North America Lipid Market

Taille du marché en milliards USD

TCAC :

%

USD

5,654.25 Million

USD

10,817.54 Million

2022

2030

USD

5,654.25 Million

USD

10,817.54 Million

2022

2030

| 2023 –2030 | |

| USD 5,654.25 Million | |

| USD 10,817.54 Million | |

|

|

|

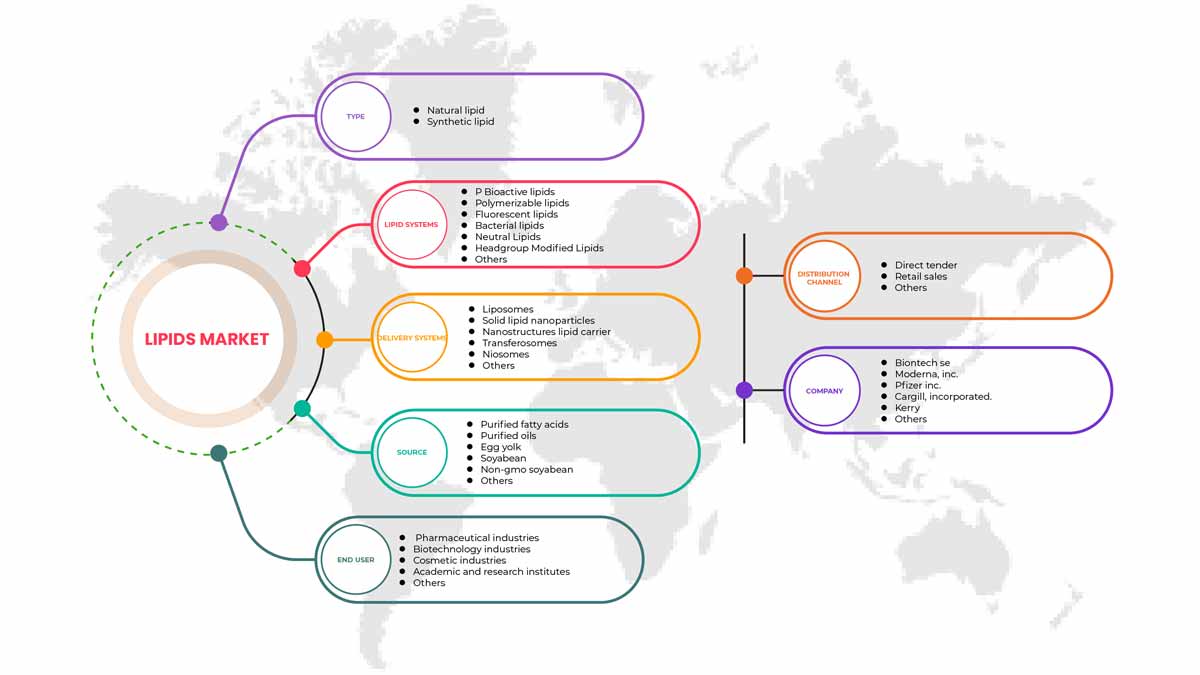

Marché des lipides en Amérique du Nord, par type (lipides naturels et lipides synthétiques), système lipidique (lipides neutres, lipides bactériens, lipides fluorescents, lipides bioactifs, lipides polymérisables, lipides modifiés par groupe de tête et autres), système de distribution (lipides, nanoparticules lipidiques solides , transporteurs lipidiques nanostructurés, niosomes, transférosomes et autres), source (jaune d'œuf, soja, soja non OGM, huiles purifiées, acides gras purifiés et autres), utilisateur final (industries pharmaceutiques, industries biotechnologiques, instituts universitaires et de recherche, industries cosmétiques et autres), canal de distribution (appel d'offres direct, ventes au détail et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des lipides en Amérique du Nord

