North America Invisible Orthodontics Market

Taille du marché en milliards USD

TCAC :

%

USD

2,715.63 Million

USD

7,927.50 Million

2021

2029

USD

2,715.63 Million

USD

7,927.50 Million

2021

2029

| 2022 –2029 | |

| USD 2,715.63 Million | |

| USD 7,927.50 Million | |

|

|

|

Marché de l'orthodontie invisible en Amérique du Nord, par produits et services (produits et services), groupe d'âge (adultes, adolescents et enfants), application ( malocclusion , surpeuplement, espacement excessif et autres), utilisateur final ( hôpitauxcliniques dentaires , cliniques d'orthodontie et autres), canal de distribution (ventes directes et distributeurs tiers), pays (États-Unis, Canada, Mexique) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : marché de l'orthodontie invisible en Amérique du Nord

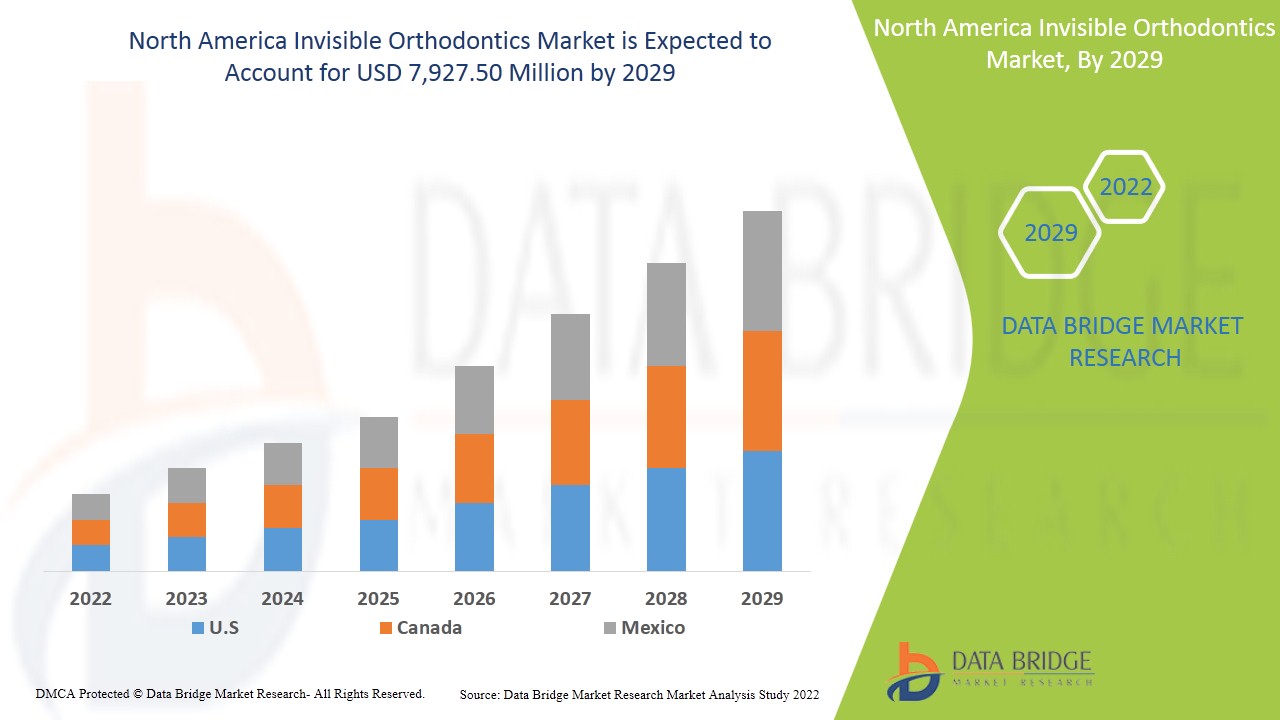

Le marché nord-américain de l'orthodontie invisible devrait atteindre 7 927,50 millions USD d'ici 2029, contre 2 715,63 millions USD en 2021, avec un TCAC de 14,3 % au cours de la période de prévision de 2022 à 2029. La demande croissante d'apparence esthétique a encore propulsé la demande de traitement orthodontique dans le monde entier. Ainsi, la prévalence croissante de la malocclusion agit comme un moteur de la croissance du marché de l'orthodontie invisible.

