Marché des tests de panel lipidique en Amérique du Nord, par produits et services (appareils, kits et services), mode de prescription (tests sur ordonnance et tests en vente libre), application ( hyperlipidémie , hypertriglycéridémie, hypercholestérolémie familiale, hypolipoprotéinémie, maladie de Tangier, athérosclérose et autres), utilisateur final (hôpitaux, cliniques spécialisées et cabinets médicaux, laboratoires de pathologie, cliniques de diagnostic, centres de chirurgie ambulatoire, laboratoires de référence, instituts universitaires et de recherche, et autres), canal de distribution (appel d'offres direct, pharmacie de détail, vente en ligne et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des tests de panel lipidique en Amérique du Nord

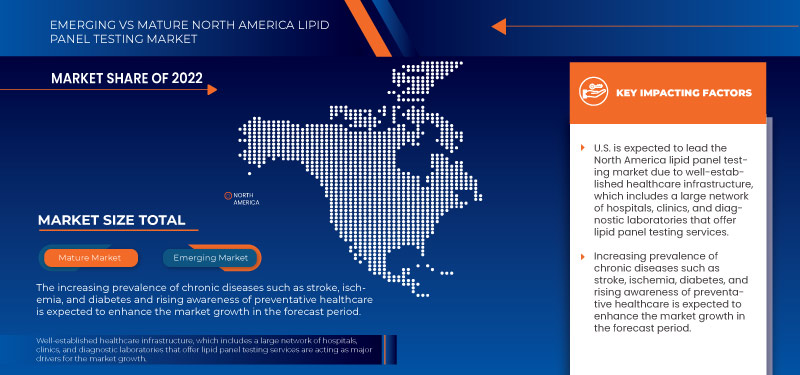

La sensibilisation croissante aux tests de panel lipidique en Amérique du Nord a accru la demande pour le marché. L'augmentation des dépenses de santé pour de meilleurs services de santé contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent sur le lancement et l'approbation de divers services au cours de cette période cruciale. En outre, l'augmentation des progrès en matière de processus et de techniques contribue également à la demande croissante de tests de panel lipidique.

Le marché nord-américain des tests de panel lipidique devrait croître au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la disponibilité de services avancés. Parallèlement à cela, les fabricants sont engagés dans l'activité de développement pour lancer de nouveaux services et des tests de panel lipidique efficaces et précis sur le marché. Le développement croissant des techniques de soins de santé avancées stimule encore la croissance du marché. Cependant, des difficultés telles que les réglementations strictes pour la production et la commercialisation de produits de test de panel lipidique pourraient entraver la croissance du marché nord-américain des tests de panel lipidique au cours de la période de prévision.

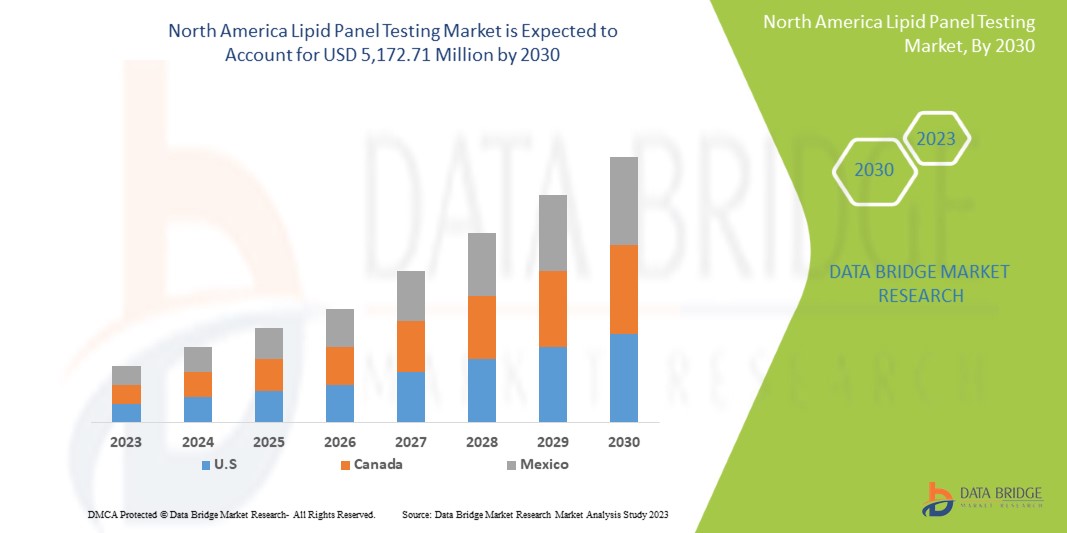

Data Bridge Market Research analyse que le marché nord-américain des tests de panel lipidique devrait atteindre la valeur de 5 172,71 millions USD d'ici 2030, à un TCAC de 7,3 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions, volumes en unités, prix en USD |

