North America Insect Protein Market

Taille du marché en milliards USD

TCAC :

%

USD

59.45 Billion

USD

340.97 Billion

2024

2032

USD

59.45 Billion

USD

340.97 Billion

2024

2032

| 2025 –2032 | |

| USD 59.45 Billion | |

| USD 340.97 Billion | |

|

|

|

|

Marché des protéines d'insectes en Amérique du Nord, par source (coléoptères et orthoptères), type d'insecte (coléoptères, chenilles, abeilles, guêpes et fourmis, sauterelles, criquets, grillons, véritables punaises, mouches soldats noires, cigales, cicadelles, cicadelles, cochenilles, termites, libellules, mouches, vers de farine et autres), application (aliments et boissons, aliments pour animaux, produits pharmaceutiques et cosmétiques), canaux de distribution (directs et indirects) - Tendances et prévisions de l'industrie jusqu'en 2032.

Taille du marché des protéines d'insectes

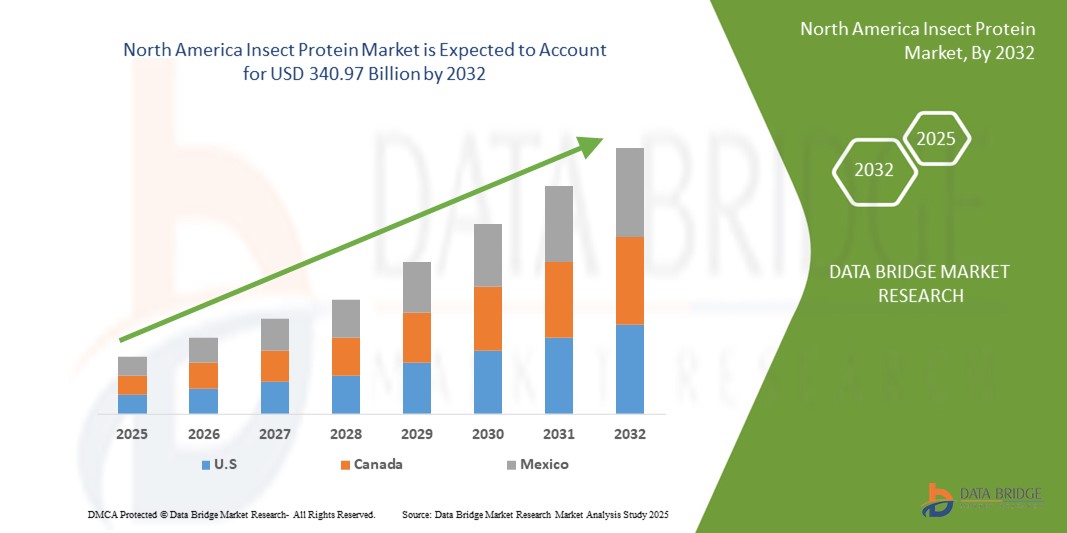

- La taille du marché des protéines d'insectes en Amérique du Nord était évaluée à 59,45 milliards USD en 2024 et devrait atteindre 340,97 milliards USD d'ici 2032 , à un TCAC de 24,40 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la sensibilisation croissante des consommateurs aux sources de protéines durables, la demande croissante d'alternatives alimentaires respectueuses de l'environnement et les progrès des technologies d'élevage d'insectes.

- Les préoccupations environnementales croissantes, associées au besoin de régimes riches en protéines et à l'intégration d'ingrédients à base d'insectes dans diverses applications, accélèrent l'adoption des protéines d'insectes, stimulant considérablement la croissance de l'industrie.

Analyse du marché des protéines d'insectes

- Les protéines d'insectes, dérivées d'insectes comestibles, apparaissent comme une alternative durable et riche en nutriments aux sources de protéines traditionnelles, trouvant des applications dans les aliments et les boissons, les aliments pour animaux, les produits pharmaceutiques et les cosmétiques en raison de leur teneur élevée en protéines, de leur faible empreinte environnementale et de leur évolutivité.

- L'augmentation de la demande de protéines d'insectes est alimentée par l'acceptation croissante des protéines alternatives par les consommateurs, des cadres réglementaires favorables et des investissements croissants dans la production alimentaire à base d'insectes.

