Marché nord-américain de la conversion de chaleur résiduelle en électricité à partir du cycle organique de Rankine (ORC), par taille (petite, moyenne, grande), capacité (moins de 1 000 kW, 1 001 à 4 000 kW, 4 001 à 7 000 kW, plus de 7 000 kW), modèle (régime stable, dynamique), application (ICE ou turbine à gaz, valorisation énergétique des déchets, production de métaux, industrie du ciment et de la chaux, industrie du verre, raffinage du pétrole, industrie chimique, ICE en décharge, autres) – Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché nord-américain de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC)

Le rôle du cycle organique de Rankine (ORC) est de convertir efficacement la chaleur thermique des liquides ou des gaz pour produire une énergie neutre en carbone. La chaleur est générée à partir de sources géothermiques ou de chaleur résiduelle industrielle ou commerciale. Le cycle organique de Rankine (ORC) permet aux entreprises de produire davantage d'électricité pour répondre à la demande croissante. L'adoption croissante de la technologie du cycle organique de Rankine (ORC) réduit la consommation de carburant pour la production d'électricité, et diverses entreprises à grande échelle utilisent ces technologies pour produire de l'électricité à partir de la récupération de chaleur résiduelle.

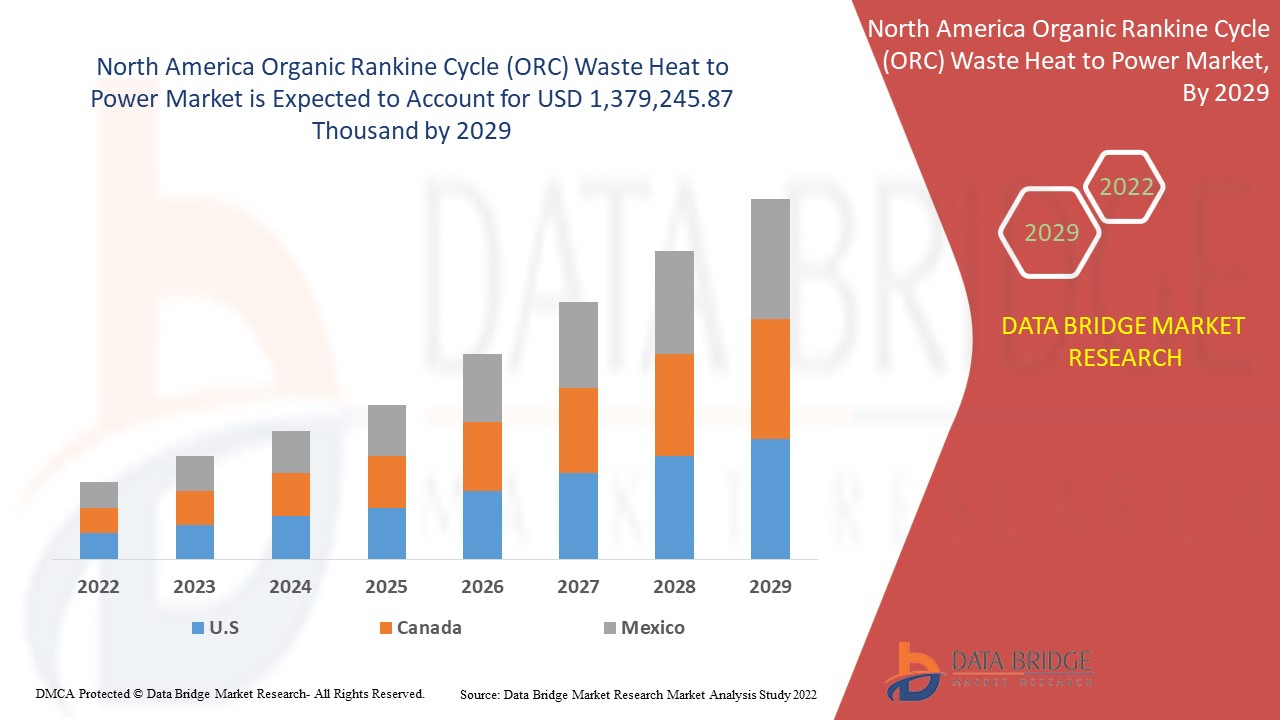

Selon les analyses de Data Bridge Market Research, le marché nord-américain de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) devrait atteindre la valeur de 1 379 245,87 milliers de dollars d'ici 2029, à un TCAC de 9,2 % au cours de la période de prévision. Le rapport sur le marché de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par taille (petite, moyenne, grande), capacité (moins de 1 000 kW, 1 001 à 4 000 kW, 4 001 à 7 000 kW, plus de 7 000 kW), modèle (régime stable, dynamique), application (ICE ou turbine à gaz, valorisation énergétique des déchets, production de métaux, industrie du ciment et de la chaux, industrie du verre, raffinage du pétrole, industrie chimique, ICE en décharge, autres). |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord. |

|

Acteurs du marché couverts |

MITSUBISHI HEAVY INDUSTRIES, LTD., Kaishan USA, Strebl Energy Pte Ltd, ORCAN ENERGY AG, ALFA LAVAL, Fujian Snowman Co., Ltd., Ormat, Rank, TMEIC, Triogen, ABB, Siemens Energy (Siemens AG), Dürr Group, ElectraTherm Inc. (BITZER Group), Enerbasque, Enertime, Enogia, EXERGY, CLIMEON, INTEC Engineering GmbH, Zuccato Energia srl., Opel Energy Systems Pvt. Ltd., Corycos Group, CTMI - Turbines à vapeur, BorgWarner Inc. |

Définition du marché

