Isolation des tuyaux en Amérique du Nord par type de produit (films minces, feuilles, enveloppes, produits isolants rigides, revêtements isolants en laine de roche, matériaux de revêtement et autres), type de matériau (laine de roche, fibre de verre, polyuréthane , polystyrène, polyoléfine, polypropylène, polycarbonate, chlorure de polyvinyle, urée-formaldéhyde, mousse phénolique, mousse élastomère et autres), température (isolation à chaud et isolation à froid), application (bâtiment et construction, électronique, industrie chimique, énergie et électricité, pétrole et gaz, automobile, transport, alimentation et boissons et autres) – Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché de l'isolation des tuyaux en Amérique du Nord

Le mélange de pétrole et de gaz chaud s'écoule depuis la tête de puits et est acheminé à travers des XMT, des collecteurs, divers instruments critiques, des bobines et des conduites d'écoulement avant d'atteindre la surface via le riser. Pour éviter la formation de bouchons d'hydrates et l'accumulation de cire, une isolation est nécessaire (paraffine). Lorsque la composition pétrole/gaz est dépressurisée et exposée à la basse température de l'eau de mer au fond de la mer, la formation de cire et d'hydrates commence. Les matériaux d'isolation haute performance sont très demandés dans l'industrie pétrolière et gazière, principalement en raison de la demande croissante d'applications de pipelines sous-marins.

