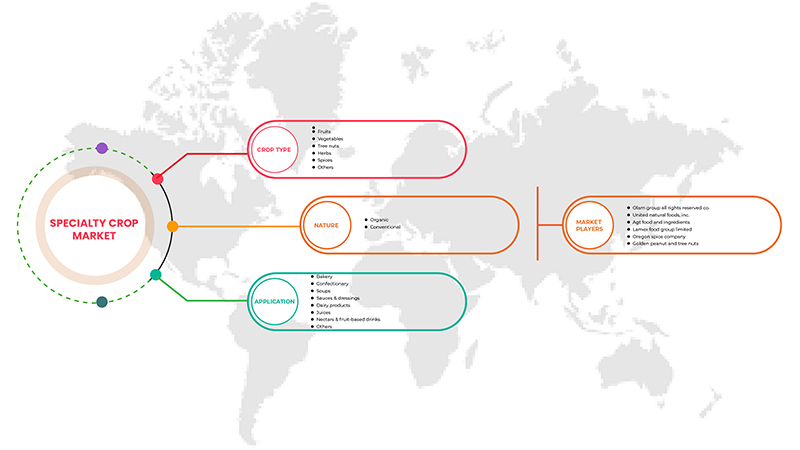

Marché des cultures spécialisées en Amérique du Nord , par type de culture ( fruits , légumes, noix , herbes, épices et autres), nature (biologique et conventionnelle), application (produits laitiers, boulangerie, jus, nectars et boissons à base de fruits, confiserie, soupes, sauces et vinaigrettes et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des cultures spécialisées en Amérique du Nord

Les fruits et légumes, les fruits à coque, les fruits secs, l'horticulture et les pépinières sont des exemples de cultures spécialisées (y compris la floriculture). Elles comprennent également des plantes exotiques cultivées dans une zone particulière en raison de caractéristiques topographiques et climatiques. Un changement de paradigme dans les comportements alimentaires des consommateurs a été constaté en raison de la croissance démographique et d'une augmentation du revenu disponible par habitant, affectant directement la demande d'aliments sains. D'autres facteurs stimulent le marché des cultures spécialisées, notamment l'urbanisation croissante, la diversité ethnique, les préoccupations en matière de santé et les changements dans les caractéristiques démographiques. Les principaux moteurs de l'industrie des cultures spécialisées comprennent l'élargissement de la gamme d'application des cultures spécialisées, l'encouragement des initiatives gouvernementales et les politiques de libre-échange. Cependant, l'expansion est limitée par les contraintes commerciales et environnementales.

