North America Medical Automation Market

Taille du marché en milliards USD

TCAC :

%

USD

35.34 Billion

USD

75.75 Billion

2025

2033

USD

35.34 Billion

USD

75.75 Billion

2025

2033

| 2026 –2033 | |

| USD 35.34 Billion | |

| USD 75.75 Billion | |

|

|

|

|

Segmentation du marché de l'automatisation médicale en Amérique du Nord, par composant (équipements, logiciels et services), type (préparation et distribution automatisées d'ordonnances, évaluation et surveillance automatisées de la santé, imagerie et analyse d'images automatisées, logistique automatisée des soins de santé, suivi des ressources et du personnel, robotique médicale et dispositifs chirurgicaux assistés par ordinateur, procédures thérapeutiques automatisées (non chirurgicales) et analyses de laboratoire automatisées), application (diagnostic et surveillance, thérapeutique, automatisation des laboratoires et des pharmacies, logistique et formation médicales et autres), connectivité (filaire et sans fil), utilisateur final (hôpitaux, centres de diagnostic, pharmacies, laboratoires et instituts de recherche, soins à domicile, cliniques spécialisées, centres de chirurgie ambulatoire et autres), canal de distribution (appel d'offres direct, vente au détail, vente en ligne et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché de l'automatisation médicale en Amérique du Nord

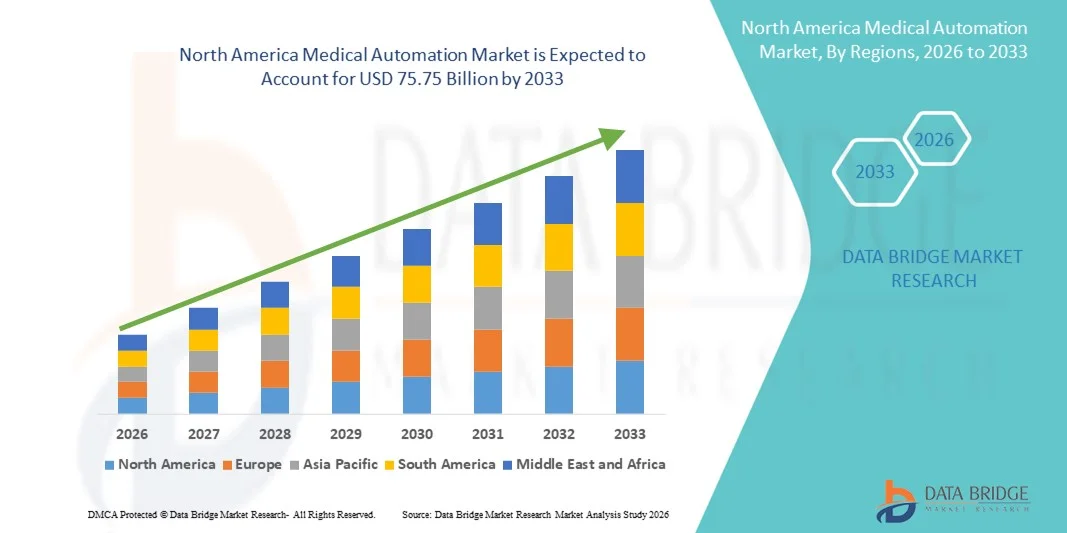

- Le marché nord-américain de l'automatisation médicale était évalué à 35,34 milliards de dollars américains en 2025 et devrait atteindre 75,75 milliards de dollars américains d'ici 2033 , avec un TCAC de 10,00 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption rapide des systèmes informatiques de pointe en matière de soins de santé, de robotique et d'intelligence artificielle dans les hôpitaux et les laboratoires de diagnostic, ce qui conduit à une automatisation accrue des flux de travail cliniques, administratifs et opérationnels, tant en milieu hospitalier qu'ambulatoire.