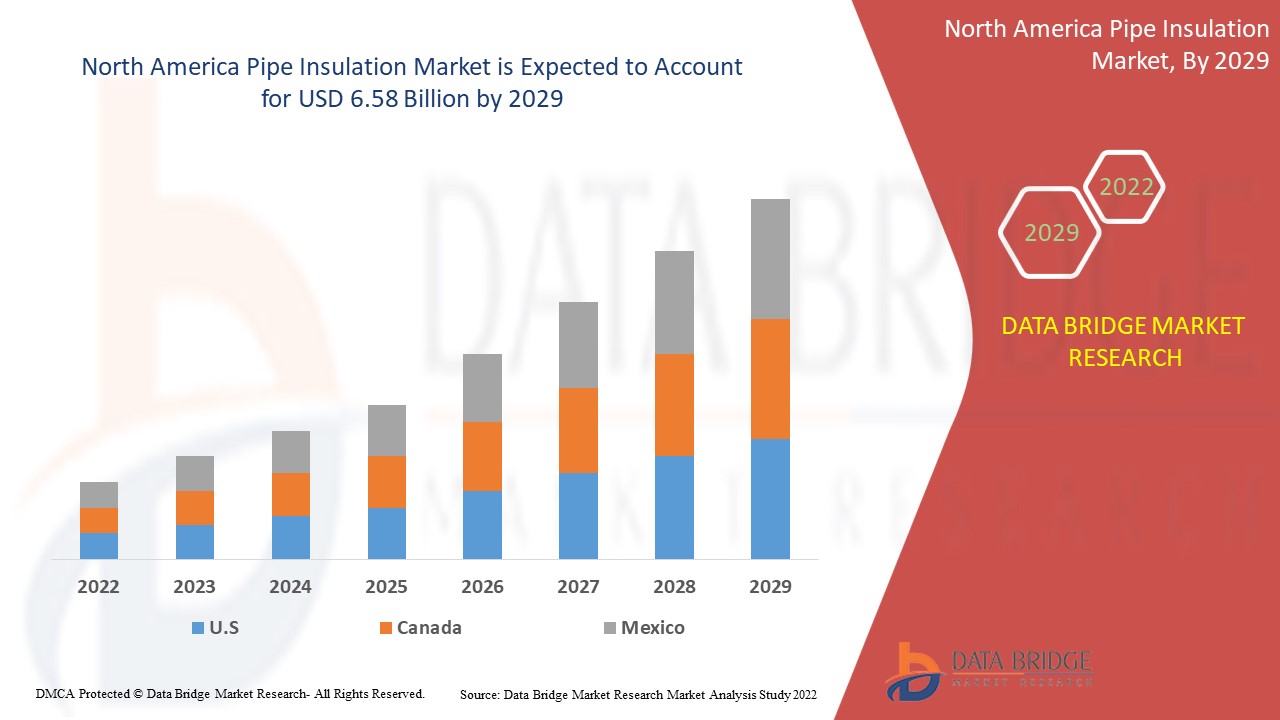

Data Bridge Market Research analyse que le marché de l'isolation des tuyaux devrait croître à un TCAC de 4,5 % au cours de la période de prévision et atteindrait une valeur estimée de 4,63 milliards USD en 2021 et atteindra 6,58 milliards USD d'ici la fin de la période de prévision, soit 2022-2029. Le rapport de Data Bridge Market Research sur le marché des matériaux d'isolation des tuyaux fournit une analyse et des informations sur les différents facteurs qui devraient prévaloir tout au long de la période de prévision tout en fournissant leurs impacts sur la croissance du marché. L'industrialisation croissante à plus grande échelle stimule le marché de l'isolation des tuyaux à plus grande échelle.

Définition du marché

Les matériaux isolants pour tuyaux sont ceux qui peuvent fonctionner à des températures élevées. Ces matériaux contribuent à améliorer les performances, la cohérence et la sécurité. Ils sont utilisés dans de nombreuses industries, notamment la pétrochimie, la céramique, le ciment, le fer et l'acier, la métallurgie des poudres, etc.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type de produit (films minces, feuilles, emballages, produits isolants rigides, couvertures isolantes en laine de roche, matériaux de revêtement et autres), type de matériau (laine de roche, fibre de verre, polyuréthane, polystyrène, polyoléfine, polypropylène, polycarbonate, chlorure de polyvinyle, urée-formaldéhyde, mousse phénolique, mousse élastomère et autres), température (isolation à chaud et isolation à froid), application (bâtiment et construction, électronique, industrie chimique, énergie et électricité, pétrole et gaz, automobile, transport, alimentation et boissons et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

3M (États-Unis), XPEL, Inc. (États-Unis), Dow (États-Unis), Eastman Chemical Company (États-Unis), Hexis SAS (France), PremiumShield (États-Unis), STEK-USA (États-Unis), Reflek Technologies Corporation (États-Unis), GRAFITYP (Belgique), ORAFOL Europe GmbH (Allemagne), DuPont (États-Unis), DAIKIN (Japon), Optic Shield (République tchèque), Solvay (Belgique), SCHWEITZER-MAUDUIT INTERNATIONAL, INC. (États-Unis), Saint-Gobain (France) et Avery Dennison Corporation (États-Unis) |

|

Opportunités |

|

Dynamique du marché de l'isolation des tuyaux

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Préoccupations environnementales croissantes

La sensibilisation croissante à l’environnement concernant les émissions de gaz à effet de serre entraîne une demande de matériaux isolants haute performance de la part des industries d’utilisation finale telles que le pétrole et le gaz, la peinture et les revêtements, le bâtiment et la construction, entre autres, car l’isolation agit comme une barrière au flux de chaleur et contribue ainsi à réduire les émissions de gaz à effet de serre.

Demande croissante de la part de divers utilisateurs finaux

demande croissante dans les industries pétrolières et chimiques, où les températures de fonctionnement sont très élevées, entraînant des pertes de chaleur, et des pipelines correctement isolés sont nécessaires pour le transport et l'exportation en toute sécurité des produits chimiques.

Opportunité

Le développement rapide de matériaux à faible biopermanence, l'émergence d'applications dans les industries aérospatiale et automobile et la montée des préoccupations concernant la conservation de l'énergie et les émissions de gaz à effet de serre dans divers pays devraient offrir une variété d'opportunités de croissance pour le marché des matériaux d'isolation à haute température au cours de la période de prévision .

Restrictions

Cependant, la nature cancérigène des fibres céramiques et les réglementations strictes concernant l'utilisation de matériaux isolants sont susceptibles d'agir comme des freins majeurs au taux de croissance du marché des matériaux isolants haute température au cours de la période de prévision de 2021 à 2028, tandis que les divers effets nocifs résultant de l'exposition peuvent remettre en cause la croissance.

