North America Soy Protein Concentrate Market

Taille du marché en milliards USD

TCAC :

%

USD

1.26 Billion

USD

3.44 Billion

2025

2033

USD

1.26 Billion

USD

3.44 Billion

2025

2033

| 2026 –2033 | |

| USD 1.26 Billion | |

| USD 3.44 Billion | |

|

|

|

|

Segmentation du marché nord-américain des concentrés de protéines de soja, par catégorie (composé unique et composé enrichi), procédé d'extraction (lavage à l'alcool aqueux, lavage à l'acide et lavage à l'eau avec dénaturation thermique), type de modification (modification thermique, chimique et enzymatique), concentration en protéines ( 70 %), forme (sèche et liquide), nature (biologique et conventionnelle), fonction (solubilité, gélification, émulsification, rétention d'eau, pouvoir moussant, texturant, stabilisant, épaississant et autres), application (produits alimentaires, boissons, nutraceutiques et compléments alimentaires, cosmétiques et soins personnels, aliments pour animaux, produits pharmaceutiques et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des concentrés de protéines de soja en Amérique du Nord

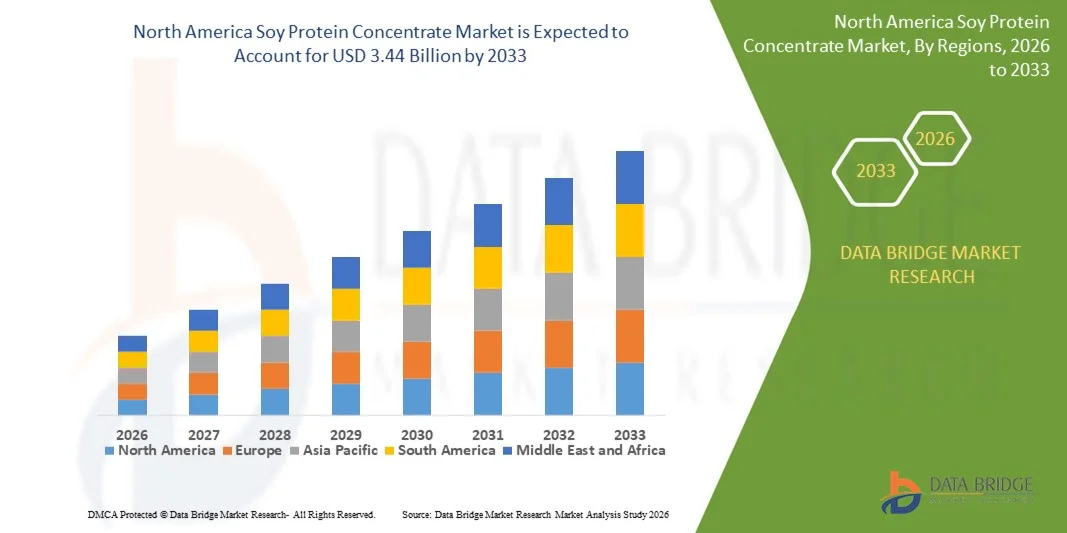

- Le marché nord-américain des concentrés de protéines de soja était évalué à 1,26 milliard de dollars américains en 2025 et devrait atteindre 3,44 milliards de dollars américains d'ici 2033 , avec un TCAC de 13,3 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante d'ingrédients alimentaires d'origine végétale et riches en protéines, soutenue par l'intérêt grandissant des consommateurs pour la santé, la nutrition et les choix alimentaires durables, tant dans les économies développées que dans les économies émergentes.

- De plus, l'adoption croissante du concentré de protéines de soja par les fabricants de produits alimentaires pour l'enrichissement en protéines, l'amélioration de la texture et la réduction des coûts dans les aliments transformés et les substituts de viande accélère la pénétration du marché, soutenant ainsi de manière significative l'expansion globale du marché.

Analyse du marché des concentrés de protéines de soja en Amérique du Nord

- Le concentré de protéines de soja est un ingrédient protéique d'origine végétale obtenu par élimination des glucides solubles de la farine de soja dégraissée. Il en résulte un produit riche en protéines utilisé pour améliorer la valeur nutritionnelle, la texture et les performances fonctionnelles des aliments, des aliments pour animaux et des produits nutraceutiques.

