North America Ophthalmology Lasers Market

Taille du marché en milliards USD

TCAC :

%

USD

938.91 Million

USD

1,583.40 Million

2022

2030

USD

938.91 Million

USD

1,583.40 Million

2022

2030

| 2023 –2030 | |

| USD 938.91 Million | |

| USD 1,583.40 Million | |

|

|

|

|

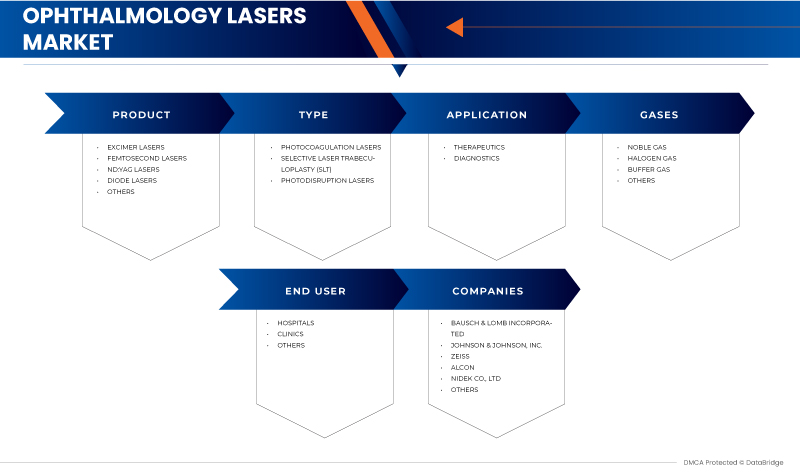

Marché des lasers ophtalmologiques en Amérique du Nord, par produit (lasers femtosecondes, lasers excimères, lasers Nd:YAG, lasers à diode et autres), type (lasers de photodisruption, trabéculoplastie sélective au laser (SLT) et lasers de photocoagulation), application (diagnostic et thérapeutique), gaz (gaz noble, gaz halogène, gaz tampon et autres), utilisateur final (hôpitaux, cliniques et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des lasers ophtalmologiques en Amérique du Nord

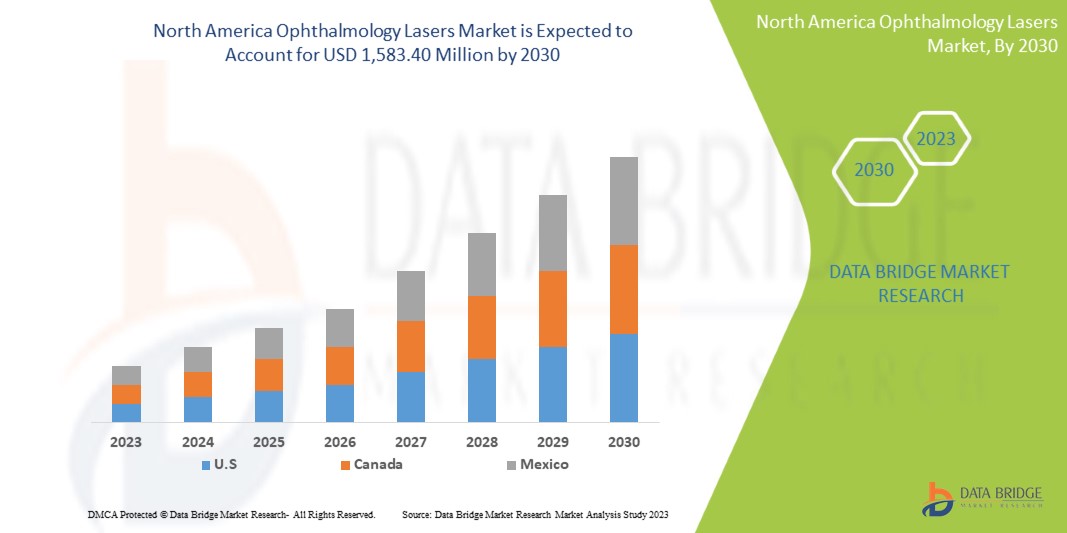

Le marché des lasers ophtalmologiques en Amérique du Nord devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,8 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 583,40 millions USD d'ici 2030 contre 938,91 millions USD en 2022.