- Les États-Unis ont dominé le marché nord-américain des protéines d'insectes, avec une part de chiffre d'affaires de 37,8 % en 2024, grâce à une forte orientation vers la durabilité, une adoption généralisée dans les industries agroalimentaires et animales, et la présence d'acteurs majeurs. Le marché américain est également propulsé par des start-up innovantes et la recherche de nouveaux produits à base d'insectes adaptés aux préférences des consommateurs.

- Le Canada devrait être le pays qui connaîtra la croissance la plus rapide sur le marché des protéines d’insectes au cours de la période de prévision, en raison de l’intérêt croissant des consommateurs pour les régimes alimentaires durables, des initiatives gouvernementales favorables et de l’urbanisation croissante.

- Le segment des coléoptères, qui comprend les coléoptères, a dominé la plus grande part de revenus du marché, soit 58,5 % en 2024, grâce à la diversité et à l'abondance des espèces de coléoptères, en particulier les vers de farine, qui offrent une teneur élevée en protéines et sont largement utilisés dans l'alimentation animale et les produits alimentaires.

Portée du rapport et segmentation du marché des protéines d'insectes

|

Attributs |

Informations clés sur le marché des protéines d'insectes |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des protéines d'insectes

« Intégration croissante des technologies de traitement avancées et de l'innovation produit »

- Le marché nord-américain des protéines d’insectes connaît une tendance notable vers l’intégration de technologies de transformation avancées et le développement de produits innovants.

- Des technologies telles que les systèmes agricoles automatisés, le contrôle de la qualité basé sur l'IA et les méthodes d'extraction de protéines optimisées améliorent l'efficacité et l'évolutivité de la production de protéines d'insectes.

- Ces avancées permettent la création de produits diversifiés tels que des poudres, des barres, des collations et des farines de protéines à base d’insectes, qui séduisent les consommateurs soucieux de leur santé et élargissent la portée du marché.

- Par exemple, les entreprises utilisent l'IA pour surveiller les conditions de croissance des insectes, garantissant ainsi une qualité et un contenu nutritionnel constants, tandis que les technologies IoT optimisent les opérations agricoles pour des rendements plus élevés.

- Cette tendance rend les protéines d'insectes plus attrayantes en améliorant la consistance, le goût et la texture du produit, attirant ainsi à la fois les consommateurs individuels et les industries telles que l'alimentation et les boissons, l'alimentation animale et les produits pharmaceutiques.

- Des analyses avancées sont également utilisées pour adapter les produits aux préférences des consommateurs, comme le développement de barres protéinées à base de grillons avec des saveurs améliorées ou de poudres de vers de farine pour les applications alimentaires pour animaux de compagnie.

Dynamique du marché des protéines d'insectes

Conducteur

« Demande croissante de sources de protéines durables et de solutions alimentaires respectueuses de l'environnement »

- La sensibilisation croissante des consommateurs à la durabilité environnementale et la demande de sources de protéines alternatives sont les principaux moteurs du marché des protéines d'insectes en Amérique du Nord.

- Les protéines d’insectes offrent une alternative durable au bétail traditionnel, nécessitant beaucoup moins de terres, d’eau et d’aliments tout en produisant moins d’émissions de gaz à effet de serre.

- Les initiatives gouvernementales et les tendances de consommation aux États-Unis, le pays dominant, et au Canada, le marché à la croissance la plus rapide, favorisent des systèmes alimentaires durables, stimulant encore davantage l'adoption de produits à base d'insectes.

- La prolifération des régimes alimentaires soucieux de la santé, tels que le céto et le paléo, stimule la demande de produits à base de protéines d'insectes riches en nutriments, qui offrent une teneur élevée en protéines (40 à 70 %) et en acides aminés essentiels.

- Des entreprises comme Aspire Food Group et EntomoFarms augmentent leurs capacités de production au Canada et aux États-Unis pour répondre à la demande croissante d'aliments, d'aliments pour animaux et de cosmétiques à base d'insectes, soutenues par les progrès de la 5G et de l'IoT pour une gestion efficace de la chaîne d'approvisionnement.

