Marché nord-américain des cellules solaires organiques (OPV), par type (membrane bicouche à hétérojonction, type Schottky et autres), matériau (polymère et petites molécules), application (BIPV et architecture, électronique grand public, appareils portables , automobile, militaire et appareil, et autres), taille physique (plus de 140*100 mm carrés et moins de 140*100 mm carrés), utilisateur final (commercial, industriel, résidentiel et autres), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et taille du marché des cellules solaires organiques (OPV) en Amérique du Nord

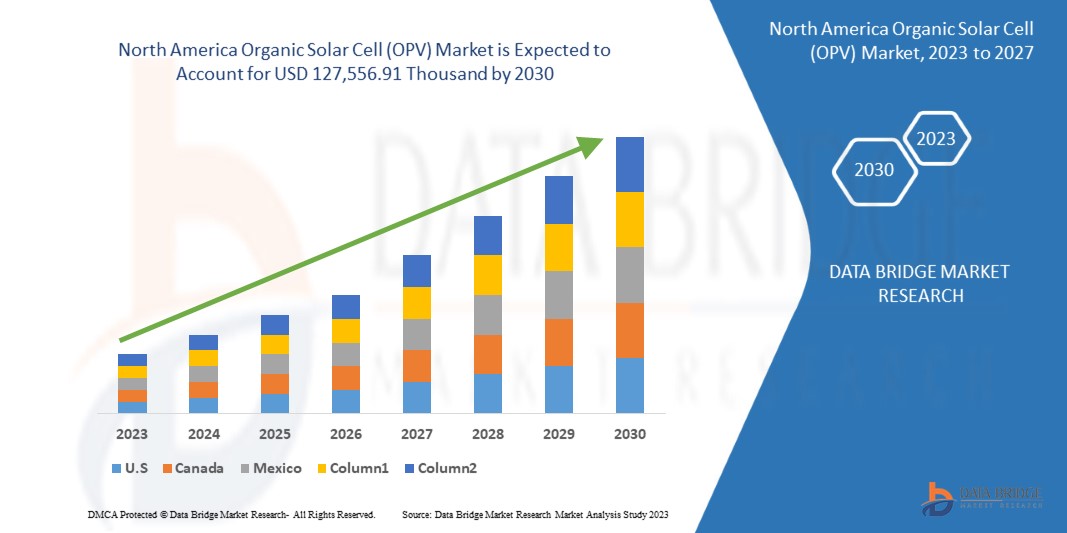

Français Le marché nord-américain des cellules solaires organiques (OPV) devrait croître de manière significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 10,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 127 556,91 milliers USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché des cellules solaires organiques (OPV) est la popularité croissante des produits de cellules solaires organiques (OPV) parmi les cellules solaires organiques et la sensibilisation croissante concernant les propriétés des produits de cellules solaires organiques (OPV).

Les cellules solaires organiques (OSC), classées comme cellules solaires de troisième génération utilisant un matériau polymère organique comme couche absorbant la lumière, sont l'une des technologies photovoltaïques (PV) les plus récentes. Les cellules solaires photovoltaïques organiques (OPV) cherchent à offrir une solution photovoltaïque (PV) à faible production d'énergie et abondante sur terre.

Le rapport sur le marché des cellules solaires organiques (OPV) en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type (membrane bicouche à hétérojonction, type Schottky et autres), matériau (polymère et petites molécules), application (BIPV et architecture, électronique grand public, appareils portables, automobile, militaire et appareils, et autres), taille physique (plus de 140*100 mm carré et moins de 140*100 mm carré), utilisateur final (commercial, industriel, résidentiel et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Eni SpA, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co., Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc., MORESCO Corporation, NanoFlex Power Corporation et Flask, entre autres |

Définition du marché

Les cellules solaires organiques ou photovoltaïques organiques désignent des dispositifs photovoltaïques multicouches fabriqués à partir de composés organiques, convertissant l'énergie solaire en électricité. Une cellule solaire organique est fabriquée à l'aide de matériaux à base de carbone et d'électronique organique au lieu du silicium comme semi-conducteur. Les cellules organiques peuvent également être appelées cellules solaires en plastique ou cellules solaires en polymère ; par rapport aux cellules solaires en silicium cristallin, les cellules solaires organiques sont fabriquées à partir de composés qui peuvent être dissous dans de l'encre et imprimés sur des plastiques. Cela confère aux cellules solaires organiques l'attribut de flexibilité, de légèreté et d'intégration facile dans des lieux ou des structures, entre autres.