Les systèmes à cycle organique de Rankine (ORC) sont utilisés pour la production d'électricité à partir de sources de chaleur à basse et moyenne température, entre 80 et 350 °C, et pour des applications de petite et moyenne envergure à n'importe quelle température. Cette technologie permet d'exploiter la chaleur de faible qualité qui serait autrement gaspillée. Le principe de fonctionnement d'une centrale électrique à cycle organique de Rankine est similaire au procédé le plus largement utilisé pour la production d'électricité, le cycle Clausius-Rakine.

La principale différence réside dans l'utilisation de substances organiques au lieu de l'eau (vapeur) comme fluide de travail. Le fluide de travail organique a un point d'ébullition plus bas et une pression de vapeur plus élevée que l'eau et est donc capable d'utiliser des sources de chaleur à basse température pour produire de l'électricité. Le fluide organique est choisi pour s'adapter au mieux à la source de chaleur en fonction de leurs différentes propriétés thermodynamiques, ce qui permet d'obtenir des rendements plus élevés du cycle et du détendeur.

Dynamique du marché nord-américain de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC)

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la réduction de la consommation d'énergie primaire dans les opérations industrielles

La conversion de la chaleur résiduelle en énergie est l'une des sources renouvelables de production d'électricité. Cette technique s'avère être la ressource la plus efficace pour produire de l'électricité car elle permet de réduire la consommation d'énergie ou de carburants pour les processus industriels, et la chaleur résiduelle générée est utilisée pour produire de l'électricité sans émissions, qui est ensuite utilisée dans le processus industriel normal ou vendue au réseau pour distribution.

La chaleur résiduelle générée est considérée comme un sous-produit dans la plupart des industries, telles que la fabrication de papier et d'acier, les raffineries, les produits chimiques et la fabrication générale, car la chaleur résiduelle est produite dans les opérations industrielles. Ainsi, l'énergie ou le coût impliqué dans le fonctionnement de l'opération industrielle principale générera également de la chaleur résiduelle qui peut être rejetée dans l'environnement.

- Accent accru sur l'amélioration de l'efficacité des centrales électriques

La production d'électricité mondiale dépend en grande partie des ressources en combustibles fossiles comme le charbon, le gaz naturel et le pétrole. Le nombre de centrales électriques à combustible fossile installées a augmenté en Amérique du Nord et le développement de telles centrales électriques est en hausse dans le monde entier. Cependant, la chaleur résiduelle est évacuée dans une centrale électrique et peut être rejetée dans l'environnement. La récupération de la chaleur résiduelle est la principale approche pour améliorer encore l'efficacité thermique et réduire les émissions de gaz à effet de serre des centrales électriques à combustible fossile.