Retenue/Défi

« Coûts de production élevés et obstacles à l'acceptation par les consommateurs »

- L'investissement initial élevé requis pour l'infrastructure d'élevage d'insectes, l'équipement de transformation et la conformité réglementaire constitue un obstacle important, en particulier pour les petites entreprises du marché nord-américain des protéines d'insectes.

- L’augmentation de la production et le développement de méthodes de transformation rentables restent complexes et coûteux, en particulier sur les marchés émergents de la région.

- L'acceptation par les consommateurs, en particulier aux États-Unis et au Canada, est entravée par les aversions culturelles à l'entomophagie (consommation d'insectes) et par une connaissance limitée de ses avantages nutritionnels et environnementaux.

- Les données d'une étude de 2018 menée par PureGym indiquent que si 35 % des membres de salles de sport sont ouverts à l'idée d'essayer des insectes comestibles, une hésitation plus large des consommateurs persiste, en particulier sur les marchés occidentaux où l'entomophagie est moins familière.

- Les défis réglementaires, tels que les normes variables pour les produits à base d'insectes aux États-Unis, au Canada et au Mexique, et les préoccupations concernant les risques allergènes (sensibilités liées à la chitine), compliquent davantage la croissance du marché.

Portée du marché des protéines d'insectes

Le marché est segmenté en fonction de la source, du type d’insecte, de l’application et des canaux de distribution.

- Par source

En fonction de leur provenance, le marché nord-américain des protéines d'insectes est segmenté en coléoptères et orthoptères. Le segment des coléoptères, qui englobe les coléoptères, a dominé le marché avec une part de marché de 58,5 % en 2024, grâce à la diversité et à l'abondance des espèces de coléoptères, notamment les vers de farine, riches en protéines et largement utilisés dans l'alimentation animale et les produits alimentaires. Leur résilience et leur adaptabilité à la culture à grande échelle renforcent encore leur domination.

Le segment des orthoptères, comprenant les grillons, les sauterelles et les criquets, devrait connaître la croissance la plus rapide, soit 26,8 % entre 2025 et 2032. Cette croissance est alimentée par la teneur élevée en protéines des espèces d'orthoptères (jusqu'à 77 % chez les sauterelles) et leur utilisation croissante dans des produits alimentaires tels que les barres protéinées et les snacks, attirant ainsi les consommateurs soucieux de leur santé. Les progrès réalisés dans l'élevage et les technologies de transformation des grillons contribuent également à l'expansion rapide de ce segment.

- Par type d'insecte

En fonction du type d'insecte, le marché nord-américain des protéines d'insectes est segmenté en coléoptères, chenilles, abeilles, guêpes et fourmis, sauterelles, criquets, grillons, punaises, mouches soldats noires, cigales, cicadelles, cicadelles, cochenilles, termites, libellules, mouches, vers de farine, etc. Le segment des coléoptères devrait dominer le marché avec une part de marché de 42,5 % en 2024, en raison de leur profil nutritionnel élevé et de leur utilisation répandue dans l'alimentation animale, en particulier les vers de farine, qui sont rentables et durables.

Le segment des grillons devrait connaître la croissance la plus rapide, soit 28,4 % entre 2025 et 2032, grâce à sa teneur élevée en protéines (jusqu'à 69 %), à sa facilité de culture et à l'acceptation croissante par les consommateurs de produits alimentaires tels que la farine de grillons et les barres protéinées. La demande croissante d'alternatives durables et riches en nutriments aux États-Unis et au Canada accélère encore la croissance de ce segment.

- Par application

En fonction des applications, le marché nord-américain des protéines d'insectes est segmenté en agroalimentaire, en alimentation animale et en produits pharmaceutiques et cosmétiques. Le segment de l'alimentation animale détenait la plus grande part de chiffre d'affaires, soit 48,5 % en 2024, grâce à la demande croissante d'aliments pour animaux durables dans les secteurs de l'aquaculture, de la volaille et des aliments pour animaux de compagnie. Avec une teneur en protéines de 40 à 70 % et une digestibilité élevée, les protéines d'insectes sont de plus en plus prisées pour leur caractère écologique.

