North America Orthopedic Surgical Robots Market, By Product Type (Robotic System, Robotic Accessories, and Software and Services), End User (Hospital and Ambulatory Surgery Centers (ASCS)), Distribution Channel (Direct Tenders and Third Party Distributors) - Industry Trends and Forecast to 2029.

North America Orthopedic Surgical Robots Market Analysis and Insight

The orthopedic surgical robots market is largely influenced by the surging focus of key players towards technological advances in molecular diagnostics and indulging towards collaboration and partnerships with other organizations. The first documented use of orthopedic surgery had started during the 15th century. Modern orthopedic surgery and musculoskeletal research makes surgery less invasive and to make implanted components better and more durable. The orthopedic surgical robots are used to correct the bone deformities and to restore the function of the human skeletal system. During the last few years, new innovative orthopedic surgical robots products have been developed for increasing the growth of orthopedic surgical robots market, and the market players are enhancing their product portfolio. Many market players are involved in the manufacturing of orthopedic surgical robots with innovations that pave the way for market growth.

North America orthopedic surgical robots market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

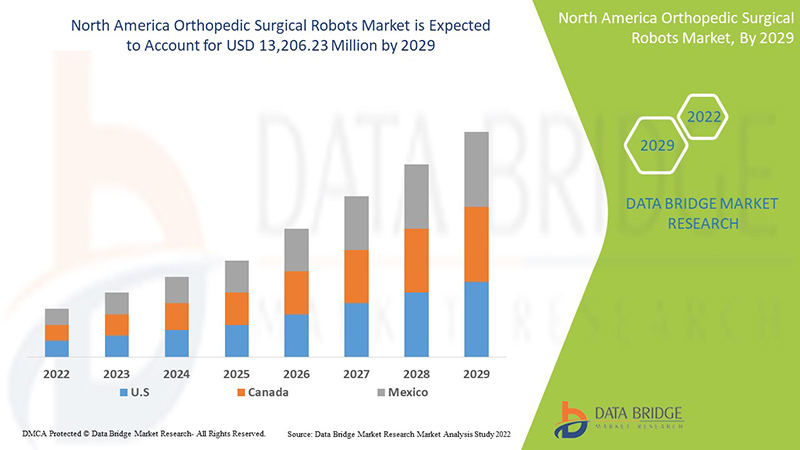

Data Bridge Market Research analyses that the orthopedic surgical robots market is expected to reach the value of USD 13,206.23 million by 2029, at a CAGR of 26.3% during the forecast period 2022-2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Product Type (Robotic System, Robotic Accessories, and Software and Services), End User (Hospital and Ambulatory Surgery Centers (ASCS)), Distribution Channel (Direct Tenders and Third Party Distributors) |

|

Countries Covered |

U.S., Canada, Mexico in North America |

|

Market Players Covered |

Parmi les autres sociétés figurent Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Smith & Nephew, Corin Group, NuVasive, Inc., Brainlab AG, Integrity Implants Inc. d/b/a/ Accelus, Beijing Tinavi Medical Technologies Co., Ltd, Medtronic, Globus Medical, Inc., Accuray Incorporated, THINK Surgical, Inc. et CUREXO, INC. |

Définition du marché

Les robots chirurgicaux orthopédiques sont utilisés pour corriger les déformations osseuses et restaurer la fonction du système squelettique humain. Il utilise de l'énergie telle que le rayonnement, la radiofréquence et les ultrasons pour sceller la peau et le tissu osseux. Les robots chirurgicaux orthopédiques nécessitent une source d'énergie, telle qu'un générateur d'électrochirurgie (ESU), et un instrument pour transférer l'énergie au patient. Les types importants comprennent la radiofréquence (RF), le courant électrique modifié et les ultrasons, qui convertissent le courant électrique en mouvement mécanique. Les technologies plus spécialisées comprennent celles qui utilisent le gaz argon, le plasma ou une combinaison de technologies. Les avancées technologiques utilisées dans les robots chirurgicaux orthopédiques sont les ultrasons, la radiofréquence et le rayonnement. La technologie de diagnostic utilisée dans les robots chirurgicaux orthopédiques a permis aux chirurgiens orthopédiques d'atteindre de nouveaux niveaux de précision et de sécurité. Elle permet au chirurgien de diagnostiquer, de planifier et d'accélérer la chirurgie orthopédique pour des résultats exceptionnels.