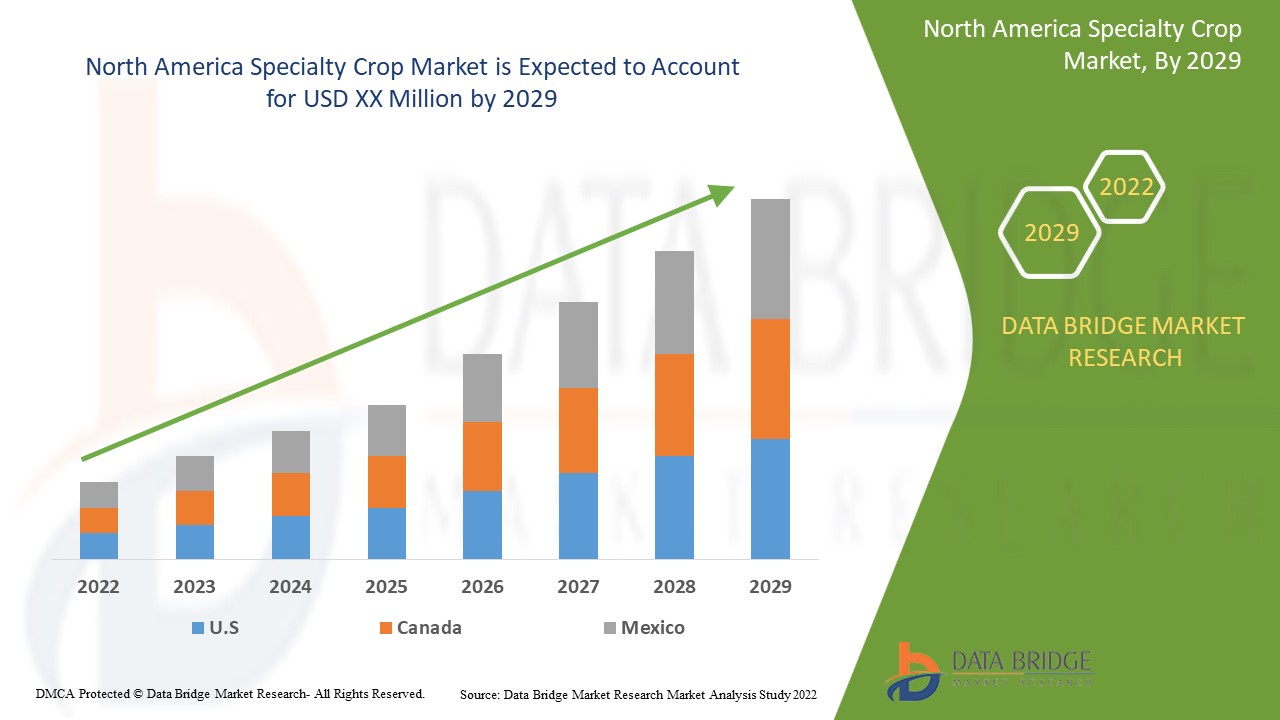

Data Bridge Market Research analyse que le marché nord-américain des cultures spécialisées connaîtra un TCAC de 4,5 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable jusqu'en 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en millions d'unités, prix en USD |

|

Segments couverts |

Par type de culture ( fruits , légumes, fruits à coque , herbes, épices et autres), nature (biologique et conventionnelle), application (produits laitiers, boulangerie, jus, nectars et boissons à base de fruits, confiserie, soupes, sauces et vinaigrettes et autres) |

|

Régions couvertes |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Banabay, Rice Fruit Company, Fisher Nut Company, SVZ Industrial Fruit & Vegetable Ingredients, United Natural Foods, Inc., Lamex Food Group Limited, Herbs N Spices International, Harbor Spice Co., Inc., Olam Group, Oregon Spice Company, Speciality Crop Company, INC., NUTSCO, AGT Food and Ingredients, Natural Specialty Crops, ULC, Golden Peanut and Tree Nuts, FARMER DIRECT ORGANIC et Barnes Williams, entre autres |

Définition du marché

Les fruits et légumes, les fruits à coque, les fruits secs, l'horticulture et les pépinières sont des exemples de cultures spécialisées (y compris la floriculture). Elles comprennent également des plantes exotiques cultivées dans une zone particulière en raison de caractéristiques topographiques et climatiques. Un changement de paradigme dans les comportements alimentaires des consommateurs a été observé en raison de la croissance démographique et de l'augmentation du revenu disponible par habitant, ce qui affecte directement la demande d'aliments sains. Parmi les autres facteurs qui stimulent le marché des cultures spécialisées, citons l'urbanisation croissante, la diversité ethnique, les préoccupations en matière de santé et les changements dans les caractéristiques démographiques.

Dynamique du marché des cultures spécialisées en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs :

- Inclination croissante des consommateurs vers la nourriture végétalienne, naturelle et saine

En tant que consommateur conscient, c'est un mode de vie particulièrement bénéfique, car devenir végétalien permet de s'isoler complètement des antibiotiques dangereux, des hormones et de la falsification, une culture répandue pour assurer une durée de conservation prolongée de la plupart des produits d'origine animale. À mesure que les exportations augmentent et que le monde se rétrécit, de plus en plus de conservateurs et de compositions chimiques sont utilisés pour garantir que les aliments survivent au voyage. Le véganisme est également un choix de vie non violent. La conscience accrue des gens en matière de santé les amène à inclure des aliments plus sains dans leur alimentation, tels que des herbes médicinales, des épices et des noix.

Ainsi, l’inclination croissante vers les aliments végétaliens et sains en raison de la prise de conscience croissante des avantages nutritionnels et médicinaux devrait être un moteur de croissance du marché des cultures spécialisées.