Le secteur de l'alimentation et des boissons devrait connaître la croissance la plus rapide, soit 27,5 % entre 2025 et 2032, grâce à l'intérêt croissant des consommateurs pour des options alimentaires durables et nutritives. Les innovations en matière de transformation ont donné naissance à des produits tels que les poudres, barres et snacks à base de protéines d'insectes, qui gagnent en popularité auprès des consommateurs soucieux de leur santé aux États-Unis et au Canada.

- Par canaux de distribution

En fonction des canaux de distribution, le marché nord-américain des protéines d'insectes est segmenté en canaux directs et indirects. Le segment indirect, qui comprend les détaillants et les distributeurs, devrait détenir la plus grande part de chiffre d'affaires du marché, soit 62,5 % en 2024, grâce à sa large présence dans les supermarchés, les magasins spécialisés et les plateformes en ligne, s'adressant à la fois aux marchés commerciaux et grand public.

Le segment de la vente directe devrait connaître sa plus forte croissance, soit 25,9 % entre 2025 et 2032, grâce à la multiplication des partenariats entre les producteurs de protéines d'insectes et les utilisateurs finaux, comme les fabricants de denrées alimentaires et les fabricants d'aliments pour animaux. La vente directe permet un meilleur contrôle de la marque et des chaînes d'approvisionnement, notamment au Canada, où la demande de protéines durables est en plein essor.

Analyse régionale du marché des protéines d'insectes

- Les États-Unis ont dominé le marché nord-américain des protéines d'insectes, avec une part de chiffre d'affaires de 37,8 % en 2024, grâce à une forte orientation vers la durabilité, une adoption généralisée dans les industries agroalimentaires et animales, et la présence d'acteurs majeurs. Le marché américain est également propulsé par des start-up innovantes et la recherche de nouveaux produits à base d'insectes adaptés aux préférences des consommateurs.

- Le Canada devrait être le pays qui connaîtra la croissance la plus rapide sur le marché des protéines d’insectes au cours de la période de prévision, en raison de l’intérêt croissant des consommateurs pour les régimes alimentaires durables, des initiatives gouvernementales favorables et de l’urbanisation croissante.

Aperçu du marché américain des protéines d'insectes

Les États-Unis ont dominé le marché nord-américain des protéines d'insectes, avec une part de chiffre d'affaires de 76 % en 2024, grâce à une forte sensibilisation des consommateurs à la durabilité et à leurs bienfaits nutritionnels. La demande de produits à base d'insectes, tels que la farine de grillon et les snacks à base de vers de farine, est en hausse dans les secteurs de l'alimentation animale et de l'alimentation humaine et animale. Le marché secondaire prospère grâce à l'intérêt des consommateurs pour les régimes alimentaires écologiques et les produits axés sur la santé, tandis que l'adoption des fabricants d'équipement d'origine par les industries de l'alimentation animale et de l'aquaculture stimule la croissance du marché. Le soutien réglementaire aux protéines d'insectes dans les applications alimentaires et l'augmentation des investissements dans les installations de production, comme la collaboration d'Innovafeed avec ADM, stimulent encore l'expansion.

Aperçu du marché canadien des protéines d'insectes

Le Canada est le pays qui connaît la croissance la plus rapide sur le marché nord-américain des protéines d'insectes, grâce à l'intérêt croissant des consommateurs pour les sources de protéines durables et au soutien gouvernemental aux pratiques agricoles respectueuses de l'environnement. La demande de protéines d'insectes dans les aliments et les boissons, comme les barres protéinées et les collations, est en hausse, en particulier chez les consommateurs soucieux de leur santé et de l'environnement. Le secteur de l'alimentation animale, notamment l'aquaculture et la volaille, est également un important moteur de croissance, grâce à des entreprises comme Enterra Feed Corporation qui sont à l'avant-garde de l'innovation. L'accent mis par le Canada sur la réduction de l'empreinte carbone et les avancées technologiques en matière d'élevage d'insectes contribuent à la croissance rapide de son marché.

