North America Medical Device Sterilization Market

Taille du marché en milliards USD

TCAC :

%

USD

2.05 Billion

USD

3.91 Billion

2024

2032

USD

2.05 Billion

USD

3.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.05 Billion | |

| USD 3.91 Billion | |

|

|

|

|

Segmentation du marché nord-américain de la stérilisation des dispositifs médicaux, par produit (instruments, réactifs et services), technologie (stérilisation thermique, stérilisation par rayonnement ionisant, stérilisation par filtration et stérilisation gazeuse et chimique), utilisateur final (laboratoires pharmaceutiques, hôpitaux, cliniques, laboratoires, instituts universitaires et de recherche, fabricants de dispositifs médicaux et autres), canal de distribution (appels d'offres directs, vente au détail et distributeurs tiers) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché nord-américain de la stérilisation des dispositifs médicaux

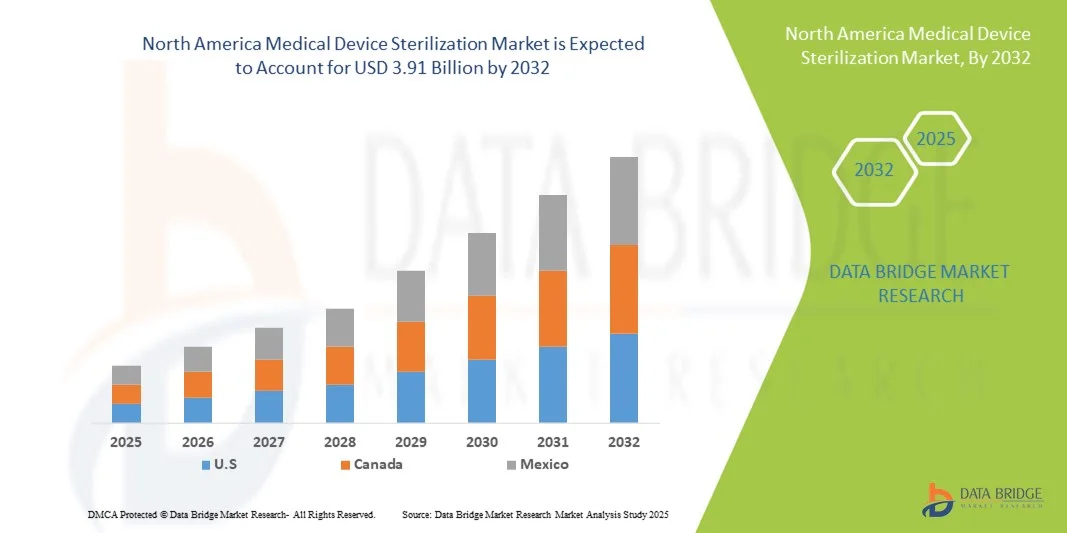

- La taille du marché nord-américain de la stérilisation des dispositifs médicaux était évaluée à 2,05 milliards USD en 2024 et devrait atteindre 3,91 milliards USD d'ici 2032 , à un TCAC de 8,40 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante des infections nosocomiales (IAS), le nombre croissant d'interventions chirurgicales et les progrès des technologies de stérilisation, ce qui entraîne une demande accrue de dispositifs médicaux stériles dans les hôpitaux et autres établissements de soins de santé.

- De plus, les exigences réglementaires croissantes en matière de contrôle des infections, conjuguées au besoin croissant de procédés de stérilisation sûrs et efficaces, font de la stérilisation des dispositifs médicaux un élément essentiel des infrastructures de santé modernes. Ces facteurs convergents accélèrent l'adoption de solutions de stérilisation, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché nord-américain de la stérilisation des dispositifs médicaux

- La stérilisation des dispositifs médicaux, qui comprend des méthodes telles que la stérilisation à la vapeur, au gaz et aux radiations pour les instruments chirurgicaux et les équipements médicaux, est de plus en plus critique dans les établissements de santé en raison des exigences croissantes en matière de contrôle des infections, des préoccupations en matière de sécurité des patients et des normes réglementaires strictes dans les hôpitaux, les cliniques et les laboratoires.

- La demande croissante de solutions de stérilisation est principalement alimentée par la prévalence croissante des infections nosocomiales (IAS), le nombre croissant d'interventions chirurgicales et les progrès technologiques dans les équipements de stérilisation qui améliorent l'efficacité et la sécurité.

