North America Ovarian Cancer Diagnostics Market

Taille du marché en milliards USD

TCAC :

%

USD

3,124.06 Billion

USD

5,675.36 Billion

2022

2030

USD

3,124.06 Billion

USD

5,675.36 Billion

2022

2030

| 2023 –2030 | |

| USD 3,124.06 Billion | |

| USD 5,675.36 Billion | |

|

|

|

|

Marché nord-américain du diagnostic du cancer de l'ovaire, par type de produit (instruments, kits et réactifs), type de procédure (test de biopsie, test d'imagerie médicale , test de marqueurs sanguins et test génétique), type de cancer ( cellules germinales , tumeur épithéliale et tumeur des cellules stromales), utilisateur final ( centres de diagnostic du cancer , laboratoires hospitaliers, instituts de recherche et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du diagnostic du cancer de l'ovaire en Amérique du Nord

Le cancer de l'ovaire est un type de cancer qui se forme dans les tissus de l'ovaire (l'une des deux glandes reproductrices féminines dans lesquelles se forment les ovules). La plupart des cancers de l'ovaire sont soit des cancers épithéliaux de l'ovaire (un cancer qui commence dans les cellules à la surface de l'ovaire) soit des tumeurs germinales malignes (un cancer qui commence dans les ovules). Les tests et procédures utilisés pour diagnostiquer le cancer de l'ovaire comprennent l'examen pelvien, les tests d'imagerie, les analyses sanguines, la chirurgie, entre autres. Lors d'un examen pelvien, le médecin insère des doigts gantés dans le vagin et appuie simultanément une main sur l'abdomen afin de sentir (palper) les organes pelviens.

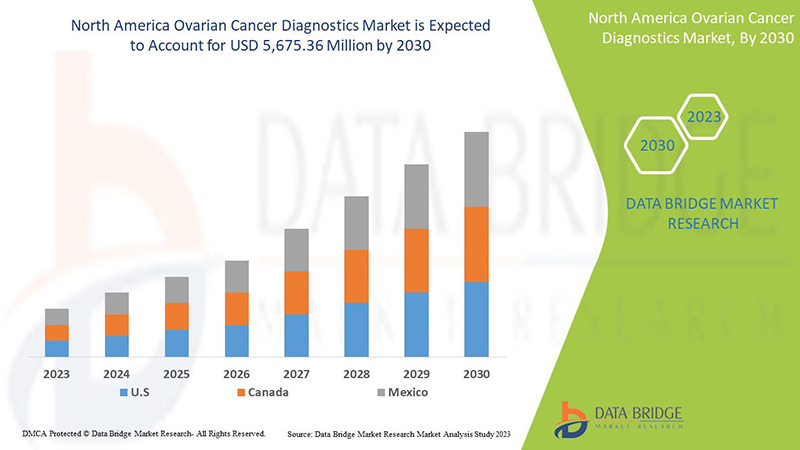

Le marché nord-américain du diagnostic du cancer de l'ovaire devrait croître au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,8 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 5 675,36 millions USD d'ici 2030 contre 3 124,06 millions USD en 2022.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (instruments, kits et réactifs), type de procédure (test de biopsie, test d'imagerie médicale, test de marqueurs sanguins et test génétique), type de cancer (cellules germinales, tumeurs épithéliales et tumeurs des cellules stromales), utilisateur final (centres de diagnostic du cancer, laboratoires hospitaliers, instituts de recherche et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Français F. Hoffmann-La Roche Ltd, Tosoh India Pvt. Ltd., Luminex Corporation, Quest Diagnostics Incorporated, Thermo Fisher Scientific Inc., Ngenebio, Abbott, Siemens Healthcare Private Limited, Myriad Genetics Inc., Bio-Rad Laboratories, Inc., R&D Systems, Inc., Foundation Medicine, Inc., Biosupply Ltd, Lcm Genect Srl, Inex Innovate Private Limited, Abcam Plc., Monobind Inc., Fujirebio, Mp Biomedicals, Biovision Inc., Boster Biological Technology, Biogenix Inc. Pvt. Ltd., Genway Biotech et Lifespan Biosciences, Inc. |

