North America Pharmaceutical Excipients Market

Taille du marché en milliards USD

TCAC :

%

USD

4.69 Billion

USD

7.82 Billion

2024

2032

USD

4.69 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 4.69 Billion | |

| USD 7.82 Billion | |

|

|

|

|

Segmentation du marché nord-américain des excipients pharmaceutiques, par fonctionnalité (liants et adhésifs, délitants, matériaux d'enrobage, désintégrants, solubilisants, arômes, édulcorants, diluants, lubrifiants , tampons, émulsifiants, conservateurs, antioxydants, sorbants, solvants, émollients, agents glissants, chélatants, antimoussants, etc.), forme galénique (solide, semi-solide et liquide), voie d'administration (excipients oraux, excipients topiques, excipients parentéraux et autres excipients), utilisateur final (sociétés pharmaceutiques et biopharmaceutiques , formulateurs sous contrat, organismes de recherche et universitaires, etc.), par canal de distribution (appel d'offres direct, vente au détail, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des excipients pharmaceutiques en Amérique du Nord

- La taille du marché nord-américain des excipients pharmaceutiques était évaluée à 4,69 milliards USD en 2024 et devrait atteindre 7,82 milliards USD d'ici 2032 , à un TCAC de 6,6 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de formulations pharmaceutiques sûres, efficaces et de haute qualité, ce qui favorise l'adoption d'excipients avancés dans l'ensemble de l'industrie pharmaceutique. Les innovations continues dans les systèmes d'administration de médicaments, notamment les formulations orales, injectables et topiques, soutiennent l'expansion du marché.

- Par ailleurs, l'accent croissant mis sur le développement de médicaments centrés sur le patient, la conformité réglementaire et le besoin d'excipients améliorant la stabilité, la biodisponibilité et la fabricabilité font des excipients pharmaceutiques des composants essentiels de la formulation moderne des médicaments. Ces facteurs convergents accélèrent l'adoption de solutions innovantes à base d'excipients, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché nord-américain des excipients pharmaceutiques

- Les excipients pharmaceutiques, servant d'ingrédients fonctionnels dans les compléments alimentaires, les nutraceutiques et les formulations pharmaceutiques, sont des composants de plus en plus essentiels des produits de santé et de bien-être modernes dans les applications commerciales et grand public en raison de leur capacité à améliorer la stabilité, l'efficacité, le goût et la qualité globale du produit.

- La demande croissante d’excipients pharmaceutiques est principalement alimentée par la consommation croissante de compléments alimentaires, d’aliments fonctionnels et de produits nutraceutiques, ainsi que par la sensibilisation croissante des consommateurs à la santé et aux progrès de la technologie des excipients.