- Les États-Unis ont dominé le marché nord-américain de la stérilisation des dispositifs médicaux avec la plus grande part de revenus de 67,8 % en 2024, caractérisé par une infrastructure de soins de santé avancée, des dépenses de santé élevées et une forte présence d'acteurs clés de l'industrie.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché nord-américain de la stérilisation des dispositifs médicaux au cours de la période de prévision en raison de l'augmentation des investissements dans les infrastructures de santé et de la sensibilisation croissante aux protocoles de contrôle des infections.

- Le segment de la stérilisation thermique a dominé le marché nord-américain de la stérilisation des dispositifs médicaux par technologie avec une part de marché de 39 % en 2024, grâce à sa fiabilité éprouvée, sa rentabilité et son application généralisée aux instruments médicaux, aux réactifs et à d'autres produits de santé.

Portée du rapport et segmentation du marché nord-américain de la stérilisation des dispositifs médicaux

|

Attributs |

Aperçu du marché nord-américain de la stérilisation des dispositifs médicaux |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché nord-américain de la stérilisation des dispositifs médicaux

Progrès dans la stérilisation à basse température et via l'IoT

- Une tendance importante et croissante sur le marché nord-américain de la stérilisation des dispositifs médicaux est l'adoption de technologies de stérilisation à basse température telles que le plasma au peroxyde d'hydrogène et l'ozone, réduisant les dommages aux instruments sensibles à la chaleur tout en maintenant la stérilité.

- Par exemple, les systèmes STERRAD NX utilisent la stérilisation au plasma au peroxyde d'hydrogène à basse température pour les instruments chirurgicaux délicats, améliorant ainsi l'efficacité opérationnelle et la durée de vie de l'appareil.

- L'intégration de stérilisateurs IoT permet une surveillance en temps réel, une maintenance prédictive et des rapports automatisés, améliorant ainsi le contrôle opérationnel et le suivi de la conformité. Par exemple, la plateforme SteriLog de Getinge intègre les stérilisateurs aux systèmes informatiques hospitaliers, permettant ainsi une gestion centralisée des cycles de stérilisation, des journaux d'utilisation et des plannings de maintenance.

- La tendance à combiner la stérilisation avec l’analyse des données et la maintenance prédictive aide les prestataires de soins de santé à réduire les temps d’arrêt et à optimiser l’allocation des ressources.

- Cette tendance vers une stérilisation plus intelligente, automatisée et à basse température remodèle les attentes en matière de sécurité et d’efficacité dans les hôpitaux et les installations pharmaceutiques.

- La demande de systèmes de stérilisation avancés combinant des processus à basse température avec une connectivité IoT augmente rapidement dans les hôpitaux, les cliniques et les unités de fabrication pharmaceutique, car les prestataires de soins de santé accordent la priorité à la sécurité des patients et à l'efficacité opérationnelle.

Dynamique du marché nord-américain de la stérilisation des dispositifs médicaux

Conducteur

Demande croissante en raison de l'augmentation des interventions chirurgicales et du contrôle des infections

- Le nombre croissant d’interventions chirurgicales et l’incidence croissante des infections nosocomiales (IAS) constituent un facteur important de la demande accrue de solutions de stérilisation avancées.

- Par exemple, en mars 2024, STERIS a annoncé une extension de ses systèmes de stérilisation automatisés dans les hôpitaux américains pour répondre aux charges de travail chirurgicales croissantes et aux exigences de contrôle des infections.

- Alors que les établissements de santé mettent l'accent sur la sécurité des patients et la conformité réglementaire, la stérilisation des dispositifs médicaux offre des processus fiables et validés pour prévenir la contamination croisée et garantir la stérilité.

- De plus, l’adoption de stérilisateurs avancés qui s’intègrent aux systèmes informatiques des hôpitaux permet une documentation, un suivi et des rapports transparents, ce qui est essentiel pour le respect de la réglementation.

- L'amélioration de l'efficacité opérationnelle, la réduction des temps d'arrêt des instruments et les procédures de stérilisation standardisées sont des facteurs clés qui favorisent l'adoption de systèmes de stérilisation modernes dans les hôpitaux, les cliniques et les unités de fabrication pharmaceutique.