Ce rapport sur le marché des lasers ophtalmologiques fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des lasers ophtalmologiques, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Produit (lasers femtosecondes, lasers excimères, lasers Nd:YAG, lasers à diode et autres), type (lasers à photodisruption, laser de trabéculoplastie sélective (SLT) et lasers à photocoagulation), application (diagnostic et thérapeutique), gaz (gaz noble, gaz halogène, gaz tampon et autres), utilisateur final (hôpitaux, cliniques et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

NIDEK CO., LTD., Calmar Laser, LENSAR, INC., OD-OS, Quantel Medical (une filiale de Lumibird Medical), Alcon, Ziemer Ophthalmic Systems AG, LIGHTMED, Johnson & Johnson Inc., Bausch & Lomb Incorporated, MEDA Co., Ltd., Topcon, Lumenis Be Ltd., IRIDEX Corporation et Zeiss, entre autres |

Définition du marché

Les lasers ophtalmologiques sont des dispositifs médicaux spécialisés qui émettent des faisceaux de lumière focalisés pour traiter diverses affections oculaires. Ces lasers sont couramment utilisés en ophtalmologie pour effectuer diverses procédures, telles que le traitement des troubles de la vision, la correction des erreurs de réfraction et la gestion de diverses maladies oculaires. Ces appareils ont gagné en importance et en adoption en raison de la forte prévalence de plusieurs maladies ophtalmiques, telles que le glaucome, la cataracte et d'autres problèmes liés à la vision.

Dynamique du marché des lasers ophtalmologiques en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l’incidence des maladies oculaires chroniques et transmissibles

Le domaine de l’ophtalmologie a connu une augmentation de l’incidence des maladies oculaires chroniques et transmissibles au cours des dernières années. Parmi les principaux facteurs contribuant à cette tendance figurent la croissance de la population nord-américaine, le vieillissement de la population, l’urbanisation croissante, l’évolution des modes de vie et l’exposition accrue aux polluants environnementaux. L’une des maladies oculaires chroniques les plus courantes est la dégénérescence maculaire liée à l’âge (DMLA). La DMLA est l’une des principales causes de cécité chez les personnes de plus de 60 ans et est causée par des lésions de la macula, une petite partie de la rétine responsable de la vision centrale. La prévalence de la DMLA devrait augmenter avec le vieillissement de la population nord-américaine. Une autre maladie oculaire chronique de plus en plus répandue est le glaucome. Le glaucome est un groupe de maladies oculaires qui endommagent le nerf optique et peuvent entraîner la cécité. Il est souvent asymptomatique jusqu’à ce qu’il atteigne un stade avancé, ce qui rend les examens oculaires réguliers essentiels pour une détection et un traitement précoces.

En mars 2023, selon un article d'Indian Express, Amérique du Nord, le glaucome est la deuxième cause de cécité après la cataracte. On estime qu'il provoque la cécité chez 4,5 millions de personnes dans le monde. Malgré cela, le glaucome reste largement non diagnostiqué, avec plus de 90 % des cas non traités. Ainsi, l'augmentation des incidences de maladies oculaires chroniques et transmissibles devrait stimuler la croissance du marché.

- Sensibilisation accrue des consommateurs aux traitements au laser

Les consommateurs sont de plus en plus sensibilisés aux thérapies au laser, ce qui a profité au marché des lasers ophtalmiques en Amérique du Nord. Plusieurs facteurs ont contribué à cette tendance, notamment les progrès technologiques, un meilleur accès à l'information et une plus grande importance accordée à l'éducation des patients. L'un des principaux moteurs de cette sensibilisation accrue des consommateurs est le développement de nouveaux systèmes laser qui offrent une précision améliorée, des temps de récupération réduits et de meilleurs résultats. Ces systèmes se sont révélés efficaces dans le traitement d'une gamme d'affections oculaires, des erreurs de réfraction aux troubles rétiniens plus complexes. Les patients sont de plus en plus intéressés par ces traitements et recherchent des ophtalmologues formés pour les utiliser. Un autre facteur contribuant à une sensibilisation accrue est la disponibilité des informations sur les lasers ophtalmiques. Les patients peuvent facilement accéder en ligne à des informations sur les différents types de traitements au laser disponibles, leurs avantages et leurs risques potentiels. Cela a contribué à démystifier les traitements au laser et à les rendre plus accessibles à un plus large éventail de patients, ce qui devrait stimuler la croissance du marché.

- Adoption croissante des procédures ambulatoires

Le domaine de l'ophtalmologie a connu des avancées significatives ces dernières années avec l'avènement de la technologie laser. Avec l'adoption croissante des procédures ambulatoires, le marché nord-américain des lasers ophtalmologiques présente une opportunité de croissance significative. Les procédures ambulatoires sont des procédures médicales qui ne nécessitent pas de séjour d'une nuit à l'hôpital. Ces procédures peuvent être effectuées dans un cabinet médical, un centre de chirurgie ambulatoire ou une clinique externe. Ainsi, l'adoption croissante des procédures ambulatoires devrait stimuler la croissance du marché.

