North America Laboratory Information Systems Lis Market

Taille du marché en milliards USD

TCAC :

%

USD

660.41 Million

USD

1,335.36 Million

2024

2032

USD

660.41 Million

USD

1,335.36 Million

2024

2032

| 2025 –2032 | |

| USD 660.41 Million | |

| USD 1,335.36 Million | |

|

|

|

|

Segmentation du marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord, par composant (service et logiciel), produit (SIL intégré et SIL autonome), livraison (cloud, hébergé à distance et sur site), utilisateur final (laboratoires hospitaliers, laboratoires indépendants, laboratoires de cabinets médicaux et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord

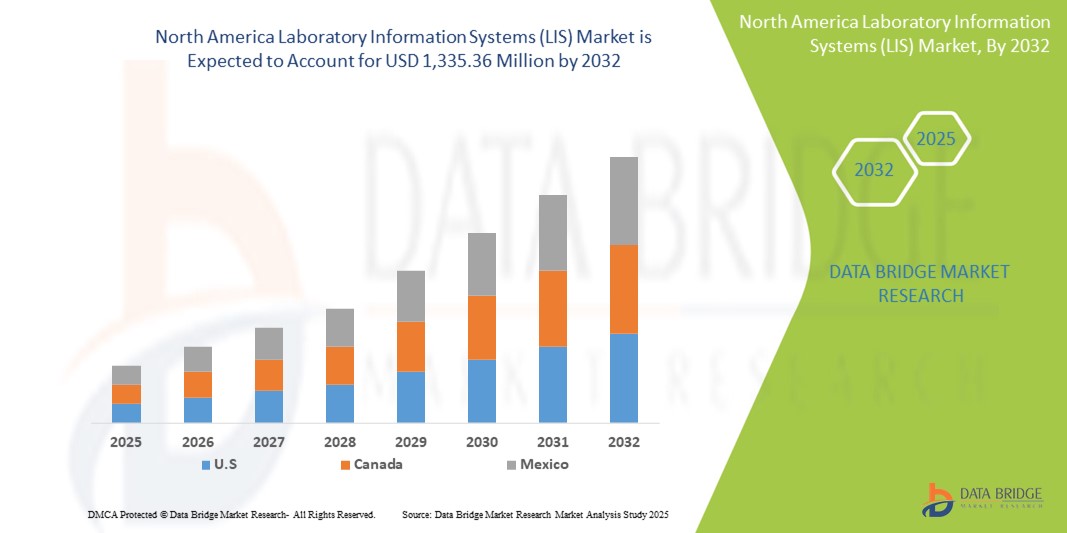

- La taille du marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord était évaluée à 660,41 millions USD en 2024 et devrait atteindre 1 335,36 millions USD d'ici 2032 , à un TCAC de 9,20 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la demande croissante de solutions de diagnostic avancées, associée au volume croissant de tests de laboratoire, qui nécessitent une gestion efficace des données et une automatisation dans les contextes cliniques.

- De plus, l'adoption croissante de plateformes LIS basées sur le cloud, la pression réglementaire pour des diagnostics précis et l'intégration avec les dossiers de santé électroniques (DSE) encouragent les prestataires de soins de santé à investir dans une informatique de laboratoire robuste.

Analyse du marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord

- Le marché nord-américain des systèmes d'information de laboratoire (SIL), qui offre des plateformes numériques pour la gestion des données de laboratoire et l'optimisation des flux de travail de diagnostic, devient de plus en plus vital dans les établissements de santé aux États-Unis, au Canada et au Mexique, en raison de sa capacité à améliorer la précision, à rationaliser les opérations et à soutenir la conformité réglementaire.

- La demande croissante de LIS est principalement alimentée par le nombre croissant de tests de diagnostic, la poussée vers la numérisation des soins de santé et le besoin de systèmes intégrés qui se connectent de manière transparente aux dossiers de santé électroniques (DSE) et à d'autres plateformes informatiques cliniques.

- Les États-Unis ont dominé le marché nord-américain des systèmes d'information de laboratoire (SIL), avec une part de chiffre d'affaires de 42,7 % en 2024, grâce à l'adoption précoce de solutions informatiques de santé, au soutien gouvernemental fort, aux volumes de tests élevés et à la concentration des principaux fournisseurs de SIL. Le pays reste leader en matière de déploiement de SIL, notamment dans les grands hôpitaux et les réseaux de diagnostic qui adoptent l'automatisation et l'analyse assistée par l'IA.