Part de marché des protéines d'insectes

L'industrie des protéines d'insectes est principalement dirigée par des entreprises bien établies, notamment :

- AgriProtein (Afrique du Sud)

- Société Enterra Feed (Canada)

- Groupe alimentaire Aspire (Canada)

- Beta Hatch (États-Unis)

- BIOFLYTECH (Espagne)

- Protéine de grillon Chapul (États-Unis)

- Entobel (Vietnam)

- Entocycle (Royaume-Uni)

- Entomo Farms (France)

- Insectes d'Amérique du Nord (Thaïlande)

- Haocheng Mealworms Inc. (Chine)

- Hexafly (Irlande)

- Innovafeed (France)

- JSC « INSECTUM » (Norvège)

- nextProtein (France)

Quels sont les développements récents sur le marché des protéines d’insectes en Amérique du Nord ?

- En octobre 2023, Tyson Foods a annoncé un partenariat stratégique avec Protix, pionnier néerlandais des ingrédients à base d'insectes, afin de promouvoir une production durable de protéines. Cette collaboration comprend une coentreprise visant à construire la première usine de production d'ingrédients à base d'insectes à grande échelle aux États-Unis. Des mouches soldats noires seront cultivées à partir de sous-produits de l'industrie alimentaire. Ces insectes seront transformés en protéines et lipides de haute qualité destinés à l'alimentation animale, à l'aquaculture et au bétail, créant ainsi une source de protéines circulaire et à faible impact. Tyson a également acquis une participation minoritaire dans Protix, soutenant ainsi son expansion mondiale et renforçant son engagement en faveur de systèmes alimentaires innovants et respectueux de l'environnement.

- En mars 2023, Aspire Food Group a reçu un financement de Next Generation Manufacturing Canada (NGen) pour moderniser son usine de production de protéines de grillons à London, en Ontario. Il s'agit du premier site de production de protéines d'insectes entièrement automatisé au monde. L'usine intègre l'intelligence artificielle, des capteurs de l'Internet industriel des objets (IIoT) et des systèmes automatisés de stockage et de récupération pour optimiser l'élevage, la transformation et le conditionnement des grillons en ingrédients protéiques durables. Avec une production annuelle prévue de neuf millions de kilogrammes, cette initiative vise à révolutionner la production de protéines de qualité alimentaire, contribuant ainsi à la fois à l'alimentation des animaux de compagnie et à la consommation humaine, tout en luttant contre l'insécurité alimentaire et en favorisant la durabilité environnementale.

- En février 2023, EntomoFarms, la plus grande ferme d'insectes comestibles d'Amérique du Nord, s'est associée à Crickstart, un fabricant alimentaire canadien, pour lancer une nouvelle gamme de barres protéinées à base de grillons. Ces barres sont conçues pour les consommateurs soucieux de leur santé et à la recherche d'alternatives durables et riches en protéines. Cette collaboration s'appuie sur l'expertise d'EntomoFarms dans la production de poudre de grillons et sur l'expérience de Crickstart dans la création de collations riches en nutriments, renforçant ainsi sa présence sur le marché nord-américain des aliments fonctionnels. Cette initiative s'inscrit dans l'intérêt croissant des consommateurs pour des sources de protéines écologiques qui favorisent à la fois le bien-être personnel et la durabilité environnementale.

- En janvier 2023, Ÿnsect est devenue la première entreprise autorisée par l'Association of American Feed Control Officials (AAFCO) à commercialiser des protéines de vers de farine dégraissés (Protein70) pour l'alimentation canine aux États-Unis. Cette autorisation historique fait suite à une évaluation de deux ans et à un essai d'alimentation de six mois, confirmant les bienfaits nutritionnels de l'ingrédient, notamment sa haute digestibilité, ses acides aminés essentiels, ses graisses insaturées et ses micronutriments. Cette décision ouvre la voie à la marque d'aliments pour animaux de compagnie Sprÿng d'Ÿnsect sur le marché américain et accompagne la transition vers des sources de protéines durables et à faible impact dans l'alimentation animale.