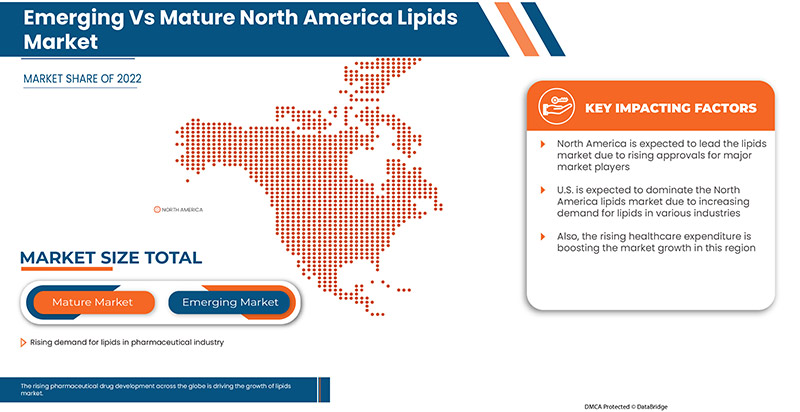

La prévalence croissante des maladies chroniques à l'échelle mondiale a accru la demande du marché. L'augmentation des dépenses de santé pour de meilleurs services de santé contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent fortement sur divers lancements de produits et approbations de médicaments au cours de cette période cruciale. En outre, la demande croissante de lipides dans diverses autres industries telles que l'industrie alimentaire et des boissons, l'industrie cosmétique et d'autres, contribue également à la demande croissante du marché des lipides.

L'augmentation des dépenses de santé et les initiatives stratégiques des acteurs du marché offrent des opportunités au marché. Cependant, les différents défis de fabrication pour la production de nanoparticules lipidiques et le manque d'établissements de santé dans les économies émergentes constituent des défis majeurs pour la croissance du marché.