Ce rapport sur le marché de l'isolation des tuyaux fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de l'isolation des tuyaux, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact post-COVID-19 sur le marché de l'isolation des tuyaux

Le marché des matériaux d'isolation des tuyaux a été impacté de diverses manières en raison de la pandémie de Covid-19. Diverses restrictions légales existaient dans le monde, ce qui a eu un impact significatif sur la demande et la croissance du marché de l'isolation des tuyaux. Les activités de production et de vente ont été considérablement perturbées, ralentissant la croissance du marché de l'isolation des tuyaux. Cependant, le marché de l'isolation des tuyaux a connu une croissance constante d'ici la fin de 2020 et devrait continuer à croître et à couvrir les pertes de l'industrie d'ici la fin de 2022.

Portée du marché de l'isolation des tuyaux en Amérique du Nord

Le marché de l'isolation des tuyaux est segmenté en fonction du type de produit, du type de matériau, de la température et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Couches minces

- Feuilles

- Enveloppements

- Produits rigides isolés

- Couvertures isolantes en laine de roche

- Matériau de revêtement

- Autres

Type de matériau

- Laine de roche

- Fibre de verre

- Polyuréthane

- Polystyrène

- Polyoléfine

- Polypropylène

- Polycarbonate

- Chlorure de polyvinyle

- Urée formaldéhyde

- Mousse phénolique

- Mousse élastomère

- Autres

Température

- Isolation thermique

- Isolation contre le froid

Application

- Bâtiment et construction

- Électronique

- Industrie chimique

- Énergie et puissance

- Pétrole et gaz

- Automobile

- Transport

- Alimentation et boissons

- Autres

Analyse/perspectives régionales du marché de l'isolation des tuyaux

Le marché de l’isolation des tuyaux est analysé et des informations sur la taille et les tendances du marché sont fournies par type de produit national, type de matériau, température et application comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de l’isolation des tuyaux sont les États-Unis, le Canada, le Mexique,

Les États-Unis dominent l'Amérique du Nord en raison de la demande croissante dans les industries pétrolières et chimiques, où les températures de fonctionnement sont très élevées, entraînant des pertes de chaleur, et des pipelines correctement isolés sont nécessaires pour le transport et l'exportation en toute sécurité des produits chimiques.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'isolation des tuyaux

Le paysage concurrentiel du marché de l'isolation des tuyaux fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'isolation des tuyaux.

Certains des principaux acteurs opérant sur le marché de l’isolation des tuyaux sont :

- 3M (États-Unis)

- XPEL, Inc. (États-Unis)

- Dow (États-Unis)

- Eastman Chemical Company (États-Unis)

- Hexis SAS (France)

- PremiumShield (États-Unis)

- STEK-USA (États-Unis)

- Reflek Technologies Corporation (États-Unis)

- GRAFITYP (Belgique)

- ORAFOL Europe GmbH (Allemagne)

- DuPont (États-Unis)

- DAIKIN (Japon)

- Bouclier optique (République tchèque)

- Solvay (Belgique)

- SCHWEITZER-MAUDUIT INTERNATIONAL, INC.

- Saint-Gobain (France)

- Avery Dennison Corporation (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PIPE INSULATION MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TECHNOLOGY LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING BUILDING CONSTRUCTION IN DEVELOPING NATIONS