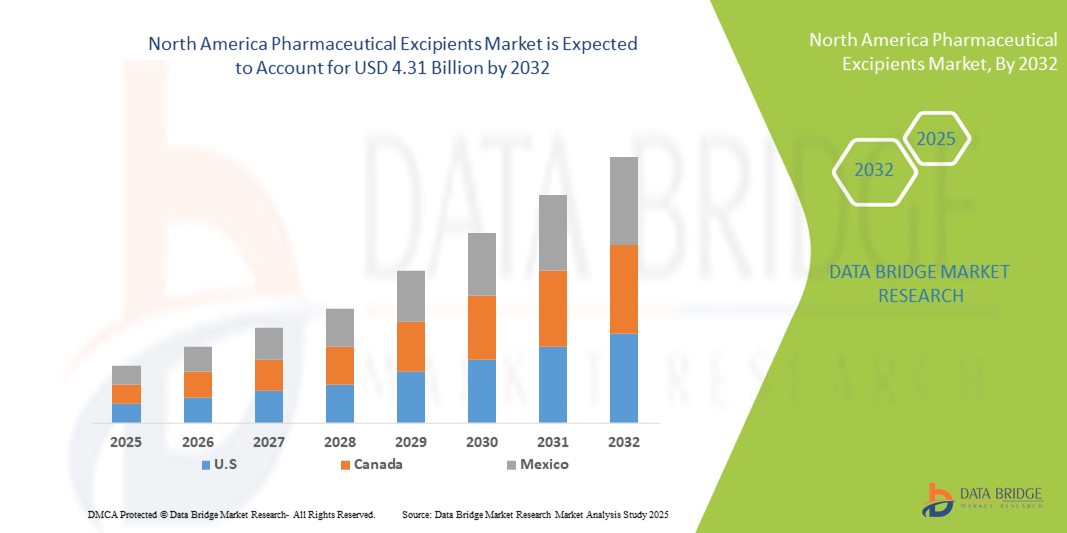

- Les États-Unis ont dominé le marché des excipients pharmaceutiques, affichant la plus forte part de chiffre d'affaires (71,5 %) en 2024, grâce à une infrastructure de santé solide, une forte sensibilisation des consommateurs aux questions de santé et de bien-être, et la présence de fournisseurs d'excipients de premier plan. Les innovations continues dans les formulations nutraceutiques et la demande croissante d'excipients de haute qualité stimulent la croissance du marché.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché des excipients pharmaceutiques au cours de la période de prévision, avec un TCAC prévu de 11,8 % de 2025 à 2032, grâce aux initiatives gouvernementales en matière de soins de santé, à la disponibilité croissante de produits nutraceutiques avancés et à l'adoption croissante de solutions de soins de santé préventifs.

- Le segment des excipients oraux a dominé le marché des excipients pharmaceutiques avec une part de chiffre d'affaires de 51,2 % en 2024, portée par la prévalence des systèmes d'administration orale de médicaments en Amérique du Nord. Les excipients oraux garantissent la stabilité, des profils de libération constants et l'observance du traitement par les patients, éléments essentiels pour les traitements chroniques et aigus.

Portée du rapport et segmentation du marché des excipients pharmaceutiques

|

Attributs |

Informations clés sur le marché des excipients pharmaceutiques |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des excipients pharmaceutiques en Amérique du Nord

Fonctionnalité et polyvalence améliorées dans les formulations pharmaceutiques

- Une tendance significative et croissante sur le marché nord-américain des excipients pharmaceutiques est l'adoption croissante d'excipients multifonctionnels qui améliorent la stabilité, la solubilité et la biodisponibilité des formulations nutraceutiques et pharmaceutiques. Ces excipients aident les fabricants à optimiser les performances de leurs produits et à respecter des normes de qualité strictes.

- Par exemple, des agents d’enrobage avancés et des excipients aromatisants sont incorporés dans les compléments alimentaires et les aliments fonctionnels pour améliorer le goût, masquer les saveurs désagréables et garantir des profils de libération cohérents, rendant les produits plus attrayants et efficaces pour les consommateurs.

- L’utilisation de supports naturels et synthétiques est en augmentation, permettant une meilleure encapsulation des ingrédients actifs, une protection contre la dégradation et une libération contrôlée, ce qui améliore en fin de compte l’efficacité et la durée de conservation des produits nutraceutiques et pharmaceutiques.

- L'intégration d'excipients dans des formulations complexes permet aux fabricants de créer des produits multifonctionnels qui combinent des avantages thérapeutiques avec des propriétés organoleptiques améliorées, une commodité et une conformité des patients.

- Cette tendance vers des excipients plus polyvalents et performants redéfinit les attentes des fabricants et des consommateurs, encourageant l'innovation en science des formulations. Par conséquent, des entreprises leaders développent de nouveaux excipients adaptés à des applications spécifiques telles que les compléments protéiques, les formules vitaminiques et les nutraceutiques enrichis en minéraux.

- La demande d'excipients offrant une multifonctionnalité, une compatibilité avec diverses formulations et une conformité réglementaire augmente rapidement dans les secteurs pharmaceutique et nutraceutique, car les fabricants accordent la priorité à la qualité, à l'efficacité et à l'acceptabilité des produits par les consommateurs.

Dynamique du marché nord-américain des excipients pharmaceutiques

Conducteur

Besoin croissant en raison de la demande croissante de formulations de médicaments avancées

- L'importance croissante accordée à une administration des médicaments centrée sur le patient, ainsi que la demande croissante de produits pharmaceutiques sûrs, efficaces et de haute qualité, constituent un facteur majeur d'adoption des excipients pharmaceutiques dans l'ensemble de l'industrie. Les excipients jouent désormais un rôle crucial dans l'amélioration de la stabilité, de la solubilité et de la biodisponibilité des médicaments, ce qui les rend essentiels à la fabrication pharmaceutique moderne.

- Par exemple, en 2024, Colorcon et Ashland ont lancé des solutions d'excipients avancées spécialement conçues pour améliorer l'efficacité des médicaments, notamment des agents masquant le goût, des polymères à libération contrôlée et des stabilisants de haute pureté. De telles initiatives, menées par des entreprises leaders, devraient stimuler considérablement la croissance du marché au cours de la période de prévision.