|

Segments couverts |

Produits et services (dispositifs, kits et services), mode de prescription (tests sur ordonnance et tests en vente libre), application (hyperlipidémie, hypertriglycéridémie , hypercholestérolémie familiale, hypolipidémie, maladie de Tangier, athérosclérose et autres), utilisateur final (hôpitaux, cliniques spécialisées et cabinets médicaux, laboratoires de pathologie, cliniques de diagnostic, centres de chirurgie ambulatoire, laboratoires de référence, instituts universitaires et de recherche, et autres), canal de distribution (appel d'offres direct, pharmacie de détail, vente en ligne et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Parmi les principales entreprises présentes sur le marché nord-américain des tests de lipides, on trouve Nova Biomedical, Spark Diagnostics Pvt. Ltd., Everlywell, Inc., HORIBA Medical, Abbott, F. Hoffmann-La Roche Ltd., SD Biosensor, INC., Elitech Group, Randox Laboratories Ltd., Diatron, Siemens Healthcare GmbH, Sinocare, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., myLAB Box, Awareness Technology, Inc., Croda International Plc., Eurofins Scientific, Boston Heart Diagnostics Corporation, cpc diagnostics, PTS Diagnostics, ARUP Laboratories, Laboratory Corporation of America Holdings, EKF Diagnostics, Beckman Coulter, Inc. (filiale de Danaher) et Sekisui Diagnostics (une partie de SEKISUI Chemical Co. Ltd.), entre autres. |

Définition du marché des tests de panel lipidique en Amérique du Nord

Le bilan lipidique est un test sanguin couramment utilisé par les professionnels de la santé pour surveiller et dépister le risque de maladie cardiovasculaire. Le bilan comprend trois mesures du cholestérol ainsi qu'une mesure des triglycérides.

Les professionnels de santé utilisent des analyses lipidiques pour évaluer la santé cardiovasculaire d'une personne en analysant le cholestérol dans son sang et pour aider à diagnostiquer d'autres problèmes de santé. L'analyse lipidique évalue la présence de molécules de graisse spécifiques appelées lipides dans le sang. Il mesure plusieurs substances dans le cadre d'un test de panel, notamment plusieurs molécules contenant du cholestérol. L'analyse lipidique évalue le risque de maladies cardiovasculaires telles que les maladies cardiaques, les crises cardiaques et les accidents vasculaires cérébraux chez les enfants et les adultes.

Dynamique du marché des tests de panel lipidique en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- PRÉVALENCE AUGMENTANTE DES MALADIES CHRONIQUES

Un bilan lipidique est un test sanguin couramment utilisé par les prestataires de soins de santé pour surveiller et dépister le risque de maladie cardiovasculaire et d'autres maladies chroniques. Le bilan comprend trois mesures du cholestérol et une mesure des triglycérides. Les prestataires et les professionnels de santé utilisent principalement les bilans lipidiques pour le dépistage ou la surveillance des taux de cholestérol. Les prestataires les utilisent parfois dans le cadre du processus de diagnostic de certains problèmes de santé qui peuvent affecter vos taux de lipides, notamment la pancréatite, la maladie rénale chronique et l'hypothyroïdie.

Ainsi, en conclusion, l’augmentation du nombre de maladies chroniques telles que les maladies cardiovasculaires, les troubles rénaux chroniques, les maladies du foie et diverses autres maladies chroniques a entraîné une augmentation de la demande de profilage lipidique et la demande croissante du marché pour les kits de test de panel lipidique stimulera la croissance du marché nord-américain des tests de panel lipidique dans les années à venir.

Retenue

- COÛT ÉLEVÉ ASSOCIÉ AUX PANNEAUX DE TEST

Un test de profil lipidique est un bilan lipidique, un profil de cholestérol ou un profil de risque cardiaque. Il s'agit d'une combinaison d'analyses sanguines qui permettent de mesurer les taux de graisses sanguines telles que le cholestérol et les triglycérides. Ces cholestérol et triglycérides sont des bons et des mauvais types de graisses.

Les panneaux de test nécessitent un coût énorme pour le processus de développement. Comme le concept doit être défini, les matériaux doivent être achetés et il est important de tenir compte des délais de livraison. De plus, le processus prend du temps car la conception de l'appareil a besoin de suffisamment de temps pour mûrir complètement avant d'être commercialisée.

De plus, tout changement devant être revérifié aura un impact sur le temps. Les progrès croissants dans les formats d’analyse des biocapteurs et d’autres technologies complémentaires ont exigé un investissement efficace pour des opérations réussies et un plan de gestion des risques du projet. La mise en place de la R&D pour mener des recherches entraîne des coûts élevés, ce qui conduit à des appareils coûteux. Ainsi, ce facteur constitue un frein majeur pour le marché nord-américain des tests de panel lipidique.