De plus, il a été constaté que l'adoption de technologies de récupération de chaleur perdue gagne en importance pour améliorer l'efficacité des centrales électriques. Ainsi, un système ORC de récupération de chaleur perdue est appliqué, basé sur un cycle thermodynamique en boucle fermée pour la production d'électricité et d'énergie thermique, qui convient aux opérations de la centrale. Il a été constaté que ce système prend en charge diverses fonctions de la centrale électrique telles que l'économiseur , la pompe à chaleur , l'échangeur de chaleur rotatif, le régénérateur et bien d'autres. Cela soutiendra le fonctionnement de la centrale électrique et améliorera son efficacité.

Opportunités

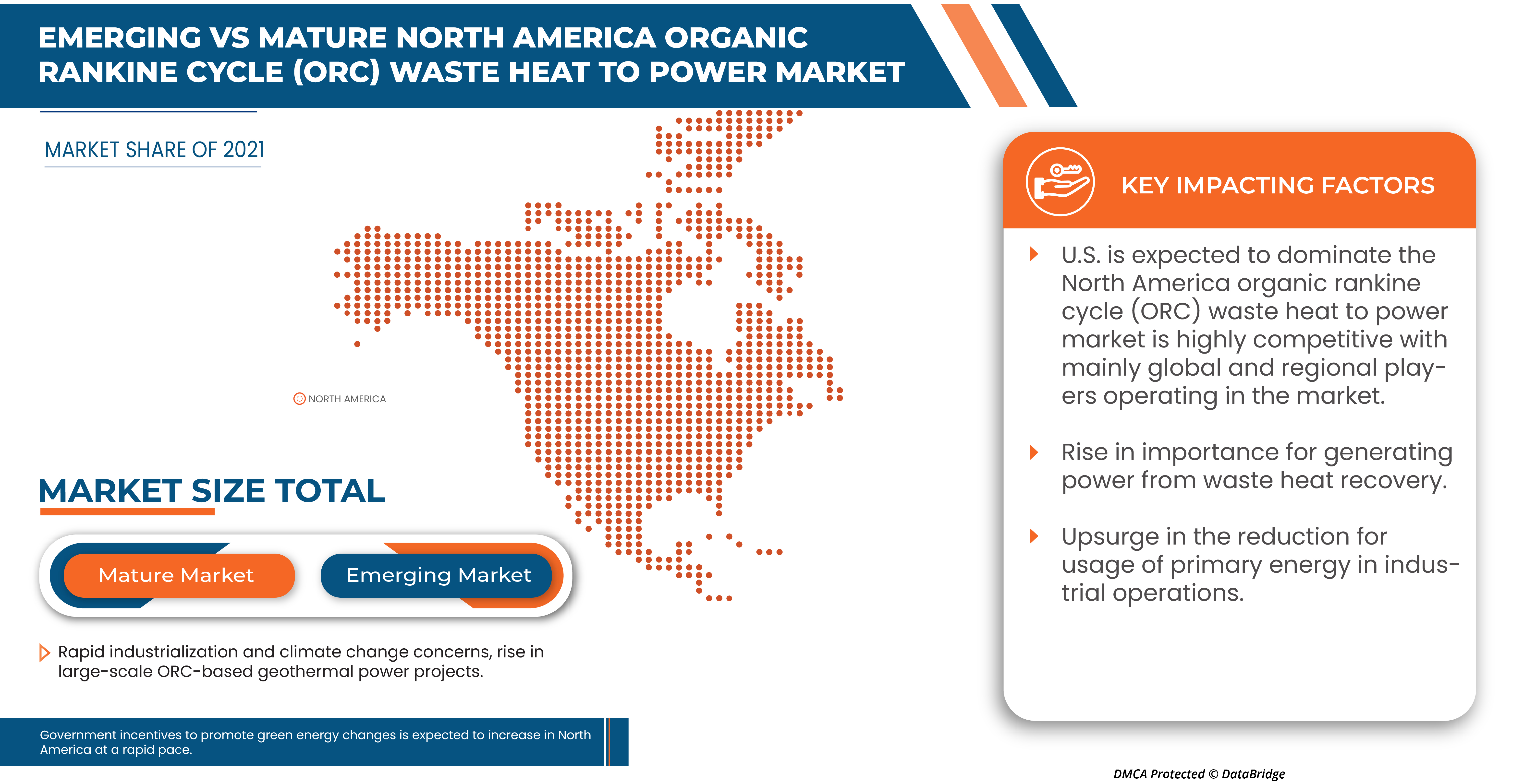

- Industrialisation rapide et préoccupations liées au changement climatique

L'industrialisation est un processus d'adoption d'une économie basée sur la fabrication. Cette étape implique de nombreux changements qui aident l'économie de la société à croître et à prospérer. L'industrialisation ne semble pas avoir de changement soudain, mais un changement progressif qui se produit sur une période donnée. Ainsi, indirectement, il y aura un grand nombre de combustibles fossiles, qui à leur tour génèreront le climat.

La cause du changement climatique est un problème sérieux qui évolue avec l'industrialisation rapide. Cependant, l'industrialisation est la voie du développement économique, mais le changement climatique est l'une des principales préoccupations à contrôler. Cela conduira à l'adoption de technologies durables et efficaces dans le processus industriel, y compris le système WHP. L'adoption de ces technologies avec l'augmentation de l'industrialisation et les préoccupations liées au changement climatique contribueront à protéger l'environnement.

Contraintes/Défis

- Coût élevé d'installation et de maintenance

Bien que les systèmes de récupération de chaleur résiduelle présentent des avantages significatifs, les coûts d'installation limitent la croissance du marché. La récupération de chaleur résiduelle peut être effectuée grâce à diverses techniques telles que le cycle de Rankine à vapeur (SRC), le cycle de Rankine organique (ORC) ou le cycle de Kalina. Ces technologies coûteront différemment en fonction de la production et de l'échelle du secteur industriel.