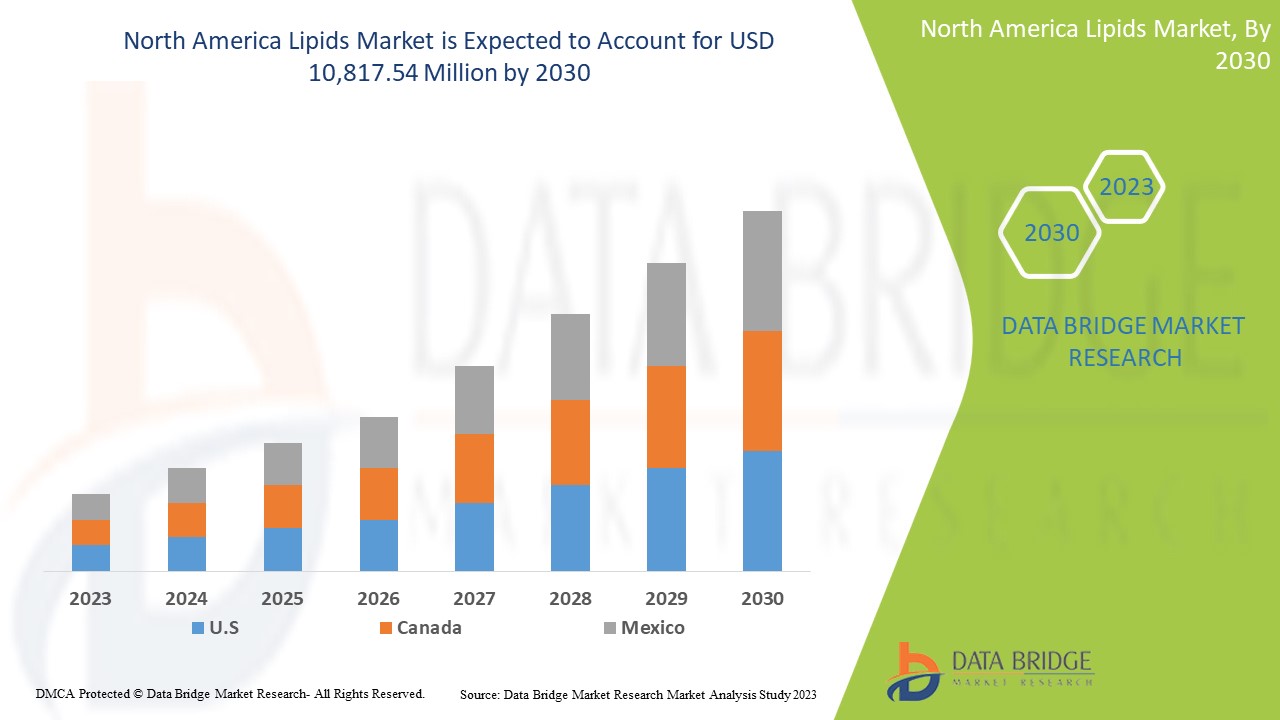

Le marché nord-américain des lipides devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,5 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 10 817,54 millions USD d'ici 2030 contre 5 654,25 millions USD en 2022.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (lipides naturels et lipides synthétiques), système lipidique (lipides neutres, lipides bactériens, lipides fluorescents, lipides bioactifs, lipides polymérisables, lipides modifiés par groupe de tête et autres), système de distribution (liposomes, nanoparticules lipidiques solides , transporteurs lipidiques nanostructurés, niosomes, transférosomes et autres), source (jaune d'œuf, soja, soja non OGM, huiles purifiées, acides gras purifiés et autres), utilisateur final (industries pharmaceutiques, industries biotechnologiques, instituts universitaires et de recherche, industries cosmétiques et autres), canal de distribution (appel d'offres direct, ventes au détail et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Alnylam Pharmaceutical, Inc., Croda International Plc., Moderna Inc., BioNTech SE., Pfizer Inc., Evonik Industries AG, Lipoid GmbH, Matreya LLC, VAV Life Sciences Pvt Ltd., Curia North America Inc., Cargill, Incorporated, Gattefossé, CD Bioparticles, Merck KGaA, NOF EUROPE GmbH, ABITEC, Cayman Chemical, CordenPharma International, CHEMI SpA, DSM, BASF SE, Tokyo Chemical Industry Co., Ltd., ADMSIO, Stepan Company et Kerry |

Définition du marché

Les lipides peuvent être définis comme un groupe de composés organiques présents dans les animaux, les plantes et les micro-organismes. Ils comprennent les stérols, les cires, les graisses et les vitamines liposolubles. Les lipides ont la capacité d'exécuter diverses activités. En même temps, ils sont connus pour avoir de faibles niveaux de toxicité. Ces qualités des lipides contribuent à l'administration efficace des médicaments. Par conséquent, ils sont de plus en plus utilisés comme excipients dans la production de médicaments. Ce facteur alimente la croissance du marché nord-américain des lipides pharmaceutiques.

Ces derniers temps, le secteur mondial de la santé connaît des changements considérables. Le développement des technologies d'administration de médicaments ainsi que l'intégration de formulaires de médicaments sont des moteurs de la croissance du marché des lipides pharmaceutiques. La croissance des problèmes de santé chroniques rapides et l'administration rapide de médicaments au patient sont l'un des facteurs clés de la croissance du marché des lipides pharmaceutiques en Amérique du Nord.

Dynamique du marché des lipides

Conducteurs

-

Augmentation de la prévalence des maladies chroniques

Le nombre de maladies chroniques augmente rapidement dans le monde entier. Selon l'OMS (Organisation mondiale de la santé), en 2021, la contribution des maladies chroniques était d'environ 60 %, ce qui représentait le nombre de décès. Dans la plupart des pays occidentaux, la principale raison de l'augmentation du nombre de maladies chroniques est l'augmentation continue de la population âgée. L'augmentation du nombre de maladies chroniques telles que les maladies cardiovasculaires, les troubles neurologiques et diverses autres maladies chroniques a entraîné une augmentation de la demande de divers médicaments qui stimuleront la croissance du marché des lipides en Amérique du Nord dans les années à venir.

-

Demande croissante de lipides dans l'industrie alimentaire et des boissons ainsi que dans l'industrie cosmétique

La demande en lipides dans les produits pharmaceutiques est très élevée, car ils sont utilisés dans le développement de divers médicaments sur le marché. En outre, la demande en lipides a augmenté dans diverses autres industries, telles que l'industrie agroalimentaire et les produits cosmétiques.

Les lipides sont un ingrédient essentiel dans la formulation de compléments alimentaires en raison de leur teneur élevée en énergie et en vitamines liposolubles. Les préoccupations croissantes des personnes concernant leur santé à la lumière de la COVID-19 ont propulsé la demande de compléments alimentaires en Amérique du Nord. De plus, la disponibilité des compléments alimentaires sous de multiples formes et saveurs les a rendus plus acceptables socialement pour tous les groupes d'âge. La consommation croissante de compléments alimentaires devrait stimuler la demande de lipides au cours des années prévues.

-

Augmentation du développement de médicaments

Dans l'industrie pharmaceutique, les lipides et les polymères sont considérés comme des excipients essentiels pour la formulation de divers médicaments. Ils sont utilisés comme stabilisants, solubilisants, activateurs de perméation et agents de transfection. L'adoption croissante d'une large gamme de lipides et de polymères naturels, synthétiques, semi-synthétiques ou entièrement artificiels dans la formulation de diverses formes posologiques devrait stimuler le marché au cours de la période de prévision.