Définition du marché du diagnostic du cancer de l'ovaire en Amérique du Nord

Le cancer de l'ovaire est plus fréquent chez les femmes âgées de 50 à 79 ans. Sa prévalence augmente à mesure que la population gériatrique mondiale augmente et que l'accent est mis sur la détection et le traitement précoces, ce qui devrait accélérer le développement du marché du diagnostic du cancer de l'ovaire. L'augmentation des investissements publics dans la sensibilisation à la détection précoce du cancer ainsi que l'augmentation des dépenses de santé stimuleraient également la croissance de l'entreprise. L'obésité semble jouer un rôle important dans le développement du cancer de l'ovaire. D'autres choix de vie peuvent augmenter le risque, notamment le tabagisme, la consommation d'alcool et le fait de ne pas avoir d'enfants. Le cancer de l'ovaire n'étant pas facilement détectable, les femmes qui risquent de développer la maladie doivent subir des tests de routine pour identifier la maladie à un stade précoce, ce qui permet au marché de se développer.

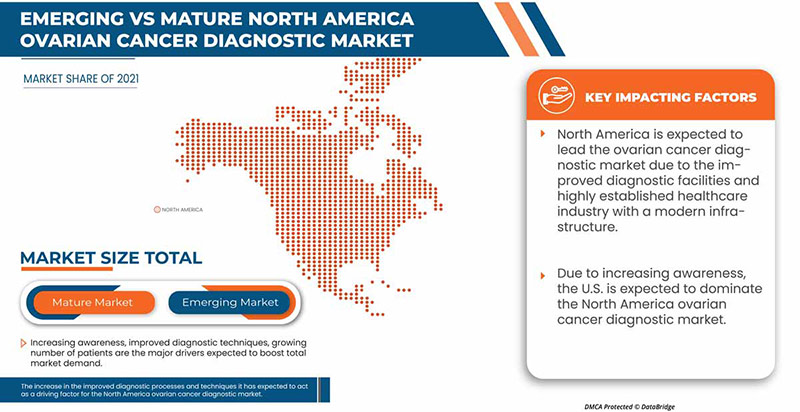

Le marché nord-américain du diagnostic du cancer de l'ovaire connaît une croissance au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la disponibilité de services avancés. Parallèlement à cela, les fabricants sont engagés dans des activités de R&D pour lancer de nouveaux services sur le marché. L'augmentation de la recherche et du développement dans le domaine du diagnostic et du développement du cancer de l'ovaire stimule encore la croissance du marché. Cependant, les difficultés liées aux techniques de dépistage du cancer de l'ovaire pourraient entraver la croissance du marché nord-américain du diagnostic du cancer de l'ovaire au cours de la période de prévision.

Dynamique du marché du diagnostic du cancer de l'ovaire en Amérique du Nord

Conducteurs

- Sensibilisation croissante au cancer de l’ovaire

La sensibilisation croissante au cancer de l’ovaire a conduit à une demande accrue de détection rapide du cancer, entraînant ainsi une croissance du marché.

Le cancer de l'ovaire est l'une des principales causes de l'augmentation du taux de mortalité chez les femmes dans le monde, ce qui alimente la croissance du marché au cours des cinq prochaines années. Le cancer des ovaires et les kystes deviennent plus fréquents en raison de divers facteurs tels que les facteurs environnementaux et les mutations génétiques.

Le cancer de l'ovaire est un type de cancer qui affecte les organes de production des ovules, les ovaires. Le cancer de l'ovaire est difficile à diagnostiquer car les symptômes sont vagues et ne sont souvent détectés qu'après que le cancer s'est propagé à l'estomac et au bassin, ce qui le rend difficile à guérir.