- La demande croissante d'instruments médicaux stériles dans les laboratoires de production et de recherche pharmaceutiques crée des opportunités de croissance supplémentaires pour les technologies de stérilisation. Par exemple, Midmark Corporation a élargi son offre de stérilisation pour les laboratoires de biotechnologie produisant des médicaments injectables, répondant ainsi aux exigences de stérilité et de conformité.

- Les initiatives gouvernementales de soutien promouvant la sécurité des patients et les normes de contrôle des infections aux États-Unis stimulent encore davantage la croissance du marché.

Retenue/Défi

Coût élevé des équipements et obstacles à la conformité réglementaire

- Le coût initial relativement élevé des équipements de stérilisation avancés, associé aux dépenses de maintenance continues, constitue un défi important pour une pénétration plus large du marché.

- Par exemple, les stérilisateurs sophistiqués à basse température ou les systèmes automatisés de STERIS ou Getinge nécessitent des investissements en capital substantiels, ce qui peut constituer un obstacle pour les petits établissements de santé.

- Le respect des normes strictes de stérilisation de la FDA et des CDC des États-Unis accroît la complexité opérationnelle et nécessite une formation continue du personnel, ce qui accroît les coûts et les difficultés d'adoption. Par exemple, les hôpitaux doivent tenir des registres de stérilisation détaillés et respecter des protocoles validés pour satisfaire aux audits réglementaires, ce qui peut grever les ressources des établissements de petite taille ou sous-financés.

- Le manque de connaissances et d'expertise technique des petits prestataires de soins en matière d'utilisation de systèmes de stérilisation avancés peut ralentir leur adoption. Par exemple, les cliniques peuvent avoir besoin d'une formation externe ou d'un service après-vente pour utiliser correctement les stérilisateurs Tuttnauer ou Midmark, ce qui complexifie les opérations.

- Les temps d’arrêt et les perturbations potentiels lors de l’installation ou de la maintenance d’équipements de stérilisation haut de gamme peuvent également entraver une adoption rapide.

Portée du marché nord-américain de la stérilisation des dispositifs médicaux

Le marché est segmenté en fonction du produit, de la technologie, de l’utilisateur final et du canal de distribution.

- Par produit

Le marché est segmenté en fonction des produits : instruments, réactifs et services. Le segment des instruments a dominé le marché avec la plus grande part de chiffre d’affaires en 2024, porté par la forte demande d’instruments chirurgicaux et d’outils de diagnostic stérilisés dans les hôpitaux, les cliniques et les laboratoires. Les hôpitaux et les centres chirurgicaux accordent une importance primordiale à la stérilisation des instruments afin de garantir la sécurité des patients et le respect des normes réglementaires strictes. L’utilisation généralisée d’instruments réutilisables et le nombre croissant d’interventions chirurgicales contribuent également à la croissance de ce segment. Les équipements de stérilisation avancés conçus pour les instruments, tels que les autoclaves automatisés et les stérilisateurs basse température, améliorent également l’efficacité opérationnelle. De plus, ce segment bénéficie d’une innovation continue dans les technologies de stérilisation adaptées aux instruments sensibles. Globalement, les instruments restent essentiels en raison de leur rôle direct dans les soins aux patients et la prévention des infections.

Le secteur des services devrait connaître la croissance la plus rapide entre 2025 et 2032, stimulé par la tendance à l'externalisation des établissements de santé et des laboratoires pharmaceutiques. Les prestataires de services proposent la stérilisation en tant que service, réduisant ainsi la nécessité pour les hôpitaux et les laboratoires d'investir massivement dans des équipements internes. Ce secteur bénéficie également d'exigences réglementaires strictes, ce qui fait des services de stérilisation par des tiers une option intéressante pour les petites structures ou les applications spécialisées. L'essor des industries biotechnologiques et pharmaceutiques, où les procédés stériles sont essentiels, stimule encore davantage la demande de services de stérilisation professionnels. De plus, les prestataires de services proposent souvent des solutions intégrées, incluant la surveillance, la documentation et la validation, améliorant ainsi l'efficacité opérationnelle. La praticité, la rentabilité et l'accès à des technologies de pointe contribuent à l'adoption rapide des services de stérilisation.