Le marché de l'orthodontie invisible propose des produits et services tels que des aligneurs transparents, des appareils orthodontiques en céramique, des appareils orthodontiques linguaux et des appareils de contention transparents pour le traitement de problèmes dentaires mineurs tels que les dents encombrées, l'espacement excessif et la malocclusion. Ces options de traitement sont très demandées en raison de l'attrait esthétique qu'elles procurent ainsi que de l'option souhaitée. De plus, la sensibilisation croissante à la dentisterie esthétique a encore propulsé la demande d'orthodontie invisible. Les organisations publiques et privées s'efforcent de répondre aux besoins changeants des clients en termes de démonstrations, de campagnes et de contrôles dentaires. Ainsi, l'utilisation de telles stratégies promet une croissance substantielle de l'orthodontie invisible.

La prévalence élevée de la malocclusion et la sensibilisation croissante à une bonne hygiène bucco-dentaire devraient servir de moteur à la croissance du marché de l'orthodontie invisible à travers le monde. Cependant, le coût élevé du traitement orthodontique invisible devrait freiner sa croissance sur le marché. La présence d'un grand nombre d'acteurs sur le marché qui prennent des initiatives stratégiques pour accroître la croissance du marché devrait constituer une opportunité pour la croissance du marché. Cependant, les réglementations gouvernementales strictes peuvent constituer un défi pour la croissance du marché.

Le marché de l'orthodontie invisible en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de l'orthodontie invisible en Amérique du Nord

Le marché nord-américain de l’orthodontie invisible est classé en cinq segments notables qui sont basés sur les produits et services, les groupes d’âge, l’application, l’utilisateur final et le canal de distribution.

- Sur la base des produits et services, le marché nord-américain de l'orthodontie invisible est segmenté en produits et services. Le segment des produits est sous-segmenté en aligneurs transparents, appareils orthodontiques en céramique, appareils de contention transparents et appareils orthodontiques linguaux. En 2022, le segment des produits devrait dominer le marché nord-américain de l'orthodontie invisible en raison de la présence de divers types d'aligneurs sur le marché.

- En fonction des tranches d'âge, le marché nord-américain de l'orthodontie invisible est segmenté en enfants, adultes et adolescents. En 2022, le segment des adultes devrait dominer le marché nord-américain de l'orthodontie invisible en raison de la demande croissante de ce traitement parmi la population adulte.

- En fonction des applications, le marché nord-américain de l'orthodontie invisible est segmenté en encombrement, espacement excessif, malocclusion et autres. En 2022, le segment de la malocclusion devrait dominer le marché nord-américain de l'orthodontie invisible en raison des progrès technologiques menant au traitement efficace de la maladie.

- En fonction de l'utilisateur final, le marché nord-américain de l'orthodontie invisible est segmenté en hôpitaux, cliniques dentaires, cliniques d'orthodontie et autres. En 2022, le segment des hôpitaux en termes d'utilisation finale va dominer le marché, car les patients se rendent dans les hôpitaux pour un diagnostic et un traitement de maladies.

- Sur la base du canal de distribution, le marché nord-américain de l'orthodontie invisible est segmenté en ventes directes et distributeurs tiers. En 2022, le segment des ventes directes dans le canal de distribution va dominer le marché, en raison de la demande croissante des hôpitaux et des cliniques dentaires.

Analyse du marché de l'orthodontie invisible au niveau des pays

Le marché de l'orthodontie invisible en Amérique du Nord est analysé et des informations sur la taille du marché sont fournies par produit et services, par groupe d'âge, par application, par utilisateur final et par canal de distribution. Les pays couverts par le rapport sur le marché de l'orthodontie invisible en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

L'Amérique du Nord devrait croître avec un TCAC de 14,3 % au cours de la période de prévision, comme dans les pays d'Amérique du Nord ; la demande de traitement orthodontique invisible augmente. Les États-Unis devraient dominer le marché nord-américain en raison de la présence de grands acteurs du marché dans la région.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Les lancements de nouveaux produits par les fabricants créent de nouvelles opportunités pour les acteurs du marché de l'orthodontie invisible

Le marché de l'orthodontie invisible vous fournit également une analyse détaillée du marché pour chaque pays, la croissance de l'industrie esthétique avec les ventes du marché de l'orthodontie invisible, l'impact des progrès sur le marché de l'orthodontie invisible et les changements dans les scénarios réglementaires avec leur soutien au marché de l'orthodontie invisible. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse du paysage concurrentiel et des parts de marché de l'orthodontie invisible

Le paysage concurrentiel du marché de l'orthodontie invisible fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché de l'orthodontie invisible.