Opportunité

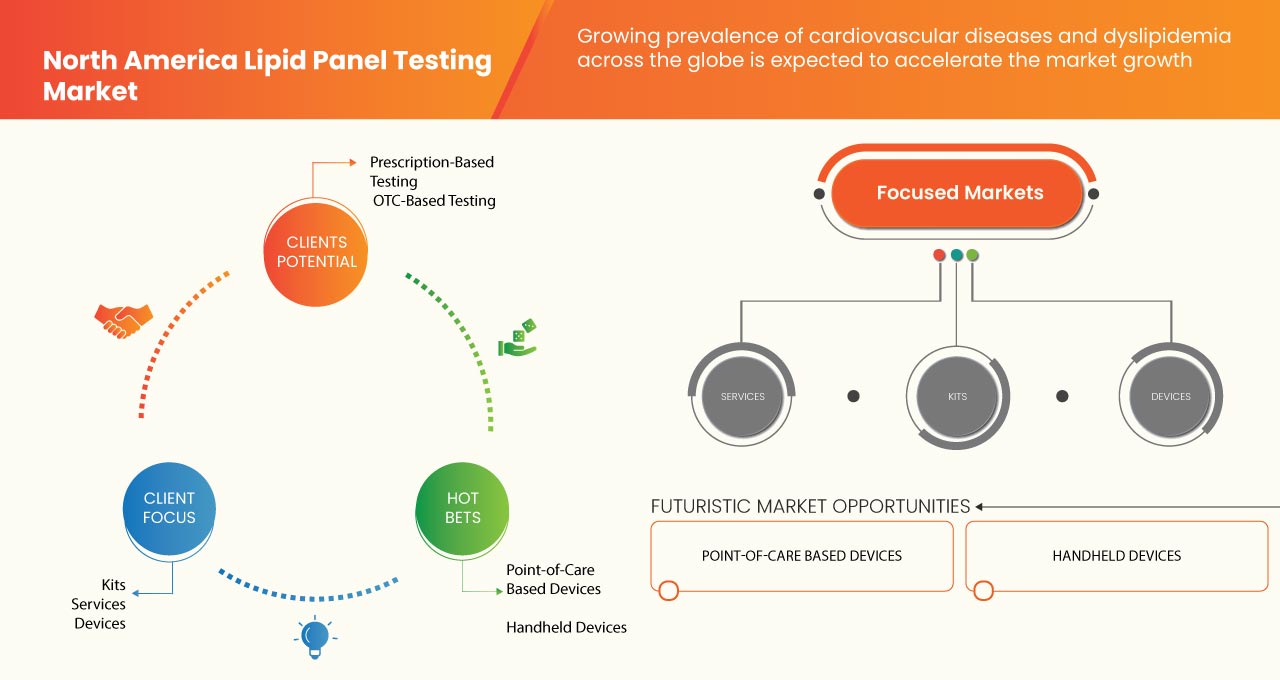

CROISSANCE DES PROGRÈS TECHNOLOGIQUES

Le bilan lipidique est un test sanguin couramment utilisé par les professionnels de la santé pour surveiller et dépister le risque de maladie cardiovasculaire. Le bilan comprend trois mesures du cholestérol ainsi qu'une mesure des triglycérides.

Les progrès technologiques dans le domaine des tests lipidiques se traduisent par une précision accrue, une sensibilité élevée, un taux de réussite plus élevé et des matériaux plus récents, en fonction de leur utilisation dans les différents tests lipidiques. La commercialisation d'appareils et de produits de test lipidique basés sur une technologie avancée utilisés pour les procédures de diagnostic et de test a augmenté la demande des consommateurs, ce qui propulse la demande du marché.

Ainsi, les avancées technologiques et le développement de la méthode de test du panel lipidique devraient stimuler la croissance du marché des tests du panel lipidique en Amérique du Nord.

Défi

MANQUE DE PROFESSIONNELS QUALIFIÉS ET CERTIFIÉS

Le besoin de professionnels qualifiés et certifiés constitue un défi majeur pour les tests de lipides. La demande de tests de lipides à des fins de diagnostic augmente en raison de l'augmentation des cas d'obésité, de maladies cardiovasculaires et de cholestérol en Amérique du Nord. Cependant, le nombre réduit de professionnels qualifiés dans les centres de diagnostic freine la croissance du marché.

Les instruments, méthodes et procédures de diagnostic par panel lipidique ont été améliorés, mais il existe certaines lacunes en matière de normalisation, d'égalisation et de connaissances. Les techniciens sont confrontés à des lacunes en matière de formation technique liées aux problèmes et adaptent les méthodes avancées en toute sécurité pour effectuer les procédures efficacement. Dans le domaine des tests par panel lipidique, des professionnels qualifiés sont indispensables pour le développement, la validation, l'exploitation et le dépannage des méthodes.

Analyse de l'impact post-COVID-19 sur le marché nord-américain des tests de panel lipidique

La Covid-19 a eu un impact considérable sur le secteur du diagnostic, avec une forte baisse du nombre de patients depuis le début de l’année 2020. La pandémie a suscité un sentiment de peur étrange chez les gens, qui a fini par avoir un impact sur les visites à l’hôpital/à la clinique et au laboratoire. Les examens réguliers sont devenus fastidieux, stressants et chronophages. Alors que le secteur du diagnostic dans son ensemble semblait avoir subi un déclin, le domaine du diagnostic à domicile a été la lueur d’espoir dans la nouvelle donne.

