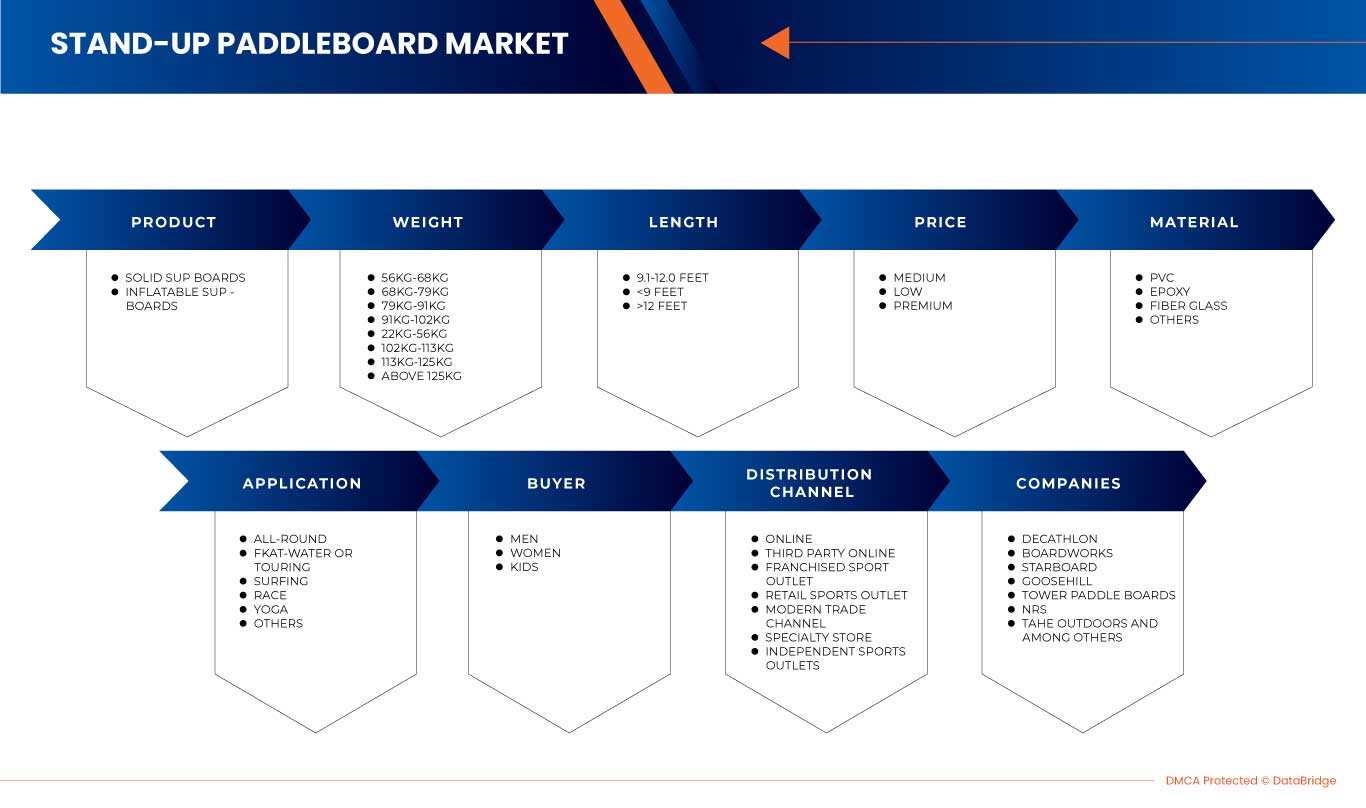

North America Stand-Up Paddleboard Market, By Product (Solid SUP Boards and Inflatable SUP Boards), Weight (56kg-68kg ,68kg-79kg, 79kg-91kg, 91kg-102kg, 22kg-56kg, 102kg-113kg, 113kg-125kg and Above 125kg), Length (9.1-12.0 feet, 12 feet), Price (Medium, Low And Premium), Material (PVC, EPOXY, Fiber Glass And Others), Application (All-Round, Fkat-Water Or Touring, Surfing, Race, Yoga and Others), Buyer (Men, Women and Kids), and Distribution Channel (Online, Third Party Online, Franchised Sport Outlet, Retail Sports Outlet, Modern Trade Channel, Specialty Store and Independent Sports Outlets) Industry Trends and Forecast to 2030.

