Marché nord-américain des écrans industriels robustes, par technologie (LCD, LED, OLED, écran E-Paper), taille de l'écran (13"-18", 8"-11", 11"-12", 19"-25", plus de 40"), résolution (1024*768, 1366*768, 1920*1080, 800*600, 1280*1023, 1920*1200, autres), type de montage (montage sur panneau, cadre ouvert, montage en rack, montage mural, montage sur bras, autres), type d'écran tactile (résistif, P Cap, capacitif, tactile IR), application (IHM, médical, automatisation industrielle, affichage numérique, kiosque/POS, jeux/loterie, imagerie), vertical (fabrication, militaire et défense, énergie et électricité, pétrole et gaz, chimie, transport, métallurgie et mines), pays (États-Unis, Canada, Mexique) Tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : marché nord-américain des écrans industriels robustes

Analyse et perspectives du marché : marché nord-américain des écrans industriels robustes

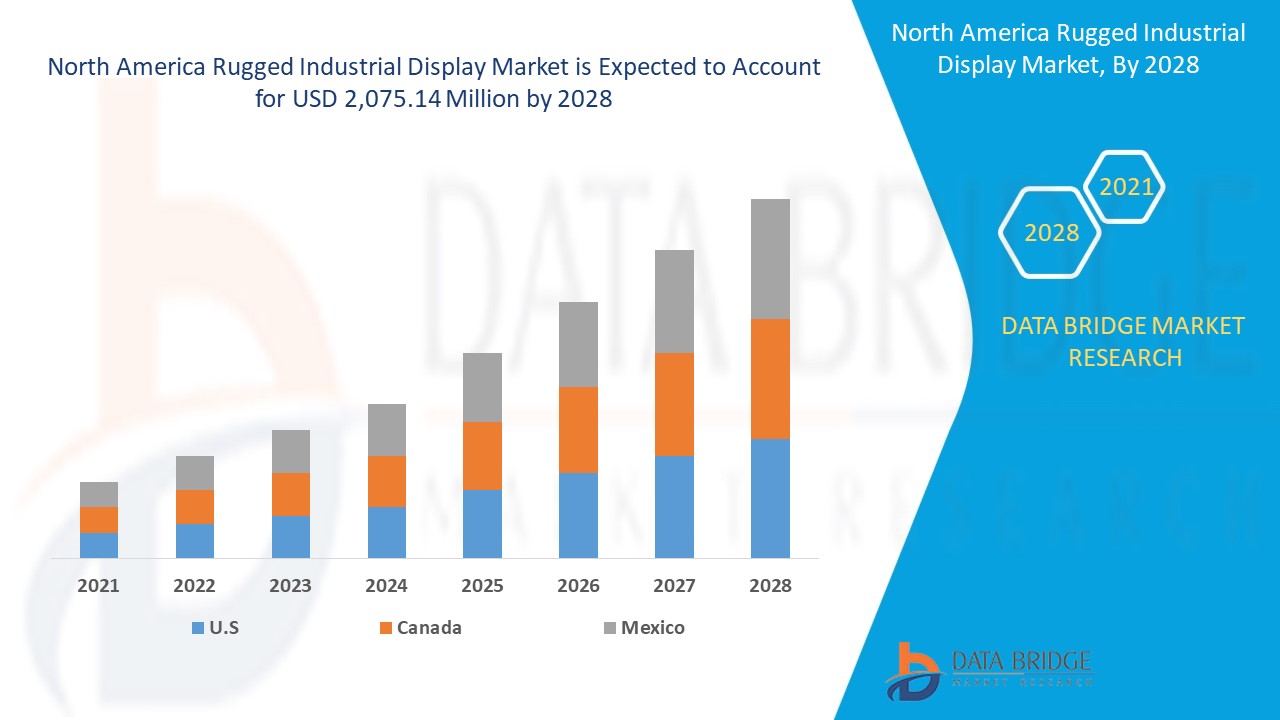

Le marché nord-américain des écrans industriels robustes devrait connaître une croissance de marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,3 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 2 075,14 millions USD d'ici 2028. L'automatisation croissante et l'IoT dans le cadre de l'industrie 4.0 et l'augmentation des données numériques dans les domaines de la médecine, de la fabrication, de l'armée et de la défense nécessitent des écrans d'interaction mieux adaptés aux environnements difficiles des secteurs respectifs, agissant ainsi comme moteur de la croissance du marché des écrans industriels robustes.