- L’attention croissante des consommateurs à un mode de vie sain

Le marché nord-américain des cultures spécialisées est porté par un désir croissant de modes de vie sains chez les gens. La préférence croissante des consommateurs pour des modes de vie sains est devenue un moteur de création de la demande pour les cultures spécialisées. Quel que soit le secteur d'activité, de nombreux pionniers ont pris en compte ce moteur et investissent activement dans des entreprises spécialisées dans les cultures spécialisées. Un aspect important d'un mode de vie sain est de manger des aliments sains tels que des aliments fabriqués à partir de cultures spécialisées. Un régime alimentaire nutritif est essentiel pour une santé et une nutrition optimales. Il protège contre un large éventail de maladies chroniques, notamment les maladies cardiaques, le diabète et le cancer. Un régime alimentaire sain comprend la consommation d'aliments variés et une consommation réduite de sel, de sucre, de graisses saturées et de graisses trans produites industriellement. De plus, une meilleure connaissance des avantages d'un mode de vie sain incite les consommateurs à sélectionner les meilleurs produits alimentaires sains, qui comprennent des aliments fabriqués à partir de cultures spécialisées telles que des noix, des épices, des herbes, etc.

Ainsi, la prise de conscience et la connaissance croissantes des avantages d’un mode de vie sain incitent les consommateurs à sélectionner les meilleurs produits alimentaires sains, tels que les produits de cultures spécialisées, devenant ainsi un moteur majeur de la croissance du marché des cultures spécialisées.

Restrictions

- Réglementation stricte pour les produits alimentaires

Pour un certain nombre de raisons, les cultures spécialisées sont particulièrement vulnérables à la prévalence des maladies d'origine alimentaire. Il peut être difficile de nettoyer ou de désinfecter complètement les cultures spécialisées, car elles sont souvent consommées crues ou avec peu de préparation, selon le fruit ou le légume concerné. À mesure que la technologie progresse, des questions telles que la responsabilité et les lois deviennent plus cruciales. Pour réduire autant que possible les dangers des maladies d'origine alimentaire, les producteurs de cultures spécialisées doivent être conscients des règles qui peuvent avoir un impact sur leur activité. Pour ces raisons, les organismes de réglementation alimentaire tels que la Food and Drug Administration (« FDA ») et le Food Safety and Inspection Service (« FSIS ») ont établi des règles et des réglementations strictes pour la production de ces cultures.

Ainsi, ces réglementations créeront un obstacle pour de nombreux entrepreneurs souhaitant démarrer et poursuivre le marché des cultures spécialisées, ce qui pourrait constituer un frein majeur à la croissance du marché.

- Installations de culture limitées pour les cultures spécialisées

Les producteurs de cultures spécialisées dépendent en grande partie de la main d'œuvre saisonnière. L'approvisionnement alimentaire d'un pays, en particulier en fruits et légumes frais, peut être menacé s'il n'y a pas suffisamment de main d'œuvre pour répondre à la demande agricole et animale. Les agriculteurs sont obligés de vendre leurs produits à bas prix aux prêteurs locaux en raison d'un transport inadéquat. Les agriculteurs ne peuvent pas conserver leurs aliments lorsque les prix sont bas car il n'y a pas assez d'entrepôts disponibles. Par conséquent, ces facteurs expliquent en grande partie la faible production de cultures spécialisées. Ces nombreux manques d'installations, de la production à la commercialisation, deviennent un obstacle majeur à la croissance du marché.

Ainsi, le manque de diverses installations de culture telles que l'irrigation, les semences, les engrais, le transport et d'autres fonctions peut constituer un frein à la croissance du marché.

Opportunité

- Initiatives gouvernementales et politiques de libre-échange

Les mesures gouvernementales positives, telles que les efforts de vente et de marketing, la prévention des ravageurs et des maladies des plantes et la recherche et le développement, contribuent toutes à l'expansion des cultures spécialisées. L'accès aux marchés internationaux aide le secteur des cultures spécialisées à se développer tout en soutenant les moyens de subsistance de ceux qui travaillent dans les fermes et dans les industries connexes. L'Agricultural Marketing Service (AMS) administre des initiatives visant à ouvrir les marchés nationaux et internationaux aux producteurs américains de denrées alimentaires, de fibres et de cultures spécialisées. Afin de garantir la disponibilité et la qualité d'aliments sains pour les clients de tout le pays, le gouvernement a pris plusieurs initiatives. Le gouvernement a également mis en place un programme d'aide alimentaire pour aider les producteurs de cultures spécialisées. Cette aide a été fournie pour encourager le développement de cultures spécialisées, telles que l'horticulture, les noix, les fruits, les légumes et l'indigo.