North America Stand-Up Paddleboard Market Analysis and Insights

Stand-up paddleboard is also known as SUP, which is a popular sport activity that, involves standing up on a board and using a paddle to make the way through the water. This sport requires usage of arms while standing or kneeling to propel the board forward. Thus, market includes variety of boards, which are classified based on weight, material, length, product, application and price. Moreover, SUP boards look like surfboards but the design for the usage of the boards are different. These boards are completely used with paddles. The user has options to use the boards for different purposes such as yoga, race, touring and even for surfing.

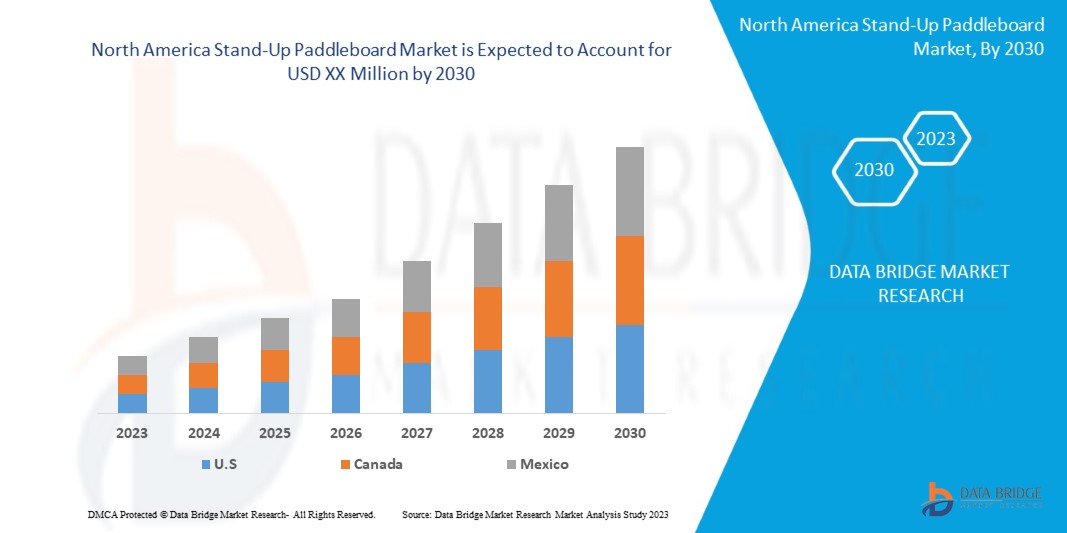

Increase in the number of soft adventure sports participation has propositional impact on the growth and adoption of stand-up paddleboards, as in recent stand-up paddleboards are widely used in water sports and yoga. Data Bridge Market Research analyses that North America stand-up paddleboard market will grow at a CAGR of 6.6% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product (Solid SUP Boards and Inflatable SUP Boards), Weight (56kg-68kg ,68kg-79kg, 79kg-91kg, 91kg-102kg, 22kg-56kg, 102kg-113kg, 113kg-125kg and Above 125kg), Length (9.1-12.0 feet, <9 feet, and >12 feet), Price (Medium, Low And Premium), Material (PVC, EPOXY, Fiber Glass And Others), Application (All-Round, Fkat-Water Or Touring, Surfing, Race, Yoga and Others), Buyer (Men, Women and Kids), and Distribution Channel (Online, Third Party Online, Franchised Sport Outlet, Retail Sports Outlet, Modern Trade Channel, Specialty Store and Independent Sports Outlets). |

|

Countries Covered |

U.S. Canada, Mexico |

|

Market Players Covered |

Aqua-Leisure Recreation, LLC, Tahe Outdoors, BOARDWORKS, Cascadia Board Co, Starboard, SUP ATX LLC, SURFTECH, LLC, Sea Eagle Boats, inc., Imagine Nation Sports, LLC, Naish International, Bluefin SUP, Goosehill, Atoll Board Company, C4 Waterman, NRS, YOLO Boards & Bikes, Mistral Watersport, Paddle Boards par iROCKERSUPP, Wetiz par Zacki Surf & Sport, Sun Dolphin Boats, Red Paddle Co, LAIRDSTANDUP, Tower Paddle Boards, THURSO SURF et Decathlon entre autres. |