5.1.2 MINIMIZED HEAT LOSS IN MANUFACTURING SITES

5.1.3 STRENGTHENING OF REGULATIONS TO INSULATE OIL & GAS PIPELINES

5.1.4 INCREASING SUPPLY OF OIL THROUGH PIPELINES OWING TO INCREASED MARINE POLLUTION CAUSED BY SHIPS

5.1.5 RISING MODERN AGRICULTURAL METHODS BOOSTS THE DEMAND FOR INSULATION OF PIPES

5.2 RESTRAINTS

5.2.1 DAMAGE CAUSED TO THE ENVIRONMENT DUE TO CONSTRUCTION OF PIPES AND ITS INSULATION

5.2.2 CHANGE OF CHEMICAL STRUCTURE DUE TO ADULTERATION THROUGH INSULATING MATERIAL IN OIL & PETROCHEMICALS AND CHEMICALS

5.2.3 ADVERSE EFFECTS ON MARINE LIFE

5.3 OPPORTUNITIES

5.3.1 GROWING PETROCHEMICALS INDUSTRY IN ASIA-PACIFIC

5.3.2 UTILIZATION OF PIPE INSULATION IN THE MECHANICAL MANAGEMENT OF THE FOOD AS WELL AS PHARMACEUTICAL INDUSTRY

5.4 CHALLENGES

5.4.1 FIRE AND EXPLOSION DUE TO CHEMICALS REACTION WITH INSULATING MATERIAL IN PIPES

5.4.2 THE AVAILABILITY OF SUBSTITUTES LIKE ELECTRIC TRACE HEATING

5.4.3 HIGH COST AND HIGH TIME CONSUMPTION IN REPLACEMENT

6 NORTH AMERICA PIPE INSULATION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 RIGID INSULATION PRODUCTS

6.2.1 RIGID FOAM

6.2.2 FIBER GLASS COVER

6.2.3 WOOD

6.2.4 OTHERS

6.3 STONE WOOL INSULATION COVERS

6.4 COATING MATERIAL

6.5 THIN FILMS

6.6 WRAPS

6.7 FOILS

6.8 OTHERS

7 NORTH AMERICA PIPE INSULATION MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 POLYURETHANE

7.3 ROCKWOOL

7.4 FIBERGLASS

7.5 POLYSTYRENE

7.5.1 EXPANDED POLYSTYRENE

7.5.2 EXTRUDED POLYSTYRENE

7.6 POLYOLEFIN

7.7 POLYPROPYLENE

7.8 POLYCARBONATE

7.9 POLYVINYL CHLORIDE

7.1 UREA FORMALDEHYDE

7.11 PHENOLIC FOAM

7.12 ELASTOMERIC FOAM

7.13 OTHERS

8 NORTH AMERICA PIPE INSULATION MARKET, BY TEMPERATURE

8.1 OVERVIEW

8.2 COLD INSULATION

8.3 HOT INSULATION

9 NORTH AMERICA PIPE INSULATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 OIL & GAS

9.2.1 OIL & GAS, BY END-USER

9.2.1.1 OIL

9.2.1.1.1 CRUDE OIL

9.2.1.1.2 PETROCHEMICAL

9.2.1.1.3 OTHER CRUDE OIL DERIVATIVES

9.2.1.2 GAS

9.2.1.2.1 NATURAL GAS

9.2.1.2.2 SYNTHETIC GAS

9.2.2 OIL & GAS, BY PRODUCT TYPE

9.2.2.1 RIGID INSULATION PRODUCTS

9.2.2.1.1 OIL & GAS, BY RIGID INSULATION PRODUCTS

9.2.2.1.1.1 RIGID FOAM

9.2.2.1.1.2 FIBER GLASS COVER

9.2.2.1.1.3 WOOD

9.2.2.1.1.4 OTHERS

9.2.2.2 STONE WOOL INSULATION COVERS

9.2.2.3 COATING MATERIAL

9.2.2.4 THIN FILMS

9.2.2.5 WRAPS

9.2.2.6 FOILS

9.2.2.7 OTHERS

9.3 CHEMICAL INDUSTRY

9.3.1 CHEMICAL INDUSTRY, BY PRODUCT TYPE

9.3.1.1 RIGID INSULATION PRODUCTS

9.3.1.1.1 CHEMICAL INDUSTRY, BY RIGID INSULATION PRODUCTS

9.3.1.1.1.1 RIGID FOAM

9.3.1.1.1.2 FIBER GLASS COVER

9.3.1.1.1.3 WOOD

9.3.1.1.1.4 OTHERS

9.3.1.2 STONE WOOL INSULATION COVERS

9.3.1.3 COATING MATERIAL

9.3.1.4 THIN FILMS

9.3.1.5 WRAPS

9.3.1.6 FOILS

9.3.1.7 OTHERS

9.4 FOOD AND BEVERAGE

9.4.1 FOOD AND BEVERAGE, BY END-USER

9.4.1.1 BEVERAGE

9.4.1.1.1 ALCOHOLIC BEVERAGE

9.4.1.1.2 DAIRY

9.4.1.1.3 AERATED DRINKS