Dynamique du marché des robots chirurgicaux orthopédiques

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

-

PRÉVALENCE AUGMENTANTE DE L'OSTÉOPOROSE

L'ostéoporose est une maladie chronique qui affaiblit les os. Si une personne souffre d'ostéoporose, elle risque davantage de subir des fractures osseuses soudaines et inattendues. En 2021, les données de l'Organisation mondiale de la santé (OMS) indiquaient qu'environ 200 millions de personnes seraient atteintes d'ostéoporose.

Bien que l'ostéoporose touche les hommes et les femmes, les femmes sont plus susceptibles de développer une ostéoporose que les hommes. Pour le traitement de l'ostéoporose, les fractures de la hanche et les remplacements du genou sont présents, et il est important de comprendre les antécédents de santé physique des patients âgés, tels que la masse osseuse réduite et la fragilité osseuse. La régularité de l'ostéoporose augmente, de sorte que l'approche chirurgicale de l'ostéoporose augmente. L'aspirateur-irrigateur alésoir est un type de pièce à main utilisé par les chirurgiens orthopédiques. Par exemple, l'outil électrique à couple élevé est un alésoir utilisé pour traiter l'ostéoporose.

Avec la prévalence croissante de l’ostéoporose à l’échelle mondiale, la demande de diagnostic précoce de la maladie augmente également, entraînant avec elle la demande de soins, de services et de technologies pour traiter les maladies chroniques chez les personnes âgées.

-

AUGMENTATION DU NOMBRE D'INTERVENTIONS CHIRURGICALES ORTHOPÉDIQUES

L'augmentation de la population gériatrique et des troubles orthopédiques tels que l'ostéoporose. En raison de l'augmentation des troubles orthopédiques, le nombre d'interventions chirurgicales liées à l'orthopédie augmente également. L'augmentation du nombre d'interventions chirurgicales orthopédiques augmenterait le nombre de chirurgiens orthopédistes. Cela augmenterait l'utilisation de robots chirurgicaux orthopédiques. Cela augmenterait la production et l'approvisionnement de robots chirurgicaux orthopédiques.

Les robots chirurgicaux transforment déjà le marché de la santé. En réalisant un volume croissant d’interventions chirurgicales, les centres de soins ambulatoires vont faire baisser les prix des dispositifs médicaux et déclencher des changements pour les payeurs et les prestataires. Par conséquent, l’augmentation du nombre d’interventions chirurgicales orthopédiques devrait stimuler la croissance du marché des robots chirurgicaux orthopédiques.

RESTRICTIONS

-

MANQUE DE SENSIBILISATION AUX CHIRURGIES ORTHOPÉDIQUES

Bien que les dispositifs d'énergie chirurgicale orthopédique se soient positionnés comme une plate-forme sur le marché des dispositifs non invasifs, l'inexistence de chirurgies orthopédiques est présente dans les pays en développement. Cela entraînerait des retards et un diagnostic de la maladie orthopédique et les robots chirurgicaux orthopédiques auraient une position inférieure sur le marché. Le manque de sensibilisation et d'auto-efficacité s'ajoute également aux obstacles potentiels et à la mise en œuvre imparfaite.