Les écrans industriels robustes, comme leur nom l'indique, sont conçus de A à Z pour résister aux conditions environnementales extrêmes rencontrées dans les applications marines, militaires et industrielles où les performances élevées et la robustesse sont cruciales. Ils offrent des caractéristiques telles qu'une coque résistante aux chocs, des écrans résistants aux rayures, une résistance à la corrosion et des revêtements spéciaux en fonction du cas d'utilisation. Ces types de produits sont utilisés dans différentes opérations commerciales telles que la fabrication, le pétrole et le gaz, le transport, l'armée , les soins de santé, etc. Il permet également de détecter toute déviation dans l'entreprise. Les appareils ou moniteurs industriels robustes offrent une protection contre une large gamme de conditions environnementales, notamment les températures extrêmes, les vibrations et les chocs, l'humidité et d'autres éléments. Ces écrans affichent également des détails critiques sur l'opération en cours qui sont essentiels pour la prise de décisions. Il existe une grande variété de systèmes d'affichage disponibles dans différentes tailles pour répondre aux besoins

Les développements technologiques émergents et les processus automatisés dans les industries s'avèrent être le principal moteur du marché nord-américain des écrans industriels robustes. L'augmentation de l'interaction homme-machine au cours des dernières années a vu l'essor du marché des écrans IHM au cours des dernières années et l'adoption croissante de l'automatisation dans le secteur manufacturier stimule le marché. Le coût plus élevé de l'adoption d'écrans robustes et le coût de développement élevé pour des conditions difficiles peuvent s'avérer être un frein, mais de nombreuses industries qui passent à l'industrie 4.0 et à la numérisation et à l'automatisation rapides constituent la plus grande opportunité pour le marché. Le développement d'écrans toutes saisons peut être un défi et les défis rencontrés en raison de l'impact de Covid-19 sur la chaîne d'approvisionnement des matières premières, en particulier les importations en provenance de Chine, qui est un fournisseur majeur de produits électroniques à l'échelle internationale.

Le rapport sur le marché des écrans industriels robustes fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché des écrans industriels robustes, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des écrans industriels robustes en Amérique du Nord

Portée et taille du marché des écrans industriels robustes en Amérique du Nord

Le marché nord-américain des écrans industriels robustes est segmenté en fonction de la technologie, de la taille de l'écran, de la résolution, du montage, du type d'écran tactile, de l'application et de la verticale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base de la technologie, le marché nord-américain des écrans industriels robustes est segmenté en écrans LCD, LED, OLED et e-paper. En 2021, les écrans LCD dominent la région en raison de leur adoption et de leur utilisation plus faciles dans les applications industrielles plus anciennes.

- En fonction de la taille de l'écran, le marché industriel robuste d'Amérique du Nord est segmenté en 8"-11", 11"-12", 13"-18", 19"-25" et 40"- plus. En 2021, les 13"-18" dominent ce segment, car la taille d'écran optimale de 15,6" est largement adoptée dans les écrans IHM et les moniteurs utilisés pour les ordinateurs.

- En fonction de la résolution, le marché nord-américain des écrans industriels robustes est segmenté en 1920*1200, 1920*1080, 1280*1024, 1024*768, 800*600, 1366*768 et autres. En 2021, l'écran 1024*768 domine ce segment en raison de son adaptabilité dans l'IHM et de sa prise en charge des logiciels existants.