Opportunités

-

Hausse des dépenses de santé

Les dépenses de santé ont augmenté dans le monde entier à mesure que le revenu disponible des citoyens de divers pays augmentait. De plus, pour répondre aux besoins de la population, les organismes gouvernementaux et les organisations de santé prennent des initiatives pour accélérer les dépenses de santé. L'augmentation des dépenses de santé aide simultanément les établissements de santé à améliorer leurs installations de traitement pour diverses maladies qui sont très répandues ces dernières années.

-

Initiatives stratégiques des principaux acteurs

L’augmentation des taux de divers types de maladies et de leur gravité est largement observée dans le monde entier. L’augmentation spectaculaire de la qualité de la recherche et des opportunités de recherche est due à diverses initiatives stratégiques prises par les acteurs du marché. Ils prennent des initiatives telles que le lancement de produits, des collaborations, des fusions, des acquisitions et bien d’autres au fil des ans et devraient être à la pointe et créer davantage d’opportunités sur le marché. Evonik a investi dans la croissance à court terme de sa production de lipides spécialisés sur ses sites de Hanau et de Dossenheim en Allemagne, qui ont fourni deux des quatre lipides du vaccin Pfizer/BioNTech. Selon Spencer, les premiers lots ont été livrés à BioNTech en avril 2021, des mois avant la date prévue.

Contraintes/Défis

- Coût élevé de la synthèse des lipides et augmentation du coût des matières premières

Le développement de médicaments à base de lipides est très coûteux. Le concept doit être défini, les matériaux doivent être trouvés et il est important de tenir compte des délais de mise au point. De plus, le processus prend du temps car le médicament a besoin de suffisamment de temps pour réaliser tous les essais cliniques avant d'être commercialisé.

De plus, tout changement devant être revérifié aura un impact sur le temps. Les progrès croissants dans les formats d’analyse des biocapteurs et d’autres technologies complémentaires ont exigé un investissement efficace pour des opérations réussies et un plan de gestion des risques du projet. La mise en place de la R&D pour mener des recherches entraîne des coûts élevés, ce qui conduit à des médicaments coûteux. Ainsi, ce facteur constitue un frein majeur pour le marché des lipides en Amérique du Nord.

- Différents défis de fabrication pour la production de nanoparticules lipidiques

Les nanoparticules lipidiques ont eu un impact majeur sur l'industrie pharmaceutique. À la base, les nanoparticules lipidiques (LNP) sont des vecteurs qui protègent les acides nucléiques. En tant que partie intégrante des récents vaccins à ARNm, elles sont injectées et transportées vers le site prévu dans la cellule. Malgré les nombreux avantages des nanoparticules lipidiques en tant que systèmes de distribution, l'industrie pharmaceutique doit relever des défis de fabrication importants.

Ces défis incluent :

- Taille/distributions granulométriques contrôlées avec précision

- Problèmes de stérilisation

- Répétabilité et évolutivité des processus

- Exigences réglementaires (telles que les réglementations cGMP)

Impact post-COVID-19 sur le marché des lipides

Le COVID-19 a eu un impact positif sur le marché. La demande de vaccin contre le COVID-19 était très forte et le point positif ici est que les lipides sont principalement utilisés dans la production de vaccins. Ainsi, le COVID-19 a eu un impact positif sur le marché des lipides.

Développements récents

- En novembre 2022, BioNTech SE a annoncé que sa filiale singapourienne BioNTech Pharmaceuticals Asia Pacific Pte. Ltd. avait conclu un accord avec Novartis Singapore Pharmaceutical Manufacturing Pte. Ltd. pour acquérir l'une de ses installations de fabrication certifiées GMP. Cette acquisition fait partie de la stratégie d'expansion de BioNTech visant à renforcer sa présence en Amérique du Nord en Asie.

- En septembre 2021, le fournisseur américain d'ingrédients ABITEC Corporation a signé un accord modifié avec DKSH pour distribuer ses lipides de spécialité sur de nouveaux marchés et dans de nouvelles régions d'Europe. Cela a aidé l'entreprise à développer ses activités dans diverses régions.

