North America Liver Cancer Diagnostics Market

Taille du marché en milliards USD

TCAC :

%

USD

4,031.47 Million

USD

6,707.57 Million

2022

2030

USD

4,031.47 Million

USD

6,707.57 Million

2022

2030

| 2023 –2030 | |

| USD 4,031.47 Million | |

| USD 6,707.57 Million | |

|

|

|

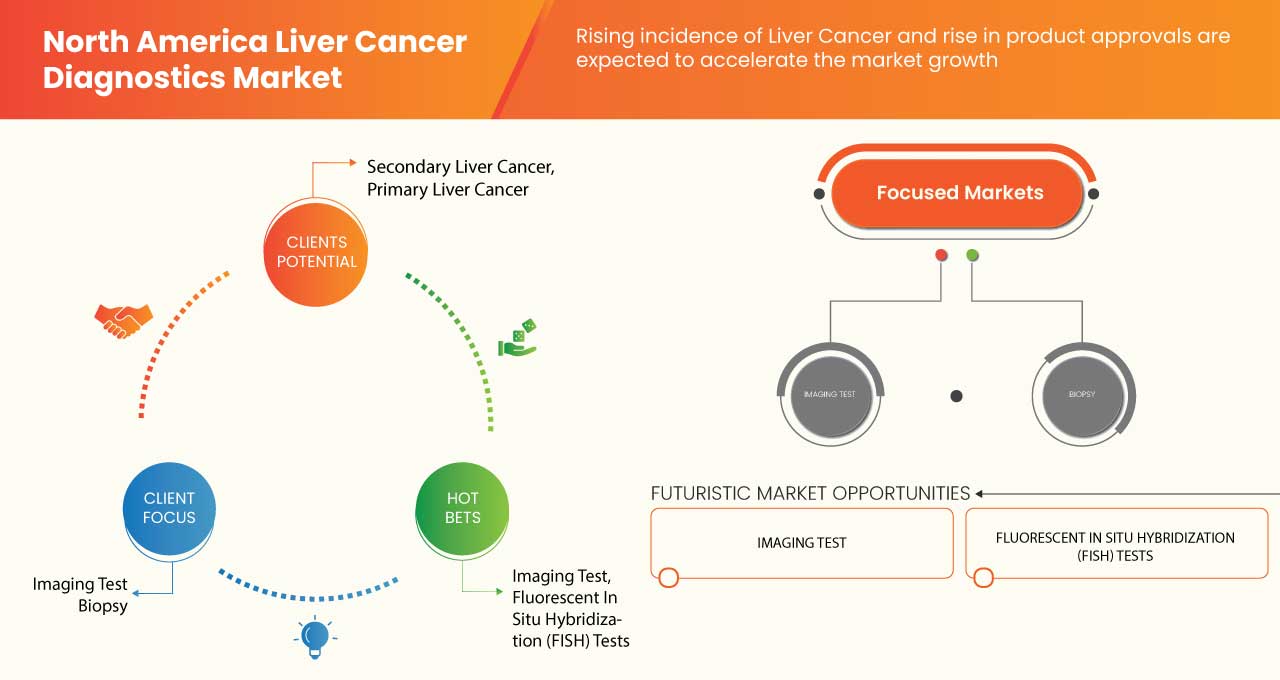

Marché nord-américain du diagnostic du cancer du foie, par type de test (test d'imagerie, biopsie, test génomique et autres), stades du cancer (stade 0, stade I, stade II, stade III et stade IV), type de cancer (cancer primaire du foie et cancer secondaire du foie), produit (produits basés sur une plate-forme, produits basés sur des instruments, kits et réactifs et autres consommables), technologie (hybridation in situ fluorescente, séquençage de nouvelle génération, fluoroimmuno-essai, hybridation génomique comparative, immunohistochimique et autres), application (dépistage, diagnostic et prédictif, pronostic et recherche), sexe (femme et homme), utilisateur final (hôpitaux, centres de diagnostic, centres de recherche sur le cancer, instituts universitaires, centres de chirurgie ambulatoire et autres), canal de distribution (appel d'offres direct, ventes au détail et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du diagnostic du cancer du foie en Amérique du Nord

Le marché nord-américain du diagnostic du cancer du foie devrait croître au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la disponibilité de services avancés. Parallèlement à cela, les fabricants sont engagés dans des activités de R&D pour lancer de nouveaux services sur le marché. La demande croissante de soins de santé de meilleure qualité pour le cancer du foie et la préférence croissante pour les bilans de santé préventifs devraient stimuler la croissance du marché.