- Le Canada devrait connaître la croissance la plus rapide sur le marché nord-américain des systèmes d'information de laboratoire (SIL), grâce à des initiatives nationales en santé numérique et à des investissements croissants dans les infrastructures de laboratoire. Le Mexique progresse progressivement grâce à la modernisation de son système de santé publique, ce qui favorise la pénétration des SIL dans les laboratoires et les hôpitaux publics.

- Le segment LIS basé sur le cloud a dominé le marché nord-américain des systèmes d'information de laboratoire (LIS) avec une part de 46,8 % en 2024, en raison de son évolutivité, de sa rentabilité et de son adéquation aux laboratoires de petite et moyenne taille.

Portée du rapport et segmentation du marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord

|

Attributs |

Informations clés sur le marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord

« L'automatisation pilotée par l'IA et l'intégration cloud améliorent l'efficacité du laboratoire »

- Une tendance importante et croissante sur le marché nord-américain des SIL est l'intégration croissante de l'intelligence artificielle (IA) et des infrastructures cloud pour moderniser les flux de travail diagnostiques et améliorer l'efficacité des laboratoires aux États-Unis, au Canada et au Mexique. Cette avancée technologique transforme les opérations de laboratoire en offrant une précision, une évolutivité et un accès aux données en temps réel accrus.

- Par exemple, LabWare et Orchard Software ont intégré à leurs plateformes SIL des modules optimisés par l'IA qui prennent en charge les diagnostics prédictifs, automatisent les tâches répétitives et détectent les anomalies de flux de travail. Ces fonctionnalités aident les laboratoires à réduire les délais d'exécution et à garantir la conformité aux normes cliniques.

- Les solutions SIL basées sur l'IA analysent également les données de tests historiques pour améliorer la prise de décision et peuvent émettre des alertes proactives en cas de problèmes de contrôle qualité ou d'erreurs de diagnostic potentielles. Parallèlement, les modèles de déploiement cloud permettent un accès centralisé aux données, une connectivité multi-sites et des mises à jour logicielles simplifiées, particulièrement essentielles pour les grands systèmes de santé aux États-Unis.

- Le besoin croissant d'interopérabilité et de diagnostic à distance rend les systèmes d'information de santé (SIS) infonuagiques de plus en plus indispensables. Au Canada, les stratégies de santé numérique favorisent le partage de données interinstitutionnel, favorisant ainsi l'adoption du cloud.

- L'intégration des capacités d'IA et de cloud dans les plateformes LIS redéfinit les attentes en matière de systèmes de laboratoire, offrant aux laboratoires un environnement unifié et intelligent qui permet l'automatisation, la création de rapports en temps réel et une supervision centralisée.

- Alors que les systèmes de santé de la région continuent de donner la priorité à la transformation numérique, la demande de plates-formes LIS avancées avec automatisation basée sur l'IA et fonctionnalités cloud évolutives devrait croître rapidement dans les secteurs public et privé.

Dynamique du marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord

Conducteur

« Augmentation du volume de diagnostics et impulsion pour la transformation numérique des soins de santé »

- La charge de travail diagnostique croissante des systèmes de santé, conjuguée aux efforts régionaux de modernisation des soins de santé numériques, constitue un moteur majeur de la croissance du marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord. Les laboratoires ont besoin de solutions de gestion de données robustes pour traiter d'importants volumes d'échantillons de patients tout en maintenant rapidité et précision.

- Par exemple, en mars 2024, le ministère américain de la Santé et des Services sociaux a introduit des directives d'interopérabilité mises à jour visant à améliorer l'échange de données électroniques, encourageant une plus grande adoption de plateformes LIS intégrées dans les hôpitaux et les centres de diagnostic.

- Les solutions SIL prennent en charge le suivi automatisé des échantillons, la validation des résultats et le contrôle de la conformité, essentiels pour les laboratoires soumis à de fortes pressions. Au Canada, des initiatives nationales visant à améliorer la connectivité des laboratoires et l'efficacité des rapports favorisent également l'adoption des SIL.

- Avec la généralisation de la médecine personnalisée, du diagnostic moléculaire et des tests génomiques, les laboratoires ont besoin de systèmes intelligents capables de traiter des ensembles de données complexes. Les plateformes SIL, dotées d'outils d'IA et d'intégration aux systèmes de DMP, sont de plus en plus privilégiées dans les centres de recherche et les laboratoires spécialisés de la région.