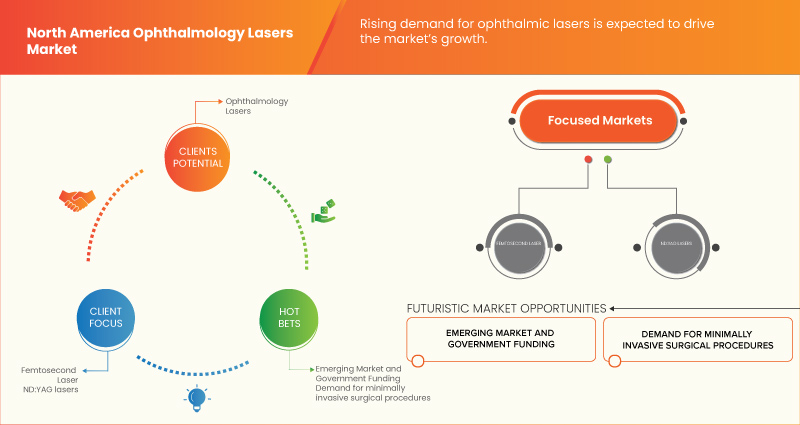

Opportunités

-

Progrès technologiques en ophtalmologie

Les avancées technologiques dans le domaine de l'ophtalmologie ont révolutionné le diagnostic, le traitement et la gestion de diverses maladies et affections oculaires. Ces avancées ont créé des opportunités importantes sur le marché nord-américain des lasers ophtalmologiques, avec le potentiel d'améliorer les résultats des patients, d'accroître l'efficacité et de stimuler la croissance du secteur. L'une des avancées technologiques les plus importantes en ophtalmologie a été le développement des lasers femtosecondes. Ces lasers sont utilisés pour des chirurgies de précision et peuvent créer des incisions plus précises et prévisibles que celles créées par les outils chirurgicaux traditionnels. Cette technologie a révolutionné des procédures telles que les lasers de photocoagulation, la trabéculoplastie sélective au laser (SLT), permettant des temps de récupération plus rapides et de meilleurs résultats visuels, ce qui devrait offrir une opportunité lucrative pour la croissance du marché.

Contraintes/Défis

- Manque de professionnels qualifiés

Les lasers ophtalmologiques sont utilisés dans diverses procédures, notamment les chirurgies réfractives, les chirurgies de la cataracte et le traitement du glaucome. Cependant, l'utilisation efficace de ces lasers nécessite des professionnels qualifiés et compétents dans leur manipulation. L'absence de tels professionnels peut entraîner des erreurs, des complications et des résultats indésirables, qui peuvent nuire aux patients et nuire à la réputation du secteur.

La principale raison de la pénurie de professionnels qualifiés est la complexité de l'équipement et des procédures impliquées. Les lasers ophtalmologiques nécessitent des connaissances et une expertise spécialisées, et la formation requise pour devenir compétent dans leur utilisation peut être longue et coûteuse. De plus, les procédures elles-mêmes sont souvent complexes et nécessitent un niveau élevé de compétence et de précision.

Par conséquent, le manque de professionnels qualifiés entravera le taux de croissance du marché des lasers ophtalmologiques. En outre, des règles et réglementations strictes constitueront un défi supplémentaire pour le marché au cours de la période de prévision.

Développement récent

- En novembre 2022, Alcon, leader nord-américain des soins oculaires dédié à aider les gens à voir brillamment, a annoncé avoir finalisé l'acquisition d'Aerie Pharmaceuticals, Inc. Cette transaction contribue à renforcer la présence d'Alcon dans l'espace pharmaceutique ophtalmique avec son portefeuille croissant de produits commerciaux et son pipeline de développement.

- En mars 2023, Bausch + Lomb Corporation et Novaliq GmbH ont annoncé que l'American Journal of Ophthalmology avait publié les résultats de MOJAVE, le deuxième essai pivot de phase 3 pour NOV03 (perfluorohexyloctane). NOV03 est étudié pour traiter les signes et symptômes de la sécheresse oculaire (SSO) associée au dysfonctionnement des glandes de Meibomius (MGD). Les résultats du premier essai pivot de phase 3, GOBI, ont été publiés plus tôt cette année dans l'American Journal of Ophthalmology.