Il est donc nécessaire d’améliorer les processus et les techniques de diagnostic pour déterminer le stade du cancer à traiter. En outre, le taux de mortalité croissant dû au cancer de l’ovaire est préoccupant, ce qui souligne l’importance d’une détection précoce pour pouvoir proposer un traitement.

En raison d’une sensibilisation accrue au cancer de l’ovaire, on s’attend à ce que cela constitue un facteur moteur de croissance du marché.

- Processus et techniques de diagnostic améliorés

Les tests et examens de dépistage sont utilisés pour détecter une maladie, comme le cancer, chez les personnes qui ne présentent aucun symptôme. De nombreuses recherches ont été menées pour développer un test de dépistage du cancer de l'ovaire, mais elles n'ont pas encore eu beaucoup de succès. Les deux tests les plus souvent utilisés (en plus d'un examen pelvien complet) pour dépister le cancer de l'ovaire sont l'échographie transvaginale (TVUS) et le test sanguin CA-125.

L'échographie vaginale est un examen qui utilise des ondes sonores pour examiner l'utérus, les trompes de Fallope et les ovaires en introduisant une sonde à ultrasons dans le vagin. Elle peut aider à détecter une masse (tumeur) dans l'ovaire, mais elle ne permet pas de déterminer si une masse est cancéreuse ou bénigne. Lorsqu'elle est utilisée à des fins de dépistage, la plupart des masses détectées ne sont pas cancéreuses.

Le test sanguin CA-125 mesure la quantité d’une protéine appelée CA-125 dans le sang. De nombreuses femmes atteintes d’un cancer de l’ovaire présentent des taux élevés de CA-125. Ce test peut être utile comme marqueur tumoral pour aider à orienter le traitement chez les femmes atteintes d’un cancer de l’ovaire, car un taux élevé diminue souvent si le traitement est efficace. Cependant, la vérification des taux de CA-125 n’est pas aussi utile qu’un test de dépistage du cancer de l’ovaire.

Ainsi, en raison de l’augmentation des processus et des techniques de diagnostic améliorés, on s’attend à ce qu’il agisse comme un facteur moteur de la croissance du marché.

RESTRICTIONS

Coût élevé du diagnostic

Partout dans le monde, les coûts du traitement du cancer ont augmenté. Les industries de la santé sont confrontées à plusieurs défis, notamment les coûts médicaux liés au traitement du cancer. Le coût du traitement du cancer s'élevait à 124,60 milliards USD en 2010, et devrait augmenter à 173,00 milliards USD d'ici 2020, les prix des médicaments contre le cancer et les soins hospitaliers aigus étant les principaux facteurs de cette hausse. Par conséquent, l'augmentation du coût de production des agents de diagnostic freine la croissance du marché.

Manque de professionnels qualifiés

Les professionnels de santé impliqués dans le processus de diagnostic ont l'obligation et la responsabilité éthique d'utiliser des compétences de raisonnement clinique, d'évaluer et de gérer les problèmes médicaux d'un patient. Lorsqu'un diagnostic est précis et posé en temps opportun, le patient a les meilleures chances d'obtenir un résultat positif pour sa santé, car la prise de décision clinique sera adaptée à une compréhension correcte du problème de santé du patient. Le manque de professionnels qualifiés peut entraver le processus de rétablissement du patient et donc freiner la croissance du marché.

OPPORTUNITÉS

Augmentation des dépenses de santé pour le diagnostic et le traitement du cancer

Partout dans le monde, les activités de recherche et développement augmentent en raison des dépenses publiques de santé et des performances économiques, tandis que le secteur de la santé se classe au deuxième rang parmi tous les secteurs en ce qui concerne le montant dépensé pour les soins de santé. L'augmentation des dépenses de santé peut se traduire par une meilleure offre d'opportunités de recherche et développement. On s'attend à ce que la demande de diagnostics du cancer de l'ovaire augmente.

