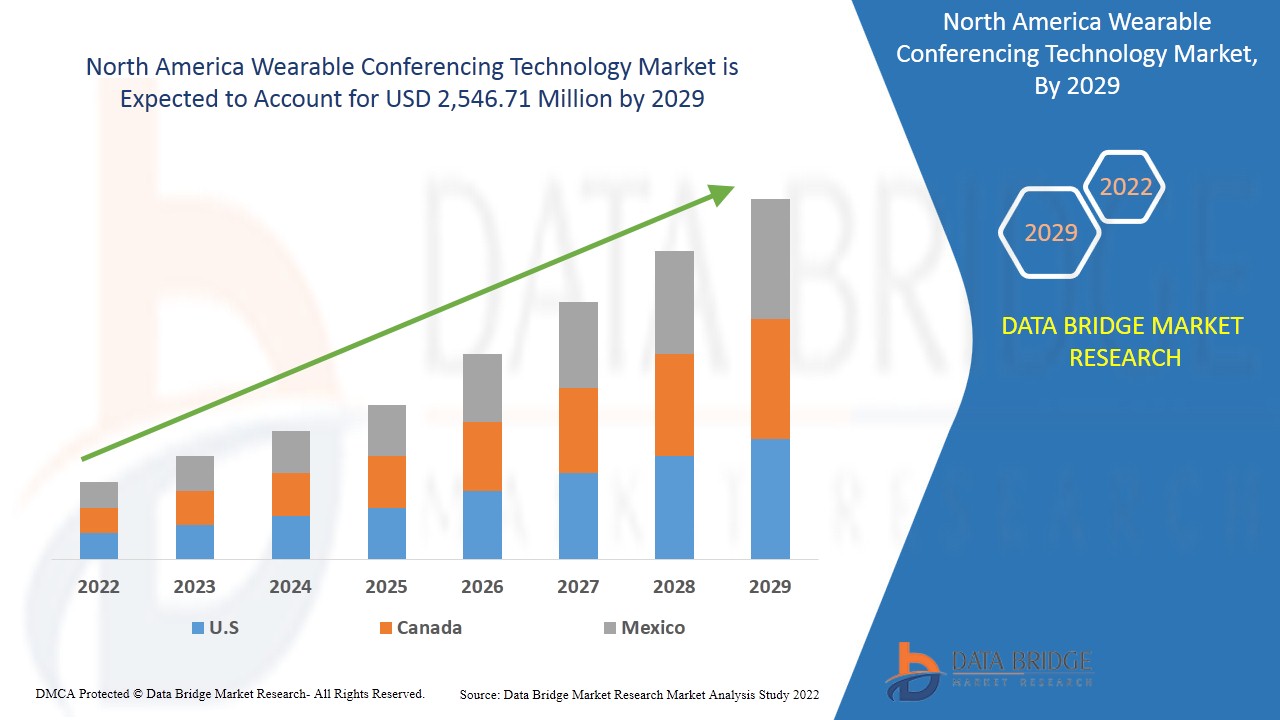

Le marché nord-américain des technologies de conférence portables devrait connaître une croissance de marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 13,6 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 2 546,71 millions USD d'ici 2029. L'accent croissant et l'adoption de la culture du travail à distance stimulent le marché nord-américain des technologies de conférence portables.

La technologie portable, souvent appelée « wearables », est une classe d'appareils électroniques qui peuvent être portés sur le corps. Les gadgets sont des appareils mains libres dotés d'applications pratiques, alimentés par des microprocesseurs et capables d'envoyer et de recevoir des données via Internet. La coopération en temps réel entre plusieurs appareils est possible grâce aux solutions de conférence. Les participants peuvent rejoindre un seul lieu numérique à l'aide de leurs appareils mobiles, ordinateurs portables ou ordinateurs personnels (PC) à l'aide d'une plate-forme de conférence. Les utilisateurs peuvent utiliser une connexion Internet pour accéder aux technologies de conférence fournies sous forme de logiciel en tant que service (SaaS). Une plate-forme de conférence Web peut également être fournie sur site, en utilisant les capacités du centre de données d'une organisation. Il s'agit donc d'une technologie utilisée dans des appareils tels que Google Glass ou Microsoft HoloLens pour l'application de conférence et de collaboration via un support audio ou vidéo. Actuellement, ce marché a de larges applications dans le monde de l'entreprise pour les collaborations professionnelles et dans les secteurs de l'éducation et de la formation.