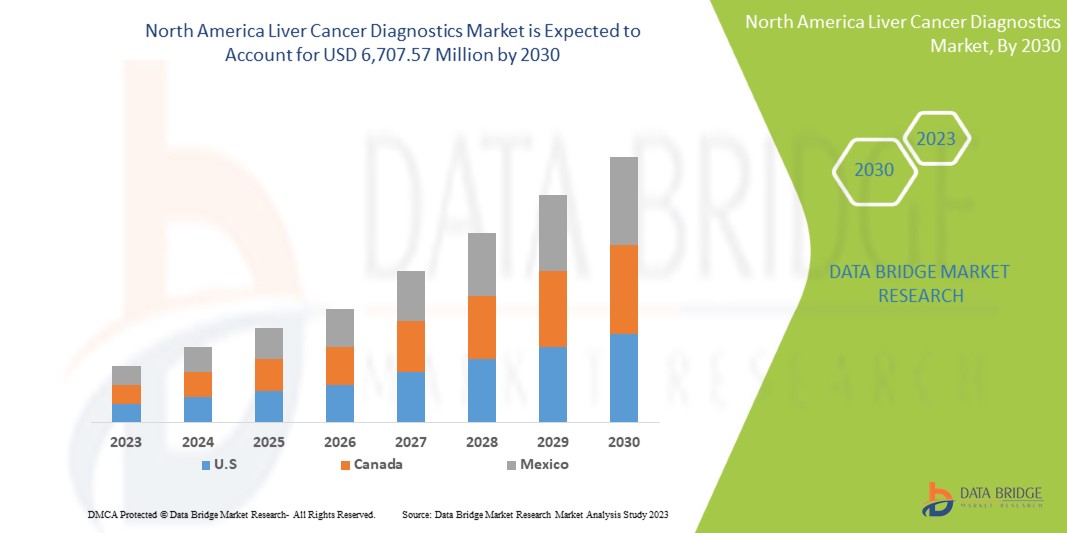

Le marché nord-américain du diagnostic du cancer du foie devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,6 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 6 707,57 millions USD d'ici 2030 contre 4 031,47 millions USD en 2022.

Le rapport sur le marché du diagnostic du cancer du foie en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité. L'évolutivité et l'expansion commerciale des unités de vente au détail dans les pays en développement de diverses régions et le partenariat avec les fournisseurs pour la distribution sûre de machines et de produits pharmaceutiques sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de test (imagerie, biopsie, test génomique et autres), stades du cancer (stade 0, stade I, stade II, stade III et stade IV), type de cancer (cancer primitif du foie et cancer secondaire du foie), produit (produits basés sur une plateforme, produits basés sur des instruments, kits et réactifs et autres consommables), technologie (hybridation in situ fluorescente, séquençage de nouvelle génération, fluoroimmuno-essai, hybridation génomique comparative, immunohistochimie et autres), application (dépistage, diagnostic et prédiction, pronostic et recherche), sexe (femme et homme), utilisateur final (hôpitaux, centres de diagnostic, centres de recherche sur le cancer, instituts universitaires, centres de chirurgie ambulatoire et autres), canal de distribution (appel d'offres direct, vente au détail et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Siemens Healthcare GmbH (Allemagne), Koninklijke Philips NV (Pays-Bas), Agilent Technologies, Inc. (États-Unis), Illumina, Inc. (États-Unis), Epigenomics AG (Allemagne), Thermo Fisher Scientific Inc. (États-Unis), QIAGEN (États-Unis), F. Hoffmann-La Roche Ltd (Suisse), Diagnostic Biosystems Inc. (États-Unis), FUJIFILM Corporation (Japon), BD (États-Unis), MOLGEN (Pays-Bas), BIOCEPT, INC. (États-Unis), Sysmex Corporation (Japon), Elabscience Biotechnology Inc. (États-Unis), Hipro Biotechnology Co., Ltd. (Chine), Altogen Biosystems (États-Unis), ABK Biomedical Inc. (Canada), Diazyme Laboratories, Inc. (États-Unis) et AB Sciex Pte Ltd. (filiale de Danaher) (États-Unis) entre autres |