- Par technologie

Sur le plan technologique, le marché est segmenté en stérilisation thermique, stérilisation par rayonnement ionisant, stérilisation par filtration et stérilisation gazeuse et chimique. Le segment de la stérilisation thermique a dominé le marché avec la plus grande part de chiffre d'affaires (39 %) en 2024, grâce à sa fiabilité éprouvée, sa rentabilité et sa large application dans les établissements de santé. Les autoclaves à vapeur et autres stérilisateurs thermiques sont privilégiés pour leur capacité à stériliser efficacement une large gamme d'instruments. Cette méthode est bien établie, validée et largement soutenue par les directives réglementaires, ce qui en fait un choix privilégié pour les hôpitaux et les laboratoires. Ce taux d'adoption élevé est également soutenu par les améliorations technologiques continues en matière de conception des autoclaves, d'efficacité énergétique et de suivi des cycles. Les professionnels de santé font confiance à la stérilisation thermique pour sa simplicité, sa reproductibilité et son efficacité durable dans la prévention des infections.

Le segment de la stérilisation par rayonnement ionisant devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son adéquation aux dispositifs médicaux et aux produits pharmaceutiques thermosensibles. Les rayons gamma, les faisceaux d'électrons et les rayons X permettent de stériliser les produits sans provoquer de dommages thermiques, un atout essentiel pour les instruments et implants médicaux modernes. Le secteur pharmaceutique recourt de plus en plus à la stérilisation par rayonnement pour les dispositifs à usage unique, les médicaments injectables et les matériaux d'emballage. Sa capacité à assurer une stérilisation uniforme à grande échelle favorise une adoption industrielle rapide. L'approbation réglementaire croissante et la sensibilisation croissante aux avantages de la stérilisation par rayonnement accélèrent encore son adoption. La précision, la rapidité et la compatibilité de cette méthode avec les matériaux sensibles en font un secteur de croissance clé sur le marché nord-américain.

- Par utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en laboratoires pharmaceutiques, hôpitaux, cliniques, laboratoires, instituts universitaires et de recherche, fabricants de dispositifs médicaux, etc. Le segment hospitalier a dominé le marché avec la plus grande part de chiffre d'affaires en 2024, grâce au volume élevé d'interventions chirurgicales, au besoin crucial d'instruments stériles et au respect de protocoles rigoureux de contrôle des infections. Les hôpitaux ont besoin de solutions de stérilisation fiables pour garantir la sécurité des patients, la conformité réglementaire et l'efficacité opérationnelle. Le nombre croissant d'interventions en milieu hospitalier et de chirurgies mini-invasives contribue à une demande soutenue. L'intégration de stérilisateurs avancés aux systèmes informatiques hospitaliers pour la surveillance et la documentation favorise également l'adoption. Les hôpitaux restent le principal utilisateur final en raison de leur utilisation intensive de dispositifs et d'instruments médicaux nécessitant une stérilisation fréquente.

Le secteur des sociétés pharmaceutiques devrait connaître la croissance la plus rapide entre 2025 et 2032, alimentée par la production croissante de médicaments stériles, de produits biologiques et de thérapies injectables. Les fabricants de produits pharmaceutiques ont besoin de solutions de stérilisation à haut volume pour les réactifs, les instruments et les lignes de production. Les directives strictes de la FDA et de l'USP en matière de stérilité, combinées à l'externalisation croissante des services de stérilisation, stimulent l'adoption par le marché. Les technologies avancées telles que la stérilisation à basse température et par irradiation sont particulièrement pertinentes pour les produits sensibles. L'augmentation des activités de R&D dans les produits biologiques et les médicaments injectables stériles soutient également la croissance du secteur. Les exigences de conformité, de sécurité et de cadence élevée font des sociétés pharmaceutiques un segment d'utilisateurs finaux en pleine expansion.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en appels d'offres directs, vente au détail et distributeurs tiers. Le segment des appels d'offres directs a dominé le marché, enregistrant la plus grande part de chiffre d'affaires en 2024, grâce aux hôpitaux, cliniques et grandes entreprises pharmaceutiques qui s'approvisionnent en équipements de stérilisation directement auprès des fabricants. L'achat direct garantit le respect des obligations contractuelles, des garanties, des contrats de service et de maintenance. L'approvisionnement en gros par appels d'offres réduit les coûts opérationnels et permet aux établissements d'accéder aux dernières technologies de stérilisation. Les accords d'appels d'offres directs favorisent également l'intégration avec les systèmes informatiques et les systèmes de flux de travail existants des hôpitaux ou des laboratoires. La préférence pour les appels d'offres directs est renforcée par des contrats de service à long terme et des investissements à forte valeur ajoutée.