- De plus, la demande croissante d'une meilleure efficacité opérationnelle, d'une réduction des erreurs humaines, d'une maîtrise des coûts et d'une sécurité accrue des patients fait de l'automatisation médicale un élément essentiel des soins de santé modernes. Ces facteurs convergents accélèrent l'adoption des solutions d'automatisation médicale, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché de l'automatisation médicale en Amérique du Nord

- L'automatisation médicale, qui englobe la robotique, les logiciels basés sur l'IA, les diagnostics automatisés et les solutions de flux de travail numériques, devient de plus en plus essentielle dans les hôpitaux, les laboratoires et les établissements de soins ambulatoires, car les prestataires de soins de santé cherchent à améliorer l'efficacité opérationnelle, la précision clinique et la sécurité des patients.

- La demande croissante d'automatisation médicale est principalement due à l'augmentation du nombre de patients, à la pression croissante pour réduire les coûts opérationnels, à la pénurie de professionnels de santé qualifiés et à l'adoption rapide des technologies de santé numérique , d'IA et de robotique dans les processus cliniques et administratifs.

- Les États-Unis ont dominé le marché de l'automatisation médicale en Amérique du Nord, avec la plus grande part de revenus (environ 38,6 %) en 2025. Cette domination s'explique par une infrastructure de santé bien établie, l'adoption précoce de solutions d'automatisation avancées, la généralisation des diagnostics basés sur l'IA, de la chirurgie robotique et de l'automatisation hospitalière, ainsi que par d'importants investissements de la part des principales entreprises de technologies médicales.

- Le Canada devrait connaître la croissance la plus rapide sur le marché de l'automatisation médicale au cours de la période de prévision, avec un TCAC robuste de 11,8 %, grâce à la modernisation croissante des établissements de santé, aux initiatives gouvernementales fortes en faveur de la numérisation des soins de santé, à l'adoption croissante de la robotique médicale et aux investissements croissants des acteurs nationaux et internationaux dans les solutions pour hôpitaux intelligents.

- Le segment câblé a dominé le marché avec une part de revenus de près de 58,2 % en 2025, principalement grâce à sa fiabilité supérieure, à la stabilité de sa transmission de données et à sa faible latence dans les environnements de soins de santé critiques.

Portée du rapport et segmentation du marché de l'automatisation médicale

|

Attributs |

Principaux enseignements du marché de l'automatisation médicale |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

• Siemens Healthineers (Allemagne) |

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, l'épidémiologie des patients, l'analyse du pipeline, l'analyse des prix et le cadre réglementaire. |

Tendances du marché de l'automatisation médicale en Amérique du Nord

Adoption croissante des flux de travail automatisés en milieu clinique et de laboratoire

- Une tendance importante et croissante sur le marché mondial de l'automatisation médicale est l'adoption généralisée des systèmes automatisés dans les hôpitaux, les laboratoires de diagnostic, les sites de production pharmaceutique et les centres de soins ambulatoires afin d'améliorer l'efficacité, la précision et la sécurité des patients.

- Par exemple, en 2024, Siemens Healthineers a étendu le déploiement de ses plateformes d'automatisation de laboratoire en Amérique du Nord et en Asie-Pacifique, prenant en charge les diagnostics à haut débit et les flux de travail de tests standardisés à l'échelle mondiale.

- Les solutions d'automatisation médicale sont de plus en plus utilisées pour rationaliser les tâches cliniques et administratives répétitives telles que la préparation des échantillons, la distribution des médicaments, la surveillance des patients et la gestion des données, réduisant ainsi considérablement les interventions manuelles et les taux d'erreur.

- La demande mondiale croissante de diagnostics plus rapides, de résultats cliniques cohérents et de tests à grande échelle accélère l'adoption de l'automatisation sur les marchés de la santé développés et émergents.

- Les progrès réalisés dans le domaine de la robotique, des plateformes logicielles intégrées et des systèmes dotés de capteurs permettent une coordination fluide entre les différentes fonctions de soins de santé, améliorant ainsi la continuité des flux de travail dans des environnements de soins complexes.

- Cette transition vers des systèmes de santé automatisés, évolutifs et interopérables transforme fondamentalement les modèles de prestation de soins de santé à l'échelle mondiale et renforce le rôle de l'automatisation médicale dans le monde entier.

Dynamique du marché de l'automatisation médicale en Amérique du Nord

Conducteur

Exigences croissantes en matière de soins de santé à l'échelle mondiale

- L'augmentation du fardeau mondial des maladies chroniques, le vieillissement des populations et la hausse du nombre de patients sont des facteurs clés qui soutiennent la croissance du marché mondial de l'automatisation médicale.