Certains des principaux acteurs opérant sur le marché de l'orthodontie invisible en Amérique du Nord sont 3M, Candid Care Co., Henry Schein Orthodontics (une filiale de Henry Schein, Inc.), TP Orthodontics, Inc., G&H Orthodontics, Great Lakes Dental Technologies, DynaFlex, American Orthodontics, Align Technology, Inc., Rocky Mountain Orthodontics, DB Orthodontics, DENTAURUM GmbH & Co. KG, ALIGNERCO, Institut Straumann AG, Ormco Corporation (une filiale d'Envista), Dentsply Sirona et SmileDirectClub, entre autres.

De nombreux lancements de produits et accords sont également initiés par des entreprises du monde entier, ce qui accélère également le marché de l'orthodontie invisible.

Par exemple,

- En avril 2020, American Orthodontics a annoncé le lancement de son nouveau produit nommé Empower 2 Clear, qui est un appareil esthétique transparent. Ce nouveau produit lancé par la société et la demande accrue d'orthodontie invisible ont augmenté sa demande et ses ventes sur le marché, ce qui a entraîné une augmentation des revenus à l'avenir.

Ce nouveau produit lancé par la société a augmenté son portefeuille d'estimation des protéines sur le marché. La collaboration, les coentreprises et d'autres stratégies de l'acteur du marché améliorent le marché de l'entreprise sur le marché de l'orthodontie invisible, ce qui offre également l'avantage aux organisations d'améliorer leur offre pour le marché de l'orthodontie invisible.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INVISIBLE ORTHODONTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS AND SERVICES LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REGULATIONS OF INVISIBLE ORTHODONTICS MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN PREVALENCE OF MALOCCLUSION

5.1.2 GROWING ADULT ORTHODONTICS

5.1.3 INCREASED COSMETIC AWARENESS

5.1.4 GROWING NUMBER OF GPS OFFERING ORTHODONTIC SERVICES

5.1.5 RISING DEMAND FOR MINIMALLY INVASIVE SURGICAL TECHNIQUES

5.2 RESTRAINTS

5.2.1 HIGH PRICE OF INVISIBLE ORTHODONTICS

5.2.2 STRICT REGULATORY APPROVAL

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENT OF COSMETIC DENTISTRY TECHNIQUES

5.3.2 INTRODUCTION OF CAM/CAD TECHNOLOGY IN ORTHODONTICS

5.3.3 INCREASING HEALTH CARE EXPENDITURE

5.3.4 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

5.4 CHALLENGES

5.4.1 LIMITATIONS ASSOCIATED WITH THE INVISIBLE ORTHODONTICS

5.4.2 MARKET COMPETITION

5.4.3 EMERGENCE OF COVID-19

6 IMPACT OF COVID-19 ON NORTH AMERICA INVISIBLE ORTHODONTICS MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY CHAIN