Portée du marché des lasers ophtalmologiques en Amérique du Nord

Le marché nord-américain des lasers ophtalmologiques est segmenté en produits, types, applications, gaz et utilisateurs finaux. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Lasers femtosecondes

- Lasers à excimère

- Lasers Nd:YAG

- Lasers à diodes

- Autres

Sur la base du produit, le marché est segmenté en lasers femtoseconde, lasers excimères, lasers Nd:YAG, lasers à diode et autres.

Taper

- Lasers à photodisruption

- Trabéculoplastie sélective au laser (SLT)

- Lasers de photocoagulation

Sur la base du type, le marché est segmenté en lasers de photodisruption, de trabéculoplastie laser sélective (SLT) et de lasers de photocoagulation.

Application

- Diagnostic

- Thérapeutique

En fonction des applications, le marché est segmenté en diagnostic et en thérapeutique.

Gaz

- Gaz noble

- Gaz halogène

- Gaz tampon

- Autres

Sur la base des gaz, le marché est segmenté en gaz noble, gaz halogène, gaz tampon et autres.

Utilisateur final

- Hôpitaux

- Cliniques

- Autres

Sur la base de l’utilisateur final, le marché est segmenté en hôpitaux, cliniques et autres.

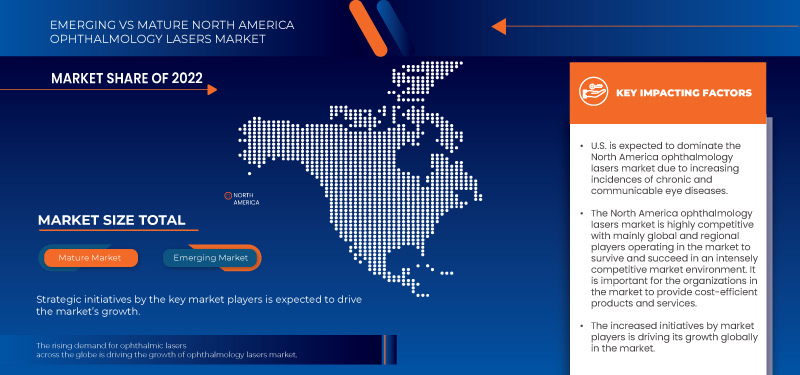

Analyse/perspectives régionales du marché des lasers ophtalmologiques en Amérique du Nord

Le marché des lasers ophtalmologiques en Amérique du Nord est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, produit, type, application, gaz et utilisateur final, comme référencé ci-dessus.

Les pays couverts par le marché des lasers ophtalmologiques en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché des lasers ophtalmologiques en Amérique du Nord en raison de la forte prévalence des troubles ophtalmiques dans la région et du développement rapide de la recherche.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des lasers ophtalmologiques en Amérique du Nord

Le paysage concurrentiel du marché des lasers ophtalmologiques en Amérique du Nord fournit des détails par concurrents. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des lasers ophtalmologiques en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché des lasers ophtalmologiques en Amérique du Nord sont NIDEK CO., LTD., Calmar Laser, LENSAR, INC., OD-OS, Quantel Medical (une filiale de Lumibird Medical), Alcon, Ziemer Ophthalmic Systems AG, LIGHTMED, Johnson & Johnson Inc., Bausch & Lomb Incorporated, MEDA Co., Ltd., Topcon, Lumenis Be Ltd., IRIDEX Corporation et Zeiss, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 STRATEGIC INITIATIVES