- Par exemple, en avril 2025, Fresenius Medical Care a annoncé le déploiement mondial de solutions automatisées de gestion et de surveillance des traitements dans ses centres de dialyse répartis dans plusieurs régions, dans le but d'améliorer la cohérence des soins et l'efficacité opérationnelle.

- Les prestataires de soins de santé du monde entier adoptent de plus en plus les technologies d'automatisation pour pallier la pénurie de personnel, réduire les coûts opérationnels et améliorer la cohérence des processus cliniques.

- L'expansion des laboratoires centralisés, des centres de production pharmaceutique et des établissements de soins ambulatoires dans des régions telles que l'Asie-Pacifique, l'Amérique latine et le Moyen-Orient alimente encore davantage la demande de systèmes médicaux automatisés.

- En outre, les initiatives mondiales de modernisation des soins de santé et les investissements dans les infrastructures numériques et automatisées accélèrent l'intégration des solutions d'automatisation dans les établissements de santé publics et privés.

- Ces facteurs, pris ensemble, créent une forte dynamique de croissance soutenue du marché mondial de l'automatisation médicale au cours de la période prévisionnelle.

Retenue/Défi

Coûts d'investissement élevés et complexité de mise en œuvre

- L'investissement initial élevé requis pour les systèmes d'automatisation médicale avancés demeure un défi majeur pour les prestataires de soins de santé, en particulier dans les régions où les coûts sont sensibles et les ressources limitées.

- Par exemple, en 2024, plusieurs hôpitaux des marchés émergents d'Asie et d'Amérique latine ont reporté des projets d'automatisation de laboratoire à grande échelle en raison de contraintes budgétaires et de difficultés liées à l'état des infrastructures, ce qui met en évidence les obstacles à l'adoption liés aux coûts.

- La complexité de l'intégration du système, notamment sa compatibilité avec l'infrastructure existante et les systèmes d'information hospitaliers, peut allonger les délais de mise en œuvre et augmenter le coût total de possession.

- De plus, des difficultés telles que les besoins en formation du personnel, la refonte des flux de travail et les perturbations opérationnelles temporaires lors du déploiement peuvent ralentir davantage l'adoption.

- La variabilité réglementaire entre les pays et les régions peut compliquer le déploiement de solutions d'automatisation standardisées, augmentant ainsi les coûts liés à la conformité.

- Le dépassement de ces contraintes grâce à une conception de système évolutive, des modèles de financement flexibles et des stratégies de mise en œuvre soutenues par les fournisseurs sera essentiel à la croissance à long terme du marché mondial de l'automatisation médicale.

Portée du marché de l'automatisation médicale en Amérique du Nord

Le marché est segmenté en fonction du composant, du type, de l'application, de la connectivité, de l'utilisateur final et du canal de distribution.

- Par composant

Le marché de l'automatisation médicale est segmenté, selon les composants, en équipements, logiciels et services. Le segment des équipements a représenté la plus grande part de revenus (environ 46,1 %) en 2025, grâce au déploiement massif de systèmes matériels automatisés dans les hôpitaux, les laboratoires de diagnostic et les cliniques spécialisées. Des équipements tels que les systèmes d'imagerie automatisés, les plateformes chirurgicales robotisées, les unités de distribution automatisées et les robots de laboratoire constituent l'épine dorsale de l'infrastructure d'automatisation médicale. Les hôpitaux continuent de privilégier les investissements dans les équipements d'automatisation afin de réduire les erreurs cliniques, d'améliorer la précision des procédures et de gérer l'augmentation du nombre de patients. La forte demande des hôpitaux universitaires et des centres hospitaliers universitaires soutient cette position dominante. Les solutions d'équipement bénéficient également de cycles de remplacement plus longs et d'un coût d'acquisition initial élevé. L'intégration de capteurs dotés d'intelligence artificielle, de robots et de contrôleurs intelligents favorise encore davantage leur adoption. Les marchés développés, tels que les États-Unis, l'Allemagne, le Japon et la France, sont en tête du déploiement des équipements. Les mises à niveau et l'expansion continues des installations automatisées permettent de maintenir ce leadership en termes de revenus.