L'intérêt croissant et l'adoption de la culture du travail à distance agissent comme un moteur sur le marché nord-américain des technologies de conférence portables. La nature intermittente de l'énergie éolienne s'avère être un défi. Cependant, l'augmentation de diverses décisions stratégiques telles que les partenariats devrait offrir des opportunités pour le marché nord-américain des technologies de conférence portables. Le coût élevé de l'infrastructure de conférence peut s'avérer être un frein pour le marché.

Le rapport sur le marché nord-américain des technologies de conférence portables fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché nord-américain des technologies de conférence portables, contactez Data Bridge Market Research pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des technologies de conférence portables en Amérique du Nord

Le marché nord-américain des technologies de conférence portables est segmenté en fonction de l'offre, du type de conférence, du mode de déploiement, de la taille de l'organisation, de l'application et de l'utilisation finale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- En fonction de l'offre, le marché nord-américain des technologies de conférence portables est segmenté en matériel, logiciels et services. Le matériel est ensuite subdivisé en caméra, microphone et autres. En outre, les services sont subdivisés en services gérés et services professionnels. En 2022, le matériel devrait dominer le marché nord-américain des technologies de conférence portables, car il génère davantage de revenus et davantage de recherche et développement dans le domaine du matériel par les grandes organisations.

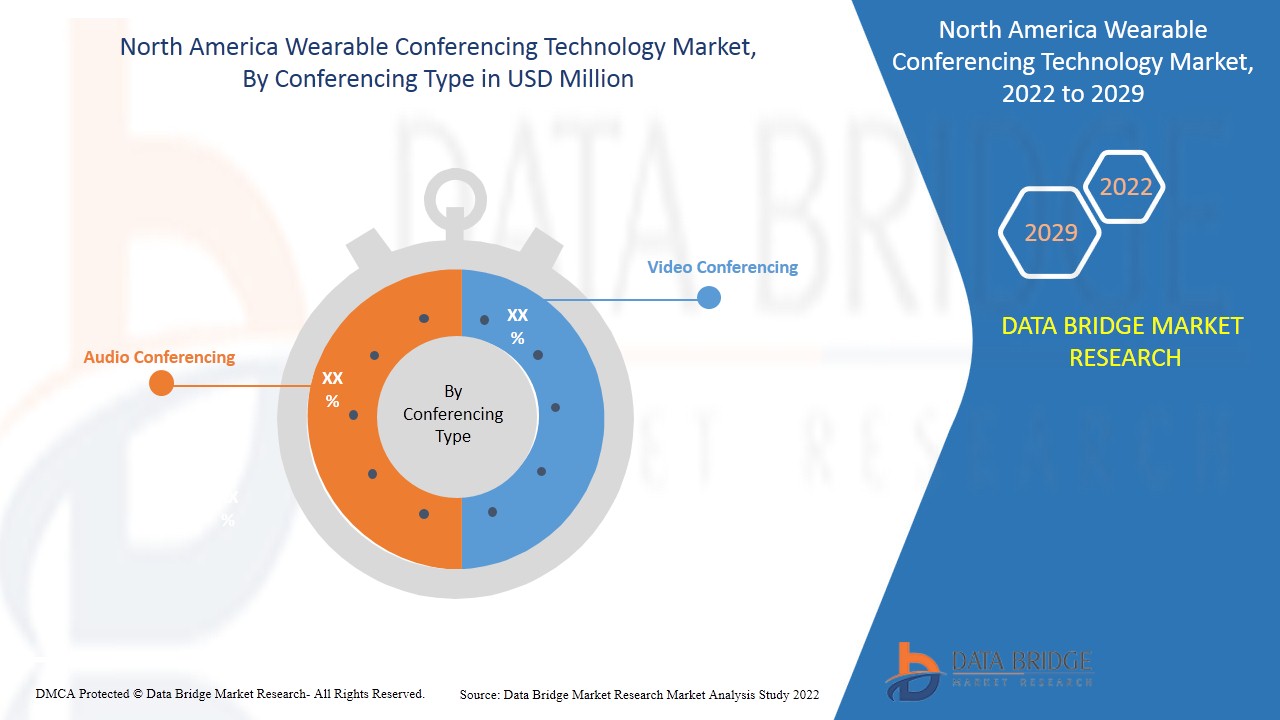

- En fonction du type de conférence, le marché nord-américain des technologies de conférence portables est segmenté en audioconférence et en vidéoconférence . En 2022, le segment de la vidéoconférence devrait dominer car il facilite les réunions virtuelles et la collaboration sur des documents numériques et des présentations partagées en connectant les individus en temps réel.

- En fonction du mode de déploiement, le marché nord-américain des technologies de conférence portables est segmenté en sur site et en cloud. En 2022, le segment sur site devrait dominer le marché car il contribue à assurer la sécurité et la confidentialité de l'infrastructure telle qu'elle est située localement. Le déploiement de ce type est moins cher que le cloud.