Définition du marché

Le stand-up paddle, également connu sous le nom de SUP, est une activité sportive populaire qui consiste à se tenir debout sur une planche et à utiliser une pagaie pour se frayer un chemin dans l'eau. Ce sport nécessite d'utiliser les bras en position debout ou à genoux pour propulser la planche vers l'avant. Ainsi, le marché comprend une variété de planches, qui sont classées en fonction du poids, du matériau, de la longueur, du produit, de l'application et du prix.

De plus, les planches de SUP ressemblent à des planches de surf, mais la conception de l'utilisation des planches est différente. Ces planches sont entièrement utilisées avec des pagaies. L'utilisateur peut utiliser les planches à différentes fins, comme le yoga, la course, le tourisme et même le surf.

Dynamique du marché nord-américain du stand-up paddle

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

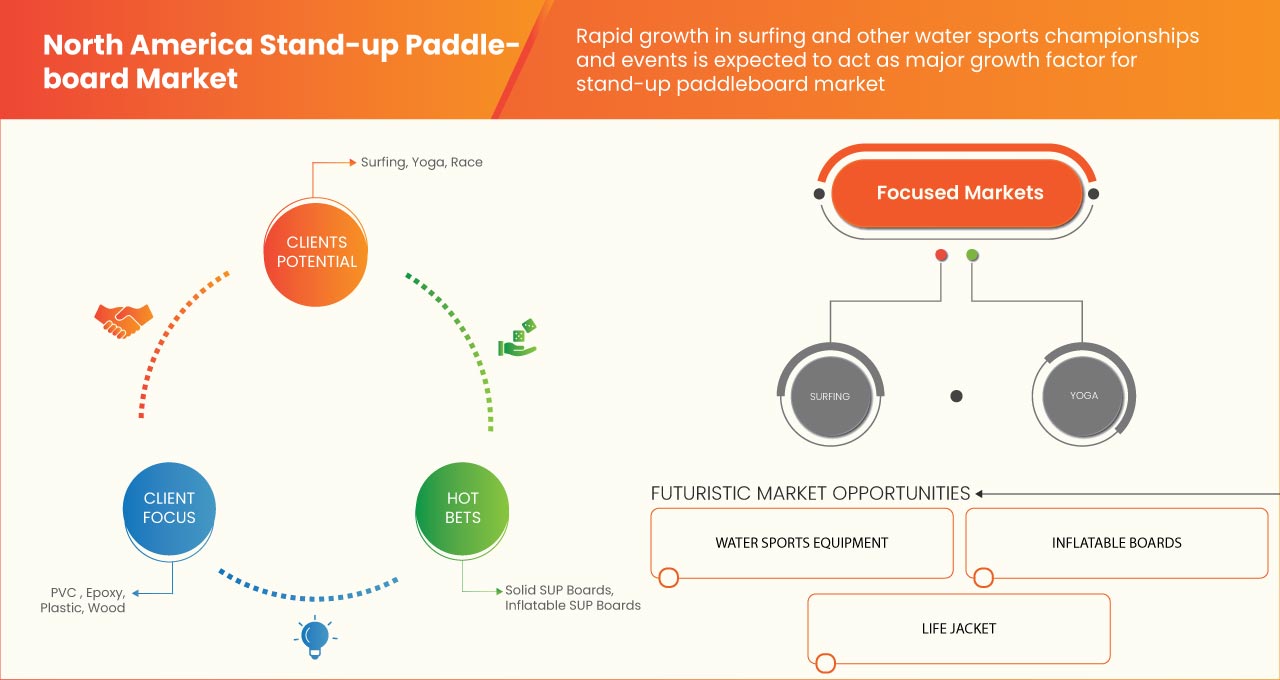

CROISSANCE RAPIDE DES CHAMPIONNATS ET ÉVÉNEMENTS DE SPORTS NAUTIQUES DE SURFACE

Les sports nautiques de surface comprennent une variété de sports tels que l'aviron, la voile, le ski nautique, le surf, le kayak, le rafting et bien d'autres. Ces sports n'étaient pas familiers au cours des dernières décennies. Cependant, la plupart de ces sports nautiques de surface ont gagné un rôle important dans l'intérêt des gens pour le sport, notamment le surf et le stand-up paddle.