- La poussée généralisée en faveur de la transformation numérique, de la prise de décision clinique basée sur les données et de l'assurance qualité devrait alimenter l'expansion de l'adoption des SIL dans toute l'Amérique du Nord dans les années à venir.

Retenue/Défi

« Préoccupations liées à la sécurité des données et obstacles à l'interopérabilité »

- Les préoccupations concernant la confidentialité des données et les vulnérabilités en matière de cybersécurité continuent de freiner le déploiement à grande échelle des solutions SIL en Amérique du Nord. Manipulant des données de patients et de diagnostics hautement sensibles, les plateformes SIL sont fréquemment la cible de cybermenaces et d'attaques par rançongiciel.

- Par exemple, plusieurs violations de données médicales signalées aux États-Unis en 2023 ont suscité des inquiétudes quant à la sécurité des systèmes cloud et des intégrations de logiciels tiers. Garantir la conformité à la loi HIPAA et aux autres lois sur la protection des données est crucial pour gagner la confiance des utilisateurs et atténuer les risques.

- L'interopérabilité constitue un autre défi persistant, notamment lorsque les plateformes SIL doivent s'intégrer à des systèmes de DSE obsolètes ou à des instruments de laboratoire dépourvus de protocoles standardisés. Cela peut entraîner des retards de mise en œuvre et une complexité informatique accrue.

- De plus, le coût initial élevé de la mise en œuvre d'un SIL, sa maintenance continue et les exigences de personnalisation peuvent constituer un obstacle financier, en particulier pour les laboratoires de petite et moyenne taille. Au Mexique, le ralentissement du développement des infrastructures numériques et les budgets limités des institutions publiques freinent encore davantage la pénétration du marché.

- Pour surmonter ces défis, les fournisseurs de LIS doivent donner la priorité à une architecture système sécurisée, promouvoir l'adoption de normes de données communes et proposer des solutions plus abordables et évolutives adaptées aux divers besoins des laboratoires de la région.

Portée du marché nord-américain des systèmes d'information de laboratoire (SIL)

Le marché est segmenté sur la base du composant, du produit, du mode de livraison et de l’utilisateur final.

- Par composant

En Amérique du Nord, le marché des systèmes d'information de laboratoire (SIL) est segmenté en logiciels et services. Le segment des logiciels a dominé le marché avec la plus grande part de chiffre d'affaires en 2024, grâce au besoin croissant d'automatisation des opérations de laboratoire et à l'intégration des plateformes SIL aux dossiers médicaux électroniques (DME). Les solutions logicielles sont essentielles pour permettre des flux de travail pilotés par les données, la validation automatisée des résultats et le suivi de la conformité, ce qui les rend indispensables aux laboratoires cliniques et de diagnostic modernes.

Le segment des services devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la demande croissante de personnalisation des SIL, de mises à niveau logicielles, de formation et de support technique. Alors que les laboratoires cherchent à optimiser et à maintenir leurs environnements SIL, les prestataires de services jouent un rôle croissant pour garantir la disponibilité et la performance à long terme des systèmes.

- Par produit

En termes de produits, le marché nord-américain des systèmes d'information de laboratoire (SIL) se divise en SIL intégrés et SIL autonomes. Le segment SIL intégré a représenté la plus grande part de chiffre d'affaires en 2024 grâce à sa compatibilité parfaite avec les systèmes informatiques de santé plus larges, notamment les DMP, les logiciels de facturation et les outils d'aide à la décision clinique. Les plateformes SIL intégrées sont de plus en plus adoptées par les laboratoires hospitaliers et les grands centres de diagnostic pour leurs capacités de contrôle centralisé et de coordination multiservices.

Le segment des systèmes d'information de laboratoire autonomes devrait connaître le TCAC le plus rapide entre 2025 et 2032, en particulier dans les laboratoires de petite et moyenne taille qui nécessitent une gestion dédiée des informations de laboratoire sans la complexité d'une intégration hospitalière complète. Ces systèmes sont appréciés pour leur rentabilité et leur facilité de déploiement dans les environnements de test de niche et les laboratoires de recherche spécialisés.

- Par mode de livraison

En fonction du mode de livraison, le marché nord-américain des systèmes d'information de laboratoire (SIL) est segmenté en modèles cloud, hébergés à distance et sur site. Le segment cloud a dominé le marché avec la plus forte part de chiffre d'affaires (46,8 %) en 2024, grâce à son évolutivité, ses coûts d'infrastructure réduits et sa capacité à prendre en charge l'accès à distance sur des réseaux de laboratoires multisites. Les plateformes SIL cloud sont de plus en plus plébiscitées aux États-Unis et au Canada en raison de leur conformité réglementaire, de la disponibilité des données en temps réel et de la simplification des mises à jour.