9.4.1.1.4 JUICES AND FLAVORED WATER

9.4.1.1.5 OTHERS

9.4.1.2 FOOD

9.4.2 FOOD AND BEVERAGE, BY PRODUCT TYPE

9.4.2.1 RIGID INSULATION PRODUCTS

9.4.2.1.1 FOOD AND BEVERAGE, BY RIGID INSULATION PRODUCTS

9.4.2.1.1.1 RIGID FOAM

9.4.2.1.1.2 FIBER GLASS COVER

9.4.2.1.1.3 WOOD

9.4.2.1.1.4 OTHERS

9.4.2.2 STONE WOOL INSULATION COVERS

9.4.2.3 COATING MATERIAL

9.4.2.4 THIN FILMS

9.4.2.5 WRAPS

9.4.2.6 FOILS

9.4.2.7 OTHERS

9.5 BUILDING AND CONSTRUCTION

9.5.1 BUILDING AND CONSTRUCTION, BY END-USER

9.5.1.1 COMMERCIAL

9.5.1.2 RESIDENTIAL

9.5.1.3 INSTITUTIONAL

9.5.1.4 INFRASTRUCTURE

9.5.2 BUILDING AND CONSTRUCTION, BY PRODUCT TYPE

9.5.2.1 RIGID INSULATION PRODUCTS

9.5.2.1.1 BUILDING AND CONSTRUCTION, BY RIGID INSULATION PRODUCTS

9.5.2.1.1.1 RIGID FOAM

9.5.2.1.1.2 FIBER GLASS COVER

9.5.2.1.1.3 WOOD

9.5.2.1.1.4 OTHERS

9.5.2.2 STONE WOOL INSULATION COVERS

9.5.2.3 COATING MATERIAL

9.5.2.4 THIN FILMS

9.5.2.5 WRAPS

9.5.2.6 FOILS

9.5.2.7 OTHERS

9.6 ENERGY AND POWER

9.6.1 ENERGY AND POWER, BY PRODUCT TYPE

9.6.1.1 RIGID INSULATION PRODUCTS

9.6.1.2 STONE WOOL INSULATION COVERS

9.6.1.2.1 ENERGY AND POWER, BY RIGID INSULATION PRODUCTS

9.6.1.2.1.1 RIGID FOAM

9.6.1.2.1.2 FIBER GLASS COVER

9.6.1.2.1.3 WOOD

9.6.1.2.1.4 OTHERS

9.6.1.3 COATING MATERIAL

9.6.1.4 THIN FILMS

9.6.1.5 WRAPS

9.6.1.6 FOILS

9.6.1.7 OTHERS

9.7 ELECTRONICS

9.7.1 ELECTRONICS, BY PRODUCT TYPE

9.7.1.1 RIGID INSULATION PRODUCTS

9.7.1.1.1 ELECTRONICS, BY RIGID INSULATION PRODUCTS

9.7.1.1.1.1 RIGID FOAM

9.7.1.1.1.2 FIBER GLASS COVER

9.7.1.1.1.3 WOOD

9.7.1.1.1.4 OTHERS

9.7.1.2 STONE WOOL INSULATION COVERS

9.7.1.3 COATING MATERIAL

9.7.1.4 THIN FILMS

9.7.1.5 WRAPS

9.7.1.6 FOILS

9.7.1.7 OTHERS

9.8 AUTOMOTIVE

9.8.1 AUTOMOTIVE, BY END-USER

9.8.1.1 PASSENGER CARS

9.8.1.2 COMMERCIAL VEHICLES

9.8.1.3 AGRICULTURAL VEHICLES

9.8.1.4 OTHERS

9.8.2 AUTOMOTIVE, BY PRODUCT TYPE

9.8.2.1 RIGID INSULATION PRODUCTS

9.8.2.1.1 AUTOMOTIVE, BY RIGID INSULATION PRODUCTS

9.8.2.1.1.1 RIGID FOAM

9.8.2.1.1.2 FIBER GLASS COVER

9.8.2.1.1.3 WOOD

9.8.2.1.1.4 OTHERS

9.8.2.2 STONE WOOL INSULATION COVERS

9.8.2.3 COATING MATERIAL

9.8.2.4 THIN FILMS

9.8.2.5 WRAPS

9.8.2.6 FOILS

9.8.2.7 OTHERS

9.9 TRANSPORTATION

9.9.1 TRANSPORTATION, BY END-USER

9.9.1.1 RAILWAY

9.9.1.2 MARINE

9.9.1.3 OTHERS

9.9.2 TRANSPORTATION, BY PRODUCT TYPE

9.9.2.1 RIGID INSULATION PRODUCTS

9.9.2.1.1 TRANSPORTATION, BY RIGID INSULATION PRODUCTS

9.9.2.1.1.1 RIGID FOAM

9.9.2.1.1.2 FIBER GLASS COVER

9.9.2.1.1.3 WOOD

9.9.2.1.1.4 OTHERS

9.9.2.2 STONE WOOL INSULATION COVERS

9.9.2.3 COATING MATERIAL

9.9.2.4 THIN FILMS

9.9.2.5 WRAPS

9.9.2.6 FOILS

9.9.2.7 OTHERS

9.1 OTHERS

9.10.1 OTHERS, BY PRODUCT TYPE

9.10.1.1 RIGID INSULATION PRODUCTS

9.10.1.1.1 OTHERS, BY RIGID INSULATION PRODUCTS

9.10.1.1.1.1 RIGID FOAM

9.10.1.1.1.2 FIBER GLASS COVER

9.10.1.1.1.3 WOOD

9.10.1.1.1.4 OTHERS

9.10.1.2 STONE WOOL INSULATION COVERS