- En fonction du type de montage, le marché nord-américain des écrans industriels robustes est segmenté en montage sur panneau, montage sur rack, montage mural, montage sur bras, cadre ouvert et autres. En 2021, le montage sur panneau domine le type de montage car il s'agit du type de montage le plus courant utilisé dans les industries pour l'automatisation et également utilisé dans les PC à écran utilisés dans l'armée et la défense.

- En fonction du type d'écran tactile, le marché nord-américain des écrans industriels robustes est segmenté en écrans résistifs, PCAP, tactiles IR et capacitifs. En 2021, le type d'écran tactile résistif domine le marché en raison de son coût inférieur et de la construction robuste requise à cet effet.

- En fonction des applications, le marché nord-américain des écrans industriels robustes est segmenté en secteurs médical, IHM, automatisation industrielle, kiosque/POS, signalisation numérique, imagerie et jeux/loterie. En 2021, l'IHM domine le segment en raison de l'industrialisation accrue et de l'augmentation de l'utilisation des machines dans tous les secteurs.

- Sur la base de la verticale, le marché nord-américain des écrans industriels robustes est segmenté en pétrole et gaz, fabrication, chimie, énergie et électricité, mines et métaux, transport, armée et défense, etc. En 2021, le secteur manufacturier domine le segment car il utilise de plus en plus les techniques de fabrication numérique et les ordinateurs pour des processus efficaces.

Analyse du marché des écrans industriels robustes en Amérique du Nord au niveau des pays

Le marché des écrans industriels robustes est analysé et des informations sur la taille du marché sont fournies par pays, technologie, taille de l'écran, résolution, montage, type d'écran tactile, application et vertical comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des écrans industriels robustes sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché en raison du développement plus important du secteur manufacturier vertical et d'un budget militaire et de défense plus élevé.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Les activités stratégiques croissantes des principaux acteurs du marché visant à accroître la notoriété de l'affichage industriel robuste stimulent la croissance du marché de l'affichage industriel robuste en Amérique du Nord.

Le marché nord-américain des écrans industriels robustes vous fournit également une analyse de marché détaillée pour la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2010 à 2019.

Analyse du paysage concurrentiel et des parts de marché des écrans industriels robustes en Amérique du Nord

Le paysage concurrentiel du marché des écrans industriels robustes fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des écrans industriels robustes.

Les principales entreprises qui opèrent dans le secteur des écrans industriels robustes en Amérique du Nord sont SAMSUNG ELECTRONICS AMERICA, AU Optronics Corp., Kyocera, Curtiss-Wright Corporation, Rockwell Automation, Inc., Advantech Co., Ltd., Bit Tradition GmbH, Bluestone Technology Ltd, BOE Technology UK Limited, BRESSNER Technology GmbH, Crystal Group Inc., General Digital Corporation, GETAC, Hope Industrial Systems, Inc., noax Technologies AG, Pepperl+Fuchs SE et Siemens, entre autres acteurs nationaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux contrats et accords sont également initiés par des entreprises du monde entier qui accélèrent également le marché des écrans industriels robustes.

Par exemple,

- En mars 2021, Advantech Co. Ltd, leader nord-américain de la technologie IoT, a annoncé le lancement de la plus grande série de conférences en ligne de partenaires au monde, dont le thème est « Edge+ vers l'avenir de l'AIoT ». La série a réuni plus de 60 experts industriels et collaborateurs de l'écosystème pour partager de nouvelles solutions et technologies Edge+. L'entreprise prévoit également de travailler avec ces collaborateurs sur le long terme pour co-créer un environnement durable et améliorer les opportunités commerciales de l'IoT.