L’augmentation des dépenses de santé pour le traitement du cancer aide également les patients à bénéficier de diagnostics et de traitements avancés sans tracas pour un rétablissement rapide. Les dépenses de santé sont constituées d’une combinaison de paiements directs (les personnes paient elles-mêmes pour leurs soins), de dépenses publiques et de sources telles que l’assurance maladie et les activités des organisations non gouvernementales (ONG). En raison de cette augmentation des dépenses de santé pour le traitement du cancer, cela constitue une opportunité de croissance du marché.

DÉFIS

Réglementations et normes strictes pour l'approbation et la commercialisation des produits de diagnostic du cancer

Les réglementations strictes concernant la commercialisation de tout produit sur le marché constituent un défi de taille pour les fabricants de produits de diagnostic du cancer aux États-Unis et en Europe. Chaque pays a ses propres réglementations et dispose d'un organisme différent pour les procédures réglementaires.

Aux États-Unis, les fabricants exigent une autorisation de mise sur le marché pour les produits IVD destinés à l'usage humain. Le produit doit être étiqueté conformément à la réglementation en matière d'étiquetage. Les établissements impliqués dans la production et la distribution de dispositifs médicaux destinés à la distribution commerciale aux États-Unis sont tenus de s'enregistrer auprès de la FDA. L'enregistrement fournit à la FDA l'emplacement des installations de fabrication et des importateurs de dispositifs médicaux. L'enregistrement d'un établissement ne constitue pas une approbation de l'établissement ou de ses dispositifs par la FDA, c'est-à-dire qu'il ne donne pas à la FDA l'autorisation de commercialiser le dispositif. Sauf exemption, une autorisation préalable à la mise sur le marché est requise avant qu'un dispositif puisse être mis en distribution commerciale aux États-Unis

Les exigences réglementaires pour l'approbation de la mise sur le marché ainsi que la déclaration de conformité et le temps nécessaire à l'examen réglementaire peuvent varier selon les produits. L'entreprise qui n'obtient pas l'approbation réglementaire porte préjudice à son activité car sans l'approbation des produits, les fabricants ne sont pas en mesure de lancer leur produit sur le marché. Pour cette raison, les réglementations et normes strictes pour l'approbation et la commercialisation des produits de diagnostic du cancer agissent comme un facteur limitant la croissance du marché.

Développements récents

- En novembre 2022, Myriad Genetics Inc. a annoncé l'acquisition de Gateway Genomics, LLC. Cette acquisition renforce le portefeuille de produits de santé féminine de Myriad Genetics, élargissant l'accès aux tests génétiques personnalisés pendant la phase de reproduction de la vie d'une femme et au-delà. Avec SneakPeek, Myriad sert désormais les femmes plus tôt dans leur grossesse, en leur fournissant des informations génétiques basées sur des données tout au long de leur vie avec le dépistage prénatal non invasif Prequel, le dépistage des porteurs Foresight et le test de cancer héréditaire MyRisk avec score de risque pour toutes les ascendances, ce qui aidera l'entreprise à augmenter ses revenus.

- En octobre 2022, Quest Diagnostics a annoncé la nouvelle phase de collaboration avec Decode health. Dans la phase de démarrage de la collaboration, les deux parties ont développé des capacités de séquençage d'ARN (transcriptome) basées sur le séquençage de nouvelle génération, l'analyse et l'expertise clinique des deux parties. Cette collaboration est importante car les données basées sur les biomarqueurs peuvent aider à réduire le temps et le coût de développement de nouveaux tests de diagnostic et à identifier de nouvelles cibles médicamenteuses pour différents types de cancers (cancer du sein, de la prostate et de l'ovaire). Cette collaboration aide l'entreprise à trouver des voies innovantes dans le domaine de la R&D et accroît la présence de l'entreprise en Amérique du Nord.