- La demande croissante de concentré de protéines de soja est principalement due à l'évolution vers des régimes alimentaires à base de plantes, à son utilisation accrue dans les aliments fonctionnels et enrichis, et à son application grandissante en nutrition animale grâce à son profil équilibré en acides aminés et à sa polyvalence fonctionnelle.

- Les États-Unis ont dominé le marché des concentrés de protéines de soja en 2025, en raison d'une forte consommation de produits alimentaires enrichis en protéines, d'une demande soutenue pour les alternatives végétales à la viande et d'industries de transformation alimentaire et nutraceutiques bien établies.

- Le Canada devrait connaître la croissance la plus rapide sur le marché des concentrés de protéines de soja au cours de la période de prévision, en raison de la demande croissante de protéines végétales, de produits alimentaires à étiquetage clair et de solutions nutritionnelles durables.

- Le segment conventionnel a dominé le marché avec une part de marché de 74,6 % en 2025, grâce à des chaînes d'approvisionnement bien établies et à des avantages en termes de coûts. Le concentré de protéines de soja conventionnel répond à une forte demande des industries agroalimentaires. Sa disponibilité stable et ses prix compétitifs lui permettent de conserver sa position de leader.

Portée du rapport et segmentation du marché des concentrés de protéines de soja

|

Attributs |

Concentré de protéines de soja : Principales informations sur le marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des concentrés de protéines de soja en Amérique du Nord

Utilisation croissante dans l'alimentation animale

- Le marché des concentrés de protéines de soja est en pleine expansion, les fabricants et les éleveurs reconnaissant leur valeur en tant qu'ingrédient riche en protéines et rentable dans l'alimentation animale, notamment pour les secteurs de la volaille, des porcs et de l'aquaculture.

- Par exemple, de grandes entreprises comme Bunge ont renforcé leur position en acquérant des fabricants spécialisés de concentrés de protéines de soja tels que CJ Selecta, ce qui leur permet de proposer des solutions d'alimentation animale sur mesure et de répondre à la demande croissante d'une nutrition animale durable et riche en protéines.

- L'adoption du concentré de protéines de soja dans l'alimentation animale est motivée par son profil d'acides aminés supérieur, sa digestibilité et sa capacité à améliorer les taux de croissance et l'efficacité alimentaire, ce qui le rend très attractif pour les exploitations agricoles commerciales à grande échelle.

- Les préoccupations croissantes concernant l'utilisation des antibiotiques et la nécessité d'optimiser la santé animale incitent les formulateurs d'aliments pour animaux à incorporer du concentré de protéines de soja comme ingrédient fonctionnel afin d'améliorer la santé intestinale et la réponse immunitaire du bétail.

- Les progrès technologiques en matière de transformation permettent de développer des concentrés de protéines de soja sans OGM, à faible teneur en oligosaccharides et hautement digestibles, conçus spécifiquement pour l'alimentation animale, ce qui élargit leur attrait auprès des producteurs aux besoins variés.

- L'approvisionnement durable, l'empreinte environnementale plus faible par rapport aux aliments pour animaux à base de protéines animales et l'attention accrue portée à la transparence de la chaîne alimentaire alimentent encore davantage son adoption croissante dans l'industrie de l'alimentation animale.

Dynamique du marché des concentrés de protéines de soja en Amérique du Nord

Conducteur

Demande croissante de protéines végétales

- L'essor des consommateurs soucieux de leur santé, conjugué à la popularité croissante des régimes végétariens, végétaliens et flexitariens, stimule considérablement la demande mondiale de protéines végétales dans les secteurs de l'alimentation et des boissons.

- Par exemple, des acteurs majeurs comme DuPont et Solae ont collaboré pour créer des concentrés de protéines de soja au goût et à la texture améliorés, les rendant plus adaptés aux substituts de viande à base de plantes et aux aliments fonctionnels.