9.10.1.3 COATING MATERIAL

9.10.1.4 THIN FILMS

9.10.1.5 WRAPS

9.10.1.6 FOILS

9.10.1.7 OTHERS

10 NORTH AMERICA PIPE INSULATION MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA PIPE INSULATION MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 MERGER & ACQUISITION

11.3 EXPANSIONS

11.4 NEW PRODUCT DEVELOPMENT

12 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

12.1 SWOT ANALYSIS

12.2 DATA BRIDGE MARKET RESEARCH ANALYSIS

13 COMPANY PROFILES

13.1 SAINT-GOBAIN

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 3M

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 BASF PLC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 DOW IZOLAN

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 HUNTSMAN INTERNATIONAL LLC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 ALL AMERICAN INSULATION SERVICES, INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 SERVICE PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ARMACELL

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 CELLOFOAM GMBH & CO. KG

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 COMMERCIAL THERMAL SOLUTIONS, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 COVESTRO AG

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DUNMORE

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 GILSULATE INTERNATIONAL, INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 GREAT LAKES TEXTILES

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 GULF COOL THERM FACTORY LTD

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 JOHNS MANVILLE

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 KINGSPAN GROUP

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 KNAUF INSULATION

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 L'ISOLANTE K-FLEX S.P.A.

13.18.1 COMPANY SNAPSHOT

13.18.2 APPLICATION PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 MAYES COATINGS & INSULATION, INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 SERVICE PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 NMC SA

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 OWENS CORNING

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCT PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

13.22 POLARCLAD TANK INSULATION

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

13.23 RÖCHLING

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENT

13.24 ROCKWOOL INTERNATIONAL A/S

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENT

13.25 SYNAVAX

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCT PORTFOLIO

13.25.3 RECENT DEVELOPMENTS

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF TUBES, PIPES AND HOSES, AND FITTINGS THEREFORE, E.G. JOINTS, ELBOWS, FLANGES, OF PLASTICS, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS) OF HEADING 3918 AND STERILE SURGICAL OR DENTAL ADHESION BARRIERS; HS CODE: 39217 (USD THOUSAND)