Portée du marché du diagnostic du cancer de l'ovaire en Amérique du Nord

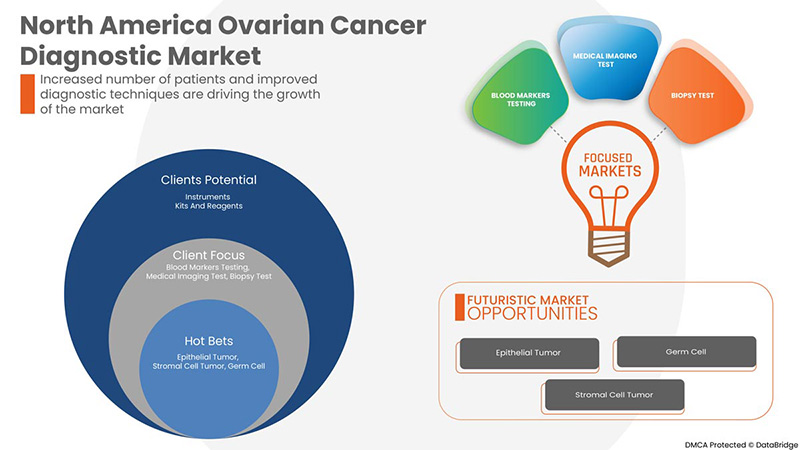

Le marché nord-américain du diagnostic du cancer de l'ovaire est segmenté en type de produit, type de procédure, type de cancer et utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Instruments

- Kits et réactifs

Sur la base du type de produit, le marché nord-américain du diagnostic du cancer de l’ovaire est segmenté en instruments, kits et réactifs.

Type de procédure

- Test des marqueurs sanguins

- Test d'imagerie médicale

- Tests de biopsie

- Test génétique

Sur la base du type de procédure, le marché nord-américain du diagnostic du cancer de l'ovaire est segmenté en tests de marqueurs sanguins, tests d'imagerie médicale, tests de biopsie et tests génétiques.

Type de cancer

- Tumeur épithéliale

- Cellule germinale

- Tumeur des cellules stromales

Sur la base du type de cancer, le marché nord-américain du diagnostic du cancer de l'ovaire est segmenté en tumeur épithéliale, tumeur à cellules germinales et tumeur à cellules stromales.

Utilisateur final

- Centres de diagnostic du cancer

- Laboratoires hospitaliers

- Instituts de recherche

- Autres

Sur la base de l'utilisateur final, le marché nord-américain du diagnostic du cancer de l'ovaire est segmenté en centres de diagnostic du cancer, laboratoires hospitaliers, instituts de recherche et autres

Analyse/perspectives régionales du marché du diagnostic du cancer de l'ovaire en Amérique du Nord

Le marché nord-américain du diagnostic du cancer de l’ovaire est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de produit, type de procédure, type de cancer et utilisateur final, comme référencé ci-dessus.

Les pays couverts par ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché nord-américain du diagnostic du cancer de l'ovaire en termes de part de marché et de chiffre d'affaires et continueront de renforcer leur domination au cours de la période de prévision. Cela est dû à la prévalence et à l'incidence élevées des troubles neurologiques dans la région, ainsi qu'à la croissance des investissements en R&D et au lancement de nouveaux produits qui stimulent le marché

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du diagnostic du cancer de l'ovaire en Amérique du Nord

The ovarian cancer diagnostics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Ovarian Cancer Diagnostics Market.

Some of the major players operating in the North America ovarian cancer diagnostics market are F. Hoffmann-la roche ltd, Tosoh india pvt. Ltd., Luminex corporation, Quest diagnostics incorporated, Thermo fisher scientific Inc., Ngenebio, Abbott, Siemens healthcare private limited, Myriad genetics Inc., Bio-rad laboratories, Inc., R&d systems, Inc., Foundation medicine, Inc., Abcam plc., Monobind Inc., Mp biomedicals, Biovision Inc., Boster biological technology, Biogenix Inc. Pvt. Ltd., Genway biotech and Lifespan biosciences, Inc among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5 INDUSTRY INSIGHTS