Le segment des logiciels devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 22,4 %, entre 2026 et 2033, grâce à la digitalisation rapide des processus de soins et à la dépendance croissante à l'égard de l'automatisation basée sur les données. Les plateformes logicielles permettent un contrôle centralisé, une surveillance en temps réel, la maintenance prédictive et une aide à la décision basée sur l'IA au sein des systèmes automatisés. L'adoption croissante des solutions cloud, des algorithmes d'IA et des logiciels interopérables intégrés aux dossiers médicaux électroniques accélère cette croissance. Les établissements de santé déploient de plus en plus de logiciels d'automatisation pour optimiser l'utilisation des équipements et réduire leurs coûts opérationnels. Les modèles d'abonnement et SaaS stimulent davantage cette adoption. Le développement de la télémédecine et du télédiagnostic alimente également la demande. Les économies émergentes investissent massivement dans les logiciels d'automatisation en raison de leurs coûts initiaux inférieurs à ceux du matériel. L'accent mis par la réglementation sur la traçabilité et la conformité soutient également la croissance du secteur des logiciels.

- Par type

Le marché est segmenté par type en plusieurs catégories : préparation et dispensation automatisées d’ordonnances, évaluation et suivi automatisés de la santé, imagerie et analyse d’images automatisées, logistique automatisée des soins de santé, suivi des ressources et du personnel, robotique médicale et dispositifs chirurgicaux assistés par ordinateur, procédures thérapeutiques automatisées (non chirurgicales) et analyses de laboratoire automatisées. Le segment de l’imagerie et de l’analyse d’images automatisées a représenté la plus grande part de revenus du marché, soit environ 35,6 % en 2025, grâce à une demande croissante d’imagerie diagnostique rapide, précise et à haut débit. L’automatisation améliore l’efficacité des flux de travail dans les services de radiologie et minimise la variabilité diagnostique. Les outils d’imagerie basés sur l’IA aident les cliniciens à détecter précocement les maladies et à prendre des décisions cliniques éclairées. Leur utilisation intensive en oncologie, en cardiologie et en neurologie favorise leur adoption. Les grands réseaux de diagnostic et les hôpitaux s’appuient fortement sur l’imagerie automatisée pour gérer l’augmentation du volume d’examens. Les approbations réglementaires des solutions d’imagerie basées sur l’IA confortent leur position dominante. L’intégration avec les systèmes PACS et les systèmes informatiques hospitaliers en accroît la valeur. Les régions développées dominent l'adoption grâce à leurs infrastructures avancées.

Le segment de la robotique médicale et des dispositifs chirurgicaux assistés par ordinateur devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 24,1 %, entre 2026 et 2033, porté par une préférence croissante pour les chirurgies mini-invasives et de précision. Les systèmes robotiques améliorent la précision chirurgicale, réduisent les pertes sanguines et raccourcissent la durée d'hospitalisation. Le développement des programmes de formation des chirurgiens et l'élargissement des indications en orthopédie, urologie, gynécologie et neurochirurgie favorisent l'adoption de ces technologies. Les avancées technologiques, telles que la navigation assistée par l'IA et les fonctions autonomes, accélèrent la croissance. Les hôpitaux investissent dans la robotique pour différencier leurs services et améliorer les résultats. L'expansion sur les marchés Asie-Pacifique et Moyen-Orient contribue également à cette croissance. Des tendances de remboursement favorables et la demande des patients pour des soins de pointe renforcent cette dynamique.

- Sur demande

En fonction de l'application, le marché est segmenté en diagnostic et surveillance, thérapeutique, automatisation des laboratoires et des pharmacies, logistique et formation médicales, et autres. Le segment du diagnostic et de la surveillance représentait la plus grande part de revenus du marché, soit environ 41,3 % en 2025, sous l'effet de la prévalence croissante des maladies chroniques et du besoin de surveillance continue des patients. Les systèmes de diagnostic automatisés améliorent la précision et réduisent les délais d'obtention des résultats. Les solutions de télésurveillance ont connu une forte adoption après la pandémie. Les hôpitaux déploient de plus en plus de systèmes de diagnostic automatisés pour gérer un flux important de patients. L'intégration avec les dispositifs portables et les plateformes IoT renforce encore cette position dominante. Les initiatives gouvernementales en faveur du diagnostic numérique y contribuent également. L'automatisation du diagnostic demeure un élément central des stratégies de santé préventive.

