North America Leak Detection Market

Taille du marché en milliards USD

TCAC :

%

USD

6.75 Billion

USD

12.59 Billion

2025

2033

USD

6.75 Billion

USD

12.59 Billion

2025

2033

| 2026 –2033 | |

| USD 6.75 Billion | |

| USD 12.59 Billion | |

|

|

|

|

Marché de la détection des fuites en Amérique du Nord, par type (en amont, intermédiaire et en aval), type de produit (détecteurs de gaz portables, détecteurs basés sur des drones, détecteurs d'aéronefs habités et détecteurs basés sur des véhicules), technologie (acoustique/ultrasons, méthodes d'écart pression-débit, modèle transitoire en temps réel étendu (E-RTTM), imagerie thermique, équilibre masse/volume, détection de vapeur, absorption laser et lidar, détection de fuite hydraulique, vannes à pression négative et autres), utilisateur final (pétrole et gaz, usine chimique, usine de traitement des eaux, centrale thermique, exploitation minière et boues et autres), pays (États-Unis, Canada, Mexique) Tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : marché de la détection des fuites en Amérique du Nord

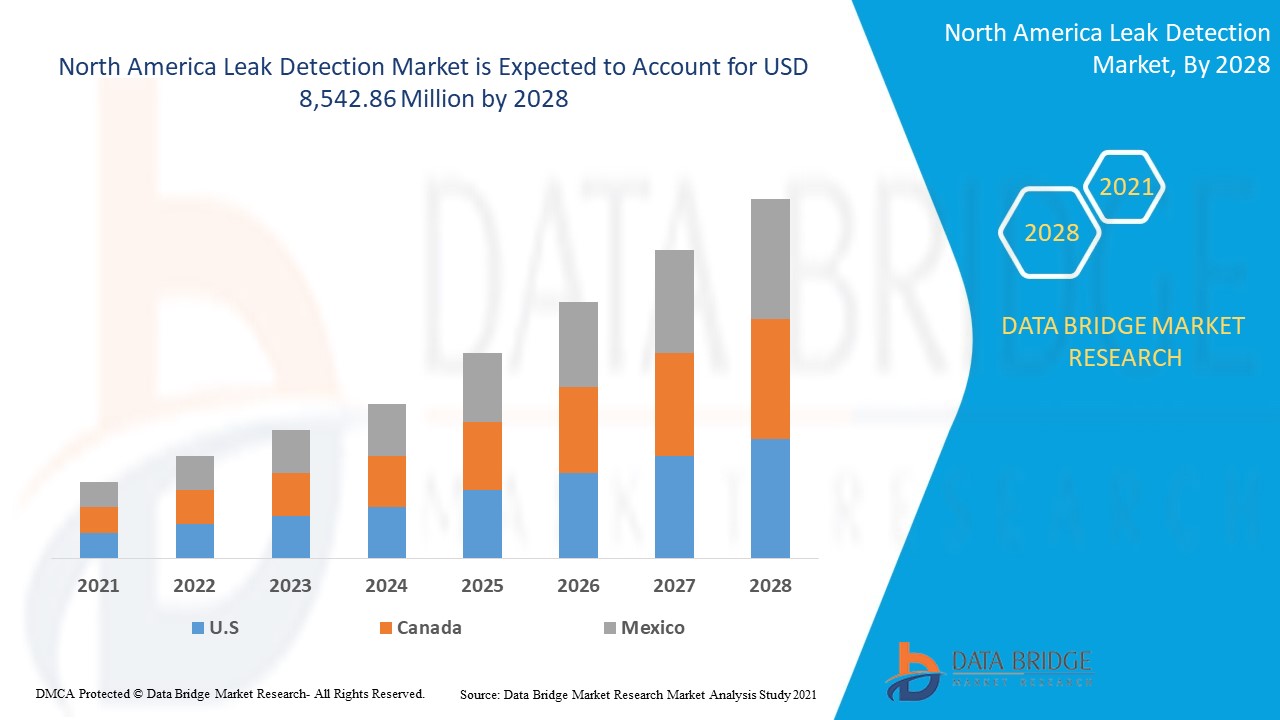

Le marché de la détection des fuites devrait connaître une croissance du marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,1 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 8 542,86 millions USD d'ici 2028.

Le terme fuite désigne une fissure, un trou ou une porosité involontaire dans une paroi ou un joint enveloppant des tuyaux, des batteries, des produits scellés, des chambres ou des conteneurs de stockage qui doivent contenir/transférer différents fluides et gaz. Ces fissures ou trous permettent l'échappement de fluides et de gaz à partir d'un milieu fermé. Les fuites doivent être identifiées le plus tôt possible pour réduire les pertes et les dommages causés à l'environnement, pour lesquels divers capteurs et instruments de détection de fuites sont utilisés. La fonction principale du système de détection de fuites est la localisation et la mesure de la taille des fuites dans les produits scellés.

Le nombre élevé d'incidents de fuites de pipelines et l'intégration croissante de technologies avancées dans les détecteurs de fuites augmentent le marché de la détection des fuites. Par exemple, en janvier 2020, FLIR Systems Inc. a lancé FLIR GF77a, sa première caméra thermique fixe non refroidie et connectée pour la détection du méthane et d'autres gaz industriels. Avec ce nouveau lancement de produits de la série d'imagerie optique des gaz (OGI), l'entreprise a élargi son portefeuille de produits et va accroître sa clientèle.