-

AUGMENTATION DU NOMBRE DE PARTICIPANTS AUX SPORTS D'AVENTURE

Les sports d'aventure ou les sports extrêmes sont généralement classés dans les activités à haut niveau de danger. Ces sports d'aventure peuvent être compétitifs ou non et impliquent souvent des participants individuels plutôt que des équipes. De plus, les sports nautiques comprennent le surf, le stand-up paddle, le rafting, le kayak et bien d'autres.

Opportunité

-

RECONNAISSANCE CROISSANTE DES SPORTS NAUTIQUES DANS LE SPORT INTERNATIONAL

Les sports nautiques gagnent en popularité dans le monde entier, car la plupart des pays offrent de nombreuses possibilités aux amateurs d'aventure en quête d'expériences variées. Cependant, l'un des sports nautiques les plus anciens est l'aviron, qui a vu le jour en 1864. Après plusieurs décennies, en 1993, ce sport a été reconnu par la création du premier centre national d'aviron à Snagov.

Retenue/Défi

- MANQUE DE PROFESSIONNELS QUALIFIÉS ET EXPÉRIMENTÉS

Le stand-up paddle est associé à divers sports nautiques, tels que le surf et le kayak. Ces sports nautiques sont différents et sont formulés pour réaliser différentes activités. Ces sports doivent être entraînés avant de les pratiquer car ils sont considérés comme des sports d'aventure et sont associés à des risques pour la vie. La formation à ces sports à risques pour la vie nécessite l'intervention de professionnels.

Impact du Covid-19 sur le marché nord-américain du stand-up paddle

Le COVID-19 a eu un impact négatif sur le marché. Les planches de stand-up paddle nord-américaines étant très demandées, des entreprises telles que Decathlon, Starboard, BOARDWORKS, NRS, Tower Paddle Boards et d'autres en Amérique du Nord ont rencontré des difficultés absolues pour fournir des planches de paddle aux nouveaux et anciens clients en raison de la pénurie de matières premières, en raison des réglementations strictes imposées par le gouvernement. De plus, l'offre limitée de matières premières et de gadgets a considérablement affecté l'offre de planches de paddle sur le marché.

Développement récent

- En septembre 2021, Dotdash Media, Inc. a soutenu le SUP yoga. L'entreprise a publié un blog pour mettre en avant les principes et l'importance du SUP yoga en rapportant son impact positif sur la santé mentale, qui peut être utilisé pour la gestion des douleurs lombaires.

Portée du marché nord-américain du stand-up paddle

Le marché nord-américain du stand-up paddle est segmenté en fonction du produit, du poids, de la longueur, du prix, du matériau, de l'application, de l'acheteur et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Planches de SUP solides

- Planches de SUP gonflables

Sur la base du produit, le marché nord-américain du stand-up paddle est segmenté en planches SUP solides et planches SUP gonflables.

Poids

- 56kg-68kg

- 68kg-79kg

- 79kg-91kg

- 91kg-102kg

- 22kg-56kg

- 102 kg à 113 kg

- 113 kg à 125 kg

- plus de 125 kg

Sur la base du poids, le marché nord-américain du stand-up paddle est segmenté en 56 kg-68 kg, 68 kg-79 kg, 79 kg-91 kg, 91 kg-102 kg, 22 kg-56 kg, 102 kg-113 kg, 113 kg-125 kg et plus de 125 kg.

Longueur

- 9,1 à 12,0 pieds,

- <9 pieds

- >12 pieds

Sur la base de la longueur, le marché nord-américain du stand-up paddle est segmenté en 9,1 à 12,0 pieds, < 9 pieds et > 12 pieds.

Prix

- Moyen

- Faible

- Prime

Sur la base du prix, le marché nord-américain du stand-up paddle est segmenté en moyen, bas de gamme et haut de gamme.