Portée du marché des lipides en Amérique du Nord

Le marché des lipides en Amérique du Nord est segmenté en types, systèmes lipidiques, systèmes de distribution, source, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Lipides naturels

- Lipides synthétiques

Sur la base du type, le marché nord-américain des lipides est segmenté en lipides naturels et lipides synthétiques.

Systèmes lipidiques

- Lipides bioactifs

- Lipides polymérisables

- Lipides fluorescents

- Lipides bactériens

- Lipides neutres

- Lipides modifiés par groupe de tête

- Autres

Sur la base des systèmes lipidiques, le marché nord-américain des lipides est segmenté en lipides neutres, lipides bactériens, lipides fluorescents, lipides bioactifs, lipides polymérisables, lipides modifiés par groupe de tête et autres.

Systèmes de livraison

- Liposomes

- Nanoparticules lipidiques solides

- Nanostructures transporteuses de lipides

- Transférosomes

- Niosomes

- Autres

En fonction des systèmes de distribution, le marché nord-américain des lipides est segmenté en liposomes, nanoparticules lipidiques solides, nanostructures porteuses de lipides, niosomes, transférosomes et autres.

Source

- Acides gras purifiés

- Huiles purifiées

- Jaune d'oeuf

- Soja

- Soja sans OGM

- Autres

Selon la source, le marché nord-américain des lipides est segmenté en jaune d’œuf, soja, soja sans OGM, huiles purifiées, acides gras purifiés et autres.

Utilisateur final

- Industries pharmaceutiques

- Industries de la biotechnologie

- Industrie cosmétique

- Instituts universitaires et de recherche

- Autres

En fonction de l’utilisateur final, le marché nord-américain des lipides est segmenté en industries pharmaceutiques, industries biotechnologiques, instituts universitaires et de recherche, industries cosmétiques et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

- Autres

En fonction du canal de distribution, le marché nord-américain des lipides est segmenté en appels d'offres directs, ventes au détail et autres.

Analyse/perspectives régionales du marché des lipides

Le marché des lipides est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, systèmes lipidiques, systèmes de distribution, source, utilisateur final et canal de distribution.

Les pays couverts par le marché des lipides en Amérique du Nord sont les États-Unis, le Canada et le Mexique. Les États-Unis dominent le marketing des lipides en termes de part de marché et de chiffre d'affaires et continueront de renforcer leur domination au cours de la période de prévision.

Les États-Unis devraient connaître une croissance en raison d'une augmentation des maladies chroniques due à une forte demande de médicaments pharmaceutiques et la demande croissante de lipides dans différentes industries devrait stimuler le marché régional au cours de la période prévue.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché des lipides

Le paysage concurrentiel du marché des lipides fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises vers le marché des vins haut de gamme.

Français Certains des principaux acteurs opérant sur le marché des lipides sont Alnylam Pharmaceutical, Inc., Croda International Plc., Moderna Inc., BioNTech SE., Pfizer Inc., Evonik Industries AG, Lipoid GmbH, Matreya LLC, VAV Life Sciences Pvt Ltd., Curia North America Inc., Cargill, Incorporated, Gattefossé, CD Bioparticles, Merck KGaA, NOF EUROPE GmbH, ABITEC, Cayman Chemical, CordenPharma International, CHEMI SpA, DSM, BASF SE, Tokyo Chemical Industry Co., Ltd., ADMSIO, Stepan Company, Kerry, et entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LIPIDS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 MERGER AND ACQUISITION, NORTH AMERICA LIPIDS MARKET