Le segment de l'automatisation des laboratoires et des pharmacies devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 23,0 %, entre 2026 et 2033, porté par l'augmentation du volume d'analyses et la demande croissante de dispensation de médicaments sans erreur. L'automatisation améliore le rendement des laboratoires, réduit les risques de contamination et garantit la conformité réglementaire. En pharmacie, elle minimise les erreurs médicamenteuses et optimise la gestion des stocks. Son adoption massive dans les pharmacies hospitalières et les laboratoires centralisés soutient cette croissance. Le développement des structures ambulatoires et de soins externes accroît la demande. L'importance croissante accordée à la médecine personnalisée accélère encore davantage l'adoption de ces solutions.

- Par connectivité

En fonction de la connectivité, le marché est segmenté en solutions filaires et sans fil. Le segment filaire a dominé le marché avec une part de revenus de près de 58,2 % en 2025, principalement grâce à sa fiabilité supérieure, la stabilité de sa transmission de données et sa faible latence, particulièrement importantes dans les environnements de soins critiques. La connectivité filaire est largement privilégiée pour les systèmes d'automatisation utilisés dans les blocs opératoires, les unités de soins intensifs (USI), l'imagerie diagnostique et les laboratoires, où une performance continue est essentielle. Les hôpitaux s'appuient sur les réseaux filaires pour garantir une disponibilité système constante et minimiser les risques de cybersécurité liés aux transferts de données sans fil. L'infrastructure hospitalière existante est en grande partie conçue pour une connectivité filaire, ce qui réduit les coûts d'investissement supplémentaires. Les systèmes filaires supportent également les volumes importants de données générés par les systèmes d'imagerie et robotiques. Les exigences réglementaires et de protection des données favorisent également les solutions filaires. Les grands établissements de santé privilégient l'automatisation filaire pour les applications critiques. La durabilité à long terme et la performance prévisible contribuent à maintenir sa position dominante.

Le segment sans fil devrait connaître la croissance annuelle composée la plus rapide, à 21,2 %, entre 2026 et 2033, portée par l'essor rapide des dispositifs médicaux connectés et des solutions de télésurveillance des patients. La connectivité sans fil offre une plus grande flexibilité et une meilleure mobilité aux professionnels de santé comme aux patients. L'adoption croissante de la télémédecine et des soins à domicile favorise fortement le déploiement de l'automatisation sans fil. Les systèmes sans fil simplifient l'installation et permettent une extension progressive au sein des établissements. La croissance des centres de chirurgie ambulatoire et des cliniques externes accélère encore leur adoption. Les progrès de la technologie 5G améliorent considérablement la bande passante, la vitesse et la fiabilité. La connectivité sans fil est également essentielle pour les dispositifs portables et les capteurs intelligents. Les économies émergentes adoptent de plus en plus les systèmes sans fil en raison de leurs exigences moindres en matière d'infrastructure. L'innovation continue renforce les perspectives de croissance à long terme.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, centres de diagnostic, pharmacies, laboratoires et instituts de recherche, soins à domicile, cliniques spécialisées, centres de chirurgie ambulatoire et autres. Le segment des hôpitaux a dominé le marché avec une part de revenus d'environ 49,4 % en 2025, grâce au déploiement massif de l'automatisation dans de nombreux services. Les hôpitaux investissent massivement dans le diagnostic automatisé, la chirurgie robotique, l'automatisation des pharmacies et les systèmes de surveillance des patients afin d'améliorer l'efficacité et les résultats cliniques. Le volume important de patients exige des flux de travail rationalisés et une réduction des erreurs humaines. Les hôpitaux bénéficient également de budgets d'investissement plus élevés et d'un accès à des financements publics ou privés. L'intégration de l'automatisation aux systèmes d'information hospitaliers favorise son adoption. Les hôpitaux universitaires et de référence sont parmi les premiers à adopter les technologies d'automatisation avancées. La pression réglementaire visant à améliorer la qualité des soins encourage la poursuite des investissements. Les hôpitaux privilégient également l'automatisation pour pallier la pénurie de personnel. Une planification à long terme des infrastructures assure le maintien de leur position de leader sur le marché.