Le segment des distributeurs tiers devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par la demande croissante des petits établissements de santé, laboratoires et cliniques qui ne peuvent pas investir massivement dans l'approvisionnement direct. Les distributeurs offrent un accès flexible à des équipements et consommables de stérilisation de pointe sans investissement initial important. Ils proposent souvent une assistance à la maintenance, à l'installation et à la formation, facilitant ainsi l'adoption par les utilisateurs finaux. La croissance des établissements de santé éloignés et de petite taille en Amérique du Nord soutient également les ventes menées par les distributeurs. La disponibilité de marques et de technologies diversifiées par l'intermédiaire des distributeurs accroît également la pénétration du marché. Leur rentabilité et leur simplicité d'utilisation font des distributeurs tiers un canal en pleine expansion.

Analyse régionale du marché nord-américain de la stérilisation des dispositifs médicaux

- Les États-Unis ont dominé le marché nord-américain de la stérilisation des dispositifs médicaux avec la plus grande part de revenus de 67,8 % en 2024, caractérisé par une infrastructure de soins de santé avancée, des dépenses de santé élevées et une forte présence d'acteurs clés de l'industrie.

- Les prestataires de soins de santé et les sociétés pharmaceutiques de la région accordent la priorité à la sécurité des patients, au contrôle des infections et à la conformité, ce qui rend les solutions de stérilisation essentielles dans les hôpitaux, les cliniques, les laboratoires et les installations de fabrication.

- Cette adoption généralisée est en outre soutenue par une forte présence d'acteurs clés de l'industrie, des dépenses de santé élevées et des investissements continus dans les technologies de stérilisation avancées, faisant des États-Unis le premier marché de la stérilisation des dispositifs médicaux en Amérique du Nord.

Aperçu du marché américain de la stérilisation des dispositifs médicaux

En 2024, le marché américain de la stérilisation des dispositifs médicaux a représenté la plus grande part de chiffre d'affaires en Amérique du Nord, avec 67,8 %, grâce à la forte prévalence des infections nosocomiales, à l'augmentation des interventions chirurgicales et à l'amélioration des infrastructures de santé. Les prestataires de soins accordent une importance primordiale à la sécurité des patients et à la conformité réglementaire, rendant les solutions de stérilisation essentielles dans les hôpitaux, les cliniques et les laboratoires. La demande croissante de systèmes de stérilisation automatisés, à basse température et compatibles avec l'IoT stimule encore davantage le marché. De plus, la présence d'acteurs clés du secteur tels que STERIS, Getinge et Tuttnauer, combinée aux avancées technologiques continues, contribue significativement à l'expansion du marché.

Aperçu du marché canadien de la stérilisation des dispositifs médicaux

Le marché canadien de la stérilisation des dispositifs médicaux devrait connaître une croissance substantielle au cours de la période de prévision, grâce à l'augmentation des investissements dans les infrastructures de santé et à la sensibilisation accrue à la prévention des infections. Les hôpitaux, les cliniques et les sociétés pharmaceutiques adoptent de plus en plus de systèmes de stérilisation avancés pour respecter les normes réglementaires et assurer la sécurité des patients. L'accent mis par le gouvernement sur la qualité des soins de santé et les exigences rigoureuses de conformité favorise la croissance du marché. De plus, l'automatisation et l'intégration de l'IdO dans les stérilisateurs gagnent du terrain, permettant une surveillance, une documentation et une maintenance prédictive efficaces dans les établissements de santé.

Aperçu du marché mexicain de la stérilisation des dispositifs médicaux

Le marché mexicain de la stérilisation des dispositifs médicaux devrait connaître une croissance annuelle moyenne (TCAC) remarquable au cours de la période de prévision, portée par la croissance du nombre d'établissements de santé et la multiplication des interventions chirurgicales. La sensibilisation croissante au contrôle des infections et à la sécurité des patients encourage les hôpitaux et les cliniques à investir dans des équipements de stérilisation fiables. La croissance du marché est également soutenue par les collaborations entre distributeurs locaux et fabricants mondiaux d'équipements de stérilisation. Par ailleurs, l'adoption des technologies de stérilisation à basse température et par rayonnement se développe, notamment dans les hôpitaux privés et les cliniques spécialisées, afin de répondre aux exigences d'efficacité et de conformité.