Définition du marché

Le diagnostic du cancer du foie fait référence aux différentes méthodes et techniques utilisées pour détecter et diagnostiquer le cancer du foie. Il peut s'agir de tests de laboratoire, d'examens d'imagerie et d'examens physiques.

Le marché du diagnostic du cancer du foie comprend une large gamme de produits et de services de diverses entreprises, notamment des laboratoires de diagnostic, des fabricants de dispositifs médicaux et des sociétés pharmaceutiques. Le marché est stimulé par l'incidence croissante du cancer du foie et la demande croissante de tests de diagnostic précis et fiables.

Dynamique du marché du diagnostic du cancer du foie en Amérique du Nord

Conducteurs

-

Besoin non satisfait de tests diagnostiques non invasifs, précis et fiables pour une détection plus précoce du cancer

Le diagnostic devient également un outil de plus en plus important pour convertir les développements les plus récents de la recherche fondamentale en meilleurs résultats cliniques pour les patients. Le développement de nouveaux tests de diagnostic moléculaire rapides, sensibles, moins invasifs et plus précis est accéléré par certains des développements scientifiques les plus passionnants du moment, notamment la génomique, la protéomique et d'autres technologies « omiques ». Cela a un impact significatif sur la capacité à identifier et à traiter différents cancers plus tôt et plus précisément. En personnalisant les médicaments en fonction du profil moléculaire distinct de chaque patient, les diagnostics aident les médecins à prendre des décisions de traitement plus éclairées.

Ainsi, le besoin non satisfait de tests de diagnostic non invasifs, précis et fiables pour une détection plus précoce du cancer devrait stimuler la croissance du marché.

-

Améliorer le diagnostic précoce du cancer du foie

L’apprentissage automatique pourrait révolutionner le diagnostic précoce du cancer, qui apprend aux ordinateurs à voir des modèles dans des données complexes. Les outils comprennent l’évaluation des données de santé courantes, l’imagerie médicale, les échantillons de biopsie et les analyses sanguines pour aider au diagnostic précoce et à la stratification des risques. Pour de nombreux types de tumeurs, la probabilité de suivre un traitement réussi augmente avec un diagnostic précoce du cancer. Une stratégie importante consiste à évaluer les patients à risque qui ne présentent pas de symptômes et à réagir rapidement et de manière appropriée à ceux qui en présentent.

Ainsi, une détection plus précoce améliore les options de traitement, les résultats des patients et la survie et devrait stimuler la croissance du marché nord-américain du diagnostic du cancer du foie.

Retenue

-

Obstacles au diagnostic du cancer du foie et mauvais pronostic

Le cancer est la principale cause de décès dans les pays développés et en développement. La mortalité par cancer devrait atteindre 13,1 millions de décès par an d’ici 2030. Cependant, certains types de cancer ont de grandes chances d’être guéris s’ils sont détectés à un stade précoce et traités de manière adéquate. Les retards dans le diagnostic du cancer peuvent survenir tout au long du parcours diagnostique : patient, soins primaires et soins secondaires. Les retards chez le patient peuvent survenir lorsque celui-ci ne parvient pas à reconnaître et à réagir aux symptômes suspects du cancer. La méconnaissance des premiers symptômes du cancer par le public est considérée comme la principale raison de la présentation tardive du patient, en particulier si les symptômes sont de nature atypique.