Matériel

- PVC

- ÉPOXY

- Fibre de verre

- Autres

Sur la base du matériau, le marché nord-américain du stand-up paddle est segmenté en PVC, EPOXY, fibre de verre et autres.

Application

- Polyvalent

- Eaux calmes ou randonnées

- Surf

- Course

- Yoga

- Autres

Sur la base des applications, le marché nord-américain du stand-up paddle est segmenté en polyvalent, eau plate ou randonnée, surf, course, yoga et autres.

Acheteur

- Hommes

- Femmes

- Enfants

Sur la base de l'acheteur, le marché nord-américain du stand-up paddle est segmenté en hommes, femmes et enfants.

Canal de distribution

- En ligne

- Tiers en ligne

- Magasin de sport franchisé

- Magasin de sport au détail

- Chaîne commerciale moderne

- Magasin spécialisé

- Points de vente de sports indépendants

Sur la base du canal de distribution, le marché nord-américain du stand-up paddle est segmenté en ligne, en ligne tiers, en points de vente de sport franchisés, en points de vente de sport au détail, en canal commercial moderne, en magasin spécialisé et en points de vente de sport indépendants.

Analyse/perspectives régionales du marché nord-américain du stand-up paddle

Le marché nord-américain du stand-up paddle est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, produit, poids, longueur, prix, matériau, application, acheteur et canal de distribution.

Les pays couverts dans le rapport sur le marché du stand-up paddle en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent la région Amérique du Nord en raison de la croissance rapide du marché des championnats et événements de sports nautiques de surface.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du stand-up paddle en Amérique du Nord

Le paysage concurrentiel du marché nord-américain du stand-up paddle fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché nord-américain du stand-up paddle.

Certains des principaux acteurs opérant sur le marché du stand-up paddle en Amérique du Nord sont Aqua-Leisure Recreation, LLC, Tahe Outdoors, BOARDWORKS, Cascadia Board Co, Starboard, SUP ATX LLC, SURFTECH, LLC, Sea Eagle Boats, inc., Imagine Nation Sports, LLC, Naish International, Bluefin SUP, Goosehill, Atoll Board Company, C4 Waterman, NRS, YOLO Boards & Bikes, Mistral Watersport, Paddle Boards by iROCKERSUP, Wetiz by Zacki Surf & Sport, Sun Dolphin Boats, Red Paddle Co, LAIRDSTANDUP, Tower Paddle Boards, THURSO SURF et Decathlon, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA STAND-UP PADDLEBOARD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 FACTORS INFLUENCING BUYING DECISION

4.2.1 INTENTION OR GOAL

4.2.2 TYPE OF SUP

4.2.3 SIZE

4.2.4 HULL TYPE

4.2.5 PRICING AND BRAND

4.3 TECHNOLOGICAL OVERVIEW

4.4 PRODUCT ADOPTION SCENARIO

4.4.1 AWARENESS

4.4.2 INTEREST

4.4.3 CONSIDERATION

4.4.4 SAMPLING

4.4.5 ADOPTION OR REJECTION

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.5.1 SOLID PADDLE BOARD CONSTRUCTION

4.5.2 INFLATABLE PADDLE BOARD CONSTRUCTION

4.6 REGULATION COVERAGE

4.7 SUPPLY CHAIN OF THE NORTH AMERICA STAND-UP PADDLEBOARD MARKET

4.7.1 RAW MATERIAL PROCUREMENT

4.7.2 MANUFACTURING

4.7.3 MARKETING AND DISTRIBUTION

4.7.4 END USERS

4.8 CLIMATE CHANGE SCENARIO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID GROWTH IN SURFACE WATER SPORTS CHAMPIONSHIPS AND EVENTS