La technologie des cellules solaires organiques est encore en développement. L'efficacité de conversion de l'énergie des cellules solaires organiques n'égale pas celle des cellules solaires au silicium inorganique. Mais les OPV présentent un large éventail d'applications potentielles et il ne faudra peut-être pas longtemps avant qu'elles ne deviennent la technologie couramment utilisée. Les OPV sont faciles à fabriquer par rapport aux cellules solaires inorganiques et bon marché à produire, et physiquement polyvalentes. Le principe de fonctionnement des cellules solaires organiques est identique à celui des cellules solaires au silicium monocristallin et polycristallin. Elles produisent de l'électricité grâce à l'effet photovoltaïque en trois étapes simples, telles que :

- Les électrons sont libérés du matériau polymère semi-conducteur lorsque la lumière est absorbée

- Le flux des électrons libres constitue un courant électrique

- Le courant est capté et transféré aux fils

La polyvalence de l'OPV peut être attribuée à la diversité des matériaux organiques conçus et synthétisés pour l'absorbeur, l'accepteur et les interfaces. Les cellules solaires organiques trouvent des applications dans l'automobile, les panneaux de toit, le photovoltaïque intégré au bâtiment (BIPV), l'électronique grand public et autres.

Dynamique du marché des cellules solaires organiques (OPV) en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Sensibilisation accrue à l'utilisation des énergies renouvelables pour la production d'électricité

La croissance continue de la population et l'essor croissant du secteur industriel, associés à la croissance du développement des infrastructures, entraînent une augmentation significative de la demande d'électricité en Amérique du Nord. Les pays investissent massivement dans les ressources de production d'électricité en installant de nouvelles centrales électriques pour répondre à la demande énergétique et assurer un développement sans entrave. Cela a entraîné une augmentation de la pollution et des risques environnementaux. Alors que l'accent est mis sur la conservation du climat, on assiste à une augmentation de l'adoption de sources d'énergie renouvelables pour la production d'électricité et l'exploitation de l'énergie solaire pour l'électricité est l'une des technologies de pointe en Amérique du Nord.

- Augmentation de la demande de produits photovoltaïques intégrés au bâtiment (BIPV)

Le photovoltaïque intégré au bâtiment (BIPV) fait référence aux matériaux utilisés pour la construction afin de remplacer les matériaux de construction conventionnels dans les toits, les puits de lumière et les façades, entre autres. Avec le BIPV, les bâtiments ont une couche extérieure de la structure qui génère également de l'électricité pour une utilisation sur site ou pour l'exportation vers le réseau. Les applications BIPV sont souvent destinées aux bâtiments commerciaux et industriels. L'utilisation de panneaux photovoltaïques organiques présente des avantages significatifs par rapport aux cellules solaires au silicium, car elles entraînent une réduction des coûts. Ils sont légers, flexibles et visiblement transparents. Cela a entraîné une croissance de l'adoption du photovoltaïque organique comme matériau dans les applications BIPV.

Les panneaux photovoltaïques organiques sont minces et flexibles et peuvent être intégrés dans les façades des bâtiments, en remplacement des fenêtres en verre conventionnelles ; ils offrent ainsi une grande surface disponible pour l'absorption de l'énergie solaire. Les puits de lumière OPC sont intégrés à l'aide de cellules solaires organiques ultra-minces, qui laissent pénétrer la lumière du jour tout en générant simultanément de l'électricité.