Le diagnostic tardif résulte souvent de ces facteurs, qui entraînent un mauvais pronostic. Ainsi, on s'attend à ce que ces facteurs freinent la croissance du marché nord-américain du diagnostic du cancer du foie.

Opportunité

-

Sensibilisation accrue au cancer du foie

La sensibilisation au cancer du foie est une occasion d’accroître les connaissances sur ces maladies et de mettre en lumière la recherche sur leurs causes, leur prévention, leur diagnostic, leur traitement et la survie. L’objectif est d’aider les personnes touchées par le cancer du foie et de promouvoir des habitudes saines. Le cancer primitif du foie est le nom donné au cancer qui se développe dans le foie. Le carcinome hépatocellulaire est le type de cancer primitif du foie le plus répandu chez les adultes (CHC). La troisième cause la plus courante de décès liés au cancer dans le monde est cette forme particulière de cancer du foie. Environ 25 000 hommes et 11 000 femmes reçoivent un diagnostic de cancer du foie chaque année aux États-Unis, et la maladie coûte la vie à 19 000 hommes et 9 000 femmes.

Ainsi, les initiatives gouvernementales en matière de diagnostic du cancer du foie devraient créer une opportunité de croissance pour le marché.

Défi

- Réglementation stricte pour l’approbation des produits de diagnostic du cancer du foie

Les directives strictes en matière d'approbation des produits et de commercialisation sur le marché s'avèrent être un obstacle majeur pour les fabricants de produits de diagnostic du cancer du monde entier. Chaque pays a ses propres réglementations et emploie un organisme de réglementation différent.

Les acteurs impliqués dans la production et la commercialisation de dispositifs médicaux doivent s'adapter en raison de la réglementation stricte. Cela affecterait toutes les parties prenantes à l'échelle mondiale, ce qui devrait mettre le marché à l'épreuve tout au long de la période de prévision. Ainsi, cela devrait constituer un défi pour le marché nord-américain du diagnostic du cancer du foie et entraver sa croissance.

Développement récent

- En décembre 2022, FUJIFILM Holdings America Corporation a annoncé que la société avait conclu un accord d'achat d'actifs avec Inspirata, Inc. pour acquérir une entreprise de pathologie numérique afin d'étendre sa solide offre d'imagerie d'entreprise. Cela permet l'intégration d'images et de données de pathologie dans le système de dossiers médicaux électroniques d'un établissement de santé afin de rationaliser la prestation de soins pour les patients atteints de cancer

Portée du marché du diagnostic du cancer du foie en Amérique du Nord

Le marché nord-américain du diagnostic du cancer du foie est classé en neuf segments notables, à savoir le type de test, le type de cancer, les stades du cancer, le produit, l’application, la technologie, le sexe, l’utilisateur final et les canaux de distribution.

Par type de test

- Test d'imagerie

- Biopsie

- Test génomique

- Autres

Par stades de cancer

- Étape 0

- Étape I

- Stade II

- Stade III

- Stade IV

Par type de cancer

- Cancer primitif du foie

- Cancer secondaire du foie

Par produit

- Produits basés sur une plateforme

- Produits basés sur des instruments

- Kits et réactifs

- Autres consommables

Par technologie

- Hybridation in situ fluorescente

- Séquençage de nouvelle génération

- Dosage fluoro-immunologique

- Hybridation génomique comparative

- Immunohistochimique

- Autres

Par application

- Dépistage

- Diagnostic et Prédiction

- Pronostic

- Recherche

Par sexe

- Femelle

- Mâle

Par utilisateur final

- Hôpitaux

- Centres de recherche sur le cancer

- Instituts universitaires

- Centres de diagnostic

- Centres de chirurgie ambulatoire

- Autres

Par canal de distribution

- Appels d'offres directs

- Ventes au détail

- Autres

Analyse/perspectives régionales du marché du diagnostic du cancer du foie en Amérique du Nord

Le marché nord-américain du diagnostic du cancer du foie est segmenté en neuf segments notables en fonction du type de test, des stades du cancer, du type de cancer, du produit, de l'application, de la technologie, du sexe, de l'utilisateur final et du canal de distribution.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché en raison de la présence d’acteurs clés sur le plus grand marché de consommation avec un PIB élevé.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du diagnostic du cancer du foie en Amérique du Nord

Le paysage concurrentiel du marché nord-américain du diagnostic du cancer du foie fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché nord-américain du diagnostic du cancer du foie.