- La polyvalence du concentré de protéines de soja — en tant qu'ingrédient de base des substituts de viande, des barres protéinées, des alternatives aux produits laitiers et des compléments alimentaires — sous-tend sa croissance sur le marché, tant auprès des producteurs alimentaires généralistes que spécialisés.

- Le prix abordable et le profil équilibré en acides aminés des concentrés de protéines de soja en font une alternative intéressante aux protéines animales, notamment dans les régions où l'accès aux sources de protéines traditionnelles est limité.

- L'intérêt croissant pour les ingrédients protéiques naturels, sans OGM et issus d'une production durable incite les entreprises alimentaires à intégrer le concentré de protéines de soja à leurs gammes de produits, répondant ainsi aux attentes changeantes des consommateurs en matière de transparence et de nutrition écologique.

Retenue/Défi

Réactions allergiques au soja

- Le soja figure parmi les huit principaux allergènes alimentaires au monde, et le risque de réactions allergiques constitue un obstacle majeur à l'adoption plus large du concentré de protéines de soja dans les industries alimentaires et d'alimentation animale.

- Par exemple, Nestlé a mis en œuvre des protocoles stricts d'étiquetage et de séparation des allergènes dans l'ensemble de ses gammes de produits à base de soja afin de se conformer aux réglementations en vigueur en Amérique du Nord et en Europe et d'atténuer les risques pour la sécurité des consommateurs.

- La recherche de formulations hypoallergéniques et l'émergence de protéines végétales alternatives, telles que les protéines de pois, de riz et d'avoine, intensifient la concurrence et stimulent l'innovation pour résoudre le problème des allergènes.

- La perception du soja par les consommateurs, parfois influencée par des idées reçues sur les OGM ou des préoccupations sanitaires, peut affecter leurs décisions d'achat et nécessiter des efforts supplémentaires de sensibilisation ou d'investissement marketing de la part des marques.

- Les différences réglementaires entre les régions concernant l'étiquetage, les niveaux autorisés de protéines allergènes et les allégations permises compliquent davantage l'expansion du marché et exigent des stratégies de conformité robustes de la part des fabricants.

Portée du marché des concentrés de protéines de soja en Amérique du Nord

Le marché est segmenté en fonction de la catégorie, du procédé d'extraction, du type de modification, de la concentration en protéines, de la forme, de la nature, de la fonction et de l'application.

- Par catégorie

Le marché des concentrés de protéines de soja est segmenté en fonction de leur catégorie : protéines simples et protéines enrichies. Le segment des protéines simples a généré la plus grande part de revenus en 2025, grâce à son utilisation répandue comme source de protéines économique dans l’industrie agroalimentaire et la nutrition animale. Les fabricants privilégient les concentrés de protéines de soja simples pour leur profil protéique constant et leur facilité de formulation dans de multiples applications. Leur fonctionnalité neutre garantit une texture stable et une amélioration nutritionnelle sans altérer les caractéristiques du produit fini. La forte demande des grandes entreprises agroalimentaires a encore renforcé leur position de leader.

Le segment des aliments enrichis devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la demande croissante de profils nutritionnels améliorés dans les aliments fonctionnels et les compléments alimentaires. Les variantes enrichies permettent l'incorporation de vitamines, de minéraux et d'acides aminés, renforçant ainsi leur positionnement santé global. La sensibilisation accrue des consommateurs à la qualité des protéines et à la nutrition ciblée favorise leur adoption. Le positionnement haut de gamme et les marges plus élevées incitent également les fabricants à développer leur offre d'aliments enrichis.

- Par procédé d'extraction

Selon le procédé d'extraction, le marché est segmenté en trois catégories : lavage à l'alcool aqueux, lavage à l'acide et lavage à l'eau avec dénaturation thermique. Le segment du lavage à l'alcool aqueux a dominé le marché en 2025 grâce à son efficacité à réduire les facteurs antinutritionnels tout en préservant la fonctionnalité des protéines. Ce procédé permet d'obtenir des concentrés de haute pureté, au goût et à la couleur améliorés, ce qui les rend adaptés à l'alimentation humaine. La constance de la qualité de la production favorise son adoption industrielle à grande échelle.