De plus, le coût total d'installation ou d'adoption des systèmes de récupération de chaleur dans n'importe quelle industrie comprend divers facteurs et équipements tels que les équipements de récupération de chaleur, les équipements de production d'électricité et les équipements de conditionnement et d'interconnexion de l'électricité. Le coût total comprend également les coûts indirects associés à la conception, à l'autorisation et à la construction du système. Cependant, les besoins de maintenance des chaudières de récupération de chaleur et d'équilibrage de l'installation sont également inclus, ce qui peut varier en fonction de la technologie et des conditions du site.

- Manque de sensibilisation à la technologie

Le besoin de récupération de chaleur perdue prend de plus en plus d'importance, mais il est essentiel de connaître les aspects liés à la sensibilisation, à la technologie et aux finances des systèmes WHP pour prendre des décisions. L'objectif ultime est d'optimiser l'efficacité énergétique globale et, ainsi, de maximiser les avantages économiques et environnementaux.

Cependant, la plupart des industries adoptent le système WHP dans leurs opérations industrielles, car la plupart des professionnels de l'industrie ne connaissent pas les aspects techniques, ce qui conduit à une idée fausse, une perception et une mise en œuvre de méthodes erronées, entraînant une inefficacité et des résultats négatifs.

Impact de la COVID-19 sur le marché nord-américain de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC)

La COVID-19 a eu un impact négatif sur le marché de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) en raison des réglementations et des règles de confinement dans les installations de fabrication.

La pandémie de COVID-19 a eu un impact négatif sur le marché de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC). Cependant, l'adoption croissante de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC) dans le secteur de l'énergie a contribué à la croissance du marché après la pandémie. En outre, la croissance a été élevée depuis l'ouverture du marché après la COVID-19, et on s'attend à ce que le secteur connaisse une croissance considérable.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans la conversion de la chaleur résiduelle en électricité du cycle organique de Rankine (ORC). Grâce à cela, les entreprises apporteront des technologies avancées au marché. En outre, les initiatives gouvernementales pour l'utilisation des technologies de recyclage ont conduit à la croissance du marché

Développement récent

- En septembre 2020, BorgWarner Inc. a conclu un partenariat avec Plug and Play. L'objectif principal de ce partenariat stratégique était de valoriser les idées inventives dans le secteur automobile et technologique afin de porter les capacités du secteur vers de nouveaux sommets. Grâce à ce partenariat, l'entreprise a élargi son marché dans le secteur automobile et technologique.