Français Certains des principaux acteurs opérant sur le marché du diagnostic du cancer du foie en Amérique du Nord sont Siemens Healthcare GmbH (Allemagne), Koninklijke Philips NV (Pays-Bas), Agilent Technologies, Inc. (États-Unis), Illumina, Inc. (États-Unis), Epigenomics AG (Allemagne), Thermo Fisher Scientific Inc. (États-Unis), QIAGEN (États-Unis), F. Hoffmann-La Roche Ltd (Suisse), Diagnostic Biosystems Inc. (États-Unis), FUJIFILM Corporation (Japon), BD (États-Unis), MOLGEN (Pays-Bas), BIOCEPT, INC. (États-Unis), Sysmex Corporation (Japon), Elabscience Biotechnology Inc. (États-Unis), Hipro Biotechnology Co., Ltd. (Chine), Altogen Biosystems (États-Unis), ABK Biomedical Inc. (Canada), Diazyme Laboratories, Inc. (États-Unis), AB Sciex Pte Ltd. (filiale de Danaher) (États-Unis) entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TEST TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.2 PORTER ANALYSIS

4.3 EPIDEMIOLOGY

5 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, REGULATIONS

6 INDUSTRY INSIGHTS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 UNMET NEED FOR NON-INVASIVE, ACCURATE, AND RELIABLE DIAGNOSTIC TESTS FOR EARLIER CANCER DETECTION