-

RISQUES OBSERVÉS DANS LES INTERVENTIONS CHIRURGICALES ORTHOPÉDIQUES

Les interventions chirurgicales orthopédiques sont pratiquées par les orthopédistes pour soigner les troubles orthopédiques, les vaisseaux sanguins, couper les tissus et arrêter les saignements. Ce sont des appareils portatifs, ils doivent donc être utilisés comme partie intégrante de l'instrument du médecin. Bien qu'ils n'offrent pas de diagnostic, ils délivrent des médicaments qui permettent un meilleur traitement. Cependant, certains risques sont observés lors de l'utilisation de chirurgies orthopédiques.

Cependant, la diversité des risques et des complications de santé associés à la chirurgie orthopédique et la nécessité d'une intervention chirurgicale supplémentaire pour en corriger certains devraient freiner la demande sur le marché. Ainsi, les complications de santé associées aux chirurgies orthopédiques devraient restreindre le marché des robots chirurgicaux orthopédiques.

OPPORTUNITÉS

-

AUGMENTATION DES POPULATIONS GÉRIATRIQUES

Les troubles du genou sont fréquents chez les personnes âgées dans le monde entier. Les adultes de 60 ans et plus, en particulier ceux qui vivent dans des établissements de soins de longue durée, sont susceptibles de souffrir de symptômes chroniques du genou. À mesure que le vieillissement s'accentue, la charge des troubles du genou dans la population gériatrique peut augmenter, ce qui ouvre la voie au développement de médicaments et d'implants dans les stratégies de diagnostic et de prévention essentielles pour améliorer les troubles du genou chez les personnes âgées.

À mesure que l’âge augmente, la sensibilité aux troubles du genou et à d’autres facteurs de risque augmente également. Pour certaines personnes, elle peut être héréditaire, tandis que pour d’autres, l’arthrose du genou peut résulter d’une blessure, d’une infection ou même d’un surpoids. L’augmentation de la population gériatrique devrait propulser la croissance du marché car elle conduit à une utilisation accrue des robots dans de nombreuses interventions chirurgicales. Ces robots ont été introduits pour répondre aux besoins des personnes âgées, notamment en matière de soins physiques et médicaux. De plus, la population âgée est fortement touchée par les maladies chroniques qui peuvent être un facteur de croissance du marché des robots chirurgicaux orthopédiques.

-

AUGMENTATION DES DÉPENSES DE SANTÉ

Les dépenses consacrées par un pays à ses soins de santé et son taux de croissance au fil du temps dépendent d'une grande variété de facteurs économiques et sociaux, notamment des modalités de financement et de la structure de l'organisation du système de santé. En particulier, il existe une forte corrélation entre le niveau global de revenu d'un pays et le montant que sa population dépense en soins de santé.

Les dépenses de santé ont augmenté dans les pays développés et émergents à mesure que le revenu disponible des citoyens augmente. Plus les dépenses de santé sont élevées, plus la population d'un pays est en bonne santé. De plus, pour répondre aux besoins de la population, les organismes gouvernementaux et les organisations de santé de différentes régions prennent des initiatives pour accélérer les dépenses de santé. Par conséquent, l'augmentation des dépenses de santé aide simultanément les organisations de santé et les organismes gouvernementaux à accroître les services de gestion des soins de santé sous divers aspects.

DÉFIS

-

MANQUE DE PROFESSIONNELS QUALIFIÉS

Le manque ou la pénurie de compétences spécialisées pourrait freiner le rythme de la reprise et de la croissance dans un endroit donné. Souvent, les chômeurs d’un endroit ont des compétences qui sont rares ailleurs. De plus, les progrès technologiques rapides dans ce domaine entraînent également un manque de compétences. Malgré l’appel à l’augmentation, le nombre de podiatres et de certains programmes de formation en résidence reste inconnu.