- En fonction de la taille de l'entreprise, le marché nord-américain des technologies de conférence portables est segmenté en petites et moyennes entreprises et en grandes entreprises. En 2022, le segment des grandes entreprises devrait dominer le marché, car la solution nécessite des investissements en capital plus importants et le coût est justifié par la génération de revenus plus élevée des entreprises grâce au déploiement de cette technologie.

- En fonction des applications, le marché nord-américain des technologies de conférence portables est segmenté en grand public et en entreprise. En 2022, le segment des entreprises devrait dominer le marché, car il aide les employés à travailler à distance avec facilité et efficacité.

- En fonction de l'utilisation finale, le marché nord-américain des technologies de conférence portables est segmenté en entreprises, éducation, soins de santé , gouvernement et défense, banque, services financiers et assurances (BSFI), médias et divertissement, etc. En 2022, le segment des entreprises devrait dominer le marché, car les solutions de conférence aident les employés à collaborer et à travailler sur des documents partagés en temps réel ou via le partage d'écran.

Analyse du marché des technologies de conférence portables en Amérique du Nord au niveau des pays

Le marché nord-américain des technologies de conférence portables est analysé, ainsi que la taille du marché, le type de conférence, le mode de déploiement, la taille de l'organisation, l'application et l'utilisation finale comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché nord-américain des technologies de conférence portables sont les États-Unis, le Canada et le Mexique. Les États-Unis dominent le marché nord-américain des technologies de conférence portables en raison de la présence d'acteurs clés issus des appareils portables ainsi que des fournisseurs de logiciels de conférence. Le Canada occupe la deuxième place car le pays connaît un développement sur le marché de la RA et de la RM grâce aux installations de recherche des petites entreprises et à la demande du secteur de la santé.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

La pénétration croissante des appareils intelligents et des services Internet stimule la croissance du marché nord-américain des technologies de conférence portables

Le marché nord-américain des technologies de conférence portables vous fournit également une analyse de marché détaillée de la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse du paysage concurrentiel et des parts de marché des technologies de conférence portables en Amérique du Nord

Le paysage concurrentiel du marché nord-américain des technologies de conférence portables fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché nord-américain des technologies de conférence portables.