Défis

- Allergies associées aux fruits à coque

Les noix sont l'une des principales causes d'allergie alimentaire. Il semble y avoir des différences dans la fréquence des allergies aux noix selon les pays en raison d'autres habitudes alimentaires et procédures de cuisson. Les réactions allergiques aux noix peuvent être graves, parfois même mortelles. Les allergies alimentaires et les provocations orales sont diagnostiquées en raison de la présence d'allergènes dans les noix. Les personnes sont allergiques aux noix, en particulier les enfants et les adultes, et cette population augmente de jour en jour. La croissance des ventes est en baisse depuis que les gens sont soucieux de leur santé.

De plus, les allergies aux noix peuvent être mortelles, et les noix et les graines font partie des aliments déclencheurs les plus courants de réactions allergiques graves potentiellement mortelles. En Amérique du Nord, les allergies aux noix sont courantes, l'allergie aux noisettes étant la plus répandue. Les noix de cajou sont la deuxième noix la plus allergène et constituent un problème de santé important en Amérique du Nord. Il n'existe aucun traitement contre les allergies aux noix autre que d'éviter les noix et les aliments qui en contiennent. Par conséquent, cette situation a eu un impact significatif sur l'expansion récente de l'industrie des noix et devrait se poursuivre à l'avenir.

La croissance du marché est donc freinée par les allergies provoquées par les noix. Les gens sont désormais plus soucieux de leur santé et veillent à éviter les noix et les produits qui provoquent des allergies. Cela pourrait mettre à mal la croissance du marché des cultures spécialisées d'Amérique du Nord.

Impact post-COVID-19 sur le marché nord-américain des cultures spécialisées

Après la pandémie, la demande de cultures spécialisées a augmenté, car il n'y aura plus de restrictions de mouvement ; par conséquent, l'approvisionnement en produits sera facile. La persistance de la COVID-19 pendant une période plus longue a affecté la chaîne d'approvisionnement car elle a été perturbée, et il est devenu difficile de fournir des produits alimentaires aux consommateurs, ce qui a initialement augmenté la demande de produits. Cependant, après la COVID, la demande de cultures spécialisées a augmenté de manière significative en raison de la bonne teneur en protéines et d'autres nutriments disponibles.

Développements récents

- En juillet 2022, SVZ Industrial Fruit & Vegetable Ingredients a annoncé un plan d'investissement pour son usine de transformation belge de Rijkevorsel. Cette extension aidera l'entreprise à répondre à la demande croissante de fruits et légumes des consommateurs en augmentant la capacité de l'usine

- En septembre 2020, The Fisher Nut Company a lancé une nouvelle ligne d'emballage en caisses en raison de la demande accrue de produits pendant la COVID-19

Portée du marché des cultures spécialisées en Amérique du Nord

Le marché nord-américain des cultures spécialisées est segmenté en fonction du type, de la nature et de l'application des cultures. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de culture

- Légumes

- Fruits

- Fruits à coque

- Herbes

- Épices

- Autres

Sur la base du type de culture, le marché des cultures spécialisées d'Amérique du Nord est segmenté en fruits, légumes, noix, herbes, épices et autres.

Nature

- Conventionnel

- Organique

Sur la base du type de produit, le marché des cultures spécialisées en Amérique du Nord est segmenté en produits biologiques et conventionnels.

Application

- Produits laitiers

- Boulangerie

- Jus

- Nectars et boissons à base de fruits

- Confiserie

- Soupes

- Sauces et vinaigrettes

- Autres

Sur la base de l'utilisateur final, le marché des cultures spécialisées d'Amérique du Nord est segmenté en produits laitiers, boulangerie, jus, nectars et boissons à base de fruits, confiseries, soupes, sauces et vinaigrettes, et autres.

Analyse/perspectives régionales du marché des cultures spécialisées en Amérique du Nord

Le marché des cultures spécialisées en Amérique du Nord est analysé et des informations sur la taille du marché et les tendances sont fournies en fonction du type de culture, de la nature et de l'application, comme indiqué ci-dessus.