4.4 PATENT ANALYSIS, NORTH AMERICA LIPIDS MARKET

4.5 DRUG TREATMENT RATE BY MATURED MARKETS

4.6 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATE

4.7 KEY PRICING STRATEGIES

4.8 KEY PATIENT ENROLLMENT STRATEGIES

4.9 PRICE ANALYSIS, NORTH AMERICA LIPIDS MARKET

4.1 NORTH AMERICA LIPIDS MARKET, CLINICAL TRIALS

4.11 NORTH AMERICA LIPIDS MARKET, DISTRIBUTION OF PRODUCTS BY PHASE

4.12 NORTH AMERICA LIPIDS MARKET, PIPELINE ANALYSIS

4.13 PHASE I CANDIDATES

4.14 PHASE I/II CANDIDATES

4.15 PHASE II CANDIDATES

4.16 PHASE III CANDIDATES

5 NORTH AMERICA LIPIDS MARKET, REGULATORY FRAMEWORK

5.1 REGULATION IN THE U.S.:

5.2 REGULATION IN EUROPE:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE PREVALENCE OF CHRONIC DISEASES

6.1.2 RISE IN DEMAND FOR LIPIDS IN FOOD AND BEVERAGE AS WELL AS THE COSMETIC INDUSTRY

6.1.3 INCREASE IN DRUG DEVELOPMENT

6.2 RESTRAINTS

6.2.1 HIGH COST OF LIPID SYNTHESIS AND INCREASING COST OF RAW MATERIALS

6.2.2 STRICT GOVERNMENT REGULATIONS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DIFFERENT MANUFACTURING CHALLENGES FOR LIPID NANOPARTICLE PRODUCTION

6.4.2 LACK OF HEALTHCARE FACILITIES IN EMERGING ECONOMIES

7 NORTH AMERICA LIPIDS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NATURAL LIPID

7.2.1 UNSATURATED PHOSPHOLIPID

7.2.2 HYDROGENATED PHOSPHOLIPID

7.2.3 SPHINGOMYELIN

7.2.4 GLYCEROLPHOSPHOCHOLINE

7.3 SYNTHETIC LIPID

7.3.1 PEGYLATED PHOSPHOLIPIDS

7.3.2 PHOSPHATIDYLSERINE

7.3.3 PHOSPHATIDYGLYCEROLS

7.3.4 PHOSPHATIDYLETHANOLAMINE

7.3.5 PHOSPHATIDYLCHOLINE

7.3.6 PHOSPHATIDIC ACIDS

8 NORTH AMERICA LIPIDS MARKET, BY LIPID SYSTEMS

8.1 OVERVIEW

8.2 BIOACTIVE LIPIDS

8.2.1 PLANT LIPIDS

8.2.2 LIPID ACTIVATORS

8.2.3 LIPID INHIBITORS

8.2.4 AGONISTS

8.2.5 BIOACTIVE CERAMIDES

8.2.6 ACYL CARNITINE LIPIDS

8.2.7 ENDOCANNABINOIDS

8.2.8 LIPO-NUCLEOTIDES

8.2.9 LYSYL-PHOSPHATIDYLGLYCEROL

8.2.10 DIACYLGLYCEROL PYROPHOSPHATE (DGPP)

8.3 POLYMERIZABLE LIPIDS

8.3.1 FUNCTIONAL PEG LIPIDS

8.3.2 MPEG STEROLS

8.3.3 MPEG CERAMIDES

8.3.4 MPEG PHOSPHOLIPIDS

8.3.5 MPEG GLYCERIDES

8.4 FLUORESCENT LIPIDS

8.4.1 FLUORESCENT SPHINGOLIPIDS

8.4.2 FLUORESCENT GLYCEROLIPIDS

8.4.3 FLUORESCENT PEG LIPIDS

8.4.4 FLUORESCENT PHOSPHOLIPIDS

8.4.5 FLUORESCENT STEROLS

8.4.6 OTHERS

8.5 BACTERIAL LIPIDS

8.5.1 MYCOLIC LIPIDS

8.5.2 N-ACYLHOMOSERINE LIPIDS

8.5.3 BRANCHED LIPIDS

8.5.4 CYCLOPROPYL LIPIDS

8.6 NEUTRAL LIPIDS

8.6.1 PRENOLS

8.6.2 VERY LONG CHAIN FATTY ACIDS

8.6.3 GLYCERIDES

8.6.4 EICSANOIDS

8.6.5 OXYGENATED FATTY ACIDS

8.6.6 GLYCOSYLATED DIACYL GLYCEROLS

8.6.7 PROSTAGLANDINS

8.7 HEADGROUP MODIFIED LIPIDS

8.7.1 FUNCTIONAL LIPIDS

8.7.2 ANTIGENIC LIPIDS

8.7.3 GLYCOSYLATED LIPIDS

8.7.4 CHELATORS

8.7.5 ADHESIVE LIPIDS

8.7.6 SNAP-TAG REACTING LIPIDS

8.7.7 ALKYL PHOSPHATES

8.8 OTHERS

9 NORTH AMERICA LIPIDS MARKET, BY DELIVERY SYSTEMS

9.1 OVERVIEW

9.2 LIPOSOMES

9.2.1 LIPOSOMES FOR DNA/RNA

9.2.1.1 DOTAP LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.2 DDAB LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.3 GL-67 LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.4 DC-CHOLESTEROL LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.5 DOTMA LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.6 DODAP LIPOSOMES FOR DNA/RNA DELIVERY