- En décembre 2022, Neo Bites, une start-up d'aliments durables pour animaux basée à Austin, au Texas, a lancé la première gamme de compléments alimentaires fonctionnels pour chiens à base de protéines d'insectes en Amérique du Nord. Formulés avec le mélange exclusif de super-insectes de l'entreprise (à base de protéines de grillon), ces compléments sont conçus pour répondre aux besoins spécifiques des chiens : santé digestive, soins de la peau et du pelage, et vitalité au quotidien. Chaque formule contient des superaliments complets comme le curcuma, la citrouille, les graines de lin et le chou frisé, et est hypoallergénique et riche en nutriments. Ce lancement reflète la mission de Neo Bites : améliorer le bien-être des animaux tout en réduisant l'impact environnemental des aliments traditionnels à base de viande.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INSECT PROTEIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 INSECT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PATENT ANALYSIS

3.2 COUNTRY LEVEL INSIGHTS

3.3 COMPANY BASED ANALYSIS

3.4 TECHNICAL CHALLENGES

3.5 CLIENT REQUIREMENT

3.5.1 COST OF MACHINES/EQUIPMENT USED IN INSECT REARING AND PROCESSING

3.5.2 PARTNERS AROUND THE WORLD SELLING INSECT REARING AND PROCESSING EQUIPMENT/TECHNOLOGY

3.6 REGULATIONS

3.6.1 EUROPEAN LAW ON INSECTS IN FOOD AND FEED

3.6.1.1 INSECTS AS FEED

3.6.1.2 INSECTS AS FOOD

4 MARKET OVERVIEW

4.1 DRIVERS

4.1.1 GROWING DEMAND FOR ALTERNATIVE PROTEIN SOURCE

4.1.2 RISING AWARENESS ABOUT THE BENEFITS OF INSECT PROTEINS

4.1.3 INCREASING INVESTMENT IN R&D

4.1.4 EASY AVAILABILITY OF EDIBLE INSECTS AND SNACKS

4.2 RESTRAINTS

4.2.1 LOWER CONSUMER ACCEPTANCE LEVEL

4.2.2 LACK OF AUTOMATED FARMING METHODS

4.2.3 STRINGENT REGULATORY FRAMEWORK

4.2.4 HIGHER COSTS OF INSECT PROTEINS

4.3 OPPORTUNITIES

4.3.1 NEW PRODUCT INNOVATION TO ATTRACT CONSUMERS

4.3.2 DEVELOPMENT OF INSECT REARING AND PROCESSING EQUIPMENT

4.4 CHALLENGES

4.4.1 GROWING TREND FOR PLANT-BASED FOOD PRODUCTS

4.4.2 MICROBIAL AND TOXICITY RISKS ASSOCIATED WITH INSECTS

5 NORTH AMERICA INSECT PROTEIN MARKET, BY INSECT TYPE

5.1 OVERVIEW

5.2 BEETLES

5.3 CATERPILLARS

5.4 BEES

5.5 WASPS & ANTS

5.6 GRASSHOPERS

5.7 LOCUSTS

5.8 CRICKETS

5.9 TRUE BUGS

5.1 BLACK SOLDIER FLIES

5.11 CICADAS

5.12 LEAFHOPPERS

5.13 PLANTHOPPERS

5.14 SCALE INSECTS

5.15 TERMITES

5.16 DRAGONFLIES

5.17 FLIES

5.18 MEALWORMS

5.19 OTHERS

6 NORTH AMERICA INSECT PROTEIN MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 FEED

6.2.1 AQUATIC ANIMALS

6.2.2 PETS

6.2.3 POULTRY

6.2.4 SWINE

6.2.5 EQUINE

6.2.6 RUMINANTS

6.2.7 OTHERS

6.3 FOOD & BEVERAGE

6.3.1 BAKERY PRODUCTS

6.3.1.1 BREADS & ROLLS

6.3.1.2 BISCUITS & COOKIES

6.3.1.3 CAKES & MUFFINS

6.3.1.4 OTHERS

6.3.2 CONVENIENCE FOOD

6.3.2.1 SAVOURY SNACKS

6.3.2.2 PASTA & NOODLES

6.3.2.3 RTE MEALS

6.3.2.4 OTHERS

6.3.3 MEAT PRODUCTS & ANALOGS

6.3.3.1 MINCED MEAT

6.3.3.2 PATTIES & SAUSAGES

6.3.3.3 PATÉS

6.3.3.4 OTHERS

6.3.4 ENERGY BARS/PROTEIN BARS

6.3.5 GRANOLA

6.3.6 DAIRY PRODUCTS

6.3.7 RTM POWDER

6.3.8 BEVERAGES

6.3.9 OTHERS

6.4 PHARMACEUTICALS AND COSMETICS

7 NORTH AMERICA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL

7.1 OVERVIEW

7.2 DIRECT

7.3 INDIRECT

7.3.1 STORE BASED RETAILERS

7.3.2 NON-STORE RETAILERS

8 NORTH AMERICA INSECT PROTEIN MARKET, BY REGION

8.1 NORTH AMERICA

8.1.1 U.S.

8.1.2 CANADA

8.1.3 MEXICO

9 NORTH AMERICA INSECT PROTEIN MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 ENVIROFLIGHT

11.1.1 COMPANY SNAPSHOT

11.1.2 COMPANY SHARE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 PROTIFARM

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 RECENT DEVELOPMENT

11.3 AGRIPROTEIN

11.3.1 COMPANY SNAPSHOT

11.3.2 COMPANY SHARE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENTS

11.4 ENTERRA FEED CORPORATION