7.1.2 INCREASING EARLY DIAGNOSIS OF LIVER CANCER

7.1.3 INCREASING CASES OF LIVER CANCER

7.1.4 RISE IN DIAGNOSTIC PRODUCT APPROVALS

7.2 RESTRAINTS

7.2.1 BARRIERS TO LIVER CANCER DIAGNOSIS AND POOR PROGNOSIS

7.2.2 HIGH FALSE-POSITIVES AND POOR SENSITIVITY OF LIVER CANCER DIAGNOSIS

7.3 OPPORTUNITIES

7.3.1 INCREASING AWARENESS TOWARDS LIVER CANCER

7.3.2 GOVERNMENT INITIATIVES TOWARD LIVER CANCER DIAGNOSTICS

7.3.3 GROWING DEMAND FOR BETTER QUALITY HEALTHCARE

7.4 CHALLENGES

7.4.1 STRICT REGULATIONS FOR THE APPROVAL OF LIVER CANCER DIAGNOSTIC PRODUCTS

7.4.2 LACK OF SKILLED AND CERTIFIED EXPERTISE

8 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE

8.1 OVERVIEW

8.2 IMAGING TEST

8.2.1 MAGNETIC RESONANCE IMAGING (MRI)

8.2.1.1 MR ANGIOGRAPHY (MRA)

8.2.1.2 MR CHOLANGIOPANCREATOGRAPHY

8.2.2 COMPUTED TOMOGRAPHY

8.2.3 POSITRON EMISSION TOMOGRAPHY

8.2.4 ULTRASOUND

8.2.5 OTHERS

8.3 GENOMIC TEST

8.4 BIOPSY

8.4.1 FINE NEEDLE ASPIRATION BIOPSY

8.4.2 CORE NEEDLE BIOPSY

8.4.3 LAPAROSCOPY

8.5 OTHERS

9 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGE

9.1 OVERVIEW

9.2 STAGE III

9.3 STAGE II

9.4 STAGE IV

9.5 STAGE I

9.6 STAGE 0

10 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 SECONDARY LIVER CANCER

10.2.1 HEMANGIOMA

10.2.2 HEPATIC ADENOMA

10.2.3 FOCAL NODULAR HYPERPLASIA

10.3 PRIMARY LIVER CANCER

10.3.1 HEPATOCELLULAR CARCINOMA (HCC)

10.3.2 INTRAHEPATIC CHOLANGIOCARCINOMA (BILE DUCT CANCER)

10.3.3 ANGIOSARCOMA HEMANGIOSARCOMA

10.3.4 HEPATOBLASTOMA

11 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT

11.1 OVERVIEW

11.2 PLATFORM BASED PRODUCTS

11.2.1 NEXT GENERATION SEQUENCING

11.2.2 MICROARRAYS

11.2.3 PCR

11.2.4 OTHERS

11.3 INSTRUMENT BASED PRODUCTS

11.3.1 IMAGING

11.3.2 BIOPSY

11.4 KITS AND REAGENTS

11.4.1 ELISA TEST KITS

11.4.2 CASSETTE TEST KITS

11.4.3 OTHERS

11.5 OTHER CONSUMABLES

12 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 SCREENING

12.2.1 PLATFORM BASED PRODUCTS

12.2.2 INSTRUMENT BASED PRODUCTS

12.2.3 KITS AND REAGENTS

12.2.4 OTHER CONSUMABLES

12.3 DIAGNOSTIC AND PREDICTIVE

12.3.1 PLATFORM BASED PRODUCTS

12.3.2 INSTRUMENT BASED PRODUCTS

12.3.3 KITS AND REAGENTS

12.3.4 OTHER CONSUMABLES

12.4 PROGNOSTIC

12.4.1 PLATFORM BASED PRODUCTS

12.4.2 INSTRUMENT BASED PRODUCTS

12.4.3 KITS AND REAGENTS

12.4.4 OTHER CONSUMABLES

12.5 RESEARCH

12.5.1 PLATFORM BASED PRODUCTS

12.5.2 INSTRUMENT BASED PRODUCTS

12.5.3 KITS AND REAGENTS

12.5.4 OTHER CONSUMABLES

13 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY

13.1 OVERVIEW

13.2 FLUORESCENT IN SITU HYBRIDIZATION

13.3 NEXT GENERATION SEQUENCING

13.4 FLUORIMMUNOASSAY

13.5 COMPARATIVE GENOMIC HYBRIDIZATION

13.6 IMMUNOHISTOCHEMICAL

13.7 OTHERS

14 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY GENDER

14.1 OVERVIEW

14.2 MALE

14.3 FEMALE

15 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.3 DIAGNOSTIC CENTERS

15.4 CANCER RESEARCH CENTERS

15.5 AMBULATORY SURGICAL CENTERS

15.6 ACADEMIC INSTITUTES

15.7 OTHERS

16 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 OTHERS

17 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 F. HOFFMANN-LA ROCHE LTD.

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENT

20.2 KONINLIJKE PHILIPS N.V.

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 THERMO FISHER SCIENTIFIC INC.

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 BD

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 SIEMENS HEALTHCARE GMBH

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 AGILENT TECHNOLOGIES, INC.

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENTS

20.7 ABK BIOMEDICAL INC.

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AB SCIEX PTE LTD. (SUBSIDIARY OF DANAHER.)

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 ALTOGEN BIOSYSTEMS

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 BIOCEPT, INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 BODITECH MED INC.

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENTS

20.12 DIAGNOSTIC BIOSYSTEMS INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 DIAZYME LABORATORIES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 ELABSCIENCE BIOTECHNOLOGY INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 EPIGENOMICS AG

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 FUJIFILM CORPORATION

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 FUJIREBIO

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 HIPRO BIOTECHNOLOGY CO., LTD.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 ILLUMINA, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENTS

20.2 MOLGEN

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 QIAGEN

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENT

20.22 Q-LINE BIOTECH PVT LTD.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 SYSMEX CORPORATION

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENT

20.24 TEBUBIO

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENT

20.25 TOSOH INDIA PVT. LTD.

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 DIFFERENT TYPES OF CANCER NON-INVASIVE SCREENING TESTS FOR DIFFERENT TYPES OF CANCERS