Les principales entreprises nord-américaines qui s'occupent de la technologie de conférence portable sont Logitech, Vuzix Corporation, Vidyo, Inc., Ricoh, Zoom Video Communications, Inc., Microsoft, LogMeIn, Inc., RealWear, Inc., DIALPAD, INC., Google (une filiale d'Alphabet Inc.), Chironix, Seiko Epson Corporation, Iristick, Robert Bosch GmbH, ezTalks, HTC Corporation, Sony Corporation, Lenovo, EON Reality, TeamViewer, entre autres acteurs nationaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux contrats et accords sont également initiés par les entreprises du monde entier, ce qui accélère le marché nord-américain des technologies de conférence portables.

Par exemple,

- En octobre 2021, LogMeIn, Inc. a lancé GoToConnect Legal, une nouvelle version de sa plateforme de communications unifiées en tant que service (UCaaS). La plateforme est conçue pour répondre aux demandes des professionnels du droit en facilitant la collaboration avec les clients et les collègues afin de maximiser les heures facturables. La solution permettra de minimiser le temps non facturé, de maximiser les revenus, de gérer les réglementations des organismes directeurs et de maintenir un niveau de sécurité élevé dans leur pratique. Ainsi, l'entreprise contribuera à fournir des services de haute qualité et facilement facturables à ses clients.

- En décembre 2021, Vidyo, Inc. a dévoilé de nouvelles interfaces VidyoRoom Solutions, dont trois nouvelles expériences de visioconférence au bureau conçues pour offrir le meilleur environnement de collaboration aux équipes hybrides. De nouvelles interfaces pour les salles de réunion, les salles de conférence et les salles de conseil, y compris les commandes de conférence et la prise en charge des expériences immersives, deviendront de plus en plus vitales à mesure que les employés tentent de retourner au bureau après la pandémie, tandis que d'autres continuent de travailler à distance. Grâce à cela, l'entreprise sera en mesure d'offrir une expérience conviviale à ses clients.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGING FOCUS AND ADOPTION OF REMOTE WORKING CULTURE

5.1.2 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES

5.1.3 RISE IN ADOPTION OF CONFERENCING TECHNOLOGY BY EDUCATIONAL INSTITUTES

5.2 RESTRAINTS

5.2.1 HIGH COST OF CONFERENCING INFRASTRUCTURE

5.2.2 LOSS OF DATA AND PRIVACY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.2 RISE IN INITIATIVES BY GOVERNMENT

5.4 CHALLENGES

5.4.1 NORTH AMERICA ECONOMIC SLOWDOWN LIMITS

5.4.2 ELECTRONIC COMPONENTS ARE PUSHING SMART GLASSES BOUNDARIES

6 IMPACT ANALYSIS OF COVID-19 ON NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISION BY MANUFACTURERS AND GOVERNMENT INITIATIVES AFTER COVID-19