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENT

11.5 ASPIRE FOOD GROUP

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 RECENT DEVELOPMENT

11.6 BETA HATCH

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 BIOFLYTECH

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENT

11.8 CHAPUL CRICKET PROTEIN

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 ENTOBEL

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENT

11.1 ENTOCYCLE

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 ENTOMO FARMS

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT DEVELOPMENT

11.12 NORTH AMERICA BUGS

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 HAOCHENG MEALWORMS INC.

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENT

11.14 HEXAFLY

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENT

11.15 INNOVAFEED

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENTS

11.16 INSECTUM

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENT

11.17 NEXTPROTEIN

11.17.1 COMPANY SNAPSHOT

11.17.2 PRODUCT PORTFOLIO

11.17.3 RECENT DEVELOPMENT

11.18 PROTENGA PTE LTD

11.18.1 COMPANY SNAPSHOT

11.18.2 PRODUCT PORTFOLIO

11.18.3 RECENT DEVELOPMENT

11.19 PROTIFLY

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT DEVELOPMENT

11.2 PROTIX

11.20.1 COMPANY SNAPSHOT

11.20.2 PRODUCT PORTFOLIO

11.20.3 RECENT DEVELOPMENT

11.21 SEEK FOOD

11.21.1 COMPANY SNAPSHOT

11.21.2 PRODUCT PORTFOLIO

11.21.3 RECENT DEVELOPMENT

11.22 THAILAND UNIQUE

11.22.1 COMPANY SNAPSHOT

11.22.2 PRODUCT PORTFOLIO

11.22.3 RECENT DEVELOPMENT

11.23 ŸNSECT

11.23.1 COMPANY SNAPSHOT

11.23.2 PRODUCT PORTFOLIO

11.23.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 NORTH AMERICA INSECT PROTEIN MARKET: VOLUME TABLE FOR INSECT PROTEIN SOLD AROUND THE GLOBE

TABLE 2 THE PRICE RANGE OF EQUIPMENT USED IN INSECT REARING AND PROCESSING

TABLE 3 COMPANIES OFFERING INSECT REARING AND PROCESSING EQUIPMENT AND TECHNOLOGY

TABLE 4 REGULATIONS FOR INSECT BASED FOOD AND FEED PRODUCT BY EUROPEAN UNION

TABLE 5 COST COMPARISON OF DIFFERENT PROTEIN SOURCES

TABLE 6 NORTH AMERICA INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 7 NORTH AMERICA BEETLES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 8 NORTH AMERICA CATERPILLARS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 9 NORTH AMERICA BEES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 10 NORTH AMERICA WASPS & ANTS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 11 NORTH AMERICA GRASSHOPPERS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 12 NORTH AMERICA LOCUSTS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 13 NORTH AMERICA CRICKETS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 14 NORTH AMERICA TRUE BUGS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 15 NORTH AMERICA BLACK SOLDIERS FLIES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 16 NORTH AMERICA CICADAS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 17 NORTH AMERICA LEAFHOPPERS INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 18 NORTH AMERICA PLANT HOPPERS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 19 NORTH AMERICA SCALE INSECTS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 20 NORTH AMERICA TERMITES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 21 NORTH AMERICA DRAGONFLIES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 22 NORTH AMERICA FLIES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 23 NORTH AMERICA MEALWORMS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 24 NORTH AMERICA OTHERS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 25 NORTH AMERICA INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 26 NORTH AMERICA FEED IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 27 NORTH AMERICA FEED IN INSECT PROTEIN MARKET, BY APPLICATION ,2018-2027 (USD THOUSAND )