Alors que le processus de revalidation des chirurgiens orthopédiques a commencé en Suisse, au Royaume-Uni et dans d'autres pays, certains professionnels de l'orthopédie et de la médecine ailleurs en Europe n'ont pas commencé à aborder la question de la formation médicale continue et des exigences connexes. Les exigences en matière de compétences étant trop élevées, la rétention et la gestion des professionnels ayant des compétences spécifiques sont devenues un défi. De plus, les progrès technologiques sont un autre aspect qui conduit à une demande accrue de professionnels qualifiés. Les podologues signalent d'importants besoins et obstacles en matière de soins de soutien non satisfaits dans leurs centres, seule une petite minorité se considérant comme compétente pour fournir des soins de soutien. Il est urgent de répondre aux besoins de podologues et de professionnels pour traiter les troubles chroniques du genou et de se procurer les ressources disponibles en matière de soins de soutien. Le manque de professionnels formés et expérimentés et les lacunes persistantes en matière de compétences limitent les perspectives d'employabilité et l'accès à des emplois de qualité. Par conséquent, cela signifie que le manque de professionnels qualifiés constitue un défi pour la croissance du marché des robots chirurgicaux orthopédiques.

-

DES CADRES RÉGLEMENTAIRES STRICTS

La réglementation des dispositifs médicaux joue un rôle important dans le secteur de la santé. Obtenir l’approbation requise pour la vente légale de dispositifs médicaux dans ces juridictions peut entraîner des dépenses financières importantes, qui peuvent prendre des mois, voire des années. Si ces contraintes ne sont pas comprises ou prises en compte, les retards peuvent sérieusement compromettre les chances de réussite sur un marché hautement concurrentiel. Les robots médicaux sont de plus en plus utilisés dans les chirurgies mini-invasives ; les chirurgies d’assistance sont importantes pour traiter diverses maladies. Mais leur approbation et leur commercialisation dans différentes régions du monde nécessitent le respect de normes réglementaires strictes et l’approbation de divers organismes de réglementation.

Impact post-COVID-19 sur le marché des robots chirurgicaux orthopédiques

La COVID-19 a eu un impact majeur sur le marché des robots chirurgicaux orthopédiques, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui interviennent dans cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché des robots chirurgicaux orthopédiques entraîne une augmentation de la prévalence de l'ostéoporose. Ce secteur a augmenté la demande car il cible les patients atteints de maladies osseuses. D'autres raisons qui stimulent la demande pour ces procédures sont le vieillissement croissant des personnes et l'augmentation des besoins en établissements de santé, ce qui peut encore entraîner une diminution de la charge de travail des établissements de santé. Par conséquent, une augmentation de la demande de procédures de robots chirurgicaux est estimée au cours de la période de prévision. Cependant, des facteurs tels que la disponibilité insuffisante des matières premières pour répondre à la demande de production de produits de robots chirurgicaux orthopédiques freinent la croissance du marché. La fermeture des installations de production pendant la situation de pandémie a eu un impact significatif sur le marché.

Développements récents

- En février 2022, Stryker finalise l'acquisition de Vocera Communications. Cette acquisition offre d'importantes opportunités de faire progresser les innovations et d'accélérer nos aspirations numériques. Vocera apporte un portefeuille hautement complémentaire et innovant à la division médicale de Stryker qui améliorera les offres de soins de santé numériques avancés de la société et fera progresser davantage l'accent mis par Stryker sur la prévention des événements indésirables tout au long du continuum des soins.

- En mars 2022, Corin Group a annoncé que la société s'associait à Efferent Health, LLC, un leader dans le domaine de la technologie d'automatisation des opérations médicales, proposant des solutions innovantes qui rationalisent les processus clés. Cela se traduit par un renforcement du portefeuille de services de données d'interopérabilité ainsi que par une augmentation de la crédibilité de l'entreprise sur le marché.