Part de marché de la stérilisation des dispositifs médicaux en Amérique du Nord

L’industrie nord-américaine de la stérilisation des dispositifs médicaux est principalement dirigée par des entreprises bien établies, notamment :

- STERIS (États-Unis)

- Sterigenics US, LLC (États-Unis)

- Sotera Health (États-Unis)

- Getinge AB (Suède)

- Cardinal Health (États-Unis)

- 3M (États-Unis)

- Midmark Corporation (États-Unis)

- Merck KGaA, (Allemagne)

- Dentsply Sirona (États-Unis)

- MATACHANA (Espagne)

- SciCan Ltée (Canada)

- MELAG Medizintechnik GmbH & Co. KG (Allemagne)

- Groupe MMM (Allemagne)

- ASP (États-Unis)

- Tuttnauer USA Co. Ltd. (États-Unis)

- Steelco SpA (Italie)

- Belimed AG (Suisse)

- Systec GmbH (Allemagne)

- BMT USA, LLC (États-Unis)

- Continental Equipment Company (États-Unis)

Quels sont les développements récents sur le marché de la stérilisation des dispositifs médicaux en Amérique du Nord ?

- En novembre 2024, la Food and Drug Administration (FDA) des États-Unis a publié des directives sur la politique d'application transitoire concernant les modifications des installations de stérilisation à l'oxyde d'éthylène pour les dispositifs de classe III. Cette politique décrit l'approche de la FDA pour garantir la sécurité continue des patients et la disponibilité des dispositifs lors de la mise en œuvre de nouvelles méthodes de stérilisation ou de modifications des installations. Ces directives reflètent l'engagement de l'agence à concilier la conformité réglementaire et la nécessité de processus de stérilisation efficaces.

- En novembre 2024, Cosmed Group Inc., une entreprise de stérilisation, s'est placée sous la protection du Chapitre 11 de la loi sur les faillites suite à de nombreuses poursuites alléguant des blessures, dont des cancers, dues à une exposition à l'oxyde d'éthylène. L'entreprise a fait face à au moins 300 poursuites et avait déjà conclu un accord à l'amiable avec l'EPA pour un montant de 1,5 million de dollars concernant les émissions d'oxyde d'éthylène (OE) de plusieurs installations. Cette évolution souligne les risques juridiques et financiers croissants associés aux méthodes de stérilisation traditionnelles.

- En juillet 2024, Noxilizer, Inc. a annoncé un investissement de 30 millions de dollars américains pour développer sa plateforme de stérilisation au dioxyde d'azote (NO₂). Cette technologie offre une alternative plus sûre et non cancérigène à l'oxyde d'éthylène (OE), répondant ainsi aux pressions réglementaires croissantes. Ce financement permettra de développer les systèmes de stérilisation au NO₂ et de fournir une solution viable pour la stérilisation des dispositifs médicaux, sans les risques sanitaires associés à l'OE.

- En avril 2024, l'usine de Sterilization Services of Tennessee à Memphis, qui utilisait de l'oxyde d'éthylène pour la stérilisation du matériel médical, a annoncé sa fermeture en raison de problèmes de prolongation de bail. Cette fermeture est perçue comme une victoire par les associations environnementales, car l'usine était une source de préoccupations sanitaires liées à l'exposition à l'oxyde d'éthylène (OE) dans les communautés voisines. Cette fermeture met en lumière les défis et la surveillance constantes auxquels sont confrontées les installations utilisant l'OE pour la stérilisation.

- En mars 2024, l'Agence américaine de protection de l'environnement (EPA) a finalisé une réglementation visant à réduire d'environ 90 % les émissions d'oxyde d'éthylène (OEt) des installations de stérilisation commerciales. Cette décision a été motivée par l'augmentation des risques de cancer associés à une exposition prolongée à l'OEt. La nouvelle réglementation impose à près de 90 installations de mettre en œuvre des contrôles de pollution et des analyses de qualité de l'air renforcés. Si cette mesure vise à protéger la santé publique, elle suscite des inquiétudes quant aux perturbations potentielles de la chaîne d'approvisionnement des dispositifs médicaux.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.