- Les fabricants de produits pharmaceutiques recherchent de plus en plus d’excipients permettant des formulations innovantes, telles que des comprimés orodispersibles, des capsules à libération prolongée et des produits biologiques injectables, pour répondre aux besoins thérapeutiques et à l’observance des patients.

- L’expansion rapide du secteur biopharmaceutique, y compris les produits biologiques, les biosimilaires et les thérapies spécialisées, alimente davantage la demande d’excipients fonctionnels de haute qualité adaptés aux formulations complexes et aux API sensibles.

- Les solutions d'excipients prêtes à l'emploi qui simplifient la formulation, réduisent le temps de fabrication et maintiennent une qualité constante gagnent du terrain parmi les sociétés pharmaceutiques, en particulier pour la production à haut volume

- Les excipients conformes à la réglementation et répondant aux normes mondiales, telles que USP, EP et JP, sont hautement préférés, offrant aux fabricants une confiance dans la sécurité et l'efficacité tout en accélérant les délais de développement des produits.

- La commodité, la polyvalence et la fiabilité des excipients avancés dans la prise en charge de multiples formes posologiques et l'amélioration des performances des médicaments les rendent indispensables dans la production pharmaceutique à petite et à grande échelle.

Retenue/Défi

Conformité réglementaire et coûts de développement élevés

- Les exigences réglementaires strictes concernant les excipients pharmaceutiques, notamment pour les grades nouveaux ou de haute pureté, représentent un défi majeur pour l'expansion du marché. Les entreprises doivent se conformer aux directives de la FDA, de l'EMA et d'autres directives mondiales, ce qui implique des processus approfondis de documentation, de tests et de validation.

- Le coût élevé de la recherche, du développement et de la mise à l’échelle de nouvelles catégories d’excipients, y compris les liants, les solubilisants et les stabilisateurs spécialisés, peut constituer un obstacle pour les petites entreprises ou les entreprises émergentes qui cherchent à entrer sur le marché.

- Relever ces défis réglementaires et liés aux coûts nécessite des systèmes d’assurance qualité robustes, des processus de fabrication validés et une étroite collaboration avec les organismes de réglementation pour garantir la conformité et les approbations en temps opportun.

- Des entreprises leaders telles que BASF, Dow, DFE Pharma et Ashland mettent l'accent sur le respect de normes de qualité strictes, en fournissant des excipients avec des profils de performance et de sécurité vérifiés pour renforcer la confiance entre les fabricants pharmaceutiques.

- La nécessité de tests approfondis de sécurité et d’efficacité, en particulier pour les excipients utilisés dans des formulations sensibles telles que les produits injectables ou biologiques, peut retarder le lancement des produits et augmenter les coûts opérationnels.

- Les coûts de développement élevés des excipients spécialisés, tels que ceux utilisés dans les systèmes à libération contrôlée ou à administration ciblée, peuvent limiter l’adoption parmi les fabricants sensibles aux coûts, en particulier dans les marchés émergents.

- Surmonter ces défis en investissant dans l’innovation, une production rentable et des conseils réglementaires est essentiel pour une croissance soutenue du marché des excipients pharmaceutiques, garantissant un équilibre entre sécurité, performance et accessibilité.

Portée du marché nord-américain des excipients pharmaceutiques

Le marché est segmenté sur la base de la fonctionnalité, de la forme posologique, de la voie d’administration, de l’utilisateur final et du canal de distribution .

- Par fonctionnalité

Sur la base de leur fonctionnalité, le marché des excipients pharmaceutiques est segmenté en liants et adhésifs, désintégrants, matériaux d'enrobage, solubilisants, arômes, édulcorants, diluants, lubrifiants, tampons, émulsifiants, conservateurs, antioxydants, sorbants, solvants, émollients, agents glissants, chélateurs, antimoussants, etc. Le segment des liants et adhésifs a dominé le marché avec une part de chiffre d'affaires de 32,4 % en 2024, grâce à son rôle essentiel dans la cohésion des comprimés, la résistance mécanique et l'uniformité des formes galéniques pharmaceutiques. Ces excipients améliorent les profils de libération des médicaments, améliorent l'observance thérapeutique et sont compatibles avec une large gamme de formulations orales, ce qui les rend indispensables pour la production à grande échelle. Largement utilisés dans les formulations de médicaments génériques et innovants en Amérique du Nord, ils sont privilégiés par les grands fabricants pharmaceutiques pour des liants de haute qualité garantissant cohérence et stabilité. Leur importance dans l’amélioration de la compressibilité des comprimés et de la robustesse de la formulation en fait un élément incontournable de chaque ligne de production, contribuant à une demande forte et soutenue.