- En avril 2021, la division des solutions de défense de Curtiss-Wright Corporation a été sélectionnée par Scientific Research Corporation (SRC) pour fournir une version de son système d'enregistrement de vol Fortress, leader du secteur, afin de mettre à niveau l'avion d'entraînement T-6 Texan II utilisé par les États-Unis. La société a fourni à SRC une nouvelle variante du Fortress CVR25, développé pour être utilisé sur des plateformes aéroportées d'avions militaires à voilure fixe et à giravions. Cela aidera l'entreprise à explorer davantage d'autres applications d'enregistreurs de vol au sein du DoD dans sa division de défense.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché des écrans industriels robustes, ce qui offre également l'avantage de la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRIAL DISPLAY TYPES

4.2 STANDARD RATINGS FOR INDUSTRIAL DISPLAYS

4.2.1 INGRESS PROTECTION (IP) RATING:

4.2.2 NATIONAL ELECTRIC MANUFACTURERS ASSOCIATION (NEMA) RATINGS

4.3 KEY CUSTOMERS BY INDUSTRY

4.3.1 MILITARY & DEFENSE INDUSTRY

4.3.2 INDUSTRIAL AUTOMATION & MANUFACTURING

4.3.3 OIL & GAS INDUSTRY

4.3.4 CHEMICAL INDUSTRY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF VARIOUS TECHNOLOGICAL DEVELOPMENTS AND AUTOMATED PROCESSES IN INDUSTRIES

5.1.2 LED AND LCD BASED DISPLAY PRODUCTS REDUCES RISK OF EYE DAMAGE

5.1.3 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES

5.1.4 INCREASE IN MANUFACTURING FACILITIES WORLDWIDE ENHANCES ADOPTION OF INDUSTRIAL DISPLAYS

5.1.5 AVAILABILITY OF ROBUST DISPLAY SCREEN AND WIRELESS CONNECTION

5.1.6 RISE IN DEMAND FOR COST-EFFECTIVE KIOSKS FOR INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 HIGH INVESTMENTS REQUIRED FOR INSTALLING OF INDUSTRIAL DISPLAYS/PANELS

5.2.2 DEVELOPING & DESIGNING OF DISPLAY EQUIPMENT FOR ALL WEATHER CONDITIONS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR DIGITAL SIGNAGE APPLICATIONS IN INDUSTRIES FOR DISPLAYING NECESSARY INFORMATION

5.3.2 INCREASE IN DIGITALIZATION OF FACILITIES WITH INDUSTRY 4.0

5.3.3 RISE IN ADOPTION OF OLED DISPLAYS IN VARIOUS APPLICATIONS

5.3.4 TRANSFORMATION OF MANUAL PROCESS INTO DIGITAL PROCESS BY COMPANIES

5.3.5 INCREASE IN PARTNERSHIPS AND ACQUISITIONS AMONGST DIFFERENT MARKET PLAYERS

5.4 CHALLENGES

5.4.1 SUITABILITY OF INDUSTRIAL DISPLAY FOR ALL WEATHER CONDITIONS

5.4.2 DEPENDENCY OF MANUFACTURERS ON VARIOUS SUPPLIERS TO PROVIDE EQUIPMENT AND COMPONENTS

5.4.3 ECONOMIC CRISIS OCCURRED DUE TO VARIOUS FACTORS

6 IMPACT OF COVID-19 ON THE NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 CONCLUSION

7 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LCD

7.3 LED

7.3.1 FULL ARRAY

7.3.2 EDGE LIT

7.3.3 DIRECT LIT

7.4 OLED

7.4.1 AMOLED DISPLAY

7.4.2 PMOLED DISPLAY

7.5 E-PAPER DISPLAY

8 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE

8.1 OVERVIEW

8.2” – 18”

8.3 8” – 11”

8.4” – 12”

8.5” – 25”

8.6 ABOVE 40"

9 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION

9.1 OVERVIEW

9.24X768

9.36X768

9.40X1080

9.5X600

9.60X1024

9.70X1200

10 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING

10.1 OVERVIEW

10.2 PANEL MOUNTING

10.3 OPEN-FRAME

10.4 RACK MOUNTING

10.5 WALL MOUNTING

10.6 ARM-MOUNTED

10.7 OTHERS

11 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE

11.1 OVERVIEW

11.2 RESISTIVE

11.3 P CAP

11.4 CAPACITIVE

11.5 IR TOUCH

12 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 HMI

12.2.1” – 18”

12.2.2 8” – 11”

12.2.3” – 25”

12.2.4” – 12”