9.2.2 REACTIVE LIPOSOMES

9.2.2.1 SUCCINYL LIPOSOMES

9.2.2.2 DBCO LIPOSOMES

9.2.2.3 BIOTINYLATED LIPOSOMES

9.2.2.4 CARBOXYLIC ACID LIPOSOMES

9.2.2.5 AMINE LIPOSOMES

9.2.2.6 CYANUR LIPOSOMES

9.2.2.7 AZIDE LIPOSOMES

9.2.2.8 FOLATE LIPOSOMES

9.2.2.9 DODECANYL LIPOSOMES

9.2.2.10 NI REACTIVE LIPOSOMES

9.2.2.11 PDP LIPOSOMES

9.2.2.12 GLUTARYL LIPOSOMES

9.2.2.13 OTHERS

9.2.3 DRUG LOADED LIPOSOMES

9.2.4 PLAIN LIPOSOMES

9.2.4.1 CARDIOLIPIN LIPIDS LIPOSOMES

9.2.4.2 DOTAP LIPOSOMES

9.2.4.3 PHOSPHATIDYLSERINE LIPOSOMES

9.2.4.4 PHOSPHATIDYLCHOLINE LIPOSOMES

9.2.4.5 PHOSPHATIDYL GLYCEROL LIPOSOMES

9.2.4.6 OTHERS

9.3 SOLID LIPID NANOPARTICLES

9.4 NANOSTRUCTURES LIPID CARRIER

9.5 TRANSFEROSOMES

9.6 NIOSOMES

9.7 OTHERS

10 NORTH AMERICA LIPIDS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 PURIFIED FATTY ACIDS

10.3 PURIFIED OILS

10.4 EGG YOLK

10.5 SOYABEAN

10.6 NON-GMO SOYABEAN

10.7 OTHERS

11 NORTH AMERICA LIPIDS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL INDUSTRIES

11.3 BIOTECHNOLOGY INDUSTRIES

11.4 COSMETIC INDUSTRIES

11.5 ACADEMIC AND RESEARCH INSTITUTES

11.6 OTHERS

12 NORTH AMERICA LIPIDS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 OTHERS

13 NORTH AMERICA LIPIDS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LIPIDS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BIONTECH SE.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 MODERNA, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 PFIZER INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 CARGILL, INCORPORATED.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 KERRY.

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 ABITEC

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ADMSIO

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ALNYLAM PHARMACEUTICALS, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 BASF SE

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 CAYMAN CHEMICAL

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 CD BIOPARTCLES.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 CHEMI S.P.A.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 CORDENPHARMA INTERNATIONAL

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 CRODA INTERNATIONAL PLC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 CURIA NORTH AMERICA, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 DSM

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 EVONIK INDUSTRIES AG

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 GATTEFOSSÉ

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 LIPOID GMBH

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MATREYA, LLC

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 MERCK KGAA

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 NOF EUROPE GMBH

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 STEPAN COMPANY

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 TOKYO CHEMICAL INDUSTRY CO., LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VAV LIFE SCIENCES PVT LTD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 ASP FOR MAJOR DRUGS IN LIPIDS MARKET (PRICE IN USD)