Portée du marché des robots chirurgicaux orthopédiques en Amérique du Nord

Le marché nord-américain des robots chirurgicaux orthopédiques est segmenté en fonction du type de produit, de l'utilisateur final et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par type de produit

- Système robotique

- Accessoires robotiques

- Logiciels et services

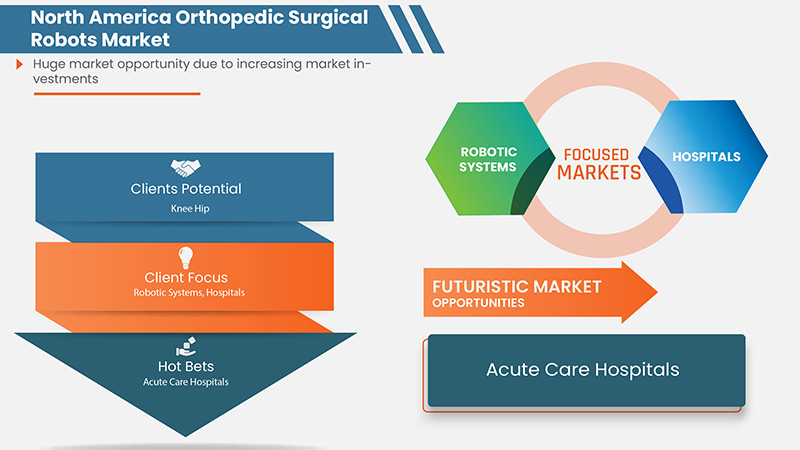

Sur la base du type de produit, le marché nord-américain des robots chirurgicaux orthopédiques est segmenté en système robotique, accessoires robotiques et logiciels et services.

Par utilisateur final

- Hôpitaux

- Centres de chirurgie ambulatoire

Sur la base de l’utilisateur final, le marché nord-américain des robots chirurgicaux orthopédiques a été segmenté en hôpitaux et centres chirurgicaux ambulatoires.

Par canal de distribution

- Appel d'offres direct

- Distributeurs tiers

Sur la base du canal de distribution, le marché nord-américain des robots chirurgicaux orthopédiques a été segmenté en appels d'offres directs et en distributeurs tiers.

Analyse/perspectives régionales du marché des robots chirurgicaux orthopédiques

Le marché des robots chirurgicaux orthopédiques est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type de produit, utilisateur final, canal de distribution comme référencé ci-dessus.

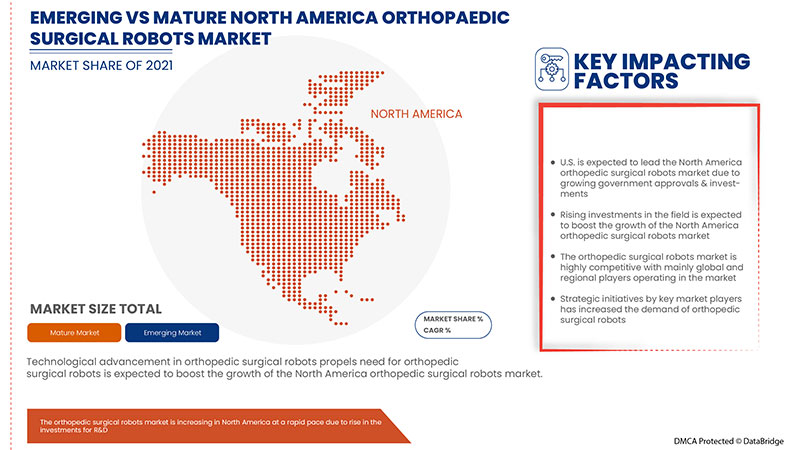

Les pays couverts dans le rapport sur le marché des robots chirurgicaux orthopédiques en Amérique du Nord sont les États-Unis, le Canada et le Mexique en Amérique du Nord.

Les États-Unis dominent la région Amérique du Nord en raison de l’utilisation exponentielle des systèmes robotiques dans le pays.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des robots chirurgicaux orthopédiques

Le paysage concurrentiel du marché des robots chirurgicaux orthopédiques fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des robots chirurgicaux orthopédiques.