5 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INCIDENCES OF CHRONIC AND COMMUNICABLE EYE DISEASES

6.1.2 INCREASED CONSUMER AWARENESS FOR LASER TREATMENTS

6.1.3 INCREASING ADOPTION OF OUTPATIENT PROCEDURES

6.1.4 RISING DEMAND FOR MINIMALLY INVASIVE SURGICAL PROCEDURES

6.2 RESTRAINTS

6.2.1 HIGH COST OF OPHTHALMOLOGY LASER PROCEDURES

6.2.2 STRINGENT REGULATORY POLICIES

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN OPHTHALMOLOGY

6.3.2 EMERGING MARKETS AND GOVERNMENT FUNDING

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 SAFETY CONCERNS

7 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 EXCIMER LASERS

7.2.1 ARF

7.2.2 KRF

7.2.3 XECL

7.2.4 XEFL

7.2.5 F2

7.2.6 XEBR

7.3 FEMTOSECOND LASERS

7.3.1 SEMICONDUCTOR LASERS

7.3.2 SOLID-STATE BULK LASERS

7.3.3 FREQUENCY-CONVERTED SOURCES

7.3.4 FIBER LASERS

7.3.5 DYE LASERS

7.3.6 OTHERS

7.4 ND:YAG LASERS

7.4.1 ND: YAG LASER AT 1064 NM

7.4.2 ND: YAG GREEN LASER AT 532 NM

7.5 DIODE LASERS

7.6 OTHERS

8 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 PHOTOCOAGULATION LASERS

8.3 SELECTIVE LASER TRABECULOPLASTY (SLT)

8.4 PHOTODISRUPTION LASERS

9 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 THERAPEUTICS

9.2.1 CATARACT REMOVAL

9.2.2 GLAUCOMA TREATMENT

9.2.3 DIABETIC RETINOPATHY TREATMENT

9.2.4 REFRACTIVE ERROR CORRECTION

9.2.5 AMD TREATMENT

9.2.6 OTHERS

9.3 DIAGNOSTICS

9.3.1 OPTICAL COHERENCE TOMOGRAPHY (OCT)

9.3.2 SCANNING LASER OPHTHALMOSCOPE (SLO)

10 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY GASES

10.1 OVERVIEW

10.2 NOBLE GAS

10.2.1 ARGON

10.2.2 XENON

10.2.3 KRYPTON

10.3 HALOGEN GAS

10.3.1 CHLORINE

10.3.2 BROMINE

10.3.3 FLOURINE

10.4 BUFFER GAS

10.4.1 HELIUM

10.4.2 NEON

10.5 OTHERS

11 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 CLINICS

11.4 OTHERS

12 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, CPS

15.1 BAUSCH & LOMB INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 JOHNSON & JOHNSON, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ZEISS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ALCON

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 NIDEK CO., LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ARC LASER GMBH

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AUROLAB

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CALMAR LASER

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 IRIDEX CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 IVIS TECHNOLOGIES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 LENSAR, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 LUMENIS BE LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 LIGHTMED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MEDA CO., LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 OD-OS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 QUANTEL MEDICAL (A SUBSIDIARY OF LUMIBIRD MEDICAL)

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 SCHWIND EYE-TECH-SOLUTIONS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TOPCON

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 ZIEMER OPHTHALMIC SYSTEMS AG

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 3 NORTH AMERICA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA DIODE LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OTHERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PHOTOCOAGULATION LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SELECTIVE LASER TRABECULOPLASTY (SLT) IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PHOTODISRUPTION LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA DIAGNOSTICS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA NOBLE GAS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA HOSPITALS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA CLINICS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT , 2021-2030 (UNITS)

TABLE 35 NORTH AMERICA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 47 U.S. OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 U.S. OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 49 U.S. OPHTHALMOLOGY LASERS MARKET, BY PRODUCTS, 2021-2030, (ASP)

TABLE 50 U.S. EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 U.S. FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 52 U.S. ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 53 U.S. OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 55 U.S. THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 U.S. DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 U.S. OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 58 U.S. NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 59 U.S. HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 60 U.S. BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 61 U.S. OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 62 CANADA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 63 CANADA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 64 CANADA OPHTHALMOLOGY LASERS MARKET, BY PRODUCTS, 2021-2030, (ASP)

TABLE 65 CANADA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 66 CANADA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 67 CANADA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 68 CANADA OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 CANADA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 CANADA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 CANADA DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 CANADA OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 73 CANADA NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 74 CANADA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 75 CANADA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 76 CANADA OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 MEXICO OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 78 MEXICO OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 79 MEXICO OPHTHALMOLOGY LASERS MARKET, BY PRODUCTS, 2021-2030, (ASP)

TABLE 80 MEXICO EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 MEXICO FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 MEXICO ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 83 MEXICO OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 MEXICO OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 85 MEXICO THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 MEXICO DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 MEXICO OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 88 MEXICO NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 89 MEXICO HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 90 MEXICO BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 91 MEXICO OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SEGMENTATION

FIGURE 11 RISING TRAUMATIC INJURIES AND AN INCREASING GERIATRIC POPULATION ARE EXPECTED TO DRIVE THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 EXCIMER LASERS IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET IN THE FORECAST PERIOD 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET

FIGURE 14 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE, 2022

FIGURE 19 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES, 2022

FIGURE 27 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES, LIFELINE CURVE

FIGURE 30 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER, 2022

FIGURE 31 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT (2023-2030)

FIGURE 39 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.