Le segment des lubrifiants devrait connaître le TCAC le plus rapide, soit 12,1 %, entre 2025 et 2032, grâce à l'adoption croissante des procédés de fabrication de comprimés à haute cadence et à la demande croissante de formulations solides orales. Les lubrifiants réduisent les frottements lors de la compression et de l'éjection des comprimés, améliorent l'efficacité du traitement et minimisent l'usure des équipements. Leur utilisation croissante en association avec d'autres excipients pour optimiser la libération des médicaments et la sécurité des patients alimente une croissance rapide. Les fabricants se concentrent sur des formulations de lubrifiants innovantes, compatibles avec les principes actifs sensibles à l'humidité ou à la chaleur. La tendance croissante à l'externalisation du développement des formulations et le besoin d'excipients améliorant l'évolutivité et la cohérence stimulent également la croissance de ce segment. La conformité réglementaire et les normes de qualité strictes en Amérique du Nord stimulent la demande de lubrifiants haute performance, ce qui en fait un domaine clé d'investissement et de recherche.

- Par forme posologique

En fonction de la forme galénique, le marché des excipients pharmaceutiques est segmenté en solides, semi-solides et liquides. Le segment des formes galéniques solides dominait avec une part de marché de 45,3 % en 2024, grâce à l'utilisation généralisée des comprimés et des gélules dans les médicaments sur ordonnance et en vente libre. Les formes solides offrent une production rentable, une durée de conservation prolongée et une facilité de transport , ce qui les rend très prisées par les fabricants. Elles permettent un dosage précis, la compatibilité avec de multiples excipients et une meilleure observance thérapeutique. Les formes galéniques solides sont largement utilisées en Amérique du Nord dans les hôpitaux, les pharmacies de détail et les usines de fabrication sous contrat. La possibilité d'intégrer plusieurs principes actifs pharmaceutiques (API) et les technologies de libération contrôlée renforcent leur domination.

Le segment des formes galéniques liquides devrait connaître le TCAC le plus rapide, soit 10,7 % entre 2025 et 2032, grâce à la demande croissante de formulations pédiatriques, gériatriques et nutraceutiques plus faciles à administrer. Les liquides offrent une absorption plus rapide et une flexibilité de dosage, ce qui les rend idéaux pour les populations souffrant de troubles de la déglutition. L'essor des boissons fonctionnelles, des sirops oraux et des suspensions a encore accéléré leur adoption. Les fabricants investissent dans des excipients qui améliorent la solubilité, la stabilité et le masquage du goût des formes liquides. La tendance croissante des soins à domicile et des formulations liquides prêtes à l'emploi contribue également à la croissance rapide de ce segment.

- Par voie d'administration

Selon la voie d'administration, le marché des excipients pharmaceutiques est segmenté en excipients oraux, excipients topiques, excipients parentéraux et autres excipients. Le segment des excipients oraux a dominé avec une part de chiffre d'affaires de 51,2 % en 2024, grâce à la prévalence des systèmes d'administration orale de médicaments en Amérique du Nord. Les excipients oraux garantissent la stabilité, des profils de libération constants et l'observance du traitement par les patients, ce qui est essentiel pour les traitements chroniques et aigus. Largement utilisés dans les comprimés, les gélules et les poudres, ils constituent la base de la fabrication pharmaceutique. Les fabricants privilégient des excipients oraux de haute qualité pour la production à grande échelle, la conformité réglementaire et l'innovation en matière de formulation.

Le segment des excipients parentéraux devrait connaître le TCAC le plus rapide, soit 11,8 % entre 2025 et 2032, grâce à l'adoption croissante des médicaments injectables, des produits biologiques et des thérapies innovantes. Ces excipients sont essentiels pour garantir la stérilité, la stabilité et la compatibilité des formulations parentérales. La demande croissante de vaccins, d'anticorps monoclonaux et de produits biopharmaceutiques en Amérique du Nord stimule cette croissance rapide. Les excipients innovants améliorent la solubilité, réduisent l'immunogénicité et préservent l'efficacité des solutions injectables. L'expansion des réseaux hospitaliers et des entreprises de fabrication sous contrat renforce cette tendance.