Ce rapport sur le marché de la détection des fuites fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de la détection des fuites

Le marché de la détection des fuites est segmenté en fonction du type, du type de produit, de la technologie et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type, le marché de la détection des fuites est segmenté en amont, intermédiaire et aval. En 2021, le segment intermédiaire représentait la plus grande part de marché, car il s'occupe essentiellement du transport de pétrole brut et de gaz naturel par divers modes de transport tels que les pipelines. Ces pipelines doivent être protégés contre les fuites pour éviter les incidents de fuite et provoquer des pertes en vies humaines et en biens. Ainsi, le segment intermédiaire domine le segment des types.

- Sur la base du type de produit, le marché de la détection des fuites est segmenté en détecteurs de gaz portables, détecteurs basés sur des drones, détecteurs d'avions habités et détecteurs basés sur des véhicules . En 2021, les détecteurs basés sur des véhicules représentaient la plus grande part de marché car ils peuvent être facilement montés sur un véhicule et être utilisés pour surveiller les canalisations à travers le véhicule en mouvement. Il s'agit du moyen le plus économique et le plus rapide de détecter les fuites et domine donc le segment des types de produits.

- Sur la base de la technologie, le marché de la détection des fuites est segmenté en acoustique/ultrasons , fibre optique, méthodes de déviation pression-débit, modèle transitoire en temps réel étendu (E-RTTM), imagerie thermique, bilan masse/volume, détection de vapeur, absorption laser et LIDAR, détection de fuite hydraulique, ondes de pression négative et autres. En 2021, l'acoustique/l'ultrason représentait la plus grande part de marché car elle offre une détection plus rapide des fuites et constitue une solution à faible coût. De plus, elle permet une détection précoce et la perte peut être évitée à un stade précoce, ces facteurs conduisent à la plus forte croissance de l'acoustique/l'ultrason dans le segment technologique.

- Sur la base de l'utilisateur final, le marché de la détection des fuites est segmenté en pétrole et gaz , usine chimique, usines de traitement des eaux, centrale thermique, exploitation minière et boues, etc. En 2021, le pétrole et le gaz représentaient la plus grande part de marché, car cette industrie est un utilisateur majeur de systèmes de détection des fuites afin de prévenir les fuites de pétrole brut et de gaz et les émissions de méthane. Les fuites peuvent entraîner de graves pertes en vies humaines et en biens. De plus, plusieurs réglementations gouvernementales visant à prévenir les incidents de fuite ont accru la demande de détection des fuites dans l'industrie pétrolière et gazière.

Analyse du marché de la détection des fuites au niveau des pays

Le marché de la détection des fuites est analysé et des informations sur la taille du marché sont fournies par pays, type, type de produit, technologie et utilisateur final.

Les pays couverts par le rapport sur le marché de la détection des fuites en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis représentent la part la plus importante du marché de la détection des fuites, en raison de la présence de grandes entreprises de fabrication et de règles et réglementations strictes concernant la détection des fuites.

La section pays du rapport sur le marché de la détection des fuites fournit également des facteurs d'impact sur le marché individuel et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et l'analyse des importations et des exportations sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Nombre élevé d'incidents de fuites de pipelines

Le marché de la détection des fuites vous fournit également une analyse de marché détaillée pour chaque pays, la croissance de l'industrie avec les ventes, les ventes de composants, l'impact du développement technologique sur la détection des fuites et les changements dans les scénarios réglementaires avec leur soutien au marché de la détection des fuites. Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché du secteur de la détection des fuites

Le paysage concurrentiel du marché de la détection des fuites fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de la détection des fuites.

Français Certains des principaux acteurs opérant sur le marché de la détection des fuites sont FLIR SYSTEMS, Inc., ABB, Honeywell International Inc., Siemens Energy, Pentair, ClampOn AS, Schneider Electric, Atmos International, Xylem, Emerson Electric Co., KROHNE Messtechnik GmbH, PERMA-PIPE International Holdings, Inc., TTK, MSA, HIMA, AVEVA Group plc, Yokogawa Electric Corporation, INFICON, Fotech Group Ltd., Asel-Tech Inc., Hawk Measurement Systems et OptaSense Ltd., entre autres. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux développements de produits sont également initiés par les entreprises du monde entier, ce qui accélère également la croissance du marché de la détection des fuites.

Par exemple,

- En janvier 2020, FLIR Systems Inc. a lancé la FLIR GF77a, sa première caméra thermique fixe connectée non refroidie pour la détection du méthane et d'autres gaz industriels. Avec ce nouveau lancement de la série de produits d'imagerie optique des gaz (OGI), l'entreprise a élargi son portefeuille de produits et va accroître sa clientèle.

L'expansion de la production, le développement de nouveaux produits et d'autres stratégies permettent à l'entreprise d'accroître sa part de marché grâce à une couverture et une présence accrues. Cela permet également à l'organisation d'améliorer son offre en matière de détection des fuites.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.