- En décembre 2018, le groupe Corycos s'est associé à Clean Energy Technologies, Inc. L'objectif de ce partenariat était de développer un générateur de récupération de chaleur innovant à cycle organique de Rankine (ORC) pour l'industrie du biogaz. Grâce à ce partenariat, les deux entreprises renforcent leur présence sur le marché et dans la région.

Portée du marché nord-américain de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC)

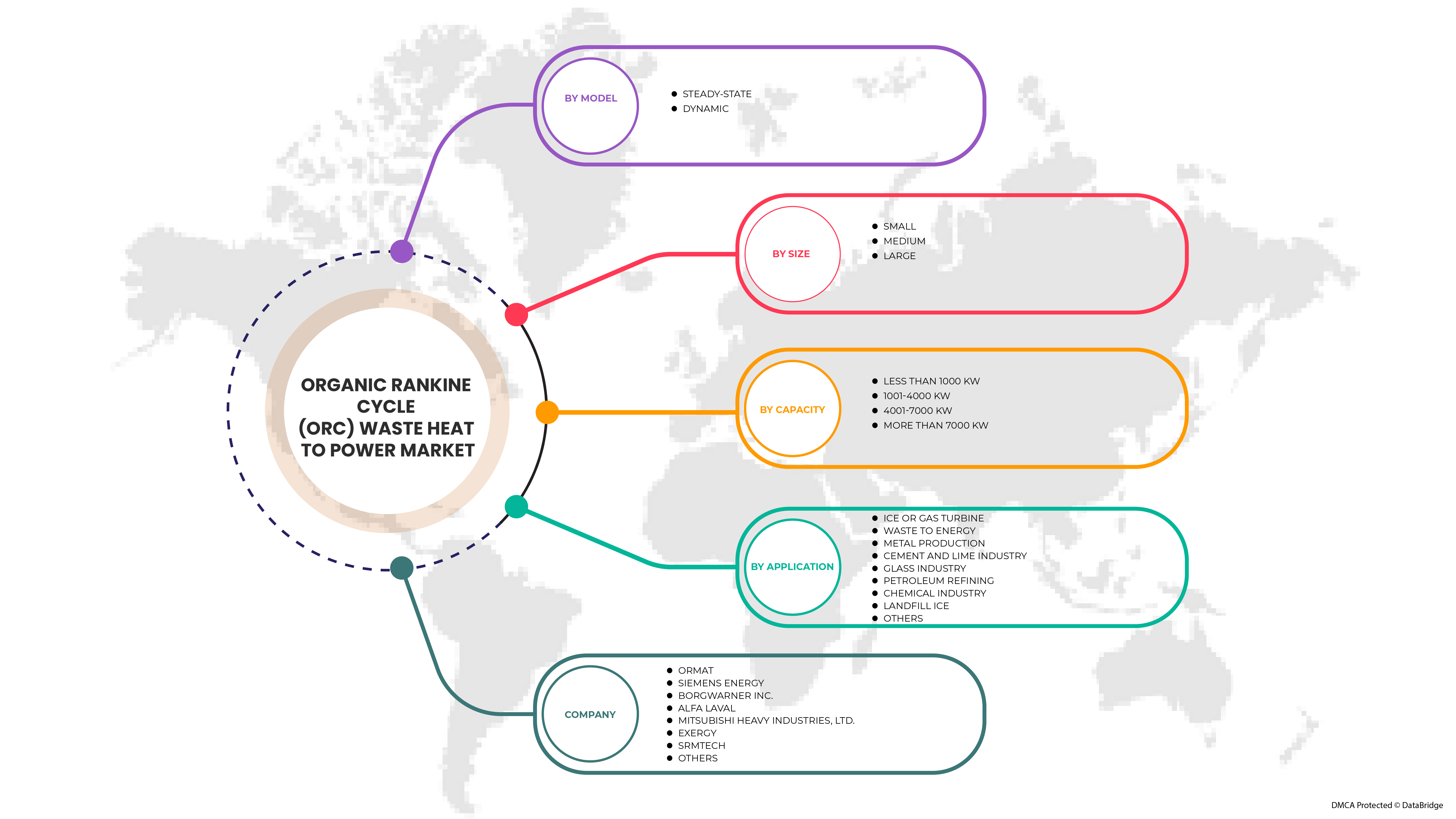

Le marché nord-américain de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC) est segmenté en fonction de la taille, de la capacité, du modèle et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taille

- Petit

- Moyen

- Grand

Sur la base de la taille, le marché nord-américain de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) est segmenté en petit, moyen et grand.