Le segment de l'hébergement à distance devrait connaître une croissance significative au cours de la période de prévision, car il offre un compromis entre contrôle sur site et flexibilité du cloud. Il s'adresse aux laboratoires qui recherchent un hébergement externe sans dépendance totale au cloud, en particulier ceux disposant de capacités informatiques modérées.

- Par utilisateur final

En fonction de l'utilisateur final, le marché nord-américain des systèmes d'information de laboratoire (SIL) est segmenté en laboratoires hospitaliers, laboratoires indépendants, laboratoires de cabinets médicaux, etc. En 2024, le segment des laboratoires hospitaliers détenait la plus grande part de marché, soutenu par un volume important de patients, les exigences réglementaires et le besoin de diagnostics intégrés et de gestion centralisée des données en milieu clinique.

Le segment des laboratoires indépendants devrait connaître le TCAC le plus rapide entre 2025 et 2032, alimenté par la demande croissante de services de diagnostic externalisés, la complexité croissante des tests et les investissements dans l'automatisation. Ces laboratoires privilégient souvent des systèmes SIL flexibles prenant en charge des opérations à haut débit et des menus de tests diversifiés.

Analyse régionale du marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord

- Les États-Unis ont dominé le marché nord-américain des systèmes d'information de laboratoire (SIL), avec la plus grande part de chiffre d'affaires (42,7 %) en 2024, grâce à l'adoption précoce de solutions informatiques de santé, au soutien gouvernemental fort, aux volumes élevés de tests et à la concentration des principaux fournisseurs de SIL. Le pays reste leader en matière de déploiement de SIL, notamment dans les grands hôpitaux et les réseaux de diagnostic qui adoptent l'automatisation et l'analyse assistée par l'IA.

- Les laboratoires américains privilégient les plateformes LIS intégrées et basées sur l'IA qui améliorent l'efficacité, garantissent la conformité aux réglementations HIPAA et permettent un échange de données transparent avec les systèmes EHR, faisant du LIS un élément essentiel des opérations cliniques.

- La croissance collective de la région est soutenue par une sensibilisation croissante aux diagnostics basés sur les données, un besoin d'automatisation des flux de travail en laboratoire et une importance croissante accordée au contrôle de la qualité et à l'exactitude des rapports dans les milieux cliniques et de recherche.

Aperçu du marché des systèmes d'information de laboratoire (SIL) aux États-Unis et en Amérique du Nord

Le marché américain des systèmes d'information de laboratoire (SIL) a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, avec 78 %, grâce à l'infrastructure de santé hautement numérisée du pays et à l'augmentation du volume de tests diagnostiques. Les hôpitaux, les cliniques et les laboratoires de recherche déploient de plus en plus de plateformes SIL avancées pour rationaliser leurs opérations, répondre aux exigences réglementaires et améliorer la précision des diagnostics. L'essor de l'interopérabilité, l'intégration aux dossiers médicaux électroniques (DME) et l'adoption d'outils d'analyse basés sur l'IA stimulent encore la demande. De plus, les initiatives gouvernementales, telles que les mandats d'interopérabilité et le financement de la modernisation des technologies de l'information en santé, favorisent la généralisation des SIL dans les secteurs de la santé publics et privés.

Aperçu du marché des systèmes d'information de laboratoire (SIL) au Canada et en Amérique du Nord

Le marché canadien des systèmes d'information de laboratoire (SIL) devrait connaître une croissance soutenue tout au long de la période de prévision, stimulé par les stratégies nationales de santé numérique et les investissements visant à moderniser les systèmes de laboratoire. Les prestataires de soins de santé publics et privés adoptent de plus en plus de solutions SIL infonuagiques afin d'améliorer l'accessibilité des données et l'efficacité de la production de rapports dans toutes les provinces. L'accent mis sur l'interopérabilité, la normalisation des données et le contrôle de la qualité favorise l'adoption de plateformes SIL intégrées. L'accent mis par le Canada sur la prestation de soins de santé décentralisée et communautaire favorise également l'expansion des SIL en milieu ambulatoire et à distance.