Français Certains des principaux acteurs opérant sur le marché des robots chirurgicaux orthopédiques sont Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Smith & Nephew, Corin Group, NuVasive, Inc., Brainlab AG, Integrity Implants Inc. d/b/a/ Accelus, Beijing Tinavi Medical Technologies Co., Ltd, Medtronic, Globus Medical, Inc., Accuray Incorporated, THINK Surgical, Inc., CUREXO, INC. sont entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES

4.3 CLINICAL TRIALS ON ORTHOPEDIC SURGICAL ROBOTS NORTH AMERICALY

4.4 STRATEGIC INITIATIVES

4.4.1 DEMOGRAPHIC TRENDS

4.4.2 KEY PATENT ENROLLMENT STRATEGIES

4.5 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING PREVALENCE OF OSTEOPOROSIS

5.1.2 GROWING TECHNOLOGICAL ADVANCEMENTS IN ROBOTIC SYSTEMS

5.1.3 INCREASE IN NUMBER OF ORTHOPEDIC SURGERIES

5.1.4 RISE IN INCIDENCE OF SPORTS AND TRAUMA INJURIES

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS ABOUT ORTHOPEDIC SURGERIES

5.2.2 RISKS OBSERVED IN ORTHOPEDIC SURGERIES

5.2.3 HIGH COST ASSOCIATED WITH THE ORTHOPEDIC SURGERY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN GERIATRIC POPULATIONS

5.3.2 RISING HEALTHCARE EXPENDITURE

5.3.3 RISE IN FRACTURE INCIDENCE

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS

5.4.2 STRICT REGULATORY FRAMEWORKS

6 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ROBOTIC SYSTEMS

6.2.1 KNEE

6.2.1.1 SURGERY TYPE

6.2.1.1.1 TOTAL KNEE ARTHROPLASTY

6.2.1.1.2 UNICOMPARTMENTAL KNEE ARTHROPLASTY

6.2.1.1.3 ANTERIOR CRUCIATE LIGAMENT RECONSTRUCTION

6.2.1.1.4 OTHERS

6.2.1.1.5 ROBOT TYPE

6.2.1.1.6 MAKO

6.2.1.1.7 CORI

6.2.1.1.8 NAVIO

6.2.1.1.9 TIROBOT

6.2.1.1.10 TSOLUTION ONE

6.2.1.1.11 OTHERS

6.2.2 HIP

6.2.2.1 SURGERY TYPE

6.2.2.1.1 TOTAL HIP ARTHROPLASTY

6.2.2.1.2 OTHERS

6.2.2.1.3 ROBOT TYPE

6.2.2.1.4 MAKO

6.2.2.1.5 TSOLUTION ONE

6.2.2.1.6 OTHERS

6.2.3 SPINE

6.2.3.1 SURGERY TYPE

6.2.3.1.1 PEDICLE SCREW IMPLANTATION

6.2.3.1.2 VERTEBRAL AUGMENTATION

6.2.3.1.3 LAPAROSCOPIC ANTERIOR LUMBAR INTERBODY FUSION

6.2.3.1.4 SPINE TUMOR RESECTION SURGERY

6.2.3.1.5 INTRAOPERATIVE LOCALIZATION

6.2.3.1.6 ANTERIOR LUMBER INTERBODY FUSION

6.2.3.1.7 OTHERS

6.2.3.1.8 ROBOT TYPE

6.2.3.1.9 MAZOR

6.2.3.1.9.1 RENAISSANCE

6.2.3.1.9.2 MAZOR X

6.2.3.1.9.3 SPINE ASSIST

6.2.3.1.10 ROSA

6.2.3.1.11 CIRQ

6.2.3.1.12 EXCELSIUSGPS

6.2.3.1.13 OTHERS

6.2.4 FEMUR

6.2.4.1 SURGERY TYPE

6.2.4.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.4.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.4.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.4.1.4 OTHERS

6.2.4.1.5 ROBOT TYPE

6.2.4.1.6 TIROBOT

6.2.4.1.7 OTHERS

6.2.5 PELVIS

6.2.5.1 SURGERY TYPE

6.2.5.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.5.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.5.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.5.1.4 OTHERS