- Par utilisateur final

En fonction de l'utilisateur final, le marché des excipients pharmaceutiques est segmenté entre les sociétés pharmaceutiques et biopharmaceutiques, les formulateurs sous contrat, les organismes de recherche et les universités, entre autres. Le segment des sociétés pharmaceutiques et biopharmaceutiques a dominé le marché avec une part de chiffre d'affaires de 48,6 % en 2024, en raison des exigences de production à grande échelle, du strict respect des normes de qualité et de la demande continue d'excipients avancés dans les formulations médicamenteuses. Ces sociétés dépendent fortement des excipients pour améliorer la stabilité des formulations, améliorer la biodisponibilité et garantir l'observance thérapeutique des patients pour diverses formes galéniques. La production à haut volume, l'innovation continue des produits et le respect rigoureux de la réglementation en Amérique du Nord renforcent encore la domination de ce segment. De plus, les sociétés pharmaceutiques et biopharmaceutiques investissent dans la recherche et le développement pour optimiser les performances des excipients, faisant de ce segment un pilier du marché. L'adoption généralisée des nouvelles technologies, conjuguée à la prévalence croissante des maladies chroniques et à la demande croissante de médicaments génériques et de spécialité, continue de stimuler une croissance soutenue.

Le segment des formulateurs sous contrat devrait connaître le TCAC le plus rapide, soit 10,5 % entre 2025 et 2032, porté par la tendance croissante à l'externalisation du développement et de la fabrication de médicaments. Les formulateurs sous contrat dépendent de plus en plus d'excipients spécialisés pour améliorer l'efficacité, l'évolutivité et la conformité réglementaire de leurs formulations en Amérique du Nord. La demande croissante de médicaments personnalisés, de nouvelles formes galéniques et de produits biopharmaceutiques accroît le besoin de solutions d'excipients sur mesure. Les entreprises de ce segment se concentrent sur les excipients haute performance qui améliorent la stabilité, la solubilité et l'acceptabilité des produits par les patients. De plus, l'expansion des services de recherche et de fabrication sous contrat en Amérique du Nord offre de nouvelles opportunités de croissance, faisant de ce segment un moteur essentiel de l'innovation sur le marché.

- Par canal de distribution

En fonction du canal de distribution, le marché des excipients pharmaceutiques est segmenté en appels d'offres directs, ventes au détail et autres. Le segment des appels d'offres directs a dominé avec une part de chiffre d'affaires de 42,1 % en 2024, grâce aux pratiques d'approvisionnement en gros des principaux fabricants pharmaceutiques et aux contrats à long terme avec les fournisseurs d'excipients. Les appels d'offres directs permettent aux fabricants de garantir une qualité constante, de maintenir la conformité réglementaire et de réaliser des économies grâce à des achats à grande échelle. Le recours à des chaînes d'approvisionnement établies et à des partenariats stratégiques renforce la domination de ce segment. De plus, le modèle des appels d'offres directs garantit la disponibilité rapide d'excipients de haute qualité pour les grandes séries de production, favorisant ainsi une production continue et l'innovation dans les formulations pharmaceutiques.

Le segment de la vente au détail devrait connaître le TCAC le plus rapide, soit 9,8 %, entre 2025 et 2032, grâce à la demande croissante des consommateurs pour les médicaments en vente libre, les nutraceutiques et les compléments alimentaires fonctionnels. L'expansion des réseaux de pharmacies de détail, les plateformes de commerce électronique et la sensibilisation croissante des consommateurs à la santé et au bien-être sont des facteurs clés de cette croissance rapide. La distribution au détail offre un accès à petite échelle à des excipients spécialisés pour les marques pharmaceutiques émergentes, les pharmacies de préparation magistrale et les fabricants locaux. De plus, la popularité croissante de l'automédication et des solutions de soins préventifs continue de stimuler l'adoption des canaux de distribution en Amérique du Nord.

Analyse régionale du marché nord-américain des excipients pharmaceutiques

- L'Amérique du Nord a dominé le marché des excipients pharmaceutiques, affichant la plus forte part de chiffre d'affaires en 2024, grâce à une infrastructure de santé solide, à la sensibilisation croissante des consommateurs aux questions de santé et de bien-être, et à la présence de fournisseurs d'excipients de premier plan. Les innovations continues dans les formulations nutraceutiques et la demande croissante d'excipients de haute qualité stimulent encore la croissance du marché.

- Les consommateurs et les fabricants de produits pharmaceutiques de la région privilégient de plus en plus les solutions d'excipients avancés qui améliorent la solubilité, la stabilité, la biodisponibilité et l'observance thérapeutique des patients. La demande d'excipients fonctionnels pour les nouveaux systèmes d'administration de médicaments, les formulations à libération contrôlée et les nutraceutiques de spécialité continue de croître.