Le procédé de lavage à l'eau avec dénaturation thermique devrait connaître la croissance la plus rapide au cours de la période de prévision, portée par une préférence croissante pour des méthodes de transformation plus propres. Ce procédé s'inscrit dans la tendance du « clean label » en minimisant l'utilisation de produits chimiques. L'amélioration de la digestibilité des protéines et de leurs performances fonctionnelles renforce son attrait dans les applications alimentaires et nutraceutiques. La pression réglementaire et celle des consommateurs en faveur de procédés naturels accélèrent encore cette croissance.

- Par type de modification

Le marché des concentrés de protéines de soja est segmenté, selon le type de modification, en modification thermique, chimique et enzymatique. La modification thermique détenait la part de marché dominante en 2025 grâce à sa large adoption et à son potentiel de mise à l'échelle rentable. Cette méthode améliore les propriétés fonctionnelles des protéines, notamment l'absorption d'eau et la texture, sans étapes de traitement complexes. Sa compatibilité avec les infrastructures de production existantes favorise une utilisation à grande échelle.

La modification enzymatique devrait connaître la croissance la plus rapide entre 2026 et 2033 grâce à sa capacité à moduler avec précision les propriétés fonctionnelles. Les procédés enzymatiques améliorent la solubilité et la digestibilité, favorisant ainsi l'élaboration de formulations alimentaires avancées. La demande croissante de protéines végétales performantes en nutrition spécialisée stimule l'adoption de ces procédés. L'innovation dans les technologies enzymatiques renforce encore les perspectives de croissance.

- Par concentration protéique

En fonction de la concentration en protéines, le marché est segmenté en trois catégories : moins de 20 % de protéines, 20 % à 70 % de protéines et plus de 70 % de protéines. Le segment des 20 % à 70 % de protéines a dominé le marché en termes de chiffre d’affaires en 2025, grâce à son profil nutritionnel équilibré et à sa grande polyvalence fonctionnelle. Cette gamme est largement utilisée dans les produits alimentaires, l’alimentation animale et les nutraceutiques en raison de son rapport coût-efficacité avantageux. Sa large applicabilité garantit une demande soutenue dans tous les secteurs.

Le segment des produits contenant plus de 70 % de protéines devrait connaître la croissance la plus rapide au cours de la période de prévision, porté par la demande croissante de formulations riches en protéines. Les fabricants de nutrition sportive et de compléments alimentaires privilégient de plus en plus les concentrés protéiques à haute teneur. L'intérêt des consommateurs pour la santé musculaire et l'apport protéique soutient cette tendance. Le positionnement haut de gamme contribue également à l'expansion du marché.

- Par formulaire

Le marché des concentrés de protéines de soja est segmenté, selon leur forme, en deux catégories : les protéines sèches et les protéines liquides. En 2025, le segment des protéines sèches dominait le marché grâce à leur longue durée de conservation et à leur facilité de transport. Les concentrés de protéines de soja secs offrent aux fabricants une grande flexibilité de formulation et un excellent rapport coût-efficacité. Leur utilisation répandue dans les produits de boulangerie, les snacks et les substituts de viande explique leur position dominante.

Le segment des produits liquides devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par leur utilisation croissante dans les boissons et les préparations prêtes à l'emploi. Les concentrés liquides permettent un traitement plus rapide et un mélange homogène. La demande croissante de boissons enrichies en protéines et de produits émulsionnés favorise leur adoption. Leur facilité d'utilisation dans les applications industrielles accélère cette croissance.

- Par nature

Selon la nature du produit, le marché se divise en deux segments : biologique et conventionnel. En 2025, le segment conventionnel représentait la plus grande part de marché (74,6 %), grâce à des chaînes d’approvisionnement bien établies et à des avantages concurrentiels en matière de coûts. Le concentré de protéines de soja conventionnel répond à une forte demande des industries agroalimentaires. Sa disponibilité stable et ses prix compétitifs lui permettent de conserver sa position dominante.