Les pays couverts par le rapport sur le marché des cultures spécialisées en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

En 2022, les États-Unis devraient dominer le marché nord-américain des cultures spécialisées en termes de part de marché et de chiffre d'affaires. Ils devraient maintenir leur domination au cours de la période de prévision en raison de la demande croissante en produits agricoles, et la consommation alimentaire est la principale raison de la croissance des cultures spécialisées en Amérique du Nord.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des cultures spécialisées en Amérique du Nord

Le marché concurrentiel des cultures spécialisées en Amérique du Nord fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de produits, la largeur et l'étendue des produits et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché des cultures spécialisées en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché des cultures spécialisées en Amérique du Nord sont Banabay, Rice Fruit Company, Fisher Nut Company, SVZ Industrial Fruit & Vegetable Ingredients, United Natural Foods, Inc., Lamex Food Group Limited, Herbs N Spices International, Harbor Spice Co., Inc., Olam Group, Oregon Spice Company, Speciality Crop Company., INC., NUTSCO, AGT Food and Ingredients, Natural Specialty Crops, ULC, Golden Peanut and Tree Nuts, FARMER DIRECT ORGANIC et Barnes Williams, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché de l'entreprise, les normes de mesure, l'Amérique du Nord par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF THE NORTH AMERICA SPECIALTY CROP MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CROP TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING THE PURCHASE DECISION OF THE NORTH AMERICA SPECIALTY CROP MARKET

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF NORTH AMERICA SPECIALTY CROP MARKET

4.3.1 COMPANIES PROVIDING MORE OPTIONS IN SPECIALTY CROP PRODUCTS DUE TO THE RISING HEALTHY LIFESTYLE TREND

4.3.2 COMPANIES PROVIDING ONLINE AND DOORSTEP DELIVERY SERVICES DUE TO THE TREND OF CONVENIENCE IN PURCHASING PRODUCTS

4.4 TECHNOLOGICAL TRENDS

4.5 SUPPLY CHAIN OF NORTH AMERICA SPECIALTY CROPS MARKET

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 PROCESSING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 VALUE CHAIN ANALYSIS: NORTH AMERICA SPECIALTY CROP MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING INCLINATION OF THE CONSUMERS TOWARD VEGAN FOOD, NATURAL AND HEALTHY FOODS