Capacité

- Moins de 1000 kW

- 1001-4000 kW

- 4001-7000 kW

- Plus de 7000 kW

Sur la base de la capacité, le marché nord-américain de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) a été segmenté en moins de 1 000 kW, 1 001 à 4 000 kW, 4 001 à 7 000 kW et plus de 7 000 kW.

Modèle

- État stable

- Dynamique

Sur la base du modèle, le marché nord-américain de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) a été segmenté en régime permanent et dynamique.

Application

- ICE ou turbine à gaz

- Valorisation énergétique des déchets

- Production de métaux

- Industrie du ciment et de la chaux

- Industrie du verre

- Raffinage du pétrole

- Industrie chimique

- Décharge ICE

- Autres

Sur la base de l'application, le marché nord-américain de la conversion de la chaleur résiduelle en électricité à partir du cycle organique de Rankine (ORC) est segmenté en ICE ou turbine à gaz, valorisation énergétique des déchets, production de métaux, industrie du ciment et de la chaux, industrie du verre, raffinage du pétrole, industrie chimique, ICE en décharge et autres.

Analyse/perspectives régionales du marché nord-américain de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC)

Le marché nord-américain de la chaleur résiduelle du cycle organique de Rankine (ORC) en énergie est analysé, et des informations sur la taille du marché et les tendances sont fournies par pays, taille, capacité, modèle et application comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché de la chaleur résiduelle en cycle organique de Rankine (ORC) sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché de la production d’électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) en raison de l’importance croissante de la production d’électricité à partir de la récupération de la chaleur résiduelle.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse de la concurrence et des parts de marché du cycle organique de Rankine (ORC) en Amérique du Nord

Le paysage concurrentiel du marché nord-américain de la production d'électricité par chaleur résiduelle à cycle organique de Rankine (ORC) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de produits, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de la production d'électricité par chaleur résiduelle à cycle organique de Rankine (ORC).

Français Certains des principaux acteurs opérant sur le marché nord-américain de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC) sont MITSUBISHI HEAVY INDUSTRIES, LTD., Kaishan USA, Strebl Energy Pte Ltd, ORCAN ENERGY AG, ALFA LAVAL, Fujian Snowman Co., Ltd., Ormat, Rank, TMEIC, Triogen, ABB, Siemens Energy (Siemens AG), Dürr Group, ElectraTherm Inc. (BITZER Group), Enerbasque, Enertime, Enogia, EXERGY, CLIMEON, INTEC Engineering GmbH, Zuccato Energia srl., Opel Energy Systems Pvt. Ltd., Corycos Group, CTMI - Steam Turbines, BorgWarner Inc.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 SIZE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN IMPORTANCE FOR GENERATING POWER FROM WASTE HEAT RECOVERY