Développements récents

- En octobre 2022, Eurofins Scientific a annoncé le lancement du plus grand projet européen de biosurveillance des PFAS (polyfluoroalkyles) dans le sang, Antwrep, commandé par l'Agence pour les soins et la santé du gouvernement flamand. Ce lancement de produit a aidé l'entreprise à élargir son portefeuille de produits.

- En décembre 2022, Laboratory Corporation of America Holdings a annoncé le lancement des opérations dans un nouveau laboratoire d'anatomie pathologique et d'histologie plus grand à Los Angeles. Ces nouvelles opérations ont aidé l'entreprise à étendre ses capacités de laboratoire central en Amérique du Nord.

Portée du marché des tests de panel lipidique en Amérique du Nord

Le marché nord-américain des tests lipidiques est segmenté en cinq segments notables tels que les produits et services, le mode de prescription, l'application, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

PRODUITS ET SERVICES

- APPAREILS

- KITS

- SERVICES

Sur la base des produits et services, le marché nord-américain des tests de panel lipidique est segmenté en appareils, kits et services.

MODE DE PRESCRIPTION

- TESTS SUR ORDONNANCE

- TESTS EN VENTE LIÉE AUX MÉDECINS EN VOIE LIBRE

Sur la base du mode de prescription, le marché nord-américain des tests de panel lipidique est segmenté en tests sur ordonnance et tests en vente libre.

APPLICATION

- HYPERLIPIDÉMIE

- HYPERTRIGLYCERIDEMIE

- HYPERCHOLESTEROLEMIE FAMILIALE

- HYPO LIPOPROTÉINAMIE

- MALADIE DE TANGER

- ATHÉROSCLÉROSE

- AUTRES

Sur la base de l'application, le marché nord-américain des tests de panel lipidique est segmenté en hyperlipidémie, hypertriglycéridémie, hypercholestérolémie familiale, hypolipidémie, maladie de Tangier, athérosclérose et autres.

UTILISATEUR FINAL

- HÔPITAL

- CLINIQUES SPÉCIALISÉES ET CABINET DE MÉDECINS

- LABORATOIRES DE PATHOLOGIE

- CLINIQUES DE DIAGNOSTIC

- CENTRES DE CHIRURGIES AMBULATOIRES

- LABORATOIRES DE RÉFÉRENCE

- INSTITUTS ACADÉMIQUES ET DE RECHERCHE

- AUTRES

Sur la base de l'utilisateur final, le marché nord-américain des tests de panel lipidique est segmenté en hôpitaux, cliniques spécialisées et cabinets médicaux, laboratoires de pathologie, cliniques de diagnostic, centres chirurgicaux ambulatoires, laboratoires de référence, instituts universitaires et de recherche, et autres.

CANAL DE DISTRIBUTION

- APPEL D'OFFRES DIRECT

- PHARMACIE DE DÉTAIL

- VENTES EN LIGNE

- AUTRES

Sur la base du canal de distribution, le marché nord-américain des tests de panel lipidique est segmenté en appel d'offres direct, pharmacie de détail, vente en ligne et autres.

Analyse/perspectives régionales du marché des tests de panel lipidique en Amérique du Nord

Le marché nord-américain des tests de panel lipidique est classé en cinq segments notables : produits et services, mode de prescription, application, utilisateur final et canal de distribution.

Les pays couverts par ce rapport de marché sont les États-Unis, le Canada et le Mexique.

En 2023, les États-Unis devraient croître en raison de l’augmentation des progrès technologiques sur le marché des tests de panel lipidique.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des tests de panel lipidique en Amérique du Nord

Le paysage concurrentiel du marché des tests de panel lipidique en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et la portée du produit, la domination de l'application, la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des tests de panel lipidique en Amérique du Nord.

Français Certaines des principales entreprises opérant sur le marché des tests de panel lipidique en Amérique du Nord sont Nova Biomedical, Spark Diagnostics Pvt. Ltd., Everlywell, Inc., HORIBA Medical, Abbott, F. Hoffmann-La Roche Ltd., SD Biosensor, INC., Elitech Group, Randox Laboratories Ltd., Diatron, Siemens Healthcare GmbH, Sinocare, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., myLAB Box, Awareness Technology, Inc., Croda International Plc., Eurofins Scientific, Boston Heart Diagnostics Corporation, cpc diagnostics, PTS Diagnostics, ARUP Laboratories, Laboratory Corporation of America Holdings, EKF Diagnostics, Beckman Coulter, Inc. (filiale de Danaher) et Sekisui Diagnostics (une partie de SEKISUI Chemical Co. Ltd.) entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LIPID PANEL TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS & SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PATENT ANALYSIS