Aperçu du marché des systèmes d'information de laboratoire (SIL) au Mexique et en Amérique du Nord

Le marché mexicain des systèmes d'information de laboratoire (SIL) devrait connaître une croissance soutenue au cours de la période de prévision, soutenue par les efforts de modernisation de l'infrastructure informatique de santé et de numérisation des laboratoires publics. Malgré la persistance de contraintes budgétaires et d'une interopérabilité limitée, la demande de solutions SIL évolutives et abordables augmente, notamment dans les hôpitaux publics et les centres de diagnostic. Les plateformes SIL basées sur le cloud gagnent en popularité grâce à leur rentabilité et à leurs faibles besoins en maintenance informatique. La prise de conscience croissante de la précision diagnostique au Mexique, conjuguée à l'expansion du réseau de santé, devrait continuer à favoriser l'adoption des SIL.

Part de marché des systèmes d'information de laboratoire (SIL) en Amérique du Nord

L'industrie des systèmes d'information de laboratoire (SIL) en Amérique du Nord est principalement dirigée par des entreprises bien établies, notamment :

- Thermo Fisher Scientific Inc. (États-Unis)

- Illumina Inc. (États-Unis)

- PerkinElmer (États-Unis)

- Roper Technologies (États-Unis)

- Agilent Technologies, Inc. (États-Unis)

- Autoscribe Informatics (Royaume-Uni)

- Benchling (États-Unis)

- Eusoft Ltd (Portugal)

- Infor AG (États-Unis)

- Kritisoft (Inde)

- Labvantage Solutions Inc. (États-Unis)

- Matériel de laboratoire (États-Unis)

- McKesson Corporation (États-Unis)

- Orchard Software Corporation (États-Unis)

- Novatek International (Canada)

- Lqms (États-Unis)

- Starlims Corporation (États-Unis)

Quels sont les développements récents sur le marché nord-américain des systèmes d’information de laboratoire (LIS) ?

- En avril 2024, LabWare a lancé LabWare 8, la dernière itération de sa plateforme LIMS/LIS d'entreprise, avec des modules d'apprentissage automatique et d'analyse d'IA améliorés qui permettent des diagnostics prédictifs et la détection d'anomalies, soulignant ainsi son engagement envers l'informatique de laboratoire de nouvelle génération.

- En mars 2024, Orchard Software Corporation a conclu un partenariat stratégique avec un important système de santé américain pour déployer sa plateforme SIL cloud dans plusieurs établissements. Cette mise en œuvre améliore l'intégration des DMP et l'accès centralisé, soulignant ainsi la transition croissante vers une infrastructure SIL évolutive et cloud.

- En juin 2024, CompuGroup Medical USA a publié CGM LABDAQ v24.4, qui introduit une recherche renforcée de rapports d'audit, des moteurs de règles de microbiologie et de facturation, ainsi qu'une vérification automatique, soulignant les avancées en matière d'IA et de flux de travail de laboratoire basés sur des règles. Peu de temps après, CGM LABDAQ a été nommé meilleur système d'information de laboratoire 2024 par Lighthouse Lab Services, validant son interface intuitive et l'excellence de ses rapports.

- En janvier 2024, Sunquest Information Systems (sous Clinisys) a intégré son LIS aux plateformes de données génomiques d'un important centre médical universitaire américain, permettant une gestion transparente des flux de travail de tests génétiques à haute complexité et renforçant la tendance vers la médecine de précision.

- En décembre 2023, Cerner Corporation (Oracle Health) a lancé un programme de modernisation du LIS dans certains réseaux hospitaliers américains, en mettant l'accent sur les améliorations de l'interopérabilité, l'amélioration de l'expérience utilisateur et le respect des normes réglementaires, démontrant ainsi un investissement soutenu dans l'informatique de laboratoire de nouvelle génération.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: REGULATIONS

5.1 REGULATORY GUIDELINES AND STANDARDS IN UNITED STATES: U.S. FOOD AND DRUG ADMINISTRATION (FDA)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE REQUIREMENT OF QUICK-DECISION MAKING PROCESS IN BIOTECHNOLOGY