12.2.5 ABOVE 40"

12.3 MEDICAL

12.3.1” – 18”

12.3.2” – 25”

12.3.3” – 12”

12.3.4 8” – 11”

12.3.5 ABOVE 40"

12.4 INDUSTRIAL AUTOMATION

12.4.1 ABOVE 40"

12.4.2” – 25”

12.4.3” – 18”

12.4.4” – 12”

12.4.5 8” – 11”

12.5 DIGITAL SIGNAGE

12.5.1 ABOVE 40"

12.5.2” – 25”

12.5.3” – 18”

12.5.4” – 12”

12.5.5 8” – 11”

12.6 KIOSK/ POS

12.6.1 8” – 11”

12.6.2” – 12”

12.6.3” – 18”

12.6.4” – 25”

12.6.5 ABOVE 40"

12.7 GAMING/ LOTTERY

12.7.1” – 18”

12.7.2” – 25”

12.7.3” – 12”

12.7.4 8” – 11”

12.7.5 ABOVE 40"

12.8 IMAGING

12.8.1” – 18”

12.8.2” – 25”

12.8.3 ABOVE 40"

12.8.4” – 12”

12.8.5 ABOVE 40"

13 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL

13.1 OVERVIEW

13.2 MANUFACTURING

13.2.1 LCD

13.2.2 LED

13.2.3 OLED

13.3 MILITARY & DEFENCE

13.3.1 LCD

13.3.2 LED

13.3.3 OLED

13.4 ENERGY & POWER

13.4.1 LCD

13.4.2 LED

13.4.3 OLED

13.5 OIL & GAS

13.5.1 LCD

13.5.2 LED

13.5.3 OLED

13.6 CHEMICAL

13.6.1 LCD

13.6.2 LED

13.6.3 OLED

13.7 TRANSPORTATION

13.7.1 LCD

13.7.2 LED

13.7.3 OLED

13.8 METAL & MINING

13.8.1 LCD

13.8.2 LED

13.8.3 OLED

13.9 OTHERS

14 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY GEOGRAPHY

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SAMSUNG ELECTRONICS AMERICA

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 AU OPTRONICS CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALSYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 KYOCERA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CURTISS-WRIGHT CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 ROCKWELL AUTOMATION INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 GETAC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ADVANCED EMBEDDED SOLUTIONS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ADVANTECH CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 BIT TRADITION GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BLUESTONE TECHNOLOGY LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BOE TECHNOLOGY UK LIMITED

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 BRESSNER TECHNOLOGY GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 CRYSTAL GROUP INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 GENERAL DIGITAL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 HEMATEC GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HOPE INDUSTRIAL SYSTEMS, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 NOAX TECHNOLOGIES AG

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PEPPERL+FUCHS SE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 SIEMENS

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 TCI GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 DESCRIPTION OF VARIOUS IP RATING NUMBERS

TABLE 2 SIGNIFICANCE OF NEMA RATING

TABLE 3 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA LCD IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 5 NORTH AMERICA LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 6 NORTH AMERICA LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 8 NORTH AMERICA OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA E-PAPER DISPLAY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 10 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA 13” – 18” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 12 NORTH AMERICA 8” – 11” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 13 NORTH AMERICA 11” – 12” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 14 NORTH AMERICA 19” – 25” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 15 NORTH AMERICA ABOVE 40" IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 16 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA 1024X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 18 NORTH AMERICA 1366X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 19 NORTH AMERICA 1920X1080 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 20 NORTH AMERICA 800X600 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 21 NORTH AMERICA 1280X1024 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 22 NORTH AMERICA 1920X1200 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 23 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA PANEL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 25 NORTH AMERICA OPEN-FRAME IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 26 NORTH AMERICA RACK MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 27 NORTH AMERICA WALL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 28 NORTH AMERICA ARM-MOUNTED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 30 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA RESISTIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 32 NORTH AMERICA P CAP IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 33 NORTH AMERICA CAPACITIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 34 NORTH AMERICA IR TOUCH IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 35 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 37 NORTH AMERICA HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 39 NORTH AMERICA MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 41 NORTH AMERICA INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 43 NORTH AMERICA DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA KIOSK/POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 45 NORTH AMERICA KIOSK/ POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 47 NORTH AMERICA GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 49 NORTH AMERICA IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 52 NORTH AMERICA MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 54 NORTH AMERICA MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA ENERGY AND POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 56 NORTH AMERICA ENERGY & POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 58 NORTH AMERICA OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 59 NORTH AMERICA CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 60 NORTH AMERICA CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 61 NORTH AMERICA TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 62 NORTH AMERICA TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 63 NORTH AMERICA METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 64 NORTH AMERICA METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 65 NORTH AMERICA OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 66 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 67 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 68 NORTH AMERICA LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 69 NORTH AMERICA OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 71 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 72 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 73 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 74 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (THOUSAND UNITS)