5 INDUSTRIAL INSIGHTS

5.1 KEY PRICING STRATEGY

6 NORTH AMERICA LIPID PANEL TESTING MARKET, REGULATIONS

6.1 REGULATORY SCENARIO IN THE U.S

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CHRONIC DISEASES

7.1.2 GROWING NUMBER OF CASES OF DYSLIPIDEMIA

7.1.3 RAPID CHANGES IN LIFESTYLE CHANGES LEAD TO LIPID DISORDERS

7.1.4 RISE IN PREFERENCE FOR HOMECARE TESTING IN LIPID PANEL TESTING

7.2 RESTRAINTS

7.2.1 STRICT GOVERNMENT REGULATIONS

7.2.2 HIGH COST ASSOCIATED WITH TESTING PANELS

7.3 OPPORTUNITIES

7.3.1 GROWTH IN TECHNOLOGICAL ADVANCEMENTS

7.3.2 RISE IN THE PREVALENCE OF OBESITY AMONG PEOPLE

7.3.3 INCREASING ADOPTION OF POINT-OF-CARE LIPID PANEL TESTING

7.4 CHALLENGES

7.4.1 LACK OF SKILLED & CERTIFIED PROFESSIONALS

7.4.2 LACK OF STANDARDIZATION OF LIPID PANEL TESTING

8 NORTH AMERICA LIPID PANEL TESTING MARKET, BY PRODUCTS & SERVICES

8.1 OVERVIEW

8.2 SERVICES

8.2.1 LOW DENSITY LIPOPROTEIN (LDL) TEST

8.2.2 TOTAL CHOLESTEROL TEST

8.2.3 HIGH DENSITY LIPOPROTEIN (HDL) TEST

8.2.4 TRIGLYCERIDES/ VLDL TEST

8.2.5 NON-HDL CHOLESTEROL TEST

8.2.6 OTHERS

8.3 KITS

8.3.1 STRIPS

8.3.1.1 THREE-ANALYTE TEST STRIPS

8.3.1.2 DUAL-ANALYTE TEST STRIPS

8.3.1.3 SINGLE-ANALYTE TEST STRIPS

8.3.2 LANCETS

8.3.3 CONTROLS

8.3.3.1 MULTI-CHEMISTRY CONTROLS

8.3.3.2 HDL CHOLESTEROL CONTROLS

8.3.3.3 OTHERS

8.3.4 CAPILLARY TUBES

8.4 DEVICES

8.4.1 BY MODALITY

8.4.1.1 STANDALONE

8.4.1.2 HANDHELD

8.4.1.3 PORTABLE

8.4.2 BY TYPE

8.4.2.1 LABORATORY BASED

8.4.2.2 POINT OF CARE BASED

9 NORTH AMERICA LIPID PANEL TESTING MARKET, BY PRESCRIPTION MODE

9.1 OVERVIEW

9.2 PRESCRIPTION-BASED TESTING

9.3 OTC-BASED TESTING

10 NORTH AMERICA LIPID PANEL TESTING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 HYPERLIPIDEMIA

10.2.1 TOTAL CHOLESTEROL TEST

10.2.2 TRIGLYCERIDES/ VLDL TEST

10.2.3 LOW DENSITY LIPOPROTEIN (LDL) TEST

10.2.4 HIGH DENSITY LIPOPROTEIN (HDL) TEST

10.2.5 NON-HDL CHOLESTEROL TEST

10.2.6 OTHERS

10.3 HYPERTRIGLYCERIDEMIA

10.3.1 TRIGLYCERIDES/ VLDL TEST

10.3.2 TOTAL CHOLESTEROL TEST

10.3.3 LOW DENSITY LIPOPROTEIN (LDL) TEST

10.3.4 HIGH DENSITY LIPOPROTEIN (HDL) TEST

10.3.5 NON-HDL CHOLESTEROL TEST

10.3.6 OTHERS

10.4 ATHEROSCLEROSIS

10.4.1 LOW DENSITY LIPOPROTEIN (LDL) TEST

10.4.2 TOTAL CHOLESTEROL TEST

10.4.3 TRIGLYCERIDES/ VLDL TEST

10.4.4 HIGH DENSITY LIPOPROTEIN (HDL) TEST

10.4.5 NON-HDL CHOLESTEROL TEST

10.4.6 OTHERS

10.5 FAMILIAL HYPERCHOLESTEROLEMIA

10.5.1 LOW DENSITY LIPOPROTEIN (LDL) TEST

10.5.2 TOTAL CHOLESTEROL TEST

10.5.3 HIGH DENSITY LIPOPROTEIN (HDL) TEST

10.5.4 TRIGLYCERIDES/ VLDL TEST

10.5.5 NON-HDL CHOLESTEROL TEST

10.5.6 OTHERS

10.6 HYPO LIPOPROTEINEMIA

10.6.1 LOW DENSITY LIPOPROTEIN (LDL) TEST

10.6.2 HIGH DENSITY LIPOPROTEIN (HDL) TEST

10.6.3 TRIGLYCERIDES/ VLDL TEST

10.6.4 TOTAL CHOLESTEROL TEST

10.6.5 NON-HDL CHOLESTEROL TEST

10.6.6 OTHERS

10.7 TANGIER DISEASE

10.7.1 HIGH DENSITY LIPOPROTEIN (HDL) TEST

10.7.2 LOW DENSITY LIPOPROTEIN (LDL) TEST

10.7.3 TOTAL CHOLESTEROL TEST

10.7.4 TRIGLYCERIDES/ VLDL TEST

10.7.5 NON-HDL CHOLESTEROL TEST

10.7.6 OTHERS

10.8 OTHERS

11 NORTH AMERICA LIPID PANEL TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITAL

11.2.1 BY TYPE

11.2.1.1 PRIVATE

11.2.1.1.1 SERVICES

11.2.1.1.2 KITS

11.2.1.1.3 DEVICES

11.2.1.2 PUBLIC

11.2.1.2.1 SERVICES

11.2.1.2.2 KITS

11.2.1.2.3 DEVICES

11.2.2 BY TIER

11.2.2.1 TIER 1

11.2.2.1.1 SERVICES

11.2.2.1.2 KITS

11.2.2.1.3 DEVICES

11.2.2.2 TIER 2

11.2.2.2.1 SERVICES

11.2.2.2.2 KITS

11.2.2.2.3 DEVICES

11.2.2.3 TIER 3

11.2.2.3.1 SERVICES

11.2.2.3.2 KITS

11.2.2.3.3 DEVICES

11.3 DIAGNOSTIC CLINICS

11.3.1 SERVICES

11.3.2 KITS

11.3.3 DEVICES

11.4 SPECIALTY CLINICS & PHYSICIAN OFFICES

11.4.1 SERVICES

11.4.2 KITS

11.4.3 DEVICES

11.5 REFERENCE LABORATORIES

11.5.1 SERVICES

11.5.2 KITS

11.5.3 DEVICES

11.6 AMBULATORY SURGICAL CENTERS

11.6.1 SERVICES

11.6.2 KITS

11.6.3 DEVICES

11.7 PATHOLOGY LABORATORIES

11.7.1 SERVICES

11.7.2 KITS

11.7.3 DEVICES

11.8 ACADEMIC AND RESEARCH INSTITUTES

11.8.1 SERVICES

11.8.2 KITS

11.8.3 DEVICES

11.9 OTHERS

12 NORTH AMERICA LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL PHARMACY

12.3.1 HOSPITAL PHARMACIES

12.3.2 DRUG STORES

12.3.3 OTHERS

12.4 ONLINE SALES

12.5 OTHERS

13 NORTH AMERICA LIPID PANEL TESTING MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LIPID PANEL TESTING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 NORTH AMERICA LIPID PANEL TESTING MARKET, COMPANY PROFILE

16.1 QUEST DIAGNOSTICS INCORPORATED

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 EUROFINS SCIENTIFIC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 LABORATORY CORPORATION OF AMERICA HOLDINGS

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 F. HOFFMANN-LA ROCHE LTD.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 RANDOX LABORATORIES LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ABBOTT

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 COMPANY SHARE ANALYSIS

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENT

16.7 AWARENESS TECHNOLOGY, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ARUP LABORATORIES