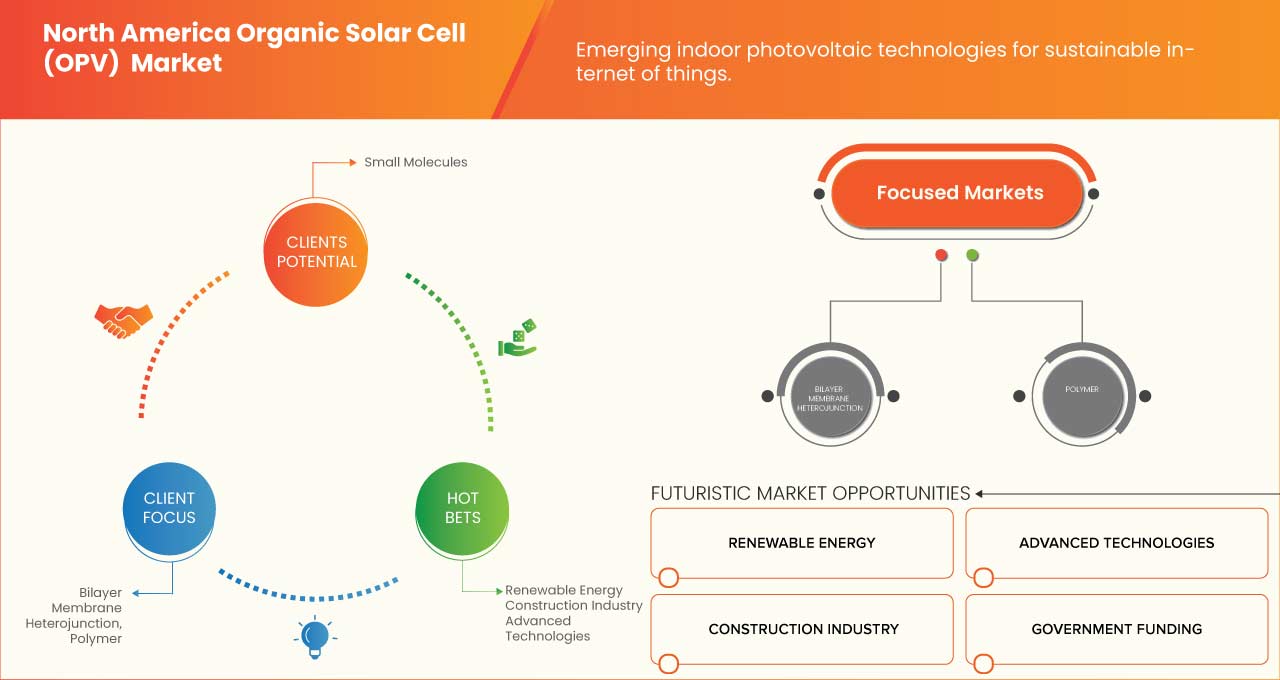

Opportunités

- Applications croissantes dans les projets de bricolage et les gadgets

Ces dernières années, des recherches approfondies ont été menées sur le développement de cellules solaires organiques pour accroître leur efficacité et les rendre plus flexibles et plus fines. Les résultats obtenus sont louables. Les chercheurs sont en mesure d'atteindre un rendement de conversion de puissance (PCE) supérieur à 10 %. Les développements récents ont conduit à des progrès en matière de nature flexible, de stabilité mécanique à la flexion et de bonne conformabilité. Cela a conduit à des applications de cellules solaires organiques dans des applications telles que la production d'énergie dans l'électronique portable et les petits projets.

Le marché connaît une demande croissante pour des appareils électroniques portables et portables du futur, tels que des montres intelligentes ou des capteurs biométriques, qui utilisent des ressources de production d'énergie légères, flexibles et efficaces. Cela a ouvert des opportunités intéressantes pour les cellules solaires organiques en tant que ressources d'alimentation électrique de nouvelle génération en raison de leurs propriétés souhaitables. En conséquence, de nombreuses activités de recherche visant à développer davantage les cellules solaires organiques afin d'augmenter leur PCE et leur flexibilité sont menées en Amérique du Nord.

- L'attention croissante du gouvernement sur le changement climatique

Le réchauffement climatique en Amérique du Nord, provoqué par les émissions de gaz à effet de serre d'origine humaine et les changements des conditions météorologiques dus à l'altération constante des écosystèmes, accélère les changements climatiques dans toutes les régions d'Amérique du Nord. Ces changements ne ralentissent pas et ont un impact immense sur le bien-être humain et la pauvreté dans le monde entier. Selon la Banque mondiale, les changements climatiques pourraient faire basculer jusqu'à 132 millions de personnes dans la pauvreté. Un mouvement est en cours dans le monde entier et les principaux gouvernements en prennent conscience et agissent pour adopter et combattre des mesures visant à éviter de nouveaux dommages à l'écosystème mondial.

Contraintes/Défis

- Coût d'installation plus élevé des systèmes OPV

L'accent a été mis sur l'accélération de l'adoption de systèmes électriques solaires, tels que les systèmes photovoltaïques organiques, pour développer des systèmes photovoltaïques intégrés aux bâtiments. Mais malgré ces efforts, l'intégration de la conception BIPV (photovoltaïque intégré au bâtiment) dans la conception des bâtiments est moindre que celle des bâtiments équipés de systèmes de cellules solaires organiques montés en rack. Cela s'ajoute au coût accru de l'intégration de la conception avant la mise en œuvre. Cela s'avère être un facteur de restriction important pour le marché.