TABLE 2 EXPORT DATA TUBES, PIPES AND HOSES, AND FITTINGS THEREFORE, E.G. JOINTS, ELBOWS, FLANGES, OF PLASTICS, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS) OF HEADING 3918 AND STERILE SURGICAL OR DENTAL ADHESION BARRIERS; HS CODE: 3917 (EURO THOUSAND)

TABLE 3 INSULATION IMPORT GROWTH RATE, 2014-2015 (%)

TABLE 4 NORTH AMERICA PIPE INSULATION MARKET, BY TYPE, 2018-2027 (KILO TONS)

TABLE 5 NORTH AMERICA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 6 NORTH AMERICA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 7 NORTH AMERICA STONE WOOL INSULATION COVERS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 8 NORTH AMERICA COATING MATERIAL IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 9 NORTH AMERICA THIN FILMS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 10 NORTH AMERICA WRAPS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 11 NORTH AMERICA FOILS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 12 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 13 NORTH AMERICA PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 14 NORTH AMERICA POLYURETHANE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 15 NORTH AMERICA ROCKWOOL MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 16 NORTH AMERICA FIBERGLASS MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 17 NORTH AMERICA POLYSTYRENE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 18 NORTH AMERICA POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 19 NORTH AMERICA POLYOLEFIN MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 20 NORTH AMERICA POLYPROPYLENE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 21 NORTH AMERICA POLYCARBONATE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 22 NORTH AMERICA POLYVINYL CHLORIDE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 23 NORTH AMERICA UREA FORMALDEHYDE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 24 NORTH AMERICA PHENOLIC FOAM MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 25 NORTH AMERICA ELASTOMERIC FOAM MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 26 NORTH AMERICA OTHERS MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 27 NORTH AMERICA PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 28 NORTH AMERICA COLD INSULATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 29 NORTH AMERICA HOT INSULATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 30 NORTH AMERICA PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 31 NORTH AMERICA OIL & GAS APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 32 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 33 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 34 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 35 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 36 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 37 NORTH AMERICA CHEMICAL INDUSTRY APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 38 NORTH AMERICA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 39 NORTH AMERICA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 40 NORTH AMERICA FOOD AND BEVERAGE APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 41 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 42 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 43 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 44 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 45 NORTH AMERICA BUILDING AND CONSTRUCTION APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 46 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 47 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 48 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 49 NORTH AMERICA ENERGY AND POWER APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 50 NORTH AMERICA ENERGY AND POWERIN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 51 NORTH AMERICA ENERGY AND POWERIN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 52 NORTH AMERICA ELECTRONICS APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 53 NORTH AMERICA ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 54 NORTH AMERICA ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 55 NORTH AMERICA AUTOMOTIVE APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 56 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 57 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 58 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 59 NORTH AMERICA TRANSPORTATION APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 60 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 61 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 62 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 63 NORTH AMERICA OTHERS APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 64 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 65 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 66 NORTH AMERICA PIPE INSULATION MARKET, BY COUNTRY, 2018-2027 (EURO THOUSAND)

TABLE 67 NORTH AMERICA PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 68 NORTH AMERICA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 69 NORTH AMERICA PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 70 NORTH AMERICA POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 71 NORTH AMERICA PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 72 NORTH AMERICA PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 73 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 74 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 75 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 76 NORTH AMERICA ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 77 NORTH AMERICA ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 78 NORTH AMERICA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 79 NORTH AMERICA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 80 NORTH AMERICA ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 81 NORTH AMERICA ENERGY & POWER IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 82 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 83 NORTH AMERICA OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 84 NORTH AMERICA GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 85 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 86 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 87 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 88 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 89 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 90 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 91 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 92 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 93 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 94 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 95 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 96 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 97 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 98 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 99 U.S. PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 100 U.S. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY PRODUCT TYPE , 2018-2027 (EURO THOUSAND)

TABLE 101 U.S. PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 102 U.S. POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 103 U.S. PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 104 U.S. PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 105 U.S. BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 106 U.S. BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 107 U.S. BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 108 U.S. ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT YPE, 2018-2027 (EURO THOUSAND)