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BIO-RAD LABORATORIES, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 BECKMAN COULTER, INC. (SUBSIDIARY OF DANAHER)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 BOSTON HEART DIAGNOSTICS CORPORATION

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 CPC DIAGNOSTICS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 CRODA INTERNATIONAL PLC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 DIATRON

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 EKF DIAGNOSTICS

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 EVERLYWELL, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 ELITECH GROUP

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 HORIBA MEDICAL

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 MYLAB BOX

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 NOVA BIOMEDICAL

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PTS DIAGNOSTICS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SIEMENS HEALTHCARE GMBH

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 SINOCARE

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 SD BIOSENSOR, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENT

16.25 SEKISUI DIAGNOSTICS (A PART OF SEKISUI CHEMICAL CO. LTD.)

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENTS

16.26 SPARK DIAGNOSTICS PVT. LTD.

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

16.27 THERMO FISHER SCIENTIFIC INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 THE BELOW-MENTIONED TABLE SHOWS THE COST OF VARIOUS LIPID PANEL TESTING DEVICES OFFERED BY DIFFERENT MANUFACTURERS-

TABLE 2 NORTH AMERICA LIPID PANEL TESTING MARKET, BY PRODUCTS & SERVICES, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA KITS IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA KITS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA STRIPS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CONTROLS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA DEVICES IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA DEVICES IN LIPID PANEL TESTING MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA LIPID PANEL TESTING MARKET, BY PRESCRIPTION MODE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA PRESCRIPTION-BASED TESTING IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OTC-BASED TESTING IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA HYPERLIPIDEMIA IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA HYPERLIPIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA HYPERTRIGLYCERIDEMIA IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA HYPERTRIGLYCERIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ATHEROSCLEROSIS IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ATHEROSCLEROSIS IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FAMILIAL HYPERCHOLESTEROLEMIA IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FAMILIAL HYPERCHOLESTEROLEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HYPO LIPOPROTEINEMIA IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA HYPO LIPOPROTEINEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA TANGIER DISEASE IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA TANGIER DISEASE IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA HOSPITAL IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA HOSPITAL IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA PRIVATE IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PUBLIC IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA HOSPITAL IN LIPID PANEL TESTING MARKET, BY TIER, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA TIER 1 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA TIER 2 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA TIER 3 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA DIAGNOSTIC CLINICS IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA DIAGNOSTIC CLINICS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA SPECIALTY CLINICS & PHYSICIAN OFFICES IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA SPECIALTY CLINICS & PHYSICIAN OFFICES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA REFERENCE LABORATORIES IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA REFERENCE LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA PATHOLOGY LABORATORIES IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA PATHOLOGY LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA OTHERS IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA DIRECT TENDER IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA RETAIL PHARMACY IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA RETAIL PHARMACY IN LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ONLINE SALES IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN LIPID PANEL TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA LIPID PANEL TESTING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA LIPID PANEL TESTING MARKET, BY PRODUCTS AND SERVICES, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (NUMBER OF TESTS)