6.4 STRATEGIC DECISIONS OF GOVERNMENT AND MANUFACTURERS

6.5 CONCLUSION

7 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES

7.1 OVERVIEW

7.2 PRODUCTS

7.2.1 CLEAR ALIGNERS

7.2.2 CERAMIC BRACES

7.2.3 CLEAR RETAINERS

7.2.4 LINGUAL BRACES

7.3 SERVICES

8 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS

8.1 OVERVIEW

8.2 ADULTS

8.2.1 CLEAR ALIGNERS

8.2.2 CERAMIC BRACES

8.2.3 CLEAR RETAINERS

8.2.4 LINGUAL BRACES

8.3 TEENAGERS

8.3.1 CLEAR ALIGNERS

8.3.2 CERAMIC BRACES

8.3.3 CLEAR RETAINERS

8.3.4 LINGUAL BRACES

8.4 CHILDREN

8.4.1 CLEAR ALIGNERS

8.4.2 CERAMIC BRACES

8.4.3 CLEAR RETAINERS

8.4.4 LINGUAL BRACES

9 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MALOCCLUSION

9.2.1 CLEAR ALIGNERS

9.2.2 CERAMIC BRACES

9.2.3 CLEAR RETAINERS

9.2.4 LINGUAL BRACES

9.3 CROWDING

9.3.1 CLEAR ALIGNERS

9.3.2 CERAMIC BRACES

9.3.3 CLEAR RETAINERS

9.3.4 LINGUAL BRACES

9.4 EXCESSIVE SPACING

9.4.1 CLEAR ALIGNERS

9.4.2 CERAMIC BRACES

9.4.3 CLEAR RETAINERS

9.4.4 LINGUAL BRACES

9.5 OTHERS

10 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 DENTAL CLINICS

10.4 ORTHODONTIC CLINICS

10.5 OTHERS

11 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 THIRD PARTY DISTRIBUTORS

12 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA INVISIBLE ORTHODONTICS: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ALIGN TECHNOLOGY, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 SMILEDIRECTCLUB

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 HENRY SCHEIN ORTHODONTICS (A SUBSIDIARY OF HENRY SCHEIN, INC.)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 DENTSPLY SIRONA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 3M

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALIGNERCO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMERICAN ORTHODONTICS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CANDID CARE CO.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 DB ORTHODONTICS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 DENTAURUM GMBH & CO. KG

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DR SMILE DENTAL CLINIC

15.11.1 COMPANY SNAPSHOT

15.11.2 SERVICE PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 DYNAFLEX

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FORESTADENT - BERNHARD FOERSTER GMBH

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 G&H ORTHODONTICS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 GREAT LAKES DENTAL TECHNOLOGIES

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 INSTITUT STRAUMANN AG

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 ORMCO CORPORATION (A SUBSIDIARY OF ENVISTA)

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 ORTHO-CARE (UK) LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 ROCKY MOUNTAIN ORTHODONTICS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SMILE2IMPRESS SL

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 STRAIGHT TEETH DIRECT

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SUNSHINE SMILE GMBH

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 TP ORTHODONTICS, INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 WONDERSMILE

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 COST OF CERAMIC BRACES IN THE U.S.

TABLE 2 GENERAL AND MEDICAL INFLATION RATES FOR SELECTED COUNTRIES

TABLE 3 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PRODUCTS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PRODUCTS IN INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DENTAL CLINICS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORTHODONTICS CLINICS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIRECT SALES IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2020 (USD MILLION)

TABLE 29 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PRODUCTS IN INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 43 U.S. INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 44 U.S. INVISIBLE PRODUCTS IN ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 45 U.S. INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 46 U.S. ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 47 U.S. TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 48 U.S. CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 49 U.S. INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 U.S. MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 U.S. CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 U.S. INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 U.S. INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 CANADA INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 56 CANADA INVISIBLE PRODUCTS IN ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 57 CANADA INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 58 CANADA ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 59 CANADA TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 60 CANADA CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 61 CANADA INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CANADA CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CANADA EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 CANADA INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 CANADA INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 MEXICO INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 68 MEXICO INVISIBLE PRODUCTS IN ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 69 MEXICO INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 71 MEXICO TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 73 MEXICO INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 MEXICO MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 MEXICO EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 MEXICO INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 MEXICO INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA INVISIBLE ORTHODONTICS MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GROWING ADULT ORTHODONTICS IS EXPECTED TO DRIVE THE NORTH AMERICA INVISIBLE ORTHODONTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INVISIBLE ORTHODONTICS MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA INVISIBLE ORTHODONTICS MARKET

FIGURE 15 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE PROVIDERS IN THE U.K. IN 2018

FIGURE 16 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES, 2021

FIGURE 17 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY AGE GROUPS, 2021

FIGURE 21 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY AGE GROUPS, 2020-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY AGE GROUPS, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY AGE GROUPS, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY APPLICATION, 2021

FIGURE 25 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY END USER, 2021

FIGURE 29 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 33 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 36 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: SNAPSHOT (2021)

FIGURE 37 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY COUNTRY (2021)

FIGURE 38 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES (2022-2029)

FIGURE 41 NORTH AMERICA INVISIBLE ORTHODONTICS: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.