5.1.2 THE INCREASED FOCUS OF CONSUMERS ON HEALTHY LIVING

5.1.3 INCREASING PUBLIC KNOWLEDGE OF THE HEALTH BENEFITS OF SPECIALTY CROPS

5.2 RESTRAINTS

5.2.1 STRICT REGULATIONS FOR FOOD PRODUCTS

5.2.2 LIMITED CROP GROWING FACILITIES FOR SPECIALTY CROPS

5.3 OPPORTUNITIES

5.3.1 GOVERNMENT INITIATIVES AND FREE TRADE POLICIES

5.3.2 ADVANCEMENTS IN AGRICULTURAL TECHNOLOGY

5.4 CHALLENGES

5.4.1 ADVERSE CLIMATIC CONDITION

5.4.2 ALLERGIES ASSOCIATED WITH TREE NUTS CROPS

6 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE

6.1 OVERVIEW

6.2 CONVENTIONAL

6.3 ORGANIC

7 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 DAIRY PRODUCTS

7.2.1 ICE CREAM

7.2.2 CHEESE

7.2.3 MILK-POWDER

7.2.4 SPREADS

7.2.5 OTHERS

7.3 BAKERY

7.3.1 BREADS

7.3.2 CAKES & PASTRIES

7.3.3 BISCUIT & COOKIES

7.3.4 MUFFINS

7.3.5 OTHERS

7.4 JUICES

7.4.1 PINEAPPLE

7.4.2 ORANGE

7.4.3 MOSAMBI

7.4.4 GUAVA

7.4.5 APPLE

7.4.6 STRAWBERRY

7.4.7 OTHERS

7.5 NECTARS & FRUIT-BASED DRINKS

7.6 CONFECTIONERY

7.6.1 CHOCOLATE

7.6.2 CREAM FEELINGS

7.6.3 HARD & SOFT CANDY

7.6.4 GUMS & JELLY

7.6.5 OTHERS

7.7 SOUPS

7.8 SAUCES & DRESSINGS

7.9 OTHERS

8 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE

8.1 OVERVIEW

8.2 FRUIT

8.2.1 COFFEE

8.2.2 BANANA

8.2.3 MANGO

8.2.4 APPLE

8.2.5 CITRUS

8.2.6 GRAPE

8.2.7 GUAVA

8.2.8 STRAWBERRY

8.2.9 LITCHI

8.2.10 COCONUT

8.2.11 AVOCADO

8.2.12 KIWI

8.2.13 GOOSEBERRY

8.2.14 CHERRY

8.2.15 BLACKBERRY

8.2.16 BLUEBERRY

8.2.17 CRANBERRY

8.2.18 CURRANT

8.2.19 CHOKEBERRY

8.2.20 DATE

8.2.21 FIG

8.2.22 OLIVE

8.2.23 BREADFRUIT

8.2.24 CACAO

8.2.25 CHERIMOYA

8.2.26 MACADAMIA

8.2.27 FEIJOA FRUIT

8.2.28 NECTARINE

8.3 VEGETABLES

8.3.1 LENTILS

8.3.2 TOMATOES

8.3.3 CUCUMBER

8.3.4 GARLIC

8.3.5 GARLIC

8.3.6 EGGPLANTS

8.3.7 CARROT

8.3.8 PEPPERS

8.3.9 CAULIFLOWER

8.3.10 PEA (GARDEN, DRY, EDIBLE)

8.3.11 BEET

8.3.12 BROCCOLI

8.3.13 LETTUCE

8.3.14 ASPARAGUS

8.3.15 CELERY

8.3.16 CHIVE

8.3.17 COLLARDS

8.3.18 ARTICHOKE

8.3.19 CELERIAC

8.3.20 EDAMAME

8.3.21 ENDIVE

8.3.22 HORSERADISH

8.3.23 KOHLRABI

8.3.24 LEEK

8.4 TREE NUT

8.4.1 ALMONDS

8.4.2 CASHEWS

8.4.3 HAZELNUTS

8.4.4 MACADAMIA NUTS

8.4.5 PINE NUTS

8.4.6 CHESTNUTS

8.4.7 HICKORY NUTS

8.4.8 BRAZIL NUTS

8.4.9 PECANS

8.4.10 ACORNS

8.5 HERBS

8.5.1 CORIANDER

8.5.2 MINT

8.5.3 BASIL

8.5.4 ALOE VERA

8.5.5 PARSLEY

8.5.6 LAVENDER

8.5.7 ROSEMARY

8.5.8 THYME

8.5.9 DILL

8.5.10 JASMINE

8.5.11 CHIVES

8.5.12 CATNIP

8.5.13 OTHERS

8.6 SPICES

8.6.1 CRUSHED RED PEPPER

8.6.2 GARLIC

8.6.3 GINGER

8.6.4 TURMERIC

8.6.5 CORIANDER SEEDS

8.6.6 CUMIN

8.6.7 BLACK PEPPER

8.6.8 CARDAMOM

8.6.9 CLOVE

8.6.10 FENUGREEK

8.6.11 MUSTARD SEEDS

8.6.12 CURRY POWDER

8.6.13 NUTMEG

8.6.14 CELERY SEEDS

8.6.15 CASSIA BARK

8.6.16 MACE

8.6.17 OTHERS

8.7 OTHERS

9 NORTH AMERICA SPECIALTY CROP MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 OLAM GROUP ALL RIGHTS RESERVED CO.

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENTS

12.2 UNITED NATURAL FOODS, INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 AGT FOOD AND INGREDIENTS

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 LAMEX FOOD GROUP LIMITED

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 GOLDEN PEANUT AND TREE NUTS

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 OREGON SPICE COMPANY

12.6.1 COMPANY SNAPSHOT

12.6.2 COMPANY SHARE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BANABAY

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 BARNES WILLIAMS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 FARMER DIRECT ORGANIC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 FISHER NUT COMPANY

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 FRUIT+ VEG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 HARBOR SPICE CO., INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 HERBS N SPICES INTERNATIONAL

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 NATURAL SPECIALTY CROPS, ULC

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 NUTSCO

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 RICE FRUIT COMPANY

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 SIMPED FOODS PTY LTD.