6.2.5.1.5 ROBOT TYPE

6.2.5.1.6 TIROBOT

6.2.5.1.7 OTHERS

6.2.6 HAND

6.2.6.1 SURGERY TYPE

6.2.6.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.6.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.6.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.6.1.4 OTHERS

6.2.6.1.5 ROBOT TYPE

6.2.6.1.6 TIROBOT

6.2.6.1.7 OTHERS

6.2.7 ELBOW

6.2.7.1 SURGERY TYPE

6.2.7.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.7.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.7.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.7.1.4 OTHERS

6.2.7.1.5 ROBOT TYPE

6.2.7.1.6 TIROBOT

6.2.7.1.7 OTHERS

6.2.8 OTHERS

6.3 ROBOTIC ACCESSORIES

6.4 SOFTWARE AND SERVICES

7 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER

7.1 OVERVIEW

7.2 HOSPITALS

7.2.1 ACTUE CARE HOSPITALS

7.2.2 LONG-TERM CARE HOSPITALS

7.2.3 NURSING FACILITIES

7.2.4 REHABILITATION CENTERS

7.3 AMBULATORY SURGICAL CENTERS

8 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT TENDER

8.3 THIRD PARTY DISTRIBUTORS

9 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 STRYKER

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SMITH & NEPHEW

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 JOHNSON & JOHNSON SERVICES, INC.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 MEDTRONIC

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 ZIMMER BIOMET

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ACCURAY INCORPORATED

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BEIJING TINAVI MEDICAL TECHNOLOGIES CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BRAINLAB AG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 CORIN GROUP

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 CUREXO, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 GLOBUS MEDICAL, INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 INTEGRITY IMPLANTS INC. D/B/A/ ACCELUS

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 NUVASIVE, INC.

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 THINK SURGICAL, INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2021-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 4 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 5 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 6 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020- 2029 (UNITS)

TABLE 7 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 8 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 9 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020- 2029 (UNITS)

TABLE 10 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 11 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 12 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 VOLUME, (UNITS)

TABLE 13 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 14 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 15 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 16 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 17 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 18 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 19 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 20 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 21 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 22 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 23 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 24 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 25 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 26 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 27 NORTH AMERICA ROBOTIC ACCESSORIES IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SOFTWARE AND DEVICES IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA DIRECT TENDER IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 42 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 45 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 48 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 50 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 53 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 56 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 59 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 62 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 U.S. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.S. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 70 U.S. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 73 U.S. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 76 U.S. MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 78 U.S. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 81 U.S. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.S. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 84 U.S. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.S. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 87 U.S. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.S. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.S. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 90 U.S. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 U.S. HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 U.S. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 CANADA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 CANADA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 98 CANADA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 101 CANADA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 104 CANADA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 105 CANADA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 106 CANADA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 109 CANADA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 112 CANADA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 115 CANADA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 118 CANADA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 CANADA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 CANADA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 MEXICO ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 MEXICO KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 126 MEXICO HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 129 MEXICO SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MEXICO SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 132 MEXICO MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 133 MEXICO MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 134 MEXICO FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 137 MEXICO PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 140 MEXICO HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 141 MEXICO HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 143 MEXICO ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 145 MEXICO ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 146 MEXICO ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 147 MEXICO HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 MEXICO ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: MARKET END USER GRID

FIGURE 9 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVELANCE OF OESTOPOROSIS AND INCREASE INCIDENCE OF SPORTS AND TRAUMA INJURY IS EXPECTED TO DRIVE THE NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 PRODUCT TYPE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET

FIGURE 14 CURRENT HEALTHCARE EXPENDITURE (% OF GDP) 2018-2019-

FIGURE 15 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, 2021-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, CAGR (2021-2029)

FIGURE 18 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, 2021

FIGURE 20 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 23 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 27 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 32 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.