- L'adoption généralisée est soutenue par les avancées technologiques dans la fabrication des excipients, la conformité réglementaire des formulations et les investissements importants en R&D des principaux acteurs de la région. Ces facteurs conjugués renforcent la domination de l'Amérique du Nord sur le marché mondial des excipients pharmaceutiques.

Aperçu du marché américain des excipients pharmaceutiques

Le marché américain des excipients pharmaceutiques a dominé le marché avec la plus grande part de chiffre d'affaires de 71,5 % en 2024, soutenu par une infrastructure de santé bien établie, une forte sensibilisation des consommateurs et la présence de grands fournisseurs d'excipients. Les innovations continues dans les formulations nutraceutiques et la demande croissante d'excipients de haute qualité stimulent davantage l'expansion du marché. Les sociétés pharmaceutiques américaines intègrent de plus en plus d'excipients avancés dans les formulations pour les formes posologiques orales, topiques et parentérales. L'accent mis sur les excipients fonctionnels qui améliorent la biodisponibilité, la stabilité et les performances thérapeutiques est un moteur de croissance clé. Des investissements importants en R&D, associés à la disponibilité d'excipients de haute pureté et spécialisés, facilitent le développement de systèmes d'administration de médicaments innovants, soutenant la position de leader du marché américain.

Aperçu du marché canadien des excipients pharmaceutiques

Le marché canadien des excipients pharmaceutiques devrait connaître la croissance la plus rapide au pays au cours de la période de prévision, avec un TCAC de 11,8 % de 2025 à 2032. Cette croissance est stimulée par l'intensification des initiatives gouvernementales en matière de santé, l'élargissement de l'accès aux produits nutraceutiques de pointe et l'adoption croissante de solutions de soins de santé préventifs. Les fabricants de produits pharmaceutiques canadiens recherchent activement des excipients de haute qualité et conformes à la réglementation pour soutenir les formulations de médicaments novatrices, en particulier dans les secteurs des nutraceutiques et des aliments fonctionnels. L'accent mis par le pays sur la prévention des maladies, l'amélioration des infrastructures de santé et la collaboration entre les établissements de recherche et les sociétés pharmaceutiques accélèrent encore l'adoption des excipients, assurant une croissance robuste du marché pendant la période de prévision.

Part de marché des excipients pharmaceutiques en Amérique du Nord

L’industrie des excipients pharmaceutiques est principalement dirigée par des entreprises bien établies, notamment :

- Kerry Group plc. (Irlande)

- DFE Pharma (Pays-Bas)

- Cargill, Incorporated (États-Unis)

- Pfanstiehl (États-Unis)

- Colorcon (États-Unis)

- MEGGLE GmbH & Co. KG (Allemagne)

- Omya AG (Suisse)

- Peter Greven GmbH & Co. KG (Allemagne)

- Ashland (États-Unis)

- Evonik Industries AG (Allemagne)

- Dow (États-Unis)

- Croda International Plc (Royaume-Uni)

- Roquette Frères (France)

- La société Lubrizol (États-Unis)

- BASF SE (Allemagne)

- Avantor, Inc. (États-Unis)

- BENEO (Allemagne)

Derniers développements sur le marché nord-américain des excipients pharmaceutiques

- En mars 2024, International Flavors & Fragrances (IFF) a annoncé la cession de son activité Pharma Solutions au spécialiste français des ingrédients Roquette pour un montant maximal de 2,85 milliards de dollars US, dette comprise. Cette cession concernait les excipients pharmaceutiques d'IFF et la division Global Specialty Solutions, dédiée aux applications alimentaires industrielles et méthylcellulosiques. La transaction, dont la clôture est prévue au premier semestre 2025, permet à IFF de se concentrer sur ses stratégies de croissance clés.

- En septembre 2025, de grandes sociétés pharmaceutiques, dont Eli Lilly, Johnson & Johnson, Roche, AstraZeneca, Novartis, Sanofi, Biogen, Merck, Amgen, Pfizer, Novo Nordisk, AbbVie, Gilead Sciences et Cipla, ont annoncé d'importants investissements pour renforcer leurs capacités de production aux États-Unis. Ces investissements visent à atténuer les risques liés à la chaîne d'approvisionnement et à se préparer à d'éventuelles perturbations commerciales, soulignant ainsi l'engagement du secteur à renforcer sa production nationale.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.