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 SPECIALTY CROP COMPANY. INC.

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 SVZ INDUSTRIAL FRUIT & VEGETABLE INGREDIENTS

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 3 NORTH AMERICA CONVENTIONAL IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CONVENTIONAL IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 5 NORTH AMERICA ORGANIC IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA ORGANIC IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 9 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 13 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 17 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 19 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 21 NORTH AMERICA NECTARS & FRUIT-BASED DRINKS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA NECTARS & FRUIT-BASED DRINKS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 23 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 27 NORTH AMERICA SOUPS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SOUPS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 29 NORTH AMERICA SAUCES & DRESSINGS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA SAUCES & DRESSINGS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 31 NORTH AMERICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 33 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 35 NORTH AMERICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 37 NORTH AMERICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 39 NORTH AMERICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 41 NORTH AMERICA HERBS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA HERBS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 43 NORTH AMERICA SPICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SPICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 45 NORTH AMERICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 47 NORTH AMERICA SPECIALTY CROP MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SPECIALTY CROP MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 49 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 51 NORTH AMERICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 53 NORTH AMERICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 55 NORTH AMERICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 57 NORTH AMERICA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 59 NORTH AMERICA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 61 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 63 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 65 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 67 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 69 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 71 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 U.S. SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 75 U.S. FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 76 U.S. FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 77 U.S. VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 78 U.S. VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 79 U.S. TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 80 U.S. TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 81 U.S. HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 82 U.S. HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 83 U.S. SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 84 U.S. SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 85 U.S. SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 86 U.S. SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 87 U.S. SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 89 U.S. BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 U.S. CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 93 U.S. DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 95 U.S. JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 CANADA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 99 CANADA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 100 CANADA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 101 CANADA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 102 CANADA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 103 CANADA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 104 CANADA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 105 CANADA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 106 CANADA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 107 CANADA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 108 CANADA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 109 CANADA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 110 CANADA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 111 CANADA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 CANADA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 113 CANADA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 115 CANADA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 117 CANADA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 CANADA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 119 CANADA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 121 MEXICO SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 123 MEXICO FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 124 MEXICO FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 125 MEXICO VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 126 MEXICO VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 127 MEXICO TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 128 MEXICO TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 129 MEXICO HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 130 MEXICO HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 131 MEXICO SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 132 MEXICO SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 133 MEXICO SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 135 MEXICO SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 MEXICO SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 137 MEXICO BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 139 MEXICO CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 MEXICO CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 141 MEXICO DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 143 MEXICO JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 NORTH AMERICA SPECIALTY CROP MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SPECIALTY CROP MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SPECIALTY CROP MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SPECIALTY CROP MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA SPECIALTY CROP MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SPECIALTY CROP MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SPECIALTY CROP MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA SPECIALTY CROP MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SPECIALTY CROP MARKET: SEGMENTATION

FIGURE 10 THE RISING TREND OF EXOTIC FLAVOURS AMONG MILLENNIALS IS EXPECTED TO DRIVE THE NORTH AMERICA SPECIALTY CROP MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE VEGETABLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SPECIALTY CROP MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF INDIA FOOD INGREDIENTS

FIGURE 13 VALUE CHAIN OF SPECIALTY CROP

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SPECIALTY CROP MARKET

FIGURE 15 NORTH AMERICA SPECIALTY CROP MARKET, BY NATURE, 2021

FIGURE 16 NORTH AMERICA SPECIALTY CROP MARKET, BY APPLICATION, 2021

FIGURE 17 NORTH AMERICA SPECIALITY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA SPECIALTY CROP MARKET: SNAPSHOT (2021)

FIGURE 19 NORTH AMERICA SPECIALTY CROP MARKET: BY COUNTRY (2021)

FIGURE 20 NORTH AMERICA SPECIALTY CROP MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 NORTH AMERICA SPECIALTY CROP MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 NORTH AMERICA SPECIALTY CROP MARKET: BY TYPE (2022-2029)

FIGURE 23 NORTH AMERICA SPECIALTY CROPS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.