Bien que l'adoption des énergies renouvelables soit encouragée et augmente donc avec l'attention croissante portée au changement climatique, les adeptes de l'énergie solaire semblent être déséquilibrés dans la plupart des régions du globe. Cette asymétrie est attribuée au niveau de revenu des populations.

- Faible taux d’efficacité des cellules solaires organiques

L'efficacité de conversion d'énergie dans une cellule solaire fait référence à la fraction d'énergie lumineuse que la cellule est capable de convertir en électricité. Les cellules solaires organiques offrent de plus en plus de possibilités d'adoption, car elles offrent une certaine flexibilité et peuvent s'adapter à n'importe quelle surface, comme le toit d'une voiture ou l'extérieur d'un appareil électronique portable. Le principal défi qui a entravé la commercialisation de cette technologie est l'efficacité de conversion d'énergie relativement faible par rapport à l'efficacité fournie par les cellules solaires au silicium inorganique.

Développement récent

- En janvier 2023, Novaled GmbH a annoncé avoir remporté le prix « Corporate Health Excellence Award » en 2022. Cela aidera l'entreprise à être mieux reconnue parmi ses concurrents.

Portée du marché nord-américain des cellules solaires organiques (OPV)

Le marché nord-américain des cellules solaires organiques (OPV) est classé en fonction du type, du matériau, de l'application, de la taille physique et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Hétérojonction à membrane bicouche

- Type Schottky

- Autres

Sur la base du type, le marché nord-américain des cellules solaires organiques (OPV) est classé en trois segments : membrane bicouche hétérojonction, type Schottky et autres.

Matériel

- Polymère

- Petites molécules

Sur la base du matériau, le marché nord-américain des cellules solaires organiques (OPV) est classé en deux segments : polymère et petites molécules.

Application

- BIPV et architecture

- Électronique grand public

- Appareils portables

- Automobile

- Militaire et appareil

- Autres

Sur la base de l'application, le marché nord-américain des cellules solaires organiques (OPV) est classé en six segments : bipv et architecture, électronique grand public, appareils portables, automobile, militaire et appareils, et autres.

Taille physique

- Plus de 140*100 MM carré

- Moins de 140*100 mm carré

Sur la base de la taille physique, le marché nord-américain des cellules solaires organiques (OPV) est classé en deux segments de plus de 140*100 MM carrés et de moins de 140*100 MM carrés.

Utilisateur final

- Commercial

- Industriel

- Résidentiel

- Autres

Sur la base de l'utilisateur final, le marché nord-américain des cellules solaires organiques (OPV) est classé en quatre segments : commercial, industriel, résidentiel et autres.

Analyse/perspectives régionales du marché des cellules solaires organiques (OPV) en Amérique du Nord

Le marché nord-américain des cellules solaires organiques (OPV) est segmenté en fonction du type, du matériau, de l’application, de la taille physique et de l’utilisateur final.

Les pays du marché nord-américain des cellules solaires organiques (OPV) sont les États-Unis, le Canada et le Mexique. Les États-Unis dominent le marché nord-américain des cellules solaires organiques (OPV) en termes de part de marché et de chiffre d'affaires en raison d'une sensibilisation croissante aux propriétés des produits de cellules solaires organiques (OPV) dans cette région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des cellules solaires organiques (OPV) en Amérique du Nord

Le paysage concurrentiel du marché des cellules solaires organiques (OPV) en Amérique du Nord fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des cellules solaires organiques (OPV) en Amérique du Nord.

Some of the prominent participants operating in the North America organic solar cell (OPV) market are Eni S.p.A, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co, Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc., MORESCO Corporation, NanoFlex Power Corporation, and Flask, among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION

5.1.2 SURGE IN DEMAND FOR BUILDING INTEGRATED PHOTOVOLTAIC PRODUCTS (BIPV)

5.1.3 GOVERNMENT INITIATIVES AND TAX BENEFITS FOR THE APPLICATION OF ALTERNATE ENERGY RESOURCE

5.1.4 ADVANTAGES OF OPVS OVER SILICON SOLAR CELLS AND SIMPLICITY IN THE MANUFACTURING PROCESS

5.1.5 INCREASING SOLAR ADOPTION IN RESIDENTIAL AREAS

5.2 RESTRAINTS

5.2.1 HIGHER SETUP COST OF OPV SYSTEMS

5.2.2 CUSTOM TARIFFS OVER SOLAR PANELS AND SOLAR CELLS BY MULTIPLE GOVERNMENTS

5.3 OPPORTUNITIES

5.3.1 INCREASING APPLICATIONS IN DIY PROJECTS AND GADGETS

5.3.2 INCREASING GOVERNMENT FOCUS ON CLIMATE CHANGE

5.3.3 INCREASING FOCUS ON THE DEVELOPMENT OF TANDEM ORGANIC CELLS

5.3.4 EMERGING INDOOR PHOTOVOLTAIC TECHNOLOGIES FOR SUSTAINABLE INTERNET OF THINGS

5.4 CHALLENGES

5.4.1 LOW-EFFICIENCY RATES OF ORGANIC SOLAR CELLS

5.4.2 STABILITY PROBLEMS IN ORGANIC SOLAR CELL

6 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 BILAYER MEMBRANE HETEROJUNCTION

6.3 SCHOTTKY TYPE

6.4 OTHERS

7 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 POLYMER

7.3 SMALL MOLECULES

8 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIPV & ARCHITECTURE

8.3 CONSUMER ELECTRONICS

8.4 WEARABLE DEVICES

8.5 AUTOMOTIVE

8.6 MILITARY & DEVICE

8.7 OTHERS

9 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE

9.1 OVERVIEW

9.2 MORE THAN 140*100 MM SQUARE

9.3 LESS THAN 140*100 MM SQUARE

10 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 COMMERCIAL, BY COMMERCIAL TYPE

10.2.1.1 PUBLIC INSTITUTIONS

10.2.1.2 GOVERNMENT AGENCIES

10.2.1.3 RESEARCH INSTITUTIONS

10.2.1.4 OTHERS

10.2.2 COMMERCIAL, BY TYPE

10.2.2.1 BILAYER MEMBRANE HETEROJUNCTION

10.2.2.2 SCHOTTKY TYPE

10.2.2.3 OTHERS

10.3 INDUSTRIAL

10.3.1 INDUSTRIAL, BY TYPE

10.3.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.3.1.2 SCHOTTKY TYPE

10.3.1.3 OTHERS

10.4 RESIDENTIAL

10.4.1 RESIDENTIAL, BY TYPE

10.4.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.4.1.2 SCHOTTKY TYPE

10.4.1.3 OTHERS

10.5 OTHERS

11 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 BUSINESS ACQUISITION & EXPANSION

12.3 COLLABORATION & PARTNERSHIP

12.4 ACQUISITION

12.5 AGREEMENT & CERTIFICATION

12.6 RECOGNITION & PRODUCT LAUNCH

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ENI SPA (2022)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 TOSHIBA CORPORATION (2022)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 ARMOR

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 TOKYO CHEMICAL INDUSTRY CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 MERCK KGAA (2022)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ALFA AESAR, THERMO FISHER SCIENTIFIC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BORUN NEW MATERIAL TECHNOLOGY CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EPISHINE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FLASK

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HELIATEK

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 LUMTEC

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MORESCO CORPORATION (2022)

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 NANOFLEX POWER CORPORATION (2022)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NINGBO POLYCROWN SOLAR TECH CO, LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NOVALED GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SHIFENG TECHNOLOGY CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SOLARIS CHEM INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 SOLARMER ORGANIC OPTOELECTRONICS TECHNOLOGY (BEIJING) CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SUNEW

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA ON PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 3 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA BILAYER MEMBRANE HETEROJUNCTION IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION , 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA SCHOTTKY TYPE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA POLYMER IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA SMALL MOLECULES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA BIPV & ARCHITECTURE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA CONSUMER ELECTRONICS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA WEARABLE DEVICES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA AUTOMOTIVE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA MILITARY & DEVICE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE , 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA MORE THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA LESS THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 CANADA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 59 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 61 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 62 MEXICO COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 MEXICO COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 MEXICO INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 MEXICO RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA ORGANIC SOLAR CELL MARKET

FIGURE 2 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: SEGMENTATION

FIGURE 14 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION IS EXPECTED TO DRIVE THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET IN THE FORECAST PERIOD

FIGURE 15 2 WHEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET

FIGURE 17 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2022

FIGURE 18 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2022

FIGURE 19 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2022

FIGURE 21 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2022

FIGURE 22 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY SNAPSHOT (2022)

FIGURE 23 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022)

FIGURE 24 EUROPE ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY TYPE (2023-2030)

FIGURE 27 NORTH AMERICA HEAVY METALS TESTING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.