5.1.2 INCREASE IN THE NUMBER OF ADVENTURE SPORTS PARTICIPATION

5.1.3 RISE IN FITNESS TREND

5.1.4 RISE IN INDOOR SUP ACTIVITIES

5.2 RESTRAINTS

5.2.1 LACK OF SKILLED AND EXPERIENCED PROFESSIONALS

5.3 OPPORTUNITIES

5.3.1 INCREASING RECOGNITION OF WATER SPORTS IN INTERNATIONAL SPORTS

5.3.2 CHANGE IN THE LIFESTYLES AND DEMOGRAPHICS OF PEOPLE

5.3.3 INCREASE IN THE ADOPTION OF NORTH AMERICA TRENDS AMONG YOUNGSTERS

5.4 CHALLENGES

5.4.1 RISING NUMBER OF SHAPE LIMITATIONS

5.4.2 HIGH COSTS ASSOCIATED WITH THE PADDLE BOARDS

6 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 SOLID SUP BOARDS

6.3 INFLATABLE SUP BOARDS

7 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT

7.1 OVERVIEW

7.2 56KG-68KG

7.3 68KG-79KG

7.4 79KG-91KG

7.5 91KG-102KG

7.6 22KG-56KG

7.7 102KG-113KG

7.8 113KG-125KG

7.9 ABOVE 125KG

8 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH

8.1 OVERVIEW

8.2 9.1-12.0 FEET

8.3 <9 FEET

8.4 >12 FEET

9 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE

9.1 OVERVIEW

9.2 MEDIUM

9.3 LOW

9.4 PREMIUM

10 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 PVC

10.3 EPOXY

10.4 FIBER GLASS

10.5 OTHERS

11 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ALL-ROUND

11.3 FKAT-WATER OR TOURING

11.4 SURFING

11.5 RACE

11.6 YOGA

11.7 OTHERS

12 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER

12.1 OVERVIEW

12.2 MEN

12.3 WOMEN

12.4 KIDS

13 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 ONLINE

13.2.1 3RD PARTY WEBSITES

13.2.2 COMPANY-OWNED

13.3 THIRD PARTY ONLINE

13.4 FRANCHISED SPORT OUTLET

13.5 RETAIL SPORTS

13.6 MODERN TRADE

13.7 SPECIALITY STORES

13.8 INDEPENDENT SPORTS OUTLETS

14 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 DECATHLON

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 BOARDWORKS

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 STARBOARD

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 GOOSEHILL

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 TOWER PADDLE BOARDS

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AQUA-LEISURE RECREATION, LLC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ATOLL BOARD COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BLUEFIN SUP

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 C4 WATERMAN

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 CASCADIA BOARD CO

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 IMAGINE NATION SPORTS, LLC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 LAIRDSTANDUP

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MISTRAL WATERSPORTS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 NAISH INTERNATIONAL

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 NRS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PADDLE BOARDS BY IROCKERSUP

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 RAVE SPORTS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 RED PADDLE CO

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 SEA EAGLE BOATS, INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 SUN DOLPHIN BOATS

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 SUP ATX LLC

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 SURFTECH, LLC

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 TAHE OUTDOORS

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 THURSO SURF

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 WETIZ BY ZACKI SURF & SPORT

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 YOLO BOARDS & BIKES

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 3 NORTH AMERICA SOLID SUP BOARDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA SOLID SUP BOARDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 5 NORTH AMERICA INFLATABLE SUP BOARDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA INFLATABLE SUP BOARDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 7 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 9 NORTH AMERICA 56KG-68KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA 56KG-68KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 11 NORTH AMERICA 68KG-79KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA 68KG-79KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 13 NORTH AMERICA 79KG-91KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA 79KG-91KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 15 NORTH AMERICA 91KG-102KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA 91KG-102KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 17 NORTH AMERICA 22KG-56KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA 22KG-56KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 19 NORTH AMERICA 102KG-113KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA 102KG-113KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 21 NORTH AMERICA 113KG-125KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA 113KG-125KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 23 NORTH AMERICA ABOVE 125KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA ABOVE 125KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 25 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 27 NORTH AMERICA 9.1-12.0 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA 9.1-12.0 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 29 NORTH AMERICA <9 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA <9 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 31 NORTH AMERICA >12 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA >12 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 33 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 35 NORTH AMERICA MEDIUM IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA MEDIUM IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 37 NORTH AMERICA LOW IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA LOW IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 39 NORTH AMERICA PREMIUM IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA PREMIUM IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 41 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 43 NORTH AMERICA PVC IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA PVC IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 45 NORTH AMERICA EPOXY IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA EPOXY IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 47 NORTH AMERICA FIBER GLASS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA FIBER GLASS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 49 NORTH AMERICA OTHERS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA OTHERS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 51 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 53 NORTH AMERICA ALL-ROUND IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA ALL-ROUND IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 55 NORTH AMERICA FKAT-WATER OR TOURING IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA FKAT-WATER OR TOURING IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 57 NORTH AMERICA SURFING IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA SURFING IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 59 NORTH AMERICA RACE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA RACE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 61 NORTH AMERICA YOGA IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA YOGA IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 63 NORTH AMERICA OTHERS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA OTHERS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 65 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 67 NORTH AMERICA MEN IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA MEN IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 69 NORTH AMERICA WOMEN IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA WOMEN IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 71 NORTH AMERICA KIDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA KIDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 73 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 75 NORTH AMERICA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 77 NORTH AMERICA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA THIRD PARTY ONLINE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA THIRD PARTY ONLINE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 80 NORTH AMERICA FRANCHISED SPORT IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA FRANCHISED SPORT IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 82 NORTH AMERICA RETAIL SPORTS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA RETAIL SPORTS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 84 NORTH AMERICA MODERN TRADE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA MODERN TRADE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 86 NORTH AMERICA SPECIALTY STORES IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA SPECIALTY STORES IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 88 NORTH AMERICA INDEPENDENT SPORTS OUTLETS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA INDEPENDENT SPORTS OUTLETS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 90 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 91 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY COUNTRY, 2021-2030 (UNITS)