TABLE 28 NORTH AMERICA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 29 NORTH AMERICA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 30 NORTH AMERICA BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 31 NORTH AMERICA CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 32 NORTH AMERICA MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 33 NORTH AMERICA PHARMACEUTICALS AND COSMETICS IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 34 NORTH AMERICA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL ,2018-2027 (USD THOUSAND )

TABLE 35 NORTH AMERICA DIRECT IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 36 NORTH AMERICA NDIRECT IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSAND )

TABLE 37 NORTH AMERICA INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL 2018-2027 (USD THOUSAND )

TABLE 38 NORTH AMERICA INSECT PROTEIN MARKET, BY COUNTRY, 2018-2027 (USD THOUSANDS)

TABLE 39 NORTH AMERICA INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 40 NORTH AMERICA INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 41 NORTH AMERICA FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 42 NORTH AMERICA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 43 NORTH AMERICA BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 44 NORTH AMERICA MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 45 NORTH AMERICA CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 46 NORTH AMERICA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 47 NORTH AMERICA INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 48 U.S. INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 49 U.S. INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 50 U.S. FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 51 U.S. FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 52 U.S. BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 53 U.S. MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 54 U.S. CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 55 U.S. INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 56 U.S. INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 57 CANADA INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 58 CANADA INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 59 CANADA FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 60 CANADA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 61 CANADA BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 62 CANADA MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 63 CANADA CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 64 CANADA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 65 CANADA INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 66 MEXICO INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 67 MEXICO INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 68 MEXICO FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 69 MEXICO FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 70 MEXICO BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 71 MEXICO MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 72 MEXICO CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 73 MEXICO INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 74 MEXICO INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

Liste des figures

LIST OF FIGURES

FIGURE 1 NORTH AMERICA INSECT PROTEIN MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INSECT PROTEIN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INSECT PROTEIN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INSECT PROTEIN MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INSECT PROTEIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INSECT PROTEIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INSECT PROTEIN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA INSECT PROTEIN MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INSECT PROTEIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA INSECT PROTEIN MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR ALTERNATIVE PROTEIN SOURCES TO DRIVE THE NORTH AMERICA INSECT PROTEIN MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 BEETLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INSECT PROTEIN MARKET IN 2020 & 2027

FIGURE 13 PATENT REGISTERED FOR ACEROLA, BY COUNTRY

FIGURE 14 PATENT REGISTERED BY YEAR (1999-2019)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA INSECT PROTEIN MARKET

FIGURE 16 PERCENTAGE OF EDIBLE PART OF ANIMAL

FIGURE 17 ABUNDANCE OF EDIBLE INSECTS (IN %)

FIGURE 18 SALE OF THE U.S. PLANT-BASED MEAT (IN USD MILLION)

FIGURE 19 NORTH AMERICA INSECT PROTEIN MARKET: BY INSECT TYPE, 2019

FIGURE 20 NORTH AMERICA INSECT PROTEIN MARKET: BY APPLICATION, 2019

FIGURE 21 NORTH AMERICA INSECT PROTEIN MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 22 NORTH AMERICA INSECT PROTEIN MARKET: SNAPSHOT (2019)

FIGURE 23 NORTH AMERICA INSECT PROTEIN MARKET: BY COUNTRY (2019)

FIGURE 24 NORTH AMERICA INSECT PROTEIN MARKET: BY COUNTRY (2020 & 2027)

FIGURE 25 NORTH AMERICA INSECT PROTEIN MARKET: BY COUNTRY (2019 & 2027)

FIGURE 26 NORTH AMERICA INSECT PROTEIN MARKET: BY TYPE (2020-2027)

FIGURE 27 NORTH AMERICA INSECT PROTEIN MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.