Le segment bio devrait enregistrer la croissance la plus rapide au cours de la période prévisionnelle, porté par la préférence croissante des consommateurs pour les produits bio et sans OGM. La certification bio renforce la crédibilité des produits sur les marchés axés sur la santé. La croissance de la consommation d'aliments « clean label » et durables soutient cette expansion. La tarification premium encourage davantage la participation des producteurs.

- Par fonction

En fonction de leur fonction, les produits sont segmentés en fonction de leur solubilité, gélification, émulsification, rétention d'eau, pouvoir moussant, texturation, stabilisation, épaississement et autres. Le segment des émulsifiants a dominé le marché en 2025 grâce à son rôle essentiel dans la stabilité des aliments transformés. Le concentré de protéines de soja est largement utilisé pour améliorer la texture et la consistance des substituts de viande et de produits laitiers. La forte demande des fabricants de produits alimentaires maintient cette position dominante.

Le segment des agents texturants devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'essor de la consommation de substituts de viande à base de plantes. La texturation améliore la sensation en bouche et la structure des protéines alternatives. L'innovation dans la formulation des analogues de viande soutient la demande croissante. L'adoption de régimes alimentaires à base de plantes par les consommateurs accélère cette croissance.

- Sur demande

Selon l'application, le marché des concentrés de protéines de soja est segmenté en produits alimentaires, boissons, nutraceutiques et compléments alimentaires, cosmétiques et soins personnels, aliments pour animaux, produits pharmaceutiques et autres. Le segment des produits alimentaires a dominé le chiffre d'affaires du marché en 2025, grâce à son utilisation intensive en boulangerie, dans les substituts de viande et les aliments transformés. L'enrichissement en protéines et les bienfaits fonctionnels favorisent une large adoption. Une consommation importante maintient la position dominante de ce segment.

Le segment des nutraceutiques et des compléments alimentaires devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par une sensibilisation accrue à la santé et la demande croissante de suppléments protéiques. Le concentré de protéines de soja offre une nutrition végétale hautement digestible. La demande émanant des populations vieillissantes et des consommateurs soucieux de leur forme physique stimule cette croissance. L'innovation produit et les formulations ciblées contribuent également à son expansion.

Analyse régionale du marché des concentrés de protéines de soja en Amérique du Nord

- Les États-Unis ont dominé le marché des concentrés de protéines de soja en 2025, avec la plus grande part de revenus, grâce à une forte consommation de produits alimentaires enrichis en protéines, une demande soutenue pour les alternatives végétales à la viande et des industries agroalimentaires et nutraceutiques bien établies.

- L'utilisation généralisée du concentré de protéines de soja dans les secteurs de la boulangerie, des aliments transformés, des compléments alimentaires et de l'alimentation animale, soutenue par des capacités de production alimentaire avancées et une forte sensibilisation des consommateurs à l'alimentation végétale, continue d'alimenter une demande soutenue dans l'ensemble des industries utilisatrices finales.

- La forte présence d'acteurs majeurs du marché tels qu'ADM, Cargill Incorporated et DuPont, conjuguée à une innovation produit continue, à l'expansion des capacités de production et aux investissements dans les ingrédients à base de soja « clean label » et sans OGM, renforce la position de leader des États-Unis. La croissance soutenue de la consommation d'aliments d'origine végétale et de produits de nutrition fonctionnelle devrait maintenir la domination du pays au cours de la période de prévision.

Aperçu du marché canadien du concentré de protéines de soja

Le Canada devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide du marché nord-américain des concentrés de protéines de soja entre 2026 et 2033, grâce à une demande croissante de protéines végétales, de produits alimentaires naturels et de solutions nutritionnelles durables. Par exemple, les fabricants canadiens de produits alimentaires intègrent de plus en plus de concentrés de protéines de soja dans les substituts de viande, les produits de nutrition sportive et les aliments enrichis afin de répondre à la demande croissante des consommateurs pour des régimes riches en protéines et à base de plantes. L’augmentation des investissements dans l’innovation alimentaire, la sensibilisation accrue à la santé et un cadre réglementaire favorable accélèrent la croissance du marché, positionnant le Canada comme le pays à la croissance la plus rapide de la région.