TABLE 109 U.S. ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 110 U.S. CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 111 U.S. CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 112 U.S. ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 113 U.S. ENERGY & POWER IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 114 U.S. OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 115 U.S. OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 116 U.S. GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 117 U.S. OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 118 U.S. OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 119 U.S. AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 120 U.S. AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 121 U.S. AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 122 U.S. TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 123 U.S. TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 124 U.S. TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 125 U.S. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 126 U.S. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 127 U.S. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 128 U.S. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 129 U.S. OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 130 U.S. OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 131 CANADA PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (TONS)

TABLE 132 CANADA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 133 CANADA PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 134 CANADA POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 135 CANADA PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 136 CANADA PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 137 CANADA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 138 CANADA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 139 CANADA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 140 CANADA ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 141 CANADA ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 142 CANADA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 143 CANADA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 144 CANADA ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 145 CANADA ENERGY & POWER IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 146 CANADA OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 147 CANADA OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 148 CANADA GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 149 CANADA OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 150 CANADA OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 151 CANADA AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 152 CANADA AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 153 CANADA AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 154 CANADA TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 155 CANADA TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 156 CANADA TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 157 CANADA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 158 CANADA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 159 CANADA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 160 CANADA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 161 CANADA OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 162 CANADA OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 163 MEXICO PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 164 MEXICO RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 165 MEXICO PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 166 MEXICO POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 167 MEXICO PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 168 MEXICO PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 169 MEXICO BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 170 MEXICO BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 171 MEXICO BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 172 MEXICO ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 173 MEXICO ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 174 MEXICO CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 175 MEXICO CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 176 MEXICO ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 177 MEXICO ENERGY & POWER IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 178 MEXICO OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 179 MEXICO OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 180 MEXICO GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 181 MEXICO OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 182 MEXICO OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 183 MEXICO AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 184 MEXICO AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 185 MEXICO AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 186 MEXICO TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 187 MEXICO TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 188 MEXICO TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 189 MEXICO FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 190 MEXICO FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 191 MEXICO FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 192 MEXICO FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 193 MEXICO OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 194 MEXICO OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA PIPE INSULATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PIPE INSULATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PIPE INSULATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PIPE INSUALTION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PIPE INSUALTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PIPE INSULATION MARKET: THE TECHNOLOGY LIFE LINE CURVE

FIGURE 7 NORTH AMERICA PIPE INSULATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA PIPE INSULATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PIPE INSULATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA PIPE INSULATION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA PIPE INSULATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA PIPE INSULATION MARKET: SEGMENTATION

FIGURE 13 RAPID INDUSTRILIZATION IS DRIVING THE NORTH AMERICA PIPE INSULATION MARKET IN THE FORECAST PERIOD OF 2020-2027

FIGURE 14 RIGID INSULATION PRODUCTS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PIPE INSULATION MARKET IN 2020 & 2027

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA PIPE INSULATION MARKET

FIGURE 16 NORTH AMERICA PIPE INSULATION MARKET: BY PRODUCT TYPE, 2019

FIGURE 17 NORTH AMERICA PIPE INSULATION MARKET: BY MATERIAL TYPE, 2019

FIGURE 18 NORTH AMERICA PIPE INSULATION MARKET: BY TEMPERATURE, 2019

FIGURE 19 NORTH AMERICA PIPE INSULATION MARKET: BY APPLICATION, 2019

FIGURE 20 NORTH AMERICA PIPE INSULATION MARKET : SNAPSHOT (2019)

FIGURE 21 NORTH AMERICA PIPE INSULATION MARKET : BY COUNTRY (2019)

FIGURE 22 NORTH AMERICA PIPE INSULATION MARKET : BY COUNTRY (2020 & 2027)

FIGURE 23 NORTH AMERICA PIPE INSULATION MARKET : BY COUNTRY (2019 & 2027)

FIGURE 24 NORTH AMERICA PIPE INSULATION MARKET BY PRODUCT TYPE (2020-2027)

FIGURE 25 NORTH AMERICA PIPE INSULATION MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.