5.1 CONCLUSION

6 REGULATIONS OF THE NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING OVARIAN CANCER AWARENESS

7.1.2 IMPROVED DIAGNOSTIC PROCESSES AND TECHNIQUES

7.1.3 INCREASE IN NUMBER OF NEW CASES EVERY YEAR

7.1.4 IMPROVED IMAGING TECHNIQUES

7.2 RESTRAINS

7.2.1 HIGH COST OF DIAGNOSIS

7.2.2 ADVERSE EFFECTS OF THE TREATMENT

7.3 OPPORTUNITIES

7.3.1 INCREASING HEALTHCARE EXPENDITURE FOR CANCER DIAGNOSIS AND TREATMENT

7.3.2 GOVERNMENT INITIATIVES TOWARDS CANCER DIAGNOSTICS

7.4 CHALLENGES

7.4.1 STRICT REGULATIONS AND STANDARDS FOR THE APPROVAL AND COMMERCIALIZATION OF CANCER DIAGNOSTIC PRODUCTS

7.4.2 LACK OF SKILLED PROFESSIONALS

8 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.3 KITS AND REAGENTS

9 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE

9.1 OVERVIEW

9.2 BLOOD MARKERS TESTING

9.3 MEDICAL IMAGING TEST

9.4 BIOPSY TEST

9.5 GENETIC TESTING

10 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 EPITHELIAL TUMOR

10.3 GERM CELL

10.4 STROMAL CELL TUMOR

11 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER

11.1 OVERVIEW

11.2 CANCER DIAGNOSTIC CENTERS

11.3 HOSPITAL LABORATORIES

11.4 RESEARCH INSTITUTES

11.5 OTHERS

12 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 F. HOFFMANN-LA ROCHE LTD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TOSOH INDIA PVT. LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 LUMINEX CORPORATION (2022)

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 QUEST DIAGNOSTICS INCORPORATED (2022)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 THERMO FISHER SCIENTIFIC INC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ABBOTT

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ABCAM PLC (2022)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 1.7.4 RECENT DEVELOPMENT

15.8 BIOSUPPLY LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BIO-RADBIO LABORATORIES

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 BIOVISION INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 BIOGENIX INC. PVT. LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 BOSTER BIOLOGICAL TECHNOLOGY

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FOUNDATION MEDICINE

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FUJIREBIO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 GENWAY BIOTECH

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 INEX INNOVATIVE PRIVATE LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 LCM GENETIC SRL

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 LIFESPAN BIOSCIENCES, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 MP BIOMEDICALS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MONOBIND INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 MYRIAD GENETICS, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 NGENEBIO

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 R&D SYSTEMS, INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 SIEMENS MEDICAL SOLUTIONS

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 24-MONTH EPISODE-OF-CARE COSTS FOR EARLY-STAGE AND LATE-STAGE CANCERS BY PAYER (USD BILLION)

TABLE 2 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA INSTRUMENTS IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA KITS AND REAGENTS IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA BLOOD MARKERS TESTING IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA MEDICAL IMAGING TEST IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA BIOPSY TEST IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA GENETIC TESTING IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA EPITHELIAL TUMOR IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA GERM CELL IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA STROMAL CELL TUMOR IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA CANCER DIAGNOSTIC CENTERS IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA HOSPITAL LABORATORIES IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA RESEARCH INSTITUTES IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 24 U.S. OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.S. OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 27 U.S. OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 28 CANADA OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 29 CANADA OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 30 CANADA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 31 CANADA OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 32 MEXICO OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 33 MEXICO OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 34 MEXICO OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 35 MEXICO OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : SEGMENTATION

FIGURE 11 THE INCREASE IN THE AWARENESS ABOUT OVARIAN CANCER IS EXPECTED TO DRIVE THE NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET IN 2022 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET

FIGURE 14 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PROCEDURE TYPE, 2022

FIGURE 19 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PROCEDURE TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PROCEDURE TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PROCEDURE TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2022

FIGURE 23 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 31 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 32 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 34 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 35 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.