Le segment des soins à domicile devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 22,6 %, entre 2026 et 2033, porté par l'évolution croissante vers une offre de soins décentralisée et centrée sur le patient. Le vieillissement de la population et la prévalence croissante des maladies chroniques stimulent fortement la demande de solutions d'automatisation à domicile. Les dispositifs de surveillance automatisés permettent un suivi continu de l'état de santé des patients. Le télédiagnostic et l'intégration de la télémédecine améliorent l'accès aux soins. L'automatisation des soins à domicile réduit les réhospitalisations et les coûts globaux des soins de santé. Les progrès technologiques ont permis le développement de dispositifs d'automatisation compacts, conviviaux et portables. La préférence croissante des patients pour les traitements à domicile soutient également cette croissance. Le développement de la connectivité sans fil en améliore la faisabilité. Des politiques de remboursement favorables dans les régions développées accélèrent l'adoption de ces solutions. Les marchés émergents présentent également un fort potentiel de croissance pour l'automatisation des soins à domicile.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en appels d'offres, ventes au détail, ventes en ligne et autres. Le segment des appels d'offres représentait la plus grande part de revenus, soit environ 53,7 % en 2025, grâce aux importants contrats d'achat conclus avec les hôpitaux, les systèmes de santé publics et les institutions publiques. Les appels d'offres permettent l'acquisition en gros d'équipements et de systèmes d'automatisation à forte valeur ajoutée. Ce canal garantit un déploiement standardisé et la conformité aux exigences réglementaires. Les gouvernements et les grands réseaux hospitaliers privilégient les appels d'offres pour leur transparence et leur rentabilité. Les contrats de service et de maintenance à long terme renforcent encore ce canal. Les appels d'offres facilitent également la personnalisation et l'intégration des systèmes. Ils restent prédominants pour les solutions d'automatisation nécessitant d'importants investissements. Les investissements publics dans le secteur de la santé soutiennent fortement la demande.

Le segment des ventes en ligne devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 21,8 %, entre 2026 et 2033, porté par la digitalisation croissante des processus d'approvisionnement. Les petites cliniques, les pharmacies et les prestataires de soins à domicile privilégient de plus en plus les plateformes en ligne pour l'achat de dispositifs d'automatisation. Les ventes en ligne offrent une meilleure transparence des prix et une plus grande disponibilité des produits. La facilité de commande et les délais de livraison plus courts favorisent l'adoption de ce segment. La croissance des plateformes de commerce électronique spécialisées dans les dispositifs médicaux soutient cette expansion. Les logiciels par abonnement et les outils d'automatisation modulaires sont parfaitement adaptés à la distribution en ligne. La pénétration croissante d'Internet dans les marchés émergents accélère encore cette croissance. Les canaux en ligne permettent également une interaction directe entre le fabricant et le client. L'innovation continue des plateformes garantit leur évolutivité à long terme.

Analyse régionale du marché de l'automatisation médicale en Amérique du Nord

- Le marché de l'automatisation médicale en Amérique du Nord devrait connaître une croissance annuelle composée substantielle tout au long de la période de prévision, principalement sous l'effet de la pression croissante exercée pour améliorer l'efficacité des soins de santé, réduire les coûts opérationnels et pallier la pénurie de main-d'œuvre dans les hôpitaux et les centres de diagnostic.

- Le cadre réglementaire solide de la région, favorable à l'adoption de la santé numérique, conjugué à l'augmentation des investissements dans les systèmes de laboratoire automatisés, la chirurgie robotique et les flux de travail cliniques basés sur l'IA, accélère la croissance du marché. Les établissements de santé nord-américains adoptent de plus en plus les solutions d'automatisation médicale pour améliorer la sécurité des patients, la précision des diagnostics et optimiser le fonctionnement des hôpitaux.

- On observe une croissance dans les établissements de santé publics et privés, avec l'intégration des technologies d'automatisation aussi bien dans les nouveaux hôpitaux que dans les initiatives de modernisation des infrastructures de santé existantes.