TABLE 76 NORTH AMERICA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 77 NORTH AMERICA MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 78 NORTH AMERICA INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 79 NORTH AMERICA DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 80 NORTH AMERICA KIOSK/ POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 81 NORTH AMERICA GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 82 NORTH AMERICA IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 83 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 84 NORTH AMERICA MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 85 NORTH AMERICA MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 86 NORTH AMERICA ENERGY & POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 87 NORTH AMERICA OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 88 NORTH AMERICA CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 89 NORTH AMERICA TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 90 NORTH AMERICA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 91 U.S. RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 92 U.S. LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 U.S. OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 94 U.S. RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 95 U.S. RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 96 U.S. RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 97 U.S. RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 98 U.S. RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 99 U.S. HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 100 U.S. MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 101 U.S. INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 102 U.S. DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 103 U.S. KIOSK/ POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 104 U.S. GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 105 U.S. IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 106 U.S. RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 107 U.S. MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 108 U.S. MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 109 U.S. ENERGY & POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 U.S. OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 111 U.S. CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 112 U.S. TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 113 U.S. METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 114 CANADA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 115 CANADA LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 116 CANADA OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 CANADA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 118 CANADA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 119 CANADA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 120 CANADA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 121 CANADA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 122 CANADA HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 123 CANADA MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 124 CANADA INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 125 CANADA DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 126 CANADA KIOSK/ POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 127 CANADA GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 128 CANADA IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION

TABLE 129 CANADA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 130 CANADA MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 131 CANADA MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 132 CANADA ENERGY & POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 133 CANADA OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 134 CANADA CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 135 CANADA TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 136 CANADA METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 137 MEXICO RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 138 MEXICO LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 139 MEXICO OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 140 MEXICO RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 141 MEXICO RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 142 MEXICO RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 143 MEXICO RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 144 MEXICO RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 145 MEXICO HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 146 MEXICO MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 147 MEXICO INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 148 MEXICO DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 149 MEXICO KIOSK/ POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 150 MEXICO GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 151 MEXICO IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 152 MEXICO RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 153 MEXICO MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 154 MEXICO MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 155 MEXICO ENERGY & POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 156 MEXICO OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 157 MEXICO CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 158 MEXICO TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 159 MEXICO METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 10 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES IS EXPECTED TO DRIVE TH NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 LCD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET

FIGURE 13 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY, 2020

FIGURE 14 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY DISPLAY SIZE, 2020

FIGURE 15 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY RESOLUTION, 2020

FIGURE 16 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY MOUNTING, 2020

FIGURE 17 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY TOUCH SCREEN TYPE, 2020

FIGURE 18 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY APPLICATION, 2020

FIGURE 19 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY VERTICAL, 2020

FIGURE 20 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: SNAPSHOT (2020)

FIGURE 21 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020)

FIGURE 22 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2021 & 2028)

FIGURE 23 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020 & 2028)

FIGURE 24 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY (2019-2028)

FIGURE 25 NORTH AMERICA RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY SHARE 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.