6.3 IMPACT ON DEMAND

6.4 PRICE IMPACT

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 CAMERA

7.2.2 MICROPHONE

7.2.3 OTHERS

7.3 SOFTWARE

7.4 SERVICES

7.4.1 MANAGED SERVICES

7.4.2 PROFESSIONAL SERVICES

8 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE

8.1 OVERVIEW

8.2 VIDEO CONFERENCING

8.3 AUDIO CONFERENCING

9 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 ON-PREMISE

9.3 CLOUD

10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ORGANIZATION

10.3 SMALL & MEDIUM ORGANIZATION

11 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ENTERPRISE

11.3 CONSUMER

12 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE

12.1 OVERVIEW

12.2 CORPORATE

12.2.1 MARKET BY DEPLOYMENT MODE

12.2.1.1 ON-PREMISE

12.2.1.2 CLOUD

12.2.2 MARKET BY ORGANIZATION SIZE

12.2.2.1 LARGE ORGANIZATION

12.2.2.2 SMALL & MEDIUM ORGANIZATION

12.3 EDUCATION

12.3.1 MARKET BY DEPLOYMENT MODE

12.3.1.1 ON-PREMISE

12.3.1.2 CLOUD

12.3.2 MARKET BY ORGANIZATION SIZE

12.3.2.1 LARGE ORGANIZATION

12.3.2.2 SMALL & MEDIUM ORGANIZATION

12.4 HEALTHCARE

12.4.1 MARKET BY DEPLOYMENT MODE

12.4.1.1 ON-PREMISE

12.4.1.2 CLOUD

12.4.2 MARKET BY ORGANIZATION SIZE

12.4.2.1 LARGE ORGANIZATION

12.4.2.2 SMALL & MEDIUM ORGANIZATION

12.5 GOVERNMENT AND DEFENSE

12.5.1 MARKET BY DEPLOYMENT MODE

12.5.1.1 ON-PREMISE

12.5.1.2 CLOUD

12.5.2 MARKET BY ORGANIZATION SIZE

12.5.2.1 LARGE ORGANIZATION

12.5.2.2 SMALL & MEDIUM ORGANIZATION

12.6 MEDIA AND ENTERTAINMENT

12.6.1 MARKET BY DEPLOYMENT MODE

12.6.1.1 ON-PREMISE

12.6.1.2 CLOUD

12.6.2 MARKET BY ORGANIZATION SIZE

12.6.2.1 LARGE ORGANIZATION

12.6.2.2 SMALL & MEDIUM ORGANIZATION

12.7 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

12.7.1 MARKET BY DEPLOYMENT MODE

12.7.1.1 ON-PREMISE

12.7.1.2 CLOUD

12.7.2 MARKET BY ORGANIZATION SIZE

12.7.2.1 LARGE ORGANIZATION

12.7.2.2 SMALL & MEDIUM ORGANIZATION

12.8 OTHER

12.8.1 MARKET BY DEPLOYMENT MODE

12.8.1.1 ON-PREMISE

12.8.1.2 CLOUD

12.8.2 MARKET BY ORGANIZATION SIZE

12.8.2.1 LARGE ORGANIZATION

12.8.2.2 SMALL & MEDIUM ORGANIZATION

13 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MICROSOFT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 LENEVO

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 RICOH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 SEIKO EPSON CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 CHIRONIX

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 DIALPAD, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 EON REALITY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EZTALKS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 HTC CORPORATION

16.10.1 COMPANY PROFILE

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 IRISTICK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 LOGITECH

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 LOGMEIN, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 REALWEAR, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ROBERT BOSCH GMBH

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 SONY CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 TEAMVIEWER

16.17.1 COMPANY SNAPSHOT

16.17.2 REVNUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 VIDYO, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 VUZIX CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 ZOOM VIDEO COMMUNICATIONS, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 COMPANY SHARE ANALYSIS

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SOFTWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA VIDEO CONFERENCING IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUDIO CONFERENCING IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ON-PREMISE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CLOUD IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LARGE ORGANIZATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA SMALL & MEDIUM ORGANIZATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ENTERPRISE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CONSUMER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 64 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 65 U.S. HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 69 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 U.S. CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 73 U.S. CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 U.S. EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 75 U.S. EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 76 U.S. HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 77 U.S. HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 78 U.S. GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 79 U.S. GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 80 U.S. MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 81 U.S. MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 82 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 83 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 84 U.S. OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 85 U.S. OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 86 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 CANADA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 91 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 92 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 94 CANADA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 95 CANADA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 96 CANADA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 97 CANADA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 98 CANADA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 99 CANADA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 100 CANADA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 101 CANADA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 102 CANADA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 103 CANADA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 104 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 105 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 106 CANADA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 107 CANADA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 109 MEXICO HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 118 MEXICO EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 RISING PREFERENCE FOR REMOTE WORKING IS EXPECTED TO DRIVE NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKETIN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

FIGURE 14 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY OFFERING, 2021

FIGURE 15 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY CONFERENCING TYPE, 2021

FIGURE 16 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 17 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 18 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY END USE, 2021

FIGURE 20 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY OFFERING (2022-2029)

FIGURE 25 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.