Analyse du marché américain de l'automatisation médicale :

En 2025, le marché américain de l'automatisation médicale dominait le marché nord-américain, avec une part de revenus d'environ 38,6 %. Cette domination s'explique par une infrastructure de santé bien établie, l'adoption précoce de solutions d'automatisation avancées, le déploiement généralisé des diagnostics basés sur l'IA, de la chirurgie robotique et de l'automatisation hospitalière, ainsi que par d'importants investissements de la part des principales entreprises de technologies médicales. Le pays continue d'observer une adoption rapide de la robotique médicale, des systèmes de laboratoire automatisés et des flux de travail cliniques pilotés par l'IA, ce qui contribue à la croissance globale du marché.

Aperçu du marché canadien de l'automatisation médicale :

Le marché canadien de l'automatisation médicale devrait connaître la croissance la plus rapide en Amérique du Nord au cours de la période de prévision, avec un TCAC robuste de 11,8 %. Cette croissance est portée par la modernisation croissante des établissements de santé, les initiatives gouvernementales fortes en faveur de la numérisation des soins de santé, l'adoption croissante de la robotique médicale et les investissements croissants dans les solutions d'hôpitaux intelligents par les acteurs nationaux et internationaux. Les hôpitaux, qu'ils soient nouvellement construits ou existants, intègrent de plus en plus de solutions d'automatisation afin d'améliorer la prise en charge des patients, l'efficacité opérationnelle et les résultats cliniques.

Part de marché de l'automatisation médicale en Amérique du Nord

Le secteur de l'automatisation médicale est principalement dominé par des entreprises bien établies, notamment :

• Siemens Healthineers (Allemagne)

• GE Healthcare (États-Unis)

• Philips Healthcare (Pays-Bas)

• Abbott (États-Unis)

• Roche Diagnostics (Suisse)

• Medtronic (Irlande)

• BD (États-Unis)

• Stryker Corporation (États-Unis)

• Boston Scientific (États-Unis)

• Olympus Corporation (Japon)

• Intuitive Surgical (États-Unis)

• Danaher Corporation (États-Unis)

• Thermo Fisher Scientific (États-Unis)

• Agilent Technologies (États-Unis)

• Johnson & Johnson (États-Unis)

• Fresenius Medical Care (Allemagne)

• Smith & Nephew (Royaume-Uni)

• Getinge AB (Suède)

• Zimmer Biomet (États-Unis)

• Omnicell (États-Unis)

Dernières évolutions du marché de l'automatisation médicale en Amérique du Nord

- En mars 2025, les hôpitaux Prashanth en Inde ont inauguré l'Institut de chirurgie robotique, doté d'un système robotique dédié aux interventions mini-invasives. Cette initiative marque une avancée significative dans l'automatisation médicale en Asie du Sud. L'hôpital a souligné les avantages du robot : réduction du temps de convalescence, des pertes sanguines et du caractère invasif des interventions, notamment en chirurgie générale, urologie et gynécologie. Il s'agit d'une étape importante pour l'adoption de l'automatisation dans la région.

- En avril 2025, IMA Automation a annoncé le lancement de sa division IMA Med-Tech, spécialisée dans les lignes d'assemblage et de conditionnement automatisées pour les dispositifs médicaux, tels que les injecteurs, les inhalateurs, les plateformes de diagnostic et les produits de santé portables. Cette initiative s'inscrit dans la tendance générale à l'automatisation des processus de fabrication et d'assemblage des dispositifs médicaux tout au long de la chaîne d'approvisionnement du secteur de la santé.

- En mars 2025, UiPath a annoncé un accord de conseil mondial avec un important fournisseur de dossiers médicaux électroniques (DME) afin d'accélérer les services d'automatisation pour les organismes de santé dans 16 pays, facilitant ainsi une intégration plus fluide entre les DME et les flux de travail automatisés et étendant la portée des outils d'automatisation dans les processus cliniques et administratifs.

- En octobre 2024, Microsoft a lancé une suite de nouveaux outils d'IA et d'automatisation pour le secteur de la santé, axés sur les modèles d'imagerie médicale, la documentation clinique automatisée et l'assistance aux flux de travail des infirmières, dans le but de réduire la charge administrative et d'améliorer la prestation des soins grâce à l'automatisation intelligente.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.