Aperçu du marché mexicain du concentré de protéines de soja

Le marché mexicain devrait connaître une croissance soutenue entre 2026 et 2033, portée par l'utilisation croissante de concentré de protéines de soja dans les aliments transformés, l'alimentation animale et les préparations alimentaires riches en protéines à prix abordable. L'urbanisation croissante, la demande accrue d'ingrédients nutritionnels économiques et le développement du secteur agroalimentaire local soutiennent une demande constante. Une meilleure intégration des chaînes d'approvisionnement avec les producteurs nord-américains et l'adoption progressive des ingrédients protéiques végétaux renforcent la pénétration du marché. La croissance continue des secteurs de la fabrication alimentaire et de l'alimentation animale contribue à la stabilité du marché du concentré de protéines de soja tout au long de la période de prévision.

Part de marché du concentré de protéines de soja en Amérique du Nord

L'industrie des concentrés de protéines de soja est principalement dominée par des entreprises bien établies, notamment :

- Cargill Incorporated (États-Unis)

- DuPont (États-Unis)

- ADM (États-Unis)

- LA SOCIÉTÉ VINCENT (ÉTATS-UNIS)

- Wilmar International Ltd (Singapour)

- Batory Foods (États-Unis)

- Nordic Soya Oy (Finlande)

- Aminola (États-Unis)

- Société Crown Soya Protein Group (Chine)

- Solbar Ningbo Protein Technology Co., Ltd (Chine)

- Groupe Victoria (Serbie)

- Yuwang (Chine)

- Shandong Yuxin Biotechnology Co., Ltd (Chine)

- Gushen Biotechnology Group Co., Ltd. (Chine)

- Arshine Pharmaceutical Co., Limited (Chine)

- Tianwei Biotech Group Co., Ltd. (Chine)

- Foodchem International Corporation (Chine)

Dernières évolutions du marché des concentrés de protéines de soja en Amérique du Nord

- En mai 2025, Bunge a présenté à l'IFFA une nouvelle gamme de concentrés de protéines de soja, dont le lancement est prévu pour l'automne. Ces concentrés sont conçus pour répondre aux principaux défis de formulation du secteur des protéines végétales en offrant un goût pur, une couleur neutre et un excellent rapport qualité-prix. Cette expansion stratégique de la gamme devrait renforcer la présence de Bunge sur le marché et favoriser l'adoption des concentrés de protéines de soja par les fabricants de produits alimentaires à la recherche d'ingrédients performants et faciles à produire.

- En février 2024, Amfora a annoncé le lancement commercial de sa première génération de produits à très haute teneur en protéines végétales. Cette arrivée sur le marché renforce la concurrence et répond à la demande croissante d'ingrédients durables et riches en nutriments. L'innovation d'Amfora devrait accélérer la croissance de l'utilisation du concentré de protéines de soja dans les aliments fonctionnels et enrichis.

- En juin 2023, Nutra Ingredients a lancé un nouveau concentré de protéines de soja enrichi en acides aminés essentiels, destiné au marché de la nutrition sportive. Ce produit innovant promet une meilleure récupération et une croissance musculaire accrue, élargissant ainsi le champ d'application des concentrés de protéines de soja dans l'industrie de la nutrition sportive.

- En février 2022, Benson Hill a lancé sa gamme d'ingrédients à base de protéines de soja TruVail, offrant des avantages distincts en matière de durabilité, adaptés à diverses applications alimentaires. Ce lancement a marqué une étape importante vers l'intégration de la responsabilité environnementale à l'innovation alimentaire. Cette approche axée sur la durabilité contribue à un intérêt accru du marché pour les solutions de protéines de soja éco-responsables et à étiquetage clair, renforçant ainsi l'adhésion des consommateurs et des fabricants aux pratiques d'approvisionnement responsables.

- En juillet 2020, DuPont a élargi sa gamme Danisco Planit avec le lancement de nouveaux produits tels que les concentrés de protéines de soja texturés Response et les concentrés de protéines de soja fonctionnels Alpha, répondant à diverses applications et améliorant son offre de concentrés de protéines de soja.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.