TABLE 61 NORTH AMERICA KITS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA STRIPS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA CONTROLS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA DEVICES IN LIPID PANEL TESTING MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA DEVICES IN DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 67 NORTH AMERICA LIPID PANEL TESTING MARKET, BY PRESCRIPTION MODE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA HYPERLIPIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA HYPERTRIGLYCERIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA ATHEROSCLEROSIS IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA FAMILIAL HYPERCHOLESTEROLEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA HYPO LIPOPROTEINAMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA TANGIER DISEASE IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA HOSPITAL IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA PRIVATE IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA PUBLIC IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA HOSPITAL IN LIPID PANEL TESTING MARKET, BY TIER, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA TIER 1 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA TIER 2 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA TIER 3 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA DIAGNOSTIC CLINICS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA SPECIALTY CLINICS AND PHYSICIAN OFFICES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA REFERENCE LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA PATHOLOGY LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA RETAIL PHARMACY IN LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 91 U.S. LIPID PANEL TESTING MARKET, BY PRODUCTS AND SERVICES, 2021-2030 (USD MILLION)

TABLE 92 U.S. SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 93 U.S. SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (PRICE PER TEST)

TABLE 94 U.S. SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (NUMBER OF TESTS)

TABLE 95 U.S. KITS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 96 U.S. STRIPS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 97 U.S. CONTROLS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 98 U.S. DEVICES IN LIPID PANEL TESTING MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 99 U.S. DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 ASP

TABLE 101 U.S. DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 102 U.S. LIPID PANEL TESTING MARKET, BY PRESCRIPTION MODE, 2021-2030 (USD MILLION)

TABLE 103 U.S. LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 104 U.S. HYPERLIPIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 105 U.S. HYPERTRIGLYCERIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 106 U.S. ATHEROSCLEROSIS IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 U.S. FAMILIAL HYPERCHOLESTEROLEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 108 U.S. HYPO LIPOPROTEINAMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 109 U.S. TANGIER DISEASE IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 110 U.S. LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 111 U.S. HOSPITAL IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 U.S. PRIVATE IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.S. PUBLIC IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 U.S. HOSPITAL IN LIPID PANEL TESTING MARKET, BY TIER, 2021-2030 (USD MILLION)

TABLE 115 U.S. TIER 1 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 116 U.S. TIER 2 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 117 U.S. TIER 3 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 118 U.S. DIAGNOSTIC CLINICS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 119 U.S. SPECIALTY CLINICS AND PHYSICIAN OFFICES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 120 U.S. REFERENCE LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 121 U.S. AMBULATORY SURGICAL CENTERS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 122 U.S. PATHOLOGY LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 123 U.S. ACADEMIC AND RESEARCH INSTITUTES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 124 U.S. LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 125 U.S. RETAIL PHARMACY IN LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 126 CANADA LIPID PANEL TESTING MARKET, BY PRODUCTS AND SERVICES, 2021-2030 (USD MILLION)

TABLE 127 CANADA SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 128 CANADA SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (PRICE PER TEST)

TABLE 129 CANADA SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (NUMBER OF TESTS)

TABLE 130 CANADA KITS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 131 CANADA STRIPS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 132 CANADA CONTROLS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 133 CANADA DEVICES IN LIPID PANEL TESTING MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 134 CANADA DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 CANADA DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 ASP

TABLE 136 CANADA DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 137 CANADA LIPID PANEL TESTING MARKET, BY PRESCRIPTION MODE, 2021-2030 (USD MILLION)

TABLE 138 CANADA LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 139 CANADA HYPERLIPIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 CANADA HYPERTRIGLYCERIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 CANADA ATHEROSCLEROSIS IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 142 CANADA FAMILIAL HYPERCHOLESTEROLEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 143 CANADA HYPO LIPOPROTEINAMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 144 CANADA TANGIER DISEASE IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 145 CANADA LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 146 CANADA HOSPITAL IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 CANADA PRIVATE IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 CANADA PUBLIC IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 CANADA HOSPITAL IN LIPID PANEL TESTING MARKET, BY TIER, 2021-2030 (USD MILLION)