TABLE 2 LIVER CANCER RATES

TABLE 3 APPROVED DIAGNOSTICS OF LIVER CANCER

TABLE 4 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA IMAGING IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA GENETIC TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA STAGE III IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA STAGE II IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA STAGE IV IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA STAGE I IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA STAGE 0 IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA RENAL CELL CARCINOMA IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CLEAR CELL RENAL CELL CARCINOMA IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA CLEAR CELL RENAL CELL CARCINOMA IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA PLATFORM BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA PLATFORM BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA KITS AND REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA KITS AND REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHER CONSUMABLES IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FLUORESCENT IN SITU HYBRIDIZATION IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA NEXT GENERATION SEQUENCING IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA FLUORIMMUNOASSAY IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA COMPARATIVE GENOMIC HYBRIDIZATION IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA IMMUNOHISTOCHEMICAL IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA MALE IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA FEMALE IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA DIAGNOSTIC CENTERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CANCER RESEARCH CENTERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ACADEMIC INSTITUTES IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA DIRECT TENDER IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA RETAIL SALES IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA PRIMARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA PLATFORM-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA INSTRUMENT-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA KITS & REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 83 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 84 U.S. IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 85 U.S. MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE 2021-2030 (USD MILLION)

TABLE 86 U.S. BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 87 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 88 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 89 U.S. SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. PRIMARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 91 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 92 U.S. PLATFORM-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 93 U.S. INSTRUMENT-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 94 U.S. KITS & REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 95 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 96 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 97 U.S. SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 U.S. DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 99 U.S. PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 100 U.S. RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 102 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 103 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 104 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 105 CANADA IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 106 CANADA MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE 2021-2030 (USD MILLION)

TABLE 107 CANADA BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 108 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 109 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 110 CANADA SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 111 CANADA PRIMARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 112 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 CANADA PLATFORM-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 114 CANADA INSTRUMENT-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 115 CANADA KITS & REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 116 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 117 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 118 CANADA SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 119 CANADA DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 120 CANADA PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 121 CANADA RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 122 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 123 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 124 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 125 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 126 MEXICO IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 127 MEXICO MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE 2021-2030 (USD MILLION)

TABLE 128 MEXICO BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 130 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 131 MEXICO SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 132 MEXICO PRIMARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 133 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 134 MEXICO PLATFORM-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 135 MEXICO INSTRUMENT-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 136 MEXICO KITS & REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 137 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 138 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 139 MEXICO SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 MEXICO DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 MEXICO PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 142 MEXICO RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 143 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 144 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 145 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS OF LIVER CANCER AND INCREASING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET FROM 2023 TO 2030

FIGURE 12 THE IMAGING TEST SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET

FIGURE 14 THE NORTH AMERICA MORTALITY RATE DUE TO CANCER

FIGURE 15 INCREASING NORTH AMERICA CANCER RATE IN 2020

FIGURE 16 BARRIERS TO EARLY CANCER DIAGNOSIS AND TREATMENT

FIGURE 17 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2022

FIGURE 18 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 19 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER STAGE, 2022

FIGURE 22 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER STAGE, 2023-2030 (USD MILLION)

FIGURE 23 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER STAGE, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER STAGE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2022

FIGURE 26 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2023-2030 (USD MILLION)

FIGURE 27 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY PRODUCT, 2022

FIGURE 30 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 31 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY APPLICATION, 2022

FIGURE 34 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 35 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 36 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TECHNOLOGY, 2022

FIGURE 38 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 39 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 40 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY GENDER, 2022

FIGURE 42 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY GENDER, 2023-2030 (USD MILLION)

FIGURE 43 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY GENDER, CAGR (2023-2030)

FIGURE 44 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 45 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 46 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 47 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 48 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 49 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 50 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 51 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 52 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 53 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 54 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 55 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 56 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 57 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: TEST TYPE (2023-2030)

FIGURE 58 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.