6.1.2 RISING DEMAND FOR ADVANCED COMPUTATIONAL TOOLS IN RESEARCH LABORATORY

6.1.3 RISING USE OF LIMS FOR COMPLIANCE WITHOUT SACRIFICING FLEXIBILITY

6.1.4 INTEGRATION OF ADVANCED TECHNOLOGIES SUCH AS AI, MACHINE LEARNING

6.2 RESTRAINTS

6.2.1 HIGHER COST OF DATA MANAGEMENT & SOFTWARE

6.2.2 LACK OF WELL-DEFINED STANDARD FORMAT FOR DATA INTEGRATION

6.2.3 STRINGENT REGULATION BY GOVERNMENT ENTITLES IN INFORMATICS DOMAIN

6.3 OPPORTUNITIES

6.3.1 INCREASING STRATEGIC DECISIONS

6.3.2 ADVANCEMENTS IN R&D LABS SPECIALLY IN PHARMACEUTICAL SECTOR

6.3.3 INCREASE IN VARIOUS INITIATIVES FROM GOVERNMENT AS WELL AS PRIVATE SECTORS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED & TRAINED PROFESSIONALS TO USE THE COMPUTATIONAL TOOLS

6.4.2 DATA COMPLEXITY & LACK OF USER FRIENDLY TOOLS

7 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 INTEGRATED LIS

7.3 STANDALONE LIS

8 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 SERVICE

8.3 SOFTWARE

8.3.1 SAMPLE MANAGEMENT SOFTWARE

8.3.2 REPORTING SOFTWARE

8.3.3 WORKFLOW MANAGEMENT SOFTWARE

8.3.4 EMR/EHR SOFTWARE

8.3.5 OTHERS SOFTWARE

9 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY

9.1 OVERVIEW

9.2 CLOUD-BASED

9.3 REMOTELY-HOSTED

9.4 ON-PREMISE

10 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL LABORATORIES

10.3 INDEPENDENT LABORATORIES

10.4 PHYSICIAN OFFICE LABORATORIES

10.5 OTHERS

11 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ROPER TECHNOLOGIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMAPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 PERKINELMER INC

14.3.1 COMPANY SNAPSHOT

14.3.2 COMAPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ILLUMINA INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMAPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 AGILENT TECHNOLOGIES, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMAPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AGARAM TECHNOLOGIES PVT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AUTOSCRIBE INFORMATICS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BENCHLING

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 COMPUGROUP MEDICAL

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.9.5 CLINISYS

14.9.6 COMPANY SNAPSHOT

1.1.4 PRODUCT PORTFOLIO 120

14.9.7 RECENT DEVELOPMENT

14.1 EPIC SYSTEMS CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 EUSOFT

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 INFORS AG

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KRITILIMS.IN

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 LABSOLS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 LABVANTAGE SOLUTIONS INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 LQMS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 MCKESSON CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 NOVATEK INTERNATIONAL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SHIMADZU CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 SIEMENS AG

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 STARLIMS CORPORATION

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 2 NORTH AMERICA INTEGRATED LIS IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 3 NORTH AMERICA STANDALONE LIS IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 4 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 NORTH AMERICA SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 NORTH AMERICA SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 8 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 9 NORTH AMERICA CLOUD-BASED IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 NORTH AMERICA REMOTELY-HOSTED IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 NORTH AMERICA ON-PREMISE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 13 NORTH AMERICA HOSPITAL LABORATORIES IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 NORTH AMERICA INDEPENDENT LABORATORIES IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 NORTH AMERICA PHYSICIAN OFFICE LABORATORIES IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 18 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 19 NORTH AMERICA SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 20 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 21 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 22 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 23 U.S. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 24 U.S. SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 25 U.S. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 26 U.S. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 27 U.S. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 28 CANADA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 29 CANADA SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 30 CANADA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 31 CANADA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 32 CANADA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 33 MEXICO LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 34 MEXICO SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 35 MEXICO LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 36 MEXICO LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 37 MEXICO LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET , BY COMPONENT

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISION

FIGURE 14 INCREASE IN THE REQUIREMENT OF QUICK-DECISION MAKING PROCESS IN BIOTECHNOLOGY IS DRIVING THE GROWTH OF THE NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET FROM 2024 TO 2031

FIGURE 15 THE SERVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET IN 2024 AND 2031

FIGURE 16 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR NORTH AMERICA LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET

FIGURE 17 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, 2023

FIGURE 18 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, 2024-2031 (USD MILLION)

FIGURE 19 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, CAGR (2024-2031)

FIGURE 20 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, 2023

FIGURE 22 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, 2024-2031 (USD MILLION)

FIGURE 23 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, CAGR (2024-2031)

FIGURE 24 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, 2023

FIGURE 26 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, 2024-2031 (USD MILLION)

FIGURE 27 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, CAGR (2024-2031)

FIGURE 28 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, 2023

FIGURE 30 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 31 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 32 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: SNAPSHOT (2023)

FIGURE 34 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: COMPANY SHARE 2023 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.