TABLE 92 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 93 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 94 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 95 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 96 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 97 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 98 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 99 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 100 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 101 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 102 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 103 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 104 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 105 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 106 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 107 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 108 NORTH AMERICA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 111 U.S. STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 113 U.S. STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 115 U.S. STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 117 U.S. STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 119 U.S. STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 121 U.S. STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 123 U.S. STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 125 U.S. ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 CANADA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 127 CANADA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 128 CANADA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 129 CANADA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 130 CANADA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 132 CANADA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 134 CANADA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 136 CANADA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 138 CANADA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 140 CANADA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 142 CANADA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 MEXICO STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 144 MEXICO STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 145 MEXICO STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 146 MEXICO STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 147 MEXICO STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 148 MEXICO STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 149 MEXICO STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 150 MEXICO STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 151 MEXICO STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 152 MEXICO STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 153 MEXICO STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 154 MEXICO STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 155 MEXICO STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 156 MEXICO STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 157 MEXICO STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 158 MEXICO STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 159 MEXICO ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA STAND-UP PADDLEBOARD MARKET :DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: PRODUCT TIMELINE CURVE

FIGURE 11 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: SEGMENTATION

FIGURE 13 RAPID GROWTH IN SURFACE WATER SPORTS CHAMPIONSHIPS AND EVENTS IS BOOSTING THE GROWTH OF STAND-UP PADDLEBOARD MARKET IN THE FORECAST PERIOD OF 2023 -2030

FIGURE 14 SOLID SUP BOARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA STAND-UP PADDLEBOARD MARKET IN 2023 - 2030

FIGURE 15 PRODUCT ADOPTION

FIGURE 16 SUPPLY CHAIN OF THE NORTH AMERICA STAND-UP PADDLEBOARD MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA STAND-UP PADDLEBOARD MARKET

FIGURE 18 TOP FIVE NORTH AMERICA SURFING EVENTS

FIGURE 19 POPULARITY OF ADVENTURE SPORTS IN INDIA

FIGURE 20 PERCENTAGE OF EUROPEAN TOUR OPERATORS SEEK ADVENTURE TOURISM

FIGURE 21 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY PRODUCT, 2022

FIGURE 22 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY WEIGHT, 2022

FIGURE 23 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY LENGTH, 2022

FIGURE 24 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY PRICE, 2022

FIGURE 25 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY MATERIAL, 2022

FIGURE 26 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY APPLICATION, 2022

FIGURE 27 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY BUYER, 2022

FIGURE 28 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 29 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: SNAPSHOT (2022)

FIGURE 30 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY COUNTRY (2022)

FIGURE 31 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY PRODUCT (2023 - 2030)

FIGURE 34 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.