TABLE 150 CANADA TIER 1 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 151 CANADA TIER 2 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 152 CANADA TIER 3 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 153 CANADA DIAGNOSTIC CLINICS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 154 CANADA SPECIALTY CLINICS AND PHYSICIAN OFFICES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 155 CANADA REFERENCE LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 156 CANADA AMBULATORY SURGICAL CENTERS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 157 CANADA PATHOLOGY LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 158 CANADA ACADEMIC AND RESEARCH INSTITUTES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 159 CANADA LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 160 CANADA RETAIL PHARMACY IN LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 161 MEXICO LIPID PANEL TESTING MARKET, BY PRODUCTS AND SERVICES, 2021-2030 (USD MILLION)

TABLE 162 MEXICO SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 163 MEXICO SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (PRICE PER TEST)

TABLE 164 MEXICO SERVICES IN LIPID PANEL TESTING MARKET, BY TEST TYPE, 2021-2030 (NUMBER OF TESTS)

TABLE 165 MEXICO KITS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 166 MEXICO STRIPS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 167 MEXICO CONTROLS IN LIPID PANEL TESTING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 168 MEXICO DEVICES IN LIPID PANEL TESTING MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 169 MEXICO DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 MEXICO DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 ASP

TABLE 171 MEXICO DEVICES IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 172 MEXICO LIPID PANEL TESTING MARKET, BY PRESCRIPTION MODE, 2021-2030 (USD MILLION)

TABLE 173 MEXICO LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 174 MEXICO HYPERLIPIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 175 MEXICO HYPERTRIGLYCERIDEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 176 MEXICO ATHEROSCLEROSIS IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 177 MEXICO FAMILIAL HYPERCHOLESTEROLEMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 178 MEXICO HYPO LIPOPROTEINAMIA IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 179 MEXICO TANGIER DISEASE IN LIPID PANEL TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 180 MEXICO LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 181 MEXICO HOSPITAL IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 MEXICO PRIVATE IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 MEXICO PUBLIC IN LIPID PANEL TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 MEXICO HOSPITAL IN LIPID PANEL TESTING MARKET, BY TIER, 2021-2030 (USD MILLION)

TABLE 185 MEXICO TIER 1 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 186 MEXICO TIER 2 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 187 MEXICO TIER 3 IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 188 MEXICO DIAGNOSTIC CLINICS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 189 MEXICO SPECIALTY CLINICS AND PHYSICIAN OFFICES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 190 MEXICO REFERENCE LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 191 MEXICO AMBULATORY SURGICAL CENTERS IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 192 MEXICO PATHOLOGY LABORATORIES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 193 MEXICO ACADEMIC AND RESEARCH INSTITUTES IN LIPID PANEL TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 194 MEXICO LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 195 MEXICO RETAIL PHARMACY IN LIPID PANEL TESTING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA LIPID PANEL TESTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LIPID PANEL TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIPID PANEL TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIPID PANEL TESTING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIPID PANEL TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIPID PANEL TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LIPID PANEL TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LIPID PANEL TESTING MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 NORTH AMERICA LIPID PANEL TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LIPID PANEL TESTING MARKET: SEGMENTATION

FIGURE 11 THE INCREASING PREVALENCE OF CHRONIC DISEASES IS EXPECTED TO DRIVE THE NORTH AMERICA LIPID PANEL TESTING MARKET IN THE FORECAST PERIOD

FIGURE 12 THE PRODUCTS & SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIPID PANEL TESTING MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LIPID PANEL TESTING MARKET

FIGURE 14 NORTH AMERICA LIPID PANEL TESTING MARKET: BY PRODUCTS & SERVICES, 2022

FIGURE 15 NORTH AMERICA LIPID PANEL TESTING MARKET: BY PRODUCTS & SERVICES, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA LIPID PANEL TESTING MARKET: BY PRODUCTS & SERVICES, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA LIPID PANEL TESTING MARKET: BY PRODUCTS & SERVICES, LIFELINE CURVE

FIGURE 18 NORTH AMERICA LIPID PANEL TESTING MARKET: BY PRECRIPTION MODE, 2022

FIGURE 19 NORTH AMERICA LIPID PANEL TESTING MARKET: BY PRECRIPTION MODE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA LIPID PANEL TESTING MARKET: BY PRECRIPTION MODE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA LIPID PANEL TESTING MARKET: BY PRECRIPTION MODE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA LIPID PANEL TESTING MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA LIPID PANEL TESTING MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA LIPID PANEL TESTING MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA LIPID PANEL TESTING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA LIPID PANEL TESTING MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA LIPID PANEL TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA LIPID PANEL TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA LIPID PANEL TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA LIPID PANEL TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA LIPID PANEL TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA LIPID PANEL TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA LIPID PANEL TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA LIPID PANEL TESTING MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA LIPID PANEL TESTING MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA LIPID PANEL TESTING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA LIPID PANEL TESTING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA LIPID PANEL TESTING MARKET: PRODUCTS & SERVICES (2023-2030)

FIGURE 39 NORTH AMERICA LIPID PANEL TESTING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.