TABLE 2 LIPID BASED NANO PARTICLE FOR COVID-19 VACCINES

TABLE 3 LIPID BASED NANO PARTICLE FOR CANCER VACCINES

TABLE 4 RNA ENCAPSULATED LIPID NANOPARTICLES

TABLE 5 LIPOSOMAL FORMULATIONS

TABLE 6 LIPID BASED NANO PARTICLE FOR COVID VACCINES

TABLE 7 LIPOSOMAL FORMULATION

TABLE 8 LIPID BASED NANO PARTICLE FOR CANCER VACCINES

TABLE 9 RNA ENCAPSULATED LIPID NANOPARTICLES

TABLE 10 LIPOSOME FORMULATIONS

TABLE 11 LIPID BASED NANO PARTICLE FOR COVID VACCINES

TABLE 12 LIPID BASED NANO PARTICLE FOR CANCER VACCINES

TABLE 13 LIPOSOMAL FORMULATION

TABLE 14 NORTH AMERICA LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA NATURAL LIPID IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA SYNTHETIC LIPID IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA BIOACTIVE LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA FLUORESCENT LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA BACTERIAL LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA NEUTRAL LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA LIPOSOMES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA SOLID LIPID NANOPARTICLES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA NANOSTRUCTURES LIPID CARRIER IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA TRANSFEROSOMES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA NIOSOMES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA PURIFIED FATTY ACIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA PURIFIED OILS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA EGG YOLK IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA SOYABEAN IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA NON-GMO SOYABEAN IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA PHARMACEUTICAL INDUSTRIES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA BIOTECHNOLOGY INDUSTRIES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA COSMETIC INDUSTRIES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA DIRECT TENDER IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA RETAIL SALES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA LIPIDS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 80 U.S. LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 U.S. NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 U.S. SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 U.S. LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 84 U.S. NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 85 U.S. BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 86 U.S. FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 87 U.S. BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 88 U.S. POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 89 U.S. HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 90 U.S. LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 91 U.S. LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 92 U.S. LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 93 U.S. REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 94 U.S. PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 95 U.S. LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 96 U.S. LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 97 U.S. LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 98 CANADA LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 CANADA NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 CANADA SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 CANADA LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 102 CANADA NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 103 CANADA BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 104 CANADA FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 105 CANADA BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 106 CANADA POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 107 CANADA HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 108 CANADA LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 109 CANADA LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 110 CANADA LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 111 CANADA REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 112 CANADA PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 113 CANADA LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 114 CANADA LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 115 CANADA LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 116 MEXICO LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 MEXICO NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 MEXICO SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 MEXICO LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 120 MEXICO NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 121 MEXICO BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 122 MEXICO FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 123 MEXICO BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 124 MEXICO POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 125 MEXICO HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 126 MEXICO LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 127 MEXICO LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 128 MEXICO LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 129 MEXICO REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 130 MEXICO PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 131 MEXICO LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 132 MEXICO LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 133 MEXICO LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA LIPIDS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LIPIDS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIPIDS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIPIDS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIPIDS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIPIDS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LIPIDS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LIPIDS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LIPIDS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LIPIDS MARKET: SEGMENTATION

FIGURE 11 THE GROWING PRVALENCE OF CHRONIC DISEASES AND RISING DEMAND FOR LIPIDS IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE NORTH AMERICA LIPIDS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 TESTING SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIPIDS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LIPIDS MARKET

FIGURE 14 NORTH AMERICA LIPIDS MARKET: BY TYPE, 2022

FIGURE 15 NORTH AMERICA LIPIDS MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA LIPIDS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA LIPIDS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA LIPIDS MARKET: BY LIPID SYSTEMS, 2022

FIGURE 19 NORTH AMERICA LIPIDS MARKET: BY LIPID SYSTEMS, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA LIPIDS MARKET: BY LIPID SYSTEMS, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA LIPIDS MARKET: BY LIPID SYSTEMS, LIFELINE CURVE

FIGURE 22 NORTH AMERICA LIPIDS MARKET: BY DELIVERY SYSTEMS, 2022

FIGURE 23 NORTH AMERICA LIPIDS MARKET: BY DELIVERY SYSTEMS, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA LIPIDS MARKET: BY DELIVERY SYSTEMS, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA LIPIDS MARKET: BY DELIVERY SYSTEMS, LIFELINE CURVE

FIGURE 26 NORTH AMERICA LIPIDS MARKET: BY SOURCE, 2022

FIGURE 27 NORTH AMERICA LIPIDS MARKET: BY SOURCE, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA LIPIDS MARKET: BY SOURCE, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA LIPIDS MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA LIPIDS MARKET: BY END USER, 2022

FIGURE 31 NORTH AMERICA LIPIDS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA LIPIDS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA LIPIDS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA LIPIDS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 NORTH AMERICA LIPIDS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA LIPIDS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA LIPIDS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA LIPIDS MARKET: SNAPSHOT (2022)

FIGURE 39 NORTH AMERICA LIPIDS MARKET: BY COUNTRY (2022)

FIGURE 40 NORTH AMERICA LIPIDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 41 NORTH AMERICA LIPIDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 NORTH AMERICA LIPIDS MARKET: BY TYPE (2023 & 2030)

FIGURE 43 NORTH AMERICA LIPIDS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.