5.1.2 UPSURGE IN THE REDUCTION OF USAGE OF PRIMARY ENERGY IN INDUSTRIAL OPERATIONS

5.1.3 INCREASED FOCUS ON IMPROVING THE POWER PLANT EFFICIENCY

5.1.4 RISING STRINGENT EMISSION NORMS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSTALLATION AND MAINTENANCE

5.2.2 SUPPLY DEFICIT OF RAW MATERIALS

5.3 OPPORTUNITIES

5.3.1 RAPID INDUSTRIALIZATION AND CLIMATE CHANGE CONCERNS

5.3.2 RISE IN LARGE-SCALE ORC-BASED GEOTHERMAL POWER PROJECTS

5.3.3 GOVERNMENT INCENTIVES TO PROMOTE GREEN ENERGY CHANGES

5.3.4 INCREASE IN THE ADOPTION OF SUSTAINABLE TECHNOLOGIES ACROSS INDUSTRIES

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS ABOUT THE TECHNOLOGY

6 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE

6.1 OVERVIEW

6.2 MEDIUM

6.3 SMALL

6.4 LARGE

7 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY

7.1 OVERVIEW

7.2 LESS THAN 1000 KW

7.3 1001-4000 KW

7.4 4001 - 7000 KW

7.5 MORE THAN 7000 KW

8 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL

8.1 OVERVIEW

8.2 STEADY-STATE

8.3 DYNAMIC

9 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ICE OR GAS TURBINE

9.2.1 MEDIUM

9.2.2 SMALL

9.2.3 LARGE

9.3 WASTE TO ENERGY

9.3.1 MEDIUM

9.3.2 SMALL

9.3.3 LARGE

9.4 METAL PRODUCTION

9.4.1 MEDIUM

9.4.2 SMALL

9.4.3 LARGE

9.5 CEMENT AND LIME INDUSTRY

9.5.1 MEDIUM

9.5.2 SMALL

9.5.3 LARGE

9.6 GLASS INDUSTRY

9.6.1 MEDIUM

9.6.2 SMALL

9.6.3 LARGE

9.7 PETROLEUM REFINING

9.7.1 MEDIUM

9.7.2 SMALL

9.7.3 LARGE

9.8 CHEMICAL INDUSTRY

9.8.1 MEDIUM

9.8.2 SMALL

9.8.3 LARGE

9.9 LANDFILL ICE

9.9.1 MEDIUM

9.9.2 SMALL

9.9.3 LARGE

9.1 OTHERS

10 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ORMAT

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCTS PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS ENERGY

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 BORGWARNER INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCTS PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 ALFA LAVAL

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCTS PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MITSUBISHI HEAVY INDUSTRIES, LTD

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCTS PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCTS PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 CLIMEON

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCTS PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 CORYCOS GROUP

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCTS PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CTMI - STEAM TURBINES

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCTS PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 DÜRR GROUP

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCTS PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 ENERBASQUE

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 ENERTIME

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCTS PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ENOGIA

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCTS PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 EXERGY INTERNATIONAL SRL

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCTS PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 ELECTRATHERM (ACQUIRED BY BITZER)

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 INTEC ENGINEERING GMBH

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 KAISHAN USA

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCTS PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 OPEL ENERGY SYSTEMS PVT. LTD.

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCTS PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 ORCAN ENERGY AG

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCTS PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 RANK ORC, S.L.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCTS PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 STREBL ENERGY PTE LTD

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCTS PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 SRMTEC

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 TMEIC

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCTS PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 TRIOGEN

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT DEVELOPMENTS

13.25 ZUCCATO ENERGIA SRL.

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCTS PORTFOLIO

13.25.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 EXISTING WHP PROJECTS AND POWER GENERATION CAPACITY BY DIFFERENT INDUSTRIES IN THE U.S.

TABLE 2 ENERGY GENERATION POTENTIAL THROUGH WASTE HEAT IN DIFFERENT SECTORS IN INDIA

TABLE 3 WHP COST COMPARISON

TABLE 4 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA MEDIUM IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA SMALL IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA LARGE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA LESS THAN 1000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA 1001-4000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA 4001-7000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA MORE THAN 7000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA STEADY-STATE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA DYNAMIC IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA LANDFILL ICE INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA OTHERS IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 47 U.S. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 48 U.S. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 68 CANADA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 70 CANADA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 76 MEXICO WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 MEXICO METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 78 MEXICO CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 79 MEXICO GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 80 MEXICO PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 MEXICO CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 82 MEXICO LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: MULTIVARIATE MODELING

FIGURE 11 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SIZE TIMELINE CURVE

FIGURE 12 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SEGMENTATION

FIGURE 13 RISE IN IMPORTANCE FOR GENERATING POWER FROM WASTE HEAT RECOVERY IS EXPECTED TO DRIVE THE NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET IN THE FORECAST PERIOD 2022-2029

FIGURE 14 MEDIUM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET

FIGURE 16 REAL GROSS DOMESTIC PRODUCT (GDP) GROWTH RATE OF INDIA

FIGURE 17 GEOTHERMAL POWER GENERATION IN THE NET ZERO SCENARIO, 2000-2030

FIGURE 18 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY SIZE, 2021

FIGURE 19 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY CAPACITY, 2021

FIGURE 20 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY MODEL, 2021

FIGURE 21 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY SIZE (2022-2029)

FIGURE 27 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.